Sun Life 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Sun Life annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROW 2012 ANNUAL REPORT

Table of contents

-

Page 1

GROW 2012 ANNUAL REPORT -

Page 2

... Financial Statements Sources of Earnings Board of Directors and Executive Team Subsidiary and affiliate companies Major offices Corporate and shareholder information 164 166 167 170 173 Grow our asset management business globally Grow Asia to become a more significant part of Sun Life... -

Page 3

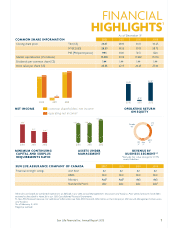

...2012 2010 2011 2012 MINIMUM CONTINUING CAPITAL AND SURPLUS REQUIREMENTS RATIO ASSETS UNDER MANAGEMENT REVENUE BY BUSINESS SEGMENT * 2 *Excludes fair value change for FVTPL assets/liabilities. UK Asia 5% 7% U.S. 34% MFS 11% SUN LIFE ASSURANCE COMPANY OF CANADA Financial strength ratings... -

Page 4

... V MONTREAL PARIS TO O TORONTO B BOSTON MADRID HONG KONG VIETNAM HONG KONG T TOKYO UNITED STATES PHOENIX P INDIA DUBAI MEXICO CITY BERMUDA MALAYSIA* S SINGAPORE PHILIPPINES Sun Life Financial ar ound the world MFS Investment Management At February 2013 SÃO PAULO SYDNEY INDONESIA BUENOS... -

Page 5

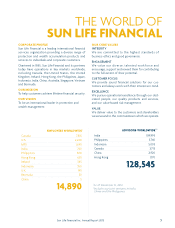

... accumulation products and services to individuals and corporate customers. Chartered in 1865, Sun Life Financial and its partners today have operations in key markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India... -

Page 6

... two services to customers. We provide funds at times of difficulty to cover critical expenses, and we invest our customers' savings productively. In November your Board had the opportunity to experience first-hand one aspect of our customer experience when we visited our Waterloo call centre. We... -

Page 7

..., hard work and enthusiasm we are increasingly well positioned to take advantage of extraordinary growth opportunities globally - making life brighter under the sun for all our customers and shareholders. JAMES H. SUTCLIFFE CHAIRMAN OF THE BOARD Sun Life Financial Inc. Annual Report 2012 5 -

Page 8

... 2012, with service enhancements across all of our businesses. Doing a superb job for customers is a prerequisite to achieving our key financial goals: driving profitable growth, improving Return on Equity, and reducing the volatility in our results. To accomplish these goals requires that we change... -

Page 9

...paper cheques to pay health and dental claims in Canada. By increasing the use of direct bank deposit, we were able to reduce that to seven million last year, and next year our target is four million. Customers, shareholders and the environment all win. Sun Life Financial Inc. Annual Report 2012 7 -

Page 10

8 -

Page 11

... Requirements ratio closing the year at 209% for Sun Life Assurance. Management acted throughout 2012 to improve both our risk profile and risk governance. Early in the year we discontinued sales of U.S. individual life insurance and annuities. In Canada, we de-emphasized capital-intensive products... -

Page 12

BECOME THE BEST PERFORMING LIFE INSURER IN CANADA 10 -

Page 13

... our business, Sun Life Global Investments - our new mutual fund company launched in 2010 - achieved more than $2 billion of sales and reached over $6 billion of client managed AUM. In Group Benefits and Group Retirement Services, we are providing more personalized solutions to plan members, whether... -

Page 14

..., disability, dental and other products, creating opportunities along the way. Our Bermuda-based high net worth business is part of our U.S. reporting segment. This business has good growth prospects, offering distinctive insurance and investment products to high net worth clients around the world... -

Page 15

... directly to asset growth, with record gross sales in 2012 and strength in both retail and institutional sales. MFS continues to gather assets and remains a leader in the management of sovereign wealth funds. The MFS global investment research platform provides a real competitive advantage, and MFS... -

Page 16

... workplace marketing. Indonesia is the fourth most populous country in the world. We made good progress growing our agency force in 2012, closing the year with over 5,000 agents. Our bancassurance business PT CIMB Sun Life, is one of the fastest growing life insurance companies in the country, aided... -

Page 17

...of our customers and drives insights that will ensure we establish and maintain the high water mark for global customer service. 1 Net Promoter, NPS, and Net Promoter Score are trademarks of Satmetrix Systems, Inc., Bain & Company, and Fred Reichheld. Sun Life Financial Inc. Annual Report 2012 15 -

Page 18

...FUTURE AHEAD IN RESHAPING SUN LIFE, WE HAVE BEEN CAREFUL TO REFLECT - AND PROTECT - OUR VISION AND OUR VALUES. WE REMAIN FULLY COMMITTED TO BUILDING A BRIGHTER FUTURE FOR THE COMMUNITIES IN WHICH WE LIVE AND WORK. AROUND THE WORLD WE ACT ON THAT COMMITMENT BY MAKING A POSITIVE CONTRIBUTION TO SOCIAL... -

Page 19

... Governance Structure and Accountabilities Risk Management Policies Risk Categories CAPITAL and LIQUIDITY MANAGEMENT Principal Sources and Uses of Funds Liquidity Capital Shareholder Dividends Capital Adequacy Financial Strength Ratings Off-Balance Sheet Arrangements Commitments, Guarantees... -

Page 20

... Available-for-sale Annual Information Form Administrative Services Only Assets Under Management Business In-force Company Action Level Chief Executive Officer Chief Financial Officer Cash Generating Unit Dynamic Capital Adequacy Testing Employee Benefits Group Earnings Per Share Fair Value Through... -

Page 21

... to product design and pricing; the performance of equity markets; risks in implementing business strategies; risk management; market conditions that affect the Company's capital position or its ability to raise capital; risks related to the sale of our U.S. Annuity Business; downgrades in financial... -

Page 22

...our segregated fund, universal life and critical illness insurance product portfolios, and the launch of Sunflex Retirement Income, an innovative new payout annuity product. • The Sun Life Financial Career Sales Force grew by 119 advisors in the year to a total count of 3,713 advisors and managers... -

Page 23

... of total sales in PT Sun Life Financial Indonesia in 2011 to 17% in 2012. • In India, Birla Sun Life Asset Management Company Limited was recognized as the 2012 "Debt Mutual Fund House of the Year" by Credit Rating and Information Services of India Limited. • In China, Sun Life Everbright Asset... -

Page 24

... investment and risk management solutions. We believe that global asset management companies, with their greater scale and diversity, have opportunity to benefit most. Financial Objectives At our March 8, 2012 Investor Day, we announced that our financial objectives include annual operating income... -

Page 25

...EPS (basic) Return on equity (%) Operating ROE(2) Reported ROE Dividends per common share Dividend payout ratio Dividend yield MCCSR ratio (Sun Life Assurance) Continuing Operations Net income (loss) Operating net income (loss) from Continuing Operations(2) Reported net income (loss) from Continuing... -

Page 26

... net impact of market factors, are non-IFRS financial measures. Operating net income (loss) excludes: (i) the impact of certain hedges in SLF Canada that do not qualify for hedge accounting; (ii) fair value adjustments on share-based payment awards at MFS; (iii) restructuring and other related costs... -

Page 27

... from revenue the impact of: (i) currency; (ii) fair value changes in FVTPL assets and liabilities; (iii) reinsurance for the insured business in SLF Canada's GB operations; and (iv) net premiums from Life and Investment Products in SLF U.S. that closed to new sales effective December 30, 2011. This... -

Page 28

...the sale of 100% of the shares of Sun Life (U.S.), which includes the U.S. domestic variable annuity, fixed annuity and fixed indexed annuity products, corporate and bank-owned life insurance products and variable life insurance products. This transaction will include the transfer of certain related... -

Page 29

... hedge accounting in SLF Canada Fair value adjustments on share-based payment awards at MFS Restructuring and other related costs Goodwill and intangible asset impairment charges Operating net income Equity market impact Net impact from equity market changes Net basis risk impact Net equity market... -

Page 30

... on life and health insurance policies and fixed annuity products, net of premiums ceded to reinsurers; (ii) net investment income comprised of income earned on general fund assets, realized gains and losses on AFS assets and changes in the value of derivative instruments and assets designated as... -

Page 31

... Represents a non-IFRS financial measure that excludes the impact of fair value changes in FVTPL assets and liabilities, currency, reinsurance for the insured business in SLF Canada's GB operations and net premiums from Life and Investment Products in SLF U.S. that were closed to new sales effective... -

Page 32

... the Canadian dollar relative to average exchange rates in 2011 increased net premiums by $48 million. Segregated fund deposits were $6.9 billion in 2012, compared to $7.5 billion in 2011. The decrease was largely attributable to reduced sales in Canada. Sales of mutual funds and managed funds were... -

Page 33

...Accounting and Control Matters - Critical Accounting Policies and Estimates and in Note 11 in our 2012 Consolidated Financial Statements. Impact of the Low Interest Rate Environment Sun Life Financial's overall business and financial operations are affected by the global economic and capital market... -

Page 34

... for hedge accounting Fair value adjustments on share-based payment awards Restructuring and other related costs Goodwill and intangible asset impairment charges Reported net income (loss) from Continuing Operations Reported net Income (loss) (1) Represents a non-IFRS financial measure. See Use of... -

Page 35

... accounting in SLF Canada Fair value adjustments on share-based payment awards at MFS Restructuring and other related costs Goodwill & intangible asset impairment charges Operating net income Equity market impact Net impact from equity market changes Net basis risk impact Net equity market impact... -

Page 36

...the net favourable impact of assumption changes and management actions during the quarter, realized gains on AFS securities and business growth, partially offset by high levels of new business strain as a result of sales in China. 34 Sun Life Financial Inc. Annual Report 2012 Management's Discussion... -

Page 37

...fair value of FVTPL assets and liabilities, partially offset by higher premium revenue from SLF Canada's GRS and SLF U.S.'s Life and Investments Products businesses, higher investment income and increased fee income from MFS. The weakening of the Canadian dollar relative to average exchange rates in... -

Page 38

... on government securities, resulting in a net benefit from interest rates in the second quarter. These net gains were partially offset by investments in growth and service initiatives in our businesses and unfavourable policyholder experience. 36 Sun Life Financial Inc. Annual Report 2012 Management... -

Page 39

...fund product requiring a lower capital base, the closing of new Guaranteed Minimum Withdrawal Benefit segregated fund sales in third-party channels, the re-pricing of universal life and critical illness insurance products, and the launch of Sunflex Retirement Income, an innovative new payout annuity... -

Page 40

... cash flows, and favourable market performance for real estate and equities. Results by Business Unit Net income by business unit ($ millions) 2012 281 347 167 795 (7) - 788 2011(1) 212 268 139 619 (3) (194) 422 Individual Insurance & Investments(2) Group Benefits(2) Group Retirement Services... -

Page 41

... Investments' principal insurance products include permanent life, participating life, term life, universal life, critical illness, long-term care and personal health insurance. We offer savings and retirement products, which include mutual funds, segregated funds, accumulation annuities, guaranteed... -

Page 42

..., representing an increase of approximately 35% from year-end 2011. EBG launched a new voluntary benefits suite of products, which includes long-term disability, short-term disability, critical illness, cancer and customized disability, and made enhancements to its existing voluntary life and dental... -

Page 43

...) were US$74.0 billion as at December 31, 2012, up 1% from 2011, largely as a result of equity market improvements, partially offset by negative net sales driven by surrenders in our closed blocks of business. Management's Discussion and Analysis Sun Life Financial Inc. Annual Report 2012 41 -

Page 44

... life, long-term and short-term disability, medical stop-loss and dental insurance, as well as a suite of voluntary benefits products, to over 10 million group plan members. EBG currently provides products and services to meet the protection needs of principally small- and medium-sized employers... -

Page 45

... insurance and investment contracts to high net worth customers; and Optimizing the value of our in-force business, with particular emphasis on increasing ROE and reducing earnings volatility through effective risk and capital management. MFS Investment Management Business Profile MFS, a global... -

Page 46

...other related costs Operating net income(1) Sales (US$ billions) Gross Net Pre-tax operating profit margin ratio Average net assets (US$ billions) Selected financial information in Canadian dollars (C$ millions) Revenue Reported net income Less: Fair value adjustments on share-based payment awards... -

Page 47

... sales in PT Sun Life Financial Indonesia in 2011 to 17% in 2012. In India, Birla Sun Life Asset Management Company Limited was recognized as the 2012 "Debt Mutual Fund House of the Year" by Credit Rating and Information Services of India Limited. Birla Sun Life Insurance Company Limited group sales... -

Page 48

...group protection, savings and retirement products through a multi-channel distribution network, including a career agency sales force, bancassurance distribution, brokers and worksite marketing. In addition, Birla Sun Life Asset Management Company Limited, our asset management joint venture in India... -

Page 49

... well as investment income, expenses, capital and other items not allocated to Sun Life Financial's other business segments. Our run-off reinsurance business is a closed block of reinsurance assumed from other insurers. Coverage includes individual disability income, long-term care, group long-term... -

Page 50

..., partially offset by the unfavourable impact of investment activity on insurance contract liabilities. Net income in both 2012 and 2011 reflected investment in regulatory initiatives such as Solvency II. 48 Sun Life Financial Inc. Annual Report 2012 Management's Discussion and Analysis -

Page 51

...General fund Segregated funds Total liabilities Cash flows provided by (used in): Operating activities Investing activities Financing Activities Net cash, cash equivalents and short-term securities 500 (98) (238) Management's Discussion and Analysis Sun Life Financial Inc. Annual Report 2012 49 -

Page 52

... rate, credit, equity market, real estate market, liquidity, concentration, currency and derivative risks. Compliance with these policies is monitored on a regular basis and reported annually to the Risk Review Committee. The Governance, Nomination and Investment Committee of the Board of Directors... -

Page 53

... include assets of the Discontinued Operations which are separately disclosed in Assets of disposal group classified as held for sale. Comparative 2011 amounts have not been restated to reflect this presentation. Management's Discussion and Analysis Sun Life Financial Inc. Annual Report 2012 51 -

Page 54

.... However, downside risk still exists as the economy remains weak and unemployment rates have yet to substantially decrease. This environment could have an adverse impact on our residential mortgage-backed portfolio. 52 Sun Life Financial Inc. Annual Report 2012 Management's Discussion and... -

Page 55

... higher loan-to-value ratio in Canada if the mortgage is insured. The estimated weighted average debt service coverage is 1.6 times, consistent with prior year-end levels. The Canada Mortgage and Housing Corporation insures 20.8% of the Canadian commercial mortgage portfolio. As at December 31, 2012... -

Page 56

... in Assets of disposal group held for sale. Approximately 87.8% of the impaired mortgage loans are in the United States. Equities Our equity portfolio is diversified, and approximately 56.0% of this portfolio is invested in exchange-traded funds. Exchange-traded fund holdings are primarily in the... -

Page 57

...rates and tightening credit spreads during the year. Impaired mortgages and loans, net of allowance for losses, amounted to $146 million as at December 31, 2012, $240 million lower than the December 31, 2011, level for these assets. Management's Discussion and Analysis Sun Life Financial Inc. Annual... -

Page 58

... factors that impact the market value of fixed income investments. (3) This amount represents the orderly release of provisions for future credit events held in insurance contract liabilities in respect of 2012. (4) Invested assets on the Consolidated Statements of Financial Position as at December... -

Page 59

...the Company's desired risk and return profile. Compensation practices for executives are approved by the Board of Directors and aligned with our risk philosophy, values, business and risk strategies, and long-term interests. As appropriate, risk management goals are considered in establishing annual... -

Page 60

...and positions, impairment reviews, quarterly financial information, the annual investment plan, new investment initiatives, investment finance systems/projects and investment control processes. Accountabilities Primary accountability for risk management is delegated by the Board of Directors to our... -

Page 61

... credit risk management policy, review and monitoring of enterprise and Business Group credit risk limits, adjudication of internal risk ratings for new fixed income investments, independent validation of internal risk ratings and internal risk models, and development and coordination of credit risk... -

Page 62

...minimums. Active credit risk governance including independent monitoring and review and reporting to senior management and the Board of Directors. Additional information concerning credit risk can be found in Note 6 to our 2012 Consolidated Financial Statements. Market Risk Risk Description We are... -

Page 63

... risk arises from certain general account products and segregated fund contracts, which contain explicit or implicit investment guarantees in the form of minimum crediting rates, guaranteed premium rates, settlement options and benefit guarantees. If investment returns fall below guaranteed levels... -

Page 64

... include new business added and product changes implemented prior to such dates. (4) Segregated Fund Guarantees is inclusive of segregated funds, variable annuities and investment products, and includes Run off reinsurance in our Corporate business segment. (5) A portion of assets designated as AFS... -

Page 65

...Guarantees on insurance and annuity contracts - minimum interest rate guarantees, guaranteed surrender values, guaranteed annuitization options Segregated fund guarantees Uses of Derivative To manage the sensitivity of the duration gap between assets and liabilities to interest rate changes To limit... -

Page 66

... include universal life and other long-term life and health insurance products. A major source of market risk exposure for individual insurance products is the reinvestment risk related to future premiums and the guaranteed cost of insurance. Interest rate risk for individual insurance products is... -

Page 67

... all other risk variables remain constant. Changes in interest rates, credit and swap spreads, equity market and real estate prices in excess of the ranges illustrated may result in other-thanproportionate impacts. Management's Discussion and Analysis Sun Life Financial Inc. Annual Report 2012 65 -

Page 68

.... This risk class includes risk factors relating to product development and pricing, mortality, morbidity, longevity, policyholder behaviour, expense and reinsurance. Insurance Risk Management Governance and Control Insurance risk is managed through a number of enterprise-wide controls addressing... -

Page 69

... We align compensation programs with business strategy, longterm shareholder value and good governance practices, and we benchmark them against peer companies. We perform ongoing monitoring and reporting of all significant operational risks, including regular briefings to senior management and Board... -

Page 70

...-functional North American Investments Environmental Committee works to identify and act on environmental risks and opportunities. We report on environmental management annually in the Public Accountability Statement and Sustainability Report. 68 Sun Life Financial Inc. Annual Report 2012 Management... -

Page 71

... of insurance and investment contract liabilities on our Consolidated Statements of Financial Position. These cash flows include estimates related to the timing and payment of death and disability claims, policy surrenders, policy maturities, annuity payments, minimum guarantees on segregated fund... -

Page 72

... for business and capital. Principal Sources and Uses of Funds Our primary source of funds is cash provided by operating activities, including premiums, investment management fees and net investment income. These funds are used primarily to pay policy benefits, dividends to policyholders, claims... -

Page 73

... individual risk profiles. Sun Life Financial, including all of its business groups, engages in a capital planning process annually in which capital deployment options, fundraising and dividend recommendations are presented to the Risk Review Committee of the Board. Capital reviews are regularly... -

Page 74

... given year. In addition, we have issued $2.1 billion of senior debentures and $1.4 billion of senior financings in connection with financing arrangements to address U.S. statutory reserve requirements for certain universal life contracts. 72 Sun Life Financial Inc. Annual Report 2012 Management... -

Page 75

...Plan Balance, end of year Number of Stock Options Outstanding (in millions) 2012 13.2 2.2 (2.2) 13.2 2011 14.2 1.7 (2.7) 13.2 Balance, beginning of year Options issued Options exercised or cancelled Balance, end of year Management's Discussion and Analysis Sun Life Financial Inc. Annual Report... -

Page 76

... capital to assess capital adequacy. Certain of these risk components, along with available capital, are sensitive to changes in equity markets and interest rates as outlined in the Risk Management section of this document. 74 Sun Life Financial Inc. Annual Report 2012 Management's Discussion... -

Page 77

... income Common and preferred shares Innovative instruments and subordinated debt Other Less: Goodwill Non-life investments and other Total capital available Required capital Asset default and market risks Insurance risks Interest rate risks Total capital required MCCSR ratio Sun Life Assurance... -

Page 78

...contracts to provide reinsurance to the Company. Information regarding our commitments, guarantees and contingencies are summarized in Notes 25 to our 2012 Consolidated Financial Statements. A table summarizing our financial liabilities and contractual obligations can be found in the Risk Management... -

Page 79

... date and the last liability cash flow, interest rates for risk-free assets, premiums for asset default, rates of inflation, and an investment strategy consistent with the Company's investment policy. The starting point for all future interest rate scenarios is consistent with the current market... -

Page 80

... insurance and certain forms of universal life policies and annuities, policyholders share investment performance through routine changes in the amount of dividends declared or in the rate of interest credited. These products generally have minimum interest rate guarantees. Hedging programs... -

Page 81

... the translation of AFS equity securities and other invested assets are recognized in OCI. The fair value of short-term securities is approximated by their carrying amount adjusted for credit risk where appropriate. Management's Discussion and Analysis Sun Life Financial Inc. Annual Report 2012 79 -

Page 82

... accredited real estate appraisers. Due to their nature, the fair value of policy loans and cash are assumed to be equal to their carrying values, which is the amount these assets are recorded at in our Consolidated Statements of Financial Position. Investments for account of segregated fund holders... -

Page 83

... Financial Statements. Transfers into level 3 occur when the inputs used to price the financial instrument lack observable market data and as a result, no longer meet the level 1 or 2 criteria at the reporting date. During the current reporting period, transfers into level 3 were primarily related... -

Page 84

... obligations in future years. Details of our pension and post-retirement benefit plans and the key assumptions used for these plans are included in Note 27 to our 2012 Consolidated Financial Statements. Changes in Accounting Policies Amended International Financial Reporting Standards Adopted in... -

Page 85

... annual expense for a funded plan will include net interest expense or income using the discount rate applied to the net defined benefit asset or liability. The amendments also require changes to the presentation in the Consolidated Financial Statements and enhanced disclosures for defined benefit... -

Page 86

... amortized cost on the basis of their contractual cash flow characteristics and the entity's business model for managing the assets. It also changes the accounting for financial liabilities measured using the fair value option. In December 2011, the effective date was deferred to January 1, 2015.The... -

Page 87

... Accounting Policies Note 1 Changes in Accounting Policies and Adjustments Note 2 Held for Sale Classification and Discontinued Operation Note 3 Segmented Information Note 4 Total Invested Assets and Related Net Investment Income Note 5 Financial Instrument Risk Management Note 6 Insurance Risk... -

Page 88

... International Financial Reporting Standards. The financial information presented elsewhere in the annual report to shareholders is consistent with these statements. The Board of Directors ("Board") oversees management's responsibilities for financial reporting. An Audit & Conduct Review Committee... -

Page 89

... per share Dividends per common share The attached notes form part of these Consolidated Financial Statements. 1.00 1.58 0.99 1.59 2.32 0.30 2.62 2.29 0.30 2.59 1.44 0.39 (1.03) (0.64) 0.39 (1.03) (0.64) 1.44 Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012... -

Page 90

...benefit (expense) included in other comprehensive income (loss) (1) Balances have been restated. Refer to Note 2. The attached notes form part of these Consolidated Financial Statements. 2012 $ 3 - (93) 34 (17) 4 (69) $ 2011 2 (8) (8) 58 (5) (5) 34 $ $ 88 Sun Life Financial Inc. Annual Report... -

Page 91

...account of segregated fund holders classified as held for sale (Note 3) Total liabilities Equity Issued share capital and contributed surplus Retained earnings and accumulated other comprehensive income Total equity Total liabilities and equity (1) Balances have been restated. Refer to Note 2. 2012... -

Page 92

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY For the years ended December 31, (in millions of Canadian dollars) Shareholders: Preferred shares (Note 16) Balance, beginning of year Issued Issuance cost, net of taxes Balance, end of year Common shares Balance, beginning of year Stock options exercised... -

Page 93

...cash items: Deferred acquisition costs Realized (gains) losses on investments Sales, maturities and repayments of investments Purchases of investments Change in policy loans Income taxes received (paid) Other cash items Net cash provided by (used in) operating activities Cash flows provided by (used... -

Page 94

... and pension products, and life and health insurance to individuals and groups through our operations in Canada, the United States, the United Kingdom and Asia. We also operate mutual fund and investment management businesses, primarily in Canada, the United States and Asia. Statement of Compliance... -

Page 95

... investment income in our Consolidated Statements of Operations. Because the carrying value of insurance contract liabilities is determined by reference to the assets supporting those liabilities, changes in the Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012... -

Page 96

... and losses on the sale of mortgages and loans, interest income earned, and fee income, are recorded in Interest and other investment income in our Consolidated Statements of Operations. ii) Derecognition A financial asset is derecognized when the contractual rights to its cash flows expire, or we... -

Page 97

... investment income in the Consolidated Statements of Operations. Cash Flow Hedges Certain equity forwards are designated as cash flow hedges of the anticipated payments of awards under certain share-based payment plans. Changes in fair value of these forwards based on spot price changes are recorded... -

Page 98

...of an insurance, investment or service contract. For the accounting for these types of contracts, see the respective policy section in this Note. Property and Equipment Owner-occupied properties and all other items classified as property and equipment are carried at historical cost less accumulated... -

Page 99

... the risks associated with the underlying investments are classified as Insurance contracts for account of segregated fund holders in our Consolidated Statements of Financial Position. Insurance contract liabilities, including policy benefits payable and provisions for policyholder dividends, are... -

Page 100

... contracts for account of segregated fund holders. The liabilities reported as insurance contracts for account of segregated fund holders are measured at the aggregate of the policyholder account balances. Changes in the fair value of the invested assets of the segregated funds are recorded in net... -

Page 101

... Post-Retirement Benefits For defined benefit plans the present value of the defined benefit obligation is calculated by independent actuaries using the projected unit credit method, and actuarial assumptions that represent best estimates of future variables that will affect the ultimate cost of... -

Page 102

... annual expense for a funded plan will include net interest expense or income using the discount rate applied to the net defined benefit asset or liability. The amendments also require changes to the presentation in the Consolidated Financial Statements and enhanced disclosures for defined benefit... -

Page 103

...amortized cost on the basis of their contractual cash flow characteristics and the entity's business model for managing the assets. It also changes the accounting for financial liabilities measured using the fair value option. In December 2011, the effective date was deferred to January 1, 2015. The... -

Page 104

... closing. The transaction will consist primarily of the sale of 100% of the shares of Sun Life Assurance Company of Canada (U.S.) ("Sun Life (U.S.)"), which includes the U.S. domestic variable annuity, fixed annuity and fixed indexed annuity products, corporate and bank-owned life insurance products... -

Page 105

... by (used in) investing activities Net cash provided by (used in) financing activities Changes due to fluctuations in exchange rates Increase (decrease) in cash and cash equivalents $ 2012 (473) 57 (5) (14) (435) 2011 $ 500 (98) (238) 26 $ 190 $ Notes to Consolidated Financial Statements Sun Life... -

Page 106

... Investment contracts for account of segregated fund holders Total financial liabilities of disposal group classified as held for sale measured at fair value (1) See tables below for further details. 104 Sun Life Financial Inc. Annual Report 2012 Notes to Consolidated Financial Statements Level... -

Page 107

... Collateralized debt obligations Other Total asset-backed securities supporting the U.S. Annuity Business Level 1 Level 2 389 391 - 166 946 Level 3 $ 1 44 26 24 95 $ Total 390 435 26 190 1,041 105 $ $ $ $ Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012 -

Page 108

... to SLF Canada and the finite life intangible assets were transferred from Corporate to MFS. Revenues from our reportable segments are derived principally from life and health insurance, investment management and annuities and mutual funds. Revenues not attributed to the strategic business units are... -

Page 109

... United Kingdom Canada Other Countries Total net income (loss) from continuing operations $ 2012 83 1,079 - 20 1,182 (29) 213 (131) (6) 47 $ 2011 183 1,336 (55) 23 1,487 (101) 156 (173) 6 (112) $ $ $ $ $ $ Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012... -

Page 110

... properties of $5,942, and Other invested assets - non-financial assets of $372. (2) Other invested assets (FVTPL and AFS) include our investments in segregated funds, mutual funds and limited partnerships. 108 Sun Life Financial Inc. Annual Report 2012 Notes to Consolidated Financial Statements -

Page 111

..., rental and occupancy rates derived from market surveys. The estimates of future cash inflows in addition to expected rental income from current leases, include projected income from future leases based on Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012 109 -

Page 112

... or internally by professionally accredited real estate appraisers. The fair value of investments for accounts of segregated fund holders is determined using quoted prices in active markets or independent valuation information provided by investment management. The fair value of direct investments... -

Page 113

... available-for-sale(1) Equity securities - fair value through profit or loss(2) Equity securities - available-for-sale Derivative assets Other invested assets Total invested assets(2) Investments for account of segregated fund holders Total financial assets measured at fair value(2) $ Level 1 8,540... -

Page 114

... Net investment income (loss) in our Consolidated Statements of Operations. (2) Transfers into Level 3 occur when the inputs used to price the financial instrument lack observable market data and as a result, no longer meet the Level 1 or 2 definitions at the reporting date. In addition, transfers... -

Page 115

... Net investment income (loss) in our Consolidated Statements of Operations. (2) Transfers into Level 3 occur when the inputs used to price the financial instrument lack observable market data and as a result, no longer meet the Level 1 or 2 definitions at the reporting date. In addition, transfers... -

Page 116

...assets and liabilities recorded to net income for the years ended December 31 consist of the following: 2012 Cash, cash equivalents and short-term securities Debt securities Equity securities Derivative investments Other invested assets Investment properties Total change in fair value through profit... -

Page 117

... not been designated as hedges for accounting purposes. Total notional amount $ 47,890 1,011 108 1,850 50,859 $ Fair value Assets 2,494 - 2 136 2,632 Liabilities $ (798) (228) (25) (8) (1,059) $ $ $ Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012 115 -

Page 118

... cash flows associated with the anticipated payments expected to occur in 2013, 2014, and 2015 under certain share-based payment plans. The amounts included in accumulated OCI related to the equity forwards are reclassified to net income as the liability is accrued for the share-based payment plan... -

Page 119

... risk governance including independent monitoring and review and reporting to senior management and the Board of Directors 6.A.i Maximum Exposure to Credit Risk Our maximum credit exposure related to financial instruments as at December 31 is the balance as presented in our Consolidated Statements... -

Page 120

... by changes in the economic or political conditions. We manage this risk by appropriately diversifying our investment portfolio through the use of concentration limits. In particular, we maintain policies which set counterparty exposure limits to manage the credit exposure for investments in... -

Page 121

... is shown in the following tables. The geographic location is based on the country of the creditor's parent. As at December 31, 2012 Canada United States United Kingdom Other Balance Fair value through profit or loss $ 18,192 13,103 5,265 7,213 43,773 Availablefor-sale $ 2,438 5,498 484 2,169 10,589... -

Page 122

... value of loans by scheduled maturity, before allowances for losses, is comprised as follows: As at December 31, Due in 1 year or less Due in years 2-5 Due in years 6-10 Due after 10 years Total loans 120 Sun Life Financial Inc. Annual Report 2012 Notes to Consolidated Financial Statements 2012... -

Page 123

... 5,902 903 21 $ 14,300 $ 148 - - 26 - 12,031 $ - - - - - 24,528 $ 2,506 613 5,902 929 21 50,859 (1) These are covered short derivative positions that may include interest rate options, swaptions or floors. Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012 121 -

Page 124

... the use of credit scoring models, to a particular mortgage or corporate loan. The internal credit ratings reflect the credit quality of the borrower as well as the value of any collateral held as security. 122 Sun Life Financial Inc. Annual Report 2012 Notes to Consolidated Financial Statements -

Page 125

... is with the exchanges and clearinghouses. (2) Used to determine the credit risk exposure if the counterparties were to default. The credit risk exposure is the cost of replacing, at current market rates, all contracts with a positive fair value. (3) The credit risk associated with derivative... -

Page 126

...portfolios are based on loss models using assumptions about key systematic risks, such as unemployment rates and housing prices, and loan-specific information such as delinquency rates and loan-to-value ratios. 124 Sun Life Financial Inc. Annual Report 2012 Notes to Consolidated Financial Statements -

Page 127

... value of the collateral. Mortgages and loans causing concern are monitored closely and evaluated for objective evidence of impairment. For these mortgages and loans, we review information that is appropriate to the circumstances, including recent operating developments, strategy review, time lines... -

Page 128

...and risk committees that oversee key market risk strategies and tactics, review compliance with applicable policies and standards, and review investment and hedging performance Hedging and asset-liability management programs are maintained in respect of market risks Product design and pricing policy... -

Page 129

... in certain general account products and segregated fund contracts, which contain explicit or implicit investment guarantees in the form of minimum crediting rates, guaranteed premium rates, settlement options and benefit guarantees. If investment returns fall below guaranteed levels, we may be... -

Page 130

... through annual reporting to the Risk Review Committee of the Board We use reinsurance to limit losses, minimize exposure to significant risks and to provide additional capacity for growth. Our Underwriting and Claims Liability Management Policy sets maximum global retention limits and related... -

Page 131

... claim management function. Individual and group insurance policies are underwritten prior to initial issue and renewals, based on risk selection, plan design and rating techniques. Underwriting and claims risk policies approved by the Risk Review Committee of the Board of Directors include limits... -

Page 132

... are monitored closely and reported annually to the Risk Review Committee. 8. Other Assets Other assets consist of the following: As at December 31, Accounts receivable Investment income due and accrued Deferred acquisition costs(1) Prepaid expenses Premium receivable Accrued benefit assets (Note... -

Page 133

... goodwill acquired through business combinations by reportable segment are as follows: SLF Canada Balance, January 1, 2011 Impairment(1) Foreign exchange rate movements Balance December 31, 2011 Disposal Inter-company transfer Foreign exchange rate movements Balance, December 31, 2012 $ $ 2,765 (194... -

Page 134

..., which could be material. CGUs with higher risk of impairment are Individual Wealth and Individual Insurance in SLF Canada due to the relatively small, if any, excess of fair value over carrying value. 132 Sun Life Financial Inc. Annual Report 2012 Notes to Consolidated Financial Statements -

Page 135

...(1) Fund management contracts are attributable to the MFS Holdings CGU, where their competitive position in, and the stability of, their respective markets support their classification as indefinite life intangible assets. Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual... -

Page 136

... of Business The majority of the products sold by the Company are insurance contracts. These contracts include all forms of life, health and critical illness insurance sold to individuals and groups, life contingent annuities, accumulation annuities, and segregated fund products with guarantees. 11... -

Page 137

... is offered on a group basis in the United States. In Canada, group morbidity assumptions are based on our five-year average experience, modified to reflect any emerging trend in recovery rates. For long-term care and critical illness insurance, assumptions are developed in collaboration with our... -

Page 138

...for policyholder dividends and provisions for experience rating refunds. (3) For insurance contract liabilities categorized as held for sale, see Note 3. As at December 31, 2011 Individual participating life Individual non-participating life(2) Group life Individual annuities Group annuities Health... -

Page 139

... disability benefits Health benefits Policyholder dividends and interest on claims and deposits Total gross claims and benefits paid $ 2012 2,764 1,128 2,803 3,663 989 11,347 $ 2011 3,052 1,091 2,631 3,526 852 11,152 $ $ Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual... -

Page 140

11.B Investment Contract Liabilities 11.B.i Description of Business The following are the types of Investment contracts in force Term certain payout annuities in Canada and the U.S. Guaranteed Investment Contracts in Canada Unit-linked products issued in the U.K. and Hong Kong; and Non-unit-linked ... -

Page 141

... the years ended December 31, Balance as at January 1 Change in liabilities on in-force Liabilities arising from new policies Changes in assumptions or methodology Increase (decrease) in liabilities Liabilities before the following: Foreign exchange rate movements Balance as at December 31 $ $ 2012... -

Page 142

.... Includes SLF U.K. business of $27 for Individual non-participating life and $72 for Individual annuities. (2) Consists of amounts on deposit, policy benefits payable, provisions for unreported claims, provisions for policyholder dividends, and provisions for experience rating refunds. (3) For... -

Page 143

... before November 8, 2015, U. S. Holdings may be required to pay a make-whole amount based on the present value of expected quarterly payments between the cancellation date and November 8, 2015. For the year ended December 31, 2012, we recorded $16 of interest expense relating to this obligation... -

Page 144

... have features of equity capital. No interest payments or distributions will be paid in cash by the SL Capital Trusts on the SLEECS if Sun Life Assurance fails to declare regular dividends (i) on its Class B Non-Cumulative Preferred Shares Series A, or (ii) on its public preferred shares, if any are... -

Page 145

...into a variable number of common shares of SLF Inc. on distribution dates on or after December 31, 2032. (4) Holders of SLEECS B may exchange, at any time, all or part of their holdings of SLEECS B at a price for each SLEECS of 40 non-cumulative perpetual preferred shares of Sun Life Assurance. SLCT... -

Page 146

...Trust and Sun Life Capital Trust II, then (i) Sun Life Assurance will not pay dividends on its public preferred shares, if any are outstanding, and (ii) if Sun Life Assurance does not have any public preferred shares outstanding, then SLF Inc. will not pay dividends on its preferred shares or common... -

Page 147

... an adjustment to the equity attributable to the SLF Inc. shareholders. Subsequent to the purchase of the minority shares, all of the shares of McLean Budden Limited were transferred to our subsidiary MFS. Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012 145 -

Page 148

...to certain employees and directors under the Executive Stock Option Plan and the Director Stock Option Plan and to all eligible employees under the Special 2001 Stock Option Award Plan. These options are granted at the closing price of the common shares on the TSX on the grant date for stock options... -

Page 149

... DSUs. Each DSU is equivalent in value to one common share and earns dividend equivalents in the form of additional DSUs at the same rate as the dividends on common shares. The designated executives must elect Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012 147 -

Page 150

...value of the awards and shares outstanding as well as the number of new awards granted and the number of issued shares repurchased. The liability accrued related to these plans as at December 31, 2012 was $546. 148 Sun Life Financial Inc. Annual Report 2012 Notes to Consolidated Financial Statements -

Page 151

..., Compensation expense Income tax expense (benefit) 2012 $ 210 $ (53) 2011 $ 206 $ (41) 21. Restructuring In the fourth quarter of 2011, we restructured our operations, primarily in the United States. The domestic U.S. variable annuity and individual life products were closed to new sales effective... -

Page 152

... 259 $ Investments As at December 31, 2011 Charged to income statement Charged to other comprehensive income Charged to equity, other than other comprehensive income Foreign exchange rate movements Less: Held for sale As at December 31, 2012 $ (792) (254) (60) - 8 (57) $ (1,155) Policy liabilities... -

Page 153

..., a new tax regime for life companies, effective January 1, 2013, has been enacted in the U.K. The net impact of these enactments is reflected in line Tax rate and other legislative changes in the table above. Notes to Consolidated Financial Statements Sun Life Financial Inc. Annual Report 2012 151 -

Page 154

... impacts under various business, interest rate and equity market scenarios. Relevant components of these capital reviews, including dividend recommendations, are presented to the Risk Review Committee on a quarterly basis. The capital policy is designed to ensure that adequate capital is maintained... -

Page 155

... Share Capital. 24. Segregated Funds 24.A Investments for Account of Segregated Fund Holders The carrying value of investments held for segregated fund holders are as follows: As at December 31, Segregated and mutual fund units Equity securities Debt securities Cash, cash equivalents and short term... -

Page 156

... investment income Total additions Deductions from segregated funds: Payments to policyholders and their beneficiaries Management fees Taxes and other expenses Foreign exchange rate movements Total deductions Net additions (deductions) Less: Held for sale (Note 3) Balance as at December 31 2012... -

Page 157

... fund assets(1) Investments for account of segregated fund holders Insurance contract liabilities(1) Investment contract liabilities Total other general fund liabilities (1) Balances have been restated. Refer to Note 2. SLF Inc. (unconsolidated) $ 18,658 8,239 - - - 10,287 Sun Life Assurance... -

Page 158

... at December 31, 2012 are listed below: Name of Joint Venture Company Birla Sun Life Asset Management Company Limited PT CIMB Sun Life Sun Life Grepa Financial Inc. Birla Sun Life Insurance Company Limited Sun Life Everbright Life Insurance Company Limited Income earned from our investments in joint... -

Page 159

...employees who retire between January 1, 2012 and December 31, 2015 will receive an annual healthcare spending account allocation and life insurance, and will have access to voluntary retiree-paid healthcare coverage; eligible employees who retire after December 31, 2015 will have access to voluntary... -

Page 160

... by country. The discount rate assumption used in each country is based on the market yields, as of December 31, of corporate AA bonds that match the expected timing of benefit payments. The expected return on assets assumption for pension cost purposes is the weighted average of expected long-term... -

Page 161

... credit, market and foreign currency risks. Due to the long-term nature of the pension obligations and related cash flows, asset mix decisions are based on longterm market outlooks within the specified policy ranges. The long-term investment objectives of the defined benefit pension plans are... -

Page 162

... of the calculation of the net income (loss) and the weighted average number of shares used in the earnings per share computations are as follows: For the years ended December 31, Basic EPS: Common shareholders' net income (loss) from continuing operations Common shareholders' net income (loss) from... -

Page 163

... net of reinsurance recoverables makes appropriate provision for all policy obligations and the Consolidated Financial Statements fairly present the results of the valuation. Lesley Thomson Fellow, Canadian Institute of Actuaries Toronto, Canada February 13, 2013 Appointed Actuary's Report Sun... -

Page 164

... statements of changes in equity, and consolidated statements of cash flows for each of the years in the two-year period ended December 31, 2012, and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Consolidated Financial Statements... -

Page 165

...and for the year ended December 31, 2012 of the Company and our report dated February 13, 2013 expressed an unqualified opinion on those financial statements. Independent Registered Chartered Accountants Licensed Public Accountants February 13, 2013 Toronto, Canada Report of Independent Registered... -

Page 166

..., 2011 that prefunded the costs of hedging our existing variable annuity and segregated fund contracts, higher net assets in MFS and normal business growth. The new business issued in 2012 led to pre-tax income loss of $185 million compared to $224 million a year ago. The change was primarily due to... -

Page 167

... Plus: Fair value adjustments on share-based payment awards in MFS Hedges in Canada that do not qualify for hedge accounting Goodwill and intangibles impairment charges, restructuring, corporate transactions and other costs Common Shareholders' Net Income (Loss) - Reported Basis For the Year Ended... -

Page 168

... FCA(1)(4) Corporate Director Dean A. Connor President & Chief Executive Officer, Sun Life Financial Inc. (1) (2) (3) (4) Member of Audit & Conduct Review Committee Member of Governance, Nomination & Investment Committee Member of Management Resources Committee Member of Risk Review Committee David... -

Page 169

...of Canada (Barbados) Limited Sun Life Capital Trust Sun Life Capital Trust II Sun Life Everbright Life Insurance Company Limited Sun Life Financial (Bermuda) Holdings, Inc. Sun Life Financial Insurance and Annuity Company (Bermuda) Ltd. Sun Life Financial (India) Insurance Investments Inc. Birla Sun... -

Page 170

...Life Financial Trust Inc. Sun Life Hong Kong Limited Sun Life Trustee Company Limited Sun Life India Service Centre Private Limited Sun Life Information Services Canada, Inc. Sun Life Information Services Ireland Limited Sun Life Insurance (Canada) Limited SLI General Partner Limited SLI Investments... -

Page 171

...Investment DELRE Holdings 2009-1, LLC SLF Private Placement Investment Company I, LLC Sun Life Insurance and Annuity Company of New York Sun MetroNorth, LLC Sun Life Financial (U.S.) Finance, Inc. Sun Life Financial (U.S.) Reinsurance Company Sun Life Financial (U.S.) Services Company, Inc. Sun Life... -

Page 172

... Life Insurance Company Limited 37/F Tianjin International Building 75 Nanjing Road Tianjin, China 300050 Tel: (8622) 2339-1188 Fax: (8622) 2339-9929 Website: sunlife-everbright.com 170 Sun Life Financial Inc. Annual Report 2012 Sun Life Assurance Company of Canada Beijing Representative Office... -

Page 173

Notes Sun Life Financial Inc. Annual Report 2012 171 -

Page 174

Notes 172 Sun Life Financial Inc. Annual Report 2012 -

Page 175

... N LIFE .COM . CORPORATE OFFICE Sun Life Financial Inc. 150 King Street West Toronto, Ontario Canada M5H 1J9 Tel: 416-979-9966 Website: sunlife.com INVESTOR RELATIONS For financial analysts, portfolio managers and institutional investors requiring information, please contact: Investor Relations Fax... -

Page 176

... that help customers achieve lifetime financial security, Sun Life Financial recognizes that environmental sustainability is critical to our overall well-being. The use of Forest Stewardship Council (FSC®) and recycled paper for this Annual Report resulted in the following savings: This report is...