Target 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TARGET CORPORATION

2012

report

annual

Table of contents

-

Page 1

annual report 2012 TARGET CORPORATION -

Page 2

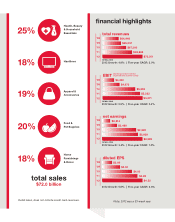

... '11 '12 2012 Growth: 2.4% | Five-year CAGR: 1.0% 18% $72.0 billion Home Furnishings & Décor diluted EPS '08 '09 '10 $2.86 $3.30 $4.00 $4.28 $4.52 2012 Growth: 5.6% | Five-year CAGR: 6.3% total sales Retail sales, does not include credit card revenues. '11 '12 Note: 2012 was a 53-week year. -

Page 3

... and hard work by our team, we've begun opening Target stores in Canada and are on track to open 124 stores across all 10 provinces by year end. In addition, we'll extend our new CityTarget urban format to additional locations in Los Angeles and San Francisco, and, for the ï¬rst time, to Portland... -

Page 4

... with conï¬dence, we introduced new price match and return policies and continued to offer additional savings with our REDcard Rewards. Through the work of Target team members around the globe, we believe we've charted a clear course for success in the years to come. 2 | TARGET 2012 ANNUAL REPORT -

Page 5

... added millions of new REDcard credit and debit accounts in the past year and strengthened our bond with these guests, driving greater shopping frequency and increased sales. And, to help all of our guests continue to shop at Target with conï¬dence, we recently extended our Price Match Guarantee to... -

Page 6

bringing value to our guests Watch design partner videos and more. Scan the code Expect More. Pay Less.-that's our promise to guests, each time they shop with us. How do we do it? We always stock more of what they need every day. We partner with emerging and established designers and recording ... -

Page 7

... to life on our shelves and online through special collections. Inï¬,uential and well-respected interior designer, author and TV personality Nate Berkus added "Target design partner" to his ever-growing resume with an exclusive line of home décor. And just in time for the busy holiday season... -

Page 8

...energy and sense of fun our guests feel around our brand doesn't happen by accident. Behind every product and guest experience are more than 361,000 talented and dedicated team members collaborating across our stores, distribution centers and headquarters facilities around the world. To make sure we... -

Page 9

... and programs are designed to help team members balance ï¬ve key well-being elements that make life and work meaningful: physical health, ï¬nancial security, social relationships, career engagement and community involvement. From comprehensive, quality health care coverage and one of the best 401... -

Page 10

... equal strong business Learn how we're helping communities. Scan the code Each year, we give 5 percent of our proï¬t toward building strong, healthy and safe communities, and in 2012 we proudly reached a new company milestone: Our giving now totals more than $4 million a week. Those dollars... -

Page 11

... to communities every week our goals and progress June 2012 marked a full year since we set our ï¬rst public-facing corporate responsibility goals in the areas of education, environment, team member well-being and volunteerism. In our annual Corporate Responsibility Report, we shared our progress... -

Page 12

...-end store count and square footage by state SALES PER CAPITA NO. OF STORES RETAIL Sq. FT. (THOuSANDS) Over $300 California Colorado Iowa Maryland Minnesota North Dakota GROUP TOTAL 257 40 22 37 75 4 435 34,051 6,080 3,015 4,802 10,777 554 59,279 $201- $300 Arizona Connecticut Delaware Florida... -

Page 13

...Vermont West Virginia Wyoming GROUP TOTAL 9 6 6 6 2 29 1,165 664 743 755 187 3,514 total stores: 1,778 total sq. feet: 237,847 in thousands Learn more about our store formats Scan the code Sales per capita is defined as sales by state divided by state population. TARGET 2012 ANNUAL REPORT | 11 -

Page 14

... and increases to operations and marketing expenses within the U.S. Credit Card Segment. Thirteen-month average retail square feet. In 2012, revenues per square foot were calculated with 52 weeks of revenues (the 53rd week of revenues was excluded) because management believes that these numbers... -

Page 15

...the closing price of $61.52 per share of Common Stock as reported on the New York Stock Exchange Composite Index. Indicate the number of shares outstanding of each of registrant's classes of Common Stock, as of the latest practicable date. Total shares of Common Stock, par value $0.0833, outstanding... -

Page 16

This page has been left blank intentionally -

Page 17

... Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accountant Fees and Services 66 66 66 66 66 PA R T I I I Exhibits and Financial Statement Schedules... -

Page 18

... investing in future growth. Our business is designed to enable guests to purchase products seamlessly in stores, online or through their mobile device. Our U.S. Credit Card Segment offers credit to qualified guests through our branded proprietary credit cards: the Target Credit Card and the Target... -

Page 19

... design and creative partnerships. We also generate revenue from in-store amenities such as Target Caf´ e, Target Clinic, Target Pharmacy and Target Photo, and leased or licensed departments such as Target Optical, Pizza Hut, Portrait Studio and Starbucks. Percentage of Sales 2012 2011 2010... -

Page 20

...or part-time status, compensation level, date of hire and/or length of service. These company-paid benefits include a pension plan, 401(k) plan, medical and dental plans, a retiree medical plan, disability insurance, paid vacation, tuition reimbursement, various team member assistance programs, life... -

Page 21

... our guests prefer to shop at Target and our team members choose Target as a place of employment is the reputation we have built over many years for serving our four primary constituencies: guests, team members, the communities in which we operate and shareholders. To be successful in the future, we... -

Page 22

..., collective bargaining efforts, health care and other benefit costs and changing demographics. If we are unable to attract and retain adequate numbers of qualified team members, our operations, guest service levels and support functions could suffer. Those factors, together with increasing wage and... -

Page 23

...our expected new store sites is located in fully developed markets, which is generally a more time-consuming and expensive undertaking than expansion into undeveloped suburban and ex-urban markets. Interruptions in our supply chain or increased commodity prices and supply chain costs could adversely... -

Page 24

... system to fund our operations and growth plans. In particular, we have historically relied on the public debt markets to raise capital for new store development and other capital expenditures and the commercial paper market and bank credit facilities to fund seasonal needs for working capital... -

Page 25

... of the United States. Our ability to successfully open the expected number of Canadian Target stores on schedule depends, in large measure, upon our ability to remodel existing assets, build our supply chain capabilities and technology systems and recruit, hire and retain qualified team members. In... -

Page 26

...announced plans to open 124 stores in Canada in 2013, with locations in each province. We also own 3 distribution centers in Canada, with a total of 3,963 thousand square feet. We own our corporate headquarters buildings located in Minneapolis, Minnesota, and we lease and own additional office space... -

Page 27

... Financial Officer since April 2012. Senior Vice President, Treasury, Accounting and Operations from February 2010 to April 2012. Vice President, Pay and Benefits from February 2007 to February 2010. Executive Vice President, Stores since January 2011. Senior Vice President, New Business Development... -

Page 28

...preferred stock, par value $0.01. At March 15, 2013, there were 16,412 shareholders of record. Dividends declared per share and the high and low closing common stock price for each fiscal quarter during 2012 and 2011 are disclosed in Note 30 of the Notes to Consolidated Financial Statements included... -

Page 29

...com. The change in peer groups was made to be consistent with the retail peer group used for our definitive Proxy Statement to be filed on or about April 29, 2013. Both peer groups are weighted by the market capitalization of each component company. The graph assumes the investment of $100 in Target... -

Page 30

...: Total revenues Net earnings Per Share: Basic earnings per share Diluted earnings per share Cash dividends declared per share Financial Position: Total assets Long-term debt, including current portion (a) Consisted of 53 weeks. 2012 (a) $73,301 2,999 As of or for the Year Ended 2011 2010 2009... -

Page 31

... share repurchase program. Following this sale, TD will underwrite, fund and own Target Credit Card and Target Visa receivables in the U.S. TD will control risk management policies and oversee regulatory compliance, and we will perform account servicing and primary marketing functions. We will earn... -

Page 32

.... Refer to Note 2 of the Notes to Consolidated Financial Statements for a definition of gift card breakage. Sales growth in 2012 and 2011 resulted from higher comparable-store sales and the contribution from new stores, with 2012 also benefitting by 1.7 percentage points from the additional week... -

Page 33

...(Target Credit Cards). Additionally, we offer a branded proprietary Target Debit Card. Collectively, we refer to these products as REDcardsá"¼. Since October 2010, guests receive a 5-percent discount on virtually all purchases at checkout, every day, when they use a REDcard. In November 2011, guests... -

Page 34

... total square feet less office, distribution center and vacant space. U.S. Credit Card Segment Credit is offered to qualified guests through the Target Credit Cards, which support our core retail operations and are important contributors to our overall profitability and engagement with our guests... -

Page 35

...by credit card receivables. (d) ROIC is return on invested capital. This rate equals our segment profit divided by average credit card receivables, at par, funded by Target, expressed as an annualized rate. (e) As a percentage of average credit card receivables, at par. For 2012, the additional week... -

Page 36

...accounts is eliminated in consolidation to present the receivables at the lower of cost (par) or fair value. On a consolidated basis, net write-offs are reported within credit card expenses in our Consolidated Statements of Operations. In 2012 and 2011, segment revenues decreased from the prior year... -

Page 37

... also have open tender offers to use up to an aggregate of $1.2 billion of cash proceeds from the sale to repurchase outstanding debt, which will impact interest expense in 2013. Net interest expense was $866 million for 2011, increasing 14.4 percent, or $109 million from 2010. This increase was due... -

Page 38

... U.S. Credit Card Segment bad debt expense and net write-offs for the fourth quarter of 2012. (d) Taxes are allocated to our business segments based on income tax rates applicable to the operations of the segment for the period. (e) For 2012, 2011 and 2010, average diluted shares outstanding were... -

Page 39

...2012, we reached an agreement to sell our entire consumer credit card portfolio to TD Bank Group (TD). On March 13, 2013, we completed the sale to TD for cash consideration of $5.7 billion, equal to the gross (par) value of the outstanding receivables at the time of closing. Concurrent with the sale... -

Page 40

... at year-end Weighted average interest rate 2012 $ 970 120 970 0.16% 2011 $1,211 244 - 0.11% 2010 $- - - -% We have additional liquidity through a committed $2.25 billion revolving credit facility obtained in October 2011 and expiring in October 2017. No balances were outstanding at any time... -

Page 41

...129 Capital Expenditures (a) (millions) New stores Store remodels and expansions Information technology, distribution and other Total (a) See Note 29 to our Consolidated Financial Statements for capital expenditures by segment. The decrease in capital expenditures in 2012 from the prior year was... -

Page 42

... to acquire inventory, freight costs incurred in connection with the delivery of product to our distribution centers and stores, and import costs, reduced by vendor income and cash discounts. The majority of our distribution center operating costs, including compensation and benefits, are expensed... -

Page 43

..., risk scores, aging trends and industry risk trends. Accounts were automatically written off when they became 180 days past due. Management believes the allowance for doubtful accounts was appropriate to cover anticipated losses in our credit card accounts receivable; however, unexpected... -

Page 44

...team members' full-time or part-time status, date of hire and/or length of service. The benefit obligation and related expense for these plans are determined based on actuarial calculations using assumptions about the expected long-term rate of return, the discount rate and compensation growth rates... -

Page 45

... Segment, the timing and amount of future capital investments in Canada and our subsequent financial performance; on a consolidated basis, statements regarding the adequacy of and costs associated with our sources of liquidity, the fair value of our consumer credit card receivables, the pending sale... -

Page 46

...this risk as we commence Canadian operations during 2013. During 2012 and 2011, gains and losses due to fluctuations in exchange rates were not significant as all stores were located in the United States, and the vast majority of imported merchandise was purchased in U.S. dollars. There have been no... -

Page 47

... Public Accounting Firm on Consolidated Financial Statements The Board of Directors and Shareholders Target Corporation We have audited the accompanying consolidated statements of financial position of Target Corporation and subsidiaries (the Corporation) as of February 2, 2013 and January 28, 2012... -

Page 48

...effective internal control over financial reporting as of February 2, 2013, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated statements of financial position of Target Corporation and... -

Page 49

Consolidated Statements of Operations (millions, except per share data) Sales Credit card revenues Total revenues Cost of sales Selling, general and administrative expenses Credit card expenses Depreciation and amortization Gain on receivables held for sale Earnings before interest expense and ... -

Page 50

... adjustment and cash flow hedges, net of provision/(benefit) for taxes of $8, $(11) and $3 Other comprehensive income/(loss) Comprehensive income See accompanying Notes to Consolidated Financial Statements. 2012 $ 2,999 2011 $ 2,929 2010 $ 2,920 92 13 105 $ 3,104 (83) (4) (17) 4 (100... -

Page 51

... debt collateralized by credit card receivables Deferred income taxes Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss Pension and other benefit liabilities Currency... -

Page 52

...Net earnings Reconciliation to cash flow Depreciation and amortization Share-based compensation expense Deferred income taxes Bad debt expense (a) Gain on receivables held for sale Noncash (gains)/losses and other, net Changes in operating accounts: Accounts receivable originated at Target Inventory... -

Page 53

..., 2012 Net earnings Other comprehensive income Dividends declared Repurchase of stock Stock options and awards February 2, 2013 PA R T I I Dividends declared per share were $1.38, $1.15 and $0.92 in 2012, 2011 and 2010, respectively. See accompanying Notes to Consolidated Financial Statements. 37 -

Page 54

... Fiscal 2013 will end February 1, 2014, and will consist of 52 weeks. Accounting policies Statements. 2. Revenues Our retail stores generally record revenue at the point of sale. Sales from our online and mobile applications include shipping revenue and are recorded upon delivery to the guest. Total... -

Page 55

... all purchases at checkout every day when they use a REDcard. In November 2011, guests also began to receive free shipping at Target.com when they use their REDcard. The discounts associated with loyalty programs are included as reductions in sales in our Consolidated Statements of Operations and... -

Page 56

...perform account servicing and primary marketing functions. We will earn a substantial portion of the profits generated by the Target Credit Card and Target Visa portfolios. This transaction will be accounted for as a sale, and the receivables will no longer be reported on our Consolidated Statements... -

Page 57

... a U.S. Credit Card Segment. Income from the profitsharing arrangement, net of account servicing expenses, will be recognized as an offset to SG&A expenses. 8. Canadian Leasehold Acquisition During 2011, we purchased the leasehold interests in 189 sites operated by Zellers in Canada, in exchange for... -

Page 58

...-profit model using Level 3 inputs, including the forecasted performance of the portfolio and a market-based discount rate. We used internal data to forecast expected payment patterns and write-offs, revenue, and operating expenses (credit EBIT yield) related to the credit card portfolio. Changes... -

Page 59

... accounts in an amount equal to the anticipated future write-offs of existing receivables and uncollectible finance charges and other credit-related fees. We estimated future write-offs on the entire credit card portfolio collectively based on historical experience of delinquencies, risk scores... -

Page 60

... 699 FICO score below 600 Total nondelinquent accounts Delinquent accounts (30+ days past due) Credit card receivables, at par Lower of cost or fair value adjustment Allowance for doubtful accounts Credit card receivables, net Funding for Credit Card Receivables As a method of providing funding for... -

Page 61

...distribution center operating costs, including compensation and benefits, are expensed in the period incurred. Inventory is also reduced for estimated losses related to shrink and markdowns. The LIFO provision is calculated based on inventory levels, markup rates and internally measured retail price... -

Page 62

... Deferred taxes Interest rate swaps (b) Other Total February 2, 2013 $ 269 224 206 85 338 $1,122 January 28, 2012 $ 371 242 56 114 249 $1,032 (a) Company-owned life insurance policies on approximately 4,000 team members who have been designated highly compensated under the Internal Revenue Code and... -

Page 63

... Liabilities (millions) Wages and benefits Real estate, sales and other taxes payable Gift card liability (a) Project costs accrual Income tax payable Straight-line rent accrual (b) Dividends payable Workers' compensation and general liability (c) Interest payable Other Total February 2, 2013 $ 938... -

Page 64

...year Amount outstanding at year-end Weighted average interest rate 2012 2011 2010 $ 970 $1,211 $- 120 244 - 970 - - 0.16% 0.11% -% In October 2011, we entered into a five-year $2.25 billion revolving credit facility that expires in October 2017. No balances were outstanding at any time during 2012... -

Page 65

...Statements of Financial Position. As of February 2, 2013 and January 28, 2012, one swap was designated as a fair value hedge for accounting purposes, and no ineffectiveness was recognized in 2012 or 2011. Outstanding Interest Rate Swap Summary (dollars in millions) Weighted average rate: Pay Receive... -

Page 66

... interest rate swaps that will be amortized into earnings over the remaining lives of the underlying debt totaled $75 million, $111 million and $152 million, at the end of 2012, 2011 and 2010, respectively. 22. Leases We lease certain retail locations, warehouses, distribution centers, office space... -

Page 67

... Minimum Lease Payments (millions) 2013 2014 2015 2016 2017 After 2017 Total future minimum lease payments Less: Interest (c) Present value of future minimum capital lease payments (d) Operating Leases (a) $ 179 174 169 158 154 3,195 $4,029 Capital Leases (b) Rent Income Total $ 136 $ (11) $ 304... -

Page 68

...assets: Accrued and deferred compensation Allowance for doubtful accounts and lower of cost or fair value adjustment on credit card receivables held for sale Accruals and reserves not currently deductible Self-insured benefits Foreign operating loss carryforward Other Total gross deferred tax assets... -

Page 69

... a $10 billion share repurchase program that was authorized by our Board of Directors in November 2007. Share Repurchases (millions, except per share data) Total number of shares purchased Average price paid per share Total investment 2012 32.2 $58.96 $1,900 2011 37.2 $50.89 $1,894 2010 47.8 $52... -

Page 70

... (millions) Total number of shares purchased Total cash investment Aggregate market value (b) 2012 0.5 $25 $29 2011 1.0 $52 $52 2010 1.1 $56 $61 (a) These contracts are among the investment vehicles used to reduce our economic exposure related to our nonqualified deferred compensation plans. The... -

Page 71

... average remaining life of all outstanding options is 6.6 years. The total fair value of options vested was $68 million, $75 million and $87 million in 2012, 2011 and 2010, respectively. Performance Share Units We have issued performance share units to certain team members annually since January... -

Page 72

... in a defined contribution 401(k) plan by investing up to 80 percent of their compensation, as limited by statute or regulation. Generally, we match 100 percent of each team member's contribution up to 5 percent of total compensation. Company match contributions are made to funds designated by the... -

Page 73

... and life-insurance proceeds received from company-owned life insurance policies and other investments used to economically hedge the cost of these plans. 28. Pension and Postretirement Health Care Plans We have qualified defined benefit pension plans covering team members who meet age and service... -

Page 74

... for the years ended February 2, 2013 and January 28, 2012, related to our pension and postretirement health care plans: Change in Accumulated Other Comprehensive Income (millions) January 29, 2011 Net actuarial loss Amortization of net actuarial Amortization of prior service January 28, 2012 Net... -

Page 75

...net pension and postretirement health care benefits expense for the years 2012, 2011 and 2010: Net Pension and Postretirement Health Care Benefits Expense (millions) Service cost benefits earned during the period Interest cost on projected benefit obligation Expected return on assets Amortization of... -

Page 76

...-term rate of return on an annual basis, and revise it as appropriate. Additionally, we monitor the mix of investments in our portfolio to ensure alignment with our long-term strategy to manage pension cost and reduce volatility in our assets. An increase in the cost of covered health care benefits... -

Page 77

... 2012 Private equity funds Other Actual Return on Plan Assets (a) Relating to Relating to Assets Still Held Assets Sold at the Reporting During the Date Period $ (6) 9 $17 4 $26 - $25 - Purchases, Sales and Settlements $(64) (21) $(89) 3 Transfer in and/or out of Level 3 $- - $- - Balance at End... -

Page 78

... the investment vehicles is based on the value of the underlying assets owned by the fund minus applicable costs and liabilities, and then divided by the number of shares outstanding. Valued at the closing price reported on the major market on which the individual securities are traded. Valued using... -

Page 79

... of profit is used by management to evaluate the return on our investment and to make operating decisions. Business Segment Results U.S. Retail $71,960 50,568 - 2012 (a) U.S. Credit U.S. Card Canadian Total Retail $1,341 $ - $73,301 $68,466 - - 50,568 47,860 196 - 196 - 2011 U.S. Credit U.S. Card... -

Page 80

... of our business, fourth quarter operating results typically represent a substantially larger share of total year revenues and earnings because they include our peak sales period from Thanksgiving through the end of December. We follow the same accounting policies for preparing quarterly and annual... -

Page 81

... filed under the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure. There were no changes in our internal... -

Page 82

...About the Board of Directors and Corporate Governance-Director Independence, of Target's Proxy Statement to be filed on or about April 29, 2013, are incorporated herein by reference. Item 14. Principal Accountant Fees and Services Audit and Non-Audit Fees, of Target's Proxy Statement to be filed on... -

Page 83

...Statements of Shareholders' Investment for the Years Ended February 2, 2013, January 28, 2012 and January 29, 2011 Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm on Consolidated Financial Statements Financial Statement Schedules For the Years Ended... -

Page 84

...Target Corporation Executive Excess Long Term Disability Plan (21) Director Retirement Program (22) Target Corporation Deferred Compensation Trust Agreement (as amended and restated effective January 1, 2009) (23) Five-Year Credit Agreement dated as of October 14, 2011 among Target Corporation, Bank... -

Page 85

... N, Annex A and Exhibits A-1 through C-2 referred to in the agreement and First Amendment, which Target Corporation agrees to furnish supplementally to the Securities and Exchange Commission upon request. * Management contract or compensation plan or arrangement required to be filed as an exhibit to... -

Page 86

..., thereunto duly authorized. TARGET CORPORATION By: 11MAR201319003653 Dated: March 20, 2013 John J. Mulligan Executive Vice President, Chief Financial Officer and Chief Accounting Officer Pursuant to the requirements of the Securities Exchange Act of 1934, the report has been signed below... -

Page 87

... of cost (par) or fair value. As a result, we no longer reported an allowance for doubtful accounts in our Consolidated Statements of Financial Position. (b) These amounts represent the gross margin effect of sales returns during the respective years. Expected merchandise returns after year-end for... -

Page 88

... 8, 2011) Target Corporation Officer EDCP (2012 Plan Statement) (as amended and restated effective June 5, 2012) Amended and Restated Deferred Compensation Plan Directors Incorporated by Reference Incorporated by Reference Incorporated by Reference Incorporated by Reference Filed Electronically... -

Page 89

... Policy Statement (as amended and restated effective June 8, 2011) Target Corporation Executive Excess Long Term Disability Plan Director Retirement Program Target Corporation Deferred Compensation Trust Agreement (as amended and restated effective January 1, 2009) Five-Year Credit Agreement... -

Page 90

... of rental expense Total fixed charges Earnings from continuing operations before income taxes and fixed charges Ratio of earnings to fixed charges February 2, 2013 $4,609 (12) 4,597 799 111 910 January 28, 2012 $4,456 5 4,461 797 111 908 Fiscal Year Ended January 29, January 30, 2011 2010 $4,495... -

Page 91

-

Page 92

... and Board of Director Committee Position Descriptions, are also available on the Internet at Target.com/investors. TRuSTEE, EMPLOYEE SAvINGS 401(K) AND PENSION PLANS STOCK ExCHANGE LISTINGS SHAREHOLDER ASSISTANCE State Street Bank and Trust Company Trading Symbol: TGT New York Stock Exchange For... -

Page 93

... Services Retiring 3/31/13 Gregg W. Steinhafel Chairman, President and Chief Executive Officer Kathryn A. Tesija Executive Vice President, Merchandising and Supply Chain Laysha L. Ward President, Community Relations and Target Foundation (1) Audit Committee (2) Compensation Committee (3) Corporate... -

Page 94

Get the 2012 Annual Report with expanded content. Scan this code. Need a scanner? Download the Target app. Or visit Target.com/annualreport 1000 Nicollet Mall · Minneapolis, MN 55403 · 612.304.6073 · Target.com