Whole Foods 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

Table of contents

-

Page 1

2012 A NN UA L REP ORT -

Page 2

...and growth. We serve and support our local and global communities. We sell the highest quality natural and organic products available. We practice and advance environmental stewardship. We satisfy, delight and nourish our customers. We create ongoing win-win partnerships with our suppliers. We... -

Page 3

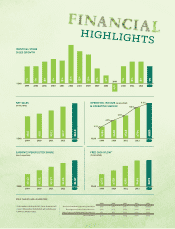

...-WEEK YEAR. 2009 * THE 2010 $585 (171) (85) $328 2011 $755 (203) (162) $390 2012 $920 (262) (194) $464 2013 $1,009 (339) (198) $472 COMPANY DEFINES FREE CASH FLOW AS NET CASH PROVIDED BY OPERATING ACTIVITIES LESS CAPITAL EXPENDITURES. Net Cash Provided by Operating Activities Development Costs... -

Page 4

... to sales per gross square foot of $972. We opened 32 new stores, expanding into 10 new markets and growing our square footage 8% to 14 million. We delivered our ï¬fth consecutive year of operating margin improvement, produced over $1 billion in EBITDA, and, on a comparative 52-week basis... -

Page 5

.... Sales productivity and operating expenses may vary, but when balanced with the appropriate store size and level of capital investment, a wide variety of markets can deliver healthy returns for our shareholders. For the last eight quarters, on average our new store class consisted of 28 stores open... -

Page 6

...the excitement our stores create within their communities. Our outlook for ï¬scal year 2014 reï¬,ects another year of record new store openings, healthy comparable store sales growth and incremental operating margin improvement. Longer term, we see demand for 1,200 Whole Foods Market stores in the... -

Page 7

... ACT OF 1934 FOR THE FISCAL YEAR ENDED SEPTEMBER 29, 2013 COMMISSION FILE NUMBER: 0-19797 WHOLE FOODS MARKET, INC. (Exact name of registrant as specified in its charter) Texas (State of incorporation) 550 Bowie Street, Austin, Texas (Address of principal executive offices) 74-1989366 (IRS Employer... -

Page 8

DOCUMENTS INCORPORATED BY REFERENCE The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference from the Registrant's definitive Proxy Statement for the Annual Meeting of the Stockholders to be held February 24, 2014. -

Page 9

... Statements and Supplementary Data. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. Controls and Procedures. Other Information. PART III Item 10. Item 11. Item 12. Item 13. Item 14. Directors, Executive Officers and Corporate Governance. Executive Compensation... -

Page 10

...in 1978, opened the first Whole Foods Market store in 1980, and is based in Austin, Texas. We completed our initial public offering in January 1992, and our common stock trades on the NASDAQ Global Select Market under the symbol "WFM." Our Company mission is to promote the vitality and well-being of... -

Page 11

... profits and growth. We serve and support our local and global communities. We practice and advance environmental stewardship. We create ongoing win-win partnerships with our suppliers. We promote the health of our stakeholders through healthy eating education. Differentiated Product Offering... -

Page 12

... and Canada, as well as online. The value guide features supplier-sponsored and Whole Foods Market store brand coupons, budget-conscious recipes, money-saving shopping and cooking tips, and Sure Deals that highlight everyday value pricing on high-quality products our customers love. Health Starts... -

Page 13

... sold in our stores that make organic claims are certified to one of two standards: the USDA's National Organic Program or NSF International's 305 Standard for Personal Care Products Containing Organic Ingredients. Eco-Scaleâ„¢ In April 2011, we introduced our exclusive Eco-Scaleâ„¢ rating system... -

Page 14

... impact our future store growth or financial results. We have a disciplined, opportunistic real estate strategy, opening stores in existing trade areas as well as new areas, including international locations. We typically target stores located on premium real estate sites, and while we may open... -

Page 15

... single largest third-party supplier, accounting for approximately 32% of our total purchases in fiscal year 2013. Our long-term relationship with UNFI as our primary supplier of dry grocery and frozen food products extends through 2020. Store Operations We strive to promote a strong company culture... -

Page 16

... share in the cost. In our most recent vote, held in September 2012, 82% of eligible team members cast a ballot to determine the Company's medical plan for 2013. Under this plan, Whole Foods Market provides health care coverage at no cost to full-time team members working 30 or more hours per week... -

Page 17

...a wide variety of educational opportunities for team members; and healthy-eating classes and networking opportunities for our customers. We believe our Health Starts Here program will grow and evolve over time to become a key competitive advantage for us, and by offering an informed approach to food... -

Page 18

... home-based businesses. Whole Foods Market covers all operating costs for Whole Planet Foundation. Program grants are funded in part by the sale of products under the Company's Whole Trade Guarantee Program, along with support from customers, suppliers and team members. As of September 29, 2013... -

Page 19

... was the Chief Executive Officer from 1978 to May 2010 and was President from June 2001 to October 2004. Mr. Mackey co-authored Conscious Capitalism: Liberating the Heroic Spirit of Business, a 2013 Wall Street Journal Best Seller. To date, profits from books sold at Whole Foods Market stores, along... -

Page 20

....com averages approximately 178,000 visits each day and provides detailed information about our Company, history, product offerings and store locations, as well as thousands of recipes and a library of information about environmental, legislative, health, food safety and product quality issues... -

Page 21

those team members into the programs and policies of the Company. We may not be able to adapt our distribution, management information and other operating systems to adequately supply products to new stores at competitive prices so that we can operate the stores in a successful and profitable manner... -

Page 22

... Company uses a combination of insurance and self-insurance plans to provide for the potential liabilities for workers' compensation, general liability, property insurance, director and officers' liability insurance, vehicle liability and team member health care benefits. Liabilities associated with... -

Page 23

... such organization attempts is distracting to management and team members and may have a negative financial impact on a store, facility or the Company as a whole. Changes in accounting standards and estimates could materially impact our results of operations. Generally accepted accounting principles... -

Page 24

...of our internal control over financial reporting could materially impact our business or stock price. The Company's management is responsible for establishing and maintaining adequate internal control over financial reporting. An internal control system, no matter how well designed and operated, can... -

Page 25

... matters involving personnel and employment issues, personal injury, intellectual property, product liability, acquisitions and other proceedings arising in the ordinary course of business which have not resulted in any material losses to date. Although management does not expect that the outcome in... -

Page 26

... Purchases of Equity Securities. Whole Foods Market's common stock is traded on the NASDAQ Global Select Market under the symbol "WFM." The Company is a member of the Standard & Poor's S&P 500 Index, the NASDAQ-100® Index, and the Dow Jones Sustainability™ North America Index. On May 7, 2013... -

Page 27

... 2014. The Company will pay future dividends at the discretion of the Company's Board of Directors. The continuation of these payments, the amount of such dividends, and the form in which dividends are paid (cash or stock) depend on many factors, including the results of operations and the financial... -

Page 28

... provides information about the Company's share repurchase activity during the twelve weeks ended September 29, 2013. Total number of shares purchased as part of publicly announced plans or programs (2) - 668,385 - 668,385 Approximate dollar value of shares that may yet be purchased under the plans... -

Page 29

... Dividends declared per common share Consolidated Balance Sheets Data Net working capital Total assets Long-term debt (including current maturities) Shareholders' equity Operating Data Number of stores at end of fiscal year Average store size (gross square footage) Average weekly sales per store... -

Page 30

... 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. Overview Whole Foods Market, Inc. is the leading retailer of natural and organic foods and America's first national "Certified Organic" grocer. Our Company mission is to promote the vitality and well-being... -

Page 31

...table sets forth the Company's statements of operations data for the fiscal years indicated expressed as a percentage of sales: Sales Cost of goods sold and occupancy costs Gross profit Direct store expenses General and administrative expenses Pre-opening expenses Relocation, store closure and lease... -

Page 32

... of goods sold. Additionally, the increase in gross profit as a percentage of sales in fiscal year 2012 reflects a 10 basis point improvement in LIFO, due to the moderation of inflation during the year. We remain committed to expanding our value offerings across the store, increasing our promotional... -

Page 33

...the financial results of the Company as well as a component of incentive compensation. Additionally, since fiscal year 2012 was a 53-week year, with an additional week in the fourth fiscal quarter, current year operating results are not directly comparable to the prior year. The Company's management... -

Page 34

... equals eight times total rent expense The Company adjusted fiscal year 2012, a 53-week year, by removing one-thirteenth of the 13-week fourth fiscal quarter results to remove the estimated impact of the additional week, as shown in the table below (in millions, except per share amounts). Sales Less... -

Page 35

...38 35 - 40 Average Ending square new store Relocations square footage footage growth 1 37,000 8% - 10% 3-4 38,000 8% - 10% Fiscal year 2014 Fiscal year 2015 We believe we will produce operating cash flows in excess of the capital expenditures needed to open the 94 stores in our current development... -

Page 36

... dividends are paid (cash or stock) depend on many factors, including the results of operations and the financial condition of the Company. Subject to these qualifications, the Company currently expects to pay dividends on a quarterly basis. The following table outlines the share repurchase programs... -

Page 37

... philosophy because it limits future earnings dilution from options and at the same time retains the broad-based stock option plan, which the Company believes is important to team member morale, its unique corporate culture and its success. At September 29, 2013, September 30, 2012 and September 25... -

Page 38

... cash flow model based on future store operating results using internal projections or based on a review of the future benefit the Company anticipates receiving from the related assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell... -

Page 39

...of our stock option grants are the closing price on the grant date. Stock option grant terms and conditions are communicated to team members within a relatively short period of time. Our Company generally approves one primary stock option grant annually, occurring during a trading window. Restricted... -

Page 40

... in the Company's financial statements are reflected as a financing cash flow. The Company intends to keep its broad-based stock option program in place, but also intends to limit the number of shares granted in any one year so that annual earnings per share dilution from share-based payment expense... -

Page 41

.... The Company does not currently hedge against the risk of exchange rate fluctuations. At September 29, 2013, a hypothetical 10% change in value of the U.S. dollar relative to the Canadian dollar or Great Britain pound sterling would not have materially affected our consolidated financial statements... -

Page 42

...Public Accounting Firm Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting Consolidated Balance Sheets at September 29, 2013 and September 30, 2012 Consolidated Statements of Operations for the fiscal years ended September 29, 2013, September 30, 2012... -

Page 43

... flows for each of the three years in the period ended September 29, 2013, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Whole Foods Market, Inc.'s internal... -

Page 44

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Whole Foods Market, Inc. as of September 29, 2013 and September 30, 2012, and the related consolidated statements of operations, comprehensive income, shareholders' equity and cash flows... -

Page 45

...' Equity Current liabilities: Current installments of capital lease obligations Accounts payable Accrued payroll, bonus and other benefits due team members Dividends payable Other current liabilities Total current liabilities Long-term capital lease obligations, less current installments Deferred... -

Page 46

... 552 209 343 0.98 350.5 0.97 354.6 0.20 Sales Cost of goods sold and occupancy costs Gross profit Direct store expenses General and administrative expenses Pre-opening expenses Relocation, store closure and lease termination costs Operating income Interest expense Investment and other income Income... -

Page 47

Whole Foods Market, Inc. Consolidated Statements of Comprehensive Income Fiscal years ended September 29, 2013, September 30, 2012 and September 25, 2011 (In millions) 2013 551 $ (4) (4) 547 $ 2012 466 $ 5 5 471 2011 343 (1) (1) 342 Net income Other comprehensive income (loss), net of tax: Foreign ... -

Page 48

...net of tax Dividends ($1.40 per common share) Issuance of common stock pursuant to team member stock plans Purchase of treasury stock Tax benefit related to exercise of team member stock options Share-based payment expense Balances at September 29, 2013 Shares Common outstanding stock 344.1 $ 1,774... -

Page 49

... Share-based payment expense LIFO expense Deferred income tax (benefit) expense Excess tax benefit related to exercise of team member stock options Accretion of premium/discount on marketable securities Deferred lease liabilities Other Net change in current assets and liabilities: Accounts... -

Page 50

...-for-one stock split. The Company has one operating segment and a single reportable segment, natural and organic foods supermarkets. The following is a summary of annual percentage sales and net long-lived assets by geographic area for the fiscal years indicated: 2013 Sales: United States Canada and... -

Page 51

...of buildings over the estimated useful lives (generally 20 to 50 years) using the straight-line method. Costs related to a projected site determined to be unsatisfactory and general site selection costs that cannot be identified with a specific store location are charged to operations currently. The... -

Page 52

... cash flow model based on future store operating results using internal projections or based on a review of the future benefit the Company anticipates receiving from the related assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell... -

Page 53

...the related merchandise is sold. Occupancy costs include store rental costs, property taxes, utility costs, repair and maintenance costs, and property insurance. Our largest supplier, United Natural Foods, Inc., accounted for approximately 32%, 31% and 31% of our total purchases in fiscal years 2013... -

Page 54

... cash flow. All full-time team members with a minimum of 400 hours of service may purchase our common stock through payroll deductions under the Company's Team Member Stock Purchase Plan ("TMSPP"). The TMSPP provides for a 5% discount on the shares' purchase date market value which meets the share... -

Page 55

... at the balance sheet date. Income and expense accounts are translated at the average exchange rates during the fiscal year. Resulting translation adjustments are recorded as a separate component of accumulated other comprehensive income. Use of Estimates The preparation of financial statements in... -

Page 56

...not material during fiscal year 2013, 2012, or 2011. (4) Investments The Company holds investments in marketable securities that are classified as either short- or long-term available-for-sale securities. The Company held the following investments at fair value as of the dates indicated (in millions... -

Page 57

... of new locations totaled approximately $339 million, $262 million and $203 million in fiscal years 2013, 2012 and 2011, respectively. Construction accruals related to development sites, remodels, and expansions were included in the "Other current liabilities" line item on the Consolidated Balance... -

Page 58

...are approximately as follows (in millions): Capital Fiscal year 2014 Fiscal year 2015 Fiscal year 2016 Fiscal year 2017 Fiscal year 2018 Future fiscal years Less amounts representing interest Net present value of capital lease obligations $ 3 3 3 3 3 33 48 19 29 Operating $ 359 404 432 437 444 5,366... -

Page 59

...indefinite life. The Company provided a valuation allowance totaling approximately $26 million for deferred tax assets associated with international operating loss carryforwards, federal credit carryforwards, and deferred tax assets associated with unrecognized tax benefits, for which management has... -

Page 60

... financial statements and applicable disclosures reflect this two-for-one stock split. Dividends per Common Share The following table provides a summary of dividends declared per common share during fiscal years 2013 and 2012 (in millions, except per share amounts): Date of declaration Fiscal year... -

Page 61

...common shares acquired Average price per common share acquired Total cost of common shares acquired $ $ Subsequent to fiscal year-end, the Company's Board of Directors authorized a new share repurchase program whereby the Company may make up to $500 million in stock purchases of outstanding shares... -

Page 62

...): Cost of goods sold and occupancy costs Direct store expenses General and administrative expenses Share-based payment expense before income taxes Income tax benefit Net share-based payment expense $ 2013 2 $ 32 23 57 (22) 35 $ 2012 2 $ 22 18 42 (16) 26 $ 2011 1 14 12 27 (10) 17 $ Stock Options... -

Page 63

...fair value of stock option grants has been estimated at the date of grant using the Black-Scholes option pricing model with the following weighted average assumptions: Expected dividend yield Risk-free interest rate Expected volatility Expected life, in years 2013 0.880% 0.77% 31.25% 3.96 2012 0.800... -

Page 64

... of Operations information for the fiscal years ended September 29, 2013 and September 30, 2012 (in millions, except per share amounts): First Quarter Fiscal Year 2013 Sales Cost of goods sold and occupancy costs Gross profit Direct store expenses General and administrative expenses Pre-opening... -

Page 65

... Foundation's mission is to empower the poor through microcredit, with a focus on developing-world communities that supply the Company's stores with product. Whole Kids Foundation is a nonprofit organization dedicated to improving children's nutrition through partnerships with schools, educators and... -

Page 66

... 29, 2013. The Company's independent registered public accounting firm, Ernst & Young LLP, audited the effectiveness of our internal control over financial reporting. Ernst & Young LLP has issued their attestation report which is included in "Item 8. Financial Statements and Supplementary Data" of... -

Page 67

... Company has adopted a Code of Business Conduct (the "Code") for all team members and directors pursuant to section 406 of the Sarbanes-Oxley Act. A copy of the Code is publicly available on our Whole Foods Market website at http:// www.wholefoodsmarket.com/sites/default/files/media/Global/Company... -

Page 68

... the Whole Foods Market 2007 Stock Incentive Plan (5) 2009 Stock Incentive Plan (2) 2007 Team Member Stock Purchase Plan (14) Form of Executive Retention Plan and Non-Compete Arrangement by and between the executive leadership team of the Registrant and the Registrant (12) Form of Director & Officer... -

Page 69

.... Filed as an exhibit to Registrant's Form 10-K for the period ended September 30, 2012 filed November 21, 2012 and incorporated herein by reference. Filed as Appendix B to Registrant's definitive Proxy Statement for the Annual Meeting of Stockholders held March 5, 2007 filed January 22, 2007 and... -

Page 70

... duly authorized. WHOLE FOODS MARKET, INC. Date: November 22, 2013 By: /s/ Glenda Flanagan Glenda Flanagan Executive Vice President and Chief Financial Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 71

..., Regional President, Northern California Region Whole Foods Market, Inc. 550 Bowie Street | Austin, TX 78703 | 512.542.0801 INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Ernst & Young LLP TRANSFER AGENT & REGISTRAR Information about stock certiï¬cates, change of address, ownership transfer or... -

Page 72

... We seek out and promote organically grown foods. Passion We are passionate about great tasting food and the pleasure of sharing it with others. Health & Well-being We provide food and nutritional products that support health and well-being. 2014 WHOLE FOODS MARKET IP, L.P. ALL RIGHTS RESERVED...