Callaway 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Callaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

callaway golf company

Table of contents

-

Page 1

c allaway g o l f c o m pa n y -

Page 2

-

Page 3

Through an unwavering commitment to innovation, Callaway Golf creates products and services designed to make every golfer a better golfer. -

Page 4

... C. Baker senior management Chairman and Chief Executive Officer, Callaway Golf Company Samuel H. Armacost Chairman, SRI International Richard C. Helmstetter Vice Chairman and Senior Executive Vice President Ronald S. Beard Lead Independent Director Partner, Zeughauser Group; Retired Former... -

Page 5

... Independent Counsel Gibson, Dunn & Crutcher LLP Jamboree Center, 4 Park Plaza Irvine, CA 92614 Investor Relations Patrick Burke Callaway Golf Company 2180 Rutherford Road Carlsbad, CA 92008-7328 760.931.1771 [email protected] for more information visit the company's websites: www... -

Page 6

Form 10-K c allaway g o l f co mpa ny 2004 Annual Report For the fiscal year ended December 31, 2004 -

Page 7

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K Â¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Ã'scal year ended December 31, 2004 Commission Ã'le number 1-10962 Callaway Golf Company (Exact name of registrant as ... -

Page 8

..., among others, are trademarks of Callaway Golf Company: Apex Ì Apex Edge Ì Apex Tour Ì Baby Ben Ì Ben Hogan Ì BH Ì BH-5 Ì Big Ben Ì Big Bertha Ì C design Ì C455 Ì CB1 Ì CS-3 Ì CTU 30 Ì Callaway Ì Callaway Golf Ì Callaway Hickory Stick Ì Carnoustie Ì Chevron Device Ì Complete... -

Page 9

CALLAWAY GOLF COMPANY INDEX PART I. Business Properties Legal Proceedings Submission of Matters to a Vote of Security Holders PART II. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion ... -

Page 10

..., the Company licenses its trademarks and service marks in exchange for a royalty fee to third parties for use on products such as golf apparel, golf shoes, watches, luggage and other golf related products such as headwear, travel bags, golf towels and golf umbrellas. The Company's business is... -

Page 11

...group are described below: Drivers and Fairway Woods. This product category includes sales of the Company's drivers and fairway woods, which are sold under the Callaway Golf, Top-Flite and Ben Hogan brands. The Company's drivers and fairway woods are generally made of metal (either titanium or steel... -

Page 12

... also includes royalties from licensing of the Company's trademarks and service marks on products such as golf apparel, golf shoes, watches, luggage and other golf related products including headwear, travel bags, golf towels and golf umbrellas. Product Design and Development Product design at the... -

Page 13

... representatives and in-house sales and customer service representatives who are employees of the Company. The Company maintains a separate sales force for the sale of Top-Flite and Ben Hogan branded products. Like Callaway Golf, the Top-Flite and Ben Hogan golf club, golf ball and accessory sales... -

Page 14

..., Japan, Canada, Korea and Australia. In addition to sales through its subsidiaries, the Company also sells through distributors in over 65 foreign countries, including Singapore, Hong Kong, Taiwan, China, the Philippines, India, South Africa and various countries in South America. Prices of golf... -

Page 15

... golf ball products achieved the number two retail market share in 2004. For both golf clubs and golf balls, the Company generally competes on the basis of technology, quality, performance, customer service and price. For risks relating to competition, see below, ""Certain Factors AÃ...ecting Callaway... -

Page 16

... related products, such as headwear, travel bags, golf towels and golf umbrellas. The Company has a current licensing arrangement with Ashworth, Inc. for a complete line of Callaway Golf men's and women's apparel for distribution in the United States, Canada, Europe, Australia, New Zealand and South... -

Page 17

... Policy'' (""NPIP''). The NPIP sets forth the terms on which the Company chooses to do business with its customers with respect to the introduction of new products. The NPIP has been the subject of several legal challenges. Currently pending cases, described below, include Lundsford v. Callaway Golf... -

Page 18

...has not made any determination that the case may proceed in the form of a class action. The complaint in Murray was Ã'led on May 14, 2004, alleging that a retail golf business was damaged by the alleged refusal of Callaway Golf Sales Company to sell certain products after the store violated the NPIP... -

Page 19

...2004, Callaway Golf Sales Company was served with a complaint captioned York v. Callaway Golf Sales Company, Ã'led in the Circuit Court for Dade County, Florida, Case No. 04-25625 CA 11, asserting a purported class action on behalf of all consumers who purchased allegedly defective HX Red golf balls... -

Page 20

.... Mr. Penicka joined Callaway Golf in 1997 when the Company acquired Odyssey Golf. At Odyssey Golf, Mr. Penicka served as Vice President of Manufacturing, based in Chicago. Prior to entering the golf business, he spent eight years with General Electric Company and six years at Harman International... -

Page 21

..., Product Management for the Company's iron, wedge and putter business from September 2001 to October 2003. Prior to joining the Company, Mr. Melican was with Nike, Inc. in a variety of sales management positions beginning in 1992, including Director of Sales for Nike's Team Sports business unit... -

Page 22

PART II Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities The Company's Common Stock is listed, and principally traded, on the New York Stock Exchange (""NYSE''). The Company's symbol for its Common Stock is ""ELY.'' As of February ... -

Page 23

... to non-executive oÇcer employees and consultants of the Company. Although the 1995 Plan permitted stock option grants to be made at less than the fair market value of the Company's Common Stock on the date of grant, the Company's practice was to generally grant stock options at exercise prices... -

Page 24

...May 28, 2004 forward. During 2004, the Company's gross proÃ't, net income and earnings per common share include the recognition of certain integration charges related to the consolidation of its Callaway Golf and Top-Flite golf ball and golf club manufacturing and research and development operations... -

Page 25

... operations of the Callaway Golf business. The Company has included in this discussion supplemental information which reconciles those non-GAAP Ã'nancial measures to the most directly comparable Ã'nancial measures prepared in accordance with GAAP. Critical Accounting Policies and Estimates The... -

Page 26

... test, the undiscounted cash Ã-ows used to assess impairments, and the fair value of a potentially impaired asset. Changes in assumptions used could have a signiÃ'cant impact on the Company's assessment of recoverability. Warranty The Company has a stated two-year warranty policy for its golf clubs... -

Page 27

... claims well after the two-year stated warranty period. Prior to the third quarter of 2002, the Company's method of estimating both its implicit and explicit warranty obligation was to utilize data and information based on the cumulative failure rate by product after taking into consideration speci... -

Page 28

... of May 28, 2004. The Company acquired FrogTrader to stimulate purchases of new clubs by growing the Trade In! Trade Up! program and to enable the Company to better manage the distribution of pre-owned golf clubs and the Callaway Golf brand. The FrogTrader acquisition was accounted for as a purchase... -

Page 29

... price for the Top-Flite Acquisition from cash on hand. The Company intends to continue the U.S. and foreign operations of the acquired golf assets, including the use of the acquired assets in the manufacturing of golf balls and golf clubs and the commercialization of the Top-Flite and Ben Hogan... -

Page 30

... the Callaway Golf and Top-Flite golf ball and golf club manufacturing and research and development operations. In connection with the consolidation, the Company incurred charges to pre-tax earnings in the amounts of $28.5 million and $24.1 million in 2004 and 2003, respectively. During 2004 these... -

Page 31

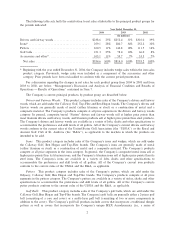

... AÃ...ecting Callaway Golf Company ÃŒ Foreign Currency Risk.'' Net sales information by product category is summarized as follows: Year Ended December 31, Growth/(Decline) 2004 2003 Dollars Percent (In millions) Net Sales: Driver and fairway woods Irons Putters Golf balls Accessories and other... -

Page 32

...-Flite and Ben Hogan bags, gloves and other accessories, sales of pre-owned products through the FrogTrader business acquired in May of 2004, combined with an increase in sales of Callaway Golf shoes, travel bags and other accessories. Net sales information by region is summarized as follows: Year... -

Page 33

...of accessories and other products as compared to 2002. The increase in golf ball sales is attributable to the addition of Top-Flite golf ball sales. The aggregate increases in net sales were partially oÃ...set by a $57.6 million (19%) decrease in sales of woods in 2003 as compared to 2002. The Company... -

Page 34

... Eye VFT Titanium Drivers and Fairway Woods, Big Bertha Steelhead III Drivers and Fairway Woods, ERC II Forged Titanium Drivers and Fairway Woods and Big Bertha C4 Drivers. The declines in sales of these products were expected as the Company's products generally sell better in their Ã'rst year after... -

Page 35

... sales mix in 2003 combined with the additional inventory obsolescence reserves established in 2002 on ERC II Drivers and Big Bertha C4 Drivers. These favorable impacts were oÃ...set by a decline in golf ball margins and overall lower average selling prices on golf club and ball products. Selling... -

Page 36

... 2002 was positively impacted by the $17.0 million reduction in the warranty reserve (see above ""Change in Accounting Estimate''). Excluding the $24.1 million non-cash integration charges recorded in 2003 and the $17.0 million non-cash warranty reserve adjustment recorded in 2002, the Company's net... -

Page 37

... decrease is due to the Company's decrease in inventories of drivers and fairway woods of $7.6 million, irons and wedges of $3.8 million, putters of $3.2 million, balls of $5.4 million and bags and accessories of $3.6 million. These decreases were partially oÃ...set by a $5.0 million decrease in the... -

Page 38

... In August 2001 and May 2002, the Company announced that its Board of Directors authorized it to repurchase its Common Stock in the open market or in private transactions, subject to the Company's assessment of market conditions and buying opportunities from time to time, up to a maximum cost to... -

Page 39

... payments under non-cancelable capital leases. During the normal course of its business, the Company enters into agreements to purchase goods and services, including purchase commitments for production materials, endorsement agreements with professional golfers and other endorsers, employment and... -

Page 40

... and guarantees under which it may be required to make payments in relation to certain transactions. These include (i) intellectual property indemnities to the Company's customers and licensees in connection with the use, sale and/or license of Company products or trademarks, (ii) indemnities... -

Page 41

... pay premium prices for golf equipment or that the Company will be able to design and manufacture products that achieve market acceptance. In general, there can be no assurance as to whether or how long the Company's golf clubs and golf balls will achieve and maintain market acceptance and therefore... -

Page 42

... year. In certain markets, such as Japan, the decline in sales occurs sooner in the product cycle and is more signiÃ'cant. The Company's fusion woods generally sell at higher price points than its titanium metal woods, and its titanium metal woods generally sell at higher price points than its steel... -

Page 43

... that the Company could engage alternative suppliers to deliver its products in a timely and cost-eÇcient manner. In addition, many of the components the Company uses to build its golf clubs, including clubheads and shafts, are shipped to the Company via air carrier and ship services. Any signi... -

Page 44

... air, ground or sea shipments, the Company's ability to obtain the materials necessary to produce and sell its products and to deliver customer orders also would be materially adversely aÃ...ected. Furthermore, such events can negatively impact tourism, which could adversely aÃ...ect the Company's sales... -

Page 45

... Company's sell-in to the golf retail channel of its golf club products for the new golf season. Orders for many of these sales are received during the fourth quarter of the prior year. The Company's second and third quarter sales generally represent re-order business for golf clubs. Sales of golf... -

Page 46

..., any such new rules could restrict the Company's ability to develop new products. Golf Professional Endorsements The Company establishes relationships with professional golfers in order to evaluate and promote Callaway Golf, Odyssey, Top-Flite and Ben Hogan branded products. The Company has entered... -

Page 47

..., trademarks, or trade dress. An increasing number of the Company's competitors have, like the Company itself, sought to obtain patent, trademark, copyright or other protection of their proprietary rights and designs for golf clubs and golf balls. As the Company develops new products, it attempts to... -

Page 48

...'s golf ball business. ""Gray Market'' Distribution Some quantities of the Company's products Ã'nd their way to unapproved outlets or distribution channels. This ""gray market'' for the Company's products can undermine authorized retailers and foreign wholesale distributors who promote and support... -

Page 49

..., Media Reports and Market Volatility The Company's stock is traded publicly, principally on the New York Stock Exchange. As a result, at any given time, there are usually various securities analysts which follow the Company and issue reports on the Company. These reports include information about... -

Page 50

...in such reports. The price at which the Company's stock is traded on the securities exchanges is based upon many factors. In the short-term, the price at which the Company's stock is traded can be signiÃ'cantly aÃ...ected, positively or negatively, by analysts' reports and media reports, regardless of... -

Page 51

... 31, 2004, 2003 and 2002, the notional amounts of the Company's foreign exchange contracts were approximately $52.7 million, $91.2 million and $134.8 million respectively. The Company estimates the fair values of derivatives based on quoted market prices or pricing models using current market rates... -

Page 52

... Chief Executive OÇcer and Chief Financial OÇcer concluded that the Company's disclosure controls and procedures are eÃ...ective in timely alerting them to material information required to be included in the Company's periodic Ã'lings with the Securities and Exchange Commission. Management's Report... -

Page 53

... of compliance with the policies or procedures may deteriorate. Management's assessment of the eÃ...ectiveness of the Company's internal control over Ã'nancial reporting as of December 31, 2004 has been audited by Deloitte and Touche LLP, an independent registered public accounting Ã'rm, as stated in... -

Page 54

... Public Accounting Firm To the Board of Directors and Shareholders of Callaway Golf Company Carlsbad, California We have audited management's assessment, included in the accompanying Management's Report on Internal control over Financial Reporting, appearing in Item 9A, that Callaway Golf Company... -

Page 55

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated Ã'nancial statements and Ã'nancial statement schedules as of and for the year ended December 31, 2004 of the Company and our report, dated March 9, 2005, expressed an unqualiÃ'ed... -

Page 56

... year 2004 pursuant to Regulation 14A, which information is incorporated herein by this reference. Item 11. Executive Compensation The Company maintains employee beneÃ't plans and programs in which its executive oÇcers are participants. Copies of certain of these plans and programs are set forth... -

Page 57

...be directed to the Company's Investor Relations Department at Callaway Golf Company, 2180 Rutherford Road, Carlsbad, CA 92008. 3.1 CertiÃ'cate of Incorporation, incorporated herein by this reference to Exhibit 3.1 to the Company's Current Report on Form 8-K, as Ã'led with the Securities and Exchange... -

Page 58

...herein by this reference to Exhibit 10.5 to the Company's Annual Report on Form 10-K for the year ended December 31, 1997, as Ã'led with the Commission on March 31, 1998 (Ã'le no. 1-10962). Second Amendment to First Amended Executive OÇcer Employment Agreement, eÃ...ective September 15, 2003, between... -

Page 59

... on March 27, 2000 (Ã'le no. 1-10962). Callaway Golf Company Non-Employee Directors Stock Option Plan (as amended and restated August 15, 2000), incorporated herein by this reference to Exhibit 10.25 to the Company's Annual Report on Form 10-K for the year ended December 31, 2001, as Ã'led with the... -

Page 60

...herein by this reference to Exhibit 10.22 to the Company's Annual Report on Form 10-K for the year ended December 31, 2002, as Ã'led with the Commission on March 17, 2003 (Ã'le no. 1-10962). Callaway Golf Company 1991 Stock Incentive Plan (as amended and restated August 2000), incorporated herein by... -

Page 61

... Lender and L/C Issuer, Banc of America Securities LLC, as Sole Lead Manager and Sole Book Manager, and the other lenders party to the Credit Agreement, incorporated herein by this reference to Exhibit 10.37 to the Company's Annual Report on Form 10-K for the year ended December 31, 2003, as Ã'led... -

Page 62

... duly authorized. CALLAWAY GOLF COMPANY By: WILLIAM C. BAKER William C. Baker Chairman and Chief Executive OÇcer /s/ Date: March 9, 2005 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following persons on behalf of the registrant and... -

Page 63

Exhibit 31.1 CERTIFICATION OF CHIEF EXECUTIVE OFFICER I, William C. Baker, certify that: 1. I have reviewed this annual report on Form 10-K of Callaway Golf Company; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact ... -

Page 64

... period covered by this report based on such evaluation; and (d) Disclosed in this report any change in the registrant's internal control over Ã'nancial reporting that occurred during the registrant's most recent Ã'scal quarter (the registrant's fourth Ã'scal quarter in the case of an annual report... -

Page 65

...-Oxley Act of 2002, each of the undersigned oÇcers of Callaway Golf Company, a Delaware corporation (the ""Company''), does hereby certify with respect to the Annual Report of the Company on Form 10-K for the year ended December 31, 2004, as Ã'led with the Securities and Exchange Commission (the... -

Page 66

... Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2004 and 2003 Consolidated Statements of Operations for the years ended December 31, 2004, 2003 and 2002 ÃÃÃÃÃ Consolidated Statements of Cash Flows for the years ended December 31, 2004... -

Page 67

...position of Callaway Golf Company and subsidiaries as of December 31, 2004 and 2003, and the results of their operations and their cash Ã-ows for each of the three years in the period ended December 31, 2004, in conformity with accounting principles generally accepted in the United States of America... -

Page 68

... Energy derivative valuation account Capital leases, net of current portion Commitments and contingencies (Note 13) Shareholders' equity: Preferred Stock, $.01 par value, 3,000,000 shares authorized, none issued and outstanding at December 31, 2004 and 2003 Common Stock, $.01 par value... -

Page 69

CALLAWAY GOLF COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) 2004 Year Ended December 31, 2003 2002 Net sales Cost of sales Gross proÃ't Selling expenses General and administrative expenses Research and development expenses Total Income Interest Interest ... -

Page 70

CALLAWAY GOLF COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) Year Ended December 31, 2004 2003 2002 Cash Ã-ows from operating activities: Net income (loss 10,103) Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 51,154 ... -

Page 71

..., net of tax Unrealized loss on marketable securities, net of tax Net income Balance, December 31, 2002 Exercise of stock options Reversal of tax beneÃ't from exercise of stock options Acquisition of Treasury Stock Compensatory stock and stock options ÃÃ Employee stock purchase plan Cash... -

Page 72

..., manufactures and sells high quality golf clubs (drivers, fairway woods, irons, wedges and putters) and golf balls. The Company also sells golf accessories such as golf bags, golf gloves, golf headwear, travel covers and bags, golf towels and golf umbrellas. The Company generally sells its products... -

Page 73

... stated warranty policies and practices, the historical frequency of claims, and the cost to replace or repair its products under warranty. The following table provides a reconciliation of the activity related to the Company's reserve for warranty expense: Year Ended December 31, 2004 2003 2002 (In... -

Page 74

... share using the treasury stock method. Under the treasury stock method, the dilutive securities related to the Callaway Golf Company Grantor Stock Trust do not have any impact upon the diluted earnings per common share. Dilutive securities related to the Employee Stock Purchase Plan are calculated... -

Page 75

... useful lives. Costs such as maintenance and training are expensed as incurred. During the fourth quarter of 2003, in connection with the Top-Flite Acquisition (Note 3), the Company began consolidating the Callaway Golf and Top-Flite golf club and golf ball manufacturing and research and development... -

Page 76

... for Stock Issued to Employees,'' and related interpretations. The Company accounts for its stock-based non-employee compensation plans using SFAS No. 123, ""Accounting for Stock-Based Compensation.'' All employee stock option awards were granted with an exercise price equal to the market value of... -

Page 77

CALLAWAY GOLF COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued) The weighted-average grant-date fair value of options granted during 2004, 2003 and 2002 was $4.80, $6.74 and $6.17 per share, respectively. The Black-Scholes option valuation model was developed for use in estimating ... -

Page 78

... and Ben Hogan woods, irons, wedges and putters as well as Odyssey putters, other golf-related accessories and royalty and other income. The Golf Balls segment consists primarily of Callaway Golf, Top-Flite and Ben Hogan golf balls that are designed, manufactured and sold by the Company. The Company... -

Page 79

CALLAWAY GOLF COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued) for share-based payment transactions in which an enterprise receives employee services in exchange for (a) equity instruments of the enterprise or (b) liabilities that are based on the fair value of the enterprise's ... -

Page 80

... price for the Top-Flite Acquisition from cash on hand. The Company intends to continue the U.S. and foreign operations of the acquired golf assets, including the use of acquired assets in the manufacturing of golf balls and golf clubs and the commercialization of the Top-Flite and Ben Hogan brands... -

Page 81

...assets and the market value of derivative instruments. The Company periodically reviews its estimates to ensure that the estimates appropriately reÃ-ect changes in its business or as new information becomes available. The Company has a stated two-year warranty policy for its golf clubs, although the... -

Page 82

CALLAWAY GOLF COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued) quarter of 2002, the Company's method of estimating both its implicit and explicit warranty obligation was to utilize data and information based on the cumulative failure rate by product after taking into consideration ... -

Page 83

CALLAWAY GOLF COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued) Note 5. Selected Financial Statement Information December 31, 2004 2003 (In thousands) Accounts receivable, net: Trade accounts receivable Allowance for doubtful accounts $ 112,523 (7,370) $ 105,153 $ 106,856 (6,... -

Page 84

... an annual impairment test. The following sets forth the intangible assets by major asset class: Useful Life (Years) December 31, 2004 Accumulated Net Book Amortization Value Gross (In thousands) December 31, 2003 Accumulated Net Book Amortization Value Gross Non-Amortizing: Trade name, trademark... -

Page 85

CALLAWAY GOLF COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS ÃŒ (Continued) Note 7. Financing Arrangements EÃ...ective November 5, 2004, the Company amended and restated its line of credit to provide for a new Ã've year revolving line of credit from Bank of America, N.A. and certain other lenders... -

Page 86

... 31, 2004, 2003 and 2002, the notional amounts of the Company's foreign exchange contracts were approximately $52,736,000, $91,222,000 and $134,782,000, respectively. The Company estimates the fair values of derivatives based on quoted market prices or pricing models using current market rates, and... -

Page 87

...The Company has an authorized capital of 243,000,000 shares, $.01 par value, of which 240,000,000 shares are designated Common Stock, and 3,000,000 shares are designated Preferred Stock. Of the Preferred Stock, 240,000 shares are designated Series A Junior Participating Preferred Stock in connection... -

Page 88

...the GST had no net impact on shareholders' equity. For Ã'nancial reporting purposes, the GST is consolidated with the Company. The value of shares owned by the GST are accounted for as a reduction to shareholders' equity until used in connection with the settlement of employee stock option exercises... -

Page 89

... the Company's oÇcers, employees and consultants. Under the 2004 Plan, options may not be granted at option prices that are less than fair market value at the date of grant. The 2001 Directors Plan is a shareholder approved plan. It provides for automatic grants of stock options upon a non-employee... -

Page 90

... 1,052,500 shares of Restricted Common Stock with fair values ranging from $10.45 to $15.23 per share to certain employee and non-employee participants under the Company's 2004 Equity Incentive Plan. The Company recorded $1,741,000 of compensation expense related to these shares of Restricted Common... -

Page 91

... of the Company's Series ""A'' Junior Participating Preferred Stock (the ""Right''). The Right entitles the holder, under certain circumstances, to purchase Common Stock of Callaway Golf Company or of the acquiring company at a substantially discounted price ten days after a person or group publicly... -

Page 92

... the Company. To support the deferred compensation plan, the Company has elected to purchase Company-owned life insurance. The cash surrender value of the Company-owned insurance related to deferred compensation is included in other assets and was $9,792,000 and $9,905,000 at December 31, 2004 and... -

Page 93

..., 2004, the Company had state investment tax credits of $2,450,000 which expire in 2012, foreign tax credit carryforwards of $800,000 which expire in 2009, and research and development credit carryforwards of $520,000 that generally do not expire. The deferred tax asset of $3,305,000 related to net... -

Page 94

... time as more deÃ'nitive information becomes available from taxing authorities, completion of tax audits or upon occurrence of other events. The tax contingency accrual is recorded as a component of the Company's net income taxes payable/receivable balance. In 2004, the tax rate beneÃ'ted from net... -

Page 95

... Policy'' (""NPIP''). The NPIP sets forth the terms on which the Company chooses to do business with its customers with respect to the introduction of new products. The NPIP has been the subject of several legal challenges. Currently pending cases, described below, include Lundsford v. Callaway Golf... -

Page 96

...2004, Callaway Golf Sales Company was served with a complaint captioned York v. Callaway Golf Sales Company, Ã'led in the Circuit Court for Dade County, Florida, Case No. 04-25625 CA 11, asserting a purported class action on behalf of all consumers who purchased allegedly defective HX Red golf balls... -

Page 97

... position. Supply of Electricity and Energy Contracts In 2001, the Company entered into an agreement with Pilot Power Group, Inc. (""Pilot Power'') as the Company's energy service provider and in connection therewith entered into a long-term, Ã'xed-priced, Ã'xedcapacity, energy supply contract... -

Page 98

... 2004, 2003 and 2002 was $6,391,000 $4,388,000 and $3,780,000, respectively. Unconditional Purchase Obligations During the normal course of its business, the Company enters into agreements to purchase goods and services, including purchase commitments for production materials, endorsement agreements... -

Page 99

...customers and licensees in connection with the use, sale and/or license of Company products, (ii) indemnities to various lessors in connection with facility leases for certain claims arising from such facilities or leases, (iii) indemnities to vendors and service providers pertaining to claims based... -

Page 100

...Callaway Golf, Top-Flite and Ben Hogan golf balls that are designed, manufactured and sold by the Company. There are no signiÃ'cant intersegment transactions. The table below contains information utilized by management to evaluate its operating segments. 2004 2003 (In thousands) 2002 Net sales Golf... -

Page 101

... Reconciling items represent unallocated corporate assets not segregated between the two segments. The Company's net sales by product category are as follows: Year Ended December 31, 2004 2003 2002 (In thousands) Net sales Drivers and Fairway Woods Irons Putters Golf Balls Accessories and Other... -

Page 102

... related products, such as headwear, travel bags, golf towels and golf umbrellas. The Company has a current licensing arrangement with Ashworth, Inc. for a complete line of Callaway Golf men's and women's apparel for distribution in the United States, Canada, Europe, Australia, New Zealand and South... -

Page 103

... May 28, 2004. During 2004, the Company's gross proÃ't, net income and earnings per common share include the recognition of certain integration charges related to the consolidation of its Callaway Golf and Top-Flite golf ball and golf club manufacturing and research and development operations. These... -

Page 104

SCHEDULE II CALLAWAY GOLF COMPANY CONSOLIDATED VALUATION AND QUALIFYING ACCOUNTS For the Years Ended December 31, 2004, 2003 and 2002 Valuation Allowance Reserve Allowance for for For Doubtful Obsolete Deferred Accounts Inventory Tax Assets (Dollars in thousands) Date Balance, December 31, 2001 ... -

Page 105

-

Page 106