Adidas 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

Annual Report

2014

M A K E A

DIFFERENCE

Table of contents

-

Page 1

MAKE A DIFFERENCE adidas Group Annual Report 2014 -

Page 2

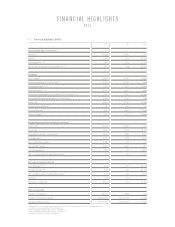

...3) Earnings per share decrease 32% to 7% - 10% â,¬ 2.72 3) Shareholder value adidas AG share price decreases Shareholder value further increase 38 % Dividend per share increase â,¬ 1.50 4) 1) Figures reï¬,ect continuing operations as a result of the planned divestiture of the Rockport business... -

Page 3

...0pp) n.a. 8.7pp (5.6pp) Balance Sheet and Cash Flow Data (â,¬ in millions) Total assets Inventories Receivables and other current assets Working capital Net cash/(net borrowings) Shareholders' equity Capital expenditure Net cash generated from operating activities 2) 12,417 2,526 2,861 2,970 (185... -

Page 4

...TRULY GLOBAL BRAND GERMAN ROOTS WITH TaylorMade TaylorMade leads the golf industry in metalwood sales and is the number one driver brand on the world's six major professional golf tours. The brand is recognised globally for its capacity to develop innovative and performance-enhancing technologies... -

Page 5

MAKE A DIFFERENCE adidas Group Annual Report 2014 SPORT, T H E Y M A K E A D I F F E R E N C E : FRACTIONS OF A SECOND. ONLY A FEW CENTIMETRES. A COUPLE OF GRAMS. T O ATHLETES , T H E Y M A K E A D I F F E R E N C E : IN our groundbreaking Our decades of Our overwhelming INNOVATIONS EX P ... -

Page 6

... ategy Other Businesses Str ategy Global Operations Research and Development Employees Sustainabilit y 46 49 53 60 66 73 82 89 G R O U P M A N A G E M E N T R E P O R T: This report contains the Group Management Report of the adidas Group, comprising adidas AG and its consolidated subsidiaries, and... -

Page 7

... 03.1 03.2 FINANCIAL REVIEW GROUP MANAGEMENT REPORT Internal Group Management System Group Business Per formance Economic and Sector Development Income Statement Statement of Financial Position and Statement of Cash Flows Treasury Financial Statements and Management Report of adidas AG Disclosures... -

Page 8

-

Page 9

01 TO OUR SHAREHOLDERS 01.1 01.2 01.3 01.4 01.5 01.6 01.7 Letter from the CEO E xecutive Board Super visor y Board Super v isor y Board Repor t Cor por ate Gover nance Repor t including the Declar ation on Corpor ate Governance Compens ation Repor t Our Share 6 10 12 14 20 28 38 TO OUR ... -

Page 10

... success of the ZX Flux and the Stan Smith product franchise as well as our ï¬rst product launches as part of our partnerships with Rita Ora and Pharrell Williams, to name just a few. Also our NEO business continues to experience dynamic growth, with sales up 27%. adidas Group / 2014 Annual Report -

Page 11

.... In addition, unfavourable hedging rates negatively impacted the Group's gross margin by 60 basis points. But none of this changes our underlying strength in the developing economies in general and our excellent market position in Russia in particular. 7 20 14 adidas Group / 2014 Annual Report -

Page 12

... ambitious strategic business plan. And even though we will not achieve our sales and earnings targets this year, the adidas Group today is signiï¬cantly stronger and better positioned than at the start of our Route 2015 journey. Two examples: we know that our brands and products resonate best with... -

Page 13

...in the market environment. The roadmap for the future is clear. We will signiï¬cantly improve our business and grow our top and bottom line in 2015. But that's only just the beginning. At the end of March we will present our long-term strategy for the period up to 2020. Of course I cannot report on... -

Page 14

...Each Board member is responsible for at least one major function within the Group. Her b er t Hainer CHIEF EXECUTIVE OFFICER Herbert Hainer was born in Dingolï¬ng, Germany, in 1954. Following his business studies, he spent eight years with Procter & Gamble in various sales and marketing positions... -

Page 15

... the adidas Group, he has held many senior management positions, including Business Unit Manager, Key Account Manager Europe and Head of Region Europe, Middle East and Africa. In 2009, he became Chief Sales Ofï¬cer Multichannel Markets. In 2013, Roland Auschel was appointed to the Executive Board... -

Page 16

... of the Supervisory Board, Eckes AG, Nieder-Olm, Germany 12 20 14 Die t er Hauens t ein* residing in Herzogenaurach, Germany Full-time member of the Works Council Herzogenaurach, adidas AG 3) Dr. W olf gang J äger * residing in Bochum, Germany Managing Director in charge of Public Relations and... -

Page 17

... * Employee representative. 1) Re-elected at the constituent meeting of the Supervisory Board on May 8, 2014. 2) Until May 7, 2014. 3) Since April 4, 2014; formerly Deputy Chairman of the Works Council Herzogenaurach. 4) Since the end of the Annual General Meeting held on May 8, 2014. adidas Group... -

Page 18

... BOARD 14 20 14 Dear Shareholders, We look back on 2014 as a challenging year. Thanks to strong brands and partnerships in the world of sport, as well as ï¬rstclass innovations, the adidas Group was again able to achieve strong sales growth. However, the ongoing weakness in the golf market... -

Page 19

... translation effects as well as the development of our individual brands. In March 2014, we reviewed and dealt intensively with the KPMG-certiï¬ed 2013 annual ï¬nancial statements and consolidated ï¬nancial statements, including the combined management report for adidas AG and the Group, as... -

Page 20

... General Meeting, including the proposal regarding the appropriation of retained earnings for the 2013 ï¬nancial year and the candidates for election as shareholder representatives on the Supervisory Board. Another topic of this meeting was the resolution on the 2014 Budget and Investment Plan... -

Page 21

... meeting in February 2015, we considered in-depth the performance of each Executive Board member in the year under review as well as during the three-year period 2012/2014, and then resolved upon the 2014 Performance Bonuses and the LTIP Bonuses 2012/2014 to be granted to them. Further information... -

Page 22

... half year report together with the Chief Financial Ofï¬cer and the auditor before the respective dates of publication, also the preliminary examination of the annual ï¬nancial statements and the consolidated ï¬nancial statements for 2013, including the combined management report of adidas AG and... -

Page 23

... that was elected that day for a term of ï¬ve years. We expressed our thanks to the departing members for their many years of dedicated and loyal collaboration. As new shareholder representatives on the Supervisory Board, the Annual General Meeting - in line with the nominations submitted by the... -

Page 24

... Group by our shareholders, business partners, employees and the ï¬nancial markets. The following report includes the Corporate Governance Report and the Declaration on Corporate Governance issued by the Executive Board and Supervisory Board. Dual board system As a globally operating public listed... -

Page 25

...also many years of international experience, they bring a broad spectrum of expertise to the performance of their Supervisory Board function. The number of female Supervisory Board members has increased from two members to four. Assuming all of the employee representatives also in principle meet the... -

Page 26

... 2014, Eric Liedtke, who has held various management positions within the adidas Group both in and outside Germany in the past 20 years, became the successor of Erich Stamminger as member of the Executive Board responsible for Global Brands. The Supervisory Board considers the increase in the number... -

Page 27

... this end, the relation between Executive Board compensation and that of senior management and employees overall is taken into account, also in terms of its development over time. Further information on Executive Board compensation is compiled in the Compensation Report. In order to increase the ef... -

Page 28

... Board HERBERT HAINER Chief Executive Ofï¬cer IGOR L AND A U Chairman of the Supervisory Board The aforementioned Declaration of Compliance dated February 12, 2015 has been published under and can be downloaded at www.adidas-Group.com/s/corporate-governance. adidas Group / 2014 Annual Report -

Page 29

...management systems at company-owned locations in compliance with ISO 14001. Code of Conduct Sustainability Social commitment Risk and opportunity management and compliance / Information and documents on the Annual General Meeting / Directors' dealings / Accounting and annual audit www.adidas-group... -

Page 30

... sustainable success of the adidas Group. 26 20 14 see Risk and Opportunity Report, p. 154 Transparency and protection of shareholders' interests It is our goal to inform all institutional investors, private shareholders, ï¬nancial analysts, business partners, employees and the interested public... -

Page 31

... the total number of shares held by all members of the Executive Board and the Supervisory Board. A detailed overview of Directors' dealings in 2014 is published on our website. www.adidas-group.com/s/directors-dealings Accounting and annual audit adidas AG prepares the annual ï¬nancial statements... -

Page 32

... To this end, the relation between the Executive Board compensation and that of senior management and employees overall is taken into account, also in terms of its development over time. In addition, the tasks and contribution of each Executive Board member to the company's success, their individual... -

Page 33

...in addition to the individual performance of the Executive Board member, the following business-related criteria (performance criteria): / increase in currency-neutral net sales / improvement of operating working capital / improvement of the operating margin in the Retail segment. In calculating the... -

Page 34

... contract by the company. A compensation component resulting from a management share option plan does not exist and is not planned. The development of the adidas AG share, however, provides one of the four performance criteria for the LTIP 2012/2014. 30 20 14 adidas Group / 2014 Annual Report -

Page 35

... J. Stalker to three percentage points of the pensionable income effective March 6, 2015. 4) Increase of the targeted provision level of Glenn Bennett and Robin J. Stalker to a pension entitlement of a maximum of 50% effective March 6, 2015. see Table 01 31 20 14 adidas Group / 2014 Annual Report -

Page 36

... Erich Stamminger and is based on the Performance Bonus granted to the respective Executive Board member for the last full ï¬nancial year. 7) There is no claim to a follow-up bonus if the Executive Board service contract is terminated by release or for good cause. adidas Group / 2014 Annual Report -

Page 37

... over a three-year period and to the increased number of Executive Board members. In addition, the service costs for the pension commitments of Glenn Bennett and Robin J. Stalker increased, as the targeted individual pension level was raised effective March 6, 2015. The recommendation of the Code to... -

Page 38

... ï¬nancial year due to amendment of the Pension Agreements effective March 6, 2015, comprising the 2014 service cost and the 2014 past service cost. 5) Exchange rate 1.3296 $/â,¬ (annual average rate 2014). 6) Exchange rate 1.3283 $/â,¬ (annual average rate 2013). adidas Group / 2014 Annual Report -

Page 39

... of March 2015 and March 2016. 6) Increase of the service costs for Glenn Bennett and Robin J. Stalker for the 2014 ï¬nancial year due to amendment of the Pension Agreements effective March 6, 2015 comprising the 2014 service cost and the 2014 past service cost. adidas Group / 2014 Annual Report -

Page 40

... Shareholders Compensation Report / 01.6 / As a variable compensation component with long-term incentive effect, our Executive Board will be granted a new Long-Term Incentive Plan, also covering a three-year period, as of the 2015 ï¬nancial year. Payments to former members of the Executive Board... -

Page 41

... charge for it separately. The total compensation paid to our Supervisory Board in the 2014 ï¬nancial year amounted to â,¬ 0.92 million (2013: â,¬ 0.92 million). At the Annual General Meeting on May 8, 2014, the shareholders resolved an increase of the ï¬xed annual compensation from â,¬ 40,000 to... -

Page 42

... of the Group's ï¬nancial position and long-term aspirations, we intend to propose an unchanged dividend per share of â,¬ 1.50 at our 2015 Annual General Meeting. Mixed international stock market development in 2014 In 2014, the performance of international stock markets was mixed, with European... -

Page 43

...adidas AG DAX-30 MSCI World Textiles, Apparel & Luxury Goods Index 03 / The adidas AG share 2014 2013 Important indices Number of shares outstanding 1) Basic earnings per share Cash generated from operating activities per share Year-end price Year high Year low Market capitalisation 5) Dividend... -

Page 44

... impacted the adidas AG share price development, given the adidas Group's high percentage of sales in emerging markets. In addition, negative newsï¬,ow with regard to the golf market as well as unfavourable point-of-sale data in North America increased negative sentiment towards the adidas AG share... -

Page 45

... relating to dividend protection, the conversion price was adjusted to â,¬ 82.56 per share. This adjustment became effective on May 9, 2014. The convertible bond closed the year at â,¬ 108.95, below the prior year value level of â,¬ 129.96. see Note 18, p. 213 adidas Group / 2014 Annual Report -

Page 46

...50 per share Given their conï¬dence in the strength of the Group's ï¬nancial position and long-term aspirations, the adidas AG Executive and Supervisory Boards intend to again recommend paying a dividend of â,¬ 1.50 to shareholders at the Annual General Meeting (AGM) on May 7, 2015 (2013: â,¬ 1.50... -

Page 47

...% of the analysts recommended to 'sell' our share (2013: 7%). 43 20 14 Successful Investor Relations activities adidas AG strives to maintain close contact to institutional and private shareholders as well as analysts. In 2014, Management and the Investor Relations team spent 29 days on roadshows... -

Page 48

-

Page 49

...ategy Other Businesses Str ategy Global Operations Research and Development Employees Sustainabilit y 46 49 53 60 66 73 82 89 G R O U P M A N A G E M E N T R E P O R T: This report contains the Group Management Report of the adidas Group, comprising adidas AG and its consolidated subsidiaries, and... -

Page 50

...a coordinated distribution through our omni-channel approach. see Global Sales Strategy, p. 49 01 / adidas Group strategic pillars Brand Portfolio Build and manage a diverse brand portfolio with distinctive brands covering consumers from sport performance to sport lifestyle. Innovation Maintain... -

Page 51

...key strategic priority is to enable faster product creation and production by continuously improving our infrastructure, processes and systems. By sharing information from point of sale to source and vice versa, we strive to connect and more closely integrate the various elements of our supply chain... -

Page 52

... price performance and dividends. see Internal Group Management System, p. 98 see Our Share, p. 38 adidas Group new strategic goals to be announced in 2015 48 20 14 In November 2010, the Group unveiled its 2015 strategic business plan named 'Route 2015', which deï¬ned strategies and objectives... -

Page 53

.../ Global Sales Strategy Global Sales drives the commercial performance of the adidas Group by building brand desire and by consistently meeting consumer needs across all touch points. Global Sales is responsible for all commercial activities of the adidas and Reebok brands. In 2014, we reviewed our... -

Page 54

...globe. It is our ambition to deliver the best branded shopping experiences at all consumer touch points, exceeding both customer and consumer expectations and accelerating our growth. see Glossary, p. 258 50 20 14 02 / adidas Performance Store Nuremberg, Germany adidas Group / 2014 Annual Report -

Page 55

... department stores, buying groups, lifestyle retail chains, e-tailers and franchisees. We will focus our joint efforts on early trend identiï¬cation, joint campaign planning, shared inventories and seamless consumer journeys. A key emphasis will be on the execution at the point of sale with managed... -

Page 56

...innovations. / People People are our most important asset and we aspire to have the best team in our industry. We invest in the development of our employees as we want them to become omni-channel experts who understand both sales and brand management. We will develop a new training programme in 2015... -

Page 57

...stream of innovative and desirable products and generating communication strategies that connect with their target consumer in an engaging and compelling way. Driving the long-term development of adidas and Reebok To secure long-term sustainable growth for the adidas Group, Global Brands is focused... -

Page 58

... the consumer. / Marketing and communication leadership to drive brand advocacy. / Activation and validation via a relevant set of promotion partnerships. / Extending brand reach and appeal through strategic partnerships. adidas strategic positioning No other brand has a more distinguished history... -

Page 59

Group Management Report - Our Group Global Brands Strategy / 02.3 / adidas is mainly targeting competitive sports based on innovation and technology with adidas Sport Performance. This sub-brand is the multi-sport specialist. The target consumers range from sports participants at the highest level... -

Page 60

Group Management Report - Our Group Global Brands Strategy / 02.3 / Reebok strategic positioning Reebok is an American-inspired global brand with a deep ï¬tness heritage and the mission to design and create the best gear and experiences for the sport of ï¬tness and for ï¬tness athletes around ... -

Page 61

... Management Report - Our Group Global Brands Strategy / 02.3 / At adidas, the brand innovates through a focus on key performance beneï¬ts. The R&D focus is on cushioning and energy solutions, lightweight, body temperature management and digital sports technologies as well as sustainable product... -

Page 62

... Management Report - Our Group Global Brands Strategy / 02.3 / Marketing and communication leadership adidas and Reebok are focused on creating inspirational and innovative marketing capabilities that build brand equity and consumer advocacy. A key tenet of our marketing and communication strategy... -

Page 63

... Management Report - Our Group Global Brands Strategy / 02.3 / Activation and validation via a relevant set of promotion partnerships The utilisation of promotion partners such as federations, teams, leagues, events and individuals is an important part of validating and endorsing brand positioning... -

Page 64

... up retail inventories, especially in the USA. In light of this, TaylorMade-adidas Golf strategically reduced the number of new product introductions compared to previous years. Strategic priority / Design and innovation see Picture 01 see Info Box, p. 63 adidas Group / 2014 Annual Report -

Page 65

... Adams Golf: Adams Golf's key strategy for growth is to adapt tour-proven technology to meet the needs of golfers seeking equipment that makes the game easier to play and thus a better experience. Additionally, Adams Golf uses its position as the number one hybrid brand on ï¬ve of the world's major... -

Page 66

... Management Report - Our Group Other Businesses Strategy / TaylorMade-adidas Golf Strategy / 02.4 / Majors Series Apparel Collection which was the brand's marketing focus in 2014, featuring a series of limited-edition golf shirts designed to commemorate the major victories of six of the company... -

Page 67

Group Management Report - Our Group Other Businesses Strategy / TaylorMade-adidas Golf Strategy / 02.4 / Effective retail strategy leverages key accounts and assets TaylorMade-adidas Golf makes it a point to create compelling point-of-sale communications and displays designed to clearly educate ... -

Page 68

... to drive growth. / Deï¬ned pricing strategy which reï¬,ects the brands' positioning. Product innovation key to brand positioning Strategic priority / Product innovation 64 20 14 The key priority for Reebok-CCM Hockey is to design and market innovative and technologically advanced products that... -

Page 69

Group Management Report - Our Group Other Businesses Strategy / Reebok-CCM Hockey Strategy / 02.4 / / Skates: The focus in the skate category is to drive market share increases through products addressing critical performance aspects such as ï¬t, weight and durability. In 2014, Reebok Hockey ... -

Page 70

... products in 2014. It is also planned to roll out OTIF to those markets that are currently not in scope, thereby increasing the overall share of adidas and Reebok products measured against 'on time' and 'in full'. 20 14 see Internal Group Management System, p. 98 adidas Group / 2014 Annual Report -

Page 71

...-to-market process Global Operations Marketing Design Product Development Sourcing Supply Chain Management Sales Subsidiaries Brieï¬ng Concept Product creation Manufacturing Distribution Sales Centre of Excellence Processes and infrastructure of the future adidas Group / 2014 Annual Report -

Page 72

... allow us to align sales processes across the brands and improve efï¬ciencies. The majority of adidas footwear and apparel is already on 60 days. In 2014, Global Operations launched the strategic initiative 'Digital Creation'. One main objective of this initiative is to increase the speed and ef... -

Page 73

..., processes and systems to support the Group's growth plans. This includes further process simpliï¬cation, consolidation of legacy systems and distribution structures, as well as the creation of state-of-the-art systems required to support new business demands. In 2014, Global Operations focused... -

Page 74

...the Group's total sourcing volume. www.adidas-group.com/sustainability see Sustainability, p. 89 70 20 Number of manufacturing partners increases In 2014, Global Operations worked with 340 independent manufacturing partners (2013: 322). Of our independent manufacturing partners, 83% were located... -

Page 75

Group Management Report - Our Group Global Operations / 02.5 / China remains largest source country for apparel In 2014, we sourced 93% of the total apparel volume for adidas, Reebok, adidas Golf and Ashworth from Asia (2013: 92%). Europe remained the second-largest apparel sourcing region, ... -

Page 76

... Management Report - Our Group Global Operations / 02.5 / China share of hardware production declines In 2014, 78% of adidas and Reebok branded hardware products, such as balls and bags, was produced in Asia (2013: 79%). European countries accounted for 22% (2013: 21%). China remained our largest... -

Page 77

.... R&D an integral part of the product and user experience creation process R&D within the adidas Group follows a decentralised approach. In line with their strategic and long-term visions and distinctive positioning, each brand runs its own R&D activities. However, fundamental research as well as... -

Page 78

... Management Report - Our Group Research and Development / 02.6 / 01 / Major R&D activities and locations Main activities Major locations The adidas FUTURE team is divided into groups that focus on performance footwear, apparel and hardware innovation, within which there are individual product... -

Page 79

... the number of manufactured physical samples by over 18%. An additional beneï¬t of creating virtual assets is their application in other areas, such as e-commerce, computer games, virtual merchandising and digital communication. see Global Operations, p. 66 adidas Group / 2014 Annual Report -

Page 80

Group Management Report - Our Group Research and Development / 02.6 / R&D expenses at prior year level R&D expenses include expenses for personnel and administration, but exclude other costs, for example those associated with the design aspect of the product creation process. In 2014, as in prior ... -

Page 81

Group Management Report - Our Group Research and Development / 02.6 / Successful product launches across all major adidas categories In 2014, adidas sales were again driven by the latest product offerings, with products launched during the course of the year accounting for 78% of brand sales (2013... -

Page 82

... and position their design until it is just right, with the ability to then save and share their designs on social networks and more. More information on these and other products can be found in the Global Brands Strategy section. see Global Brands Strategy, p. 53 adidas Group / 2014 Annual Report -

Page 83

...direct accelerations in real time and provide actionable objective measurement of impact force. More information on these and other products can be found in the Global Brands Strategy section. see Global Brands Strategy, p. 53 Innovation a key success factor for TaylorMade-adidas Golf At TaylorMade... -

Page 84

Group Management Report - Our Group Research and Development / 02.6 / Reebok-CCM Hockey innovates in sticks and skates At Reebok-CCM Hockey, products launched in 2014 accounted for 60% of global sales (2013: 53%). Only 16% of sales were generated with products introduced three or more years ago (... -

Page 85

... TaylorMade-adidas Golf and its university research partners. More information on 2015 product initiatives can be found in our outlook section. see Subsequent Events and Outlook, p. 146 04 / Brand 2014 product awards Category Product Award adidas adidas adidas adidas adidas adidas adidas adidas... -

Page 86

... the organisation. In order to prepare them for more complex future roles, they participate in targeted development programmes and have tailored individual development plans. Strategic area / People Talent, performance and succession management see Diagram 01 adidas Group / 2014 Annual Report -

Page 87

... second year. It was not carried out in 2014 (2013: 49 participants). / Management Development Programme (MDP): a global programme which is executed regionally. This programme is tailored to employees from different functional areas and brands who show potential for director positions. In 2014, we... -

Page 88

...receives feedback at least twice a year, and employee development planning is further supported by the process and system solution. Succession management: The adidas Group succession management approach aims to ensure stability and certainty in business continuity. We achieve this through a globally... -

Page 89

... Germany offered 335 courses and 45 events, which were attended by more than 6,500 participants (2013: > 6,000). 20 14 02 / Key employee statistics 1) 2014 2013 Total number of employees Total employees (in %) Male Female Management positions (in %) Male Female Average age of employees (in years... -

Page 90

... other women, and promote female career development across the company. Following the Supervisory Board election in 2014, the number of female Supervisory Board members increased from two members to four. Additional diversity initiatives include: / The adidas Group is an active member of the 'Charta... -

Page 91

... Internal collaboration and e-learning 87 20 14 04 / Number of employees by function 1) 2014 2013 Employees 2) Full-time equivalents 3) Employees 2) Full-time equivalents 3) Own retail Sales Logistics Marketing Central functions and administration Production Research & development IT Total... -

Page 92

... share of employees working on a part-time basis in the Retail segment, this ï¬gure is lower than the ï¬gure reported on a headcount basis. Personnel expenses for continuing operations increased slightly to â,¬ 1.842 billion in 2014 (2013: â,¬ 1.833 billion), representing 13% of Group sales (2013... -

Page 93

... principles in the early identiï¬cation and treatment of potential issues of concern at our suppliers' sites. Strategic pillar / People Responsibility to workers in our suppliers' factories see Global Operations, p. 66 www.adidas-group.com/s/workplace-standards adidas Group / 2014 Annual Report -

Page 94

... see Table 01 see Internal Group Management System, p. 98 90 During 2014, we conducted 1,299 factory visits (2013: 1,489 visits) involving different types of audits, trainings and meetings with factory management as well as employees at various levels in our supply chain. We have seen more... -

Page 95

... entities. In this way, the consideration of fair working conditions becomes a routine part of our business activities. In 2014, the SEA team conducted 131 training sessions and workshops (2013: 148). We offered more group trainings, i.e. training sessions for more than one supplier instead of... -

Page 96

...in many of our footwear and apparel products. In addition, we strive to continuously broaden the range of more sustainable products by developing environmentally friendly product solutions and using innovative materials. Strategic pillar / Product Product creation adidas Group / 2014 Annual Report -

Page 97

...traditional running shoe. Virtual technologies: We increasingly use virtual technologies to reduce the quantity of physical samples required to design and sell new products. Virtualising processes help us save resources and money by reducing material waste, transportation and distribution costs. And... -

Page 98

... adidas Group's workforce is located at these sites. Further information can be found on our website. Strategic pillar / Planet Environmental management at own sites www.adidas-group.com/s/green-company Driving environmental improvements in our supply chain In our supply chain, activities focus... -

Page 99

... Management Report - Our Group Sustainability / 02.8 / / Disclosure: As part of our approach in enhancing disclosure practices and transparency within our supply chain, the adidas Group has actively promoted reputable platforms such as the Institute of Public and Environmental Affairs (IPE) China... -

Page 100

-

Page 101

... VIE W GROUP MANAGEMENT REPORT 03.1 03.2 03.3 03.4 03.5 03.6 Internal Group Management System Group Business Per formance Economic and Sector Development Income Statement Statement of Financial Position and Statement of Cash Flows Treasury Financial Statements and Management Report of adidas AG... -

Page 102

... goal for increasing shareholder value is maximising operating cash ï¬,ow. We strive to achieve this goal by continually improving our top- and bottom-line performance while at the same time optimising the use of invested capital. Our Group's planning and controlling system is therefore designed to... -

Page 103

... the Days of Sales Outstanding (DSO) and improve the ageing of accounts receivable. Likewise, we strive to optimise payment terms with our suppliers to best manage our accounts payable. adidas Group financial KPIs / Change in operating working capital 99 20 14 adidas Group / 2014 Annual Report -

Page 104

... operating working capital = Sum of operating working capital at quarter-end 4 Net cash/Net borrowings Cash and cash equivalents + short-term ï¬nancial assets = - short-term borrowings - long-term borrowings 1) Excluding acquisitions and ï¬nance leases. adidas Group / 2014 Annual Report -

Page 105

... partners on the sell-through success of our collections at the point of sale as well as data received from our own-retail activities is becoming even more important. On-Time In-Full (OTIF): OTIF measures the adidas Group's delivery performance towards customers and our own-retail stores. Managed... -

Page 106

... development, management analyses sell-through information from our own-retail activities as well as short-term replenishment orders from retailers. Taking into account year-to-date performance as well as opportunities and risks, the Group's full year ï¬nancial performance is forecasted four times... -

Page 107

2 Group Management Report - Financial Review Group Business Performance / Economic and Sector Development / 03.2 / Group Business Performance In 2014, adidas Group results were signiï¬cantly impacted by a challenging golf market, negative currency effects and a weakening of consumer sentiment in ... -

Page 108

Group Management Report - Financial Review Group Business Performance / Economic and Sector Development / 03.2 / The US economy grew modestly in 2014, expanding 2.4%, despite a contraction in the ï¬rst quarter. The recovery was supported by the Fed's very accommodative monetary policy. In ... -

Page 109

... Management Report - Financial Review Group Business Performance / Economic and Sector Development / 03.2 / Western Europe saw a solid increase in the industry's size, partly owing to the importance of football and the large number of teams from this region that qualiï¬ed for the 2014 FIFA World... -

Page 110

Group Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / 05 / Exchange rate development 1) (â,¬ 1 equals) Average rate 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Average rate 2014 06 / 2014 oil price development 1) (in US $ per barrel) | Jan. 1, 2014 Dec. 31, ... -

Page 111

Group Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / Group sales increase driven by strong growth in Wholesale and Retail In 2014, currency-neutral Wholesale revenues increased 6%. While sales at adidas grew at a mid-single-digit rate, revenues at ... -

Page 112

Group Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / Currency-neutral Group sales up in footwear and apparel In 2014, currency-neutral footwear sales increased 5%, mainly due to double-digit sales growth in the running category and at adidas NEO. Sales ... -

Page 113

Group Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / In 2014, cost of sales was â,¬ 7.610 billion, representing an increase of 6% compared to â,¬ 7.202 billion in 2013. This development was due to the growth of our business as well as increases in input... -

Page 114

...Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / Other operating expenses as a percentage of sales up 0.3 percentage points Other operating expenses, including depreciation and amortisation, consist of items such as sales working budget, marketing working... -

Page 115

Group Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / Operating overhead expenses as a percentage of sales decrease 0.3 percentage points Group operating overheads include overhead costs related to marketing, logistics, sales and R&D as well as central ... -

Page 116

... Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / Goodwill impairment in an amount of â,¬ 78 million As a result of the annual impairment test, the adidas Group has impaired goodwill and recorded a â,¬ 78 million pre-tax charge as at December 31, 2014... -

Page 117

Group Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / Income before taxes excluding goodwill impairment down 22% Income before taxes (IBT) for the adidas Group decreased 25% to â,¬ 835 million from â,¬ 1.113 billion in 2013. IBT as a percentage of sales ... -

Page 118

Group Management Report - Financial Review Group Business Performance / Income Statement / 03.2 / Net income attributable to shareholders excluding goodwill impairment down 32% The Group's net income attributable to shareholders, which in addition to net income from continuing operations includes ... -

Page 119

... payable Long-term borrowings Other liabilities Total equity â- 2014 â- 2013 12,417 2.3% 13.3% 12.8% 26.4% 45.2% 11,599 5.9% 15.7% 5.6% 25.5% 47.3% 1) For absolute ï¬gures see adidas AG Consolidated Statement of Financial Position, p. 190. adidas Group / 2014 Annual Report 20 14 Assets... -

Page 120

Group Management Report - Financial Review Group Business Performance / Statement of Financial Position and Statement of Cash Flows / 03.2 / Assets At the end of December 2014, total assets increased 7% to â,¬ 12.417 billion versus â,¬ 11.599 billion in the prior year, as a result of an increase ... -

Page 121

Group Management Report - Financial Review Group Business Performance / Statement of Financial Position and Statement of Cash Flows / 03.2 / instruments. Other current assets decreased 16% to â,¬ 425 million at the end of December 2014 from â,¬ 506 million in 2013, mainly due to the decrease in ... -

Page 122

Group Management Report - Financial Review Group Business Performance / Statement of Financial Position and Statement of Cash Flows / 03.2 / Liabilities and equity Total current liabilities decreased 7% to â,¬ 4.378 billion at the end of December 2014 from â,¬ 4.732 billion in 2013. Accounts ... -

Page 123

Group Management Report - Financial Review Group Business Performance / Statement of Financial Position and Statement of Cash Flows / 03.2 / Total non-current liabilities increased 75% to â,¬ 2.422 billion at the end of December 2014 from â,¬ 1.386 billion in the prior year. Long-term borrowings ... -

Page 124

Group Management Report - Financial Review Group Business Performance / Statement of Financial Position and Statement of Cash Flows / 03.2 / Liquidity analysis In 2014, net cash generated from operating activities increased to â,¬ 701 million (2013: â,¬ 634 million). Net cash generated from ... -

Page 125

Group Management Report - Financial Review Group Business Performance / Treasury / 03.2 / Off-balance sheet items The Group's most signiï¬cant off-balance sheet items are commitments for promotion and advertising as well as operating leases, which are related to own-retail stores, ofï¬ces, ... -

Page 126

Group Management Report - Financial Review Group Business Performance / Treasury / 03.2 / Centralised treasury function In accordance with our Group's Treasury Policy, all worldwide credit lines are directly or indirectly managed by the Group Treasury department. Portions of those lines are ... -

Page 127

... that cash generated from operating activities, together with access to external sources of funds, will be sufï¬cient to meet our future operating and capital needs. see Subsequent Events and Outlook, p. 146 47 / Total credit facilities (â,¬ in millions) 2014 2013 Bilateral credit facilities... -

Page 128

Group Management Report - Financial Review Group Business Performance / Treasury / 03.2 / Gross borrowings increase Gross borrowings increased 40% to â,¬ 1.873 billion at the end of 2014 from â,¬ 1.334 billion in the prior year. This increase is mainly due to the issuance of two Eurobonds with an ... -

Page 129

... Q1 2014 Q1 2013 1) At end of period. 54 / 2014 2013 2012 2011 2010 Interest rate development 1) (in %) 3.1 3.8 4.4 4.9 5.1 55 / 2014 2013 2012 2011 2010 Financial leverage (in %) 3.3 (5.4) (8.5) (1.7) 4.8 1) Weighted average interest rate of gross borrowings. adidas Group / 2014 Annual Report -

Page 130

Group Management Report - Financial Review Group Business Performance / Treasury / 03.2 / 56 / Financing structure 1) (â,¬ in millions) 2014 2013 Cash and short-term ï¬nancial assets Bank borrowings Commercial paper Private placements Eurobond Convertible bond Gross total borrowings Net cash 1)... -

Page 131

... - Financial Review Group Business Performance / Financial Statements and Management Report of adidas AG / 03.2 / Financial Statements and Management Report of adidas AG adidas AG is the parent company of the adidas Group. It includes operating business functions, primarily for the German market... -

Page 132

Group Management Report - Financial Review Group Business Performance / Financial Statements and Management Report of adidas AG / 03.2 / 59 / adidas AG net sales 1) (â,¬ in millions) 2014 2013 Royalty and commission income adidas Germany Foreign subsidiaries Y-3 Other revenues Total 1) Rounding ... -

Page 133

... 2014 Dec. 31, 2013 Assets Intangible assets Property, plant and equipment Financial assets Fixed assets Inventories Receivables and other assets Cash and cash equivalents, securities Current assets Prepaid expenses Total assets Equity and liabilities Shareholders' equity Provisions Liabilities and... -

Page 134

... Management Report - Financial Review Group Business Performance / Financial Statements and Management Report of adidas AG / 03.2 / Total assets increase 11% At the end of December 2014, total assets grew 11% to â,¬ 7.415 billion compared to â,¬ 6.694 billion in the prior year. This was mainly... -

Page 135

...on the Code of Conduct in conjunction with an internal guideline of adidas AG, however, particular lock-up periods do exist for members of the Executive Board with regard to the purchase and sale of adidas AG shares. These lock-up periods are connected with the publication of quarterly and full year... -

Page 136

Group Management Report - Financial Review Group Business Performance / Disclosures pursuant to § 315 Section 4 and § 289 Section 4 of the German Commercial Code / 03.2 / The Supervisory Board may revoke the appointment of an individual as member of the Executive Board or CEO for good cause, ... -

Page 137

...Management Report - Financial Review Group Business Performance / Disclosures pursuant to § 315 Section 4 and § 289 Section 4 of the German Commercial Code / 03.2 / Contingent Capital / The nominal capital of the company is conditionally increased by up to â,¬ 36,000,000 (Contingent Capital 2010... -

Page 138

...Agenda for the Annual General Meeting held on May 8, 2014. The shares may in particular be used as follows: 134 / They may be sold via the stock exchange, through a public share purchase offer made to all shareholders or sold otherwise against cash (limited to 10% of the nominal capital taking into... -

Page 139

... by the Annual General Meeting on May 8, 2014, the Executive Board is furthermore authorised to conduct the share buyback also by using equity derivatives which are arranged with a credit institution or ï¬nancial services institution in close conformity with market conditions. adidas AG may acquire... -

Page 140

3 Group Management Report - Financial Review Business Performance by Segment / Wholesale Business Performance / 03.3 / Business Performance by Segment The adidas Group has divided its operating activities into Wholesale, Retail and Other Businesses. The Wholesale segment comprises the adidas and ... -

Page 141

Group Management Report - Financial Review Business Performance by Segment / Wholesale Business Performance / 03.3 / Segmental operating expenses in Wholesale primarily relate to sales working budget expenses as well as expenditure for sales force, administration and logistics. In euro terms, ... -

Page 142

Group Management Report - Financial Review Business Performance by Segment / Wholesale Business Performance / 03.3 / Wholesale development by brand In 2014, adidas Sport Performance wholesale revenues grew 6% on a currency-neutral basis. This development was mainly driven by double-digit sales ... -

Page 143

...as the sales working budget. In 2014, segmental operating expenses increased 10% to â,¬ 1.608 billion from â,¬ 1.465 billion in 2013. This was mainly a result of higher expenses related to the expansion of the Group's store base, particularly in emerging markets. Higher sales working budget expenses... -

Page 144

Group Management Report - Financial Review Business Performance by Segment / Retail Business Performance / 03.3 / Segmental operating proï¬t decreased 1% to â,¬ 673 million in 2014 versus â,¬ 678 million in the prior year. Segmental operating margin declined 2.1 percentage points to 17.5% (2013: ... -

Page 145

Group Management Report - Financial Review Business Performance by Segment / Retail Business Performance / 03.3 / Retail development by store format Concept store revenues include sales from adidas and Reebok concept stores. In 2014, concept store revenues grew 20% on a currency-neutral basis, as ... -

Page 146

Group Management Report - Financial Review Business Performance by Segment / Retail Business Performance / 03.3 / 14 / Retail segmental operating proï¬t by quarter (â,¬ in millions) Q4 2014 Q4 2013 Q3 2014 Q3 2013 Q2 2014 Q2 2013 Q1 2014 Q1 2013 181 166 207 195 180 216 105 101 closed 16. As a... -

Page 147

... product margins at TaylorMade-adidas Golf as a result of ongoing efforts to clean retail inventories, particularly in the USA, as well as the strategic decision to postpone product launches planned for 2014. Segmental operating expenses in Other Businesses primarily relate to expenditure for sales... -

Page 148

...rate. Revenues in Greater China, Other Asian Markets and Latin America decreased 31%, 35% and 20%, respectively, due to double-digit sales decreases at TaylorMade-adidas Golf. Currency translation effects had a mixed impact on regional sales in euro terms. see Table 18 Other Businesses development... -

Page 149

...-digit growth at Y-3, Five Ten and Porsche Design Sport by adidas. Currency translation effects had a negative impact on sales in euro terms. Revenues in Other Centrally Managed Brands also increased 19% to â,¬ 134 million in 2014 (2013: â,¬ 112 million). 21 / Other Businesses net sales by quarter... -

Page 150

... all brands and the positive effects from increased brandbuilding activities, tight control of inventory levels and strict cost management, we project top- and bottom-line improvements in our Group's ï¬nancial results in 2015. We forecast adidas Group sales to increase at a mid-single-digit rate on... -

Page 151

... e.g. Brazil and Argentina, where currency ï¬,uctuations and the unfavourable job market conditions with its negative implications for household consumption will drive the forecasted decline in economic activity. 20 14 1) Sources: World Bank, HSBC Global Research. adidas Group / 2014 Annual Report -

Page 152

...margin Operating margin Net income from continuing operations Average operating working capital in % of sales Capital expenditure Store base Gross borrowings 1) Figures reï¬,ect continuing operations as a result of the planned divestiture of the Rockport business. adidas Group / 2014 Annual Report -

Page 153

... sales associated with the 2014 FIFA World Cup. As a result, we project currency-neutral combined sales of adidas and Reebok in Latin America to increase at a low- to mid-single-digit rate, with both brands contributing to this development. In Japan, last year's increase in the consumption tax rate... -

Page 154

... Businesses are expected to increase at a double-digit rate on a currencyneutral basis, driven by double-digit currency-neutral sales increases at TaylorMade-adidas Golf. After a year characterised by high inventory levels and discounting activities, TaylorMade-adidas Golf will see major product... -

Page 155

... level (2014: 42.7%). Sales and marketing working budget as a percentage of sales is projected to increase versus the prior year. Given the robust momentum at adidas and Reebok, we will step up marketing and point-of-sale investments in 2015 to secure and drive faster growth rates and market share... -

Page 156

Group Management Report - Financial Review Subsequent Events and Outlook / 03.4 / Capital expenditure of around â,¬ 600 million In 2015, capital expenditure is expected to increase to a level of around â,¬ 600 million (2014: â,¬ 554 million). Investments will mainly focus on adidas and Reebok ... -

Page 157

... Management Report - Financial Review Subsequent Events and Outlook / 03.4 / 03 / Product Major 2015 product launches Brand A totally new F50 football boot Newly designed Predator Nitrocharge and 11 Pro football boots New F50 Messi football boot Ultra Boost running shoe Supernova Glide 7 running... -

Page 158

5 Group Management Report - Financial Review Risk and Opportunity Report / 03.5 / Risk and Opportunity Report The adidas Group continuously explores and develops opportunities to sustain earnings and drive long-term increases in shareholder value. We acknowledge that in our daily business we are ... -

Page 159

... environment, developments in the sporting goods industry, as well as internal processes, to identify risks and opportunities as early as possible. Our Group-wide network of Risk Owners (i.e. all direct reports to the adidas AG Executive Board, including the Managing Directors of all our markets... -

Page 160

... Major ≥ â,¬ 100 million Almost no media coverage Almost no senior management attention Extensive international media coverage Over 20% additional senior management attention Potential impact 1) Based on operating proï¬t, ï¬nancial result or tax expenses. adidas Group / 2014 Annual Report -

Page 161

... supported and facilitated by a globally used Group-wide IT solution that was implemented in 2011. Firstly, on a quarterly basis, Risk Owners are required to report to Group Risk Management risks with a possible gross impact rating of at least moderate or a net impact rating of at least minor, both... -

Page 162

... functions throughout the entire value chain, from supply chain through to the end consumer. As a result, the identiï¬cation, analysis and evaluation of potential compliance risks are essential for our risk and opportunity management process. The Group Risk Management department works closely... -

Page 163

Group Management Report - Financial Review Risk and Opportunity Report / 03.5 / Prevention includes, for example, training such as the web-based Code of Conduct training (which is mandatory for all employees worldwide), general data protection training and an anti-trust training programme (for ... -

Page 164

Group Management Report - Financial Review Risk and Opportunity Report / 03.5 / Description of the main features of the internal control and risk management system relating to the consolidated ï¬nancial reporting process pursuant to § 315 section 2 no. 5 German Commercial Code (Handelsgesetzbuch... -

Page 165

Group Management Report - Financial Review Risk and Opportunity Report / 03.5 / The accounting for Group companies is conducted either locally or by an adidas Group Shared Service Centre. Most of the IT ERP systems used are based on a Group-wide standardised SAP system. Some Group companies use ... -

Page 166

...and regulatory risks Risks related to risk and control environment Risks related to media and stakeholder activities Competition risks Risks related to organisational structure and change Operational risks Business partner risks Own-retail risks Hazard risks 14 Major Major Signiï¬cant Signiï¬cant... -

Page 167

...activities accordingly upon any change in conditions. Potential adjustments may be changes in product prices, closures of own-retail stores, more conservative product purchasing, tight working capital management and an increased focus on cost control. In addition, by building on our leading position... -

Page 168

... new partners to refresh and diversify our portfolio, e.g. Manchester United, UFC, James Rodriguez or Andrew Wiggins. In addition, our product and communication initiatives are designed to drive market share growth and to strengthen our brands' market position. 164 20 14 adidas Group / 2014 Annual... -

Page 169

... negative effects on our wholesale activities and thus the Group's business performance. Losing important customers in key markets due to sub-par relationship management would result in signiï¬cant sales shortfalls. In a few individual markets, we work with distributors or strategic partners whose... -

Page 170

.... Furthermore, we run multiple training initiatives for own-retail employees at all levels, from store assistant to top management. At the same time, we constantly monitor staff turnover and actively manage succession and career development to reduce attrition. adidas Group / 2014 Annual Report -

Page 171

... plans to quickly recover business activities in order to minimise potential negative effects. IT risks Key business processes, including product marketing, order management, warehouse management, invoice processing, customer support and ï¬nancial reporting, are all dependent on IT systems... -

Page 172

...Internal Group Management System, p. 98 see Global Operations, p. 66 168 20 14 Marketing risks Flawless execution of marketing activities is critical to the success of the Group and its brands. Therefore, unaligned product creation, range development, go-to-market or brand communication processes... -

Page 173

... impact top-line development. In addition, a lack of breadth and depth of our product ranges as well as an inappropriate price/value relationship in our products may negatively affect the Group's top- and bottom-line performance. Therefore, we continue to invest in innovation and design processes... -

Page 174

... and provide subject-matter training to our employees (e.g. competition law training). In addition, our internal legal, customs or tax departments advise our operational management teams to ensure appropriate and compliant business practices. Furthermore, we work closely with customs authorities and... -

Page 175

Group Management Report - Financial Review Risk and Opportunity Report / Financial Risks / 03.5 / Risks related to product counterfeiting and imitation As popular consumer brands which rely on technological and design innovation as deï¬ning characteristics, the Group's brands are frequent targets... -

Page 176

... market interest rates could trigger increases in discount rates used in our impairment test for goodwill and require impairment charges. An impairment charge would be a purely accounting, non-cash effect impacting the Group's operating result. see Note 02, p. 197 adidas Group / 2014 Annual Report -

Page 177

Group Management Report - Financial Review Risk and Opportunity Report / Financial Risks / 03.5 / 04 / Exposure to foreign exchange risk 1) (based on notional amounts, â,¬ in millions) USD RUB GBP JPY As at December 31, 2014 Exposure from ï¬rm commitments and forecasted transactions Balance ... -

Page 178

... Management Report - Financial Review Risk and Opportunity Report / Financial Risks / 03.5 / Credit risks A credit risk arises if a customer or other counterparty to a ï¬nancial instrument fails to meet its contractual obligations. The adidas Group is exposed to credit risks from its operating... -

Page 179

Group Management Report - Financial Review Risk and Opportunity Report / Financial Risks / 03.5 / The Group Treasury department arranges currency, commodity and interest rate hedges, and invests cash, with major banks of a high credit standing throughout the world. adidas Group companies are ... -

Page 180

... basis point increase or decrease in interest rates at December 31, 2014 would have had no major impact on shareholders' equity and net income. To reduce interest rate risks and maintain ï¬nancial ï¬,exibility, a core tenet of our Group's ï¬nancial strategy is to continue to use surplus cash ï¬,ow... -

Page 181

... international banks, which does not include a market disruption clause. The â,¬ 2.020 billion in credit lines are designed to ensure sufï¬cient liquidity at all times. Future cash outï¬,ows arising from ï¬nancial liabilities that are recognised in the Consolidated Statement of Financial Position... -

Page 182

Group Management Report - Financial Review Risk and Opportunity Report / Strategic and Operational Opportunities / 03.5 / Opportunities which have a mid- to long-term positive impact for the Group's top- and bottom-line performance are already reï¬,ected in the Group's strategic aspirations and ... -

Page 183

... operational ability to drive additional revenue growth and working capital improvements. Process improvements in other areas of the Group's business activities could also positively impact proï¬tability. For example, further centralising ranging and product purchasing for our own-retail business... -

Page 184

..., possess certain assets that could help the adidas Group further improve its business performance. 180 20 14 Financial Opportunities Favourable ï¬nancial market changes Favourable exchange and interest rate developments can potentially have a positive impact on the Group's ï¬nancial results... -

Page 185

... of sales increased versus the prior year and thus exceeded our initial expectations. see Table 01 see Economic and Sector Development, p. 103 181 20 14 see Income Statement, p. 106 see Statement of Financial Position and Statement of Cash Flows, p. 115 adidas Group / 2014 Annual Report -

Page 186

... shares above 30% and 20%, respectively. A key focus for TaylorMade-adidas Golf in 2014 was the clean-up of retail inventories, especially in the USA. In light of this, TaylorMade-adidas Golf made the strategic decision to reduce the number of new product introductions compared to previous years... -

Page 187

... and Opportunity Report, p. 154 Assessment of ï¬nancial outlook In November 2010, the Group unveiled its 2015 strategic business plan named 'Route 2015', which deï¬ned strategies and objectives for the period up to 2015. In 2014, mainly due to the continued weakness in the golf market, negative... -

Page 188

-

Page 189

... of Changes in Equit y Consolidated Statement of Cash Flows Notes Notes to the Consolidated Statement of Financial Position Notes to the Consolidated Income Statement Notes - Additional Information Statement of Movements of Intangible a n d Ta n g i b l e A s s e t s Shareholdings 18 6 18 7 18 8 19... -

Page 190

...nancial statements give a true and fair view of the assets, liabilities, ï¬nancial position and proï¬t or loss of the Group, and the Group Management Report, which has been combined with the Management Report of adidas AG, includes a fair review of the development and performance of the business... -

Page 191

... by adidas AG, Herzogenaurach, comprising the statement of ï¬nancial position, income statement, statement of comprehensive income, statement of changes in equity, statement of cash ï¬,ows and the notes, together with the management report of the Company and the Group for the business year from... -

Page 192

...Statement of Financial Position .. / adidas AG Consolidated Statement of Financial Position (IFRS) (â,¬ in millions) Note Dec. 31, 2014 Dec. 31, 2013 Change in % ASSETS Cash and cash equivalents Short-term ï¬nancial assets Accounts receivable Other current ï¬nancial assets Inventories Income tax... -

Page 193

... Consolidated Statement of Financial Position / 04.3 / .. / adidas AG Consolidated Statement of Financial Position (IFRS) (â,¬ in millions) Note Dec. 31, 2014 Dec. 31, 2013 Change in % LIABILITIES AND EQUITY Short-term borrowings Accounts payable Other current ï¬nancial liabilities Income taxes... -

Page 194

...â,¬) Diluted earnings per share from continuing and discontinued operations (in â,¬) Rounding differences may arise in percentages and totals. The accompanying notes are an integral part of these consolidated ï¬nancial statements. 35 35 35 35 2.67 2.67 2.35 2.35 adidas Group / 2014 Annual Report -

Page 195

... gains or losses relating to deï¬ned beneï¬t obligations, return on plan assets (excluding interest income) and the asset ceiling effect. Rounding differences may arise in percentages and totals. The accompanying notes are an integral part of these consolidated ï¬nancial statements. 496 790 24... -

Page 196

...adidas AG Consolidated Statement of Changes in Equity (IFRS) (â,¬ in millions) Note Share capital Capital reserve Balance at December 31, 2012 Net income recognised directly in equity Net income Total comprehensive income Dividend payment Balance at December 31, 2013 Net income recognised directly... -

Page 197

Consolidated Financial Statements Consolidated Statement of Changes in Equity / 04.6 / Cumulative currency translation differences Hedging reserve Other reserves 1) Retained earnings Shareholders' equity Non-controlling interests Total equity... (318) 5,618 adidas Group / 2014 Annual Report -

Page 198

... of adidas AG Dividend paid to non-controlling interest shareholders Repurchase of treasury shares Proceeds from short-term borrowings Repayments of short-term borrowings Net cash used in ï¬nancing activities Effect of exchange rates on cash Increase/(decrease) of cash and cash equivalents Cash and... -

Page 199

..., Germany. adidas AG and its subsidiaries (collectively the 'adidas Group' or the 'Group') design, develop, produce and market a broad range of athletic and sports lifestyle products. The operating activities of the adidas Group are divided into six operating segments: Wholesale, Retail, TaylorMade... -

Page 200

.... The consolidated ï¬nancial statements are presented in euros (â,¬) and, unless otherwise stated, all values are presented in millions of euros (â,¬ in millions). Due to rounding principles, numbers presented may not sum up exactly to totals provided. 196 20 14 adidas Group / 2014 Annual Report -

Page 201

... is directly recorded in shareholders' equity. The ï¬nancial effects of intercompany transactions as well as any unrealised gains and losses arising from intercompany business relations are eliminated in preparing the consolidated ï¬nancial statements. 197 20 14 adidas Group / 2014 Annual Report -

Page 202

... gains and losses are recorded directly in the income statement. Assets and liabilities of the Group's non-euro functional currency subsidiaries are translated into the presentation currency, the euro, which is also the functional currency of adidas AG, at closing exchange rates at the balance sheet... -

Page 203

Consolidated Financial Statements Notes / 04.8 / A summary of exchange rates to the euro for major currencies in which the Group operates is as follows: Exchange rates (â,¬ 1 equals) Average rates for the year ending Dec. 31, Spot rates at Dec. 31, 2014 2013 2014 2013 USD GBP JPY CNY RUB 1.... -

Page 204

..., and on the ageing structure of receivables past due. 14 200 20 Inventories Merchandise and ï¬nished goods are valued at the lower of cost or net realisable value, which is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated... -

Page 205

... losses for the associated assets are recognised. Depreciation is performed over the lease term or, if shorter, over the useful life of the asset. Under operating lease agreements, rent expenses are recognised on a straight-line basis over the term of the lease. adidas Group / 2014 Annual Report -

Page 206

...ve-year average market-weighted debt/equity structure and ï¬nancing costs referencing the Group's major competitors for each cash-generating unit. The discount rates used are after-tax rates and reï¬,ect the speciï¬c equity and country risk of the relevant cash-generating unit. In total, goodwill... -

Page 207

... millions) Dec. 31, 2014 Dec. 31, 2013 Dec. 31, 2014 Discount rate (after taxes) Dec. 31, 2013 Wholesale Western Europe Wholesale Greater China Wholesale - Other Wholesale Retail Western Europe Retail CIS Retail - Other Retail TaylorMade-adidas Golf Rockport Other Businesses Total 422 168 158 748... -

Page 208

... Financial Statements Notes / 04.8 / The discount rate is based on a weighted average cost of capital calculation derived using a ï¬ve-year average market-weighted debt/equity structure and ï¬nancing costs referencing the Group's major competitors. The discount rate used is an after-tax rate... -

Page 209

... company concerned will generate sufï¬cient taxable income to realise the associated beneï¬t. Income tax is recognised in the income statement except to the extent that it relates to items recognised directly in equity, in which case it is recognised in equity. adidas Group / 2014 Annual Report -

Page 210

...statement for all periods: Discontinued operations (â,¬ in millions) Dec. 31, 2014 Dec. 31, 2013 206 14 20 Net sales Expenses Income from operating activities Income taxes Income from operating activities, net of tax Loss recognised on the measurement to fair value less costs to sell Income taxes... -

Page 211

...for the year ending December 31, 2014. 207 20 14 Notes to the Consolidated Statement of Financial Position 05 Cash and cash equivalents Cash and cash equivalents consist of cash at banks, cash on hand, short-term bank deposits and investments in money market funds. Short-term ï¬nancial assets are... -

Page 212

... to concrete plans to sell the Rockport operating segment, assets amounting to â,¬ 49 million were transferred from 'Accounts receivable' to 'Assets classiï¬ed as held for sale' at year-end 2014 / SEE NOTE 11. For further information about credit risks / SEE RISK AND OPPORTUNITY REPORT, P. 154. 08... -

Page 213

... liability GEV GmbH with adidas AG. In addition, at December 31, 2014, all assets and liabilities of the Rockport operating segment are presented as a disposal group held for sale due to the concrete plans to sell the operating segment. The Rockport operating segment is part of Other Businesses... -

Page 214

... the Consolidated Statement of Financial Position / 04.8 / At December 31, 2014, the disposal group Rockport was stated at fair value less costs to sell and comprised the following major classes of assets and liabilities: Classes of assets and liabilities (â,¬ in millions) Dec. 31, 2014 Accounts... -

Page 215

... allocated to the cash-generating unit Rockport was transferred to 'Assets held for sale' due to the concrete plans to sell the Rockport operating segment and is impaired completely in connection with the fair value measurement of the disposal group / SEE NOTE 11. adidas Group / 2014 Annual Report -

Page 216

... unlisted and do not have an active market. There is no intention to sell these shares. Additionally, long-term ï¬nancial assets include investments which are mainly invested in insurance products and are measured at fair value, as well as other ï¬nancial assets. adidas Group / 2014 Annual Report -

Page 217

Consolidated Financial Statements Notes / Notes to the Consolidated Statement of Financial Position / 04.8 / Long-term ï¬nancial assets (â,¬ in millions) Dec. 31, 2014 Dec. 31, 2013 Investment in FC Bayern München AG Investments and other ï¬nancial assets Long-term ï¬nancial assets 80 49 129... -

Page 218

... initially issued. Furthermore, as of July 14, 2017, adidas AG is entitled to redeem the bonds in whole if, on 20 of 30 consecutive trading days, the share price of adidas AG exceeds the current conversion price of â,¬ 82.56 by at least 30%. According to IAS 32 'Financial Instruments: Presentation... -

Page 219

... to the return of products sold by the Group. The amount of the provision follows the historical development of returns, allowances and warranty as well as current agreements. Provisions for taxes other than income taxes mainly relate to value added tax, real estate tax and motor vehicle tax. Sundry... -

Page 220

... Finance lease obligations Sundry Other non-current ï¬nancial liabilities 2 - 7 0 9 / SEE NOTE 29. 11 2 9 0 22 For further information about currency options and forward exchange contracts about ï¬nance lease obligations / SEE NOTE 28. For information adidas Group / 2014 Annual Report -

Page 221

... pension plans are partly covered by plan assets. In Germany, adidas AG grants its employees contribution-based and ï¬nal salary deï¬ned beneï¬t pension schemes, which provide employees with entitlements in the event of retirement, disability and death. In general, German pension plans operate... -

Page 222

...the Consolidated Statement of Financial Position / 04.8 / Breakdown of the present value of the obligation arising from deï¬ned beneï¬t pension plans in the major countries (â,¬ in millions) Dec. 31, 2014 Dec. 31, 2013 Germany UK Japan Germany UK Japan Active members Former employees with... -

Page 223

... for members of the Executive Board of adidas AG in 2014 resulted in past service cost of â,¬ 1 million. The pension expense is mainly recorded within other operating expenses. The production-related part of the pension expenses is recognised within cost of sales. 219 20 14 Present value of... -

Page 224

... to the trustee. The cash has been invested in equity index funds, hybrid bonds, ï¬xed interest rate bonds and money market funds. adidas AG does not intend to further fund the CTA in the 2015 ï¬nancial year. Another part of the plan assets in Germany is invested in insurance contracts via pension... -

Page 225

...31, 2014 Dec. 31, 2013 Cash and cash equivalents Equity instruments Bonds Real estate Pension plan reinsurance Insurance policies Other assets Fair value of plan assets 31 51 41 1 27 5 0 157 14 28 11 1 25 4 0 83 All equities and bonds are traded freely and have a quoted market price in an active... -

Page 226

... the implementation of the contingent capital increase. The Executive Board of adidas AG did not issue shares from the Contingent Capital 2014 in the 2014 ï¬nancial year or in the period beyond the balance sheet date up to and including February 13, 2015. adidas Group / 2014 Annual Report -

Page 227

..., adidas AG may conduct an early redemption of the bond, if, on 20 of 30 consecutive trading days, the share price of adidas AG exceeds the current conversion price of â,¬ 82.56 by at least 30%. The bonds are listed on the Open Market segment of the Frankfurt Stock Exchange. Repurchase of adidas AG... -

Page 228

...maintain a balance between a higher return on equity that might be possible with higher levels of borrowings and the advantages and security afforded by a sound capital position. The Group further aims to maintain net debt below two times EBITDA over the long term. adidas Group / 2014 Annual Report -

Page 229

... Statements Notes / Notes to the Consolidated Statement of Financial Position / 04.8 / Financial leverage is deï¬ned as the ratio between net borrowings (short- and long-term borrowings less cash and cash equivalents as well as short-term ï¬nancial assets) in an amount of â,¬ 185 million (2013... -

Page 230

.... Financial information on subsidiaries with non-controlling interests (â,¬ in millions) Material non-controlling interests Dec. 31, 2014 Dec. 31, 2013 Dec. 31, 2014 Other Total non-controlling interests Dec. 31, 2014 Dec. 31, 2013 Dec. 31, 2013 Net sales (non-Group) Net income/loss Net income... -

Page 231

... long-term contracts. Financial commitments under these contracts mature as follows: Financial commitments for service arrangements (â,¬ in millions) Dec. 31, 2014 Dec. 31, 2013 Within 1 year Between 1 and 5 years After 5 years Total 75 101 18 193 89 99 28 216 adidas Group / 2014 Annual Report -

Page 232

... Fair value Dec. 31, 2014 Financial assets Cash and cash equivalents Short-term ï¬nancial assets Accounts receivable Other current ï¬nancial assets Derivatives being part of a hedge Derivatives not being part of a hedge Other ï¬nancial assets Long-term ï¬nancial assets Other equity investments... -

Page 233

... Fair value Dec. 31, 2013 Financial assets Cash and cash equivalents Short-term ï¬nancial assets Accounts receivable Other current ï¬nancial assets Derivatives being part of a hedge Derivatives not being part of a hedge Other ï¬nancial assets Long-term ï¬nancial assets Other equity investments... -

Page 234

... within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices). Level 3 is based on inputs for the asset or liability that are not based on observable market data (unobservable inputs). adidas Group / 2014 Annual Report -

Page 235

... adidas Group speciï¬c credit risk premium. Fair values of long-term ï¬nancial assets classiï¬ed as 'Available-for-sale' are based on quoted market prices in an active market or are calculated as present values of expected future cash ï¬,ows. The fair values of currency options, forward exchange... -

Page 236

... consolidated income statement (â,¬ in millions) Year ending Dec. 31, 2014 Year ending Dec. 31, 2013 Financial assets or ï¬nancial liabilities at fair value through proï¬t or loss Thereof: designated as such upon initial recognition Thereof: classiï¬ed as held for trading Loans and receivables... -

Page 237

... until the investment in the foreign entity has been sold. As at December 31, 2014, no ineffective part of the hedges was recorded in the income statement. In order to determine the fair values of its derivatives that are not publicly traded, the adidas Group uses generally accepted quantitative... -

Page 238

... as promotion contracts, advertising, events and other communication activities. However, it does not include marketing overhead expenses, which are presented in marketing overheads. In 2014, marketing working budget of continuing operations accounted for 25% (2013: 24%) of the total other operating... -

Page 239

... Expenses are presented by function according to the 'cost of sales method' in the income statement. Supplementary information on the expenses by nature is detailed below. Cost of materials The total cost of materials (continuing operations) relating to the amount of inventories recognised as an... -

Page 240

... the Group's available-for-sale investments, borrowings and ï¬nancial instruments is also included in these Notes / SEE NOTES 06, 15, 18 AND 29. 34 Income taxes adidas AG and its German subsidiaries are subject to German corporate and trade taxes. For the years ending December 31, 2014 and 2013... -

Page 241

... Dec. 31, 2013 Current tax expenses Deferred tax income Income tax expenses 315 (43) 271 354 (14) 340 The deferred tax income includes tax income of â,¬ 24 million in total (2013: â,¬ 25 million) related to the origination and reversal of temporary differences. adidas Group / 2014 Annual Report -

Page 242

... US tax group. For 2013, the line item 'Changes in tax rates' mainly reï¬,ects a UK tax rate deduction effective in 2013. 35 Earnings per share 20 Basic earnings per share from continuing operations are calculated by dividing the net income from continuing operations attributable to shareholders... -

Page 243

... design, distribution and marketing of athletic and sports lifestyle products. Following the Group's internal management reporting and in accordance with the deï¬nition of IFRS 8 'Operating Segments', six operating segments have been identiï¬ed: Wholesale, Retail, TaylorMade-adidas Golf, Rockport... -

Page 244

... Retail Other Businesses (continuing operations) Other Businesses (discontinued operations) Other Businesses (total) Total 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 Net sales (non-Group) Segmental operating proï¬t Segmental assets Segmental liabilities Capital... -

Page 245

Consolidated Financial Statements Notes / Notes - Additional Information / 04.8 / Capital expenditure (â,¬ in millions) Year ending Dec. 31, 2014 Year ending Dec. 31, 2013 Reportable segments Other Businesses HQ/Consolidation Total 205 26 322 554 201 28 250 479 Depreciation and amortisation ... -

Page 246

...well as non-current assets amounting to â,¬ 833 million and â,¬ 862 million for the years 2014 and 2013, respectively. The reporting by segments will be adjusted starting 2015 in order to reï¬,ect the new internal management reporting. In the future, the management and reporting of the Group will no... -

Page 247

... lower working capital requirements. Net cash outï¬,ow from investing activities in 2014 was mainly related to spending for property, plant and equipment such as investments in the furnishing and ï¬tting of stores in the Retail segment, in new ofï¬ce buildings, warehouses and IT systems. Cash out... -

Page 248

... agreed conditions. 40 Other information Employees The average numbers of employees are as follows: Employees Year ending Dec. 31, 2014 Year ending Dec. 31, 2013 Own retail Sales Logistics Marketing Central administration Production Research and development Information technology Total 14... -

Page 249

... to customary closing conditions, is expected to be completed later in 2015. Due to concrete plans to sell the Rockport operating segment, it is reported as discontinued operations as at December 31, 2014 / SEE NOTE 03, leading to a non-operational effect in the consolidated income statement in an... -

Page 250

... losses Transfers to assets held for sale Transfers Disposals December 31, 2014 Net carrying amount January 1, 2013 December 31, 2013 December 31, 2014 Rounding differences may arise in percentages and totals. 1,281 1,204 1,169 1,484 1,419 1,432 162 155 138 adidas Group / 2014 Annual Report -

Page 251