PNC Bank 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY

DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE

CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK

RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY

CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK

RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY

QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE

DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY

DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE

CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK

RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY

CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK

RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY

QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE

DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY

DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE

CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK

RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY

CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK

RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY

QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE

DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY

DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE

CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK

RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY

CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK

RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY

QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE

DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE

PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK CUSTOMER FOCUS

TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER DIVERSITY QUALITY OF LIFE

2002 ANNUAL REPORT

Table of contents

-

Page 1

...DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK 2002 ANNUAL REPORT RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT... -

Page 2

-

Page 3

... our team's commitment to achieving our goal of growing PNC and delivering premium returns for the risk we're willing to take. Clearly, though, the economic pressures facing our industry had an impact. In a year marked by declining equity markets, record bankruptcies, lower capital investment, and... -

Page 4

... stream. In 2002, deposits, asset management, processing, and lending each contributed roughly equal portions of total business revenue. I believe we've been succesful in building a strong balance sheet and enhancing risk management and corporate governance. Moving forward, we're working to harness... -

Page 5

... relationships by selling fee-based treasury management and capital markets products. In addition, eliminating redundancies should help Wholesale Banking reduce expenses. At PNC Advisors and PFPC, our wealth management and global fund servicing businesses, the declining equity markets and client... -

Page 6

... in Regional Community Banking was recognized by technology consultant Peppers and Rogers as one of the ten best customer relationship management programs in the country. Technology alone does not get the job done. I've always believed that our team of 24,000 employees is our best advantage. They... -

Page 7

...ours, deposits, asset management, processing, and lending all contributed a roughly equal portion of business revenue last year. That diversity should help in the current environment. Beyond that, we need to continue attracting customers and developing relationships one by one...business by business... -

Page 8

... and efficiencies, in 2003 we're beginning to manage our corporate banking, real estate ï¬nance, and asset-based lending activities as one business. Moving forward, we'll report their results as one business - Wholesale Banking. - Demchak Q: What have you learned about PNC in your time here... -

Page 9

... ï¬nancial services industry knowledge. Our goal is not simply to comply with the new legal and regulatory requirements that govern companies listed on the New York Stock Exchange ...our goal is to become a company with best-in-class corporate governance practices. From an employee perspective, we... -

Page 10

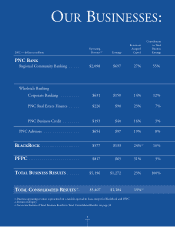

... Capital Contribution to Total Business Earnings PNC BANK Regional Community Banking ...$2,098 $697 27% 55% Wholesale Banking Corporate Banking ...PNC Real Estate Finance ...$631 $226 $150 $90 14% 23% 12% 7% PNC Business Credit ...PNC Advisors ... $193 $654 $40 $97 16% 19% 3% 8% BLACKROCK... -

Page 11

...-largest servicer of commercial mortgagebacked securities Top 5 asset-based lender One of the nation's largest wealth managers PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE 9 3rd-largest publicly-traded asset manager Largest full-service mutual fund transfer agent -

Page 12

... accounts, we can easily and CONVENIENTLY track our money online, by phone, or at the ATM. And we always get knowledgeable guidance and friendly service at our local branch. PNC understands our needs. " It's important knowing that, for STEVE AND DOROTHY COOLEY PERSONAL AND SMALL BUSINESS CLIENTS... -

Page 13

... the highest penetration rates in the industry. In 2002, we more than doubled the number of deposits and loans opened through pnc.com. Our 24-hour telephone banking center is one of the industry's best with nearly 90% of customers surveyed rating its service as excellent. Our ATM network, the eighth... -

Page 14

... as capital markets, commercial real estate loan servicing (offered through Midland Loan Services), treasury management, and equipment leasing, to clients when we consider the relationship risk/returns to be appropriate and competitive advantages exist. This approach is designed to help Wholesale... -

Page 15

" I want my bank to be a partner I can TRUST to support my ï¬nancial and strategic goals, as well as the community. That's why we moved all of our credit and treasury management relationships to PNC. FRANK B. FUHRER, JR. CHAIRMAN, FRANK B. FUHRER WHOLESALE COMPANY " -

Page 16

" really From our ï¬rst meeting, the PNC Advisors team LISTENED to me. They understood the ï¬nancial issues I faced as a recently widowed mother running a family business. They continue to help me meet my personal and business ï¬nancial needs. YONCA GERLACH CO-OWNER OF MARBLE IMPORTER DOYLE ... -

Page 17

..., highly integrated solutions. By implementing an enhanced investment management process, PNC Advisors seeks to provide clients with more competitive investment returns, relative to appropriate benchmarks, during all market cycles. In addition, the new equity research leadership team, put in place... -

Page 18

... equity effort. We also are investing in our international, private client, and high net worth distribution and service capabilities. In addition, we continue to invest in BlackRock Solutions, our technology and risk management business, to support investment operations for BlackRock and our clients... -

Page 19

including BlackRock Solutions, we help our clients monitor their overall investment program, assess balance sheet risks, and navigate earnings, tax, and regulatory constraints. These efforts have helped establish BlackRock as one of the largest independent managers of insurance assets nationwide. "... -

Page 20

...worked closely with us to help optimize the service and TECHNOLOGY we provide our clients. The results have been impressive. Due in part to PFPC's support, Eaton Vance received the nationally recognized DALBAR Financial Intermediary Service Award in 2002. RUSSELL CURTIS VICE PRESIDENT, MUTUAL FUND... -

Page 21

...-service mutual fund transfer agent and second largest provider of mutual fund accounting and administration services, PFPC helped its clients navigate challenging market conditions in 2002. PFPC remains committed to building upon its role as a leading provider of technology and servicing solutions... -

Page 22

...Chairman The PNC Financial Services Group, Inc. JAMES E. ROHR(2, 3, 6) (pictured on page 21) Chairman and Chief Executive Officer The PNC Financial Services Group, Inc. LORENE K. STEFFES(2, 5, 6) Vice President Global Electronics Industry International Business Machines Corporation (sales, marketing... -

Page 23

... Chief Executive Officer BlackRock JOAN L. GULLEY Chief Executive Officer PNC Advisors NEIL F. HALL Chief Executive Officer Regional Community Banking Bottom row from left VANCE WILLIAMS LAVELLE Chief Marketing Officer HELEN P. PUDLIN* General Counsel WILLIAM E. ROSNER Chief Human Resources Officer... -

Page 24

... of minority businesses. NORTHERN NEW JERSEY Regional President PETE CLASSEN contributes time to the PNC-sponsored New Jersey SEEDS program, which helps place talented disadvantaged students in private schools. PHILADELPHIA/S. NEW JERSEY DELAWARE PITTSBURGH NORTHWEST PA Regional President... -

Page 25

... to community service. Money® magazine named PNC's comprehensive beneï¬ts package as one of the best in the country in a survey of large employers. Reï¬,ecting a commitment to work life balance, PNC opened a second corporate-sponsored back-up child care center in September 2002 in Philadelphia... -

Page 26

...Before cumulative effect of accounting change ...Cumulative effect of accounting change ...Net income ...Cash dividends declared ...SELECTED RATIOS ...From net income ...Return on ...Average common shareholders' equity ...Average assets ...YEAR-END BALANCES ...Assets ...Loans, net of unearned income... -

Page 27

...30 Regional Community Banking ...31 Wholesale Banking Corporate Banking ...32 PNC Real Estate Finance ...33 PNC Business Credit ...34 PNC Advisors ...35 BlackRock ...36 PFPC ...37 Consolidated Statement Of Income Review ...38 Consolidated Balance Sheet Review ...40 Risk Factors ...48 Risk Management... -

Page 28

... ("Corporation" or "PNC") Consolidated Financial Statements and Statistical Information included herein. Certain prior-period amounts have been reclassified to conform with the current year presentation. For information regarding certain business risks, see the Risk Factors, Risk Management... -

Page 29

... related to insured residual value exposures, the efficiency ratios from continuing operations and from net income were 58.14% and 58.07%, respectively. (c) The leverage ratio represents Tier 1 capital divided by adjusted average total assets as defined by regulatory capital requirements for bank... -

Page 30

... corporate banking, real estate finance and assetbased lending; wealth management; asset management and global fund processing services. The Corporation provides certain products and services nationally and others in PNC's primary geographic markets in Pennsylvania, New Jersey, Delaware, Ohio... -

Page 31

... lending business. The term "loans" in this report excludes loans held for sale and securities that represent interests in pools of loans. Changes in loans held for sale are described in 2001 Strategic Repositioning and in Loans Held for Sale in the Consolidated Balance Sheet Review section... -

Page 32

REVIEW OF BUSINESSES PNC operates seven major businesses engaged in regional community banking; wholesale banking, including corporate banking, real estate finance and asset-based lending; wealth management; asset management and global fund processing services. Treasury management activities, which ... -

Page 33

... through cross-selling of other products and services. The significant growth in online banking users is helping to improve customer loyalty and retention. During 2002, Regional Community Banking increased the number of checking relationships by 8% causing increases in transaction deposits and fee... -

Page 34

... loans and pooled reserves. See Market Street in the Risk Management section of this Financial Review for additional information. Treasury management, capital markets and equipment leasing products offered through Corporate Banking are sold by several businesses across the Corporation and related... -

Page 35

... third-party provider of loan servicing and technology to the commercial real estate finance industry. Columbia Housing Partners, L.P. ("Columbia Housing") is a national syndicator of affordable housing equity. Certain incremental activities related to Columbia Housing will continue to require... -

Page 36

... lending repositioning Loans held for sale Credit exposure Outstandings PNC Business Credit provides asset-based lending, treasury management and capital markets products and services to middle market customers nationally. PNC Business Credit's lending services include loans secured by accounts... -

Page 37

...BlackRock and through funds managed by unaffiliated investment managers. In July 2002, the Corporation and BlackRock entered into a revised agreement with respect to investment management services. The agreement includes a reduction in the rate of fees received from BlackRock based on current market... -

Page 38

... Advisors' customer assets managed by BlackRock. PNC client-related assets subject to fund administration and servicing payments declined approximately $4.8 billion for the year ended December 31, 2002. During 2002, BlackRock adopted a new long-term incentive and retention program for key employees... -

Page 39

...Total funds PERFORMANCE RATIOS Return on assigned capital Operating margin OTHER INFORMATION Average FTEs SERVICING STATISTICS (b) Accounting/administration assets Domestic Foreign Total Custody assets Shareholder accounts (in millions) (a) Net of nonoperating expense. (b) At December 31. Dollars... -

Page 40

... for 2002 reflected additions to reserves for PNC Business Credit and Corporate Banking and losses in Corporate Banking primarily related to Market Street Funding Corporation ("Market Street") liquidity facilities. See Credit Risk in the Risk Management section and Critical Accounting Policies And... -

Page 41

...benefit resulting from a reduction in the put option liability related to the NBOC acquisition, a $14 million gain on the sale of a real estate investment and a lower level of asset write-downs compared with the prior year. The impact of these items was more than offset by lower revenue from trading... -

Page 42

... in the portfolio. Details by Wholesale Banking business follow. Institutional Lending Held for Sale Activity Year ended December 31, 2002 In millions Net gains on liquidation Valuation adjustments Total Corporate Banking PNC Real Estate Finance PNC Business Credit Total $368 20 9 $397 $(213... -

Page 43

... lending repositioning Commercial Manufacturing Communications Health care Financial services Service providers Retail/wholesale Real estate related Other Total commercial Commercial real estate Lease financing Total institutional lending repositioning Education loans Other Total loans held for sale... -

Page 44

... Residential mortgage Commercial real estate Commercial Lease financing Total loans Loans held for sale Total loans and loans held for sale 2002 $82 187 2 142 5 $418 2001 $52 220 6 109 4 $391 Regional Community Banking Corporate Banking PNC Real Estate Finance PNC Business Credit PNC Advisors... -

Page 45

.... The Corporation seeks to manage credit risk through, among others, diversification, limiting credit exposure to any single industry or customer, requiring collateral, selling participations to third parties, and purchasing credit-related derivatives. Allowances For Credit Losses And Unfunded Loan... -

Page 46

... in asset quality. The provision includes amounts for probable losses on loans and credit exposure related to unfunded loan commitments and letters of credit. Rollforward Of Allowance For Credit Losses In millions 2002 Commercial Commercial real estate Consumer Residential mortgage Lease financing... -

Page 47

... swaps for 2002 were not significant. Interest Rate Derivative Risk Participation Agreements The Corporation enters into risk participation agreements to share credit exposure with other financial counterparties related to interest rate derivative contracts. Risk participation agreements executed... -

Page 48

... ("PNC Bank") PNC's principal bank subsidiary, is a member, are generally secured by residential mortgages, other real-estate related loans and mortgage-backed securities. At December 31, 2002, total unused borrowing capacity from the Federal Home Loan Bank under current collateral requirements was... -

Page 49

... Loan commitments are reported net of participations, assignments and syndications. (b) Includes standby bond repurchase agreements, NBOC acquisition put option and equity funding commitments related to equity management and affordable housing. CAPITAL The access to and cost of funding new business... -

Page 50

The capital position is managed through balance sheet size and composition, issuance of debt and equity instruments, treasury stock activities, dividend policies and retention of earnings. In January 2002, the Board of Directors authorized the Corporation to purchase up to 35 million shares of its ... -

Page 51

... business, including credit risk and the risk that vehicles returned during or at the conclusion of the lease term cannot be disposed of at a price at least as great as the Corporation's remaining investment in the vehicles after application of any available residual value insurance or related... -

Page 52

... Balance Sheet Review and Note 1 Accounting Policies for additional information. Equity Management Asset Valuation Equity management (private equity) assets are valued at each balance sheet date based on primarily either, in the case of limited partnership investments, the financial statements... -

Page 53

...additional information. SUPERVISION AND REGULATION The Corporation operates in highly regulated industries. Applicable laws and regulations restrict permissible activities and investments and require compliance with protections for loan, deposit, brokerage, fiduciary, mutual fund and other customers... -

Page 54

...ability to attract funds from existing and new clients might diminish. FUND SERVICING Fund servicing fees are primarily derived from the market value of the assets and the number of shareholder accounts administered by the Corporation for its clients. A rise in interest rates or a sustained weakness... -

Page 55

... to enhance the Corporation's risk management structure. • In April 2002 the Corporation created a new position, Chief Risk Officer. The Chief Risk Officer directs credit policy, balance sheet risk management and operational risk management, with the aim to help PNC sharpen its strategic focus and... -

Page 56

... long-term interest rate risk inherent in the Corporation's existing on-balance-sheet and off-balance-sheet positions. The Corporation uses the economic value of equity model to complement the net interest income simulation modeling process. The Corporation's interest rate risk management policies... -

Page 57

... for additional information. Base Rates PNC Economist Market Forward Low / Steep High / Flat OPERATIONAL RISK The Corporation is exposed to a variety of operational risks that can affect each of its business activities, particularly those involving processing and servicing. Operational risk is... -

Page 58

... Corporation for interest rate risk management. Interest rate swaps are agreements with a counterparty to exchange periodic fixed and floating interest payments calculated on a notional amount. The floating rate is based on a money market index, primarily short-term LIBOR. Total rate of return swaps... -

Page 59

... each respective date, if floating. Financial Derivatives - 2002 December 31, 2002 - dollars in millions Notional Value Fair Value Weighted-Average Interest Rates Paid Received Interest rate risk management Asset rate conversion Interest rate swaps (a) Receive fixed designated to loans Pay fixed... -

Page 60

... asset rate conversion Liability rate conversion Interest rate swaps (a) Receive fixed designated to borrowed funds Total liability rate conversion Total interest rate risk management Commercial mortgage banking risk management Pay fixed interest rate swaps designated to loans held for sale (a) Pay... -

Page 61

... of PNC. Most of these involve financial products distributed to customers, trust and custody services, and processing and funds transfer services, and the amounts involved can be quite large in relation to the Corporation's assets, equity and earnings. Currently, the primary accounting for... -

Page 62

.... See Note 1 Accounting Policies for additional information. PNC Bank provides certain administrative services, a portion of the program-level credit enhancement and the majority of the liquidity facilities to Market Street in exchange for fees negotiated based on market rates. Credit enhancement is... -

Page 63

... defined benefit pension plan ("plan" or "pension plan") covering most employees. Contributions to the pension plan are actuarially determined with assets transferred to a trust to fund benefits payable to plan participants. Plan assets are currently approximately 60% invested in equity investments... -

Page 64

... Accounting Policies for further information. BLACKROCK LONG-TERM RETENTION AND INCENTIVE PLAN In October 2002, BlackRock adopted a new long-term retention and incentive program for key employees. The program permits BlackRock to grant up to 3.5 million stock options with an exercise price of market... -

Page 65

...in the amended agreement); or (iii) proceed as expeditiously as is commercially reasonable to sell its ownership interest in BlackRock capital securities, such that neither PNC nor its affiliates is the beneficial owner of more than 4.9% of any class of voting stock of BlackRock, to a third party in... -

Page 66

... and corporate services revenue as a result of lower capital markets activity. Asset management fees of $848 million for 2001 increased $39 million or 5% primarily driven by new institutional business and strong fixed-income performance at BlackRock which more than offset decreases at PNC Advisors... -

Page 67

...total risk-based capital at December 31, 2000. CONSOLIDATED BALANCE SHEET REVIEW Loans Loans were $38.0 billion at December 31, 2001, a decrease of $12.6 billion from year end 2000 primarily due to residential mortgage securitizations and runoff, transfers to held for sale and the managed reduction... -

Page 68

... reduction in net interest income, value of assets under management and assets serviced, value of private equity investments and of other debt and equity investments, value of loans held for sale or value of other on-balance-sheet and offbalance-sheet assets; or changes in the availability and terms... -

Page 69

... as of December 31, 2002, and the related consolidated statements of income, shareholders' equity, and cash flows for the year then ended. These financial statements are the responsibility of The PNC Financial Services Group, Inc.'s management. Our responsibility is to express an opinion on these... -

Page 70

...Loans and fees on loans Securities Loans held for sale Other Total interest income INTEREST EXPENSE Deposits Borrowed funds Total interest expense Net interest income Provision for credit losses Net interest income less provision for credit losses NONINTEREST INCOME Asset management Fund servicing... -

Page 71

... losses Net loans Goodwill Other intangible assets Other Total assets LIABILITIES Deposits Noninterest-bearing Interest-bearing Total deposits Borrowed funds Federal funds purchased Repurchase agreements Bank notes and senior debt Federal Home Loan Bank borrowings Subordinated debt Other borrowed... -

Page 72

CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY THE PNC FINANCIAL SERVICES GROUP, INC. Accumulated Other Comprehensive Income (Loss) from Preferred Stock Common Stock Capital Surplus Retained Earnings Deferred Benefit Expense Continuing Discontinued Operations Operations Treasury Stock Shares ... -

Page 73

...by investing activities FINANCING ACTIVITIES Net change in Noninterest-bearing deposits Interest-bearing deposits Federal funds purchased Repurchase agreements Sales/issuances Bank notes and senior debt Federal Home Loan Bank borrowings Subordinated debt Other borrowed funds Common stock Repayments... -

Page 74

... corporate banking, real estate finance and asset-based lending; wealth management; asset management and global fund processing services. The Corporation provides certain products and services nationally and others in PNC's primary geographic markets in Pennsylvania, New Jersey, Delaware, Ohio... -

Page 75

...liquidity facilities available supporting individual pools of receivables totaling $3.9 billion, of which $3.2 billion was provided by PNC Bank. As Market Street's program administrator, PNC received fees of $13.9 million for the year ended December 31, 2002. Commitment fees related to PNC's portion... -

Page 76

...Within the PNC Advisors' business segment, PNC GPI, Inc., ("GPI") a wholly owned subsidiary of the Corporation, is the general partner and in some cases the commodity pool operator for, and PNC Bank is the investment manager for, a number of private investment funds organized as limited partnerships... -

Page 77

... accounts, all of which are associated with the securitized asset. Any gain or loss recognized on the sale of the loans depends on the allocation between the loans sold and the retained interests, based on their relative fair market values at the date of transfer. The Corporation generally estimates... -

Page 78

...loans held for sale are reported as other nonperforming assets. Foreclosed assets are comprised of property acquired through a foreclosure proceeding or acceptance of a deed-inlieu of foreclosure. These assets are recorded on the date acquired at the lower of the related loan balance or market value... -

Page 79

... Corporation for interest rate risk management. Interest rate swaps are agreements with a counterparty to exchange periodic fixed and floating interest payments calculated on a notional amount. The floating rate is based on a money market index, primarily short-term LIBOR. Total rate of return swaps... -

Page 80

... Corporation enters into interest rate and total rate of return swaps, caps, floors and interest rate futures derivative contracts to hedge designated commercial mortgage loans held for sale, securities available for sale, commercial loans, bank notes, senior debt and subordinated debt for changes... -

Page 81

... assets under management and performance fees based on a percentage of the returns on such assets. Fund servicing fees are primarily based on a percentage of the fair value of the assets, and the number of shareholder accounts, administered by the Corporation. INCOME TAXES Income taxes are accounted... -

Page 82

...new standard. Impairment testing for goodwill at a reporting unit level is required on at least an annual basis. The standard also addresses other accounting matters, disclosure requirements and financial statement presentation issues relating to goodwill and other intangible assets. The Corporation... -

Page 83

...long-lived assets that are held and used by a company. SFAS No. 147 became effective October 1, 2002 and did not have a material impact on the Corporation's consolidated financial statements. In November 2002, the FASB issued FIN 45, "Guarantor's Accounting and Disclosure Requirements for Guarantees... -

Page 84

..."). These agreements address such issues as risk, management and financial controls. The Corporation and PNC Bank also entered into agreements with the Federal Reserve and the OCC, respectively, requiring the Corporation and PNC Bank to provide a plan for PNC Bank to meet the "well capitalized" and... -

Page 85

...or make other capital distributions. Without regulatory approval, the amount available for payment of dividends by PNC Bank was $460 million at December 31, 2002. Management expects that the parent company will have sufficient liquidity available to pay dividends at current rates through 2003. Under... -

Page 86

... the Corporation's portfolio for gains from market movements. PNC participates in derivatives and foreign exchange trading as well as underwriting and "market making" in equity securities as an accommodation to customers. PNC also engages in trading activities as part of risk management strategies... -

Page 87

... held to maturity December 31, 2000 SECURITIES AVAILABLE FOR SALE Debt securities U.S. Treasury and government agencies Mortgage-backed Asset-backed State and municipal Other debt Total debt securities Corporate stocks and other Total securities available for sale $813 8,916 2,699 61 58 12,547... -

Page 88

...31, 2002 Dollars in millions Within 1 Year 1 to 5 Years 5 to 10 Years After 10 Years Total SECURITIES AVAILABLE FOR SALE U.S. Treasury and government agencies Mortgage-backed Asset-backed State and municipal Other debt Total securities available for sale Fair value Weighted-average yield SECURITIES... -

Page 89

...Such instruments are typically issued to support industrial revenue bonds, commercial paper, and bid-or-performance related contracts. At year-end 2002, the largest industry concentration within standby letters of credit was for real estate projects, which accounted for approximately 8% of the total... -

Page 90

...December 31, 2002 and 2001, respectively. (b) Excludes $40 million (including $12 million of troubled debt restructured assets), $18 million, $18 million and $13 million of equity management assets at December 31, 2002, 2001, 2000 and 1999, respectively, that are carried at estimated fair value. 88 -

Page 91

... of the new standard. Impairment testing for goodwill at a reporting unit level will be required on at least an annual basis. In accordance with SFAS No. 142, the Corporation identified its reporting unit structure for goodwill impairment testing purposes as of January 1, 2002. Management performed... -

Page 92

A summary of the changes in goodwill by business during 2002 follows: Goodwill In millions January 1 Goodwill 2002 Acquired Adjustments Dec. 31 2002 Regional Community Banking Corporate Banking PNC Real Estate Finance PNC Business Credit PNC Advisors BlackRock PFPC Total $438 39 298 23 151 175 912... -

Page 93

... portfolios in which the Corporation had interest-only strips outstanding at December 31, 2002 and related delinquencies follows: Assuming a prepayment speed of 10% and weighted average life of 10.7 years discounted at 8.5%, the estimated fair value of commercial mortgage servicing rights was $227... -

Page 94

... December 31, 2002 Dollars in millions Residential Mortgages Student Loans Other Fair value of retained interest (carrying value) Weighted-average life (in years) Residual cash flows discount rate Impact on fair value of 10% adverse change Impact on fair value of 20% adverse change Prepayment speed... -

Page 95

... cumulative effect of a change in accounting principle of $5 million reported in the consolidated income statement and an after-tax accumulated other comprehensive loss of $4 million. The impact of the adoption of this standard related to the residential mortgage banking business is reflected in the... -

Page 96

...primarily consist of listed common stocks, U.S. government and agency securities and various mutual funds managed by BlackRock from which BlackRock and PFPC receive compensation for providing investment advisory, custodial and transfer agency services. Plan assets are managed by BlackRock and do not... -

Page 97

...one-percentage-point change in assumed health care cost trend rates would have the following effects: Year ended December 31, 2002 - in millions INCENTIVE SAVINGS PLAN The Corporation sponsors an incentive savings plan that covers substantially all employees. Under this plan, employee contributions... -

Page 98

... based on the number of ESOP shares allocated. Compensation expense related to these plans was $47 million, $28 million and $30 million for 2002, 2001 and 2000, respectively. NOTE 22 STOCK-BASED COMPENSATION PLANS The Corporation has a long-term incentive award plan ("Incentive Plan") that provides... -

Page 99

... is measured using the fluctuation in quarter-end closing stock prices over a five-year period. Option Pricing Assumptions Year ended December 31 2002 4.4% 3.5 26.7 5 yrs. 2001 4.9% 3.2 25.7 5 yrs. 2000 6.6% 3.1 21.8 5 yrs. Risk-free interest rate Dividend yield Volatility Expected life 97 -

Page 100

... 2002 $297 2001 $225 31 75 330 163 824 1,182 53 Deferred tax assets Allowance for credit losses Compensation and benefits Net unrealized securities losses Loan valuations related to institutional lending repositioning Other Total deferred tax assets Deferred tax liabilities Leasing Depreciation... -

Page 101

... from cumulative effect of accounting change Basic earnings per common share CALCULATION OF DILUTED EARNINGS PER COMMON SHARE Income from continuing operations Less: Dividends declared on nonconvertible Series F preferred stock (a) Income from continuing operations applicable to diluted earnings... -

Page 102

... of loan servicing and technology to the commercial real estate finance industry. Columbia Housing Partners, LP is a national syndicator of affordable housing. PNC Business Credit provides asset-based lending, treasury management and capital markets products and services to middle market customers... -

Page 103

Results Of Businesses Year ended December 31 In millions Regional Community Banking Corporate Banking PNC Real Estate Finance PNC Business Credit PNC Advisors BlackRock PFPC Other Consolidated 2002 INCOME STATEMENT Net interest income Noninterest income Total revenue Provision for credit losses ... -

Page 104

...INCOME The Corporation's other comprehensive income primarily consists of unrealized gains or losses on securities available for sale and ... are as follows: Year ended December 31 In millions Pretax Amount Tax Benefit (Expense) After-tax Amount The accumulated balances related to each component of ... -

Page 105

... sale Net loans (excludes leases) Other assets Commercial mortgage servicing rights Financial derivatives Interest rate risk management Commercial mortgage banking risk management Customer/other derivatives Liabilities Demand, savings and money market deposits Time deposits Borrowed funds Financial... -

Page 106

... FOR SALE Fair values are estimated based on the discounted value of expected net cash flows incorporating assumptions about prepayment rates, credit losses and servicing fees and costs. For revolving home equity loans, this fair value does not include any amount for new loans or the related fees... -

Page 107

... of its customers to third parties. If the customer fails to meet its financial or performance obligation to the third party under the terms of the contract, then upon their request PNC would be obligated to make payment to the guaranteed party. Standby letters of credit and risk participations in... -

Page 108

... $460 million, none Commercial paper and all other debt issued by PNC Funding Corp., a wholly owned finance subsidiary, is fully and unconditionally guaranteed by the parent company. In addition, in connection with certain affiliates' commercial mortgage servicing operations, the parent company has... -

Page 109

... earnings of subsidiaries Other Net cash provided by operating activities INVESTING ACTIVITIES Net change in short-term investments with subsidiary bank Net capital (contributed to) returned from subsidiaries Securities available for sale Sales and maturities Purchases Other Net cash (used) provided... -

Page 110

... Minority interest in income of consolidated entities Income taxes Income (loss) from continuing operations (Loss) income from discontinued operations Income (loss) before cumulative effect of accounting change Cumulative effect of accounting change Net income (loss) PER COMMON SHARE DATA Book value... -

Page 111

..., government agencies and corporations Other debt State and municipal Corporate stocks and other Total securities available for sale Securities held to maturity Total securities Loans, net of unearned income Commercial Commercial real estate Consumer Residential mortgage Lease financing Other... -

Page 112

... and government agencies and corporations Other debt State and municipal Corporate stocks and other Total securities available for sale Securities held to maturity Total securities Loans, net of unearned income Commercial Commercial real estate Consumer Residential mortgage Lease financing Credit... -

Page 113

...Average Balances Interest Average Yields/Rates Average Balances 1999 Interest Average Yields/Rates Average Balances 1998 Interest Average Yields/Rates ...3.15 .71 3.86% $2,514 3.22 .77 3.99% Loan fees for each of the years ended December 31, 2002, 2001, 2000, 1999 and 1998 were $106 million, $119... -

Page 114

... Commercial Commercial real estate Consumer Residential mortgage Lease financing Credit card Total recoveries Net charge-offs Provision for credit losses Acquisitions/(divestitures) Net change in allowance for unfunded loan commitments and letters of credit Allowance at end of year Allowance... -

Page 115

... rate swaps, caps and floors designated to commercial loans altered the interest rate characteristics of such loans. The basis adjustment related to fair value hedges for commercial loans is included in the above table. TIME DEPOSITS OF $100,000 OR MORE Time deposits in foreign offices totaled... -

Page 116

...stock is listed on the New York Stock Exchange under the symbol PNC. At the close of business on February 7, 2003, there were 51,948 common shareholders of record. (See also Executive Officers pictured on page 21) ROBERT C. BARRY, JR. Director of Finance MICHAEL J. HANNON Chief Credit Policy Officer... -

Page 117

... QUALITY OF Services Group, Inc. LIFE POne ERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER PNC Plaza TEAMWORK RESPECT INTEGRITY DIVERSITY QUALITY OF LIFE PERFORMANCE CUSTOMER FOCUS TEAMWORK RESPECT FOCUS 249 Fifth Avenue Pittsburgh, PA 15222-2707...