WellPoint 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 WellPoint annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Anthem Insurance Companies, Inc.

Consolidated Financial Statements

as filed with Form S-1 on August 16, 2001

Years ended December 31, 2000, 1999 and 1998

with Report of Independent Auditors

Table of contents

-

Page 1

Anthem Insurance Companies, Inc. Consolidated Financial Statements as filed with Form S-1 on August 16, 2001 Years ended December 31, 2000, 1999 and 1998 with Report of Independent Auditors -

Page 2

Anthem Insurance Companies, Inc. Consolidated Financial Statements Years ended December 31, 2000, 1999 and 1998 Contents Report of Independent Auditors...1 Audited Consolidated Financial Statements: Consolidated Balance Sheets ...2 Consolidated Statements of Income ...3 Consolidated Statements of ... -

Page 3

Report of Independent Auditors Board of Directors Anthem Insurance Companies, Inc. We have audited the accompanying consolidated balance sheets of Anthem Insurance Companies, Inc. as of December 31, 2000 and 1999, and the related consolidated statements of income, policyholders' surplus and cash ... -

Page 4

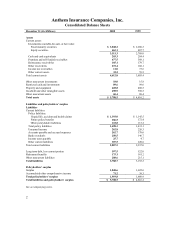

... Policyholders' surplus Surplus Accumulated other comprehensive income Total policyholders' surplus Total liabilities and policyholders' surplus See accompanying notes. 2000 1999 $ 3,048.2 463.1 3,511.3 203.3 477.5 105.1 272.4 11.0 32.2 4,612.8 18.0 89.6 428.8 498.9 60.4 $ 5,708.5 $ 2,280... -

Page 5

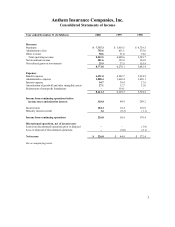

Anthem Insurance Companies, Inc. Consolidated Statements of Income Year ended December 31 (In Millions) 2000 1999 1998 Revenues Premiums Administrative fees Other revenue Total operating revenue Net investment income Net realized gains on investments $ 7,737.3 755.6 50.6 8,543.5 201.6 25.9 8,... -

Page 6

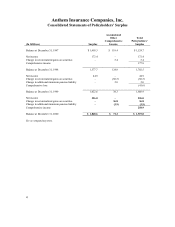

... Change in net unrealized gains on securities Change in additional minimum pension liability Comprehensive income Balance at December 31, 2000 See accompanying notes. Surplus $ 1,405.3 172.4 - Total Policyholders' Surplus $ 1,524.7 172.4 5.4 177.8 1,702.5 44.9 (88.5) 2.0 (41.6) 1,660.9 226.0 36... -

Page 7

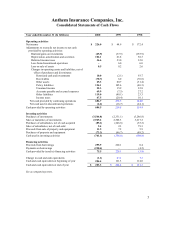

... and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year See accompanying notes. 2000 1999 1998 $ 226.0 $ 44.9 $ 172.4 (25.9) 102.1 36.6 - 0.5 (37.5) 61.8 23.0 6.0 0.2 (155.9) 58.3 32.0 6.0 2.6 10.0 (70.7) 25.3 124.1 22.3 69.9 119.0 47... -

Page 8

...have readily determinable fair values and all fixed maturity securities are reported at fair value. The Company has determined that all investments...uncollectible amounts of $33.4 and $29.4 as of December 31, 2000 and 1999, respectively. Restricted Cash and Investments: Restricted cash and investments... -

Page 9

...at December 31, 2000 and 1999 was $58.4 and $27.3, respectively. The carrying value of goodwill and other intangible assets is reviewed annually to determine if...: Liabilities for unpaid claims include estimated provisions for both reported and unreported claims incurred on an undiscounted basis. The ... -

Page 10

... net assets and results of operations have been included in the Company' s consolidated financial statements from the respective purchase dates. During 2000, purchase price allocations for these acquisitions were refined based on final valuation studies resulting in increases to goodwill and other... -

Page 11

Anthem Insurance Companies, Inc. Notes to Consolidated Financial Statements (continued) 2. Acquisitions, Divestitures and Discontinued Operations (continued) Unaudited pro forma results of operations assuming the 1999 acquisitions occurred on January 1, 1999 would have resulted in total revenues of ... -

Page 12

... reserve of $43.2 (net of income tax benefit of $23.3) which was reported as discontinued operations in 1997. Additionally, during 1998 the Company recognized a loss of...from discontinued operations prior to disposal in 1998 (none in 2000 or 1999), exclusive of the aforementioned provisions, were as ... -

Page 13

...781.6 944.1 1.5 2,280.3 487.7 $ 2,768.0 - 0.4 0.9 - 1.5 186.0 $ 187.5 The amortized cost and fair value of fixed maturity securities at December 31, 2000, by contractual maturity, are shown below. Expected maturities may be less than contractual maturities because the issuers of the securities may... -

Page 14

...Long Term Debt and Commitments Debt consists of the following at December 31: 2000 Surplus notes at 9.00% due 2027 Surplus notes at 9.125% due 2010...on minimum net worth, maximum consolidated debt, and maximum asset dispositions annually. Any payment of interest or principal on the surplus notes may ... -

Page 15

... all of the financial instruments. The carrying values and estimated fair values of certain financial instruments are as follows at December 31: 2000 Carrying Value Fixed maturity securities Equity securities Restricted investments Debt $ 3,048.2 463.1 42.7 597.7 Fair Value $ 3,048.2 463.1 42.7 562... -

Page 16

...and ending balances for unpaid life, accident and health claims: 2000 Balances at January 1, net of reinsurance Business combinations Incurred related ...estimated liabilities as the claims are ultimately settled. Negative amounts reported for incurred related to prior years resulted from claims being ... -

Page 17

Anthem Insurance Companies, Inc. Notes to Consolidated Financial Statements (continued) 9. Reinsurance (continued) 2000 Written Reportable segments: Midwest East West Specialty Other Total $ 4,240.4 2,753.0 571.1 123.7 76.3 $ 7,764.5 Earned $ 4,203.1 2,768.9 569.6 123.7 72.0 $ 7,737.3 Written $ 3,... -

Page 18

...increased its valuation allowance accordingly. The net change in the valuation allowance for 2000, 1999 and 1998 totaled $190.5, $(14.4) and $1.1, respectively. Deferred tax assets and liabilities reported with other current assets and other noncurrent assets on the accompanying consolidated balance... -

Page 19

... in pretax net unrealized gains on securities Less change in deferred taxes Less net realized gains on securities, net of income taxes (2000, $8.0; 1999, $11.3; 1998, $54.6), included in net income Change in net unrealized gains of discontinued operations Change in net unrealized gains on securities... -

Page 20

... their age and service when the credit was earned. A lump sum benefit is calculated for each participant based on this formula. Effective December 31, 2000, the RMHMS plan was frozen and its participants became participants of the Company' s plan on January 1, 2001. Anthem Health Plans of Maine, Inc... -

Page 21

... Financial Statements (continued) 13. Retirement Benefits (continued) The reconciliation of the benefit obligation for the years ended December 31 is as follows: Pension Benefits 2000 1999 $ 473.3 $ 471.8 27.3 36.6 (1.2) 35.4 50.8 (53.1) $ 567.6 26.6 31.4 - (47.9) 73.2 (84.8) $ 471.8 Other Benefits... -

Page 22

... trend rate used in measuring the other benefit obligations is generally 6% in 2000 and is assumed to decrease to 5% in 2001, and remain level thereafter... trend rate assumption can have a significant effect on the amounts reported. A one-percentagepoint change in assumed health care cost trend rates... -

Page 23

Anthem Insurance Companies, Inc. Notes to Consolidated Financial Statements (continued) 14. Contingencies Litigation: A number of managed care organizations have recently been sued in class action lawsuits asserting various causes of action under federal and state law. These lawsuits typically ... -

Page 24

...("the Health Care Risk"). Anthem has guaranteed Anthem Alliance' s assumption of the Health Care Risk, which is capped by the contract at $20.0 annually and $75.0 cumulatively over the five-year contract period. Anthem Alliance has subcontracts with two other Blue Cross and Blue Shield companies not... -

Page 25

... November 16, 1999. BCBS-ME is included in the East segment since its acquisition date of June 5, 2000. In addition to its three principal reportable geographic segments, the Company operates a Specialty segment which includes business units providing group life insurance benefits, pharmacy benefit... -

Page 26

... (continued) 15. Segment Information (continued) The following tables present operating gain (loss) by reportable segment for each of the years ended December 31, 2000, 1999 and 1998: Reportable Segments West Specialty $ 569.6 52.8 - 622.4 491.7 128.2 619.9 $ $ 2.5 - 8.7 $ $ 123.7 31.8 176.8 332... -

Page 27

... from continuing operations before income taxes and minority interest included in the consolidated statements of income for 2000, 1999 and 1998 is as follows: 2000 Reportable segments operating gain Net investment income Net realized gains on investments Interest expense Amortization of goodwill and... -

Page 28

...Information Statutory policyholders' surplus of Anthem amounted to $1,907.5 and $1,444.2 at December 31, 2000 and 1999, respectively. Statutory net income of Anthem was $91.7, $201.7 and $80.6 for 2000, 1999 and 1998, respectively. Surplus of insurance subsidiaries of Anthem is subject to regulatory...