Comerica 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Comerica annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comerica

Incorporated

2010

Annual

Report

When our customers succeed, so do we.

SM

LLECTIVE

Success

Table of contents

-

Page 1

LLECTIVE Success SM Comerica Incorporated 2010 Annual Report When our customers succeed, so do we. -

Page 2

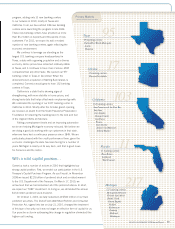

... company headquartered in Dallas, Texas, and strategically aligned by three business segments: The Business Bank, The Retail Bank, and Wealth & Institutional Management. Comerica focuses on relationships, and helping people and businesses be successful. In addition to Texas, Comerica Bank locations... -

Page 3

... 17 134 (118) Per Share Of Common Stock Diluted net income (loss) ...Cash dividends declared ...Common shareholders' equity ...Market value ...Average common shares outstanding - diluted ...0.88 0.25 32.82 42.24 173 (0.79) 0.20 32.27 29.57 149 Ratios Return on average assets ...Return on average... -

Page 4

...market companies, and where we can leverage our personal banking and wealth management services. In light of the current economy, we slowed our banking center expansion * Based on June 10, 2010 FDIC data On January 18, 2011, we announced plans to acquire Sterling Bancshares, Inc., of Houston, Texas... -

Page 5

... the nation. California 103 banking centers San Francisco & the East Bay San Jose Los Angeles Orange County San Diego Fresno Sacramento Santa Cruz/Monterey Inland Empire Florida 11 217 Comerica Incorporated 2010 Annual Report With a solid capital position...Comerica took a number of actions in... -

Page 6

... added 13 new banking centers in 2010. We believe our core fundamentals will continue to show improvement in 2011. Continued improvement in ï¬nancial performance...Comerica's 2010 ï¬nancial performance was highlighted by our strong credit performance relative to our peers, solid customer deposit... -

Page 7

... our employees raised more than $2.1 million for the United Way and Black United Fund, and they donated their personal time and talents with some 60,000 volunteer hours in 2010. In December 2010, the Federal Reserve Bank of Dallas rated Comerica Bank's Community Reinvestment Act program "Outstanding... -

Page 8

... growth plans. Several strategic acquisitions later, AirBorn has seen its revenue double every five years, while expanding its facilities around the globe. Georgetown, TX 1 How did Lone Star help build low-income communities when the economy fell apart? When you're in the business of investing in... -

Page 9

... Guitar Salon's unique needs. By immersing ourselves in their business, we developed the right ensemble of credit, cash management and international trade services that helped Guitar Salon strengthen its position in a weakened economy. Santa Monica, CA Comerica Incorporated 2010 Annual Report 07 -

Page 10

... thing Plum Market needed was a bank willing to take a chance on a "budding" upstart. At Comerica, we saw a management team ripe with experience and a business model plump with potential. In no time, we developed a flexible financing structure that has allowed Plum Market to stay private and grow... -

Page 11

..., ASI turned to their long-term partner Comerica to assist them in weathering the economic challenges. In the face of a tight credit market and slowing sales, we worked hand-in-hand with ASI to help find efficiencies, tighten processes, and develop a plan that ensure their access to capital. 10... -

Page 12

... Leadership Team Ralph W. Babb Jr. Chaifman and Chief Executive Ofï¬cef Curtis C. Farmer Executive Vice Pfesident Retail Bank and Wealth & Institutional Management Charles L. Gummer Executive Vice Pfesident and Chaifman, Comefica Bank - Texas Mafket Lars C. Anderson Vice Chaifman The Business... -

Page 13

... REVIEW AND REPORTS Comerica Incorporated and Subsidiaries Performance Graph ...Financial Results and Key Corporate Initiatives ...Overview ...Strategic Lines of Business ...Balance Sheet and Capital Funds Analysis ...Risk Management ...The Dodd-Frank Wall Street Reform and Consumer Protection Act... -

Page 14

... $100 Invested on 12/31/05 and Reinvestment of Dividends) $140 $120 $100 $80 $60 $40 $20 $0 Comerica Incorporated Keefe Bank Index S&P 500 Index 2005 Comerica Incorporated Keefe Bank Index S&P 500 Index $100 $100 $100 2006 108 117 116 2007 84 91 122 2008 41 48 77 2009 62 47 97 2010 89 58... -

Page 15

... Diluted earnings per common share: Income (loss) from continuing operations Net income (loss) Cash dividends declared Common shareholders' equity Market value Average diluted shares (in millions) YEAR-END BALANCES Total assets Total earning assets Total loans Total deposits Total medium and long... -

Page 16

... recovering economic environment as well as expected runoff in the Commercial Real Estate business line. • Average core deposits increased $3.4 billion, or 10 percent, in 2010, compared to 2009. The increase in average core deposits reflected increases in average money market and NOW deposits of... -

Page 17

.... Sterling is a Houston-based bank holding company with total assets of $5.2 billion at December 31, 2010, which operates banking centers in Houston, San Antonio, Fort Worth and Dallas, Texas. OVERVIEW Comerica Incorporated (the Corporation) is a financial holding company headquartered in Dallas... -

Page 18

...-year 2010, based on a continuation of modest growth in the economy. This outlook does not include any impact from the pending acquisition of Sterling Bancshares, Inc. • A low single-digit decrease in average loans. Excluding the Commercial Real Estate business line, a low single-digit increase... -

Page 19

... short-term investments Total earning assets Cash and due from banks Allowance for loan losses Accrued income and other assets Total assets $ 3,191 8 126 2 51,004 1,858 825 (1,019) 4,743 55,553 Money market and NOW deposits $ 16,355 51 0.31 $ 12,965 63 0.49 $ 14,245 207 1.45 Savings deposits 1,394... -

Page 20

...: Interest-bearing deposits: Money market and NOW accounts Savings deposits Customer certificates of deposit Other time deposits Foreign office time deposits Total interest-bearing deposits Short-term borrowings Medium- and long-term debt Total interest expense Net interest income (FTE) 2010 / 2009... -

Page 21

... in "interest-bearing deposits with banks" on the consolidated balance sheets. The Corporation implements various asset and liability management strategies to manage net interest income exposure to interest rate risk. Refer to the "Interest Rate Risk" section of this financial review for additional... -

Page 22

... business line includes Energy Lending, Leasing, Technology and Life Sciences, Mortgage Banker Finance, Entertainment Lending and the Financial Services Division. The $114 million decrease in net loan charge-offs in the Commercial Real Estate business line reflected decreases in all markets... -

Page 23

... acquisition of Sterling Bancshares, Inc. NONINTEREST INCOME (in millions) Years Ended December 31 Service charges on deposit accounts Fiduciary income Commercial lending fees Letter of credit fees Card fees Foreign exchange income Bank-owned life insurance Brokerage fees Net securities gains Other... -

Page 24

...'s officers is invested in stocks and bonds to reflect the investment selections of the officers. Income (loss) earned on these assets is reported in noninterest income and the offsetting increase (decrease) in the liability is reported in salaries expense. Management expects a low single-digit... -

Page 25

... an increase in defined benefit pension expense driven by a decrease in the discount rate. For a further discussion of defined benefit pension expense, refer to the "Critical Accounting Policies" section of this financial review and Note 18 to the consolidated financial statements. Net occupancy and... -

Page 26

...the repurchase of auction-rate securities, refer to "Investment Securities Available-for-Sale" in the "Balance Sheet and Capital Funds Analysis" section and "Critical Accounting Policies" section of this financial review and Note 4 to the consolidated financial statements. Other noninterest expenses... -

Page 27

... were allocated between the preferred stock and the related warrant based on relative fair value, which resulted in an original discount to the preferred stock of $124 million, which was accreted on a level yield basis and recognized as additional preferred stock dividends. In 2010, the Corporation... -

Page 28

... Real Estate, Global Corporate Banking and Middle Market business lines. Noninterest income of $303 million in 2010 increased $12 million from 2009, primarily due to increases in commercial lending fees ($15 million), letter of credit fees ($7 million), card fees ($6 million), and foreign exchange... -

Page 29

... for the long-term value of deposits based upon their assumed lives. The three major business segments pay the Finance Division for funding based on the repricing and term characteristics of their loans. The reduction in loan volume from 2009 to 2010 resulted in less income to the Finance Division... -

Page 30

... the Middle Market, Leasing, Commercial Real Estate and Small Business Banking business lines. Noninterest income of $397 million in 2010 decreased $37 million from 2009, primarily due to decreases in service charges on deposit accounts ($13 million), fiduciary income ($9 million) and brokerage fees... -

Page 31

... in the Commercial Real Estate business line was more than offset by decreases in the Specialty Businesses, Middle Market and Small Business Banking business lines. Noninterest income of $91 million in 2010 increased $5 million from 2009, primarily due to an increase in commercial lending fees of... -

Page 32

... Division and Other category discussions under the "Business Segments" heading above. The following table lists the Corporation's banking centers by geographic market segment. December 31 Midwest (Michigan) Western: California Arizona Texas Florida International Total 2010 217 103 17 120 95 11 1 444... -

Page 33

... Other corporate debt securities 26 Equity and other non-debt securities: Auction-rate preferred securities 570 Money market and other mutual funds 84 Total investment securities available-for-sale $ 7,560 Commercial loans $ 22,145 Real estate construction loans: Commercial Real Estate business line... -

Page 34

... International loans 1,222 1,533 (311) (20) Total loans $ 40,517 $ 46,162 $ (5,645) (12) % Average Loans By Business Line: Middle Market $ 12,074 $ 13,932 $ (1,858) (13) % Commercial Real Estate 5,218 6,437 (1,219) (19) Global Corporate Banking 4,562 6,006 (1,444) (24) National Dealer Services 3,459... -

Page 35

... of the "Risk Management" section of this financial review. Based on a continuation of modest growth in the economy, management expects a low single-digit decrease in average loans for full-year 2011, compared to full-year 2010. Excluding the Commercial Real Estate business line, management expects... -

Page 36

... State and municipal securities (b) Corporate debt securities: Auction-rate debt securities Other corporate debt securities 26 Equity and other non-debt securities: Auction-rate preferred securities (c) Money market and other mutual funds (d) Total investment securities available-for-sale $ 157... -

Page 37

...31 Mexico Government and Official Institutions $ Banks and Other Financial Institutions $ Commercial and Industrial $ 645 681 883 Total $ 645 681 883 2010 2009 2008 - - International assets are subject to general risks inherent in the conduct of business in foreign countries, including economic... -

Page 38

... of purchased funds. The Corporation participated in the Transaction Account Guarantee Program (TAGP) from its inception in October 2008 through June 30, 2010. During that time, the FDIC provided unlimited deposit insurance protection on noninterest-bearing transaction accounts (as defined by the... -

Page 39

...the change in accumulated other comprehensive income (loss) is provided in Note 15 to the consolidated financial statements. In July 2010, the Financial Reform Act was signed into law, which prohibits holding companies with more than $15 billion in assets from including trust preferred securities in... -

Page 40

... by the Chief Credit Officer and approves recommendations to address credit risk matters through credit policy, credit risk management practices, and required credit risk actions. In order to facilitate the corporate credit risk management process, various other corporate functions provide the... -

Page 41

... reporting on portfolio credit risks, continuous assessment and verification of risk rating models, quarterly calculation of the allowance for loan losses and the allowance for credit losses on lending-related commitments and calculation of economic credit risk capital. The Special Assets Group... -

Page 42

... 31 Balance at beginning of year Loan charge-offs: Domestic Commercial Real estate construction: Commercial Real Estate business line (a) Other business lines (b) Total real estate construction Commercial mortgage: Commercial Real Estate business line (a) Other business lines (b) Total commercial... -

Page 43

...for loan losses consisted of decreases in the Commercial Real Estate (primarily the Western market), Middle Market (primarily the Midwest market) and Global Corporate Banking business lines, partially offset by an increase in industry specific allowances for customers in the Private Banking business... -

Page 44

... Allocated Allocated Allocated Allocated Allowance Ratio (a) % (b) Allowance % (b) Allowance % (b) Allowance % (b) Allowance % (b) 2010 2.24 % 80 1.6 x 2009 2.34 % 83 1.1 x 2008 1.52 % 84 1.6 x Business loans Commercial $ Real estate construction Commercial mortgage Lease financing International... -

Page 45

... lending-related commitments. SUMMARY OF NONPERFORMING ASSETS AND PAST DUE LOANS (dollar amounts in millions) December 31 2010 Nonaccrual loans: Business loans: Commercial $ 252 Real estate construction: Commercial Real Estate business line (a) 259 Other business lines (b) 4 Total real estate... -

Page 46

... residential real estate developments), partially offset by an increase in commercial mortgage loans ($164 million). Nonperforming assets as a percentage of total loans and foreclosed property was 3.06 percent at both December 31, 2010 and 2009. The following table presents a summary of changes in... -

Page 47

...in the Commercial Real Estate and Middle Market business lines, respectively. In 2010, the Corporation sold $144 million of nonaccrual business loans at prices approximating carrying value plus reserves, which were primarily from the Commercial Real Estate and Global Corporate Banking business lines... -

Page 48

... commercial mortgage loans (within the Middle Market and Small Business Banking business lines) at December 31, 2010. At December 31, 2009, troubled debt restructurings totaled $34 million, including $11 million performing restructured loans, $7 million nonaccrual loans and $16 million reduced-rate... -

Page 49

...foreclosed properties with balances greater than $2 million at December 31, 2010, $46 million were from the Commercial Real Estate business line and $15 million were from the Middle Market business line. At December 31, 2010, there were two foreclosed properties with carrying values greater than $10... -

Page 50

...The Corporation limits risk inherent in its commercial real estate lending activities by limiting exposure to those borrowers directly involved in the commercial real estate markets and adhering to conservative policies on loan-to-value ratios for such loans. Commercial real estate loans, consisting... -

Page 51

... late 2008 in the Western, Florida and Midwest markets proved extremely difficult for many of the smaller residential real estate developers. Of the $1.8 billion of real estate construction loans in the Commercial Real Estate business line, $259 million were on nonaccrual status at December 31, 2010... -

Page 52

... risk within the portfolio. The following table reflects real estate construction and commercial mortgage loans to borrowers in the Commercial Real Estate business line by project type and location of property. December 31, 2010 Location of Property Other % of Western Michigan Texas Florida Markets... -

Page 53

...based estimates by major metropolitan area, resulting in an increased allowance allocated for residential real estate loans when home values decline. Additionally, to mitigate increasing credit exposure due to depreciating home values, the Corporation periodically reviews home equity lines of credit... -

Page 54

... review market and liquidity risk management strategies and consists of executive and senior management from various areas of the Corporation, including finance, economics, lending, deposit gathering and risk management. The Corporation's Treasury Department supports the Asset and Liability Policy... -

Page 55

...a longer term view of the interest rate risk position. The economic value of equity analysis begins with an estimate of the economic value of the financial assets and liabilities on the Corporation's balance sheet, derived through discounting cash flows based on actual rates at the end of the period... -

Page 56

... 31, 2010. The change in the sensitivity of the economic value of equity to a 200 basis point parallel increase in rates between December 31, 2009 and December 31, 2010 was primarily driven by core deposit growth and lower shareholders' equity levels due to the redemption of preferred stock. LOAN... -

Page 57

... interest rate and foreign currency risks associated with specific assets and liabilities (e.g., customer loans or deposits denominated in foreign currencies). Such instruments may include interest rate caps and floors, total return swaps, foreign exchange forward contracts and foreign exchange swap... -

Page 58

... earning assets, commitments to fund indirect private equity and venture capital investments, unused commitments to extend credit, standby letters of credit and financial guarantees, and commercial letters of credit. The following commercial commitments table summarizes the Corporation's commercial... -

Page 59

... certificates of deposits and securities sold under agreements to repurchase. In addition, the Corporation is a member of the FHLB of Dallas, Texas, which provides short- and long-term funding to its members through advances collateralized by real estate-related assets. The actual borrowing capacity... -

Page 60

... valuation of stock options and restricted stock, refer to the "Critical Accounting Policies" section of this financial review. Nonmarketable Equity Securities At December 31, 2010, the Corporation had a $47 million portfolio of investments in indirect private equity and venture capital funds, with... -

Page 61

... may expose the Corporation to compliance risk include, but are not limited to, those dealing with the prevention of money laundering, privacy and data protection, community reinvestment initiatives, fair lending challenges resulting from the Corporation's expansion of its banking center network and... -

Page 62

... their holding company. Directly impacts client-driven energy derivatives business (approximately $1 million in annual revenue, based on full-year 2010 estimates). Interchange Fee: Limits debit card transaction processing fees that card issuers can charge to merchants. Based on the options currently... -

Page 63

...evaluated impaired loan, an estimate of the amounts and timing of expected future cash flows, an estimate of the value of collateral, including the fair value of assets with few transactions (e.g., residential real estate developments and nonmarketable securities), many of which may be stressed, and... -

Page 64

... reserve factors consistent with business loans. In general, the probability of draw for letters of credit is considered certain for all letters of credit supporting loans and for letters of credit assigned an internal risk rating generally consistent with regulatory defined substandard or doubtful... -

Page 65

... basis included primarily auction-rate securities at December 31, 2010. Additionally, from time to time, the Corporation may be required to record at fair value other financial assets or liabilities on a nonrecurring basis. Note 3 to the consolidated financial statements includes information about... -

Page 66

... financial statements for further discussion of share-based compensation expense. Nonmarketable Equity Securities At December 31, 2010, the Corporation had a $47 million portfolio of investments in indirect private equity and venture capital investments, with commitments of $21 million to fund... -

Page 67

...robust secondary auction-rate securities market with active fair value indications, fair value at December 31, 2010 was determined using an income approach based on a discounted cash flow model utilizing two significant assumptions in the model: discount rate (including a liquidity risk premium) and... -

Page 68

... income approach, estimated future cash flows (derived from internal forecasts and economic expectations for each reporting unit) and terminal value (value at the end of the cash flow period, based on price multiples) were discounted. The discount rate was based on the imputed cost of equity capital... -

Page 69

... actual fair market value of plan assets over the long term. The Employee Benefits Committee, which consists of executive and senior managers from various areas of the Corporation, provides broad asset allocation guidelines to the asset managers, who report results and investment strategy quarterly... -

Page 70

... future, and are included in "accrued income and other assets" or "accrued expenses and other liabilities" on the consolidated balance sheets. The Corporation assesses the relative risks and merits of tax positions for various transactions after considering statutes, regulations, judicial precedent... -

Page 71

...Capital Ratio: Tier 1 capital (b) Less: Fixed rate cumulative perpetual preferred stock Trust preferred securities Tier 1 common capital Risk-weighted assets (b) Tier 1 common capital ratio Tangible Common Equity Ratio: Total shareholders' equity Less: Fixed rate cumulative perpetual preferred stock... -

Page 72

...qualifying trust preferred securities from Tier 1 capital as defined by and calculated in conformity with bank regulations. The tangible common equity ratio removes preferred stock and the effect of intangible assets from capital and the effect of intangible assets from total assets. The Corporation... -

Page 73

... develop, market and deliver new products and services; • operational difficulties or information security problems could adversely affect the Corporation's business and operations; • changes in the financial markets, including fluctuations in interest rates and their impact on deposit pricing... -

Page 74

... BALANCE SHEETS Comerica Incorporated and Subsidiaries (in millions, except share data) December 31 ASSETS Cash and due from banks Interest-bearing deposits with banks Other short-term investments Investment securities available-for-sale Commercial loans Real estate construction loans Commercial... -

Page 75

... INCOME Service charges on deposit accounts Fiduciary income Commercial lending fees Letter of credit fees Card fees Foreign exchange income Bank-owned life insurance Brokerage fees Net securities gains Other noninterest income Total noninterest income NONINTEREST EXPENSES Salaries Employee benefits... -

Page 76

...common stock Redemption of preferred stock Redemption discount accretion on preferred stock Accretion of discount on preferred stock Net issuance of common stock under employee stock plans Share-based compensation Other BALANCE AT DECEMBER 31, 2010 $ Common Stock Nonredeemable Preferred Shares Stock... -

Page 77

... Federal Home Loan Bank stock Net decrease (increase) in loans Proceeds from early termination of leveraged leases Net increase in fixed assets Net decrease in customers' liability on acceptances outstanding Proceeds from sale of business Net cash provided by (used in) investing activities FINANCING... -

Page 78

... funds, private equity funds and mutual funds. The deferral is also applicable to a reporting enterprise's interest in an entity that is required to comply with or operates in accordance with requirements similar to those in Rule 2a-7 of the Investment Company Act of 1940 for registered money market... -

Page 79

... be measured at fair value. Fair value is defined as the exchange price that would be received to sell an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction (i.e., not a forced transaction, such as a liquidation or... -

Page 80

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries Trading securities are carried at market value. Realized and unrealized gains or losses on trading securities are included in "other noninterest income" on the consolidated statements of income. Loans held-for-sale, ... -

Page 81

... and retail loans. The Corporation defines business loans as those belonging to the commercial, real estate construction, commercial mortgage, lease financing and international loan portfolios. Retail loans consist of traditional residential mortgage, home equity and other consumer loans. A loan is... -

Page 82

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries Loans which do not meet the criteria to be evaluated individually are evaluated in homogeneous pools of loans with similar risk characteristics. Internal risk ratings are assigned to each business loan at the time of ... -

Page 83

... reserve factors consistent with business loans. In general, the probability of draw for letters of credit is considered certain for all letters of credit supporting loans and for letters of credit assigned an internal risk rating generally consistent with regulatory defined substandard or doubtful... -

Page 84

... income approach, estimated future cash flows (derived from internal forecasts and economic expectations for each reporting unit) and terminal value (value at the end of the cash flow period, based on price multiples) were discounted. The discount rate was based on the imputed cost of equity capital... -

Page 85

... the Corporation is required to hold for various reasons and consist primarily of Federal Home Loan Bank of Dallas (FHLB) and Federal Reserve Bank (FRB) stock. Restricted equity securities, classified in "accrued income and other assets" on the consolidated balance sheets, are not readily marketable... -

Page 86

... Further information on the Corporation's share-based compensation plans is included in Note 17. Defined Benefit Pension and Other Postretirement Costs Defined benefit pension costs are charged to "employee benefits" expense on the consolidated statements of income and are funded consistent with the... -

Page 87

... by the total of weightedaverage number of common shares and common stock equivalents outstanding during the period. Statements of Cash Flows Cash and cash equivalents are defined as those amounts included in "cash and due from banks", "federal funds sold and securities purchased under agreements to... -

Page 88

... headquartered in Houston, Texas, in a stock-for-stock transaction. Sterling operates 57 banking centers located in Houston, San Antonio, Fort Worth and Dallas, Texas. At December 31, 2010, Sterling had $5.2 billion in assets, including $2.8 billion of loans and $1.6 billion of investment securities... -

Page 89

...-counter markets and other securities traded on an active exchange, such as the New York Stock Exchange. Deferred compensation plan liabilities represent the fair value of the obligation to the employee, which corresponds to the fair value of the invested assets. Level 2 trading securities include... -

Page 90

...market price, the Corporation classifies the impaired loan as nonrecurring Level 3. Business loans consist of commercial, real estate construction, commercial mortgage, lease financing and international loans. The estimated fair value for variable rate business loans that reprice frequently is based... -

Page 91

...the use of net asset value, provided the net asset value is calculated by the fund in compliance with fair value measurement guidance applicable to investment companies. Where there is not a readily determinable fair value, the Corporation estimates fair value for indirect private equity and venture... -

Page 92

...CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries The Corporation also holds restricted equity investments, primarily Federal Home Loan Bank (FHLB) and Federal Reserve Bank (FRB) stock. Restricted equity securities are not readily marketable and are recorded at cost (par value... -

Page 93

...-rate debt securities Other corporate debt securities Equity and other non-debt securities: Auction-rate preferred securities Money market and other mutual funds Total investment securities available-for-sale Derivative assets (c): Interest rate contracts Energy derivative contracts Foreign exchange... -

Page 94

...-rate debt securities Other corporate debt securities Equity and other non-debt securities: Auction-rate preferred securities Money market and other mutual funds Total investment securities available-for-sale Derivative assets (c): Interest rate contracts Energy derivative contracts Foreign exchange... -

Page 95

...CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries The following table summarizes the changes in Level 3 assets and liabilities measured at fair value on a recurring basis for the years ended December 31, 2010 and 2009. Net Realized/Unrealized Gains (Losses) Recorded in Balance... -

Page 96

... FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries The following table presents the income statement classification of realized and unrealized gains and losses due to changes in fair value recorded in earnings for the years ended December 31, 2010 and 2009 for recurring Level 3 assets... -

Page 97

... 31, 2010 Loans held-for-sale: Residential mortgage Loans: Commercial Real estate construction Commercial mortgage Residential mortgage Lease financing International Total loans (a) Nonmarketable equity securities (b) Other real estate (c) Loan servicing rights Total assets at fair value Total... -

Page 98

... millions) Assets Cash and due from banks Interest-bearing deposits with banks Loans held-for-sale Total loans, net of allowance for loan losses (a) Customers' liability on acceptances outstanding Nonmarketable equity securities (b) Loan servicing rights (c) Liabilities Demand deposits (noninterest... -

Page 99

... and municipal securities (b) Corporate debt securities: Auction-rate debt securities Other corporate debt securities Equity and other non-debt securities: Auction-rate preferred securities Money market and other mutual funds Total investment securities available-for-sale Fair Value $ 131 6,653... -

Page 100

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries A summary of the Corporation's investment securities available-for-sale in an unrealized loss position as of December 31, 2010 and 2009 follows: Impaired 12 months or more Fair Unrealized Value Losses (in millions) ... -

Page 101

...years through ten years After ten years Subtotal Equity and other nondebt securities: Auction-rate preferred securities Money market and other mutual funds Total investment securities available-for-sale Amortized Cost $ 157 229 136 6,335 6,857 597 84 7,538 $ Fair Value 157 239 139 6,371 6,906 570 84... -

Page 102

...-sale" on the consolidated balance sheets. (b) Changes in fair value recognized in accumulated other comprehensive income (loss). In January 2011, $67 million par value of auction-rate securities were redeemed at par, including $53 million of auction-rate preferred securities and $14 million state... -

Page 103

... loan line items and real estate acquired through foreclosure is included in "accrued income and other assets" on the consolidated balance sheets. (in millions) December 31 2010 2009 Nonaccrual loans: Business loans: Commercial $ 252 $ Real estate construction: Commercial Real Estate business line... -

Page 104

... lines (b) 28 Total commercial mortgage 36 Lease financing International 1 Total business loans 150 Retail loans: Residential mortgage 33 Consumer: Home equity 11 Other consumer 4 Total consumer 15 Total retail loans 48 Total loans $ 198 $ (a) Primarily loans to real estate investors and developers... -

Page 105

... Income Recognized $ 6 1 1 3 6 9 16 1 1 1 $ 17 Business loans: Commercial $ 9 $ 237 Real estate construction: Commercial Real Estate business line (a) 249 Other business lines (b) Total real estate construction 249 Commercial mortgage: Commercial Real Estate business line (a) 178 Other business... -

Page 106

...Doubtful category as defined by regulatory authorities. (e) Primarily loans to real estate investors and developers. (f) Primarily loans secured by owner-occupied real estate. NOTE 6 - SIGNIFICANT GROUP CONCENTRATIONS OF CREDIT RISK Concentrations of credit risk may exist when a number of borrowers... -

Page 107

...Estate business line (a) Other business lines (b) Total commercial mortgage loans Total commercial real estate loans Total unused commitments on commercial real estate loans (a) Primarily loans to real estate investors and developers. (b) Primarily loans secured by owner-occupied real estate. $ 2010... -

Page 108

... course of business, the Corporation enters into various transactions involving derivative and credit-related financial instruments to manage exposure to fluctuations in interest rate, foreign currency and other market risks and to meet the financing needs of customers. These financial instruments... -

Page 109

... FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries Market risk is the potential loss that may result from movements in interest rates, foreign currency exchange rates or energy commodity prices that cause an unfavorable change in the value of a financial instrument. The Corporation manages... -

Page 110

...or issued by the Corporation for both risk management and customer-initiated and other activities are as follows. Interest Rate Swaps Interest rate swaps are agreements in which two parties periodically exchange fixed cash payments for variable payments based on a designated market rate or index, or... -

Page 111

... - cash flow - receive fixed/pay floating $ 800 $ 3 $ - $ 1,700 $ 30 $ Swaps - fair value - receive fixed/pay floating 1,600 263 1,600 194 Total risk management interest rate swaps designated as hedging instruments 2,400 266 3,300 224 Derivatives used as economic hedges Foreign exchange contracts... -

Page 112

...reclassified from accumulated OCI into interest and fees on loans (effective portion) $ 2010 2 1 28 $ 2009 15 (2) 34 Foreign exchange rate risk arises from changes in the value of certain assets and liabilities denominated in foreign currencies. The Corporation employs spot and forward contracts in... -

Page 113

... maturities of assets and funding sources which, in turn, reduce the overall exposure of net interest income to interest rate risk, although there can be no assurance that such strategies will be successful. Customer-Initiated and Other Fee income is earned from entering into various transactions at... -

Page 114

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries CREDIT-RELATED FINANCIAL INSTRUMENTS The Corporation issues off-balance sheet financial instruments in connection with commercial and consumer lending activities. The Corporation's credit risk associated with these ... -

Page 115

... 31, 2010 and 2009. The Corporation manages credit risk through underwriting, periodically reviewing and approving its credit exposures using Board committee approved credit policies and guidelines. December 31 (dollar amounts in millions) 2010 2009 Total watch list standby and commercial letters of... -

Page 116

...recorded as a reduction of income tax expense (or an increase to income tax benefit) and a reduction of federal income taxes payable. These income tax credits and deductions are allocated to the funds' investors based on their ownership percentages. Investment balances, including all legally binding... -

Page 117

... commercial paper, borrowed securities, term federal funds purchased, short-term notes and treasury tax and loan deposits, generally mature within one to 120 days from the transaction date. The following table provides a summary of short-term borrowings. At December 31, 2010, Comerica Bank (the Bank... -

Page 118

...2 capital. Comerica Bank (the Bank), a subsidiary of the Corporation, is a member of the FHLB, which provides short- and long-term funding collateralized by mortgage-related assets to its members. In the third quarter 2010, the Bank early redeemed, without penalty, $2.0 billion of floating-rate FHLB... -

Page 119

... In the first quarter 2010, the Corporation fully redeemed $2.25 billion of Fixed Rate Cumulative Perpetual Preferred Stock (preferred stock) issued in 2008 in connection with the U.S. Department of Treasury (U.S. Treasury) Capital Purchase Program. The redemption was funded by the net proceeds... -

Page 120

... stock reserved for stock option exercises and 1.8 million shares of restricted stock outstanding to employees and directors under share-based compensation plans. In November 2010, the Board of Directors of the Corporation (the Board) authorized the purchase of up to 12.6 million shares of Comerica... -

Page 121

... included in net income Change in net cash flow hedge gains before income taxes Less: Provision for income taxes Change in net cash flow hedge gains, net of tax Balance at end of period, net of tax Accumulated defined benefit pension and other postretirement plans adjustment: Balance at beginning of... -

Page 122

... Preferred stock dividends Redemption discount accretion on preferred stock Income allocated to participating securities Income (loss) from continuing operations attributable to common shares Net income Less: Preferred stock dividends Redemption discount accretion on preferred stock Income allocated... -

Page 123

... been anti-dilutive. NOTE 17 - SHARE-BASED COMPENSATION Share-based compensation expense is charged to "salaries" expense on the consolidated statements of income. The components of share-based compensation expense for all share-based compensation plans and related tax benefits are as follows: (in... -

Page 124

... FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries In the first quarter 2010, the Corporation began providing phantom stock units (PSUs) as a component of compensation for certain executives. The number of PSUs awarded for each pay period is determined by dividing the amount of base salary... -

Page 125

... CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries The aggregate intrinsic value of outstanding options shown in the table above represents the total pretax intrinsic value at December 31, 2010, based on the Corporation's closing stock price of $42.24 at December 31, 2010. The... -

Page 126

... accumulated benefit obligation for postretirement benefit plan. (b) The Corporation recognizes the overfunded and underfunded status of the plans in "accrued income and other assets" and "accrued expenses and other liabilities," respectively, on the consolidated balance sheets. n/a-not applicable... -

Page 127

... FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries The 2009 non-qualified defined benefit pension plan change of $4 million reflected the recognition of special agreement benefits not previously included in plan valuations. The accumulated benefit obligation exceeded the fair value of plan... -

Page 128

... service cost (credit) Amortization of net loss Recognition of special agreement benefits Net periodic defined benefit cost Actual return (loss) on plan assets Actual rate of return (loss) on plan assets Weighted-average assumptions used: Discount rate Expected long-term return on plan assets Rate... -

Page 129

.... Fixed income securities include U.S. Treasury and other U.S. government agency securities, mortgage-backed securities, corporate bonds and notes, municipal bonds, collateralized mortgage obligations and money market funds. Fair Value Measurements The Corporation's qualified defined benefit pension... -

Page 130

...value measurement is based upon the closing price reported on the New York Stock Exchange. Level 1 common stock includes domestic and foreign stock and real estate investment trusts. Level 2 common stock includes American Depositary Receipts. U.S. Treasury and other U.S. government agency securities... -

Page 131

... notes Collective investments and mutual funds Private placements Other assets: Derivatives Total investments at fair value December 31, 2009 Equity securities: Collective investment and mutual funds Common stock Fixed income securities: U.S. Treasury and other U.S. government agency bonds Corporate... -

Page 132

...a portion of base salary until retirement or separation from the Corporation. The employee may direct deferred compensation into one or more deemed investment options. Although not required to do so, the Corporation invests actual funds into the deemed investments as directed by employees, resulting... -

Page 133

... to investments in low income housing partnerships. Tax interest, state and foreign taxes are then added to the federal tax provision. In the ordinary course of business, the Corporation enters into certain transactions that have tax consequences. From time to time, the Internal Revenue Service (IRS... -

Page 134

...CONSOLIDATED FINANCIAL STATEMENTS Comerica Incorporated and Subsidiaries The following tax years for significant jurisdictions remain subject to examination as of December 31, 2010: Jurisdiction Federal California Tax Years 2008-2009 2001-2009 In 2008, the Corporation reassessed the size and timing... -

Page 135

...assets: Allowance for loan losses Deferred loan origination fees and costs Other comprehensive income Foreign tax credit Tax interest Auction-rate securities Other tax credits... transactions Allowance for depreciation Employee benefits Total deferred tax liabilities Net deferred tax asset 2010 ... -

Page 136

... level of customer deposits in the Corporation's banking subsidiaries. The average required reserve balances were $311 million and $290 million for the years ended December 31, 2010 and 2009, respectively. Banking regulations limit the transfer of assets in the form of dividends, loans or advances... -

Page 137

...could have a direct material effect on the Corporation's financial statements. At December 31, 2010 and 2009, the Corporation and its U.S. banking subsidiaries exceeded the ratios required for an institution to be considered "well capitalized" (total risk-based capital, Tier 1 risk-based capital and... -

Page 138

... in the business segments. Operational risk is allocated based on loans and letters of credit, deposit balances, non-earning assets, trust assets under management, certain noninterest income items, and the nature and extent of expenses incurred by business units. Virtually all interest rate risk is... -

Page 139

..., student loans, home equity lines of credit and residential mortgage loans. Wealth & Institutional Management offers products and services consisting of fiduciary services, private banking, retirement services, investment management and advisory services, investment banking and discount securities... -

Page 140

... operations, net of tax Net income (loss) $ Net credit-related charge-offs $ Selected average balances: Assets Loans Deposits Liabilities Attributed equity Statistical data: Return on average assets (a) Return on average attributed equity Net interest margin (b) Efficiency ratio $ 531 $ 105 174 648... -

Page 141

... for loan losses Noninterest income Noninterest expenses Provision (benefit) for income taxes (FTE) Income from discontinued operations, net of tax Net income (loss) Net credit-related charge-offs Selected average balances: Assets Loans Deposits Liabilities Attributed equity Business Bank $ 1,277... -

Page 142

... from discontinued operations, net of tax Net income (loss) Net credit-related charge-offs Selected average balances: Assets Loans Deposits Liabilities Attributed equity Finance & Other International Businesses Midwest Western Texas Florida Other Markets Total $ 816 $ 199 397 751 92 639... -

Page 143

... Net income (loss) Net credit-related charge-offs Selected average balances: Assets Loans Deposits Liabilities Attributed equity Statistical data: Return on average assets (a) Return on average attributed equity Net interest margin (b) Efficiency ratio Midwest Western Texas Florida Other Markets... -

Page 144

... 24 - PARENT COMPANY FINANCIAL STATEMENTS BALANCE SHEETS - COMERICA INCORPORATED (in millions, except share data) December 31 Assets Cash and due from subsidiary bank Short-term investments with subsidiary bank Other short-term investments Investment in subsidiaries, principally banks Premises and... -

Page 145

...income taxes Income (loss) before equity in undistributed earnings of subsidiaries Equity in undistributed earnings (losses) of subsidiaries, principally banks Net income Less: Preferred stock dividends Income allocated to participating securities Net income (loss) attributable to common shares 2010... -

Page 146

... (benefit) for deferred income taxes Excess tax benefits from share-based compensation arrangements Other, net Net cash provided by operating activities Investing Activities Net proceeds from private equity and venture capital investments Net increase in fixed assets Net cash provided by investing... -

Page 147

...2010, the Corporation and the investor group that acquired Munder negotiated a cash settlement of the note receivable for $35 million, which resulted in a $27 million gain ($17 million, after tax), recorded in "income from discontinued operations, net of tax" on the consolidated statements of income... -

Page 148

... loan losses Net securities gains Noninterest income (excluding net securities gains) Noninterest expenses Provision (benefit) for income taxes Income (loss) from continuing operations Income from discontinued operations, net of tax Net income (loss) Less: Preferred stock dividends Income allocated... -

Page 149

...'s Chief Executive Officer and Chief Financial Officer, internal control over financial reporting as it relates to the Corporation's consolidated financial statements presented in conformity with U.S. generally accepted accounting principles as of December 31, 2010. The assessment was based on... -

Page 150

..., effective internal control over financial reporting as of December 31, 2010, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the 2010 consolidated financial statements of Comerica Incorporated and... -

Page 151

...in accordance with the standards of the Public Company Accounting Oversight Board (United States), Comerica Incorporated's internal control over financial reporting as of December 31, 2010, based on criteria established in "Internal Control-Integrated Framework" issued by the Committee of Sponsoring... -

Page 152

... loan losses Net loans Accrued income and other assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Noninterest-bearing deposits Money market and NOW deposits Savings deposits Customer certificates of deposit Total interest-bearing core deposits Other time deposits Foreign office time deposits... -

Page 153

... for loan losses Net interest income after provision for loan losses NONINTEREST INCOME Service charges on deposit accounts Fiduciary income Commercial lending fees Letter of credit fees Card fees Foreign exchange income Bank-owned life insurance Brokerage fees Net securities gains Income from... -

Page 154

... assets (a) Per Common Share Data Book value at year-end Market value at year-end Market value for the year High Low Other Data (share data in millions) Average common shares outstanding - basic Average common shares outstanding - diluted Number of banking centers Number of employees (full-time... -

Page 155

... Comerica may have their dividends deposited into their savings or checking account at any bank that is a member of the National Automated Clearing House (ACH) system. Information describing this service and an authorization form can be requested from the transfer agent shown above. *Dividend yield... -

Page 156

comerica.com Comerica Corporate Headquarters Comerica Bank Tower 1717 Main Street Dallas, Texas 75201 -

Page 157

LLECTIVE Success SM Comerica Incorporated 2010 Annual Report Comerica Incorporated | 2010 Annual Report When our customers succeed, so do we.