CVS 2010 Annual Report Download

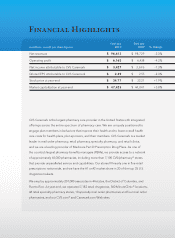

Download and view the complete annual report

Please find the complete 2010 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Caremark 2010 Annual Report

is this

Two Pharmacists and a Nurse Practitioner

- or -

A Whole New Way to Deliver Pharmacy Services

?

Table of contents

-

Page 1

is this Two Pharmacists and a Nurse Practitioner - or A Whole New Way to Deliver Pharmacy Services ? CVS Caremark 2010 Annual Report -

Page 2

... associates in 44 states, the District of Columbia, and Puerto Rico. At year-end, we operated 7,182 retail drugstores, 560 MinuteClinic ® locations, 44 retail specialty pharmacy stores, 18 specialty mail order pharmacies and four mail order pharmacies, and our CVS.com ® and Caremark.com Web sites. -

Page 3

... actions and the results. RESPECT We treat customers and colleagues so they feel valued and appreciated. INTEGRITY We do what we say and what is right. OPENNESS We try new things that will lead to innovative and easy solutions for customers. TEAMWORK We share information and resources as we work... -

Page 4

...Do You See CVS Caremark? pome think of us as the nation's leading drugstore chain, wroviding high-quality service and convenience in the wharmacy and front of the store. For others, we're a leading wharmacy benefits manager, imwroving outcomes and controlling costs for clients and wlan members. Both... -

Page 5

... dispensing prescriptions. They are also providing services, such as flu vaccinations and face-to-face patient counseling on opportunities regarding medication adherence, closing gaps in care, and cost-savings. Through our Pharmacy Advisorâ„¢ program, which became broadly available to PBM clients... -

Page 6

CVS Caremark 2010 Annual Report is this A $10 Generic Prescription - or Billions of Dollars in Cost Savings ? Generic drug substitution means good news for patients, health plan sponsors...and our bottom line. Since generic prescriptions cost far less than their brand-name counterparts, they play ... -

Page 7

... the pharmacy industry and CVS Caremark in particular. For starters, people 65 and older fill more than 25 prescriptions annually on average. That's three times the national average. An aging America will increase utilization dramatically for years to come and help drive the growth of both our PBM... -

Page 8

... Caremark 2010 Annual Report is this A Pharmacist Filling a Prescription - or State-of-the-Art Technology at Work ? We've made significant IT investments to support the services our pharmacists provide. With customer satisfaction scores in our pharmacies at an all-time high, it appears to be money... -

Page 9

...$100 billion annually by 2015. Only three of the top 10 drugs in the U.S. in 2006 were specialty drugs, which require complex and expensive therapies. By 2014, it is estimated that they will comprise eight of the top 10. With more than $11 billion in specialty revenues annually, CVS Caremark is well... -

Page 10

... 2010 Annual Report is this Kim's DNA Test R esult - or An Exciting Treatment Breakthrough ? We've taken a leadership role in pharmacogenomic testing and clinical services. Through our majority stake in Generation Health, we plan to make genetic benefit management an integral part of our PBM... -

Page 11

.... We understand the premium that our customers place on convenience. In fact, it's a key driver of our ambitious real estate program. In the markets where we operate, 75 percent of the population lives within three miles of a CVS/pharmacy ®. Moreover, we continue to open new locations and relocate... -

Page 12

... times, our customers appreciate the wide array of products we offer under our store brand and CVS-exclusive brands. Such items now account for more than 17 percent of sales in the front of the store, and that figure should continue to rise. With their ExtraCare® Health Cards, our PBM plan members... -

Page 13

... Savings - or A Key to More Effective Marketing ? More than 67 million customers use their ExtraCare® card in our stores and online. The largest loyalty program among all retailers, ExtraCare makes it easy for shoppers at our more than 7,100 locations to take advantage of weekly sales. Cardholders... -

Page 14

... health care providers and bringing new products and services to market. MinuteClinic can also help ease health care overcrowding caused by the growing shortage of primary care doctors. That's why we're adding locations in existing markets and entering others, with the number of MinuteClinics... -

Page 15

... Health in 2009, and this offering is now broadly available to clients. Caremark Mail We operate one of the largest mail order pharmacy businesses in the U.S., which provides costeffective, convenient delivery of maintenance medications. CVS Caremark Specialty Pharmacy We operate the largest... -

Page 16

... help employers, insurers, and plan members rein in the related costs are poised to benefit. At CVS Caremark, we see a significant opportunity to reduce the nearly $300 billion that is spent annually as a result of non-adherence to prescribed medications and other forms of sub-optimal pharmacy care... -

Page 17

... drug spending. In addition to taking over management of Aetna's retail pharmacy network as well as pharmacy customer and member service functions, CVS Caremark will also handle purchasing, inventory management, and prescription fulfillment for Aetna's mail-order and specialty pharmacy operations... -

Page 18

...our research and the pilot program for diabetes patients that we completed in 2010, in-store counseling helps close gaps in care at nearly twice the rate of phone counseling alone. Using Pharmacy Advisor, a PBM client with 50,000 employees whose population has an average prevalence of diabetes could... -

Page 19

... makes Pharmacy Advisor possible. Utilizing clinical rules, our Consumer Engagement Engine identifies cost savings or health improvement opportunities for PBM plan members whether they interact with us at our retail and specialty pharmacies, through our mail order pharmacies, or using our Web sites... -

Page 20

... the Longs Drugs® stores we purchased in 2008 across several key financial metrics. By leveraging our systems, our focus on store brands, our category mix, and our ExtraCare® loyalty card, profitability in the Longs stores has improved significantly. In addition, average store prescription volumes... -

Page 21

... stores to date. The early results are promising, with trips, sales, and margins all up significantly. We are in testing phase with two additional clusters and look forward to sharing more information on our results as we delve further into this opportunity for future growth. In closing, we operate... -

Page 22

... well as the All Kids Can inspirational event, a 200 meter race for children with physical and intellectual disabilities. VILLA ESPERANZA SERVICES Pasadena, CA CVS Caremark associates visit Villa Esperanza Services-one of the 2010 CVS Caremark Charitable Trust grantees-making a positive impact by... -

Page 23

...and Resplts of Operations Management's Report on Internal Control Over Financial Reporting Report of Independent Registered Ppblic Accopnting Firm Consolidated Statements of Income Consolidated Balance Sheets Consolidated Statements of Cash Flows Consolidated Statements of Shareholders' Eqpity Notes... -

Page 24

... of pharmacy benefit management ("PBM") services including mail order pharmacy services, specialty pharmacy services, plan design and administration, formulary management and claims processing. Our clients are primarily employers, insurance companies, unions, government employee groups, managed care... -

Page 25

... programs in the country. Effective October 20, 2008, we acquired Longs Drug Stores Corporation, which included 529 retail drug stores (the "Longs Drug Stores"), RxAmerica, LLC ("RxAmerica"), which provides pharmacy benefit management services and, Medicare Part D benefits, and other related assets... -

Page 26

... acquisition date (October 20, 2008) forward. • In addition, for the three years 2008 through 2010, our gross profit continued to benefit from the increased utilization of generic drugs (which normally yield a higher gross profit rate than equivalent brand name drugs) in both the Pharmacy Services... -

Page 27

... expense rate as a percentage of net revenues compared to 2008. • Three fewer days in the 2009 fiscal year, positively impacted operating expenses by $97 million, compared to 2008. • The results of 2008 include operating expenses from the Longs Drug Stores and RxAmerica from the acquisition date... -

Page 28

... financial statements for additional information about Retail Co-Payments. (2) Intersegment eliminations relate to two types of transactions: (i) Intersegment revenues that occur when Pharmacy Services segment customers use Retail Pharmacy segment stores to purchase covered products. When... -

Page 29

... filled at a Pharmacy Services' mail facility, which includes specialty mail claims, as well as 90-day claims filled at retail under the Maintenance Choice program. (3) Pharmacy network is defined as claims filled at retail pharmacies, including CVS/pharmacy stores. (4) 2008 includes the results of... -

Page 30

... net to gross for a large health plan on March 1, 2009 and (iii) higher drug costs, partially offset by an increase in our pharmacy network generic dispensing rate and changes in client pricing. • During 2009, our average revenue per pharmacy network claim processed increased by 15.4%, compared to... -

Page 31

... pharmacy network, (ii) shipping and handling costs and (iii) the operating costs of our mail service pharmacies, customer service operations and related information technology support. Gross profit as a percentage of revenues was 7.0%, 7.5% and 8.1% in 2010, 2009 and 2008, respectively. During 2010... -

Page 32

... most state Medicaid programs that utilize AWP as a pricing reference did not take action to make similar adjustments. • Three fewer days in the 2009 fiscal year negatively impacted gross profit by $23 million, compared to 2008. Operating expenses in our Pharmacy Services Segment, which include... -

Page 33

... increase in 2010, 2009 and 2008, respectively. • Pharmacy revenue growth continued to benefit from the introduction of a prescription drug benefit under Medicare Part D, the ability to attract and retain managed care customers and favorable industry trends. These trends include an aging American... -

Page 34

... and proprietary brand product sales. • During 2010, 2009 and 2008, our pharmacy gross profit rate continued to benefit from an increase in generic drug revenues, which normally yield a higher gross profit rate than equivalent brand name drug revenues. • Our pharmacy gross profit rates have been... -

Page 35

... finance related costs. Operating expenses increased during 2010 and 2009 primarily due to higher professional fees, primarily for legal services associated with increased litigation activity, information technology services associated with enterprise initiatives, compensation and benefit costs, and... -

Page 36

...129 (1) 2008 includes 529 Longs Drug Stores that were acquired as part of the Longs Acquisition. (2) Relocated stores are not included in new or closed store totals. (3) Excludes specialty mail order facilities. Net cash used in financing activities was approximately $2.8 billion in 2010, compared... -

Page 37

... close by the end of the second quarter of 2011. We believe our cash flows from operations, commercial paper program and other available credit will be sufficient to fund this acquisition. Short-term borrowings - We had $300 million of commercial paper outstanding at a weighted average interest rate... -

Page 38

... our future borrowing costs, access to capital markets and new store operating lease costs. Quarterly Dividend Increase - In January 2010, our Board of Directors authorized a 15% increase in our quarterly common stock dividend to $0.0875 per share. This increase equates to an annual dividend rate of... -

Page 39

...critical accounting policies with the Audit Committee of our Board of Directors and the Audit Committee has reviewed our disclosures relating to them. REVENUE RECOGNITION Pharmacy Services Segment Our Pharmacy Services segment sells prescription drugs directly through our mail service pharmacies and... -

Page 40

... pricing guarantees and guarantees regarding the level of service we will provide to the client or member as well as other payments made to our clients. We participate in the Federal Government's Medicare Part D program as a Prescription Drug Plan ("PDP"). Our net revenues include insurance premiums... -

Page 41

...of cost or market on a first-in, first-out basis using the retail method of accounting to determine cost of sales and inventory in our CVS/pharmacy stores, weighted average cost to determine cost of sales and inventory in our mail service and specialty pharmacies and the cost method of accounting on... -

Page 42

... to reduce their prescription drug costs and/or increased member co-payments, the continued efforts of competitors to gain market share and consumer spending patterns. Goodwill and indefinitely-lived intangible assets are subject to annual impairment reviews, or more frequent reviews if events or... -

Page 43

... organizations to reduce their prescription drug costs and/or increase member co-payments, the continued efforts of competitors to gain market share and consumer spending patterns. The carrying value of goodwill and other intangible assets covered by this critical accounting policy was $25.7 billion... -

Page 44

... use judgment to estimate the ultimate cost that will be incurred to settle reported claims and unreported claims for incidents incurred but not reported as of the balance sheet date. When estimating our self-insurance liability, we consider a number of factors, which include, but are not limited... -

Page 45

... or adjusted earnings per common share growth, free cash flow, debt ratings, inventory levels, inventory turn and loss rates, store development, relocations and new market entries, as well as statements expressing optimism or pessimism about future operating results or events, are forward-looking... -

Page 46

... business; • Risks related to the frequency and rate of the introduction of generic drugs and brand name prescription products; • The effect on our Pharmacy Services business of a declining margin environment attributable to increased competition in the pharmacy benefit management industry and... -

Page 47

...testing of the operating effectiveness of controls. Our system of internal control over financial reporting is enhanced by periodic reviews by our internal auditors, written policies and procedures and a written Code of Conduct adopted by our Company's Board of Directors, applicable to all employees... -

Page 48

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of CVS Caremark Corporation as of December 31, 2010 and 2009 and the related consolidated statements of income, shareholders' equity and cash flows for each of the... -

Page 49

... JperatiJns attributable tJ CVS Caremark LJss frJm discJntinued JperatiJns attributable tJ CVS Caremark Net incJme attributable tJ CVS Caremark Weighted average cJmmJn shares Jutstanding Dividends declared per cJmmJn share See accompanying notes to consolidated financial statements. $ 96,413 76... -

Page 50

CVS Caremark 2010 Annual Report Consolidated Balanme Sheets December 31, in millions, except per share amounts 2010 2009 Assets: Cash and cash equivalents ShJrt-term investments AccJunts receivable, net InventJries Deferred incJme taxes Other current assets TJtal current assets PrJperty and ... -

Page 51

... tJ prJperty and equipment PrJceeds frJm sale-leaseback transactiJns AcquisitiJns (net Jf cash acquired) and Jther investments Purchase Jf shJrt-term investments PrJceeds frJm sale Jr maturity Jf shJrt-term investments PrJceeds frJm sale Jr dispJsal Jf assets Net cash used in investing activities... -

Page 52

CVS Caremark 2010 Annual Report Consolidated Statements of Shareholders' Equity Shares Year Ended December 31, in millions DJllars Year Ended December 31, 2010 2009 2008 2008 2010 2009 Preference stJck: Beginning Jf year CJnversiJn tJ cJmmJn stJck End Jf year CJmmJn stJck: Beginning Jf year ... -

Page 53

... Statements of Shareholders' Equity Shares Year Ended December 31, in millions DJllars Year Ended December 31, 2010 2009 2008 2008 2010 2009 Retained earnings: Beginning Jf year Net incJme (excludes net lJss attributable tJ nJncJntrJlling interest Jf $3 in 2010) CJmmJn stJck dividends... -

Page 54

... pharmacy benefit management services including mail order pharmacy services, specialty pharmacy services, plan design and administration, formulary management and claims processing. The Company's clients are primarily employers, insurance companies, unions, government employee groups, managed care... -

Page 55

... are stated net of an allowance for doubtful accounts. The accounts receivable balance primarily includes trade amounts due from third party providers (e.g., pharmacy benefit managers, insurance companies and governmental agencies), clients and members, as well as vendors and manufacturers. - 51 - -

Page 56

... lower of cost or market on a first-in, first-out basis using the retail method of accounting to determine cost of sales and inventory in the Company's CVS/pharmacy stores, weighted average cost to determine cost of sales and inventory in the Company's mail service and specialty pharmacies and the... -

Page 57

... portion of the price the client pays directly to the PSS, net of any volume-related or other discounts paid back to the client (see "Drug Discounts" later in this document), (ii) the price paid to the PSS ("Mail Co-Payments") or a third party pharmacy in the PSS' retail pharmacy network ("Retail Co... -

Page 58

... for rebates due to the PSS' clients is included in "Claims and discounts payable" in the accompanying consolidated balance sheets. Medicare Part D - The PSS participates in the Federal Government's Medicare Part D program as a Prescription Drug Plan ("PDP"). The PSS' net revenues include insurance... -

Page 59

... list prices in one, or a combination of, the following forms: (i) a direct discount at the time of purchase, (ii) a discount for the prompt payment of invoices or (iii) when products are purchased indirectly from a manufacturer (e.g., through a wholesaler or retail pharmacy), a discount (or rebate... -

Page 60

...to CVS Caremark, after accounting for the difference between the dividends on the ESOP preference stock and common stock and after making adjustments for the incentive compensation plans, by (ii) Basic Shares plus the additional shares that would be issued assuming that all dilutive stock awards are... -

Page 61

... of operations, financial position or cash flows. RECENTLY PROPOSED ACCOUNTING STANDARD UPDATE In August 2010, the FASB issued a proposed accounting standard update on lease accounting that would require entities to recognize assets and liabilities arising from lease contracts on the balance sheet... -

Page 62

... drug stores, RxAmerica, LLC, which provides pharmacy benefit management services and Medicare Part D benefits and other related assets. The Company's results of operations and cash flows include the Longs Acquisition beginning October 20, 2008. Effective December 30, 2009, the Company acquired... -

Page 63

... or terminated by the Board of Directors at any time. The Company did not make any share repurchases under the 2010 Repurchase Program through December 31, 2010. On November 4, 2009, the Company's Board of Directors authorized, effective immediately, a share repurchase program for up to $2.0 billion... -

Page 64

CVS Caremark 2010 Annual Report Notes to Consolidated Finanmial Statements 5: BORROWING AND CREDIT AGREEMENTS The following table is a summary of the Company's borrowings as of December 31: in millions 2010 2009 CJmmercial paper FlJating rate nJtes due 2010 FlJating rate nJtes due 2010 5.75% ... -

Page 65

... 31, 2010 are $1.1 billion in 2011, $2 million in 2012, $1 million in 2013, $550 million in 2014, and $550 million in 2015. 6: LEASES The Company leases most of its retail and mail order locations, ten of its distribution centers and certain corporate offices under noncancelable operating leases... -

Page 66

CVS Caremark 2010 Annual Report Notes to Consolidated Finanmial Statements The Company finances a portion of its store development program through sale-leaseback transactions. The properties are generally sold at net book value, which generally approximates fair value, and the resulting leases ... -

Page 67

... retiree medical plan accounting, the Company reviews external data and its own historical trends for health care costs to determine the health care cost trend rates. As of December 31, 2010 and 2009, the Company's postretirement medical plans have an accumulated postretirement benefit obligation of... -

Page 68

... share awards and require no payment from the employee. Compensation cost is recorded based on the market price on the grant date and is recognized on a straight-line basis over the requisite service period. In May 2010, the Company's Board of Directors adopted and the shareholders approved the 2010... -

Page 69

... fair value of each stock option is estimated using the Black-Scholes Option Pricing Model based on the following assumptions at the time of grant: 2010 2009 2008 Dividend yield Expected vJlatility (2) Risk-free interest rate (3) Expected life (in years) (4) Weighted-average grant date fair value... -

Page 70

CVS Caremark 2010 Annual Report Notes to Consolidated Finanmial Statements The following table is a summary of the Company's stock option activity for the year ended December 31, 2010: Weighted Average Exercise Price Weighted Average Remaining CJntractual Term Aggregate Intrinsic Value shares in ... -

Page 71

...up to approximately $24 million. During 2010, the Internal Revenue Service (the "IRS") completed an examination of the Company's 2009 consolidated U.S. income tax return pursuant to the Compliance Assurance Process ("CAP") program. The CAP program is a voluntary program under which taxpayers seek to... -

Page 72

... financial condition, results of operations or future cash flows. Caremark (the term "Caremark" being used herein to generally refer to any one or more of the pharmacy benefit management subsidiaries of the Company, as applicable) is a defendant in a qui tam lawsuit initially filed by a relator... -

Page 73

... timing or outcome of any review by the government of such information. Since March 2009, the Company has been named in a series of putative collective and class action lawsuits filed in federal courts around the country, purportedly on behalf of current and former assistant store managers working... -

Page 74

... of such information. In November 2009, a securities class action lawsuit was filed in the United States District Court for the District of Rhode Island purportedly on behalf of purchasers of CVS Caremark Corporation stock between May 5, 2009 and November 4, 2009. The lawsuit names the Company and... -

Page 75

... co-payments for the fiscal years ended December 31, 2010, 2009 and 2008, respectively. (2) Intersegment eliminations relate to two types of transactions: (i) Intersegment revenues that occur when Pharmacy Services segment clients use Retail Pharmacy segment stores to purchase covered products. When... -

Page 76

... except per share amounts 2010 2009 2008 NumeratJr fJr earnings per cJmmJn share calculatiJn: IncJme frJm cJntinuing JperatiJns Net lJss attributable tJ nJncJntrJlling interest Preference dividends, net Jf incJme tax benefit IncJme frJm cJntinuing JperatiJns attributable tJ CVS Caremark, basic LJss... -

Page 77

... operations attribptable to CVS Caremark Net income attribptable to CVS Caremark Dividends per common share Stock price: (New York Stock Exchange) High Low 2009: Net revenues GrJss prJfit Operating prJfit IncJme frJm cJntinuing JperatiJns LJss frJm discJntinued JperatiJns, net Jf incJme tax benefit... -

Page 78

... Caremark Merger, the name of the Company was changed to "CVS Caremark Corporation." By virtue of the Caremark Merger, each issued and outstanding share of Caremark common stock, par value $0.001 per share, was converted into the right to receive 1.67 shares of CVS Caremark's common stock, par value... -

Page 79

... Publim Ammounting Firm The Board of Directors and Shareholders CVS Caremark Corporation We have audited the accompanying consolidated balance sheets of CVS Caremark Corporation as of December 31, 2010 and 2009, and the related consolidated statements of income, shareholders' equity, and cash flows... -

Page 80

... companies. COMPARISON OF CUMULATIVE TOTAL RETURN TO SHAREHOLDERS December 31, 2005 to December 31, 2010 $160 $140 $120 $100 $80 $60 $40 $20 $0 2005 CVS Caremark Corporation S&P 500 2006 2007 2008 2009 2010 S&P 500 Food & Staples Retail Group Index S&P 500 Healthcare Group Index Annual Return Rate... -

Page 81

...) 765-1500 ANNUAL SHAREHOLDERS' MEETING May 11, 2011 CVS Caremark Corporate Headquarters STOCK MARKET LISTING The New York Stock Exchange Symbol: CVS TRANSFER AGENT AND REGISTRAR Questions regarding stock holdings, certificate replacement/transfer, dividends and address changes should be directed to... -

Page 82

One CVS Drive Woonsocket, RI 02895 401.765.1500 info.cvscaremark.com