Adaptec 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Adaptec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

For the fiscal year ended: December 26, 2010

or

For the transition period from: to

Commission File Number 0-19084

PMC-Sierra, Inc.

(Exact name of registrant as specified in its charter)

1380 Bordeaux Drive

Sunnyvale, CA 94089

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (408) 239-8000

Securities registered pursuant to Section 12(b) of the Act:

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during

the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a

smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule

12b-2 of the Exchange Act.

Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes No

The aggregate market value of the voting stock held by nonaffiliates of the registrant, based upon the closing sale price of the

Common Stock on June 27, 2010 as reported by the NASDAQ Global Select Market, was approximately $1.1 billion. Shares of

Common Stock held b

y

each executive officer and director and b

y

each

p

erson known to the re

g

istrant who owns 5% or more of the

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

Delaware

94-2925073

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

Title of each class Name of exchange on which registered

Common Stock, $0.001 Par Value

Preferred Stock Purchase Ri

g

hts

NASDAQ Global Select Market

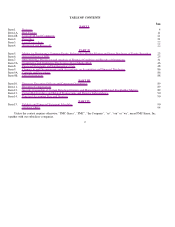

Table of contents

-

Page 1

... value of the voting stock held by nonaffiliates of the registrant, based upon the closing sale price of the Common Stock on June 27, 2010 as reported by the NASDAQ Global Select Market, was approximately $1.1 billion. Shares of Common Stock held by each executive officer and director and by each... -

Page 2

... had 233,221,019 shares of Common Stock, $0.001 par value, outstanding. DOCUMENTS INCORPORATED BY REFERENCE Portions of the Proxy Statement for Registrant's 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K Report. Such Proxy Statement will be filed... -

Page 3

... and Related Transactions and Director Independence Principal Accountant Fees and Services PART IV Exhibits and Financial Statement Schedules SIGNATURES 90 94 4 11 21 21 22 22 23 25 31 46 48 86 86 88 89 89 89 90 90 Unless the context requires otherwise, "PMC-Sierra", "PMC", "the Company", "us... -

Page 4

... of purchased intangible assets; our expectations regarding our acquisitions of the Channel Storage business from Adaptec, Inc., and of Wintegra, Inc. and expectations regarding distribution from certain investments. This Annual Report should be read in conjunction with our periodic filings... -

Page 5

...") markets, including 6 Gbps SAS/SATA and 8Gbps Fibre Channel ("FC") controllers and expanders for this market segment. We also offer server adaptor products with highperformance Solid State Drive ("SSD") caching capability that are used to configure, manage and monitor storage volumes. 4 BUSINESS. -

Page 6

... convert high-speed analog signals ("wired" or "wirelessly") to digital signals and split or combine various transmission signals. Controllers: rapid growth in data storage is driving a need for more cost-effective and larger capacity storage systems. Controller products based on Fibre Channel... -

Page 7

... in the storage and data center market segments. Our focus remains on high-performance interconnect devices and controllers based on SAS/SATA and Fibre Channel protocol standards. We also offer controller and adaptor solutions for server-attached storage systems for OEM and Channel customers. We... -

Page 8

... carriers are upgrading their wireless base stations, mobile backhaul networks, and aggregation systems to handle the increasing traffic and demand for bandwidth. We are bringing to market new devices for our OEM customers in the areas of Radio Frequency (RF) and Remote Radio Head (RRH) solutions... -

Page 9

.... Our sales to customers in Asia, including Japan and China, were 77%, 84% and 73% of total revenues in 2010, 2009, and 2008, respectively. See Item 1A. Risk Factors for further information on risks attendant to our foreign operations and dependence. MANUFACTURING PMC-Sierra is a fabless company... -

Page 10

... approved and audited flows conforming to PMC's Quality Assurance requirements. Since the acquisition of the Channel Storage business from Adaptec, PMC has significant business in manufacturing and selling Printed Circuit Board ("PCB") based products. These products are assembled and tested by an... -

Page 11

..., trade secret laws, employee and third-party nondisclosure agreements, and licensing arrangements to protect our intellectual property. PMC, PMC-Sierra and our logo are registered trademarks and service marks. We own other trademarks and service marks not appearing in this Annual Report. Any other... -

Page 12

... SEC REPORTS Our principal executive offices are located at 1380 Bordeaux Drive, Sunnyvale, CA 94089. Our internet webpage is located at www.pmc-sierra.com; however, the information accessed on or through our webpage is not part of this report. Our annual reports on Form 10-K, quarterly reports on... -

Page 13

...through distributors and other resellers or contract manufacturers, or both, as our forecasts of demand are then based on estimates provided by multiple parties. Our customers often shift buying patterns as they manage inventory levels, market different products, or change production schedules. This... -

Page 14

... distributors provide us with periodic reports of their backlog to end customers, sales to end customers and quantities of our products that they have on hand. If the data that is provided to us is inaccurate, it could lead to inaccurate forecasting of our revenues or errors in our reported revenues... -

Page 15

..., in India and China. The geographic diversity of our business operations could hinder our ability to coordinate design, manufacturing and sales activities. If we are unable to develop systems and communication processes to support our geographic diversity, we may suffer product development delays... -

Page 16

... our future revenues. With the shortening product life and design-in cycles in many of our customers' products, our competitors may have more opportunities to supplant our products in next generation systems. Our customers are increasingly price conscious, as semiconductors sourced from third... -

Page 17

... with these companies or other customers could be jeopardized. Our business strategy contemplates acquisition of other products, technologies or businesses, which could adversely affect our operating performance. Acquiring products, intellectual property, technologies and businesses from third... -

Page 18

... in connection with an acquisition, we may dilute our common stock with securities that have an equal or a senior interest in our company. From time to time, we license, or acquire, technology from third parties to incorporate into our products. Incorporating technology into our products may be more... -

Page 19

... foundry suppliers also make products for other companies and some make products for themselves, thus we may not have access to adequate capacity or certain process technologies. We have less control over delivery schedules, manufacturing yields and costs than competitors with their own fabrication... -

Page 20

... technology systems in Israel or India could harm our ability to conduct normal business operations and our operating results. On an on-going basis, some of our Israeli employees are periodically called into active military duty. In the event of severe hostilities breaking out, a significant number... -

Page 21

... customers. The majority of our customers are required to obtain licenses from and pay royalties to third parties for the sale of systems incorporating our semiconductor devices. Customers may also make claims against us with respect to infringement. Furthermore, we may initiate claims or litigation... -

Page 22

... and Burnaby, during 2010 we also operated thirteen additional research and development centers: two in Canada, five in the U.S., one in Bangalore, India, two in Israel, two in Germany, and one in Shanghai, China. We have 18 sales/operations offices located in Europe, Asia, and North America. 21 -

Page 23

Subsequent to the year ended December 26, 2010, PMC moved its corporate headquarters from Santa Clara, California to Sunnyvale, California, where it has leased approximately 62,000 square feet of office premise to replace the Santa Clara office space. ITEM 3. None. ITEM 4. [REMOVED AND RESERVED] 22 ... -

Page 24

... FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. Stock Price Information Our Common Stock trades on the NASDAQ Global Select Market under the symbol PMCS. The following table sets forth, for the periods indicated, the high and low closing sale... -

Page 25

Stock Performance Graph The following graph shows a comparison of cumulative total stockholder returns for PMC, the line-of-business index for semiconductors and related devices (SIC code 3674) furnished by Research Data Group, Inc., and the S&P 500 Index. In addition, we have included the Russell ... -

Page 26

.... Year Ended (in thousands, except for per share data) December 27, December 28, December 30, 2009(2) 2008(3) 2007(4) December 26, 2010(1) December 31, 2006(5) STATEMENT OF OPERATIONS DATA: Net revenues Cost of revenues Gross profit Research and development Selling, general and administrative... -

Page 27

... 2007, and December 31, 2006. (1) Results for the year ended December 26, 2010 include $0.8 million stock-based compensation expense and $1.0 million acquisition-related costs included in Cost of revenues; $9 million stock-based compensation and $4.9 million asset impairment included in Research and... -

Page 28

... of revenues; $16.2 million stock-based compensation expense included in Research and development expenses; $2.4 million for employee-related taxes; $19.9 million stock-based compensation expense and $0.2 million acquisition-related relocation expenses included in Selling, general and administrative... -

Page 29

...Cost of revenues; $2.3 million stock-based compensation expense included in Research and development expense; $3.1 million stockbased compensation expense and $4.7 million acquisition related costs included in Selling, general and administrative expense; $0.5 million foreign exchange loss on foreign... -

Page 30

... to unrecognized tax benefits, and $0.2 million tax recovery related to stock-based compensation. (3) Results include $0.2 million stock-based compensation and $0.1 million acquisition related costs included in Cost of revenues; $0.2 million stock-based compensation expense included in Research and... -

Page 31

...relating to inter-company transactions, $0.5 million tax recovery related to non-deductible intangible asset amortization, and $0.1 million tax recovery relating to prior periods. (8) Results include $0.2 million stock-based compensation expense included in Cost of revenues; $2.3 million stock-based... -

Page 32

... 8, 2010, we completed the acquisition of the Channel Storage business from Adaptec. The Channel Storage business includes Adaptec's RAID storage product line, a well-established global value added reseller customer base, and leading SSD cache performance solutions. We purchased the Channel Storage... -

Page 33

... two acquisitions the Company completed during the year. The acquisitions of the Channel Storage business from Adaptec, Inc., and Wintegra, Inc. completed in 2010 generated additional net revenues of $40.2 million compared to 2009 and 2008. Net revenues generated from our Enterprise Storage products... -

Page 34

... fourth quarter of 2010. Also, R&D expenses were higher due to an asset impairment of $4.9 million based on a determination made in the period that certain intangible assets were made redundant by assets acquired with our purchase of the Channel Storage business from Adaptec. Payroll costs increased... -

Page 35

... expense for 2010 does include $2.4 million and $1.8 million of amortization related to the intangible assets identified in the preliminary purchase price allocation for our acquisitions of the Channel Storage business from Adaptec, and Wintegra, Inc., respectively. The annual amortization of... -

Page 36

... our operating expense exposures to changes in the value of the Canadian dollar relative to the United States dollar have been hedged in accordance with our general practice of hedging approximately three quarters in advance. Our net foreign exchange loss was $2.4 million in 2010 and 2009 and a net... -

Page 37

... Statements and Supplementary Data, Notes to the Consolidated Financial Statements, Note 16. Income Taxes). In addition, we accrued $35.2 million (including associated interest) relating to an ongoing liability arising from the examination of our existing transfer pricing practices prior to the... -

Page 38

... securities and our short-term loan. We employ these sources of liquidity to support ongoing business activities, acquire or invest in critical or complementary technologies, purchase capital equipment, repurchase and repay our senior convertible notes and finance working capital. The combination of... -

Page 39

... December 26, 2010 Gross Gross Unrealized Unrealized Gains* Losses* (in thousands) Amortized Cost Fair Value Cash and cash equivalents: Cash Corporate bonds and notes US treasury and government agency notes Money market funds Foreign government and agency notes US states and municipal securities... -

Page 40

... in stock based compensation. Changes in net working capital accounts generated $25.2 million of our net operating cash flows in 2010 Inventory turns decreased slightly from 5.3 in 2009 to 5 in 2010, as inventory levels grew following the acquisitions of Wintegra, Inc. at the end 2010, resulting... -

Page 41

... income correlated with the increase in revenues. • INVESTING ACTIVITIES In 2010, we used $200 million to acquire Wintegra, Inc. and $34.3 million to acquire the Channel Storage Business from Adaptec, Inc. We had no acquisitions in 2009. In 2010, we also purchased a total of $17 million (2009... -

Page 42

... 15 of each of 2012, 2015 and 2020. Holders may convert the Notes into the right to receive the conversion value (i) when our stock price exceeds 120% of the approximately $8.80 per share initial conversion price for a specified period, (ii) in certain change in control transactions and (iii) when... -

Page 43

... generally accepted in the United States. The preparation of these financial statements requires us to make estimates and assumptions that affect the amounts we report as assets, liabilities, revenue and expenses, and the related disclosure of contingent assets and liabilities. Management bases... -

Page 44

... intangible assets in 2010, except for the asset impairment of $4.9 million relating to certain intangible assets that were made redundant by assets acquired with our purchase of the Channel Storage business from Adaptec. The carrying value of these assets was no longer recoverable based on expected... -

Page 45

... in future periods. Income Taxes PMC has operations in several tax jurisdictions, which subjects us to multiple tax rates that impact our overall effective tax rate. We use estimates and assumptions in allocating income to each tax jurisdiction. As a result of certain business activities carried out... -

Page 46

... notes, Federal FDIC-insured corporate notes, United States State and Municipal Securities, foreign government and agency notes and corporate bonds and notes, using quoted prices from active markets, quoted prices for similar assets from third-party sources and by performing valuation analyses. In... -

Page 47

... 15 of each of 2012, 2015 and 2020. Holders may convert the Notes into the right to receive the conversion value (i) when our stock price exceeds 120% of the approximately $8.80 per share initial conversion price for a specified period, (ii) in certain change in control transactions and (iii) when... -

Page 48

... in U.S. dollars. We generate a significant portion of our revenues from sales to customers located outside the United States including Canada, Europe, the Middle East and Asia. We are subject to risks typical of an international business including, but not limited to, differing economic conditions... -

Page 49

... Statements Reports on Internal Control Over Financial Reporting included in Item 9A: Management's Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Schedules for each of the three years in the period ended December 26, 2010 included... -

Page 50

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of PMC-Sierra, Inc. We have audited the accompanying consolidated balance sheets of PMC-Sierra, Inc. and subsidiaries (the "Company") as of December 26, 2010 and December 27, 2009, and the related ... -

Page 51

PMC-Sierra, Inc. CONSOLIDATED BALANCE SHEETS (in thousands, except par value) December 26, 2010 December 27, 2009 ASSETS: ...PMC special shares convertible into 1,370 (2009-1,570) shares of common stock Stockholders' equity: Common stock, par value $.001: 900,000 shares authorized; 232,008 shares... -

Page 52

PMC-Sierra, Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except for per share amounts) December 26, 2010 Twelve Months Ended December 27, 2009 December 28, 2008 Net revenues Cost of revenues Gross profit Other costs and expenses: Research and development Selling, general and ... -

Page 53

...income Net cash provided by operating activities Cash flows from investing activities: Acquisition of Wintegra, Inc., net of cash acquired of $17.3 million Acquisition of Channel Storage business from Adaptec, Inc. Purchases of property and equipment Purchase of intangible assets Redemption of short... -

Page 54

...of derivatives Change in fair values of investment securities Comprehensive income Conversion of special shares into common shares Issuance of common stock under stock benefit plans Stock-based compensation expense Benefit of stock option related loss carryforwards Balances at December 26, 2010 217... -

Page 55

... SIGNIFICANT ACCOUNTING POLICIES Description of business. PMC-Sierra, Inc (the "Company" or "PMC") designs, develops, markets and supports semiconductor solutions by integrating its mixed-signal, software and systems expertise through a network of offices in North America, Europe and Asia. Basis of... -

Page 56

... 2,079 - $13,909 Goodwill. Goodwill is recorded when the purchase price paid for an acquisition exceeds the estimated fair value of the net identified tangible and intangible assets acquired. The Company performs a two-step process on an annual basis, or more frequently if necessary, to determine... -

Page 57

... During the quarter ended September 26, 2010, the Company recognized an asset impairment of $4.9 million based on a determination made in the period that certain intangible assets were made redundant by assets acquired with our purchase of the Channel Storage business from Adaptec, Inc. The carrying... -

Page 58

... statements of operations. Derivatives and Hedging Activities. Fluctuating foreign exchange rates may significantly impact PMC's net income (loss) and cash flows. The Company periodically hedges forecasted foreign currency transactions related to certain operating expenses. All derivatives... -

Page 59

...in the sales from these distributors to end customers and the Company may utilize inventory at these distributors to satisfy product demand by other customers. PMC recognizes revenues from some distributors at the time of shipment. These distributors are also given business terms to return a portion... -

Page 60

... of shipment. The Company estimates its warranty costs based on historical failure rates and related repair or replacement costs. The following table summarizes the activity related to the product warranty liability during fiscal 2010, 2009 and 2008: December 26, 2010 Year Ended December 27, 2009... -

Page 61

... and as a direct wholly-owned subsidiary of PMC (the "Merger"). PMC purchased Wintegra to accelerate the Company's product offering in IP/Ethernet packet-based mobile backhaul equipment and fits strategically with its overall efforts to accelerate the transition of existing communications equipment... -

Page 62

... as purchase consideration, and $5.4 million will be recorded as post-combination compensation expense on a straight-line basis over the remaining vesting period. The Company incurred $3.7 million in acquisition-related costs which were expensed during 2010 and are included in selling, general and... -

Page 63

... sale of products to existing customers of the acquired company. The Company used the same method to determine the fair value of this intangible asset as core technology assets and utilized a discount rate of 24%. Trademarks represent the value of the revenues associated with the WinPath registered... -

Page 64

... The Channel Storage business includes Adaptec's redundant array of independent disks ("RAID") storage product line, a well-established global value added reseller customer base, board logistics capabilities, and leading solid-state drive ("SSD") cache performance solutions. The total purchase price... -

Page 65

... liabilities. The Company's Level 1 assets include cash equivalents, short-term investments, and long-term investment securities, which are generally acquired or sold at par value and are actively traded. Level 2-Observable inputs other than Level 1 prices, such as quoted prices for similar assets... -

Page 66

... that are generally not observable in the marketplace. These inputs may be used with internally developed methodologies that result in management's best estimate of fair value. At each balance sheet date, the Company performs an analysis of all applicable instruments and would include in Level 3 all... -

Page 67

.... The Company did not capitalize any stock-based compensation cost, and recorded compensation expense as follows: Stock-based compensation expense: December 26, 2010 Year Ended December 27, 2009 December 28, 2008 (in thousands) Cost of revenues Research and development Selling, general and... -

Page 68

...risk-free rate for periods within the contractual life of the stock option is based on the U.S. Treasury yield curve in effect at the time of the grant. The fair values of the Company's stock option and Employee Stock Purchase Plan, ("ESPP") awards were estimated using the following weighted average... -

Page 69

... part of the merger consideration in that business combination. Activity under the option plans during the year ended December 26, 2010 was as follows: Weighted average exercise price per share Weighted average remaining contractual term (years) Aggregate intrinsic value at December 26, 2010 Number... -

Page 70

...ESPP under Section 423 of the Internal Revenue Code. The ESPP allows eligible participants to purchase shares of the Company's common stock through payroll deductions at a purchase price of 85% of the lower of the fair market value of the Company's stock on the close of the first trading day or last... -

Page 71

NOTE 6. RESTRUCTURING AND OTHER COSTS The activity related to excess facility and severance accruals under the Company's restructuring plans during the three years ended December 26, 2010, by year of plan, were as follows: Excess facility costs (in thousands) 2007 2006 2005 2001 Total Balance at ... -

Page 72

... will end in 2011. NOTE 7. INVESTMENT SECURITIES At December 26, 2010, the Company had investments of $531.4 million (December 27, 2009-$423.6 million) comprised of money market funds, United States Treasury and Government Agency notes, Federal Deposit Insurance Corporation ("FDIC")insured corporate... -

Page 73

..., 2009: December 26, 2010 Gross Gross Unrealized Unrealized Gains* Losses * (in thousands) Amortized Cost Fair Value Cash equivalents: Corporate bonds and notes US treasury and government agency notes Money market funds Foreign government and agency notes US states and municipal securities Total... -

Page 74

... a period of time sufficient to allow for any anticipated recovery of market value. As of December 26, 2010, the Company determined that the unrealized losses are temporary in nature and recorded them as a component of accumulated other comprehensive income (loss). The investments in Reserve Funds... -

Page 75

... $ $ - 370 10,317 10,687 $ $ 2,000 572 7,603 10,175 During 2010, the Company acquired Wintegra, Inc., in a step-acquisition. The Company had previously held a non-controlling interest in Wintegra, Inc., a private-company and accounted for the investment on a cost basis at $2.0 million. Upon... -

Page 76

... of each of 2012, 2015 and 2020. Holders may convert the Notes into the right to receive the conversion value (i) when the Company's stock price exceeds 120% of the approximately $8.80 per share initial conversion price for a specified period, (ii) in certain change in control transactions, and (iii... -

Page 77

...$39,112 The Company has existing, or is in the process of renewing, its supply agreements with UMC and TSMC. Generally, terms the Company seeks, includes but is not limited to, supply terms without minimum unit volume requirements for PMC, indemnification and warranty provisions, quality assurances... -

Page 78

... did not change as of December 26, 2010. NOTE 13. SPECIAL SHARES At December 26, 2010 and December 27, 2009, the Company maintained a reserve of 1,370,000 and 1,570,000, respectively, of PMC common stock to be issued to holders of PMC-Sierra, Ltd. ("LTD") special shares. The special shares of LTD... -

Page 79

... subsidiary of the Company to their employees, which reflects the undiscounted amount of the liability, is based upon the number of years of service and the latest monthly salary, and is partly covered by insurance policies and by regular deposits with recognized severance pay funds. The Israeli... -

Page 80

... Adjustment/expiry of loss carryforwrrd Utilization of stock option related loss carry-forwards recorded in equity Adjustment of prior year taxes and tax credits Investment tax credits, net Foreign and other rate differential Change in valuation allowance Provision for (recovery of) income taxes... -

Page 81

... for income taxes of $26 million. The effective tax rate was 27% and 8% for 2010 and 2009, respectively. During 2010, PMC began utilizing available stock option related loss carry-forwards. As a result, the Company recognized $13.4 million of additional income tax provision due to the benefit of... -

Page 82

... used in prior periods, plus an increase of $28 million as a result of receiving notice of a proposed adjustment from the foreign tax authority pertaining to the year 2000, based on which PMC modified its assessment of a specific exposure. $33 million balance at the end of the second quarter... -

Page 83

... of the Company's net operating losses were used in 2010 and 2009 to reduce the taxes otherwise payable on inter-company dividends and inter-company sale of assets. The utilization of a portion of these net operating losses may be subject to annual limitations under federal and state income tax... -

Page 84

...-to-the-Home Products, Enterprise Storage Products and Microprocessor Products. All operating segments noted above have been aggregated into one reportable segment because they have similar long-term economic characteristics, products, production processes, types or classes of customers and methods... -

Page 85

... assets. Geographic information about long-lived assets is based on the physical location of the assets. December 26, 2010 Year Ended December 27, 2009 December 28, 2008 (in thousands) Net revenues China Asia, other Japan United States Taiwan Europe and Middle East Other foreign Total $ 217,148... -

Page 86

...net of tax, are as follows: December 26, 2010 Year Ended December 27, 2009 December 28, 2008 (in thousands) Net income Other comprehensive income (loss): Change in net unrealized gains on investments, net of tax of $164 in 2010 (2009-$264; 2008-$nil) Change in fair value of derivatives, net of tax... -

Page 87

...net revenues, and (0.5%) of net income of the consolidated financial statement amounts as of and for the year ended December 26, 2010. Based on our assessment and those criteria, management concludes that we maintained effective control, at the reasonable assurance level, over financial reporting as... -

Page 88

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of PMC-Sierra, Inc. We have audited the internal control over financial reporting of PMC-Sierra, Inc. and subsidiaries (the "Company") as of December 26, 2010, based on criteria established in Internal... -

Page 89

ITEM 9B. None. OTHER INFORMATION. 88 -

Page 90

...Item is incorporated by reference from the information set forth in the sections entitled "Election of Directors", "Code of Business Conduct and Ethics", "Executive Officers", and "Section 16(a) Beneficial Ownership Reporting Compliance" in our Proxy Statement for the 2011 Annual Stockholder Meeting... -

Page 91

... the 1991 Plan 12,000,000 shares of our common stock have been reserved for issuance under the 2011 Plan. During 2010, Mr. Bailey, a director of the Company, Mr. Kurtz, a director of the Company, Mr. Stibitz, our Vice President and General Manager, Enterprise and Storage Division, Mr. Elmurib, Vice... -

Page 92

... Terms of PMC-Sierra, Ltd. Special Shares Preferred Stock Rights Agreement, as amended and restated as of July 27, 2001, by and between the Registrant and American Stock Transfer and Trust Company Purchase and Sale Agreement dated October 28, 2005, between PMCSierra, Inc. and Avago Technologies Pte... -

Page 93

... for Purchase and Sale of Real Property between PMCSierra, Inc. and WB Mission Towers, L.L.C. Director Compensation-Equity Acceleration upon Change of Control United States District Court of Northern District of California San Jose Division-In re PMC-Sierra, Inc. Derivative Litigation-Master... -

Page 94

.... Indicates management compensatory plan or arrangement required to be filed as an exhibit pursuant to Item 15(c) of Form 10K. (1) Refer to Note 18 of the consolidated financial statements included in Item 8 of Part II of this Annual Report. (2) Refer to Signature page of this Annual Report. 93 -

Page 95

... 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. PMC-SIERRA, INC. (Registrant) Date: February 23, 2011 /s/ Michael W. Zellner Michael W. Zellner Vice President, (duly authorized officer) Chief Financial Officer and Principal... -

Page 96

... to the requirements of the Securities Exchange Act of 1934, this Annual Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated. Name Title Date /s/ Gregory S. Lang Gregory S. Lang /s/ Michael W. Zellner Michael W. Zellner... -

Page 97

SCHEDULE II-Valuation and Qualifying Accounts Balance at Beginning of year Charged to expenses or other accounts Writeoffs Balance at end of year Allowance for doubtful accounts December 26, 2010 December 27, 2009 December 28, 2008 Allowance for obsolete inventory and excess inventory December 26... -

Page 98

....CAL 101.DEF 101.LAB 101.PRE Statement of Computation of Ratio of Earnings to Fixed Charges Subsidiaries of the Registrant Consent of Deloitte & Touche LLP, Independent Registered Public Accountants Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002... -

Page 99

...PMC-SIERRA, INC. STATEMENT OF COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES December 26, 2010 December 27, 2009 Year Ended December 28, 2008 December 30, 2007 December 31, 2006 Earnings: Income (loss... of operating lease rental expense that the Company believes to be a reasonable approximation of... -

Page 100

...SUBSIDIARIES (All 100% Owned) Subsidiaries of the Registrant State or Other Jurisdiction of Incorporation PMC-Sierra Ltd. PMC-Sierra Israel, Ltd. PMC-Sierra US, Inc. PMC-Sierra International Sdn. Bhd. Wintegra, Inc. British Columbia, Canada Herzliya,Israel Delaware, USA Penang, Malaysia Texas, USA -

Page 101

... statements and financial statement schedules of PMC-Sierra Inc., and the effectiveness of internal control over financial reporting appearing in this Annual Report on Form 10-K of PMC-Sierra Inc. for the year ended December 26, 2010. /s/ DELOITTE & TOUCHE LLP Vancouver, Canada February 23, 2011 -

Page 102

... end of the period covered by this report based on such evaluation; and Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual... -

Page 103

... end of the period covered by this report based on such evaluation; and Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual... -

Page 104

Exhibit 32.1 CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO 18 U.S.C. SECTION 1350 AS ADOPTED ... my capacity as an officer of PMC-Sierra, Inc. ("PMC"), that, to my knowledge, this Annual Report of PMC on Form 10-K for the annual period ended December 26, 2010 fully complies with the requirements... -

Page 105

Exhibit 32.2 CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO 18 U.S.C. SECTION 1350 AS ADOPTED PURSUANT ...in my capacity as an officer of PMC-Sierra, Inc. ("PMC"), that, to my knowledge, this Annual Report of PMC on Form 10-K for the annual period ended December 26, 2010, fully complies with the ...