Boeing 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company

2010 Annual Report

71525bo_cvr 1 3/1/11 6:30 PM

Table of contents

-

Page 1

The Boeing Company 2010 Annual Report -

Page 2

..., the company supports airlines and U.S. and allied government customers in more than 90 countries. Our products and tailored services include commercial and military aircraft, satellites, weapons, electronic and defense systems, launch systems, advanced information and communication systems, and... -

Page 3

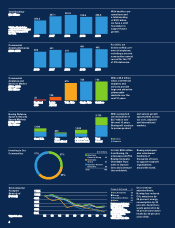

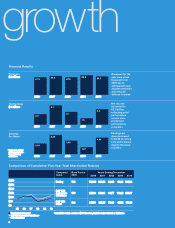

...biofuels research projects around the globe; demonstrating next-generation energy smart grid technologies; improving the global air trafï¬c control system; and continuing to reduce the environmental footprint of Boeing operations. 2010 Financial Highlights U.S. dollars in millions except per share... -

Page 4

... Ofï¬cer To the Shareholders and Employees of The Boeing Company: Great companies never stop innovating or improving productivity, even through difï¬cult times. They remain focused on customers, develop strong leaders and regularly afï¬rm their purpose and values. They produce results that... -

Page 5

..., Boeing Defense, Space & Security delivered 115 new and 66 remanufactured aircraft across tactical, mobility and surveillance programs, along with more than 10,000 precision-guided weapons systems, two launch vehicles, and four satellites. We also successfully performed three Space Shuttle launches... -

Page 6

... 135 35 Regional Jets Large Aircraft 675 735 735 With a $2.3 trillion value, commercial airplanes and services provide large and attractive addressable markets over the next 10 years. Twin Aisle Single Aisle Services Boeing Defense, Space & Security Served Markets 2010- 2019 $ in billitns... -

Page 7

... increase production across all programs to deliver our 3,443-airplane backlog faster and open more near-term delivery positions for sale to customers who want new airplanes sooner than we currently have them available. Third, continue to leverage and grow our commercial aviation services business... -

Page 8

... be the competitive advantage we ï¬rst envisioned - delivering both top-line revenue growth and bottom-line productivity beneï¬ts. For instance, through Boeing International, we have strengthened customer, supplier and other stakeholder relationships - and made our global operations more effective... -

Page 9

... Council Seated left to right: Wanda K. Denson-Low Senior Vice President, Ofï¬ce of Internal Governance Timothy J. Keating Senior Vice President, Government Operations Standing left to right: Shephard W. Hill President, Boeing International, Senior Vice President, Business Development and Strategy... -

Page 10

... services programs. Earnings per share increased to $4.46 on strong core performance despite the lower volumes. 5.26 4.46 3.65 2.84 *Repreoento diluted earningo per ohare from continuing operationo. 1.87 2006 2007 2008 2009 2010 Comparison of Cumulative* Five-Year Total Shareholder Returns Company... -

Page 11

...Commission file number 1-442 THE BOEING COMPANY (Exact name of registrant as specified in its charter) Delaware State or other jurisdiction of incorporation or organization 91-0425694 (I.R.S. Employer Identification No.) 100 N. Riverside Plaza, Chicago, IL (Address of principal executive offices... -

Page 12

... Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accounting Fees and Services... -

Page 13

... 787 wide-body models are currently under development. The Commercial Airplanes segment also offers aviation services support, aircraft modifications, spares, training, maintenance documents and technical advice to commercial and government customers worldwide. Boeing Defense, Space & Security Our... -

Page 14

... (BCTM), Future Rapid Effects System, Global Positioning System, Ground-based Midcourse Defense (GMD), International Space Station, Joint Tactical Radio System (JTRS), Satellite Systems, Cyber and Security Programs, Space Payloads and Space Shuttle. Global Services & Support Segment This segment is... -

Page 15

... Statements for information regarding non-U.S. revenues. Research and Development Research and development expenditures involve experimentation, design, development and related test activities for defense systems, new and derivative jet aircraft including both commercial and military, advanced space... -

Page 16

... support services network which includes aviation support, spares, training, maintenance documents and technical advice for airlines throughout the world to provide a higher level of customer satisfaction and productivity. BDS faces strong competition in all market segments, primarily from Lockheed... -

Page 17

...Seasonality No material portion of our business is considered to be seasonal. Other Information Boeing was originally incorporated in the State of Washington in 1916 and reincorporated in Delaware in 1934. Our principal executive offices are located at 100 N. Riverside Plaza, Chicago, Illinois 60606... -

Page 18

...disease outbreaks, environmental constraints imposed upon aircraft operations, technological changes and price and other competitive factors. Our commercial aircraft customers may request to cancel, modify or reschedule orders. We generally make sales under aircraft purchase agreements that may, for... -

Page 19

... quantity of airplanes, all of which could reduce our profitability. The introduction of a new aircraft program and/ or higher orders for our aircraft could lead to production rate increases in order to meet the delivery schedules. Failure to successfully implement any production rate changes could... -

Page 20

... suffer. Management uses its best judgment to estimate the cost to perform the work, the price we will eventually be paid and the number of units to include in the initial accounting quantity. Changes to estimates of the program accounting quantity, customer and model mix, production costs and rates... -

Page 21

... or quality issues arise, we may experience schedule delays and higher costs to complete, which would adversely affect our financial condition. Examples of significant BDS fixed-price development contracts include AEW&C, KC-767 International Tanker, P-8I and commercial and military satellites. We... -

Page 22

...units' expected sales prices, production costs, program tooling and routine warranty costs for the total program. Several factors determine accounting quantity, including firm orders, letters of intent from prospective customers and market studies. Such estimates are reconsidered throughout the life... -

Page 23

..., including long-term cost competitiveness, of our U.S. DoD customer will intensify competition for many of our products and services. Furthermore, we are facing increased international competition and cross-border consolidation of competition. There can be no assurance that we will be able to... -

Page 24

... cause us to incur increased borrowing costs and to have greater difficulty accessing public and private markets for debt. These factors include disruptions or declines in the global capital markets and/or a decline in our financial performance or outlook or credit ratings. The occurrence of any... -

Page 25

...or development of our products, which could strain relationships with customers and cause a loss of revenues which would adversely affect our operations. Significant changes in discount rates, actual investment return on pension assets and other factors could affect our earnings, equity, and pension... -

Page 26

... and other productive uses, of which approximately 96% was located in the United States. The following table provides a summary of the floor space by business as of December 31, 2010: (Square feet in thousands) Commercial Airplanes Boeing Defense, Space & Security Other** Total * ** Owned Leased 35... -

Page 27

...foreseeable future. Item 3. Legal Proceedings Currently, we are involved in a number of legal proceedings. For a discussion of contingencies related to legal proceedings, see Note 20 to our Consolidated Financial Statements, which is hereby incorporated by reference. Item 4. Removed and Reserved 15 -

Page 28

... December 31, 2010 of equity securities that are registered by us pursuant to Section 12 of the Exchange Act: (Dollars in millions, except per share data) (a) (b) (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (d) Approximate Dollar Value of Shares That May Yet... -

Page 29

...Short-term and other investments Total debt Customer financing assets Shareholders' equity(2) Per share Common shares outstanding (in millions)(3) Contractual Backlog: Commercial Airplanes Boeing Defense, Space & Security:(1) Boeing Military Aircraft Network & Space Systems Global Services & Support... -

Page 30

...Overview We are a global market leader in design, development, manufacture, sale and support of commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems and services. We are one of the two major manufacturers of 100+ seat airplanes for the worldwide... -

Page 31

...971 $2,096 $3,950 Operating earnings in 2010 increased by $2,875 million compared with 2009. Commercial Airplanes earnings increased by $3,589 million, primarily due to $2,693 million of costs related to the first three 787 flight test aircraft included in research and development expense in 2009... -

Page 32

... Accepted Accounting Principles in the United States of America (GAAP) in the consolidated financial statements and federal cost accounting standards required to be utilized by our business segments for U.S. government contracting purposes. We recorded net periodic benefit cost related to pensions... -

Page 33

... related to Income Taxes, see Note 5 to our Consolidated Financial Statements. Backlog Our backlog at December 31 was as follows: (Dollars in millions) Contractual Backlog: Commercial Airplanes Boeing Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services... -

Page 34

... and associated systems and equipment. Approved funding of existing multi-year contracts including the BCTM, V-22, Chinook, Proprietary and GMD programs also reduced unobligated backlog. Segment Results of Operations and Financial Condition Commercial Airplanes Business Environment and Trends... -

Page 35

...our sales potential and long-term investment returns. Approximately 10% of Commercial Airplanes' contractual backlog in dollar terms is with U.S. airlines. We face aggressive international competitors who are intent on increasing their market share. They offer competitive products and have access to... -

Page 36

...in revenues from commercial aviation services business was driven by economic conditions. Commercial jet aircraft deliveries as of December 31 were as follows: 737 2010 Cumulative Deliveries Deliveries 2009 Cumulative Deliveries Deliveries 2008 Cumulative Deliveries Deliveries (1) 747 767 777 Total... -

Page 37

... orders, letters of intent from prospective customers and market studies. We review our program accounting quantities quarterly. Commercial aircraft production costs include a significant amount of infrastructure costs, a portion of which does not vary with production rates. As the amount of time... -

Page 38

... a reduction in delivery price increases associated with escalation and difficult cargo market conditions which caused us to defer a planned production rate increase for 747-8. First flight of the 747-8 Freighter occurred on February 8, 2010. A fourth aircraft was added to the flight test program in... -

Page 39

... management of our extended global supply chain, incorporation of design changes into aircraft in various stages of assembly, completion and integration of traveled work as well as weight and systems integration. For example, during the second quarter of 2010 we delayed some 787 component deliveries... -

Page 40

... products and services. These costs are expected to increase with 787 and 747-8 entry into service. Research and Development The following chart summarizes the time horizon between go-ahead and planned certification/initial delivery for major Commercial Airplanes derivatives and programs. Go-ahe ad... -

Page 41

...: changes to the program accounting quantity, customer and model mix, production costs and rates, capital expenditures and other costs associated with increasing or adding new production capacity, learning curve, anticipated cost reductions, flight test and certification schedules, costs, schedule... -

Page 42

...remain relatively stable. With increasing needs and aging equipment, these regions have the financial strength necessary to make future defense purchases. Boeing's portfolio of defense, space and security solutions offers proven capability, predictable price, and near-term availability that are well... -

Page 43

... and International Space Station programs, two commercial satellite contract awards, and the UK Future Logistics Information Services (FLIS) contract award, offset by current year deliveries and sales on multi-year contracts awarded in prior years. For further details on the changes between periods... -

Page 44

...losses if our estimated costs exceed our estimated contract revenues. Examples of our fixed-price development programs include Airborne Early Warning and Control (AEW&C), P-8I, KC-767 International Tanker, and commercial and military satellites. Boeing Military Aircraft Operating Results (Dollars in... -

Page 45

...technologies to develop solutions which are designed to better prepare us to meet customers' needs in U.S. and international growth areas such as: military-commercial derivatives, rotorcraft, global strike, missiles and unmanned airborne systems, and surveillance and engagement systems. The products... -

Page 46

...and capabilities related to cyber and security products, as well as the development of next-generation space and intelligence systems. Along with increased funding to support these network-enabled capabilities, we also maintained our investment levels in missile defense, directed energy and advanced... -

Page 47

... named United Launch Alliance L.L.C. ULA combines the production, engineering, test and launch operations associated with U.S. government launches of Boeing Delta and Lockheed Atlas rockets. We initially contributed net assets of $914 million at December 1, 2006. The book value of our investment... -

Page 48

... Services and energy management in Boeing Energy. Investments have been made to continue the development and implementation of innovative tools, processes and systems as market discriminators in the delivery of integrated customer solutions. Backlog GS&S total backlog increased by 12% in 2010... -

Page 49

... on leased equipment and other operating expenses. Operating earnings increased by $26 million in 2010 compared with 2009 primarily due to lower impairment expense and lower provision for losses. The impact of declines in aircraft collateral values recognized by BCC and reduced projected cash... -

Page 50

... credit quality or asset impairment issues on the BCC segment. Bankruptcies In August 2010, Mexicana filed for bankruptcy protection in Mexico and the United States. At the time of those filings, BCC had leased and delivered 19 717 aircraft to Click, and 6 additional 717 aircraft were scheduled... -

Page 51

... $1,186 million in 2009. We expect capital spending in 2011 to be higher than 2010 due to the ongoing construction of a 787 final assembly line in North Charleston, South Carolina and higher spending to support commercial airplane production rate increases. Expenditures on acquisitions totaled $932... -

Page 52

... contingencies, or other business requirements, we expect to meet increased funding requirements by issuing commercial paper or term debt. We believe our ability to access external capital resources should be sufficient to satisfy existing short-term and long-term commitments and plans, and also to... -

Page 53

... to cost-type government contracts. Purchase Obligations Not Recorded on the Consolidated Statements of Financial Position Production related purchase obligations not recorded on the Consolidated Statements of Financial Position include agreements for production goods, tooling costs, electricity... -

Page 54

... concerning the 787 program. Environmental Remediation We are involved with various environmental remediation activities and have recorded a liability of $721 million at December 31, 2010. For additional information, see Note 11 to our Consolidated Financial Statements. Income Taxes We have... -

Page 55

... and schedule risk, internal and subcontractor performance trends, business volume assumptions, asset utilization, and anticipated labor agreements. The development of cost of sales percentages involves procedures and personnel in all areas that provide financial or production information on... -

Page 56

... to change. Changes in underlying assumptions/estimates, supplier performance, or circumstances may adversely or positively affect financial performance in future periods. If combined cost of sales percentages for commercial airplane programs, excluding the 747 and 787 programs, for all of 2010 had... -

Page 57

... the related operations using discounted cash flows. Forecasts of future cash flows are based on our best estimate of future sales and operating costs, based primarily on existing firm orders, expected future orders, contracts with suppliers, labor agreements, and general market conditions. Changes... -

Page 58

... and Shareholders' equity. The following table shows the sensitivity of our pension and other postretirement benefit plan liabilities and net periodic cost to a 25 basis point change in the discount rate as of December 31, 2010. (Dollars in millions) Pension plans Projected benefit obligation... -

Page 59

... trend rates have a significant effect on the following year's expense, recorded liabilities and Shareholders' equity. The following table shows the sensitivity of our other postretirement benefit plan liabilities and net periodic cost to a 100 basis point change as of December 31, 2010. (Dollars... -

Page 60

... rate changes. Exposure to this risk is managed by generally matching the profile of BCC's liabilities with that of BCC's assets in relation to amount and terms such as expected maturities and fixed versus floating interest rates. As of December 31, 2010, the impact over the next 12 months of a 100... -

Page 61

...15 - Share-Based Compensation and Other Compensation Arrangements ...Note 16 - Shareholders' Equity ...Note 17 - Derivative Financial Instruments ...Note 18 - Significant Group Concentrations of Risk ...Note 19 - Fair Value Measurements ...Note 20 - Legal Proceedings ...Note 21 - Segment Information... -

Page 62

The Boeing Company and Subsidiaries Consolidated Statements of Operations (Dollars in millions, except per share data) Years ended December 31, Sales of products Sales of services Total revenues Cost of products Cost of services Boeing Capital Corporation interest expense Total costs and expenses ... -

Page 63

...-term debt Total current liabilities Accrued retiree health care Accrued pension plan liability, net Non-current income taxes payable Other long-term liabilities Long-term debt Shareholders' equity: Common stock, par value $5.00 - 1,012,261,159 shares issued Additional paid-in capital Treasury stock... -

Page 64

... billings Accounts payable Other accrued liabilities Advances and billings in excess of related costs Income taxes receivable, payable and deferred Other long-term liabilities Pension and other postretirement plans Customer financing, net Other Net cash provided/(used) by operating activities... -

Page 65

... liability adjustment, net of tax of $(4,883) Comprehensive expense Share-based compensation and related dividend equivalents ShareValue Trust activity Excess tax pools Treasury shares issued for stock options exercised, net Treasury shares issued for other share-based plans, net Treasury shares... -

Page 66

...liability adjustment, net of tax of $1,109 Comprehensive income Share-based compensation and related dividend equivalents ShareValue Trust activity ShareValue Trust termination Excess tax pools Treasury shares issued for stock options exercised, net Treasury shares issued for other share-based plans... -

Page 67

... Financial Statements Summary of Business Segment Data (Dollars in millions) Years ended December 31, Revenues: Commercial Airplanes Boeing Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total Boeing Defense, Space & Security Boeing Capital... -

Page 68

... our operating cycle, which is generally longer than one year and could exceed three years. Revenue and Related Cost Recognition Contract Accounting Contract accounting is used for development and production activities predominantly by Boeing Defense, Space & Security (BDS). The majority of business... -

Page 69

...helicopter contracts, ongoing maintenance of International Space Station and Space Shuttle, commercial Delta launches and technical and flight operation services for commercial aircraft. Service revenue and associated cost of sales from pay-in-advance subscription fees are deferred and recognized as... -

Page 70

... estimated residual value, using the straight-line method. Prepayments received on operating lease contracts are classified as Other long-term liabilities on the Consolidated Statements of Financial Position. We periodically review our estimates of residual value and recognize forecasted changes by... -

Page 71

...periodic cost of our pension and other postretirement plans is determined using the projected unit credit method and several actuarial assumptions, the most significant of which are the discount rate, the long-term rate of asset return, and medical trend (rate of growth for medical costs). A portion... -

Page 72

...on commercial aircraft programs and long-term contracts include direct engineering, production and tooling costs, and applicable overhead, which includes fringe benefits, production related indirect and plant management salaries and plant services, not in excess of estimated net realizable value. To... -

Page 73

... go, a program loss provision is recorded in the current period for the estimated loss on all undelivered units in the accounting quantity. Used aircraft purchased by the Commercial Airplanes segment and general stock materials are stated at cost not in excess of net realizable value. See 'Aircraft... -

Page 74

...fair value of the asset. Investments We classify investment securities as either held-to-maturity or available-for-sale. Held-to-maturity securities include time deposits and are carried at cost. Available-for-sale securities include marketable debt and equity securities and Enhanced Equipment Trust... -

Page 75

... the financial statements and measured at fair value regardless of the purpose or intent of holding them. We use derivative instruments to principally manage a variety of market risks. For derivatives designated as hedges of the exposure to changes in fair value of the recognized asset or liability... -

Page 76

...for Sale Aircraft but prior to the purchase of the used trade-in aircraft. Estimates based on current aircraft values would be included in Other accrued liabilities. The fair value of trade-in aircraft is determined using aircraft-specific data such as model, age and condition, market conditions for... -

Page 77

...how long we will hold an asset subject to operating lease before it is sold, the expected future lease rates, lease terms, residual value of the asset, periods in which the asset may be held in preparation for a follow-on lease, maintenance costs, remarketing costs and the remaining economic life of... -

Page 78

..., equipment, parts, and software manufactured by us to certain contractual specifications. Estimated costs related to standard warranties are recorded in the period in which the related product sales occur. The warranty liability recorded at each balance sheet date reflects the estimated number of... -

Page 79

... is intended to strengthen our 787 program and bolster our capability to develop and produce large composite structures. The results of operations from the acquisition date are included in our Commercial Airplanes' segment. The final allocation of the purchase price is as follows: Inventory Property... -

Page 80

Note 3 - Goodwill and Acquired Intangibles Changes in the carrying amount of goodwill by reportable segment for the years ended December 31, 2010, 2009 and 2008 were as follows: Boeing Network Global Commercial Military & Space Services Airplanes Aircraft Systems & Support Balance at January 1, 2008... -

Page 81

...not exceed the exercise/threshold price. However, these shares may be dilutive potential common shares in the future. (Shares in millions) Years ended December 31, Stock options Performance Awards ShareValue Trust Performance Shares Stock units Note 5 - Income Taxes The components of earnings before... -

Page 82

... tax assets, net of deferred tax liabilities, at December 31 were as follows: 2010 Retiree health care accruals Inventory and long-term contract methods of income recognition, fixed assets and other (net of valuation allowance of $27 and $23) Partnerships and joint ventures Other employee benefits... -

Page 83

... outstanding issues have been made for all jurisdictions and all open years. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows: 2010 Unrecognized tax benefits - January 1 Gross increases - tax positions in prior periods Gross decreases - tax positions in... -

Page 84

... timing and outcome of the audit settlement, unrecognized tax benefits that affect the effective tax rate could increase earnings by up to $300 based on current estimates. The research and development credit expired on December 31, 2009. On December 17, 2010, President Obama signed into law, the Tax... -

Page 85

... related to loans made to Sea Launch, we could incur additional pre-tax charges of up to $356. Note 7 - Inventories Inventories at December 31 consisted of the following: 2010 Long-term contracts in progress Commercial aircraft programs Commercial spare parts, used aircraft, general stock materials... -

Page 86

... 31, 2010 and 2009, the value of completed but unsold aircraft in inventory was insignificant. Note 8 - Customer Financing Customer financing at December 31 consisted of the following: 2010 Financing receivables Investment in sales-type/finance leases Notes Operating lease equipment, at cost, less... -

Page 87

...than investment-grade credit. For the year ended December 31, 2010, we applied default rates, on average, of 11% and 51% for customers with internally assigned B and CCC ratings. Declines in collateral values are a significant driver of our allowance for losses. Generally, out-of-production aircraft... -

Page 88

... with market decline. Our Customer financing portfolio has a concentration of various model aircraft. Customer financing carrying values related to major aircraft concentrations at December 31 were as follows: 2010 717 Aircraft ($561 and $662 accounted for as operating leases)(1) 757 Aircraft ($629... -

Page 89

..., which are recorded in Short-term and other investments or Investments, consisted of the following at December 31: 2010 Time deposits Pledged money market funds(1) Available-for-sale investments Equity method investments Other investments Total (1) 2009 $5,100 $1,900 57 15 139 1,072 974... -

Page 90

... of equity method investments consisted of the following as of December 31: Segment United Launch Alliance United Space Alliance Other Network & Space Systems Network & Space Systems Primarily Commercial Airplanes and Global Services & Support Ownership Percentages Investment Balance 2010 2009 2010... -

Page 91

... the 2004 purchase and sale agreement with General Electric Capital Corporation related to the sale of Boeing Capital Corporation's (BCC) Commercial Financial Services business, BCC is involved in a loss sharing arrangement for losses on transferred portfolio assets, such as asset sales, provisions... -

Page 92

... with Company Owned Life Insurance (COLI), which are life insurance policies with a cash surrender value. Although we do not use COLI currently, these obligations from the merger with McDonnell Douglas are still a commitment at this time. We have loans in place to cover costs paid or incurred... -

Page 93

.... As we have the right to offset the loans against the cash surrender value of the policies, we present the net asset in Other assets on the Consolidated Statements of Financial Position as of December 31, 2010 and 2009. Note 12 - Arrangements with Off-Balance Sheet Risk We enter into arrangements... -

Page 94

... property at our Wichita site. Tax benefits associated with IRBs include a ten-year property tax abatement and a sales tax exemption from the Kansas Department of Revenue. We record the property on our Consolidated Statements of Financial Position, along with a capital lease obligation to repay the... -

Page 95

... of long-term debt at December 31 consisted of the following: 2010 2009 Consolidated BCC Consolidated Total Only Total Unsecured debt securities Non-recourse debt and notes Capital lease obligations Other notes Total Debt at December 31 consisted of the following: 2010 Boeing Capital Corporation... -

Page 96

...2008. We fund our major pension plans through trusts. Pension assets are placed in trust solely for the benefit of the plans' participants, and are structured to maintain liquidity that is sufficient to pay benefit obligations as well as to keep pace over the long term with the growth of obligations... -

Page 97

.../ dispositions, net Benefits paid Exchange rate adjustment Ending balance at fair value Amounts recognized in statement of financial position at December 31 consist of: Pension plan assets, net Other accrued liabilities Accrued retiree health care Accrued pension plan liability, net Net amount... -

Page 98

... average for all plans, are used to calculate the benefit obligation at December 31 of each year and the net periodic benefit cost for the subsequent year. December 31, Discount rate: Pension Other postretirement benefits Expected return on plan assets Rate of compensation increase 2010 5.30% 4.90... -

Page 99

...-point change in assumed health care cost trend rates would have the following effect: Increase Effect on total of service and interest cost Effect on postretirement benefit obligation $ 51 742 Decrease $ (44) (654) Plan Assets Investment Strategy The overall objective of our pension assets is... -

Page 100

...in long duration instruments. Global equity securities are invested broadly in U.S. and non-U.S. companies which are in various industries and countries and through a range of market capitalizations. Real estate and real assets include global private investments and publicly traded investments (such... -

Page 101

... securities are primarily valued using a market approach with inputs that include broker quotes, benchmark yields, base spreads and reported trades. Cash equivalents and other short-term investments, which are used to pay benefits, are primarily held in registered money market funds which are valued... -

Page 102

... and real assets, hedge funds and global strategies, do not have readily determinable market values given the specific investment structures involved and the nature of the underlying investments. For the December 31, 2010 and 2009 plan asset reporting, publicly traded asset pricing was used where... -

Page 103

... of approximately 60% equities and 40% debt securities. The index fund is valued using a market approach based on the quoted market price of an identical instrument (Level 1). The expected rate of return on these assets does not have a material effect on the net periodic benefit cost. Cash Flows... -

Page 104

... a change in control of the Company which is not approved by the Board of Directors and the plans are terminated within five years thereafter, the assets in the plan first will be used to provide the level of retirement benefits required by ERISA, and then any surplus will be used to fund a trust to... -

Page 105

... since it is incentive compensation issued primarily to our executives. The share-based plans expense and related income tax benefit follow: Years ended December 31, Stock options Restricted stock units and other awards ShareValue Trust Share-based plans expense Income tax benefit 2010 $ 96 83 36... -

Page 106

... a reasonable basis upon which to estimate expected term. Restricted Stock Units On February 22, 2010, we granted to our executives 1,459,256 restricted stock units (RSUs) as part of our long-term incentive program with a grant date fair value of $63.83 per share. On February 23, 2009, we granted to... -

Page 107

...related to the undistributed shares were written off at June 30, 2010, offset against previous excess tax benefits recorded in Additional paid-in capital. Other Compensation Arrangements Performance Awards Performance Awards are cash units that pay out based on the achievement of long-term financial... -

Page 108

...potentially unfavorable price changes for items used in production. These include commitments to purchase electricity at fixed prices through 2016. Fair Value Hedges Interest rate swaps under which we agree to pay variable rates of interest are designated as fair value hedges of fixed-rate debt. The... -

Page 109

... Values The notional amounts and fair values of derivative instruments in the Consolidated Statements of Financial Position as of December 31 were as follows: Notional amounts(1) Other assets 2010 2009 2010 2009 Derivatives designated as hedging instruments: Foreign exchange contracts Interest rate... -

Page 110

... credit risk are predominantly with commercial aircraft customers and the U.S. government. Of the $10,496 in gross accounts receivable and gross customer financing included in the Consolidated Statements of Financial Position as of December 31, 2010, $4,996 related to commercial aircraft customers... -

Page 111

...$(108) $(108) $5 $5 Money market funds and equity securities are valued using a market approach based on the quoted market prices of identical instruments. Available-for-sale debt investments are primarily valued using a market approach based on benchmark yields, reported trades and broker/dealer... -

Page 112

... values of fixed rate notes receivable are estimated using discounted cash flow analysis using interest rates currently offered on loans with similar terms to borrowers of similar credit quality. The fair value of our debt is based on current market yields for our debt traded in the secondary market... -

Page 113

...the termination to one for "the convenience of the government," and to obtain payment for work done and costs incurred on the A-12 contract but not paid to date. As of December 31, 2010, inventories included approximately $586 of recorded costs on the A-12 contract, against which we have established... -

Page 114

..., unfair competition, and other claims. ICO added The Boeing Company as a defendant in October 2005 to some of these claims and for interference with contract and misappropriation of trade secrets. On January 13, 2006, BSSI filed a cross-complaint against ICO, ICO Global Communications (Holdings... -

Page 115

... 13, 2009, plaintiff shareholders filed a putative securities fraud class action against The Boeing Company and two of our senior executives in federal district court in Chicago. This lawsuit arises from our June 2009 announcement that the first flight of the 787 Dreamliner would be postponed... -

Page 116

... aircraft; network and tactical systems, including information and battle management systems, intelligence and security systems, missile defense systems, space and intelligence systems, including satellites and commercial satellite launching vehicles, and space exploration. BDS support and services... -

Page 117

... directly from the segments' internal financial reporting used for corporate management purposes. Research and Development Expense Years ended December 31, Commercial Airplanes Boeing Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total Boeing... -

Page 118

Depreciation and Amortization Years ended December 31, Commercial Airplanes Boeing Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total Boeing Defense, Space & Security Boeing Capital Corporation Other segment Unallocated items and eliminations ... -

Page 119

... related to BCC. Segment assets and liabilities are summarized in the tables below. Assets December 31, Commercial Airplanes Boeing Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total Boeing Defense, Space & Security Boeing Capital Corporation... -

Page 120

... of 2009, we recorded pre-tax charges of $347 and $1,005 on the 747 program in our Commercial Airplanes segment. During the third quarter of 2009, we recorded $2,619 of research and development costs relating to the first three 787 flight test aircraft in our Commercial Airplanes segment. 108 -

Page 121

... of Directors and Shareholders of The Boeing Company Chicago, Illinois We have audited the accompanying consolidated statements of financial position of The Boeing Company and subsidiaries (the "Company") as of December 31, 2010 and 2009, and the related consolidated statements of operations, equity... -

Page 122

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of The Boeing Company Chicago, Illinois We have audited the internal control over financial reporting of The Boeing Company and subsidiaries (the "Company") as of December 31, 2010, based on criteria established in Internal Control... -

Page 123

... Over Financial Reporting. There were no changes in our internal control over financial reporting that occurred during the fourth quarter of 2010 that have materially affected or are reasonably likely to materially affect our internal control over financial reporting. Item 9B. Other Information None... -

Page 124

... Internal and Executive Communications and General Manager of Communications and Community Relations for Military Aircraft and Missile Systems unit. Mr. Downey joined the Company in 1986. President, Boeing International since November 2007 and Senior Vice President, Business Development and Strategy... -

Page 125

...to September 2005. Prior positions include President of Shared Services Group and Vice President and General Manager, Homeland Security and Services. Mr. Stephens joined the Company in 1980. Chief Technology Officer and Senior Vice President of Engineering, Operations & Technology since October 2006... -

Page 126

...that information is incorporated by reference herein. Codes of Ethics. We have adopted (1) The Boeing Company Code of Ethical Business Conduct for the Board of Directors; (2) The Boeing Company Code of Conduct for Finance Employees which is applicable to our Chief Financial Officer (CFO), Controller... -

Page 127

...forth information regarding outstanding options and shares available for future issuance under these plans as of December 31, 2010: Number of securities Number of shares remaining available for to be issued upon Weighted-average future issuance under exercise of exercise price of equity compensation... -

Page 128

.... Å The Boeing Company Bank Credit Agreements (i) U.S. $2.376 Billion 364-Day Credit Agreement dated as of November 12, 2010, among The Boeing Company, the Lenders named therein, Citigroup Global Markets Inc. and J.P. Morgan Securities LLC as joint lead arrangers and joint book managers, JPMorgan... -

Page 129

(iv) Delta Inventory Supply Agreement, dated as of December 1, 2006 by and between United Launch Alliance L.L.C. and The Boeing Company (Exhibit (10)(vi) to the Company's Form 10-K for the year ended December 31, 2006). Asset Purchase Agreement by and between Vought Aircraft Industries, Inc. and ... -

Page 130

..., N.A., solely in its capacity as duly appointed and acting investment manager of a segregated account held in The Boeing Company Employee Retirement Plans Master Trust (Exhibit 10.1 to the Company's Registration Statement on Form S-3 filed November 10, 2009). (12) Computation of Ratio of Earnings... -

Page 131

...Financial Officer pursuant to Section 906 of SarbanesOxley Act of 2002. (99) Additional Exhibits (i) Commercial Program Method of Accounting (Exhibit (99)(i) to the 1997 Form 10-K). (101) Interactive Data Files...holders of long-term debt of the Company or its subsidiaries are not filed herewith. ... -

Page 132

... 13 of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on February 9, 2011. THE BOEING COMPANY By: By: W. James McNerney, Jr. - Chairman, President and Chief Executive Officer By: James... -

Page 133

... of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities indicated on February 9, 2011. John H. Biggs - Director Edward M. Liddy - Director John E. Bryson - Director John F. McDonnell - Director David... -

Page 134

...to costs and expenses. During 2010, our claims against Sea Launch were discharged by the bankruptcy court and the related balances and reserves were written off. See Note 6 to our Consolidated Financial Statements for more information regarding amounts receivable from other Sea Launch partners. 122 -

Page 135

... of Ratio of Earnings to Fixed Charges The Boeing Company and Subsidiaries (Dollars in millions) Years ended December 31, Earnings before federal taxes on income Fixed charges excluding capitalized interest Amortization of previously capitalized interest Net adjustment for earnings from affiliates... -

Page 136

EXHIBIT (21) List of Company Subsidiaries The Boeing Company and Subsidiaries Name 757UA, Inc. ACN 106 604 871 Pty Ltd AeroSpace Technologies of Australia Limited Aileron Inc. Akash, Inc. Alteon Training International Spain, S.L. Alteon Training Mexico, S.A. de C.V. Alteon Training Services, Inc. ... -

Page 137

... Ltda. Boeing Business Services Company Boeing Canada Holding Ltd. Boeing Canada Operations Ltd. Boeing Capital Corporation Boeing Capital Leasing Limited Boeing Capital Loan Corporation Boeing Capital Securities Inc. Boeing CAS GmbH Boeing CAS Holding GmbH Boeing China, Inc. Boeing Commercial Space... -

Page 138

... Research & Technology Europe, S.L. Boeing Russia, Inc. Boeing Sales Corporation Boeing Satellite Systems International, Inc. Boeing Satellite Systems, Inc. Boeing Service Company Boeing Shanghai Aviation Flight Training Co., Ltd. Boeing Singapore Training and Flight Services Pte. Ltd. Boeing Space... -

Page 139

Name CBSA Leasing, Inc. CBSA Partners, LLC CDM Technologies, Inc. C-Map USA, Inc. C-Map/Commercial, Ltd. Coherent Systems International Corporation Coherent Systems International, LLC Connexion by Boeing Ireland Limited Connexion By Boeing of Canada Company Continental DataGraphics Limited ... -

Page 140

... Corporation Sandia National Security LLC Spectrolab, Inc. Taiko Leasing, Inc. Tapestry Solutions, Inc. Thayer Leasing Company-1 Wingspan, Inc. Yunnan Alteon Boeing Advanced Flight Training Co., Ltd Total Number of Subsidiaries: 247 128 Place of Incorporation United Kingdom Ukraine Kansas Delaware... -

Page 141

... on Form S-3 of our reports dated February 9, 2011, relating to the consolidated financial statements and financial statement schedule of The Boeing Company and subsidiaries (the "Company"), and the effectiveness of the Company's internal control over financial reporting appearing in this Annual... -

Page 142

... auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): (a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect... -

Page 143

... auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): (a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect... -

Page 144

... of the Securities Exchange Act of 1934, as amended; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. W. James McNerney, Jr. Chairman, President and Chief Executive Officer February 9, 2011... -

Page 145

... Securities Exchange Act of 1934, as amended; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. James A. Bell Executive Vice President, Corporate President and Chief Financial Officer February... -

Page 146

... also Boeing Commercial Aviation Services offers a portfolio of products, services and support aimed at helping our customers maximize the lifetime value of their airplanes, providing them a competitive edge in their markets. The organization offers a comprehensive global customer support network... -

Page 147

... on the ï¬rst aircraft in Seattle. The Ground Support Center at the Military Operating Base is progressing through its development, test and evaluation in Konya, Turkey. Mission system ï¬,ight testing is under way on the ï¬rst aircraft for the Republic of Korea's Peace Eye program. Three other AEW... -

Page 148

... business and provides the global services market with innovative, costcompetitive, world-class services and custom software development for the U.S. military and other government customers, as well as the private sector. In 2010, D&GS expanded its The E-4B Advanced Airborne Command Post is used... -

Page 149

...launched the ï¬rst IIF satellite in May 2010. The GPS IIF satellites incorporate several key technology enhancements, including greater Global Services & Support provides best-value mission readiness to its customers through total support solutions. The global business sustains aircraft and systems... -

Page 150

...ed propulsion system. Intelsat 22 is scheduled to launch in 2012. It will carry an ultrahigh frequency government-hosted payload to provide service to the Australian Defence Force. Intelsat Satellites International Space Station (ISS) the space station. In addition to designing and building the... -

Page 151

...The space shuttle is the world's only operational, reusable launch vehicle capable of delivering and returning large payloads and scientiï¬c experiments to and from space. Boeing is a major subcontractor to NASA's space program operations contractor, United Space Alliance. As the original developer... -

Page 152

... mission planning solutions for both Boeing and non-Boeing programs worldwide. Awardwinning training solutions encompass software, Using the combined assets of the Boeing Delta and Lockheed Martin Atlas launch vehicle programs (including mission management, support, engineering, vehicle production... -

Page 153

... change of address. Annual Meeting The annual meeting of Boeing shareholders is scheduled to be held on Monday, May 2, 2011. Details are provided in the proxy statement. Written Inquiries May Be Sent To: Shareholder Services The Boeing Company Mail Code 5003-1001 100 North Riverside Plaza Chicago... -

Page 154

... Company Boeing director since 2001 Committee: Special Programs (Chair) Susan C. Schwab, 55 Professor, University of Maryland School of Public Policy; Former U.S. Trade Representative Boeing director since 2010 Committees: Audit; Finance Ronald A. Williams, 61 Chairman, Aetna Inc. (managed care... -

Page 155

... go into developing our innovative products and services to help strengthen communities around the world, making them healthier and more supportive places to live and work. http://www.boeing.com/companyofï¬ces/ aboutus/community/2010_report/index.html Environment Report From designing more fuel... -

Page 156

The Boeing Company 100 North Riverside Plaza Chicago, IL 60606-1596 U.S.A. 002CSI0994