ADP 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 ANNUAL REPORT

Building Momentum

Table of contents

-

Page 1

Building Momentum 2 0 0 5 ANNUAL REPORT -

Page 2

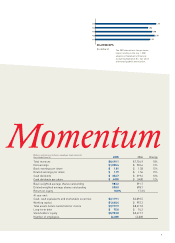

... Services - 12 Dealer Services - 14 Claims Services - 15 Financial Review - 16 Directors and Corporate Officers - 48 Corporate Information - Inside Back Cover 05 04 03 02 01 7,755 7,147 7,004 6,854 8,499 TOTAL REVENUES (Dollars in millions) Building Our Mission - to add value to our clients... -

Page 3

... weighted average shares outstanding Return on equity At year end: Cash, cash equivalents and marketable securities Working capital Total assets before funds held for clients Long-term debt Stockholders' equity Number of employees $8,499.1 $1,055.4 $ 1.81 $ 1.79 $ 352.7 $ .6050 583.2 590.0 18... -

Page 4

...590,000 clients worldwide > Strong market leadership in each of our core businesses > 44,000 ADP associates worldwide > Rated AAA and Aaa by Standard & Poor's and Moody's, respectively EMPLOYER SERVICES The leading provider of human resource information, payroll and benefit administration solutions... -

Page 5

... U.S. Clearing and BrokerDealer Services divisions and introduced Securities Clearing and Outsourcing Services, signing nine new broker-dealer clients to this new business • Delivered approximately 37 million investor communications via the Internet, 60% more than last year • Distributed nearly... -

Page 6

...15%-20%, assuming stock compensation was expensed in fiscal 2005. Excluding stock compensation expense in both periods, we anticipate growth in earnings per share would have been 12%-15%. Left: Arthur F. Weinbach, Chairman & Chief Executive Officer Right: Gary C. Butler, President & Chief Operating... -

Page 7

... Securities Clearing and Outsourcing Services in Brokerage. We plan to increase our investment and broaden our offerings. In our Employer Services business we expanded our alliance with SAP for a global human resource solution and we established an agreement with Microsoft which includes ADP Payroll... -

Page 8

... was strong at $1.4 billion and included $0.2 billion of net cash used for our new Securities Clearing and Outsourcing Services segment. • We acquired over 14 million ADP shares for approximately $600 million. • Cash and marketable securities at year-end were $2.1 billion. • Long-term debt was... -

Page 9

... world class service to our 590,000 clients. Our associates are exceptionally client-oriented, motivated, committed, and dedicated. They are the reason we win in the marketplace. This year we announced the promotions of John Gleason, Regina Lee, Alan Sheiness, and Jan Siegmund to Corporate Officer... -

Page 10

... IN EMPLOYER SERVICES End-to-End Solutions Employer Services achieved incremental growth by providing market-leading HR, payroll, time and labor management, and benefit administration solutions to employers of every size. Our clients utilized more applications than in any previous year, and... -

Page 11

Client Case Studies CHALLENGE: Manage payroll, HR, and CHALLENGE: Gain more timely access benefit administration needs without employing a professional support staff ADP'S SOLUTION: Online administrative services from ADP's Professional Employer Organization (PEO). "A PEO relationship with ADP was ... -

Page 12

... services, workers' compensation and healthcare insurance coverage, and access to online HR tools and robust employee benefit packages that might otherwise be unavailable to a smaller employer. TIME AND LABOR MANAGEMENT Employers reduce risk and save time and money when ADP processes their payroll... -

Page 13

...around the world, the payroll and HR services market outside the United States remains a huge, largely unpenetrated, growth opportunity. ADP, with a dedicated business to serve the needs of employers in the international marketplace, is favorably positioned to expand our worldwide footprint. Similar... -

Page 14

...centralize our securities processing with a single vendor, and should yield significant cost savings." CHALLENGE: Continue to print, distribute, and archive customer statements and confirmations in a reliable, scalable, and cost-effective way ADP'S SOLUTION: ADP Investor Communications. "The proven... -

Page 15

... ADP's capital to finance trade or security clearance SOLUTION Transaction Processing: Global order entry, trade processing, and settlement, enabling firms to trade virtually any instrument in any market at any time % Investor Communications Services: Provides electronic delivery, statements... -

Page 16

... Phone IP telephony solution creates a single network for voice and data communications, integrating a dealer's Customer Relationship Management (CRM) and core DMS applications. Our Web-based F&I (Finance and Insurance) eForms Library enables dealers to efficiently download and produce laser-printed... -

Page 17

... new value-added services in existing markets and expanding into new geographies helped to provide a platform for growth. payments online. "ADP's Payments Solution, on average, can improve a repair shop's accounts receivable by up to twenty days," notes Erick Bickett, Founder and CEO of Fix Auto... -

Page 18

...forma diluted earnings per share* Basic weighted average shares outstanding Diluted weighted average shares outstanding Cash dividends per share Return on equity At year end: Cash, cash equivalents and marketable securities Working capital Total assets before funds held for clients Total assets Long... -

Page 19

... recreational) vehicle retailers and manufacturers throughout North America and Europe. More than 19,500 automotive, heavy truck and powersports dealers use our DMS, other software-based solutions, networking solutions, data integration, consulting and/or marketing services. Securities Clearing and... -

Page 20

... million in the prior fiscal year. The increase in the consolidated interest earned on funds held for Employer Services' clients was primarily due to the increase of 11% in our average client funds balances in fiscal 2005 to $12.3 billion as a result of Employer Services' new business and growth in... -

Page 21

...integration of certain fiscal 2003 acquisitions, and a decrease in investment income on funds held for Employer Services' clients and corporate funds of $90.0 million, primarily due to the lower interest rates during fiscal 2004. Provision for Income Taxes Our effective tax rate for fiscal 2004 was... -

Page 22

...number of clients utilizing these services. Earnings Before Income Taxes Years Ended June 30, Change 2005 Employer Services $1,143.8 $ Brokerage Services 294.3 Dealer Services 142.8 Securities Clearing and Outsourcing Services (23.6) Other 73.1 Reconciling items: Foreign exchange 29.4 Client funds... -

Page 23

... retail trades and volume processed under tiered pricing agreements. In addition, the acquisition of the U.S. Clearing and BrokerDealer Business, which was previously a customer of Brokerage Services, reduced revenues by approximately $14 million, as the back-office services previously provided to... -

Page 24

... users for Application Service Provider ("ASP") managed services, increased Credit Check installations, new network installations and increased market penetration of our Customer Relationship Management ("CRM") product. In addition, our revenue growth was impacted by our continued strong client... -

Page 25

... million and the increase in accounts payable and accrued expenses primarily due to the timing of income tax payments made during fiscal 2005 as compared to fiscal 2004. Net cash flows used in operating activities for the Securities Clearing and Outsourcing Services segment were $193.0 million from... -

Page 26

... We are also required to pay facility fees on the credit agreements. The primary uses of the credit facilities are to provide liquidity to the commercial paper program and to provide funding for general corporate purposes, if necessary. There were no borrowings under the credit agreements at June 30... -

Page 27

... and the related interest expense on the borrowings are reported in other income, net on our Statements of Consolidated Earnings. Average interest rates earned exclusive of realized gains/ (losses) on: Corporate investments Funds held for clients Total Realized gains on availablefor-sale securities... -

Page 28

...(e.g., Employer Services' payroll processing fees and Brokerage Services' trade processing fees) as well as investment income on payroll funds, payroll tax filing funds and other Employer Services' client-related funds. We typically enter into agreements for a fixed fee per transaction (e.g., number... -

Page 29

...: ADP's success in obtaining, retaining and selling additional services to clients; the pricing of products and services; changes in laws regulating payroll taxes, professional employer organizations, employee benefits and registered clearing agencies and broker-dealers; overall market and economic... -

Page 30

... on funds held for Employer Services' clients PEO revenues(A) Total revenues Operating expenses Selling, general and administrative expenses Systems development and programming costs Depreciation and amortization Other income, net Earnings before income taxes Provision for income taxes Net earnings... -

Page 31

... assets Long-term marketable securities Long-term receivables, net Property, plant and equipment, net Other assets Goodwill Intangible assets, net Total assets before funds held for clients Funds held for clients Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable... -

Page 32

... at June 30, 2003 Net earnings Foreign currency translation adjustments Unrealized net loss on securities, net of tax Minimum pension liability adjustment, net of tax Comprehensive income Employee stock plans and related tax benefits Treasury stock acquired (15.8 shares) Acquisitions Debt conversion... -

Page 33

... in securities clearing payables Net cash flows provided by operating activities Cash Flows From Investing Activities Purchases of marketable securities Proceeds from the sales and maturities of marketable securities Net (purchases of) proceeds from client funds securities Change in client funds... -

Page 34

...the fees charged to an introducing broker-dealer to process trades in clearing accounts are recorded on a trade-date basis. D. Cash and Cash Equivalents. Investment securities with a maturity of ninety days or less at the time of purchase are considered cash equivalents. E. Corporate Investments and... -

Page 35

... common stock for fiscal 2005 and 2004, respectively, were excluded from the calculation of diluted earnings per share because their exercise prices exceeded the average market price of outstanding common shares for the fiscal year. M. Internal Use Software. Expenditures for major software purchases... -

Page 36

...basis. No stock-based employee compensation expense related to the Company's stock options and employee stock purchase plans is reflected in net earnings, as all options granted under the stock option plans had an exercise price equal to the market value of the underlying common stock on the date of... -

Page 37

..., consist primarily of software, and customer contracts and lists that are being amortized over a weighted average life of 9 years. In addition, the Company made $12.2 million of contingent payments (including $0.5 million in common stock) relating to previously consummated acquisitions. As of June... -

Page 38

...consist primarily of software, and customer contracts and lists that are being amortized over a weighted average life of 9 years. In addition, the Company made contingent payments totaling $25.4 million (including $0.5 million in common stock) relating to previously consummated acquisitions. On June... -

Page 39

...12,903.6 $14,996.1 Corporate investments: Cash and cash equivalents Short-term marketable securities Long-term marketable securities Total corporate investments Funds held for clients Total corporate investments and funds held for clients The Company's trading securities include $27.9 million that... -

Page 40

...insurance coverage, this subsidiary is required to maintain aggregate net capital of $200.0 million. NOTE 7. PROPERTY, PLANT AND EQUIPMENT Securities failed to deliver and failed to receive represent the contract value of securities that have not been delivered or received as of the settlement date... -

Page 41

... institutions prior to borrowing. The Company is also required to pay facility fees on the credit agreements. The primary uses of the credit facilities are to provide liquidity to the commercial paper program and to provide funding for general corporate purposes, if necessary. The Company had no... -

Page 42

... stock option plans for the three fiscal years ended June 30, 2005 is as follows: Number of Options (in thousands) Years Ended June 30, Weighted Average Price (in dollars) 2005 70,159 8,698 (4,012) (4,450) 70,395 36,992 18,183 88,578 2004 60,958 18,080 (4,557) (4,322) 70,159 32,140 22,431 92,590... -

Page 43

... will pay supplemental pension benefits to certain key officers upon retirement based upon the officers' years of service and compensation. A June 30 measurement date was used in determining the Company's benefit obligations and fair value of plan assets. The Company's pension plans funded status... -

Page 44

... Financial Statements The pension plans' assets are currently invested in various asset classes with differing expected rates of return, correlations and volatilities including large capitalization and small capitalization U.S. equities, international equities, and U.S. fixed income securities and... -

Page 45

... and $3.4 million at June 30, 2005 and 2004, respectively, relate to net deferred tax assets which were recorded in purchase accounting. Any recognition of such amounts in future years will be a reduction to goodwill. Income tax payments were approximately $490.1 million, $539.1 million and $686... -

Page 46

...2004, Employer Services was credited with interest earned on client funds at 6.0%. Given the decline in interest rates, the standard rate was changed to 4.5%. The reportable segments' results also include an internal cost of capital charge related to the funding of acquisitions and other investments... -

Page 47

..., INC. AND SUBSIDIARIES Employer Services Brokerage Services Dealer Services Securities Clearing and Outsourcing Services Other Foreign Exchange Reconciling Items Client Fund Interest Cost of Capital Charge Total Year ended June 30, 2005 Revenues Earnings before income taxes Assets Capital... -

Page 48

... and directors of ADP; and (iii) provide reasonable assurance regarding the prevention or timely detection of unauthorized acquisition, use or disposition of ADP's assets that could have a material effect on the financial statements of ADP. Because of its inherent limitations, internal control over... -

Page 49

Report of Independent Registered Public Accounting Firm Board of Directors and Stockholders of Automatic Data Processing, Inc. Roseland, New Jersey We have audited management's assessment, included in the accompanying Management Report on Internal Control Over Financial Reporting, that Automatic ... -

Page 50

... ADP Audit Committee R. Glenn Hubbard Dean of The Graduate School of Business at Columbia University (1)*, (4) John P. Jones(2) Chairman and Chief Executive Officer, Air Products and Chemicals, Inc. CORPORATE OFFICERS Arthur F. Weinbach Chairman and Chief Executive Officer Gary C. Butler President... -

Page 51

... SUBSIDIARIES CORPORATE HEADQUARTERS Automatic Data Processing, Inc. One ADP Boulevard Roseland, New Jersey 07068-1728 973.974.5000 ANNUAL REPORT, FORM 10-K AND OTHER REPORTS AND FILINGS This 2005 Annual Report is also available online under "Investor Information" on ADP's Web site at www.adp.com... -

Page 52

AUTOMATIC DATA PROCESSING, INC. One ADP Boulevard Roseland, NJ 07068-1728 973.974.5000 www.adp.com