Adidas 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

15

ADIDAS GROUP

ANNUAL REPORT

Table of contents

-

Page 1

2 0 1 5 ADIDAS GROUP ANNUAL REPORT -

Page 2

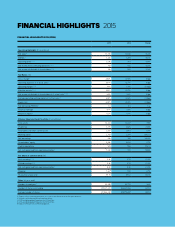

... income from continuing operations Net income from continuing operations INCREASE AT A RATE OF 7% TO 10% Shareholder value INCREASES 12% to â,¬ 720 million INCREASE AT A RATE BETWEEN 10% AND 12% to around â,¬ 800 million Shareholder value adidas AG share price INCREASE INCREASES 56% Dividend... -

Page 3

...margin 1, 3, 4 Effective tax rate 1, 3, 4 Net income attributable to shareholders in % of net sales 2, 3, 4 Average operating working capital in % of net sales 1 Equity ratio Net borrowings/EBITDA 1 Financial leverage Return on equity 2 Balance Sheet and Cash Flow Data (â,¬ in millions) Total assets... -

Page 4

... adidas Originals adidas Sport Style TaylorMade TaylorMade leads the golf industry in metalwood sales and is the number one driver brand on the world's six major professional golf tours. The brand is recognised globally for its capacity to develop innovative and performanceenhancing technologies for... -

Page 5

...ATHLETES MAKE A DIFFERENCE. FOR US, IT ALSO STARTS WITH THE ASPIRATION TO BE THE BEST. WE WANT TO BE THE BEST SPORTS COMPANY IN THE WORLD. THIS IS WHAT WE ARE HERE FOR. THIS IS WHAT WE WANT TO ACCOMPLISH. WE WANT TO WIN. WE MAKE THE RULES. WE ARE THE CREATORS. AND: WE ARE CREATING THE NEW. VALUE -

Page 6

... 87 94 3 GROUP MANAGEMENT REPORT - FINANCIAL REVIEW Internal Group Management System Group Business Performance Economic and Sector Development Income Statement Statement of Financial Position and Statement of Cash Flows Treasury Financial Statements and Management Report of adidas AG Disclosures... -

Page 7

... Income Consolidated Statement of Changes in Equity Consolidated Statement of Cash Flows Notes Notes to the Consolidated Statement of Financial Position Notes to the Consolidated Income Statement Additional Information Statement of Movements of Intangible and Tangible Assets Shareholdings... -

Page 8

-

Page 9

TO Operational and Sporting Highlights Letter from the CEO Executive Board Supervisory Board Supervisory Board Report Corporate Governance Report including the Declaration on Corporate Governance Compensation Report Our Share 6 10 16 18 20 28 36 46 OUR SHARE - HOLD - ERS -

Page 10

... adidas Group introduces its new strategic business plan 'Creating the New' at the Investor Day 2015 in Herzogenaurach, Germany. By bringing brand desirability to new heights, the Group aims to increase its top line at a high-single-digit rate and improve net income by around 15% on average per year... -

Page 11

... for both the sport of UFC and the Reebok brand. 28.04. FC Bayern Munich and adidas extend their successful long-term partnership until 2030. JUNE 18.06. adidas Originals and Kanye West present the second sneaker developed in their close collaboration: Yeezy Boost 350. The shoe is designed to be... -

Page 12

... adidas AG is selected to join the Dow Jones Sustainability Indices (DJSI). Within the 'Textiles, Apparel & Luxury Goods' industry, the adidas Group is rated best in class in the category Innovation Management and achieves high scores in further categories. 10.09. The adidas Group Annual Report 2014... -

Page 13

... to game-changing products with the technology that has the power to advance the performance of hockey and that of the player. 09.12. adidas Originals launches NMD, its latest footwear franchise, at an event in New York City. The NMD is technically a running shoe, realised as a lifestyle sneaker... -

Page 14

1 TO O U R S H A RE H O L D E RS Letter from the CEO HERBERT HAINER ADIDAS GROUP CEO LETTER FROM THE CEO 10 -

Page 15

...step up marketing investments to spur revenue growth and drive long-term brand desire. With an increase of 56%, our share was not only the top performer in the DAX-30 in 2015, but also outperformed all major peers and reached a new all-time high towards the end of the year. These financials provide... -

Page 16

... Yeezy Boost 350, which received the prestigious Footwear News 'Shoe of the Year' award. It is product launches like these that helped adidas Originals to become the world's most relevant and best sneaker brand and deliver strong double-digit growth in every quarter of 2015. 2015 saw the complete... -

Page 17

... through grassroots events at the high school and college level, much higher visibility in all of the major US sports and highly engaging marketing campaigns, we have become much more relevant for the US consumer in only a short period of time. In American football, for example, our partnership with... -

Page 18

... strong and profitable growth, TaylorMade-adidas Golf experienced two very difficult years in 2014 and 2015, caused by a number of structural, commercial and operational issues. As a result, halfway through last year we started analysing future options for our golf business. This strategic review is... -

Page 19

... world and achieve the Group's long-term financial ambition. Our brands are benefiting from the ever-increasing relevance of sport in the lives of people around the globe. Our products are in high demand with consumers in every part of the world. Our order books are full across all major performance... -

Page 20

1 TO O U R S H A RE H O L D E RS E xe cuti ve B o a rd EXECUTIVE BOARD 2 1 3 4 5 16 -

Page 21

... team as a Strategic Planner in 1989. During his career with the adidas Group, he has held many senior management positions, including Business Unit Manager, Key Account Manager Europe and Head of Region Europe, Middle East and Africa. In 2009, he became Chief Sales Officer Multichannel Markets... -

Page 22

... of the Supervisory Board, Windeln.de AG, Munich, Germany 1 DIETER HAUENSTEIN * residing in Herzogenaurach, Germany Full-time member of the Works Council Herzogenaurach, adidas AG DR. WOLFGANG JÄGER * residing in Bochum, Germany Managing Director in charge of Public Relations and Scholarships... -

Page 23

...in Herzogenaurach, Germany Vice President Customer Service Central Europe West, adidas AG HEIDI THALER-VEH * residing in Uffenheim, Germany Member of the Central Works Council, adidas AG • Deputy Chairman of the Supervisory Board, CeramTec GmbH, Plochingen, Germany STANDING COMMITTEES Steering... -

Page 24

... DEAR SHAREHOLDERS, We look back on 2015 as a very successful financial year. Thanks to strong brands and partnerships in the world of sport, as well as first-class innovations, the adidas Group was able to achieve strong sales and earnings growth. Despite the continuing weakness of the golf market... -

Page 25

... Board Report in North America, this primarily reflects double-digit growth rates in Western Europe, Greater China and numerous other emerging markets in which the Group is superbly positioned. Additionally, in the past year, the company introduced its new strategic business plan 'Creating the New... -

Page 26

...global economic developments as well as the development of our individual brands and markets. In February 2015, the Executive Board presented us with details of the new strategic business plan Creating the New for the period until 2020, established on the three key strategic pillars of Speed, Cities... -

Page 27

... Board members, we also introduced a cap of 5% of the sum of the annual fixed salary plus the (potential) Performance Bonus. At our meeting in March, we discussed in detail the targets and key criteria for the new Long Term Incentive Plan LTIP 2015/2017 that is measured over a three-year period... -

Page 28

... the company with effect from June 30, 2015. As the fixed-term service contracts expired at the end of the year under review, in December 2015 and under exclusion of the Supervisory Board member concerned, by way of circular resolution we approved the conclusion of a new framework contract starting... -

Page 29

... the preliminary examination of the annual financial statements and the consolidated financial statements for 2014, including the combined management report of adidas AG and the Group, as well as the Executive Board's proposal regarding the appropriation of retained earnings. Following an in-depth... -

Page 30

... programme based on the authorisation granted by the Annual General Meeting in May 2014, and approved the proposal of the Executive Board to repurchase up to a maximum of six million shares in the period between March 6 and July 3, 2015 at an overall purchase price of up to â,¬ 300 million. At the... -

Page 31

...the combined Management Report for adidas AG and the Group. The financial statements, the proposal put forward by the Executive Board regarding the appropriation of retained earnings and the auditor's reports were distributed by the Executive Board to all Supervisory Board members in a timely manner... -

Page 32

... our shareholders, business partners, employees and the ï¬nancial markets. The following report includes the Corporate Governance Report and the Declaration on Corporate Governance issued by the Executive Board and Supervisory Board. DUAL BOARD SYSTEM As a globally operating public listed company... -

Page 33

... elected by the shareholders at the Annual General Meeting, and the employee representatives by the employees. The last periodic election took place in 2014. The term of office of the current members of the Supervisory Board expires at the end of the 2019 Annual General Meeting. In accordance with... -

Page 34

... Board member. To this end, the relation between Executive Board compensation and that of senior management and employees overall is taken into account, also in terms of its development over time. Further information on Executive Board compensation is compiled in the Compensation Report. In order... -

Page 35

...BOARD AND SUPERVISORY BOARD At the end of the 2015 financial year, the individual ownership of shares in the company or related financial instruments held by members of the Executive Board and the Supervisory Board was below 1% of the shares issued by adidas AG. The same applies for the total number... -

Page 36

...with effect from January 1, 2016. Thus, all Executive Board service contracts are now compliant with the recommendations of the Code. Deï¬nition of the target level of provision (section 4.2.3 subsection 3) For Executive Board members of adidas AG initially appointed on or after October 1, 2013 and... -

Page 37

...which we completely revised in 2014. Our business activities are oriented towards the legal systems in the various countries and markets in which we operate. This implies a high level of social and environmental responsibility. Compliance with working and social standards: The development of company... -

Page 38

... on long-term risks and opportunities. The risk and opportunity management system ensures risk-aware, opportunity-oriented and informed actions in a dynamic business environment in order to guarantee the competitiveness and sustainable success of the adidas Group. see Risk and Opportunity Report... -

Page 39

...proxies appointed by the company. Further, all shareholders can follow the Annual General Meeting in full length live on the company's website. www.adidas-group.com/ investors see Our Share, p. 46 ACCOUNTING AND ANNUAL AUDIT adidas AG prepares the annual financial statements in accordance with the... -

Page 40

... relation between the Executive Board compensation and that of senior management and employees overall is taken into account, also in terms of its development over time. In addition, the tasks and contribution of each Executive Board member to the company's success, their individual performance as... -

Page 41

...statements of the past financial year. As criteria for the 2015 Performance Bonus the Supervisory Board established the following businessrelated criteria (performance criteria): • increase in net income from continuing operations, • increase in net contribution at TaylorMade-adidas Golf (global... -

Page 42

... Report For the LTIP 2015/2017, the Supervisory Board determined the following performance criteria for the three-year period: • achievement of a defined net income from continuing operations, • increase in the US market share measured/assessed by the increase in market shares of adidas... -

Page 43

... the same structure as the existing 'adidas Management Pension Plan' for managers. An amount (currently) equalling 50% of the individual annual fixed salary is credited by the company to the virtual pension account of the individual Executive Board member each year. The pension assets yield a fixed... -

Page 44

..., who belonged to the group of senior executives of adidas AG prior to their Executive Board appointments, will at the time of their retirement receive additional payments from the 'adidas Management Pension Plan'. Until their appointment as Executive Board members, adidas AG had contributed pension... -

Page 45

...2014 financial year as, in the 2014 financial year, the service costs were increased by the past service costs resulting from the increase 9 of the targeted provision level. The recommendation of the Code to individually disclose the compensation components for each Executive Board member and to use... -

Page 46

...Board member, Global Operations Eric Liedtke Executive Board member, Global Brands Since March 6, 2014 2015 (max.) 2014 2015 2015 (min.) 2015 (max.) 2014 1 2015 2 2015 (min.) Fixed compensation Other benefits Total One-year variable compensation 3 Multi-year variable compensation LTIP 2012/2014... -

Page 47

... Executive Board member, Global Sales Glenn Bennett Executive Board member, Global Operations 2014 1 2015 2 2014 2015 2014 2015 Fixed compensation Other benefits Total One-year variable compensation 3 Multi-year variable compensation LTIP 2012/2014 4 LTIP 2015/2017 Other Total 5 Service cost... -

Page 48

... entitlements of this group of persons totalled â,¬ 42.730 million (2014: â,¬ 45.900 million). The decrease is mainly attributable to an increase of the underlying interest rate from 2.1% to 2.5%. There are further pension commitments towards three former Executive Board members who resigned after... -

Page 49

...Board members incumbent until the end of the Annual General Meeting on May 8, 2014 Alexander Popov 2 Christian Tourres 2 Total 1 First-time Supervisory Board member since the end of the Annual General Meeting held on May 8, 2014. 2 Supervisory Board member until the end of the Annual General Meeting... -

Page 50

...AG share regained signiï¬cant momentum in 2015. The positive share price development was supported by the introduction of the adidas Group's new strategic business plan 'Creating the New' as well as strong operational momentum during the year. As a result, the adidas AG share reached a new all-time... -

Page 51

... ADIDAS AG SHARE 2015 2014 Important indices Number of shares outstanding 1 Basic earnings per share Cash generated from operating activities per share Year-end price Year high Year low Market capitalisation 4 Dividend per share Dividend payout 4 Dividend payout ratio 4 Dividend yield Shareholders... -

Page 52

..., supported by positive company-specific as well as sector-related newsflow. On November 5, following the publication of a very strong set of third quarter results, together with increased guidance for the 2015 financial year and a better-than-expected initial outlook for 2016, the adidas AG share... -

Page 53

... stellar operational performance in 2015, the Group's strong financial position as well as Management's confidence in our long-term growth aspirations, the adidas AG Executive and Supervisory Boards will recommend paying a dividend of â,¬ 1.60 per share to shareholders at the Annual General Meeting... -

Page 54

... and consequently 4.31% of the company's nominal capital. As of year-end 2015, the adidas AG had successfully completed 40% of its multi-year shareholder return programme. STRONG INTERNATIONAL INVESTOR BASE Based on our share register, we estimate that adidas AG currently has slightly more than 70... -

Page 55

... world 9% Germany 26 6% Switzerland 5% France 87 1 As of February 2016. 1 As of February 2016. SUCCESSFUL INVESTOR RELATIONS ACTIVITIES adidas AG strives to maintain close contact to institutional and private shareholders as well as analysts. In 2015, Management and the Investor Relations team... -

Page 56

-

Page 57

... Golf Strategy Reebok-CCM Hockey Strategy Global Operations Research and Development Our People Sustainability 54 61 67 69 72 74 80 87 94 GROUP Group Management Report This report contains the Group Management Report of the adidas Group, comprising adidas AG and its consolidated subsidiaries... -

Page 58

... as building our market share in the USA and Western Europe. • Creating a ï¬,exible supply chain: Speed and agility are key to outpacing the competition, providing a constant flow of new and relevant products for our consumers and high service levels for our customers. We are committed to meeting... -

Page 59

... our control, making strategic choices that will drive sustainable revenue and earnings growth and, ultimately, operating cash flow. We are committed to increasing returns to shareholders with above-industry-average share price performance and dividends. see Internal Group Management System, p. 102... -

Page 60

...we have started to adapt the learnings from neo and to build Speed capabilities for a defined share of their business. We will use our industry-leading experience to re-shape our entire business model end-to-end, from range planning to product creation, sourcing, supply chain, go-to-market and sales... -

Page 61

... strategic choices Speed and Open Source. It is our goal to achieve a leading position within these cities by 2020 and we will track our impact via improvement in our city-specific Net Promoter Score and market share. see Research and Development, p. 80 see Global Operations, p. 74 see Internal... -

Page 62

... million. This will ensure we are at the pulse of the consumer journey at key moments and touchpoints in their lives. By using the insights we will generate from these sources, we will craft better products and services for our consumers, driving increases in Net Promoter Score and market share. 58 -

Page 63

...brands by working closely with our franchise partners and through active management of branded spaces in key wholesale doors and cities. • Consumer service excellence: In 2015, we re-energised our in-store consumer experience with the successful launch of our 'Connect-Engage-Inspire' service model... -

Page 64

... global key accounts. Strategic partnerships will enable us to deliver a premium consumer experience in a multi-branded environment, through the power of managed space. ROLE OF OUR GLOBAL MARKETS Our Global Sales strategy is crafted by a centralised Sales Strategy & Excellence team, which supports... -

Page 65

... what's new. A large portion of creators live, play and create in the world's most influential and aspirational cities, a key reason for the Group's Key Cities strategic choice. In 2016, adidas will accelerate global and local marketing initiatives to amplify the brand's creator positioning in the... -

Page 66

... Promoter Score (NPS), in its employee incentive system. Investing in and rolling out a global NPS ecosystem, top down and bottom up, is one of the key change pillars of Creating the New for driving better execution at a consumer level across the brand's touchpoints. see Internal Group Management... -

Page 67

... drive consumer advocacy and build brand equity. The brand spends around half of its marketing investments on partnership assets, with the remainder on brand marketing activities such as digital, advertising, point-of-sale and grassroots activations. With its new strategy, adidas intends to decrease... -

Page 68

... in key cities. Communities: Digital leadership will play a critical role in driving the Group's 2020 strategy, and adidas has the ambitious goal to grow its social community to over 250 million by 2017. To increase speed, bring greater consistency and drive higher levels of brand activation online... -

Page 69

...well as play a central role in driving the future of digital in sport in cooperation with Runtastic. see Research and Development, p. 80 • The second category where adidas is focused on driving significant market share gains is with adidas neo. adidas neo targets a younger, more price-conscious... -

Page 70

... and national pride. At the same time, adidas will use online channels and third-party distributors to ensure that consumers of any sport the brand serves can access its best-inclass products, thus maximising growth and providing avenues for future expansion. • 08 ROLE OF CATEGORIES Focus... -

Page 71

... sports to fitness in order to position Reebok as the best fitness brand in the world, including a clear focus on a new target consumer, new key categories and new partnerships. Reebok is focused on creating inspirational marketing capabilities that build brand equity and consumer advocacy... -

Page 72

...business and approaching women with a distinct campaign or messaging, Reebok is putting women at the heart of everything the brand does - be it in terms of product launches, content strategy, marketing activation or distribution. Through a strong focus on innovation, Reebok is leading the way in new... -

Page 73

... strategy with some of golf's most respected brands, in particular TaylorMade and adidas Golf. • Focus on design and technologically advanced products. • Validation of products by tour professionals competing on the world's major professional golf tours. • A clear focus on marketing innovation... -

Page 74

...two very difficult years in 2014 and 2015, caused by a number of structural, commercial and operational issues, which resulted in sharp declines in net sales and profitability. As a consequence, TaylorMade-adidas Golf initiated a major restructuring programme in June 2015, with the main objective to... -

Page 75

... the same time extending product life cycles. • Management will further optimise trade terms with its retail partners through a focus on full-price sellthrough. Promotions will be very closely linked to the individual customer performance. Product cost and supply chain TaylorMade-adidas Golf aims... -

Page 76

... Defined pricing strategy which reflects the brands' positioning. PRODUCT INNOVATION KEY TO BRAND POSITIONING The key priority for Reebok-CCM Hockey is to design and market innovative and technologically advanced products that give players the opportunity to perform at their highest levels on the... -

Page 77

... licensed apparel. Skates: The focus in the skates category is to drive market share increases through products addressing critical performance aspects such as fit, weight and durability. In 2015, CCM launched the new Ribcor 50K skate, currently being worn by Sidney Crosby as well as many other pro... -

Page 78

... omni-channel approach to supply chain agility. • Enabling the best experience by creating tools that engage consumers through interactive mobile platforms, in-store technology and the ability to co-create. Within the adidas Group's new strategic business plan 'Creating the New', Global Operations... -

Page 79

... to co-create in an interactive production process. see Group Strategy, p. 54 see Research and Development, p. 80 01 GLOBAL OPERATIONS IN GO-TO-MARKET PROCESS Global Operations Marketing Design Product Development Sourcing Supply Chain Management & Market IT Distribution Sales Subsidiaries... -

Page 80

... while increasing its speed of service with 180 own-retail stores benefiting from next-day product replenishment. Global Operations is developing further IT capabilities to build platforms that support key initiatives which drive brand desire such as personalised footwear tools. With the close... -

Page 81

...in our own factories. In addition, we promote adherence to social and environmental standards throughout our supply chain. Global Operations manages product development, sourcing and distribution for adidas and Reebok as well as for adidas Golf and Ashworth. Due to the specific sourcing requirements... -

Page 82

...Operations worked with 320 independent manufacturing partners (2014: 340). Of our independent manufacturing partners, 79% were located in Asia (2014: 83%), 12% in Europe (2014: 7%) and 9% in the Americas (2014: 9%). see Diagram 02 VIETNAM SHARE OF FOOTWEAR PRODUCTION INCREASES 96% of our total 2015... -

Page 83

... include adidas, Reebok and adidas Golf. 07 HARDWARE PRODUCTION BY REGION 1 08 HARDWARE PRODUCTION 1, 2 IN MILLION UNITS 2015 2014 113 99 94 93 96 3 20 76% Asia 20% Europe 76 3% Americas 2013 2012 2011 1 Figures include adidas, Reebok, adidas Golf and Ashworth. 2 2011 - 2013 restated due... -

Page 84

... and Development RESEARCH AND DEVELOPMENT Creating innovative products to meet the needs of professional and everyday athletes and consumers is a prerequisite to strengthening our market position in the sporting goods industry and a premise to being the best sporting goods company in the world. In... -

Page 85

... and further drive consumer desire. Within the framework of our new strategic business plan 'Creating the New' we identified five strategic pillars within our R&D principles, which enable us to develop the best product for our athletes, while at the same time drive game-changing innovations in the... -

Page 86

... technology. With increasing speed of urban digitalisation, this field will remain one of our core areas. To enhance our digital capabilities, in 2015 the adidas Group acquired Runtastic, one of the leading global players in the health and fitness app market. Major recent innovations in the digital... -

Page 87

... performance meets high fashion' running shoe for women. The PureBOOST X is a product of innovation and style to meet the demands of today's female athlete. Stella McCartney cooperation: Launched in 2005, adidas by Stella McCartney was the first functional sports performance range for women designed... -

Page 88

...RO U P Research and Development SUCCESSFUL PRODUCT LAUNCHES ACROSS ALL MAJOR ADIDAS CATEGORIES In 2015, adidas sales were again driven by the latest product offerings, with products launched during the course of the year accounting for 81% of brand sales (2014: 78%). Only 3% of sales were generated... -

Page 89

..., adidas Originals introduced a product inspired by the past but looking forward to the future. This new shoe is a mix of iconic adidas Originals concepts and breakthrough technology of today, such as Boost and Primeknit. NMD was created thanks to the inspiration given by the archives of successful... -

Page 90

... an innovative product which integrates Reebok's pump technology in CCM's traditional Ribcor skate line. The brand strongly promoted the new product on digital and social media platforms, meeting with very positive response from the ice hockey world. • R&D EXPENSES INCREASE 10% R&D expenses... -

Page 91

... are the key to the company's success. Their performance, well-being and knowledge have a signiï¬cant impact on brand desire, consumer satisfaction, speedto-market and our ï¬nancial performance. The adidas Group has therefore developed a dedicated 'People Strategy', which is supported and ï¬lled... -

Page 92

... specific scores relating to performance management as well as learning and development opportunities. The existing engagement survey approach is currently being re-designed, given that both employees and business leaders are demanding a more pragmatic and frequent approach that caters to the speed... -

Page 93

... 553 interns in Germany (2014: 524). Succession management: The adidas Group succession management approach aims to ensure stability and certainty in business continuity. We achieve this through a globally consistent succession plan which covers successors for director level positions and above... -

Page 94

...Senior Management positions globally. Through this programme, 20 participants from across the company were placed in a new role in a different location to their current position for two years. Learnings and participant feedback of the Talent Carousel will be used to conceptualise new development and... -

Page 95

... to promote communication and the sharing of best practices and insights. • We have regular events highlighting diversity as a key topic, such as our global Diversity Day. • We provide diversity training to our employees. • Within our Group, for example, we support the 500-member strong 'Women... -

Page 96

... at all levels of management. In 2016, our initiatives will focus on developing a concrete strategy to promote the gender balance. www.adidas-group.com/en/ sustainability/employees/ diversity-and-inclusion 04 KEY EMPLOYEE STATISTICS 1 2015 2014 Total number of employees 2 Total employees (in... -

Page 97

... 9% Latin America 2% Japan 10% MEAA 15% Group functions 3% Other Businesses 07 NUMBER OF EMPLOYEES BY FUNCTION 1 Employees 2 Full-time equivalents 3 2015 2014 2015 2014 Own retail Sales Logistics Marketing Central functions and administration Production Research & development IT Total 32,543... -

Page 98

.... By means of an innovative compliance rating system (C rating) we assess the performance of our suppliers. These ratings are a non-financial KPI for our Group. www.adidas-group.com/s/ standards-and-policies see Global Operations, p. 74 see Internal Group Management System, p. 102 MATERIALITY... -

Page 99

...During 2015, we conducted 1,255 factory visits (2014: 1,320 visits) comprising different types of audits (including chemical management audits), trainings and meetings with factory management as well as employees at various levels in our supply chain. In addition to our own monitoring activities, we... -

Page 100

.... They include activities at Group headquarters, projects in suppliers' countries and relief operations. In 2015, we targeted considerable volumes of our financial and product donations to people affected by the refugee crisis and worked in close collaboration with our long-term partners Wings of... -

Page 101

.... Results will be available in our annual Green Company Performance Analysis 2015. During 2015, we developed the second generation of our Green Company programme, including targets to be achieved by 2020. These new targets build on our seven years of achievements and also demonstrate our continued... -

Page 102

... the right chemicals, we successfully phased out the use of long-chain PFCs in 2014. Disclosure/transparency: As part of our approach in enhancing disclosure practices and transparency within our supply chain, the adidas Group has actively promoted reputable platforms such as the Institute of Public... -

Page 103

... global sustainability index family tracking the performance of the leading sustainability-driven companies worldwide. In the sector 'Textiles, Apparel & Luxury Goods', adidas AG scored industry-best ratings in the category Innovation Management and received far above-average scores in Supply Chain... -

Page 104

-

Page 105

FINAN - CIAL Internal Group Management System Group Business Performance Economic and Sector Development Income Statement Statement of Financial Position and Statement of Cash Flows Treasury Financial Statements and Management Report of adidas AG Disclosures pursuant to § 315 Section 4 and § 289 ... -

Page 106

... CASH FLOW AS INTERNAL GROUP MANAGEMENT FOCUS We believe operating cash flow is the most important driver to increase shareholder value. To support this, Group Management focuses on four major financial Key Performance Indicators (KPIs). Increasing net sales and operating profit are the main... -

Page 107

... curtailing operational investments, for example staff hiring. Furthermore, we carefully analyse the different mix effects which impact the Group's profit ratios, as our business performance differs significantly across geographical markets, business models and sales channels. The strategic... -

Page 108

... and managed by the respective Group functions. Non-financial KPIs include market share and Net Promoter Score, our customer delivery performance (On-Time In-Full), our employee engagement and a set of KPIs in the area of our sustainability performance. In the context of our strategic business plan... -

Page 109

... sell-through success of our collections at the point of sale as well as data received from our own-retail activities is becoming increasingly important. On-Time In-Full (OTIF): OTIF measures the adidas Group's delivery performance towards customers and our own-retail stores. Managed by our Global... -

Page 110

... recent market and consumer research are assessed as available. see Glossary, p. 260 ENHANCED INTEGRATED BUSINESS PLANNING AND MANAGEMENT APPROACH In order to further optimise profitability and working capital efficiency as well as operating cash flow development, we continue to drive the Group... -

Page 111

.... In euro terms, Group revenues grew 16% to â,¬ 16.915 billion from â,¬ 14.534 billion in 2014. The Group's gross margin increased 0.6 percentage points to 48.3% (2014: 47.6%), driven by the positive effects from a more favourable pricing, channel and category mix. In 2015, the adidas Group incurred... -

Page 112

... In Latin America, GDP remained stable versus the prior year with divergences across the region's major countries. Argentina's economy recorded positive GDP growth, driven by improvements in the labour market as well as increased government spending. In Brazil, low investment activity, weak consumer... -

Page 113

... W Group Business Performance - Economic and Sector Development MOMENTUM IN THE SPORTING GOODS INDUSTRY CONTINUES In 2015, the global sporting goods industry grew, supported by rising consumer spending in both emerging and developed markets. The e-commerce channel continued to see rapid expansion... -

Page 114

... the expansion of the sporting goods industry. This trend was particularly evident in China, supporting healthy industry growth, especially in the lower-tier cities. Sporting goods sales in Japan saw improvements as the year developed, driven by stronger consumer spending and domestic demand. In... -

Page 115

..., income and expenses of the Rockport business segment are reported as discontinued operations at the end of December 2015. All figures related to the 2014 and 2015 financial years in this report refer to the Group's continuing operations unless otherwise stated. ADIDAS GROUP CURRENCY-NEUTRAL SALES... -

Page 116

... VIE W Group Business Performance - Income Statement GROUP SALES UP IN FOOTWEAR AND APPAREL In 2015, currency-neutral footwear sales grew 19%, mainly due to double-digit increases in the football category as well as at adidas Originals and adidas neo. In addition, mid-single-digit growth in running... -

Page 117

... VIE W Group Business Performance - Income Statement GROUP SALES DEVELOPMENT SUPPORTED BY DOUBLE-DIGIT GROWTH IN RETAIL In 2015, retail revenues increased 11% on a currency-neutral basis, mainly as a result of double-digit sales growth at adidas. Reebok revenues increased at a low-single-digit rate... -

Page 118

... PERCENTAGE POINTS In 2015, gross profit for the adidas Group increased 18% to â,¬ 8.168 billion versus â,¬ 6.924 billion in the prior year. Gross margin of the adidas Group increased 0.6 percentage points to 48.3% (2014: 47.6%), driven by a more favourable pricing, channel and product mix at adidas... -

Page 119

... partnerships, advertising, public relations and other communication activities. In absolute terms, expenditure for point-of-sale and marketing investments increased 22% to â,¬ 2.348 billion in 2015 from â,¬ 1.923 billion in the prior year. This development mainly reflects the Group's planned... -

Page 120

...L RE VIE W Group Business Performance - Income Statement NUMBER OF GROUP EMPLOYEES UP 3% At the end of 2015, the Group employed 55,555 people. This represents an increase of 3% versus the prior year level of 53,731. New hirings related to the Group's global marketing and sales organisation aimed at... -

Page 121

... N AGE M E NT RE P O RT - F INA NCIA L RE VIE W Group Business Performance - Income Statement OPERATING MARGIN EXCLUDING GOODWILL IMPAIRMENT DECREASES 0.1 PERCENTAGE POINTS TO 6.5% Group operating profit increased 20% to â,¬ 1.059 billion in 2015 versus â,¬ 883 million in 2014. The operating margin... -

Page 122

... operations increased 22% to â,¬ 3.32 from â,¬ 2.72 in 2014. The weighted average number of shares used in the calculation was 201,536,418 (2014: 208,776,457). see Diagram 25 see Note 35, p. 239 24 NET INCOME ATTRIBUTABLE TO SHAREHOLDERS 1, 2, 3, 4, 5, 6 â,¬ IN MILLIONS 2015 2014 2013 2012 2011... -

Page 123

...2015 2014 Liabilities and equity (â,¬ in millions) Short-term borrowings Accounts payable Long-term borrowings Other liabilities Total equity â- 2014 â- 2015 Rounding differences may arise in percentages and totals. 1 For absolute figures see adidas AG Consolidated Statement of Financial Position... -

Page 124

... - F INA NCIA L RE VIE W Group Business Performance - Statement of Financial Position and Statement of Cash Flows Total current assets increased 2% to â,¬ 7.497 billion at the end of December 2015 compared to â,¬ 7.347 billion in 2014. Cash and cash equivalents decreased 19% to â,¬ 1.365 billion at... -

Page 125

... A N AGE M E NT RE P O RT - F INA NCIA L RE VIE W Group Business Performance - Statement of Financial Position and Statement of Cash Flows LIABILITIES AND EQUITY Total current liabilities increased 23% to â,¬ 5.364 billion at the end of December 2015 from â,¬ 4.378 billion in 2014. Accounts payable... -

Page 126

... - Statement of Financial Position and Statement of Cash Flows INVESTMENT ANALYSIS Capital expenditure is defined as the total cash expenditure for the purchase of tangible and intangible assets (excluding acquisitions). Group capital expenditure decreased 7% to â,¬ 513 million in 2015 (2014... -

Page 127

.... The Group's ratio of net borrowings over EBITDA amounted to 0.3 at the end of December 2015 (2014: 0.1). Operating cash flow, as described in the Internal Group Management System, increased 17% to â,¬ 620 million in 2015 from â,¬ 530 million in 2014, mainly due to a higher operating profit. see... -

Page 128

... Group's financial expenses. The operating activities of our Group segments and the resulting cash inflows represent the Group's main source of liquidity. Liquidity is planned on a rolling monthly basis under a multi-year financial and liquidity plan. This comprises all consolidated Group companies... -

Page 129

3 G ROUP M A N AGE M E NT RE P O RT - F INA NCIA L RE VIE W Group Business Performance - Treasury GROUP FINANCIAL FLEXIBILITY The adidas Group's financial flexibility is ensured by the availability of unutilised credit facilities of â,¬ 1.906 billion at the end of 2015 (2014: â,¬ 1.846 billion), ... -

Page 130

... development was mainly due to the repayment of a US private placement of US $ 115 million, partly offset by an increase in short-term borrowings. Bank borrowings amounted to â,¬ 229 million compared to â,¬ 194 million in the prior year. At the end of 2015, no commercial paper was outstanding (2014... -

Page 131

...RE VIE W Group Business Performance - Treasury EURO DOMINATES CURRENCY MIX The vast majority of our Group's gross borrowings are denominated in euros and US dollars. At the end of 2015, gross borrowings denominated in euros accounted for 80% of total gross borrowings (2014: 80%). The share of gross... -

Page 132

...INA NCIA L RE VIE W Group Business Performance - Treasury 43 FINANCING STRUCTURE 1 â,¬ IN MILLIONS 2015 2014 Cash and short-term financial assets Bank borrowings Commercial paper Private placements Eurobonds Convertible bond Gross total borrowings Net borrowings 1 Rounding differences may arise in... -

Page 133

...total gross borrowings at the end of the year (2014: 10%). see Diagram 47 47 INTEREST RATE DEVELOPMENT 1 IN % 2015 2014 2013 2012 2011 1 Weighted average interest rate of gross borrowings. 2.4 3.1 3.8 4.4 4.9 EFFECTIVE CURRENCY MANAGEMENT A KEY PRIORITY As a globally operating company, the adidas... -

Page 134

... companies are settled, represent another 27% of total assets and 44% of total liabilities and equity as at December 31, 2015. see Subsequent Events and Outlook, p. 148 see Risk and Opportunity Report, p. 156 PREPARATION OF ACCOUNTS Unlike the consolidated financial statements of the adidas Group... -

Page 135

...A N AGE M E NT RE P O RT - F INA NCIA L RE VIE W Group Business Performance - Financial Statements and Management Report of adidas AG 49 ADIDAS AG NET SALES 1 â,¬ IN MILLIONS 2015 2014 Royalty and commission income adidas Germany Foreign subsidiaries Y-3 Other revenues Total 1 Rounding differences... -

Page 136

... Business Performance - Financial Statements and Management Report of adidas AG FINANCIAL RESULT IMPROVES SIGNIFICANTLY The financial result of adidas AG improved to â,¬ 394 million in 2015 from â,¬ 128 million in 2014. This increase was due to higher income from investments in affiliated companies... -

Page 137

...W Group Business Performance - Financial Statements and Management Report of adidas AG TOTAL ASSETS UP 1% At the end of December 2015, total assets grew 1% to â,¬ 7.517 billion versus â,¬ 7.415 billion in the prior year. The increase in financial assets was largely offset by the decrease in current... -

Page 138

...Annual General Meeting. All shares carry the same rights and obligations. As at December 31, 2015, adidas AG holds 9,018,769 treasury shares, which however do not confer any rights to the company in accordance with § 71b German Stock Corporation Act (Aktiengesetz - AktG). In the USA, we have issued... -

Page 139

... holders or creditors of bonds that were issued up to May 5, 2015 based on the resolution of the Annual General Meeting on May 6, 2010 subscription or conversion rights relating to no more than a total of 36,000,000 shares in compliance with the corresponding conditions of the bonds. see Note 26... -

Page 140

... rights relating to no more than a total of 12,500,000 shares in compliance with the corresponding conditions of the bonds. Based on the authorisation granted by the Annual General Meeting on May 8, 2014, the Executive Board is authorised, subject to Supervisory Board approval, to issue bonds... -

Page 141

... by the Annual General Meeting on May 8, 2014, the Executive Board is furthermore authorised to conduct the share buyback also by using equity derivatives which are arranged with a credit institution or financial services institution in close conformity with market conditions. adidas AG may acquire... -

Page 142

... results of TaylorMade-adidas Golf, Reebok-CCM Hockey, Runtastic and Other centrally managed businesses, including brands such as Y-3 and Five Ten, are aggregated under Other Businesses. Segmental operating expenses primarily relate to expenditure for point-of-sale and marketing investments as well... -

Page 143

... Gross margin in Western Europe increased 2.1 percentage points to 47.5% in 2015 from 45.4% in 2014. This development was driven by positive currency effects as well as a more favourable product and channel mix, partly offset by higher input costs and a less favourable pricing mix. Gross profit in... -

Page 144

... Gross margin in North America increased 1.1 percentage points to 36.6% in 2015 from 35.5% in 2014. This development was mainly due to the positive effects from a more favourable channel, product and pricing mix, partly offset by higher input costs as well as negative currency effects. Gross profit... -

Page 145

... OPERATING MARGIN INCREASES TO 35.1% Gross margin in Greater China increased 0.1 percentage points to 57.1% in 2015 (2014: 57.1%). This development was driven by a more favourable pricing, channel and product mix, partly offset by higher input costs as well as negative currency effects. Gross profit... -

Page 146

... in the prior year. see Table 05 see Table 05 05 RUSSIA/CIS AT A GLANCE â,¬ IN MILLIONS 2015 2014 Change Change (currency-neutral) Net sales 1 adidas Reebok Gross profit Gross margin Segmental operating profit Segmental operating margin 1 Rounding differences may arise in totals. 739 570 170... -

Page 147

... in the prior year. see Table 06 see Table 06 06 LATIN AMERICA AT A GLANCE â,¬ IN MILLIONS 2015 2014 Change Change (currency-neutral) Net sales 1 adidas Reebok Gross profit Gross margin Segmental operating profit Segmental operating margin 1 Rounding differences may arise in totals. 1,783 1,516... -

Page 148

... in 2015 from 43.4% in 2014. The increase was driven by a more favourable channel and pricing mix, partly offset by negative currency effects, higher input costs as well as a less favourable product mix. Gross profit in Japan increased 13% to â,¬ 365 million versus â,¬ 323 million in 2014. Operating... -

Page 149

... in the prior year. see Table 08 OPERATING PROFIT IN MEAA UP 20% Gross margin in MEAA decreased 0.2 percentage points to 51.4% in 2015 from 51.7% in 2014. The positive impact from a more favourable pricing, product and channel mix was more than offset by negative currency effects and higher input... -

Page 150

...businesses revenues increased 35% on a currency-neutral basis, mainly as a result of double-digit sales growth at Y-3 and Five Ten. Currency translation effects had a positive impact on sales in euro terms. Revenues in Other centrally managed businesses increased 38% to â,¬ 242 million in 2015 (2014... -

Page 151

... 09 09 OTHER BUSINESSES AT A GLANCE â,¬ IN MILLIONS 2015 2014 Change Change (currency-neutral) Net sales 1 TaylorMade-adidas Golf Reebok-CCM Hockey Other centrally managed businesses Gross profit Gross margin Operating profit Operating margin 1 Rounding differences may arise in totals. 1,467 902... -

Page 152

... of new and innovative products, increased brand-building activities and the positive effects from major sporting events, including the UEFA EURO 2016, we project signiï¬cant top- and bottom-line improvements in our Group's ï¬nancial results in 2016. We forecast adidas Group sales to increase at... -

Page 153

... than last year, supported by robust domestic demand and ongoing accommodative monetary policies. GDP in developing countries is forecasted to rise 4.8% in 2016, benefiting from the strengthened recovery in high-income markets as well as the expected stabilisation of commodity prices. In Western... -

Page 154

...mid-single-digit rate in 2016. In particular, the industry is projected to benefit from major sporting events, such as the UEFA EURO 2016 as well as the Rio 2016 Olympic Games. Consumer spending on sporting goods in the emerging economies is expected to grow faster than in the more developed markets... -

Page 155

...sales development (in %): adidas Group Western Europe 1 North America 1 Greater China 1 Russia/CIS 1 Latin America 1 Japan 1 MEAA 1 Other Businesses TaylorMade-adidas Golf Reebok-CCM Hockey Gross margin Other operating expenses in % of net sales Operating margin Net income from continuing operations... -

Page 156

...-single-digit rate, driven by the ongoing robust brand momentum of both adidas and Reebok across most of the region's major markets, in particular South Korea and the United Arab Emirates. CURRENCY-NEUTRAL SALES OF OTHER BUSINESSES TO BE BELOW THE PRIOR YEAR LEVEL In 2016, currency-neutral revenues... -

Page 157

... to net income from continuing operations excluding goodwill impairment losses of â,¬ 720 million in 2015. Net financial expenses are forecasted to increase in 2016, as a result of the non-recurrence of positive exchange rate effects. The Group's tax rate is projected to be at a level of around... -

Page 158

... stellar operational performance in 2015, the Group's strong financial position as well as Management's confidence in our long-term growth aspirations, the adidas AG Executive and Supervisory Boards will recommend paying an increased dividend of â,¬ 1.60 to shareholders at the Annual General Meeting... -

Page 159

3 G ROUP M A N AGE M E NT RE P O RT - F INA NCIA L RE VIE W Subsequent Events and Outlook 02 MAJOR 2016 PRODUCT LAUNCHES Product Brand Ace 16+ Pure Control and X15.1 football boots Messi football boot Ace 16+ Primeknit and X15.1 football boots for women Football apparel club kits of Bayern Mü... -

Page 160

... the structure as well as company and management culture of the adidas Group. This system focuses on the identification, evaluation, handling, monitoring and reporting of risks and opportunities. The key objective of the risk and opportunity management system is to support business success and... -

Page 161

... and developments in the sporting goods industry, as well as internal processes, to identify risks and opportunities as early as possible. Our Group-wide network of Risk Owners (i.e. all direct reports to the adidas AG Executive Board, including the Managing Directors of all our markets) ensures... -

Page 162

... are based on the potential financial effect on the relevant income statement metrics (operating profit, financial result or tax expenses). Qualitative measurements used are, for example, the degree of media exposure or additional senior management attention needed. Likelihood represents the... -

Page 163

... to the Executive Board, are also reported outside the regular quarterly reporting stream on an ad hoc basis. COMPLIANCE MANAGEMENT SYSTEM (ADIDAS GROUP FAIR PLAY COMPLIANCE FRAMEWORK) At the adidas Group, we consider compliance with the law as well as with external and internal regulations to be... -

Page 164

... at one of its meetings at least once a year concerning the contents and the further development of the compliance programme. DESCRIPTION OF THE MAIN FEATURES OF THE INTERNAL CONTROL AND RISK MANAGEMENT SYSTEM RELATING TO THE CONSOLIDATED FINANCIAL REPORTING PROCESS PURSUANT TO § 315 SECTION... -

Page 165

... the Group Internal Audit department regularly review accounting-related processes. Additionally, as part of the year-end audit, the external auditor selects and examines internal controls, including IT controls, to assess their effectiveness. The Audit Committee of the adidas AG Supervisory Board... -

Page 166

... (2014 rating) Strategic Risks Risks related to organisational structure and change Risks related to distribution strategy Competition risks Risks related to media and stakeholder activities Macroeconomic, sociopolitical and regulatory risks Operational Risks Personnel risks Business partner risks... -

Page 167

... Group-wide business plan model, taking into account our many years of own-retail experience and best practices from around the world. In addition, we conduct specific trainings for our sales force to appropriately manage product distribution and ensure that the right product is sold at the right... -

Page 168

... proactively adjust our marketing and sales activities when needed. Continuous investment in research and development ensures we remain innovative and create a point of difference from competitors. We also pursue a strategy of entering into long-term agreements with key promotion partners such as FC... -

Page 169

... Group's business performance. Losing important customers in key markets due to sub-par relationship management would result in significant sales shortfalls. In a few individual markets, we work with distributors or strategic partners whose approach might differ from our own distribution practices... -

Page 170

... costs. Data leakage could trigger in-depth forensic investigation resulting in temporary unavailability of key systems and business interruption. Key business processes, including product marketing, order management, warehouse management, invoice processing, customer support and financial reporting... -

Page 171

... of our planning environment in order to shorten order-to-delivery times and ensure availability of products while trying to avoid excess inventories. see Internal Group Management System, p. 102 see Global Operations, p. 74 LEGAL & COMPLIANCE RISKS Risks related to customs and tax regulations... -

Page 172

... to our strong global position, we are able to partly minimise currency risk by utilising natural hedges. Our gross US dollar cash flow exposure after natural hedges calculated for 2016 was roughly â,¬ 6.3 billion at year-end 2015, which we hedged using forward exchange contracts, currency options... -

Page 173

... charges. In addition, increases in market interest rates could trigger increases in discount rates used in our impairment test for goodwill and require impairment charges. An impairment charge would be a purely accounting, non-cash effect impacting the Group's operating result. see Notes 13... -

Page 174

... of ageing. At the end of 2015, no customer accounted for more than 10% of accounts receivable. The Group Treasury department arranges currency, commodity and interest rate hedges, and invests cash, with major banks of a high credit standing throughout the world. adidas Group companies are... -

Page 175

... adverse effects on the Group's profitability, liquidity and financial position. In line with IFRS 7 requirements, we have analysed the impact of changes in the Group's most important interest rates on net income and shareholders' equity. The effect of interest rate changes on future cash flows is... -

Page 176

... increase or decrease in interest rates at December 31, 2015 would have had no major impact on shareholders' equity and net income. To reduce interest rate risks and maintain financial flexibility, a core tenet of our Group's financial strategy is to continue to use surplus cash flow from operations... -

Page 177

... Africa. Successful results from these initiatives could enable us to accelerate top- and bottom-line growth. Marketing activation/promotion partnerships: Well-executed campaigns and marketing initiatives could increase brand desire and consumer appeal, which may drive full-price sell-through and... -

Page 178

... open up new channels of distribution or create cost savings and as a result positively impact Group profitability. see Glossary, p. 260 FINANCIAL OPPORTUNITIES Favourable financial market changes Favourable exchange and interest rate developments can potentially have a positive impact on... -

Page 179

... and brand-building activities as well as the presentation of the Group's new strategic business plan 'Creating the New', the adidas Group enjoyed strong momentum, which accelerated during the course of 2015. As a result, we increased our top- and bottom-line guidance for the full year 2015 in... -

Page 180

...see Internal Group Management System, p. 102 see TaylorMade-adidas Golf Strategy, p. 69 see Global Operations, p. 74 see Research and Development, p. 80 see Sustainability, p. 94 01 ADIDAS GROUP TARGETS VERSUS ACTUAL KEY METRICS 2014 Results 1 2015 Targets 1 2015 Results 2016 Outlook Sales (year... -

Page 181

... as Boost, expanding our digital activities as well as rolling out our controlled space initiatives globally. Through our extensive pipeline of highly attractive and innovative products, which have received favourable reviews from retailers, the positive effects from major sporting events, including... -

Page 182

-

Page 183

... Income Consolidated Statement of Changes in Equity Consolidated Statement of Cash Flows Notes Notes to the Consolidated Statement of Financial Position Notes to the Consolidated Income Statement Additional Information Statement of Movements of Intangible and Tangible Assets Shareholdings... -

Page 184

... financial statements give a true and fair view of the assets, liabilities, financial position and profit or loss of the Group, and the Group Management Report, which has been combined with the Management Report of adidas AG, includes a fair review of the development and performance of the business... -

Page 185

... by adidas AG, Herzogenaurach, comprising the statement of financial position, income statement, statement of comprehensive income, statement of changes in equity, statement of cash flows and the notes, together with the management report of the Company and the Group for the business year from... -

Page 186

...POSITION ADIDAS AG CONSOLIDATED STATEMENT OF FINANCIAL POSITION (IFRS) â,¬ IN MILLIONS Note Dec. 31, 2015 Dec. 31, 2014 Change in % Assets Cash and cash equivalents Short-term financial assets Accounts receivable Other current financial assets Inventories Income tax receivables Other current assets... -

Page 187

... NT S Consolidated Statement of Financial Position ADIDAS AG CONSOLIDATED STATEMENT OF FINANCIAL POSITION (IFRS) â,¬ IN MILLIONS Note Dec. 31, 2015 Dec. 31, 2014 Change in % Liabilities and equity Short-term borrowings Accounts payable Other current financial liabilities Income taxes Other current... -

Page 188

...NT S Consolidated Income Statement CONSOLIDATED INCOME STATEMENT ADIDAS AG CONSOLIDATED INCOME STATEMENT (IFRS) â,¬ IN MILLIONS Note Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Change Net sales Cost of sales Gross profit (% of net sales) Royalty and commission income Other operating income... -

Page 189

... CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME ADIDAS AG CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (IFRS) â,¬ IN MILLIONS Note Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Net income after taxes Items of other comprehensive income that will not be reclassified subsequently to profit... -

Page 190

... ADIDAS AG CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (IFRS) â,¬ IN MILLIONS Note Share capital Capital reserve Balance at December 31, 2013 Net income recognised directly in equity Net income Total comprehensive income Repurchase of treasury shares Dividend payment Balance at December 31, 2014... -

Page 191

... CON S OLI DAT E D F INA NCIA L STAT E M E NT S Consolidated Statement of Changes in Equity Cumulative currency translation differences Hedging reserve Other reserves 1 Retained earnings Shareholders' equity Non-controlling interests Total equity (363) 106 106 (34) 210 210 (59) (57) 4,959... -

Page 192

...FLOWS ADIDAS AG CONSOLIDATED STATEMENT OF CASH FLOWS (IFRS) â,¬ IN MILLIONS Note Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Operating activities: Income before taxes Adjustments for: Depreciation, amortisation and impairment losses Reversals of impairment losses Unrealised foreign exchange... -

Page 193

... operations as at December 31, 2015 and 2014, respectively SE E N OTE 03 . Each market comprises all wholesale, retail and e-commerce business activities relating to the distribution and sale of adidas and Reebok products to retail customers and end consumers. adidas and Reebok branded products... -

Page 194

... are applicable for the first time for financial years beginning on January 1, 2015: • IAS 19 Amendment - Deï¬ned Beneï¬t Plans: Employee Contributions (EU effective date: July 1, 2014): This amendment had no material impact on the Group's financial statements. • Improvements to IFRSs (2010... -

Page 195

.... Furthermore, the schedule of the shareholdings of adidas AG will be published on the electronic platform of the German Federal Gazette. Within the scope of the first-time consolidation, all acquired assets and liabilities are recognised in the statement of financial position at fair value at the... -

Page 196

... consolidated financial statements. OVERVIEW OF SELECTED MEASUREMENT PRINCIPLES Item Measurement principle Assets Cash and cash equivalents Short-term financial assets Accounts receivable Inventories Assets classified as held for sale Property, plant and equipment Goodwill Intangible assets (except... -

Page 197

... income statement and consolidated statement of cash flows are restated and presented as if the operation had been discontinued from the start of the comparative year. Derivative financial instruments The Group uses derivative financial instruments, such as currency options, forward exchange... -

Page 198

... other financial assets. For non-current receivables and other financial assets, the fair value is estimated as the present value of future cash flows discounted at the market rate of interest at the balance sheet date. Subsequently, these are measured at amortised cost using the 'effective interest... -

Page 199

...less costs to sell and value in use. Non-financial instruments measured at the recoverable amount primarily relate to impaired property, plant and equipment being measured at Level 3 according to IFRS 13 'Fair Value Measurement' and taking unobservable inputs (e.g. profit or cash flow planning) into... -

Page 200

... Research and development Research costs are expensed in full as incurred. Development costs are also expensed as incurred if they do not meet the recognition criteria of IAS 38 'Intangible Assets'. Financial assets All purchases and sales of financial assets are recognised on the trade date. Costs... -

Page 201

... without conversion rights, applying risk-adjusted interest rates. The liability component is subsequently measured at amortised cost using the 'effective interest method'. The equity component is determined as the difference between the fair value of the total compound financial instrument and... -

Page 202

... 20 . Provided that the customers meet certain pre-defined conditions, the adidas Group grants its customers different types of globally aligned performance-based rebates. Examples are sales growth and loyalty as well as sell-out support, e.g. through retail space management/franchise. When it is... -

Page 203

... the conditions attached. Grants related to income are reported in the consolidated income statement as a deduction from the related expenses. Income taxes Current income taxes are computed in accordance with the applicable taxation rules established in the countries in which the Group operates. The... -

Page 204

...a consequence, the Rockport operating segment was reported as discontinued operations for the first time in the 2014 consolidated financial statements. On January 23, 2015, the adidas Group signed a definitive agreement to sell the Rockport operating segment. The transaction was completed on July 31... -

Page 205

...excess-earnings method' was used. The respective future excess cash flows were identified and adjusted in order to eliminate all elements not associated with these assets. Future cash flows were measured on the basis of the expected net sales by deducting variable and sales-related imputed costs for... -

Page 206

... 1, 2015, total Group net sales would have been â,¬ 16.9 billion and net income attributable to shareholders would have been â,¬ 636 million for the year ending December 31, 2015. Effective January 2, 2015, Reebok International Limited completed the acquisition of Refuel (Brand Distribution) Limited... -

Page 207

... for the year ending December 31, 2014. NOTES TO THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION 05 CASH AND CASH EQUIVALENTS Cash and cash equivalents consist of cash at banks, cash on hand, short-term deposits and investments in money market funds. Short-term financial assets are only shown... -

Page 208

... to the Consolidated Statement of Financial Position 07 ACCOUNTS RECEIVABLE Accounts receivable consist mainly of the currencies US dollar, euro, Chinese renminbi as well as Japanese yen and are as follows: ACCOUNTS RECEIVABLE â,¬ in millions Dec. 31, 2015 Dec. 31, 2014 Accounts receivable, gross... -

Page 209

... which were reported as assets/liabilities held for sale since December 31, 2014 due to the concrete plans to sell the operating segment are consequently derecognised from the consolidated statement of financial position as of July 31, 2015. The Rockport operating segment is part of Other Businesses... -

Page 210

... costs to sell and comprised the following major classes of assets and liabilities: CLASSES OF ASSETS AND LIABILITIES â,¬ in millions Dec. 31, 2014 Accounts receivable Other current financial assets Inventories Total current assets Property, plant and equipment Trademarks Other intangible assets... -

Page 211

... on current statutory corporate tax rates of the individual cash-generating units. Cash flows beyond this five-year period are extrapolated using steady growth rates of 1.7% (2014: 1.7%). According to the Group's expectations, these growth rates do not exceed the long-term average growth rate of... -

Page 212

.../equity structure and financing costs referencing the Group's major competitors for each cash-generating unit. The discount rates used are after-tax rates and reflect the specific equity and country risk of the relevant cash-generating unit. Due to the implementation of an omni-channel distribution... -

Page 213

... Consolidated Statement of Financial Position In total, goodwill impairment losses of â,¬ 34 million were recognised in 2015 (2014: â,¬ 78 million). The carrying amounts of acquired goodwill allocated to the respective cash-generating units and the respective discount rates applied to the cash flow... -

Page 214

...costs referencing the Group's major competitors. The discount rate used is an after-tax rate and reflects the specific equity and country risk. The applied discount rate depends on the respective intangible asset being valued and ranges between 6.8% and 8.4% (2014: between 6.7% and 8.4%). The adidas... -

Page 215

... market. There is no intention to sell these shares. Additionally, long-term financial assets include investments which are mainly invested in insurance products and are measured at fair value, as well as other financial assets. LONG-TERM FINANCIAL ASSETS â,¬ in millions Dec. 31, 2015 Dec. 31, 2014... -

Page 216

...(2015: 80%; 2014: 80%) and US dollars (2015: 15%; 2014: 12%). The weighted average interest rate on the Group's gross borrowings decreased to 2.4% in 2015 (2014: 3.1%). As at December 31, 2015, the Group had cash credit lines and other long-term financing arrangements totalling â,¬ 3.7 billion (2014... -

Page 217

... in millions Dec. 31, 2015 Dec. 31, 2014 Currency options Forward exchange contracts Commodity futures Finance lease obligations Sundry Other current financial liabilities 2 59 - 3 79 143 0 50 3 3 35 91 The increase in the line item 'Sundry' mainly relates to purchase price obligations for non... -

Page 218

... Notes to the Consolidated Statement of Financial Position Marketing provisions mainly consist of provisions for promotion contracts. Provisions for personnel mainly consist of provisions for short- and long-term variable compensation components as well as of provisions for social plans relating to... -

Page 219

... in 2015 (2014: â,¬ 46 million). Defined benefit pension plans Given the diverse Group structure, different defined benefit pension plans exist, comprising a variety of post-employment benefit arrangements. The Group's major defined benefit pension plans relate to adidas AG and its subsidiaries in... -

Page 220

...the Consolidated Statement of Financial Position In Germany, adidas AG grants its employees contribution-based and final salary defined benefit pension schemes, which provide employees with entitlements in the event of retirement, disability and death. In general, German pension plans operate under... -

Page 221

...THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION â,¬ in millions Dec. 31, 2015 Dec. 31, 2014 Present value of funded obligation from defined benefit pension plans Fair value of plan assets Funded status Present value of unfunded obligation from defined benefit pension plans Asset ceiling effect Net... -

Page 222

... - Notes to the Consolidated Statement of Financial Position PENSION EXPENSES FOR DEFINED BENEFIT PENSION PLANS â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Current service cost Net interest expense Thereof: interest cost Thereof: interest income Past service cost Gain on... -

Page 223

...return. In August 2014, an amount of â,¬ 65 million in cash was transferred to the trustee. The plan assets in the registered association are mainly invested in equity index funds, hybrid bonds, fixed and variable interest rate bonds and money market funds. Another part of the plan assets in Germany... -

Page 224

... 2013/II cancelled by the Annual General Meeting on May 7, 2015, which had also not been utilised up to May 7, 2015. The authorised capital of the company entitles the Executive Board, subject to Supervisory Board approval, to increase the nominal capital until June 30, 2018 by issuing new shares... -

Page 225

... resolution. The new shares shall carry dividend rights from the commencement of the financial year in which the shares are issued. On March 14, 2012, the Executive Board, with the approval of the Supervisory Board, made partial use of the authorisation of the Annual General Meeting from May... -

Page 226

... capital increase. The Executive Board of adidas AG did not issue shares from the Contingent Capital 2014 in the 2015 financial year or in the period beyond the balance sheet date up to and including February 15, 2016. Repurchase of adidas AG shares The Annual General Meeting on May 8, 2014 granted... -

Page 227

... in % Number of voting rights BlackRock, Inc., Wilmington, DE, USA 1 Albert Frère / Desmarais Family Trust, Montréal, Canada 2 FMR LLC, Wilmington, DE, USA 3 Capital Research and Management Company, Los Angeles, CA, USA 4 The Capital Group Companies, Inc., Los Angeles, CA, USA 5 adidas AG... -

Page 228

... on the resolution of the 2015 Annual General Meeting, the dividend for 2014 was â,¬ 1.50 per share (total amount: â,¬ 306 million). The Executive Board of adidas AG will propose to shareholders a dividend payment of â,¬ 1.60 per dividend-entitled share for the year 2015 to be made from retained... -

Page 229

... and partly through purchases or foundations in the last years. With respect to the consolidated financial statements of adidas AG, on a single basis, no subsidiary has a material non-controlling interest. As at December 31, 2015, signed purchase agreements which become effective as of January 2016... -

Page 230

...assets attributable to non-controlling interests according to the consolidated statement of financial position Net cash generated from/(used in) operating activities Net cash used in investing activities Net cash generated from financing activities Net increase of cash and cash equivalents Dividends... -

Page 231

... to the Consolidated Statement of Financial Position Future minimum lease payments for minimum lease durations on a nominal basis are as follows: MINIMUM LEASE PAYMENTS FOR OPERATING LEASES â,¬ in millions Dec. 31, 2015 Dec. 31, 2014 Within 1 year Between 1 and 5 years After 5 years Total 516... -

Page 232

... Dec. 31, 2015 Financial assets Cash and cash equivalents Short-term financial assets Accounts receivable Other current financial assets Derivatives being part of a hedge Derivatives not being part of a hedge Other financial assets Long-term financial assets Other equity investments Available-for... -

Page 233

... Dec. 31, 2014 Financial assets Cash and cash equivalents Short-term financial assets Accounts receivable Other current financial assets Derivatives being part of a hedge Derivatives not being part of a hedge Other financial assets Long-term financial assets Other equity investments Available-for... -

Page 234

...not being part of a hedge Long-term borrowings Earn-out components Financial liabilities 5 181 47 117 42 392 366 36 26 1,626 21 2,075 1,626 1,626 5 181 47 36 269 366 36 26 21 428 21 81 42 123 Level 1 is based on quoted prices in active markets for identical assets or liabilities. Level 2 is based... -

Page 235

...Long-term financial assets This category relates to an 8.33% investment in FC Bayern München AG of â,¬ 81 million. Dividends are distributed by FC Bayern München AG instead of regular interest payments. These dividends are recognised in other financial income. On January 23, 2015 the adidas Group... -

Page 236

... Statement of Financial Position FINANCIAL INSTRUMENTS LEVEL 2 MEASURED AT FAIR VALUE Type Valuation method Signiï¬cant unobservable inputs Category Short-term financial assets The discounted cash flow method is applied, which considers the present value of expected payments, discounted using... -

Page 237

... Statement of Financial Position NET GAINS/LOSSES ON FINANCIAL INSTRUMENTS RECOGNISED IN THE CONSOLIDATED INCOME STATEMENT â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Financial assets or financial liabilities at fair value through profit or loss Thereof: designated... -

Page 238

... sold. As at December 31, 2015, no ineffective part of the hedges was recorded in the income statement. In order to determine the fair values of its derivatives that are not publicly traded, the adidas Group uses generally accepted quantitative financial models based on market conditions prevailing... -

Page 239

... to the production costs. OTHER OPERATING EXPENSES â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Expenditure for marketing investments Expenditure for point-of-sale investments Marketing overhead 1 Sales force 1 Logistics 1 Research and development 1 Central administration... -

Page 240

...: FINANCIAL INCOME â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Interest income from financial instruments measured at amortised cost Interest income from financial instruments at fair value through profit or loss Interest income from non-financial assets Net foreign exchange... -

Page 241

... assets amounting to â,¬ 1 million for the year ending December 31, 2015 (2014: â,¬ 2 million). Information regarding the Group's available-for-sale investments, borrowings and financial instruments is also included in these Notes SE E N OT E S 0 6, 15, 18 AN D 2 9 . 34 INCOME TAXES adidas AG... -

Page 242

... tax if they were remitted as dividends or if the Group were to sell its shareholdings in the subsidiaries. Tax expenses Tax expenses are split as follows: INCOME TAX EXPENSES â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Current tax expenses Deferred tax income Income tax... -

Page 243

...the US tax group. For 2015, the line item 'Changes in tax rates' mainly reflects a UK tax rate reduction effective in 2015. 35 EARNINGS PER SHARE Basic earnings per share from continuing operations are calculated by dividing the net income from continuing operations attributable to shareholders by... -

Page 244

... information for the year ending December 31, 2014. As at December 31, 2015, following the Group's new internal management reporting by markets and in accordance with the definition of IFRS 8 'Operating Segments', 13 operating segments were identified: Western Europe, North America, Greater China... -

Page 245

... activities of the adidas neo label as well as International Clearance Management. Certain centralised Group functions do not meet the definition of IFRS 8 for a reportable operating segment. This includes functions such as Global Brands and Global Sales (central brand and distribution management... -

Page 246

... financial statements, taking into account items which are not directly attributable to a segment or a group of segments. NET SALES (NON-GROUP) â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Reportable segments Other Businesses Reclassification to discontinued operations Total... -

Page 247

...Year ending Dec. 31, 2014 Operating profit for reportable segments Operating profit for Other Businesses Segmental operating profit HQ/Consolidation Central expenditure for marketing investments Goodwill impairment losses Reclassification to discontinued operations Operating profit Financial income... -

Page 248

... current liabilities Non-current liabilities Reclassification to liabilities as held for sale Total 566 117 683 1,342 509 2,831 2,332 0 7,696 528 171 699 990 379 2,346 2,422 (37) 6,799 Product information NET SALES (NON-GROUP) â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014... -

Page 249

... activities mainly related to the dividend paid to shareholders of adidas AG and to the repurchase of treasury shares. NET CASH (USED IN)/GENERATED FROM DISCONTINUED OPERATIONS â,¬ in millions Year ending Dec. 31, 2015 Year ending Dec. 31, 2014 Net cash generated from operating activities Net cash... -

Page 250