Avid 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Avid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AVID 2014 ANNUAL REPORT

Table of contents

-

Page 1

AVID 2014 ANNUAL REPORT -

Page 2

... and our customers. Avid Everywhere is our strategic vision of providing a ï¬,exible and open common platform to address the most intense business issues facing the industry. It is designed to achieve a better return on our extensive distribution network, drive higher cross-sell activity with top... -

Page 3

... Commission File Number: 1-36254 _____ Avid Technology, Inc. (Exact Name of Registrant as Specified in Its Charter) Delaware (State or Other Jurisdiction of Incorporation or Organization) 04-2977748 (I.R.S. Employer Identification No.) 75 Network Drive Burlington, Massachusetts 01803 (Address of... -

Page 4

...Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations Quantitative and Qualitative Disclosures about Market Risk Financial Statements and Supplementary Financial Information Report of Independent Registered... -

Page 5

...the following the development, marketing and selling of new products and services; our ability to successfully implement our Avid Everywhere strategic plan and other strategic initiatives, including our cost saving strategies; anticipated trends relating to our sales, financial condition or results... -

Page 6

... not limited to, the following: Avid Everywhere, Avid Motion Graphics, AirSpeed, EUCON, Fast Track, iNEWS, Interplay, ISIS, Avid MediaCentral Platform, Mbox, Media Composer, NewsCutter, Nitris, Pro Tools, Sibelius and Symphony. Other trademarks appearing in this Form 10-K are the property of their... -

Page 7

... a set of modular application suites that together represent an open, integrated, and flexible media production and distribution environment for the media industry. The Avid Advantage complements Avid Everywhere by offering a new standard in service, support and education to enable our customers to... -

Page 8

...and teachers in career technical education programs in high schools, colleges and universities, as well as in post-secondary vocational schools, that prepare students for professional media production careers in the digital workplace. For this market, we offer a range of products and solutions based... -

Page 9

... editorial workflow of team members at each site, many of whom may be working on the same projects at the same time. Avid Interplay | Production also manages the detailed composition of a project and provides the ability to track media, production file formats, and a project's history. 3 -

Page 10

... project needs with an open shared storage platform that includes the ISIS file system technology on lower cost hardware, support for third-party applications and streamlined administration to create more content more affordably. In April 2014, we introduced ISIS 2500 as a near-line storage solution... -

Page 11

... venues to meet a broad range of demands. The S3 control surface from the S3L-X system was made available in December 2014 as a standalone product allowing users to control Pro Tools or other EUCON-enabled EUCON digital audio workstations in a studio or home environment. Revenues from control... -

Page 12

...information on our revenue backlog can be found in "Management's Discussion and Analysis of Financial Condition and Results of Operation." We provide customer care services directly through regional in-house and contracted support centers and major-market field service representatives and indirectly... -

Page 13

... with our manufacturing operations, see "Risk Factors" in Item 1A of this Form 10-K. Research and Development We are committed to delivering best-in-class digital media content-creation solutions that are designed for the unique needs, skills and sophistication levels of our target customer markets... -

Page 14

... of our intellectual property, see "Risk Factors" in Item 1A of this Form 10-K. HISTORY AND EMPLOYEES Avid was incorporated in Delaware in 1987. We are headquartered in Burlington, Massachusetts, with operations in North America, South America, Europe, Asia and Australia. At December 31, 2014, our... -

Page 15

...are in developing products or in attracting and retaining customers, our financial condition and operating results could be adversely affected. The rapid evolution of the media industry is changing our customers' needs, businesses and revenue models, and if we cannot anticipate or adapt quickly, our... -

Page 16

... industry and engage with providers of software as a service. We continually assess new products and solutions for our customers and we continue to implement our Avid Everywhere strategy and platform designed to address changes in the industry by offering an open platform that will enable people to... -

Page 17

..., or experience delays, disruptions or quality control problems in development or manufacturing operations, or if we had to change development or manufacturing vendors, our ability to provide services to our customers would be delayed and our business, operating results and financial condition would... -

Page 18

... products, encounter financial difficulties or are unable to secure necessary raw materials from their suppliers, or suffer any other disruption or reduction in efficiency, we may encounter supply delays or disruptions. Pricing terms offered by contractors may be highly variable over time reflecting... -

Page 19

...of management's attention from normal business operations; • potential loss of key employees of the acquired company; • difficulty implementing effective internal controls over financial reporting and disclosure controls and procedures; • impairment of relationships with customers or suppliers... -

Page 20

... manage the delivery model for our products and services could adversely affect our revenues and gross margins and therefore our profitability. We distribute many of our products indirectly through third-party resellers and distributors. We also distribute products directly to end-user customers... -

Page 21

... or errors (commonly referred to as "bugs"), which in some cases may interfere with or impair a customer's ability to operate or use the software. Similarly, our hardware products could include design or manufacturing defects that could cause them to malfunction. Although we employ quality control... -

Page 22

... products or services that incorporate the challenged intellectual property; • make substantial payments for legal fees, settlement payments or other costs or damages; • obtain a license, which may not be available on reasonable terms, to sell or use the relevant technology, which such license... -

Page 23

... products and services. A prolonged disruption of our business could also damage our reputation, particularly among our global news organization customers who are likely to require our solutions and support during such time. Any of these factors could cause a material adverse impact on our financial... -

Page 24

... our revenues from foreign markets and our manufacturing costs in the long term. Our international sales are, for the most part, transacted through foreign subsidiaries and generally in the currency of the end-user customers. Consequently, we are exposed to short-term currency exchange risks that... -

Page 25

... revenue, gross margin, earnings or growth rates and difficulty managing inventory levels. Sustained uncertainty about global economic conditions may adversely affect demand for our products and services and could cause demand to differ materially from our expectations as customers curtail or delay... -

Page 26

... and procedures; • enhance our revenue recognition and other existing accounting policies and procedures; • introduce new or enhanced accounting systems and processes; and • improve our internal control over financial reporting. We cannot assure you that the changes and enhancements made to... -

Page 27

.... Until we filed our quarterly report on Form 10-Q for the quarter ended September 30, 2014, which was filed on November 13, 2014, we were delinquent in our financial reporting obligations. Although we are current in our reporting obligations as of the date of filing of this annual report on Form 10... -

Page 28

... in Burlington, Massachusetts for our principal corporate and administrative offices, as well as for significant R&D activities. The leases for these facilities expire in May 2020. We also lease 106,000 square feet in Mountain View, California, primarily for R&D, product management and manufacturing... -

Page 29

... above, we are involved in legal proceedings from time to time arising from the normal course of business activities, including claims of alleged infringement of intellectual property rights and contractual, commercial, employee relations, product or service performance, or other matters. We... -

Page 30

ITEM 4. MINE SAFETY DISCLOSURES Not Applicable. 24 -

Page 31

... years ended December 31, 2014 and 2013. 2014 High Low High 2013 Low First Quarter Second Quarter Third Quarter Fourth Quarter $8.29 $7.64 $10.55 $14.48 $4.93 $6.10 $7.45 $9.25 $7.99 $7.01 $6.30 $8.89 $6.27 $5.88 $5.22 $6.16 On March 13, 2015, the last reported sale price of our common stock... -

Page 32

... companies in terms of market capitalizations and revenue. The Avid Peer Group Index for 2014 was composed of: Dolby Laboratories, Inc., Harmonic Inc., Imation Corp., Mentor Graphics Corporation, National Instruments Corporation, Pegasystems Inc., Progress Software Corporation, QLogic Corporation... -

Page 33

...to January 1, 2011, product revenues are generally recognized upon delivery and Implied Maintenance PCS and other service and support elements are recognized as services are rendered. See our policy on "Revenue Recognition" in Note B to our Consolidated Financial Statements in Item 8 of this Form 10... -

Page 34

... a set of modular application suites that together represent an open, integrated, and flexible media production and distribution environment for the media industry. The Avid Advantage complements Avid Everywhere by offering a new standard in service, support and education to enable our customers to... -

Page 35

... between our customers and us. As a part of our strategy, we are continuing to focus on cost reductions and are continually reviewing and implementing programs throughout the company to reduce costs, increase efficiencies and enhance our business, including by shifting a portion of our employee base... -

Page 36

... as well as bug fixes on a when-and-if-available basis, or collectively Software Updates, for a period of time after initial sales to end users. The implicit obligation to make such Software Updates available to customers over a period of time represents implied post-contract customer support, which... -

Page 37

... of time the product version purchased by the customer is planned to be supported with Software Updates. If facts and circumstances indicate that the original service period of Implied Maintenance Release PCS for a product has changed significantly after original revenue recognition has commenced... -

Page 38

... the product is shipped. Revenue from support that is considered a non-software deliverable is initially deferred and is recognized ratably over the contractual period of the arrangement, which is generally twelve months. Professional services and training services are typically sold to customers on... -

Page 39

..., we have no present intention to pay cash dividends and our current credit agreement precludes us from paying dividends. Our expected stock-price volatility assumption is based on recent (six-month trailing) implied volatility of the traded options. These calculations are performed on exchange... -

Page 40

...amount of income taxes we pay is subject to our interpretation of applicable tax laws in the jurisdictions in which we file. We have taken and will continue to take tax positions based on our interpretation of such tax laws. There can be no assurance that a taxing authority will not have a different... -

Page 41

... expected severance payments are probable and can be reasonably estimated. Restructuring charges require significant estimates and assumptions, including sub-lease income and severance period assumptions. Our estimates involve a number of risks and uncertainties, some of which are beyond our control... -

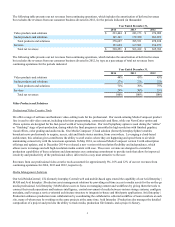

Page 42

...audio hardware and software products and solutions for digital media content creation, distribution and monetization, and related professional services and maintenance contracts. Net Revenues from Continuing Operations for the Years Ended December 31, 2014 and 2013 (dollars in thousands) 2014 Change... -

Page 43

... table sets forth the percentage of our net revenues from continuing operations attributable to geographic regions for the periods indicated: 2014 Year Ended December 31, 2013 2012 United States Other Americas Europe, Middle East and Africa Asia-Pacific Video Products and Solutions Revenues 2014... -

Page 44

... increased maintenance revenues, driven by maintenance contracts attached to new product sales. During 2013, we continued to include a one-year maintenance contract with certain product sales, which we began during 2011. While this has had a positive impact on 2012 and 2013 maintenance revenues, the... -

Page 45

...; customer support related to maintenance; royalties for third-party software and hardware included in our products; amortization of technology; and providing professional services and training. Amortization of technology included in cost of revenues represents the amortization of developed... -

Page 46

... operations for 2013, compared to 2012, was driven by a significant increase in services revenues from maintenance contracts, which have higher gross margins than professional services and training, as well as margin improvement for professional services resulting from enhanced productivity. 40 -

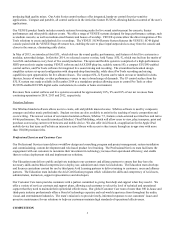

Page 47

... Income for the Years Ended December 31, 2013 and 2012 (dollars in thousands) 2013 Change Expenses $ % 2012 Expenses Research and development expenses Marketing and selling expenses General and administrative expenses Amortization of intangible assets Restructuring costs, net Total operating... -

Page 48

... information technology overhead. The increases in computer hardware and supplies expenses and consulting and outside services expenses were primarily the result of the timing of certain development projects in 2014, compared to 2013, as we develop new products and solutions consistent with our Avid... -

Page 49

... services costs for 2013, compared to 2012, was the result of lower costs related to long-term sales and marketing strategy planning. The decrease in tradeshow and other promotional expenses was the result of our cost reduction initiatives started in 2013. General and Administrative Expenses General... -

Page 50

... of developed technology is recorded within cost of revenues. Amortization of customer-related intangibles, trade names and other identifiable intangible assets is recorded within operating expenses. Year-Over-Year Change in Amortization of Intangible Assets for the Years Ended December 31, 2014 and... -

Page 51

... of the business operations and a reduction in force. Actions under the plan included the elimination of approximately 280 positions in June 2012, the abandonment of one of the Company's facilities in Burlington, Massachusetts and the partial abandonment of facilities in Mountain View and Daly City... -

Page 52

... in the applicable tax jurisdictions. We regularly review our deferred tax assets for recoverability with consideration for such factors as historical losses, projected future taxable income, the expected timing of the reversals of existing temporary differences, and tax planning strategies. ASC... -

Page 53

...base rate (as defined in the Credit Agreement) plus 1.75%, at the option of Avid Technology, Inc. or Avid Europe, as applicable. We must also pay Wells Fargo a monthly unused line fee at a rate of 0.625% per annum. Any borrowings under the credit facilities are secured by a lien on substantially all... -

Page 54

... includes component parts, finished goods as well as inventory at customer sites related to shipments for which we have not yet recognized revenue. Inventory is sourced from third party suppliers, located primarily in Asia. Cash Flows from Investing Activities For the year ended December 31, 2014... -

Page 55

...FASB, and the International Accounting Standards Board, or the IASB, issued substantially converged final standards on revenue recognition. FASB Accounting Standards Update, or ASU, No. 2014-09, Revenue from Contracts with Customers (Topic 606), was issued in three parts: (a) Section A, "Summary and... -

Page 56

...a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. The new revenue recognition guidance becomes effective for us on January 1, 2017, and early... -

Page 57

...more than half of our revenues from customers outside the United States. This business is, for the most part, transacted through international subsidiaries and generally in the currency of the end-user customers. Therefore, we are exposed to the risks that changes in foreign currency could adversely... -

Page 58

... balances and subject to other terms and conditions. At December 31, 2014, we had no outstanding borrowings under the credit facilities. A hypothetical 10% increase or decrease in interest rates payable on outstanding borrowings under the credit facilities would not have a material impact on our... -

Page 59

... TECHNOLOGY, INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULE Page CONSOLIDATED FINANCIAL STATEMENTS INCLUDED IN ITEM 8: Report of Independent Registered Public Accounting Firm Consolidated Statements of Operations for the years ended December 31, 2014, 2013 and 2012... -

Page 60

... ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting... -

Page 61

AVID TECHNOLOGY, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) Year Ended December 31, 2014 Net revenues: Products Services Total net revenues Cost of revenues: Products Services Amortization of intangible assets Total cost of revenues Gross profit Operating ... -

Page 62

... Other comprehensive (loss) income: Foreign currency translation adjustments Comprehensive income The accompanying notes are an integral part of the consolidated financial statements. $ (7,540) 7,188 $ (1,717) 19,436 $ 606 93,497 $ Year Ended December 31, 2013 2012 $ 21,153 $ 92,891 14,728 56 -

Page 63

AVID TECHNOLOGY, INC. CONSOLIDATED BALANCE SHEETS (in thousands, except per share data) December 31, 2014 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net of allowances of $10,692 and $13,963 at December 31, 2014 and 2013, respectively Inventories Deferred tax assets, net ... -

Page 64

... Net income Other comprehensive income Balances at December 31, 2013 Stock issued pursuant to employee stock plans Stock-based compensation Net income Other comprehensive loss Balances at December 31, 2014 The accompanying notes are an integral part of the consolidated financial statements. 58 -

Page 65

... of property and equipment Change in other long-term assets Proceeds from divestiture of consumer business Proceeds from sale of assets Net cash (used in) provided by investing activities Cash flows from financing activities: Proceeds from the issuance of common stock under employee stock plans... -

Page 66

... Avid Technology, Inc. ("Avid" or the "Company") provides technology solutions that enable the creation, distribution and monetization of audio and video content. Specifically, the Company develops, markets, sells and supports software and hardware for digital media content production, management... -

Page 67

...length of time the product version purchased by the customer is planned to be supported with Software Updates. If facts and circumstances indicate that the original deemed service period of Implied Maintenance Release PCS for a product has changed significantly after original revenue recognition has... -

Page 68

... the product is shipped. Revenue from support that is considered a non-software deliverable is initially deferred and is recognized ratably over the contractual period of the arrangement, which is generally twelve months. Professional services and training services are typically sold to customers on... -

Page 69

...fully deferred contracts are recorded as a component of inventories in the consolidated balance sheet, and generally all other costs of sales are recognized when revenue recognition commences. The Company records as revenues all amounts billed to customers for shipping and handling costs and records... -

Page 70

...customer concentrations, customer credit worthiness and current economic trends. To date, actual bad debts have not differed materially from management's estimates. The following table sets forth the activity in the allowance for doubtful accounts for the years ended December 31, 2014, 2013 and 2012... -

Page 71

...States. This business is, for the most part, transacted through international subsidiaries and generally in the currency of the end-user customers. Therefore, the Company is exposed to the risks that changes in foreign currency could adversely affect its revenues, net income, cash flow and financial... -

Page 72

... and non-compete agreements from acquisitions. Internally developed assets consist primarily of various technologies that form the basis of products sold to customers. Costs are capitalized from when technological feasibility is established up until when the product is available for general release... -

Page 73

... the expected life of the related products, generally 12 to 36 months. The straight-line method generally results in approximately the same amount of expense as that calculated using the ratio that current period gross product revenues bear to total anticipated gross product revenues. The Company... -

Page 74

... for all of the Company's products is generally 90 days to one year, but can extend up to five years depending on the manufacturer's warranty or local law. For internally developed hardware and in cases where the warranty granted to customers for externally sourced hardware is greater than that... -

Page 75

... table sets forth the net foreign exchange gains (losses) recorded as marketing and selling expenses in the Company's statements of operations during the years ended December 31, 2014, 2013 and 2012 that resulted from the gains and losses on Company's foreign currency contracts not designated as... -

Page 76

...marketable securities and insurance contracts held in deferred compensation plans. At December 31, 2014 and 2013, all of the Company's financial assets and liabilities were classified as either Level 1 or Level 2 in the fair value hierarchy. Assets valued using quoted market prices in active markets... -

Page 77

...,782 35,186 The Company capitalizes certain development costs incurred in connection with its internal use software. For the year ended December 31, 2014, the Company capitalized $3.4 million of contract labor and internal labor costs related to internal use software, and recorded the capitalized... -

Page 78

...the years ended December 31, 2014, 2013 and 2012, respectively. I. INTANGIBLE ASSETS Amortizing identifiable intangible assets related to the Company's acquisitions or capitalized costs of internally developed or externally purchased software that form the basis for the Company's products consisted... -

Page 79

... present value basis, as well as other facilities-related obligations. The Company received $0.7 million of sublease income during the year ended December 31, 2014, but none during the years ended December 31, 2013 and 2012, respectively. The Company's leases for corporate office space in Burlington... -

Page 80

... to provide accurate forecasts or manage inventory levels in response to shifts in customer demand, the Company may have insufficient, excess or obsolete product inventory. Contingencies In March 2013 and May 2013, two purported securities class action lawsuits were filed against us and certain of... -

Page 81

... in cases where the warranty granted to customers for externally sourced hardware is greater than that provided by the manufacturer, the Company records an accrual for the related liability based on historical trends and actual material and labor costs. The following table sets forth the activity in... -

Page 82

... has no present expectation to pay cash dividends and the Company's current credit agreement precludes the Company from paying dividends. Historically, the expected stock-price volatility assumption has been based on recent (six-month trailing) implied volatility calculations. These calculations are... -

Page 83

... Expected life (in years) Weighted-average fair value of options granted (per share) During the years ended December 31, 2014, 2013 and 2012, the cash received from and the aggregate intrinsic value of stock options exercised was not significant. The Company did not realize a material tax benefit... -

Page 84

... the completion of certain required reports to the Securities Exchange Commission. A special plan period was opened from December 1, 2014 to January 31, 2015 and was available to all eligible employees of the Company. In order to compensate for the shortened special plan period, the maximum payroll... -

Page 85

... plans. The Company expects this amount to be amortized approximately as follows: $6.6 million in 2015, $3.5 million in 2016 and $0.9 million in 2017. At December 31, 2014, the weighted-average recognition period of the unrecognized compensation cost was approximately 1.1. M. EMPLOYEE BENEFIT PLANS... -

Page 86

... income taxes and the components of the income tax provision consisted of the following for the years ended December 31, 2014, 2013 and 2012 (in thousands): Year Ended December 31, 2013 2012 2014 Income (loss) from continuing operations before income taxes: United States Foreign Total income from... -

Page 87

...between 2019 and 2034. The federal net operating loss and tax credit amounts are subject to annual limitations under Section 382 change of ownership rules of the Internal Revenue Code. The Company completed an assessment at March 31, 2014 regarding whether there may have been a Section 382 ownership... -

Page 88

... taxes. The following table sets forth a reconciliation of the Company's income tax provision (benefit) to the statutory U.S. federal tax rate for the years ended December 31, 2014, 2013 and 2012: Year Ended December 31, 2013 2012 2014 Statutory rate Tax credits Foreign operations Non-deductible... -

Page 89

... of the business operations and a reduction in force. Actions under the plan included the elimination of approximately 280 positions in June 2012, the abandonment of one of the Company's facilities in Burlington, Massachusetts and the partial abandonment of facilities in Mountain View and Daly City... -

Page 90

..., 2014 and 2013 represent severance and outplacement costs to former employees that will be paid out during the year ended December 31, 2015, and are, therefore, included in the caption "accrued expenses and other current liabilities" in the Company's consolidated balance sheets at December 31, 2014... -

Page 91

...Release PCS. The Company provides online and telephone support and access to software upgrades for customers whose products are under warranty or covered by a maintenance contract. The Company's professional services team provides installation, integration, planning, consulting and training services... -

Page 92

... rate (as defined in the Credit Agreement) plus 1.75%, at the option of Avid Technology or Avid Europe, as applicable. The Borrowers must also pay Wells Fargo a monthly unused line fee at a rate of 0.625% per annum. Any borrowings under the Credit Agreement are secured by a lien on substantially all... -

Page 93

... from unaudited consolidated financial statements that, in the opinion of management, include all normal recurring adjustments necessary for a fair presentation of such information. Quarter Ended (In thousands, except per share data) Dec. 31 Net revenues Cost of revenues Amortization of intangible... -

Page 94

... over financial reporting is an integral part of our disclosure controls and procedures. Management's Annual Report on Internal Control over Financial Reporting Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule... -

Page 95

... to identify, update and assess risks, including changes in our business practices, that could significantly impact our consolidated financial statements as well as the system of internal control over financial reporting. Control Activities - We did not have control activities that were designed and... -

Page 96

... in October 2013. In addition, a number of new, qualified accounting and finance personnel have been hired to supplement the experience and depth of the team responsible for designing, implementing, monitoring and executing internal control over financial reporting during 2013 and 2014. In order to... -

Page 97

... strengthen our internal control over financial reporting and remediate the material weaknesses we have identified. We expect that our remediation efforts, including design, implementation and testing will continue throughout fiscal year 2015. Changes in Internal Control over Financial Reporting As... -

Page 98

... Stockholders of Avid Technology, Inc. Burlington, Massachusetts We have audited the internal control over financial reporting of Avid Technology, Inc. and subsidiaries (the "Company") as of December 31, 2014, based on criteria established in Internal Control - Integrated Framework (2013) issued by... -

Page 99

/s/ Deloitte & Touche LLP Boston, Massachusetts March 16, 2015 ITEM 9B. OTHER INFORMATION Not Applicable. 93 -

Page 100

... Avid, 75 Network Drive, Burlington, MA 01803, Attention: Corporate Secretary. Our Code of Business Conduct and Ethics is also available in the Investor Relations section of our website at www.avid.com. If we were to amend or waive any provision of our Code of Business Conduct and Ethics applicable... -

Page 101

... Deficit for the years ended December 31, 2014, 2013, and 2012 Consolidated Statements of Cash Flows for the years ended December 31, 2014, 2013 and 2012 Notes to Consolidated Financial Statements (a) 3. LISTING OF EXHIBITS. The list of exhibits, which are filed or furnished with this report or are... -

Page 102

... to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. AVID TECHNOLOGY, INC. (Registrant) By: /s/ Louis Hernandez, Jr. Louis Hernandez, Jr. Chairman... -

Page 103

... 16, 2011 by and among Avid Technology, Inc., Avid Technology International B. V., Pinnacle Systems, Inc., Avid General Partner B.V., each of the lenders party thereto, and Wells Fargo Capital Finance, LLC, as agent, dated October 1, 2010 Amendment #2 to Credit Agreement dated March 16, 2012 by and... -

Page 104

...Network Drive at Northwest Park Office Lease dated as of November 20, 2009 between Avid Technology, Inc. and Netview 1,2,3,4 & 9 LLC (for premises at 75 Network Drive, Burlington, Massachusetts) 1993 Director Stock Option Plan, as amended Second Amended and Restated 1996 Employee Stock Purchase Plan... -

Page 105

...100.SCH **100.CAL **100.DEF **100.LAB **100.PRE X X X X X X _____ # * ** Management contract or compensatory plan identified pursuant to Item 15(a)3. Effective date of Form S-1. Pursuant to Rule 406T of Regulation S-T, XBRL (Extensible Business Reporting Language) information is deemed not filed... -

Page 106

(This page has been left blank intentionally.) -

Page 107

... Advisors Dr. Youngme E. Moon Senior Associate Dean for Strategy and Innovation; Donald K. David Professor of Business Administration, Harvard Business School John H. Park Partner, Jackson Park Capital, LLC Avid Corporate Headquarters 75 Network Drive Burlington, MA 01803 tel 978 640 6789 www... -

Page 108

Avid 75 Network Drive Burlington, MA 01803 USA www.avid.com BR05367P-0315-AR