Air Canada 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2007

Table of contents

-

Page 1

ANNUAL REPORT 2007 -

Page 2

...42 43 45 46 49 50 57 61 63 64 65 74 75 76 Management's Report ...77 Independant Auditors' Report ...78 Consolidated Financial Statements and Notes 2007 ...79 Ofï¬cers and Directors ...142 Investor and Shareholder Information ...143 Ofï¬cial Languages at Air Canada ...143 Corporate Proï¬le ...144 -

Page 3

... the ï¬nal annual report I will submit as Air Canada chairman, having relinquished my board role at the end of 2007. At this time, I would like to recognize the achievement of Montie Brewer and his management team in delivering on the ambitious plan presented to investors during the public offering... -

Page 4

... 2008 so customers boarding most Air Canada aircraft will enjoy personalized seatback audio visual entertainment and access to a power plug and USB port. Those in Executive First will luxuriate in industry-leading, lie ï¬,at suites on international ï¬,ights. Our award winning new revenue model will... -

Page 5

... in business. Finally, Air Canada's stabilization is making it possible to equip our people with new tools. This includes not only new aircraft, but also technology to facilitate important tasks such as scheduling and maintenance. The payout to employees of $29.2 million in Sharing Our Success... -

Page 6

... impose constraints and demand added vigilance in managing our business. I would like to conclude by thanking investors for their conï¬dence in Air Canada and our employees for their hard work during 2007. Shareholders should be encouraged that their company has a solid plan, the resources and the... -

Page 7

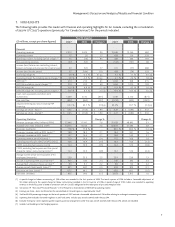

...expense and the special charge for labour restructuring (cents) (1) Average number of full-time equivalent (FTE) employees (thousands) Aircraft in operating ï¬,eet at period end (5) Average ï¬,eet utilization (hours per day) (6) Average aircraft ï¬,ight length (miles) (6) Fuel price per litre (cents... -

Page 8

... 2007, Air Canada had two reportable segments: Air Canada Services (which is now referred to as Air Canada), the passenger and cargo transportation services business operated by Air Canada and related ancillary services, and Jazz, Air Canada's regional capacity provider. Segment information was used... -

Page 9

Management's Discussion and Analysis of Results and Financial Condition CAUTION REGARDING FORWARD-LOOKING INFORMATION Air Canada's public communications may include written or oral forward looking statements within the meaning of applicable securities laws. Such statements are included in this MD&A ... -

Page 10

... of Air Canada seats to be provided to Aeroplan members who choose to redeem their Aeroplan miles for air travel rewards. The Corporation also generates revenues from cargo services provided by Air Canada and AC Cargo Limited Partnership ("Air Canada Cargo"), from tour operator services provided by... -

Page 11

... Airline in Canada" by the readers of Business Traveler magazine. We received Air Transport World magazine's 2007 Airline Industry Achievement Award for Market Leadership. We were recognized by the Canadian Information Productivity Awards (CIPA), for our Corporate Flight Pass, web check-in and kiosk... -

Page 12

...check into Air Canada ï¬,ights departing from any Canadian city and from select US and select international cities to Canada up to 24 hours prior to departure by using the web check-in facility provided on the Air Canada website. This has allowed us to generate cost savings while increasing customer... -

Page 13

... Refurbished aircraft will have new seats and personal in-ï¬,ight entertainment systems and in-seat power outlets at every seat in Economy Class, Executive Class and Executive First. In the domestic market, Air Canada will have a world class product to build on the signiï¬cant travel awards already... -

Page 14

... a mobile boarding pass pilot in the US. Finally, with the expected enhancements to our ï¬,ight notiï¬cation product, we will be able to provide customers with more information with respect to changes to their travel plans. NetLine The legacy technology of Air Canada's current ï¬,ight operations... -

Page 15

Management's Discussion and Analysis of Results and Financial Condition OASIS Online Aircraft Support Integrated Solution, or OASIS, is a corporate initiative to upgrade the current legacy maintenance and engineering system - referred to as ARTOS. The maintenance and engineering system provides the ... -

Page 16

... Wages, salaries and beneï¬ts Aircraft fuel Aircraft rent Airport and navigation fees Aircraft maintenance, materials and supplies Communications and information technology Food, beverages and supplies Depreciation, amortization and obsolescence Commissions Capacity purchase with Jazz Special... -

Page 17

Management's Discussion and Analysis of Results and Financial Condition Air Canada reported operating income of $72 million in the fourth quarter of 2007 compared to an operating loss of $5 million in the fourth quarter of 2006, an improvement of $77 million. The fourth quarter of 2007 included a ... -

Page 18

... of 0.2 percentage points. Trafï¬c growth was reï¬,ected in the United Kingdom market as a result of the newly launched Edmonton - London service, increased capacity on the Vancouver - London route and the addition of the larger Boeing 777 aircraft on the Toronto - London route. Trafï¬c growth... -

Page 19

...addition of a new non-stop service from Vancouver to Sydney, Australia. A yield decline of 2.9% (excluding the favourable adjustment of $26 million) reï¬,ecting the large capacity increase driven by Air Canada Vacations as well as the capacity growth on the South America routes. Pricing actions were... -

Page 20

... supplies Communications and information technology Food, beverages and supplies Commissions Capacity purchase with Jazz Other Operating expense, excluding fuel expense and the special charge for labour restructuring (2) Aircraft fuel Special charge for labour restructuring Total operating expense... -

Page 21

...'s operating ï¬,eet which accounted for an increase of $18 million. Depreciation expenses of $10 million in 2007 related to Air Canada's aircraft interior refurbishment program. No depreciation was recorded for this program in 2006. Airport and navigation fees increased 3% from the fourth quarter... -

Page 22

... a new commission structure at Air Canada Vacations in 2007. Commercial initiatives implemented by Air Canada to lower commission costs. An increase in web penetration which lowers distribution costs. Web penetration in Canada reached 64% in the fourth quarter of 2007, a 7 percentage point increase... -

Page 23

... quarter of 2006 Other operating expenses, largely comprised of terminal handling expenses, credit card fees, building rent and maintenance, the cost of ground packages at Air Canada Vacations and miscellaneous fees and services, amounted to $347 million in the fourth quarter of 2007, an increase... -

Page 24

... of Jazz (previously the "Air Canada Services" segment) for the full year 2006. Year ($ millions) Operating revenues Passenger Cargo Other Special charge for Aeroplan miles Operating expenses Wages, salaries and beneï¬ts Aircraft fuel Aircraft rent Airport and navigation fees Aircraft maintenance... -

Page 25

...Air Canada recorded a special charge of $102 million in operating revenues in connection with Air Canada's obligations for the redemption of pre-2002 Aeroplan miles. In the ï¬rst quarter of 2006, Air Canada recorded a special charge for labour restructuring of $28 million related to a non-unionized... -

Page 26

... of the larger Boeing 777 aircraft. Expanded services on the seasonal Montreal - Rome route was also a factor in the trafï¬c growth over 2006. A yield decline of 2.4% due to increased competition, particularly in the second and third quarters of 2007, as a result of the new service on British... -

Page 27

... of $26 million in 2007 versus nil in 2006. A growth in third party revenues at Air Canada Vacations of $17 million as a result of higher passenger volumes. An increase in third party line maintenance revenues of $5 million. A growth in third party ground handling revenues of $5 million. Additional... -

Page 28

... supplies Communications and information technology Food, beverages and supplies Commissions Capacity purchase with Jazz Other Operating expense, excluding fuel expense and the special charge for labour restructuring (2) Aircraft fuel Special charge for labour restructuring Total operating expense... -

Page 29

... accounted for a decrease of $135 million. Fuel hedging gains of $31 million in 2007 versus hedging losses of $43 million in 2006, resulting in a favourable variance of $74 million. â- The following table provides Air Canada's quarterly fuel price per litre and fuel consumption information for... -

Page 30

...impact of a new commission structure at Air Canada Vacations in 2007. Commercial initiatives implemented by Air Canada to lower commission costs. An increase in web penetration which lowers distribution costs. Capacity purchase fees paid to Jazz increased 6% from 2006 Capacity purchase fees paid to... -

Page 31

Management's Discussion and Analysis of Results and Financial Condition Other operating expenses increased 3% from 2006 Other operating expenses, largely comprised of terminal handling expenses, credit card fees, building rent and maintenance, the cost of ground packages at Air Canada Vacations and ... -

Page 32

...removed from service. Owned aircraft as well as capital leases and leases consolidated under AcG-15 are carried on Air Canada's statement of ï¬nancial position. Owned aircraft include aircraft ï¬nanced under conditional sales agreements. Pursuant to the Jazz CPA, Jazz operates an operating ï¬,eet... -

Page 33

...leased to another airline. The following table provides the existing and planned ï¬,eet changes to our ï¬,eet (excluding aircraft operated by Jazz): Actual Sublease/lease to Third Party / Sale by Air Canada Sublease to Third Party Planned Planned 2009 ï¬,eet changes 1 (1) - New Deliveries New... -

Page 34

... position of Air Canada (previously "Air Canada Services"), excluding the consolidation of Jazz, as at December 31, 2006. December 31, 2007 December 31, 2006 Condensed Statement of Financial Position ($ millions) Assets Cash, cash equivalents and short-term investments Other current assets Current... -

Page 35

Management's Discussion and Analysis of Results and Financial Condition 7.2 ADJUSTED NET DEBT The following table reï¬,ects Air Canada's net debt balances and net debt to net debt plus equity ratio as at December 31, 2007 and as at December 31, 2006. The information provided below excludes the ... -

Page 36

...provides additional information on our working capital balances at December 31, 2007 as compared to December 31, 2006 excluding the consolidation of Jazz operations (previously "Air Canada Services"). December 31, 2007 Cash and short-term investments Accounts receivable Other current assets Accounts... -

Page 37

... FLOW MOVEMENTS The following tables provide Air Canada's consolidated cash ï¬,ow movements for the periods indicated. Prior to May 24, 2007, Air Canada had two reportable segments: Air Canada Services (now referred to as Air Canada) and Jazz. Segment information was used to allow for the separate... -

Page 38

... to additions to capital assets mainly related to aircraft partly offset by an increase in net cash provided by operating activities during mainly to improved operating results. In the fourth quarter of 2007, Air Canada's additions to capital assets totaled $922 million and mainly related to the PDP... -

Page 39

... current service contributions. Air Canada entered into the Pension and Beneï¬ts Agreement with ACTS LP and ACTS Aero Technical Support & Services Inc. ("ACTS Aero"). Refer to section 12 of this MD&A ("Related Party Transactions") for additional information. The net deï¬cit, on an accounting basis... -

Page 40

.... During 2007, the Corporation amended agreements with Boeing to cancel orders for two Boeing 777 aircraft scheduled for delivery in 2009. In addition, the Corporation increased its order for Boeing 787 aircraft by 23, bringing its total ï¬rm orders to 37 Boeing 787 aircraft. The ï¬rst delivery of... -

Page 41

... Boeing 777 aircraft is 12 years. The other two Boeing 777 aircraft each have 10.5 year lease terms and Air Canada has options to extend each for an additional 18 months. All four leases are at market rates. This replaces an equivalent number of aircraft loan guarantee support commitments provided... -

Page 42

... Air Canada Annual Report The following table provides Air Canada's current and planned committed capital expenditures and the related ï¬nancing arrangements as at December 31, 2007. The table also reï¬,ects the letters of intent for the sale and lease back of four of the nine Boeing 777 aircraft... -

Page 43

... and Analysis of Results and Financial Condition 8. QUARTERLY FINANCIAL DATA Prior to May 24, 2007, Air Canada had two reportable segments: Air Canada Services (now referred to as Air Canada) and Jazz. Segment information was used to allow for the separate presentation of Air Canada's ï¬nancial... -

Page 44

...May 24, 2007. There was no consolidation of Jazz in the third and fourth quarters of 2007. Q1 2006 Q2 2006 Q3 2006 Q4 2006 Q1 2007 Q2 2007 Q3 2007 Q4 2007 ($ millions, except per share ï¬gures) Consolidated Total Operating revenues Special charge for Aeroplan miles (1) Operating revenues Ownership... -

Page 45

... 9. SELECTED ANNUAL INFORMATION The following table provides selected annual consolidated information for the Corporation for the years 2005 through to 2007. The selected annual consolidated information for 2007 only includes the operations of Jazz up to May 24, 2007. As a result, Air Canada... -

Page 46

... Air Canada had hedged 20% of its projected fuel requirement for 2008, 3% of its projected fuel requirement for 2009 and 2% of its fuel requirement for 2010. Since December 31, 2007, Air Canada has entered into new hedging positions, using swap and costless collar option structures, which have added... -

Page 47

Management's Discussion and Analysis of Results and Financial Condition The following information summarizes the ï¬nancial statement impact of derivatives designated under fuel hedge accounting before the impact of tax: â- The fair value of outstanding fuel derivatives under hedge accounting at ... -

Page 48

... Air Canada Annual Report Air Canada has entered into two interest rate swap agreements with a term to January 2024 which convert lease payments related to two Boeing 767 aircraft leases consolidated under AcG-15 from ï¬xed to ï¬,oating rates. These have not been designated as hedges for accounting... -

Page 49

.... Each contracting airline participating in a Fuel Facility Corporation shares prorata, based on system usage, in the guarantee of this debt. Indemniï¬cation Agreements Air Canada enters into real estate leases or operating agreements, which grant a license to Air Canada to use certain premises... -

Page 50

... it pays a fee to participate in the Aeroplan program, which fee is based on the Aeroplan miles awarded to Aeroplan members who are Air Canada customers traveling on AC Flights. Aeroplan is required to purchase a minimum number of reward travel seats on AC Flights annually, 2007 - $171 million (2006... -

Page 51

...services to Jazz in return for a fee based on the fair market value of the services provided by Air Canada to Jazz. Pursuant to the Jazz MSA, Air Canada provides Jazz with infrastructure support consisting principally of administrative services in relation with information technology, corporate real... -

Page 52

... power unit maintenance services, aircraft heavy maintenance services (excluding line and cabin maintenance services which are provided by Air Canada), component maintenance services, paint services, training services and ancillary services. ACTS Aero serves as Air Canada's exclusive repair agency... -

Page 53

...funded by Air Canada through quarterly payments to ACTS Aero until 2012. Until such future time as the assets and obligations under the Air Canada Beneï¬t Arrangements pertaining to non-unionized employees may be transferred to ACTS Aero, the current service pension cost and the current service and... -

Page 54

... which Air Canada previously held interests), or to carry on a business activity, related to the following commercial maintenance, repair and overhaul services in the airline industry, namely, airframe heavy maintenance and paint services, engine and auxiliary power unit ("APU") overhaul maintenance... -

Page 55

... of Air Canada's investments in Aeroplan, Jazz and ACTS LP to ACE have been included in Air Canada's consolidated ï¬nancial statements as a contribution from ACE to Shareholders' Equity. Share purchase rights sold by Air Canada to ACE During 2007, Air Canada entered into an aircraft transaction... -

Page 56

... from Aeroplan related to Aeroplan rewards, net of purchases of Aeroplan miles Property rental revenues from related parties Revenues from information technology services to related parties Revenues from corporate services and other Aircraft sublease revenues from Jazz Air Canada Ground Handling... -

Page 57

... on a straight-line basis over the period during which the travel pass is valid. Air Canada has formed alliances with other airlines encompassing loyalty program participation, code sharing and coordination of services including reservations, baggage handling and ï¬,ight schedules. Revenues are... -

Page 58

2007 Air Canada Annual Report Discount Rate The discount rate used to determine the pension obligation was determined by reference to market interest rates on corporate bonds rated "AA" or better with cash ï¬,ows that approximately match the timing and amount of expected beneï¬t payments. Expected ... -

Page 59

...) Past service cost for registered pension plans Current service cost for registered pension plans Other pension arrangements(1) Air Canada(2) (1) (2) Includes retirement compensation arrangements, supplemental plans and international plans. Includes obligations relating to employees who have... -

Page 60

... of the lease term or ï¬ve years. Ground and other equipment is depreciated over three to 25 years. Aircraft depreciable life is determined through economic analysis, a review of existing ï¬,eet plans and comparisons to other airlines operating similar ï¬,eet types. Residual values are estimated... -

Page 61

Management's Discussion and Analysis of Results and Financial Condition 14. CHANGES IN ACCOUNTING POLICIES Financial Instruments On January 1, 2007, Air Canada adopted CICA accounting handbook section 3855, Financial Instruments - Recognition and Measurement, section 3861, Financial Instruments and... -

Page 62

2007 Air Canada Annual Report Impact upon Adoption In accordance with the transitional provisions of the standards, prior periods have not been restated for the adoption of these new accounting standards. The transition adjustments attributable to the re-measurement of ï¬nancial assets and ï¬... -

Page 63

Management's Discussion and Analysis of Results and Financial Condition 15. FUTURE ACCOUNTING STANDARD CHANGES The Corporation will adopt the following new accounting standards on January 1, 2008: Capital Disclosures and Financial Instruments - Presentation and Disclosure The CICA issued three new ... -

Page 64

2007 Air Canada Annual Report 16. SENSITIVITY OF RESULTS Air Canada's ï¬nancial results are subject to many different internal and external factors which can have a signiï¬cant impact on operating results. In order to provide a general guideline, the following table describes, on an indicative ... -

Page 65

... to pay its debts and lease obligations. Need for Additional Capital The Corporation faces a number of challenges in its current business operations, including high fuel prices and increased competition from international, transborder and low-cost domestic carriers. In order to meet such challenges... -

Page 66

... Canada Annual Report Fuel Costs Fuel costs constituted the largest percentage of the total operating costs of the Corporation in 2007. Fuel prices ï¬,uctuate widely depending on many factors including international market conditions, geopolitical events and the Canada/US dollar exchange rate. Air... -

Page 67

... and implement strategic, business, technology and other important initiatives, such as those relating to the aircraft ï¬,eet restructuring program, the aircraft refurbishment program, the new revenue model, the reservation and airport customer service initiative (which will also support the revenue... -

Page 68

... Management believes that rewarding customers with Aeroplan miles is a signiï¬cant factor in customers' decision to travel with Air Canada and Jazz and contributes to building customer loyalty. The failure by Aeroplan to adequately fulï¬ll its obligations towards the Corporation under the Aeroplan... -

Page 69

... the Corporation's business, results from operations and ï¬nancial condition. Refer to section 7.6 of this MD&A for Air Canada's projected cash pension funding obligations. Star Alliance® The strategic and commercial arrangements with Star Alliance® members provide the Corporation with important... -

Page 70

... key employees, Air Canada's business, results from operations and ï¬nancial condition could be materially adversely affected. Additionally, Air Canada may be unable to attract and retain additional qualiï¬ed key personnel as needed in the future. Risks Relating to the Airline Industry Economic... -

Page 71

...against non-essential travel to Toronto, Canada. The seven day WHO travel advisory relating to Toronto, the location of the Corporation's primary hub, and the international SARS outbreak had a signiï¬cant adverse effect on passenger demand for air travel in the Corporation's markets and resulted in... -

Page 72

... could adversely affect the Corporation's international operations. In July 2000, the Government of Canada amended the CTA, the Competition Act and the Air Canada Public Participation Act to address the competitive airline environment in Canada and ensure protection for consumers. This legislation... -

Page 73

... arrangements, which may have a material adverse effect on the Corporation's business, results from operations and ï¬nancial condition. Risks Related to the Corporation's Relationship with ACE Control of the Corporation and Related Party Relationship ACE owns shares of Air Canada representing... -

Page 74

... The Corporation has added qualiï¬ed income tax professionals with the appropriate knowledge and experience which addressed the weakness. Air Canada's Audit Committee reviewed this MD&A, and the audited consolidated ï¬nancial statements, and Air Canada's Board of Directors approved these documents... -

Page 75

... presented by other public companies. Operating income (loss) excluding the special charge for Aeroplan miles and the special charge for labour restructuring for Air Canada (previously "Air Canada Services") is reconciled to operating income (loss) as follows: Fourth Quarter 2007 2006 Year $ Change... -

Page 76

2007 Air Canada Annual Report Operating Expense excluding Fuel Expense and the Special Charge for Labour Restructuring Air Canada uses operating expense excluding fuel expense and the special charge for labour restructuring to assess the operating performance of its ongoing business without the ... -

Page 77

...and audit-related fees and expenses. The Board of Directors approves the Corporation's consolidated ï¬nancial statements, management's discussion and analysis and annual report disclosures prior to their release. The Audit, Finance and Risk Committee meets with management, the internal auditors and... -

Page 78

...nancial position of Air Canada as at December 31, 2007 and December 31, 2006 and the consolidated statements of operations, shareholders' equity, comprehensive income and cash ï¬,ows for the years then ended. These consolidated ï¬nancial statements are the responsibility of the company's management... -

Page 79

... dollars in millions except per share ï¬gures) Operating revenues Passenger Cargo Other Special charge for Aeroplan Miles Note 22 2007* 2006 (Note 3) $ 9,329 550 720 10,599 10,599 $ 8,887 629 651 10,167 (102) 10,065 Operating expenses Wages, salaries and beneï¬ts Aircraft fuel Aircraft... -

Page 80

... Deposits and other assets Note 4 Note 5 Note 6 Note 7 $ 11,837 $ 11,749 LIABILITIES Current Accounts payable and accrued liabilities Advance ticket sales Aeroplan miles obligation Current portion of long-term debt and capital leases Note payable to ACTS Current taxes payable Note 19 Note... -

Page 81

... of year Conversion of Special common shares into Common shares End of year Adjustment to shareholders' equity Total share capital Contributed surplus Balance, beginning of year Fair value of stock options issued to Corporation employees recognized as compensation expense Contribution from ACE... -

Page 82

2007 Air Canada Annual Report CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME For the year ended December 31 (Canadian dollars in millions) Comprehensive income (loss) Net income (loss) for the year Other comprehensive income, net of taxes: Unrealized period change in fair value of fuel derivatives ... -

Page 83

... Non-controlling interest Special charge for Aeroplan miles Allocation of corporate expenses Aircraft lease payments in excess of rent expense Capitalized interest Changes in non-cash working capital balances Other Financing Issue by Air Canada of share capital Issue of Jazz units Transfer of ACTS... -

Page 84

...and transborder services for Air Canada under a capacity purchase agreement, which is consolidated within Air Canada for the period up to May 24, 2007. (refer below for additional information on the accounting for Jazz); and Certain aircraft and engine leasing entities and fuel facility corporations... -

Page 85

...ï¬liates emerged from proceedings under the Companies' Creditors Arrangement Act (the "CCAA"). The shareholders' equity reï¬,ects the shareholders' equity of Air Canada adjusted for the above transactions, as applicable. Refer to Note 3 for additional information. Accounting for Jazz Air Canada is... -

Page 86

... travel agencies in Canada as well as Air Canada Vacations website, aircanadavacations.com. Jazz is the largest regional airline and the second largest airline in Canada, after Air Canada, based on ï¬,eet size and number of routes operated. Pursuant to the Jazz CPA, Jazz provides service to Air... -

Page 87

... on a straight-line basis over the period during which the travel pass is valid. The Corporation has formed alliances with other airlines encompassing loyalty program participation, code sharing and coordination of services including reservations, baggage handling and ï¬,ight schedules. Revenues are... -

Page 88

2007 Air Canada Annual Report F) AEROPLAN LOYALTY PROGRAM Air Canada is an Aeroplan partner providing certain of Air Canada's customers with Aeroplan Miles, which can be redeemed by customers for air travel or other rewards acquired by Aeroplan. Under the Commercial Participation and Services ... -

Page 89

...to operating expenses as incurred, with the exception of maintenance and repair costs related to return conditions on short-term aircraft leases, which are accrued over the term of the lease. Line maintenance consists of routine daily and weekly scheduled maintenance inspections and checks, overhaul... -

Page 90

... in the consolidated statement of ï¬nancial position at fair value in Prepaid expenses and other current assets, Deposits and other assets, Accounts payable and accrued liabilities, or Other long-term liabilities as appropriate. The Corporation from time to time enters into interest rate swaps to... -

Page 91

Consolidated Financial Statements and Notes expenses and other current assets, Deposits and other assets, Accounts payable and accrued liabilities, or Other long-term liabilities as appropriate. Fuel Derivatives Under Hedge Accounting The Corporation has designated certain of its fuel derivatives as... -

Page 92

... rate on short-term investments as at December 31, 2007 is 4.61% (2006 - 4.38%). R) RESTRICTED CASH The Corporation has recorded $124 (2006 - $109) in restricted cash, under current assets, representing funds held in trust by Air Canada Vacations in accordance with regulatory requirements governing... -

Page 93

...nite lives are amortized on a straight line basis to nil over their estimated useful lives. Estimated Useful Life International route rights and slots Air Canada trade name Other marketing based trade names Star Alliance membership Other contract and customer based intangible assets Technology based... -

Page 94

2007 Air Canada Annual Report X) AIRCRAFT LEASE PAYMENTS IN EXCESS OF OR LESS THAN RENT EXPENSE Total aircraft operating lease rentals over the lease term are amortized to operating expense on a straight-line basis. Included in deferred charges and long-term liabilities is the difference between the... -

Page 95

... entity manages those risks. Inventories The CICA issued section 3031, Inventories, which will replace section 3030, Inventories. This new standard is effective for ï¬scal years beginning on or after July 1, 2007, and the Corporation will adopt this section on January 1, 2008. Section 3031 provides... -

Page 96

... to the Corporation includes its proportionate share of such general corporate expenses incurred by ACE, including executive management, legal, investor relations, treasury, ï¬nance, ï¬nancial reporting, tax, internal audit and human resources services as well as costs of governance, professional... -

Page 97

...Note payable outstanding to a subsidiary of ACE of $200 in connection with the initial public offering of Jazz Air Income Fund (Note 21). Income Taxes As part of a tax loss utilization strategy that was planned in conjunction with the Air Canada IPO and corporate restructuring, a current tax payable... -

Page 98

2007 Air Canada Annual Report 4. PROPERTY AND EQUIPMENT 2007 Cost Flight equipment, including spare engines (a) Assets under capital leases (b) Buildings, including leasehold improvements Ground and other equipment Accumulated depreciation and amortization Flight equipment, including spare engines ... -

Page 99

... a book value of $21, resulting in a gain on sale of $2 (loss of $2 net of tax). The Corporation sold a building to ACTS Aero for proceeds of $28 which was equal to the carrying value of the asset (refer to Note 20). A CRJ-100 aircraft owned by Air Canada and leased to Jazz was damaged beyond repair... -

Page 100

... Air Canada Financing costs - Air Canada Aircraft lease payments in excess of rent expense - Jazz Financing costs - Jazz Note 2X Note 2X $ $ 47 4 51 $ 2006 55 18 28 2 103 $ 6. INTANGIBLE ASSETS 2007 Indeï¬nite life assets International route rights and slots Air Canada trade name Other marketing... -

Page 101

... of the underlying assets in the proposed structure. Air Canada is not accruing interest on these investments. During 2007, Air Canada recorded a charge of $8 ($5 after tax) in non-operating income (expense). The charge is based on a number of assumptions as to the fair value of the investments... -

Page 102

...2007, the Corporation took delivery of eight Boeing 777 aircraft, seven of which were acquired under the Boeing Purchase Agreement and ï¬nanced under the loan guarantee support provided by EXIM, the other one being subject to an operating lease agreement with International Lease Finance Corporation... -

Page 103

... Financial Statements and Notes the committed long-term aircraft ï¬nancing for the aircraft to be delivered. The last aircraft in this PDP ï¬nancing is currently scheduled for delivery in November 2008, at which time, Air Canada expects to have fully repaid the PDP loans. At year-end 2007... -

Page 104

... Air Canada Annual Report (j) The Corporation has entered into aircraft and engine lease transactions with several special purpose entities that qualify as VIEs. The debt has a weighted average effective interest rate of approximately 8% (2006 - 8%). These aircraft and engines have a carrying value... -

Page 105

... As part of a tax loss utilization strategy that was planned in conjunction with the initial public offering of Air Canada and corporate restructuring, a current tax payable of $345 was created in 2006. This tax payable arose upon a transaction to transfer tax assets from Air Canada to ACE. This tax... -

Page 106

2007 Air Canada Annual Report c) Future Income Tax Liability It has been assumed that certain intangibles and other assets with nominal tax cost and a carrying value of approximately $661, have indeï¬nite lives and accordingly, the associated future income tax liability is not expected to reverse ... -

Page 107

...the proceeds from repair schemes and non-compete agreement with ACTS (refer to Note 20). Refer to Note 17 for future income taxes recorded in other comprehensive income related to fuel derivatives designated under fuel hedge accounting. Income taxes paid in 2007 by the Corporation were $6. No income... -

Page 108

2007 Air Canada Annual Report 10. PENSION AND OTHER BENEFIT LIABILITIES The Corporation maintains several deï¬ned beneï¬t and deï¬ned contribution plans providing pension, other post-retirement and post-employment beneï¬ts to its employees, including those employees of the Corporation who are ... -

Page 109

... and Plan Assets The following tables present ï¬nancial information related to the changes in the pension and other post-employment beneï¬ts plans: Pension Beneï¬ts 2007 2006 Change in beneï¬t obligation Beneï¬t obligation at beginning of year Current service cost Interest cost Employees... -

Page 110

... the accounting deï¬cit is mainly the result of an increase in the discount rate and funding of past service employer contributions of $134, offset by a negligible return on plan assets. The net beneï¬t obligation is recorded in the statement of ï¬nancial position is as follows: 2007 Pension bene... -

Page 111

...health care plans. A 9.25% annual rate of increase in the per capita cost of covered health care beneï¬ts was assumed for 2007 (2006 - 9.75%). The rate is assumed to decrease gradually to 5% by 2013. A one percentage point increase in assumed health care trend rates would have increased the service... -

Page 112

...to provide for the pension plan beneï¬ts. While the review considers recent fund performance and historical returns, the assumption is primarily a long-term, prospective rate. Deï¬ned Contribution Plans The Corporation's management, administrative and certain unionized employees may participate in... -

Page 113

...Aircraft rent in excess of lease payments (c) Long-term employee liabilities (d) Workplace safety and insurance board liabilities Other (e) $ Note 2X 29 54 54 47 45 107 336 $ 2006 105 77 121 54 45 70 472 $ $ (a) Air Canada has a liability related to Aeroplan Miles which were issued by Air Canada... -

Page 114

2007 Air Canada Annual Report (e) Other includes asset retirement obligations of the Corporation. Under the terms of their respective land leases each Fuel Facility Corporation has an obligation to restore the land to vacant condition at the end of the lease and to rectify any environmental damage ... -

Page 115

... Financial Statements and Notes 12. STOCK-BASED COMPENSATION ACE Stock Option Plan Certain of the Corporation's employees participate in the ACE stock option plan. Plan participation is limited to employees holding positions that, in ACE Board's view (or a committee selected by the ACE Board... -

Page 116

2007 Air Canada Annual Report A summary of the activity related to Air Canada employees participating in the ACE stock option plan is as follows: 2007 Weighted Average Exercise Price/Share $ 24.42 18.70 24.49 19.71 17.15 26.16 20.37 17.35 18.53 26.00 16.73 14.43 13.... -

Page 117

... Corporation's employees participate in the Air Canada Long-term Incentive Plan (the "Long-term Incentive Plan") administered by the Board of Directors of Air Canada. The Long-term Incentive Plan provides for the grant of options and performance share units to senior management and ofï¬cers of Air... -

Page 118

2007 Air Canada Annual Report The number of Air Canada stock options granted to employees, the related compensation expense recorded and the assumptions used to determine stock-based compensation expense, using the Black-Scholes option valuation model were as follows: 2007 Compensation expense ($... -

Page 119

... this plan relate to units in Jazz Air Income Fund. Effective May 24, 2007, Jazz is no longer consolidated. Employee Ownership Plans Employee ownership plans have been established for shares of ACE and Air Canada under which eligible employees are allowed to invest up to 6% of their base salary for... -

Page 120

...Air Canada Annual Report 13. SHAREHOLDERS' EQUITY Share capital (net of issue costs) consists of the following: Share Capital Common shares Adjustment to shareholders' equity (a) $ $ 2007 562 (288) 274 $ $ 2006 562 (288) 274 (a) As a result of the ï¬nancial reorganization under CCAA, the assets... -

Page 121

... such securities are assumed to be used to purchase Class B Voting Shares. Excluded from the calculation of diluted earnings per share were 1,606,820 outstanding options where the options' exercise prices were greater than the average market price of the common shares for the year (2006 - 1,699,678... -

Page 122

... statements is as follows: 2007 Air Canada Segment Passenger revenue Cargo revenue Other revenue External revenue Inter-segment revenue Special charge for Aeroplan miles Total revenues Wages, salaries and beneï¬ts Aircraft fuel Aircraft rent Airport and navigation fees Aircraft maintenance... -

Page 123

Consolidated Financial Statements and Notes 2006 Consolidated Total $ 9,329 550 720 10,599 10,599 10,599 2,059 2,553 323 1,021 799 277 319 557 201 537 1,458 10,104 495 94 (351 ) 108 19 26 (18 ) (71 ) 317 (190 ) (66 ) $ 429 $ Air Canada Segment $ 8,887 629 644 10,160 106 10,266 (102 ) 10,164 1,816... -

Page 124

... and equipment are related to operations in Canada. The Air Canada segment is comprised of the passenger and cargo transportation services business operated by the Corporation and related ancillary services. The Jazz segment, included up to May 24, 2007, is operating under the Jazz CPA with the... -

Page 125

.... The other two Boeing 777 aircraft each have 10.5 year lease terms and the Corporation has options to extend each for an additional 18 months. All four leases are at market lease rates. This replaces an equivalent number of aircraft loan guarantee support commitments provided by EXIM. As a result... -

Page 126

2007 Air Canada Annual Report Embraer The agreement with Embraer covers ï¬rm orders for 45 Embraer 190 series aircraft. The purchase agreement also contains rights to exercise options for up to 60 additional Embraer 190 series aircraft as well as providing for conversion rights to other Embraer ... -

Page 127

... Financial Statements and Notes Operating Lease Commitments As at December 31, 2007 the future minimum lease payments under existing operating leases of aircraft and other property amount to $2,108 (December 31, 2006 - $2,957) using year end exchange rates. This also includes payments for aircraft... -

Page 128

2007 Air Canada Annual Report 17. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT Under its risk management policy, the Corporation manages its currency risk, interest rate risk, and market risk through the use of various foreign exchange, interest rate, and fuel derivative ï¬nancial instruments. The ... -

Page 129

... they continue to be good economic hedges in managing its exposure to jet fuel prices. The following information summarizes the ï¬nancial statement impact of derivatives designated under fuel hedge accounting, before the impact of tax: â- The fair value of outstanding fuel derivatives under hedge... -

Page 130

2007 Air Canada Annual Report The following information summarizes the ï¬nancial statement impact of derivatives not designated under fuel hedge accounting, but held as economic hedges, before the impact of tax: â- The fair value of outstanding fuel derivatives not under hedge accounting at ... -

Page 131

... be excluded from operating ï¬,ights from Toronto City Centre (Island) Airport (the "TCCA"). On October 26, 2007, the Porter Defendants counter-claimed against Jazz and Air Canada alleging various violations of competition law, including that Jazz and Air Canada's commercial relationship contravenes... -

Page 132

...arrangements entered in connection therewith, changes of law and certain income, commodity and withholding tax consequences. When the Corporation, as a customer, enters into technical service agreements with service providers, primarily service providers who operate an airline as their main business... -

Page 133

... Statements and Notes 19. RELATED PARTY TRANSACTIONS At December 31, 2007, ACE has a 75% ownership interest in Air Canada. Air Canada has various related party transactions with ACE and other ACE-related entities, including Aeroplan, Jazz and ACTS Aero. ACTS Aero conducts the business operated... -

Page 134

... from Aeroplan related to Aeroplan rewards, net of purchase of Aeroplan miles Property rental revenues from related parties Revenues from information technology services to related parties Revenues from corporate services and other Aircraft sublease revenues from Jazz Air Canada Ground Handling... -

Page 135

... it pays a fee to participate in the Aeroplan program, which fee is based on the Aeroplan miles awarded to Aeroplan members who are Air Canada customers traveling on AC Flights. Aeroplan is required to purchase a minimum number of reward travel seats on AC Flights annually, 2007 - $171 (2006 - $170... -

Page 136

2007 Air Canada Annual Report applicable term. The rates under the Jazz CPA are subject to periodic adjustment with the next adjustment scheduled for the start of 2009. Amounts related to the CPA are included on the Expense from CPA with Jazz line in the table above. Jazz Master Services Agreement (... -

Page 137

... of $28 effective as of October 16, 2007. In connection with the sale, Air Canada and ACTS Aero entered into a land sublease for certain land contiguous with the building and a service contract whereby the Corporation provides ACTS Aero certain services related to the operation of the building. 137 -

Page 138

...Air Canada provides certain administrative services to ACE in return for a fee. Such services relate to ï¬nance and accounting, information technology, human resources and other administrative services. Share Purchase Rights Sold by Air Canada to ACE During 2007, Air Canada entered into an aircraft... -

Page 139

... value of these quarterly payments is also referred to as the compensation amount. Until such future time as the assets and obligations under the Air Canada Beneï¬t Arrangements pertaining to non-unionized employees may be transferred to ACTS Aero, the current service pension cost and the current... -

Page 140

... which Air Canada previously held interests), or to carry on a business activity, related to the following commercial maintenance, repair and overhaul services in the airline industry, namely, airframe heavy maintenance and paint services, engine and auxiliary power unit ("APU") overhaul maintenance... -

Page 141

...for all Miles issued beginning January 1, 2002. On December 31, 2001, there were 171 billion Miles outstanding of which, after considering breakage, management estimated that 103 billion Miles would be redeemed. In 2006, management of Air Canada and Aeroplan re-estimated the number of Miles expected... -

Page 142

... and Product Distribution Vice President and General Counsel Vice President, Network Planning Vice President, Customer Service, In-Flight and Call Centres Corporate Secretary Controller President and Chief Executive Officer, ACGHS President and Chief Executive Officer, Air Canada Cargo DIRECTORS... -

Page 143

... For Air Canada, offering service in the language chosen by its customers is essential. Verbal exchanges with clients, public-address announcements at the airport and on board, brieï¬ng of passengers with special needs all constitute the very heart of customer service and call upon our employees... -

Page 144

... its strategic and commercial arrangements with Star Alliance members and several other airlines, Air Canada offers service to 897 destinations in 160 countries, with reciprocal participation in frequent flyer programs and use of airport lounges. The Corporation provides tour operator services and...