WellPoint 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 WellPoint annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Taking Great Strides

2001 Annual Report

Table of contents

-

Page 1

2001 Annual Report Taking Great Strides -

Page 2

Contents Financial Highlights ...1 To Our Shareholders...2 A Year of Growth, Change and Success ...7 Growing Our Enrollment ...8 Specialty Business: Moving Toward Total Beneï¬ts ...9 Reducing Our Administrative Costs ...10 Optimizing the Cost of Health Care ...11 Developing Our Associates ...12 ... -

Page 3

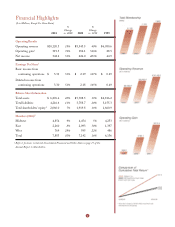

Financial Highlights ($ in Millions, Except Per Share Data) 2001 % Change vs. 2000 2000 % Change vs. 1999 1999 Operating Results Operating revenue Operating gain1 ... 486 6,136 to footnotes to Selected Consolidated Financial and Other Data on page 17 of this Annual Report to Shareholders. 1 -

Page 4

To Our Shareholders: October 30, 2001, was a milestone for Anthem as the "ATH" symbol moved across the New York Stock Exchange ticker for the ï¬rst time. The completion of our demutualization ... -

Page 5

... beneï¬ts industry continues to consolidate, and we remain focused on growing internally, as well as through acquisition. Membership growth was strong in 2001. We now serve 7.9 million members, a 10-percent increase over 2000 on a same-store basis. This growth is due to recognizing and meeting the... -

Page 6

... Assurance (NCQA) have received it. NCQA is the nation's most respected unanimously by the Kansas plan's board of directors in the fall of 2001, and approved by the policyholders in January 2002, the Kansas Insurance Commissioner chose to disapprove the transaction. On February 19, 2002, the Board... -

Page 7

care is an inherently local business and allows local managers to retain control over functions that touch customers directly. This consolidation strategy is unique in our industry. As a result, we believe Anthem is the most successful consolidator in the health beneï¬ts industry. To support our ... -

Page 8

to provide their employees with affordable health care beneï¬ts. As we look ahead to 2002, our mission remains ï¬rm: To improve the health of the people we serve. We believe we can achieve this mission, grow our business, provide customers with affordable beneï¬t programs and increase value to ... -

Page 9

Taking Great Strides: A year of growth, change and success In 2001, Anthem experienced growth, as our membership climbed to 7.9 million members; change, as we successfully completed our demutualization and became a publicly traded company; and success, as ... -

Page 10

Taking Great Strides: Growing our enrollment In 2001, new customers chose Anthem as their health plan and more than 90 percent of our existing customers renewed their Anthem plans. As a result, we increased ... -

Page 11

... entity to create a "one-stop" shop that makes our customers' employee beneï¬t purchases more efï¬cient and convenient. Specialty Business 2001 highlights: • Anthem Prescription Management, our pharmacy beneï¬t management company, now serves about 85 percent of all Anthem groups that have... -

Page 12

... major focus for Anthem. We were successful in containing these costs in 2001, even as we maintained strong growth and made progress on the integration of... propelled us from 444th to 159th in Information Week magazine's annual survey of the nation's largest, most innovative organizations. Information... -

Page 13

... the cost of quality health care for our members. We were pleased to be able to reduce slightly Anthem's consolidated beneï¬t expense ratio in 2001 compared to 2000, despite continued increases in the cost of care. While managing very broad provider networks - usually the broadest networks in our... -

Page 14

... advancement and training opportunities and to build trust, respect and camaraderie among all of our associates, at every level of the company. Again in 2001, we teamed with the Great Place to Work® Institute to survey our associates and gauge the success of our efforts. The results were dramatic... -

Page 15

... to simplifying administration and processes for physicians and their patients, to keeping health care affordable and to improving health care outcomes. In 2001, Anthem remained deeply involved in the work of the coalition. Anthem's President and CEO, Larry Glasscock, served as vice chairman and... -

Page 16

Taking Great Strides: Improving the health of our members • Our Ohio health plan sought and received NCQA accreditation with the "Excellent" designation for its combined HMO and Point of Service products, which serve more than 700,000 members. We received accreditation with the "Commendable" ... -

Page 17

...rmly rooted in the Blue Cross and Blue Shield tradition, and carries with it a commitment to customers and to the communities we serve. In 2001, Anthem and its foundations made donations of almost $5 million. Combined with thousands of volunteer hours, Anthem and its associates made a difference for... -

Page 18

... Sheets ...41 Consolidated Statements of Income...42 Consolidated Statements of Shareholders' Equity ...43 Consolidated Statements of Cash Flows ...44 Notes to Consolidated Financial Statements ...45 Report of Management ...65 Report of Independent Auditors ...65 16 -

Page 19

... revenue and premium equivalents Operating margin Members (000s)6 Midwest East West Total Balance Sheet Data Total assets Long term debt Total shareholders' equity7 1 2001 $10,120.3 10,444.7 342.2 342.2 $ 3.31 3.30 As of and for the Year Ended December 31 20001 19991, 2 1998 $ 8,543.5 8,771.0 226... -

Page 20

...Connecticut, New Hampshire, Maine, Colorado and Nevada. Our reportable segments are strategic business units delineated by geographic areas ... factors in the population as a whole. Our results in 1999, 2000 and 2001 were significantly impacted by the acquisitions of Blue Cross and Blue Shield of New ... -

Page 21

... gain consists of operating revenue less benefit expense and administrative expense. We sold our TRICARE operations on May 31, 2001. The results of our TRICARE operations are reported in our Other segment (for Anthem Alliance), and in our Midwest business segment, which assumed a portion of the... -

Page 22

... over the other two quarters. The following table presents our membership count by segment, customer type and funding arrangement as of December 31, 2001 and 2000. The membership data presented are unaudited and in certain instances include our estimates of the number of members represented by each... -

Page 23

... + Choice market in Colorado due to low membership in this market. Our Medicare + Choice membership in Colorado was 6,000 at December 31, 2001. Individual membership increased primarily due to new business resulting from higher sales of Individual (under age 65) products, particularly in our Midwest... -

Page 24

...our consolidated results of operations for the years ended December 31, 2001 and 2000: Change ($ in Millions) Operating revenue and premium ... enrollment services. The self-funded claims included for the year ended December 31, 2001 were $3,937.1 million and for the year ended December 31, 2000 were ... -

Page 25

... unit costs. Prescription drug cost increases for the year varied among regions and by product, but have generally averaged from 16% to 17% in 2001 over 2000. The cost increases resulted from the introduction of new, higher cost drugs and higher overall utilization as a result of increases in direct... -

Page 26

... and pressure to recover the costs of additional investments in new medical technology and facilities. Administrative expense increased $177.7 million, or 10%, in 2001, which includes the impacts of our acquisition of BCBS-ME and the sale of our TRICARE business. Excluding our acquisition of BCBS-ME... -

Page 27

...4,854 2000 $4,460.5 $ 87.8 2.0% 4,4541 % Change 14%0 84%0 120 bp 9%0 Excludes 128,000 TRICARE members Operating revenue increased $632.5 million, or 14%, in 2001 due primarily to premium rate increases and the effect of higher average membership in our Local Large Group, Small Group and Medicare... -

Page 28

... resulted in a 220 basis point increase in operating margin to 2.6% in 2001. Membership increased 174,000, or 29%, to 769,000, due to increased...in Colorado for the conversion of Sloan's Lake HMO business effective January 1, 2001. The terms of the agreement include payment to Sloan's Lake for each ... -

Page 29

... at APM. APM's operating revenue grew primarily due to increased mail order prescription volume and the implementation of APM's pharmacy benefit programs beginning in 2001 by BCBS-CO/NV and BCBS-ME, and in late 2000 by BCBS-NH. Mail service membership increased 28%, while retail service membership... -

Page 30

...We withdrew from the Medicare + Choice program in Connecticut effective January 1, 2001, due to losses in this line of business. At December 31, 2000...Midwest was in the old plans and 50% in the new plans. During 2001, we introduced a line of competitive Medicare Supplement policies in the Midwest to ... -

Page 31

Self-funded membership increased in 2000 primarily due to the increase in BlueCard membership, while fully insured membership grew primarily as a result of the growth in our Small Group membership sales. Our Midwest membership grew in 2000 primarily from the growth in BlueCard membership discussed ... -

Page 32

Premiums increased by $2,318.8 million, or 43%, to $7,737.3 million in 2000 primarily due to our acquisitions of BCBS-NH and BCBS-CO/NV in the fourth quarter of 1999 and BCBS-ME in June 2000. Excluding these acquisitions, premiums increased by $870.5 million, or 16%, primarily due to premium rate ... -

Page 33

Net investment income increased $49.6 million, or 33%, primarily due to higher rates of investment returns earned on our fixed income portfolio and higher portfolio balances. The higher portfolio balances included net cash resulting from acquisitions, net proceeds of $295.9 million from our surplus ... -

Page 34

Operating revenue increased $485.0 million, or 12%, in 2000 primarily due to premium rate increases in group (both Local Large Group and Small Group) and Medicare + Choice businesses, and the effect of higher average membership throughout the year. Medicare + Choice premium rates increased due to ... -

Page 35

West Our West segment is comprised of health benefit and related business for members in Colorado and Nevada, and it was established following our acquisition of BCBS-CO/NV on November 16, 1999. Results of this segment have been included in our consolidated results from that date forward. ... -

Page 36

... liabilities for the tax effect of temporary differences between financial reporting and tax reporting. A valuation allowance must be established for deferred tax assets... under Internal Revenue Code Section 833, at December 31, 2001, we have tax temporary differences of approximately $199.7 million... -

Page 37

... were issued in July 2001. FAS 141 requires business combinations completed after June 30, 2001, to be accounted for...reported separately from goodwill. Under FAS 142, goodwill and other intangible assets (with indefinite lives) will not be amortized but will be tested for impairment at least annually... -

Page 38

... used in investing activities was $498.1 million for the year ended December 31, 2001, and $761.1 million for the year ended December 31, 2000, a decrease ..., we will make quarterly contract fee payments on the purchase contracts at the annual rate of 0.05% of the stated amount of $50.00 per purchase ... -

Page 39

... in value is other than temporary. If any declines are determined to be other than temporary, we charge the losses to income. At December 31, 2001, we had gross unrealized gains of $90.4 million and gross unrealized losses of $18.4 million, none of which were deemed to be other than temporary... -

Page 40

... ordinary dividend. Credit Facilities and Commercial Paper On November 5, 2001, Anthem and Anthem Insurance entered into two new unsecured revolving ... general, under these laws, an insurance company must submit a report of its RBC level to the state insurance department or insurance commissioner... -

Page 41

...to manage interest rate risk. Our portfolio consists of corporate securities (approximately 36% of the total fixed income portfolio at December 31, 2001) which are subject to credit/default risk. In a declining economic environment, corporate yields will usually increase prompted by concern over the... -

Page 42

... million. No portion of our equity portfolio was invested in non-US dollar denominated investments as of December 31, 2001. As of December 31, 2001, we held no derivative financial or commodity-based instruments. This management's discussion and analysis contains certain forward-looking information... -

Page 43

...,000,000; shares issued and outstanding-none Common stock, par value $0.01, shares authorized-900,000,000; shares issued and outstanding: 2001, 103,295,675; 2000, none Additional paid in capital Retained earnings Accumulated other comprehensive income Total shareholders' equity Total liabilities and... -

Page 44

...Premiums Administrative fees Other revenue Total operating revenue Net investment income Net realized gains on investments Gain on sale of subsidiary operations 2001 2000 1999 $ 9,244.8 817.3 58.2 10,120.3 238.6 60.8 25.0 10,444.7 $7,737.3 755.6 50.6 8,543.5 201.6 25.9 - 8,771.0 $5,418.5 611.1 51... -

Page 45

... in the demutualization Cash payments to eligible statutory members in lieu of stock Balance at December 31, 2001 1 - - - - $- - - - $ - - - - $1,577.7 44.9 - - $124.8 - (88.5) 2.0 $1,702.5 44.9 (88.5) 2.0 (41.6) 1,660.9 226.0 36.8 (3.9) 258.9 1,919.8 - - - - - - - - - - - - 1,622.6 226... -

Page 46

... cash equivalents Cash and cash equivalents at beginnning of year Cash and cash equivalents at end of year See accompanying notes. 2001 2000 1999 $ 342.2 $ 226.0 $ 44.9 (60.8) (25.0) 120.5 71.4 - 3.1 (25.9) - 102.1 36.6 - 0.5 (37.5) - 61.8 23.0 6.0 0.2 8.1 (28.0) (16.7) 155.7 66.7 27.8 (43... -

Page 47

... securities are classified as "available-for-sale" securities and are reported at fair value. The Company has determined that all investments in...for uncollectible amounts of $23.2 and $32.3 at December 31, 2001 and 2000, respectively. Restricted Cash and Investments: Restricted cash and investments ... -

Page 48

...31, 2001 and 2000 was $90.8 and $58.4, respectively. The carrying value of goodwill and other intangible assets is reviewed annually to ... of acquired intangible assets that are required to be recognized and reported separately from goodwill. Under FAS 142, goodwill and certain other intangible... -

Page 49

...addition, Anthem will pay quarterly contract fee payments on the purchase contracts at the annual rate of 0.05% of the stated amount of $50.00 per purchase ... proceeds from the Units offering were approximately $219.8. In December 2001, proceeds from the common stock and Units offerings in the amount... -

Page 50

...) and resulted in $90.5 of goodwill and other intangible assets which are being amortized over periods ranging from ten to 20 years. In 2001, goodwill was reduced by $2.1 for purchase price allocation adjustments based on final valuation studies. This acquisition was accounted for as a purchase and... -

Page 51

... 3,048.2 463.1 $3,511.3 - (20.1) (13.0) (0.1) (35.7) (46.1) $ (81.8) The amortized cost and fair value of fixed maturity securities at December 31, 2001, by contractual maturity, are shown below. Expected maturities may be less than contractual maturities because the issuers of the securities may... -

Page 52

...488.8, $2,911.8 and $2,336.8, respectively. Gross gains of $164.3, $71.3 and $86.8 and gross losses of $103.5, $45.4 and $49.3 were realized in 2001, 2000 and 1999, respectively, on those sales. 6. Long Term Debt and Commitments Debt consists of the following at December 31: Surplus notes at 9.125... -

Page 53

... under the facilities, if the Indiana Insurance Commissioner approves Anthem Insurance's guarantee of Anthem's obligations under the facilities. Interest paid during 2001, 2000 and 1999 was $57.4, $49.9 and $28.2, respectively. Future maturities of debt are as follows: 2002, $0.3; 2003, $100.1; 2004... -

Page 54

... and ending balances for unpaid life, accident and health claims: 2001 Balances at January 1, net of reinsurance Business purchases (divestitures)...estimated liabilities as the claims are ultimately settled. Negative amounts reported for incurred related to prior years resulted from claims being ... -

Page 55

... thousand dollars of stock in any calendar year. The Company's 2001 Stock Incentive Plan (the "Stock Plan") provides for the granting...A summary of the activity in the Stock Plan for the period from January 1, 2001 to December 31, 2001 is as follows: Number of Options - 1,479,000 20,368 1,458,632 36... -

Page 56

...2001 Earnings per share - basic and diluted net income after demutualization and initial public offering Weighted average fair value of each option granted during the year As Reported... to 150% of annual base salary for each year of the three-year period. The LTIP expense for 2001, 2000 and 1999 ... -

Page 57

... valuation allowance was reduced accordingly. The net change in the valuation allowance for 2001, 2000 and 1999 totaled $(88.3), $190.5 and $(14.4), respectively. Deferred tax assets and liabilities reported with other current assets or liabilities and other noncurrent assets or liabilities on the... -

Page 58

... Change in pretax net unrealized gains on investments Less change in deferred taxes Less net realized gains on investments, net of income taxes (2001, $21.3; 2000, $8.0; 1999, $11.3), included in net income Change in net unrealized gains (losses) on investments 15. Leases The Company leases office... -

Page 59

...employees who have completed one year of continuous service and attained the age of twenty-one. The Company's plan, which beginning January 1, 2001, includes all affiliates except for Anthem Health Plans of New Hampshire, Inc., is a cash balance arrangement where participants have an account balance... -

Page 60

... (gain) loss Benefits paid Business combinations Benefit obligation at end of year The changes in plan assets were as follows: Pension Benefits 2001 2000 Fair value of plan assets at beginning of year Actual return on plan assets Employer contributions Benefits paid Business combinations Fair value... -

Page 61

... trend rate assumption can have a significant effect on the amounts reported. A one-percentagepoint change in assumed health care cost trend rates...Contributions made by the Company totaled $11.2, $10.3 and $8.7 during 2001, 2000 and 1999, respectively. 17. Contingencies Litigation: A number of ... -

Page 62

... court. The court later granted attorneys' fees of $0.8. An appeal of the verdict was filed by the defendants on November 19, 1999. On May 22, 2001, the Ohio Court of Appeals (Fifth District) affirmed the jury award of $1,350 (actual dollars) for breach of contract against CIC, affirmed the award of... -

Page 63

... Managed Care Support Program for military families from May 1, 1998 through May 31, 2001. There was no call on the guarantee for the period from May 1, 1998 ...of June 5, 2000. In addition to its three principal reportable geographic segments, the Company operates a Specialty segment, which includes... -

Page 64

... of segment operating management. The following tables present financial data by reportable segment for each of the years ended December 31, 2001, 2000 and 1999: Reportable Segments Midwest 2001 Operating revenue from external customers Intersegment revenues Operating gain (loss) Depreciation... -

Page 65

... income from continuing operations before income taxes and minority interest included in the consolidated statements of income for 2001, 2000 and 1999 is as follows: 2001 Reportable segments operating gain Net investment income Net realized gains on investments Gain on sale of subsidiary operations... -

Page 66

.... Shares may be repurchased in the open market and in negotiated transactions for a period of twelve months beginning February 6, 2002. On May 30, 2001, Anthem Insurance and Blue Cross and Blue Shield of Kansas ("BCBS-KS") signed a definitive agreement pursuant to which BCBS-KS would become a wholly... -

Page 67

... Company's consolidated financial statements included in this Annual Report. Our consolidated financial statements have been prepared...flows for each of the three years in the period ended December 31, 2001, in conformity with accounting principles generally accepted in the United States. Indianapolis... -

Page 68

Board of Directors L. Ben Lytle Chairman of the Board Anthem, Inc. Susan B. Bayh Distinguished Visiting Professor College of Business Administration Butler University Larry C. Glasscock President and Chief Executive Ofï¬cer Anthem, Inc. William B. Hart Chairman National Trust for Historic ... -

Page 69

Board Committees Audit Committee Victor S. Liss, Chairman George A. Schaefer, Jr., Vice Chairman Allan B. Hubbard James W. McDowell, Jr. B. LaRae Orullian Senator Donald W. Riegle, Jr. Compensation Committee William G. Mays, Chairman William J. Ryan, Vice Chairman Victor S. Liss B. LaRae Orullian ... -

Page 70

... Relations website at www.anthem.com. To request an annual report to shareholders, Form 10-K or additional information, please ...York Stock Exchange on October 30, 2001. The following table shows high and low sales prices for the company's common stock as reported on the New York Stock Exchange... -

Page 71

-

Page 72

120 Monument Circle Indianapolis, Indiana 46204 wwww.anthem.com 2320-AR-0402