Snapple 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

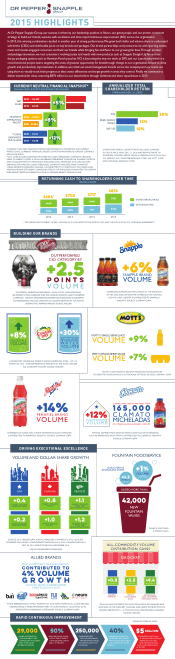

2015 HIGHLIGHTS

RETURNING CASH TO SHAREHOLDERS OVER TIME

*CURRENCY NEUTRAL FINANCIAL METRICS DETERMINED BY CONVERTING OUR CURRENT

PERIOD LOCAL CURRENCY FINANCIAL RESULTS USING THE PRIOR PERIOD FOREIGN CURRENCY

EXCHANGE RATES.

**2015 CORE DILUTED EARNINGS PER SHARE EXCLUDES UNREALIZED COMMODITY-RELATED

MARK-TO-MARKET LOSSES, A NON-CASH BRAND IMPAIRMENT CHARGE FOR GARDEN COCKTAIL

AND AN ADJUSTMENT TO A PREVIOUSLY DISCLOSED LEGAL PROVISION. 2014 CORE DILUTED

EARNINGS PER SHARE EXCLUDES UNREALIZED COMMODITY-RELATED MARK-TO-MARKET

LOSSES, SEPARATION RELATED CHARGES, AN ADJUSTMENT TO A PREVIOUSLY DISCLOSED LEGAL

PROVISION AND A SETTLEMENT CHARGE RELATED TO THE PURCHASE OF ANNUITIES FOR CERTAIN

PARTICIPANTS RECEIVING BENEFITS IN OUR U.S. DEFINED BENEFIT PENSION PLANS.

COMPOUND ANNUAL GROWTH RATE INCLUDES CHANGES

IN STOCK PRICE SINCE DEC. 31, 2010, AND REINVESTMENT OF

DIVIDENDS. THE PEER GROUP INDEX COMPRISES: THE COCA-COLA

CO., PEPSICO, INC., MONSTER BEVERAGE CORP., THE COTT CORP.

AND NATIONAL BEVERAGE CORP.

* DPS MADE A TAX PAYMENT OF $531 MILLION IN 2012 RELATED TO THE PEPSICO, INC. AND THE COCA-COLA CO. LICENSING AGREEMENTS.

NET

SALES

DPS

S&P 500

SEGMENT

OPERATING

PROFIT

**CORE

EARNINGS

PER SHARE

2012 2013 2014 2015

DIVIDENDS PAID

SHARE REPURCHASES

2015 • $6,397

2015 • $1,629

2015 • $4.10

2014 • $6,121

2014 • $1,504

$284 $302 $317 $355

$400 $400 $400

$521

2014 • $3.65

At Dr Pepper Snapple Group, our success is driven by our leadership position in fl avors, our great people, and our proven, consistent

strategy to build our brands, execute with excellence and drive rapid continuous improvement (RCI) across the organization.

In 2015, this winning combination resulted in another year of strong performance. We grew both dollar and volume share in carbonated

soft drinks (CSDs) and shelf-stable juices on key brands and packages. Our brand partnerships and product tie-ins with sporting events,

music and movies engaged consumers and built our brands while bringing fun and fl avor to our growing fan base. Through product

and package innovation, we met consumers’ evolving tastes and needs with new products such as Snapple Straight Up Tea and on-

the-go packaging options such as Hawaiian Punch pouches. RCI is becoming the way we work at DPS, and our Lean tracks, which are

cross-functional project teams targeting the areas of greatest opportunity for breakthrough change in our organization, helped to drive

growth and productivity improvements. In addition, we rolled out visual management boards across the company, and our teams are

using them to visually track their progress as they create effi ciencies and target growth in areas they control. Finally, we continued to

deliver shareholder value, returning $876 million to our shareholders through dividends and share repurchases in 2015.

25%

10%

PEER GROUP

INDEX 12%

$876

$717

$702

$684*

ANNUALIZED TOTAL

SHAREHOLDER RETURN

+12%

+8%

+5%

(IN MILLIONS, EXCEPT EARNINGS PER SHARE)

(THROUGH DEC. 31, 2015)

(IN MILLIONS)

CURRENCY NEUTRAL FINANCIAL SNAPSHOT*

BUILDING OUR BRANDS

SUCCESSFUL MARKETING PROGRAMS – SUCH AS THE LONG-STANDING

DR PEPPER TUITION GIVEAWAY AND THE STADIUM-FAVORITE LARRY CULPEPPER

CAMPAIGN – DROVE CONSUMER ENGAGEMENT AND RESULTED IN DR PEPPER

OUTPERFORMING THE CSD CATEGORY IN VOLUME GROWTH BY +2.5 POINTS

DURING THE CAMPAIGN PERIOD. SOURCE: NIELSEN

POINTS

+2.5

+9%

+7%

+14%

VOLUME

MOTT’S SINGLE-SERVE JUICE

VOLUME

PEÑAFIEL BRAND

MOTT’S SINGLE-SERVE SAUCE

CLAMATO WAS USED TO MIX MORE THAN

AT A MAJOR LEAGUE BASEBALL STADIUM.

CLAMATO

MICHELADAS

VOLUME

VOLUME

CAMPAIGNS SUPPORTING THE LAUNCH OF THE STRAIGHT

UP TEA LINE AND LIMITED-TIME OFFERINGS FOR FLAVORS

SUCH AS LADY LIBERTEA CONTRIBUTED TO SNAPPLE’S

GROWTH. SOURCE: COMPANY DATA

MOTT’S CONTINUES TO DELIGHT MOMS AND KIDS ALIKE WITH

ITS GREAT TASTE AND SNACK & GO PACKAGE OPTIONS. SOURCE: COMPANY DATA

CANADA DRY GINGER ALE MARKET SHARE IS BUBBLING OVER – UP +2.3

POINTS IN 2015 – AND REPRESENTS 56 PERCENT OF THE TOTAL GINGER

ALE CATEGORY VOLUME. SOURCE: NIELSEN

DISTRIBUTION GAINS AND FLAVOR EXTENSIONS SUCH AS FRESADA

CONTRIBUTED TO PEÑAFIEL’S GROWTH. SOURCE: COMPANY DATA

STRONG DISTRIBUTION GAINS IN MEXICO AND FLAVOR EXTENSIONS

SUCH AS PREPARADO AND LIMÓN CONTRIBUTED TO CLAMATO’S GROWTH.

SOURCE: COMPANY DATA

165,000

+8% +30%

VOLUME VOLUME

+12%

CLAMATO BRAND

VOLUME

+6%

SNAPPLE BRAND

OUTPERFORMED

CSD CATEGORY BY

VOLUME

GINGER ALE SPARKLING

UNSWEETENED

WATER

4% VOLUME

GROWTH

ELIMINATED MORE THAN

$5 MILLION NON-WORKING

MARKETING DOLLARS

TO BE REINVESTED BACK

INTO CONSUMER-FACING

ACTIVITIES.

$5MILLION

DRIVING EXECUTIONAL EXCELLENCE

RAPID CONTINUOUS IMPROVEMENT

WE ALSO HELD DISTRIBUTION FOR CSDS ACROSS KEY BRANDS AND

PACKAGES IN THE GROCERY CHANNEL AND GREW DISTRIBUTION OF

SNAPPLE PREMIUM BY +1.2 POINTS IN THE CONVENIENCE CHANNEL.

SOURCE: NIELSEN

SOURCE: 2015 NIELSEN DATA FOR ALL MEASURED CHANNELS: U.S. ALL OUTLETS

COMBINED INCLUDING CONVENIENCE THROUGH JAN. 2, 2016; CANADA THROUGH

DEC. 26, 2015; MEXICO THROUGH DECEMBER 2015.

*LIQUID REFRESHMENT BEVERAGES

VOLUME AND DOLLAR SHARE GROWTH FOUNTAIN FOODSERVICE

ALLIED BRANDS

ALL-COMMODITY VOLUME

DISTRIBUTION GAINS

CANADAUSA MEXICO

CANADA DRY

AND SCHWEPPES

SPARKLING WATER

MOTT’S

SINGLE-SERVE

JUICE

SNAPPLE

PREMIUM

GROCERY

+1%

+0.2 VOLUME

QUICK-SERVICE

RESTAURANT SHARE

POINTS

WHILE REPRESENTING A SMALL PORTION OF OUR TOTAL PORTFOLIO, ALLIED BRANDS

ARE BECOMING A MORE IMPORTANT PART OF OUR STRATEGY, ALLOWING US TO

PARTICIPATE IN EMERGING CATEGORIES. SOURCE: COMPANY DATA

SOURCE: COMPANY DATA

SOURCE: CREST AND

COMPANY DATA

GAINED DISTRIBUTION

AND AVAILABILITY FOR

CANADA DRY BY CLOSING

MORE THAN 29,000

DISTRIBUTION VOIDS.

29,000

ADDED MORE THAN

42,000

NEW

FOUNTAIN

VALVES

OUR ASSORTMENT OF ALLIED BRANDS

CONTRIBUTED TO

IN OUR NON-CARBONATED

PORTFOLIO IN 2015.

REDUCED DRIVER CHECK-

IN/OUT TIME AT DIRECT-

STORE DELIVERY SITES BY

ABOUT 50 PERCENT.

ELIMINATED MORE

THAN 250,000 ANNUAL

TRANSPORTATION MILES

BY SHIPPING DIRECT TO

CUSTOMERS.

INCREASED SALES NEARLY

40 PERCENT FOR ENERGY

AND WATER CATEGORIES IN

OUR OHIO VALLEY TEL-SELL

REGIONS.

50% 250,000 40%

+0.4 +0.8 +1.1

+0.2 +1.0 +1.2

POINTS VOLUME

SHARE OF CSDS POINTS VOLUME

IN LRB* POINTS VOLUME

TOTAL LRB*

(EXCLUDING COLA)

POINTS DOLLAR

SHARE OF CSDS POINTS DOLLAR

IN LRB* POINTS DOLLAR

TOTAL LRB*

(EXCLUDING COLA)

+9.4+3.5+0.8 POINTSPOINTSPOINTS

Table of contents

-

Page 1

... OF THE STRAIGHT UP TEA LINE AND LIMITED-TIME OFFERINGS FOR FLAVORS SUCH AS LADY LIBERTEA CONTRIBUTED TO SNAPPLE'S GROWTH. SOURCE: COMPANY DATA +8% GINGER ALE VOLUME +30% UNSWEETENED MOTT'S SINGLE-SERVE JUICE SPARKLING WAT E R VOLUME +9% MOTT'S SINGLE-SERVE SAUCE VO L U M E CANADA DRY GINGER...