EMC 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 EMC annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

EMC CORP (EMC)

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 02/27/2007

Filed Period 12/31/2006

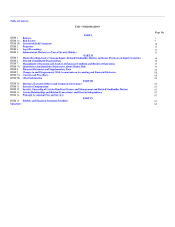

Table of contents

-

Page 1

EMC CORP

(EMC)

10-K

Annual report pursuant to section 13 and 15(d) Filed on 02/27/2007 Filed Period 12/31/2006

-

Page 2

...South Street Hopkinton, Massachusetts 01748 (Address of principal executive offices, including zip code) (508) 435-1000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class: Common Stock, par value $.01 per share Name of...

-

Page 3

DOCUMENTS INCORPORATED BY REFERENCE Information required in response to Part III of Form 10-K (Items 10, 11, 12, 13 and 14) is hereby incorporated by reference to the specified portions of the registrant's Proxy Statement for the Annual Meeting of Shareholders to be held on May 3, 2007.

-

Page 4

... About Market Risk Financial Statements and Supplementary Data Changes in and Disagreements With Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership...

-

Page 5

... in 1979. Our corporate headquarters are located at 176 South Street, Hopkinton, Massachusetts. Products and Offerings Our principal segments consist of Information storage, Content management and archiving, RSA information security and VMware virtual infrastructure. Information Storage Segment The...

-

Page 6

...the new UltraScale architecture, and a series of software products to monitor the performance of and improve application performance over IP networks. EMC Centera Content Addressed Storage ("CAS") Systems Our EMC Centera CAS systems provide fast, secure online access to archived fixed content - data...

-

Page 7

...images, XML, reports, records, rich media and application data. Additionally, the EMC Captiva family of input management software provides for conversion, indexing and processing of paper-based information to digital formats. In 2006, EMC modified its family of enterprise archiving software products...

-

Page 8

... 2006, RSA introduced its RSA Key Manager software, which enables businesses to effectively manage the lifecycle of encryption keys. The solution also helps companies comply with the key lifecycle management guidelines of the Payment Card Industry ("PCI") Data Security Standard, a global initiative...

-

Page 9

... Ireland or at global manufacturing service suppliers. See Item 2 "Properties." We work closely with our suppliers to design, assemble and test product components in accordance with production standards and quality controls established by us. Our software products are designed, developed and tested...

-

Page 10

... written request to EMC Investor Relations, 176 South Street, Hopkinton, MA 01748. None of the information posted on our website is incorporated by reference into this Annual Report. CEO Certification An annual CEO Certification was submitted by our CEO to the New York Stock Exchange (the "NYSE") on...

-

Page 11

... or a limited number of qualified suppliers, including some of our competitors. These components and products include disk drives, high density memory components, power supplies and software developed and maintained by third parties. We have experienced delivery delays from time to time because of...

-

Page 12

... of new products include delays in development and changes in data storage, networking virtualization, infrastructure management, information security and operating system technologies which could require us to modify existing products. Risks inherent in the transition to new products include...

-

Page 13

... packages for many of our employees. Under recent accounting rules, we are required to treat stock-based compensation as an expense. In addition, changes to regulatory or stock exchange rules and regulations and in institutional shareholder voting guidelines on equity plans may result in additional...

-

Page 14

...Board ("FASB") promulgates new accounting principles that are applicable to us. In the first quarter of 2006, we adopted Financial Accounting Standard ("FAS") FAS No. 123R "Share-based Payment" ("FAS No. 123R"). This standard requires us to expense the fair value of stock options issued to employees...

-

Page 15

... problems in our products could directly impair our financial results. If flaws in design, production, assembly or testing of our products (by us or our suppliers) were to occur, we could experience a rate of failure in our products that would result in substantial repair, replacement or service...

-

Page 16

... be after the IPO. We cannot assure you that the IPO, if completed, will produce any increase for our shareholders in the market value of their holdings in our company. In addition, the market price of our common stock could be volatile for several months after the IPO and may continue to be more...

-

Page 17

... offices, R&D, customer 227,000 service and sales

Information Storage, Content Mgmt. & Archiving

Franklin, MA Bedford, MA Apex, NC

Information Storage RSA Information Security Information Storage

Palo Alto, CA

leased:

VMware Virtual Infrastructure

Other North American locations Asia Pacific...

-

Page 18

... Financial Officer Executive Vice President and President of VMware Executive Vice President, Global Marketing and Customer Quality Executive Vice President, Chief Development Officer Executive Vice President, Human Resources Position

Joseph M. Tucci has been the Chairman of the Board of Directors...

-

Page 19

... of Human Resources with Citigroup Inc., a financial services company.

AutoSwap, EMC, CLARiiON, Captiva, Celerra, Centera, Connectrix, DatabaseXtender, Direct Matrix Architecture, DMX, Documentum, EMC ControlCenter, EMC Proven, EDM, EmailXtender, Insignia, LEGATO, NetWin, Open Replicator, RSA...

-

Page 20

... OF EQUITY SECURITIES

Our common stock, par value $.01 per share, trades on the New York Stock Exchange under the symbol EMC. The following table sets forth the range of high and low sales prices of our common stock on the New York Stock Exchange for the past two years during the fiscal periods...

-

Page 21

16

-

Page 22

Table of Contents

ISSUER PURCHASES OF EQUITY SECURITIES IN THE FOURTH QUARTER OF 2006

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

Total Number of Shares Purchased(1) Period

Average Price Paid per Share

Maximum Number (or Approximate Dollar Value) of Shares ...

-

Page 23

.... ("Avamar") and acquired the assets of ProActivity Software Solutions Ltd., ("ProActivity") (see Note B to the Consolidated Financial Statements). In 2005, EMC acquired all of the outstanding shares of System Management Arts Incorporated ("Smarts") and Captiva Software Corporation ("Captiva") (see...

-

Page 24

... our business into four segments: Information storage, Content management and archiving, VMware virtual infrastructure and RSA information security. We have conformed our prior period presentations to be consistent with our current segments. The following table presents revenue by our segments...

-

Page 25

..., largely to support and implement information lifecycle management-based solutions, contributed to the increase. The increase in 2005 services revenues was also impacted by greater demand for hardware maintenance contracts associated with increased sales of information storage systems. Partially...

-

Page 26

.... In 2006, our Black-Scholes option model included the following weighted average assumptions for our employee stock options and ESPP:

Stock Options ESPP

Dividend yield Expected volatility Risk-free interest rate Expected life (in years) Weighted-average fair value at grant date

$

None 35.2% 4.80...

-

Page 27

... VMware virtual infrastructure segment. The Content management and archiving segment had a neutral impact on our overall gross margin in 2005 compared to 2004. For segment reporting purposes, stock-based compensation and acquisition-related intangible asset amortization are recognized as corporate...

-

Page 28

... stock-based compensation expense, R&D expenses increased in 2006 compared to 2005 and 2005 compared to 2004 due to increased investments to support new product development and incremental R&D efforts resulting from the acquisitions of RSA in 2006 and Smarts and Captiva in 2005. Selling, General...

-

Page 29

... amount exceeded its fair value, measured as the present value of their estimated discounted cash flows. The restructuring programs impacted the Information storage and Content management and archiving segments. The workforce reductions include $10.7 of non-cash stock-based compensation expense. The...

-

Page 30

..., and 33% were based in Europe, Latin America, Mexico and the Asia Pacific region. As of December 31, 2006, the restructuring programs had been substantially completed. The restructuring programs impacted the Information storage and Content management and archiving segments. The adjustment to the...

-

Page 31

Workforce reductions Consolidation of excess facilities Total

$

26.8 $ 2.2 29.0 $

(2.4) $ (0.1) (2.4) $

(8.1) $ (0.5) (8.6) $

16.4 1.7 18.0

$

25

-

Page 32

... vacating facilities associated with our 2001 restructuring program. These additions were partially offset by a reduction in the number of individuals originally identified for termination. The prior year restructuring programs impacted the Information storage and Content management and archiving...

-

Page 33

... of the headcount increases was due to the general growth of the business, as well as increased acquisition activity including the acquisitions of Smarts and Captiva in 2005 and RSA in 2006. Greater levels of inventory purchases to support the transition to our next generation storage systems also...

-

Page 34

...per Note of the applicable series for each day of that measurement period was less than 98% of the product of the last reported sale price of our common stock and the conversion rate on each such day; (2) during any calendar quarter, if the last reported sale price of our common stock for 20 or more...

-

Page 35

...Sold Warrants. The Purchased Options and Sold Warrants will generally have the effect of increasing the conversion price of the Notes to approximately $19.55 per share of our common stock, representing an approximate 55 percent conversion premium based on the closing price of $12.61 per share of our...

-

Page 36

... Under some of these agreements, we have agreed to indemnify the supplier for certain claims that may be brought against such party with respect to our acts or omissions relating to the supplied products or technologies. We have agreed to indemnify the directors and executive officers of EMC and our...

-

Page 37

...Data General acquisition that provides certain medical and life insurance benefits for retired former Data General employees. The plan's assets are invested in common stocks, bonds and cash. The market related value of the plan's assets is equal to the assets' fair value. The expected long-term rate...

-

Page 38

... Deliverables"; Statement of Position ("SOP") No. 97-2, "Software Revenue Recognition"; FAS No. 48, "Revenue Recognition When Right of Return Exists"; FAS No. 13, "Accounting for Leases"; and SOP No. 81-1, "Accounting for Performance of Construction-Type and Certain Production-Type Contracts," among...

-

Page 39

Table of Contents

Accounting for Stock-based Compensation On January 1, 2006, we adopted FAS No. 123R, which requires the recognition of compensation expense for all share-based payment awards made to employees and directors based upon the awards' estimated grant date fair value. Previously, we ...

-

Page 40

... loss in fair value that could arise from changes in market conditions, using a 95% confidence level and assuming a one-day holding period. The value-at-risk on the combined foreign exchange position was $0.5 million as of December 31, 2006 and $0.7 million as of December 31, 2005. The average, high...

-

Page 41

... to loan fixed income securities generally on an overnight basis. Under these securities lending agreements, the value of the collateral is equal to 102% of the fair market value of the loaned securities. The collateral is generally cash, U.S. government-backed securities or letters of credit. At...

-

Page 42

Table of Contents

ITEM 8:

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA EMC CORPORATION AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND SCHEDULE

Management's Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated ...

-

Page 43

... control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the company's principal executive and principal financial officers and effected by the company's board of directors, management and...

-

Page 44

... the consolidated financial statements, the Company changed the manner in which it accounts for share-based compensation in 2006 and the manner in which it accounts for defined benefit pension and other postretirement plans effective December 31, 2006. Internal control over financial reporting Also...

-

Page 45

... with the policies or procedures may deteriorate. As described in Management's Report on Internal Control over Financial Reporting, management has excluded RSA Security Inc. from its assessment of internal control over financial reporting as of December 31, 2006 because this entity was acquired by...

-

Page 46

Table of Contents

EMC CORPORATION CONSOLIDATED BALANCE SHEETS (in thousands, except per share amounts)

December 31,

2006

2005

ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and notes receivable, less allowance for doubtful accounts of $39,509 and $38,126 ...

-

Page 47

Table of Contents

EMC CORPORATION CONSOLIDATED INCOME STATEMENTS (in thousands, except per share amounts)

For the Year Ended December 31,

2006

2005

2004

Revenues: Product sales Services

$

8,078,042 $ 3,077,048 11,155,090

7,009,026 $ 2,654,929 9,663,955 3,363,017 1,108,119 1,004,829 2,605,977...

-

Page 48

... stock Repurchase of common stock Excess tax benefits from stock-based compensation Payment of short and long-term obligations Proceeds from short and long-term obligations Purchase of call options Sale of warrants Debt issuance costs Net cash used in financing activities Effect of exchange rate...

-

Page 49

...-cash activity: Issuance of common stock and stock options exchanged in business combinations $

234,164 (7,269) 2,140,424 $

280,563 (4,082) 2,216,296 $

298,407 24,023 2,102,295

$

41,151 $

77,645 $

73,351

The accompanying notes are an integral part of the consolidated financial statements. 42

-

Page 50

... paid-in capital Stock options issued in purchase acquisitions Stock-based compensation Purchase of call options Tax benefit from purchase of call options Sale of warrants Impact of adoption of new accounting standard for pension and other post-retirement plans (see Note A) Change in market value...

-

Page 51

Table of Contents

EMC CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in thousands)

For the Year Ended December 31,

2006

2005

2004

Net income $ 1,223,982 $ 1,133,165 $ 871,189 Other comprehensive income (loss), net of taxes (benefit): Foreign currency translation adjustments, net ...

-

Page 52

... and Celerra systems, Centera systems and Connectrix systems. Revenue for hardware is generally recognized upon shipment. • Software sales

Software sales consist of the sale of software application programs. Our software products provide customers with resource management, backup and archiving...

-

Page 53

... of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) • Services revenue

Services revenue consists of installation services, professional services, software maintenance, hardware maintenance and training. Installation and professional services are not considered...

-

Page 54

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) We hedge our exposure in foreign currency denominated monetary assets and liabilities with foreign currency forward and option contracts. Since these derivatives hedge existing exposures that are denominated ...

-

Page 55

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) We also hold strategic equity investments. Strategic equity investments in publicly traded companies are classified as available for sale when there are no restrictions on our ability to liquidate such ...

-

Page 56

... statement of financial position the net funded status of each of its defined benefit postretirement plans. Prior to the issuance of FAS No. 158, the net amount recognized as an asset or liability on our consolidated balance sheet with respect to our defined benefit pension and other post-retirement...

-

Page 57

... compensation costs for all share-based payment awards made to employees and directors based upon the awards' estimated grant date fair value. The standard covers employee stock options, restricted stock, restricted stock units and employee stock purchases related to our employee stock purchase plan...

-

Page 58

... tax-related amounts within the statement of cash flows. The gross amount of windfall tax benefits resulting from stock-based compensation will be reported as financing inflows. For stock options, we have selected the Black-Scholes option-pricing model to determine the fair value of our stock option...

-

Page 59

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) for financial advisory, legal and accounting services. The fair value of our stock options issued to employees of RSA was estimated using a Black-Scholes option-pricing model. The fair value of the stock ...

-

Page 60

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 2007 and the liabilities associated with the lease and contract terminations through 2008. Management is in the process of determining whether additional liabilities relating to employee termination benefits ...

-

Page 61

..., legal and accounting services. The fair value of our stock options issued to employees was estimated using a Black-Scholes option-pricing model. The fair value of the stock options was estimated assuming no expected dividends and the following weighted-average assumptions: Expected life (in years...

-

Page 62

... fair values as of the acquisition date. The following represents the final allocation of the purchase price (table in thousands): Current assets Property, plant and equipment Other long-term assets Goodwill Intangible assets: Developed technology (weighted-average useful life of 4.4 years) Customer...

-

Page 63

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) and accounting services. The fair value of our stock options issued to employees was estimated using a Black-Scholes option-pricing model. The fair value of the stock options was estimated assuming no ...

-

Page 64

... of fees paid for financial advisory, legal and accounting services. The fair value of our stock options issued to employees was estimated using a Black-Scholes option-pricing model. The fair value of the stock options was estimated assuming no expected dividends and the following weighted-average...

-

Page 65

... of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) completion of each in-process project was estimated to determine the discount rate to be applied to the valuation of the in-process technology. Based upon the level of completion and the risk associated with in...

-

Page 66

58

-

Page 67

... 31, 2006

Information Storage

Content Management and Archiving

VMware Virtual Infrastructure

RSA Information Security

Total

Balance, beginning of the year Goodwill acquired Tax deduction from exercise of stock options Finalization of purchase price allocations Reduction in income tax valuation...

-

Page 68

Workforce reductions Asset impairment Consolidation of excess facilities Contractual and other obligations Total

$

129,369 $ 29,659 5,698 10,925 175,651 $

(1,549) $ (29,659) (162) (6,111) (37,481) $

127,820 $ - 5,536 4,814 138,170 $

10,720 29,659 - - 40,379

$

59

-

Page 69

...exceeded its fair value, measured as the present value of their estimated discounted cash flows. The restructuring programs impacted the Information storage and Content management and archiving segments. The workforce reductions include $10.7 million of non-cash stock-based compensation expense. The...

-

Page 70

... of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 2004 Restructuring Programs The activity for the 2004 restructuring programs for the years ended December 31, 2006, 2005 and 2004 is presented below (tables in thousands):

Adjustments to the Provision During 2006...

-

Page 71

...per Note of the applicable series for each day of that measurement period was less than 98% of the product of the last reported sale price of our common stock and the conversion rate on each such day; (2) during any calendar quarter, if the last reported sale price of our common stock for 20 or more...

-

Page 72

... 55 percent conversion premium based on the closing price of $12.61 per share of our common stock on November 13, 2006. The cost of the Purchased Options and net proceeds from the sale of the Sold Warrants are classified in stockholders' equity. In April 2006, we redeemed the Documentum Notes for...

-

Page 73

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) E. Derivatives At December 31, 2006, the fair value of our foreign currency derivative contracts resulted in both an unrealized gain of $16.7 million classified in other current assets and an unrealized loss ...

-

Page 74

Foreign debt securities Total $

73,075 5,066,431 $

72,094 5,033,084

64

-

Page 75

... loss position are as follows (table in thousands):

Less Than 12 Months 12 Months or Greater Total

Fair Value

Gross Unrealized Losses

Fair Value

Gross Unrealized Losses

Fair Value

Gross Unrealized Losses

U.S. government and agency obligations U.S. corporate debt securities Asset and mortgage...

-

Page 76

Strategic investments in publicly-held companies Strategic investments in privately-held companies

$

7,206 $ 20,112

16,247 $ N/A

7,700 $ 24,524

7,599 N/A

Gross unrealized gains on these investments were $10.1 million and $0.6 million at December 31, 2006 and 2005, respectively. Gross ...

-

Page 77

...from amounts shown on the table due to early customer buyouts, trade-ins or refinancings. We typically sell without recourse our notes receivable and underlying equipment associated with our sales-type leases to third parties. We maintain an allowance for doubtful accounts for the estimated probable...

-

Page 78

... of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) J. Accrued Expenses Accrued expenses consist of (table in thousands):

December 31, 2006

December 31, 2005

Salaries and benefits Product warranties Restructuring (See Note C) Other

$

595,691 242,744 199,538...

-

Page 79

...$ 162,664 $

(16,367) 519,078 $

66,529 313,841

In 2006, we recognized an income tax benefit of $171.8 million from the favorable resolution of income tax audits and expiration of statutes of limitations. Partially offsetting these benefits were non-deductible IPR&D charges of $35.4 million from 67

-

Page 80

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) acquisitions and $73.3 million in non-deductible stock-based compensation expense for options issued as incentive stock options and shares issued under EMC's Employee Stock Purchase Plan. The American Jobs ...

-

Page 81

68

-

Page 82

...also has a defined benefit pension plan. Benefits under these plans are generally based on either career average or final average salaries and creditable years of service as defined in the plans. The annual cost for these plans is determined using the projected unit credit actuarial cost method that...

-

Page 83

... the fair value of the assets of the Pension Plans is as follows (table in thousands):

December 31, 2006

December 31, 2005

Fair value of plan assets, at beginning of year Actual return on plan assets Employer contributions Foreign exchange gain Benefits paid Settlement payments Fair value of plan...

-

Page 84

Accumulated actuarial loss Tax benefit Net amount reclassified

$

100,535 (37,701) 62,834

$

70

-

Page 85

... weighted-average assumptions used in the Pension Plans to determine periodic benefit cost for the years ended December 31 are as follows:

December 31, 2005

December 31, 2006

December 31, 2004

Discount rate Expected long-term rate of return on plan assets Rate of compensation increase

5.7% 8.25...

-

Page 86

Years 2012 - 2016 71

104,700

-

Page 87

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Post Retirement Medical and Life Insurance Plan Our post retirement benefit plan, which was assumed in connection with the acquisition of Data General, provides certain medical and life insurance benefits for...

-

Page 88

72

-

Page 89

... year-end post retirement obligation

$

6 $ 106

(5) (99)

The expected long-term rate of return on plan assets considers the current level of expected returns on risk free investments (primarily government bonds), the historical level of the risk premium associated with the other asset classes in...

-

Page 90

Equity securities Debt securities Cash Total

71% 26 3 100%

68% 27 5 100%

73

-

Page 91

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The target allocation of the assets in the plan as of December 31, 2006 was 70% equity securities and 30% debt securities. The plan assets are managed by outside investment managers. Our investment strategy ...

-

Page 92

... Under some of these agreements, we have agreed to indemnify the supplier for certain claims that may be brought against such party with respect to our acts or omissions relating to the supplied products or technologies. We have agreed to indemnify the directors and executive officers of EMC and our...

-

Page 93

... of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) N. Stockholders' Equity Net Income Per Share The reconciliation from basic to diluted earnings per share for both the numerators and denominators is as follows (table in thousands):

2006 2005 2004

Numerator: Net...

-

Page 94

76

-

Page 95

... of stock options, stock appreciation rights, restricted stock and restricted stock units. The exercise price for a stock option shall not be less than 100% of the fair market value of our common stock on the date of grant. Options generally become exercisable in annual installments over a period of...

-

Page 96

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Employee Stock Purchase Plan Under our 1989 Employee Stock Purchase Plan (the "1989 Plan"), eligible employees may purchase shares of common stock through payroll deductions at the lower of 85% of the fair ...

-

Page 97

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Summarized information about stock options outstanding that are expected to vest and stock options exercisable at December 31, 2006 is as follows (options and intrinsic values in thousands):

Options ...

-

Page 98

...with our employee stock purchase plan. The restructuring charges represent FAS No. 123R expense associated with our 2006 restructuring program. See Note C for more information. In connection with the adoption of FAS No. 123R, we recorded a cumulative effect adjustment to recognize compensation costs...

-

Page 99

... stock, restricted stock units and options under our employee stock purchase plan was $563.7 million. Approximately 85% of our employees have received grants through these equity compensation programs. This non-cash expense will be recognized through 2011 with a weighted average remaining period...

-

Page 100

.... 25 and related interpretations in accounting for our stock-based compensation plans. The following is a reconciliation of net income per weighted average share had we adopted the fair value recognition provisions of FAS No. 123 in 2005 and 2004 (table in thousands, except per share amounts):

2005...

-

Page 101

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The fair value of each option granted during 2006, 2005 and 2004 is estimated on the date of grant using the Black-Scholes option-pricing model with the following weighted average assumptions:

For the Year ...

-

Page 102

From time to time, we make strategic investments in privately-held companies that develop software, hardware and other technologies or provide services supporting our technologies. We may purchase from or make sales to these organizations. 82

-

Page 103

...prior period presentations to be consistent with our current segments. Our management measures are designed to assess segment operating performance. As a result, the corporate reconciling items are used to capture stock-based compensation expense and acquisition related intangible asset amortization...

-

Page 104

Gross profit percentage

50.0%

72.5%

91.7%

-

-

51.2%

83

-

Page 105

...

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Our revenues are attributed to the geographic areas according to the location of the customers. Revenues by geographic area are included in the following table (table in thousands):

2006 2005 2004

United States Europe...

-

Page 106

...of December 31, 2006, our management excluded the evaluation of the disclosure controls and procedures of RSA, which was acquired by EMC on September 15, 2006. See Note B to the Consolidated Financial Statements (Business Acquisitions, Goodwill and Intangible Assets) under Item 8 for a discussion of...

-

Page 107

Table of Contents

PART III STOCK PRICE PERFORMANCE GRAPH

2001

2002

2003

2004

2005

2006

EMC S&P 500 Index S&P 500 Information Technology Sector Index

Source: Returns were derived from Thomson Financial

$ $ $

100.00 $ 100.00 $ 100.00 $

45.68 $ 76.63 $ 62.42 $

96.13 $ 96.85 $ 91.48 $

110....

-

Page 108

... by reference to the Proxy Statement. Also see "Executive Officers of the Registrant" in Part I of this Annual Report on Form 10-K. We have a code of ethics that applies to all of our employees and non-employee directors. This code (available on our website) satisfies the requirements set forth...

-

Page 109

...the undersigned, thereunto duly authorized on February 27, 2007. EMC CORPORATION By: /S/ JOSEPH M. TUCCI

Joseph M. Tucci Chairman, President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on...

-

Page 110

.... (5) EMC Corporation Executive Deferred Compensation Retirement Plan, as amended. (filed herewith) EMC Corporation Executive Incentive Bonus Plan. (6) Form of Severance Agreement for the Named Executive Officers. (7) Form of Stock Option Agreement under the EMC Corporation 2003 Stock Plan. (8) Form...

-

Page 111

Table of Contents

EMC CORPORATION AND SUBSIDIARIES SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS (in thousands) Allowance for Bad Debts Charged to Selling, General and Administrative Expenses

Allowance for Bad Debts Description Year ended December 31, 2006 allowance for doubtful accounts Year ...

-

Page 112

Exhibit 10.6

EMC CORPORATION EXECUTIVE DEFERRED COMPENSATION RETIREMENT PLAN, as amended December 5, 2005 effective for amounts earned and vested after December 31, 2004

-

Page 113

... below) has adopted the Plan (as defined below) to provide a competitive level of retirement benefits to certain designated employees and directors of the Company or any of its Subsidiaries by allowing them to defer receipt of designated percentages of their Compensation (as defined below) and...

-

Page 114

... of highly compensated or managerial employees of the Company or any of its Subsidiaries. 2.10. "Company Stock" means the Company's common stock, par value $.01 per share. 2.11. "Compensation" means any cash bonuses, restricted stock units ("RSUs"), and directors' fees payable from time to time by...

-

Page 115

... or both. An employee is treated as an Eligible Employee as of the date the employee is notified of his or her eligibility. 2.17. "Eligible Director" means any member of the Board. 2.18. "ERISA" means the Employee Retirement Income Security Act of 1974, as amended from time to time. Reference to any...

-

Page 116

... his or her Account. Article 4. DEFERRALS AND CREDITS 4.1. Elective Deferrals (a) Initial election to defer. An Elective Deferral Eligible Employee or Eligible Director may make an initial election to defer a designated portion of his or her Compensation to be earned during a Plan Year, by filing an...

-

Page 117

...to be deferred for the applicable Plan Year is to be paid (e.g., upon Retirement or Resignation of Service, upon a fixed distribution date pursuant to Section 6.2, or upon a Change of Control) and the method of payment (e.g., in a single lump sum payment, in a number of annual installments or in any...

-

Page 118

...thirty (30) days or at such other times or as frequently as the Administrator may prescribe. Each Participant's Account shall be adjusted from time to time (at least quarterly) to reflect the fair market value that would be ascribed to the Account if the amounts credited to the Account were actually...

-

Page 119

...to comply with any term set forth in the Company's Key Employee Agreement (irrespective of whether the Participant is a party to the Key Employee Agreement), (f) engaged in any activity that results in termination of the Participant's employment for cause, (g) violated any rule, policy, procedure or...

-

Page 120

..., that such fixed distribution date shall not be earlier than the third anniversary of the last day of the Plan Year in which such Compensation was deferred. Any lump sum or installment distributions shall be paid in cash or, in the case of Compensation payable in Company stock, in Company Stock. If...

-

Page 121

... or death. Any lump sum or installment distributions shall be paid in cash or, in the case of Compensation payable in Company Stock, in Company Stock. 6.3. Payment Upon Termination of Employment or Service as a Director Other than by Retirement or Resignation of Service. In the event a Participant...

-

Page 122

... terms of the Plan or a timely election made under the terms of the Plan. However, in cases of extreme financial hardship, the Administrator may authorize (on a nondiscriminatory basis and taking into account other resources of the Participant) a hardship distribution to be made 7 days following...

-

Page 123

...'s Account attributable to Compensation earned by the Participant as an employee of the Company or any of its Subsidiaries shall be paid in accordance with the applicable provisions of this Article 6 relating to the termination of such Participant's employment by reason of Retirement, Disability...

-

Page 124

... and other services, as it may deem necessary or appropriate in carrying out the provisions of the Plan and its duties hereunder. 7.2. Claims Procedure. (a) In general. If any person believes he or she has been denied any rights or benefits under the Plan, such person may file a claim in writing...

-

Page 125

... rights or benefits due on Disability under the Plan, such person may file a claim in writing with the Administrator. If any such claim is wholly or partially denied, the Administrator will notify such person of its decision in writing. Such notification will be given within 45 days after the claim...

-

Page 126

... and amounts paid in settlement of any claims approved in writing by the Company) arising out of or relating to any act or omission to act in connection with the Plan, if such act or omission is in good faith. Such benefit will be provided through insurance if necessary to comply with Code section...

-

Page 127

.... 9.4. No Employment or Service Continuation Rights. Neither the adoption or the establishment and maintenance of the Plan, the participation in the Plan nor any action of the Company, any Subsidiary or the Administrator, shall be held or construed to confer upon any employee or director of the...

-

Page 128

employment or service with the Company or any of its Subsidiaries, as the case may be, nor does it interfere in any way with the right of the Company or any of its Subsidiaries to terminate the services of any of its employees or directors at any time. Each of the Company and its Subsidiaries ...

-

Page 129

... trust, associated with the administration or operation of the Plan shall be paid by the Company from its general assets unless, in the sole discretion of the Administrator, the Administrator elects to charge such expenses against the appropriate Participant's Account or Participants' Accounts. Any...

-

Page 130

Exhibit 12.1 EMC CORPORATION STATEMENT REGARDING COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

Year Ended December 31, 2006 2005 2004 2003 2002

Computation of Earnings: Pre-tax income (loss) Fixed charges Total earnings Computation of Fixed Charges: Interest expense Estimate of interest within ...

-

Page 131

Exhibit 21.1 Significant Subsidiaries The Corporation owns 100% of the voting securities of each subsidiary listed below.

Name State of Jurisdiction of Organization

EMC (Benelux) B.V., S.a.r.l. EMC Global Holdings Company RSA Security Inc. VMware, Inc.

Luxembourg Massachusetts Delaware Delaware

-

Page 132

...-137472, 333-138861, and 333-139282) of EMC Corporation of our report dated February 27, 2007 relating to the financial statements, financial statement schedule, management's assessment of the effectiveness of internal control over financial reporting and the effectiveness of internal control over...

-

Page 133

... Joseph M. Tucci, Chairman, President and Chief Executive Officer of EMC Corporation (the "Registrant"), certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of the Registrant; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state...

-

Page 134

... I. Goulden, Executive Vice President and Chief Financial Officer of EMC Corporation (the "Registrant"), certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of the Registrant; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state...

-

Page 135

... filed with the Securities and Exchange Commission on the date hereof (the "Report"), fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and The information contained in the Report fairly presents, in all material respects, the financial condition...

-

Page 136

... Executive Vice President and Chief Financial Officer February 27, 2007 This certification accompanies this Report pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not be deemed filed by the Company for purposes of Section 18 of the Securities Exchange Act of 1934, as amended...