PNC Bank 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2001 ANNUAL REPORT

Table of contents

-

Page 1

2001 ANNUAL REPORT -

Page 2

CONTENTS Financial Highlights ...Chairman's Letter ...Q&A ...1 2 8 How Are We Creating Value? . . 10 Banking Businesses ...12 Asset Management and Processing ...18 Enriching Lives ...22 Board of Directors ...24 Financials ...25 Executive Management ...100 Corporate Information ...101 -

Page 3

... 5,946 YEAR-END BALANCES ...Assets ...Loans, net of unearned income ...Deposits ...Shareholders' equity ... Note: This annual report contains forward-looking statements. Please refer to the section of this report captioned "Forward-Looking Statements" on page 60 for important information related to... -

Page 4

"...OUR LONG-TERM OBJECTIVE REMAINS CLEAR AND UNCHANGED: TO BUILD A DIVERSIFIED FINANCIAL CHAIRMAN'S LETTER SERVICES COMPANY THAT GENERATES SUPERIOR FINANCIAL PERFORMANCE AND ACHIEVES A PREMIUM " VALUATION. -

Page 5

... focus on the strategic growth of our businesses, value-added customer relationships, executing our loan downsizing initiative and asset quality. FOCUSED ON GROWTH Our Regional Community Bank has grown higher-return, lower-risk transaction deposits by 11% on average over the past year. This is the... -

Page 6

...) increased assets under management by 17% in 2001, and delivered 23% growth in net income. PFPC is the nation's largest full-service mutual fund transfer agent and second-largest provider of mutual fund accounting and administration services. Its complement of technology-based, customized solutions... -

Page 7

... opportunities to liquidate loans held for sale. Our 2001 loan reduction initiative included institutional credits that no longer meet our risk/return criteria and our $1.9 billion vehicle leasing business. We decided to discontinue vehicle leasing due to the rapidly changing environment and what we... -

Page 8

...sales performance in a number of key businesses. Our employees are also community ambassadors for PNC. Thanks to them, we're rapidly approaching our goal of performing 1 million hours of service under our "Promise to Neighborhood Children" initiative. We've worked to support the values-based culture... -

Page 9

... revenue base in 2001 was derived from more highly-valued deposit, asset management and processing products. PNC REVENUE MIX BY BUSINESS (1) Year ended December 31, 2001 0 15% 30% 45% 60% 75% PFPC 14% BlackRock 10% PNC Advisors 14% Banking 62% We've diversiï¬ed our revenue stream by growing... -

Page 10

... VALUE IN PNC'S BANKING BUSINESSES? Over the past three years, we have dramatically reduced our exposure to certain large corporate credits, and we have sold or downsized a number of other lending businesses that didn't meet our goals for shareholder return. As a result, as we execute on our loan... -

Page 11

...our reach in secured lending. And the acquisition of Investor Services Group in late 1999 has signiï¬cantly enhanced our growth prospects in global funds processing, another area where PNC has created shareholder value. - Gregg CAN GROWTH IN BLACKROCK AND PFPC BE SUSTAINED? BlackRock and PFPC have... -

Page 12

HILLMAN BUS SERVICE BLACKROCK'S GROWING GLOBAL PRESENCE HANDEE MARTS ADVISORCENTRAL -

Page 13

... in 27 countries and portfolios invested in all major markets worldwide. At year-end, BlackRock managed $33 billion of assets for international investors, up $21 billion in the past two years. Over the same period, net new business in international equities approached $9 billion. And clients are... -

Page 14

-

Page 15

... AND MORE 190,000 SMALL BUSINESS, CORPORATE AND THAN COMMERCIAL REAL ESTATE CLIENTS THROUGH: •THE 8TH-LARGEST ATM NETWORK •THE 9TH-LARGEST BANKING BUSINESSES BUSINESS TREASURY MANAGEMENT •THE 2ND-LARGEST SERVICER OF COMMERCIAL MORTGAGEBACKED SECURITIES • A TOP-5 ASSET-BASED LENDER -

Page 16

... by investing in people, processes and technology helps position this business for continued success. The strategic focus is on building a retail franchise that delivers sustainable revenue growth and improved returns. This will help create additional value for shareholders, customers, employees and... -

Page 17

...Capital Markets' client portfolio. Corporate Banking also taps the expertise of PNC Advisors to cross-sell sophisticated personal investment management products to high-net-worth executives and corporate clients. Innovative solutions that capitalize on PNC's strong technology base continued to drive... -

Page 18

...servicing solutions. In October 2001, PNC Real Estate Finance acquired certain lending- and servicingrelated assets of TRI Acceptance Corporation, a provider of loans for market-rate and affordable multi-family company and the nation's secondlargest servicer of commercial mortgage-backed securities... -

Page 19

... fee-based products and services, such as treasury management, capital markets and Workplace Banking. In 2002, PNC Business Credit BUSINESS CREDIT In 2001, PNC Business Credit strengthened its position as one of the nation's largest asset-based lenders. In a challenging economic environment, PNC... -

Page 20

ASSET MANAGEMENT AND -

Page 21

... in net asset inï¬,ows from new and existing customers in a difficult market environment. Hilliard Lyons increased the proportion of employees dedicated to client contact and grew total accounts by more than 37,000 last year while streamlining support functions. To take advantage of Hilliard Lyons... -

Page 22

... retail banking region, while Hilliard Lyons will retain its brand name in the markets where it is well established. Investments in technology also continue to enhance PNC Advisors' distribution platform. Clients can effect certain transactions through the PNC Bank Account Link® system, a secure... -

Page 23

... providers of services to the investment fund and retirement services industry and now services more than $1.5 trillion in total assets. PFPC is the nation's largest fullservice mutual fund transfer agent and the second-largest provider of mutual fund accounting and administration services. PFPC is... -

Page 24

-

Page 25

... achieving exceptional business results. In addition to recognizing their successes, we strive to provide employees with a work environment that promotes our shared values and improves their quality of life. In 2001, Fortune magazine named PNC one of its "Most Admired Companies," and Working Mother... -

Page 26

... Company (food products company) Director since 1997 JAMES E. ROHR (2,6) Chairman, President and Chief Executive Officer The PNC Financial Services Group, Inc. Director since 1989 MILTON A. WASHINGTON (5,6) President and Chief Executive Officer Allegheny Housing Rehabilitation Corporation (housing... -

Page 27

FINANCIALS THE PNC FINANCIAL SERVICES GROUP, INC. FINANCIAL REVIEW Selected Consolidated Financial Data ...26 Overview ...28 Review Of Businesses ...31 Regional Community Banking ...32 Corporate Banking ...33 PNC Real Estate Finance . . 34 PNC Business Credit ...35 PNC Advisors ...36 BlackRock ...... -

Page 28

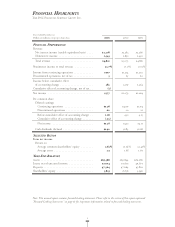

FINANCIAL REVIEW THE PNC FINANCIAL SERVICES GROUP, INC. SELECTED CONSOLIDATED FINANCIAL DATA Year ended December 31 Dollars in millions, except per share data 2001 2000 1999 1998 1997 SUMMARY OF OPERATIONS Interest income Interest expense Net interest income Provision for credit losses ... -

Page 29

... income. Amortization, distributions on capital securities and mortgage banking risk management activities are excluded for purposes of computing this ratio. Excluding the impact of charges in 2001 related to strategic initiatives and additions to reserves related to insured residual value... -

Page 30

... SERVICES GROUP, INC. The Corporation is one of the largest diversified financial services companies in the United States, operating businesses engaged in regional community banking, corporate banking, real estate finance, asset-based lending, wealth management, asset management and global fund... -

Page 31

... Credit Total loans held for sale EXIT Corporate Banking PNC Real Estate Finance Total exit Total into transactions with subsidiaries of a third party financial institution (American International Group, Inc.) involving the sale of loans and venture capital investments and the receipt of preferred... -

Page 32

... to invest in and sustain revenue growth of fee-based businesses such as asset management and processing notwithstanding market volatility and intense competition; and Continuing to improve the risk/return dynamics of traditional banking businesses by building value-added customer relationships... -

Page 33

... statement assignments and transfers to measure performance of the businesses. Methodologies change from time to time as management accounting practices are enhanced and businesses change. Securities available for sale or borrowings and related net interest income are assigned based on the net asset... -

Page 34

... Residential mortgage Commercial Vehicle leasing Other Total loans Securities available for sale Loans held for sale Assigned assets and other assets Total assets Deposits Noninterest-bearing demand Interest-bearing demand Money market Total transaction deposits Savings Certificates Total deposits... -

Page 35

...PERFORMANCE RATIOS Return on assigned capital Noncredit revenue to total revenue Efficiency Corporate Banking provides credit, equipment leasing, treasury management and capital markets products and services primarily to mid-sized corporations and government entities within PNC's geographic region... -

Page 36

...Noninterest income to total revenue Efficiency 2001 $54 25 (11) $68 2000 $45 17 (8) $54 January 1 Acquisitions/additions Repayments/transfers December 31 PNC Real Estate Finance provides credit, capital markets, treasury management, commercial mortgage loan servicing and other financial products... -

Page 37

... Total funds PERFORMANCE RATIOS Return on assigned capital Efficiency PNC Business Credit provides asset-based lending, capital markets and treasury management products and services to middle market customers nationally. PNC Business Credit's lending services include loans secured by accounts... -

Page 38

... RATIOS Return on assigned capital Noninterest income to total revenue Efficiency PNC Advisors provides a full range of tailored investment products and services to affluent individuals and families, including full-service brokerage through J.J.B. Hilliard, W.L. Lyons, Inc. ("Hilliard Lyons... -

Page 39

... securities lending Equity Alternative investment products Total separate accounts Mutual funds (a) Fixed income Liquidity Equity Total mutual funds Total assets under management (a) Includes BlackRock Funds, BlackRock Provident Institutional Funds, BlackRock Closed End Funds, Short Term Investment... -

Page 40

... assets Total assets Assigned funds and other liabilities Assigned capital Total funds PERFORMANCE RATIOS Return on assigned capital Operating margin (a) Net of nonoperating expense PFPC is the largest full-service mutual fund transfer agent and second largest provider of mutual fund accounting... -

Page 41

... assets/ interest income Noninterest-earning assets Investment in discontinued operations Total assets Interest-bearing liabilities Deposits Demand and money market Savings Retail certificates of deposit Other time Deposits in foreign offices Total interest-bearing deposits Borrowed funds Total... -

Page 42

... of revenues from fees earned by managing investments for others. See Business and Economic Conditions and Critical Accounting Policies and Judgments in the Risk Factors section of this Financial Review for additional information regarding equity management assets. Net securities gains were $131... -

Page 43

...Retail/wholesale Service providers Real estate related Financial services Communications Health care Other Total commercial Commercial real estate Mortgage Real estate project Total commercial real estate Consumer Home equity Automobile Other Total consumer Residential mortgage Lease financing Other... -

Page 44

...under Risk Management in the Financial Review section for additional information. Details Of Funding Sources December 31 - in millions Amortized Cost Fair Value December 31, 2001 SECURITIES AVAILABLE FOR SALE Debt securities U.S. Treasury and government agencies Mortgage-backed Asset-backed State... -

Page 45

... equity capital markets, and the strength of the U.S. economy, in general, and the regional economies in which the Corporation conducts business. A sustained weakness or further weakening of the economy could decrease the value of loans held for sale, decrease the demand for loans and other products... -

Page 46

... investment in the vehicles after application of any available residual value insurance or related reserves. In January 2001, PNC sold its residential mortgage banking business. Certain closing date purchase price adjustments aggregating approximately $300 million pretax are currently in dispute... -

Page 47

...or, with respect to direct investments, the estimated fair value. Changes in the market value of these investments are reflected in the Corporation's results of operations as equity management income. The value of limited partnership investments is based on the financial statements received from the... -

Page 48

.... FUND SERVICING Fund servicing fees are primarily based on the market value of the assets and the number of shareholder accounts administered by the Corporation for its clients. A rise in interest rates or a sustained weakness or further weakening or volatility in the debt and equity markets could... -

Page 49

... assets, net charge-offs and provision for credit losses. RISK MANAGEMENT In the normal course of business, the Corporation assumes various types of risk, which include, among other things, credit risk, interest rate risk, liquidity risk, and risk associated with trading activities, financial... -

Page 50

... at December 31, 2001. Charge-Offs And Recoveries 2000 Allowance Loans to Total Loans Year ended December 31 Dollars in millions Charge-offs Recoveries Net Charge-offs Percent of Average Loans Commercial Commercial real estate Consumer Residential mortgage Other Total $467 67 49 8 39... -

Page 51

...$372 Commercial Commercial real estate Consumer Residential mortgage Lease financing Total loans Loans held for sale Total loans and loans held for sale Regional Community Banking Corporate Banking PNC Real Estate Finance PNC Business Credit PNC Advisors Total nonperforming assets Loans and loans... -

Page 52

... income and net interest margin. To further these objectives, the Corporation uses securities purchases and sales, short-term and long-term funding, financial derivatives and other capital markets instruments. Interest rate risk is centrally managed by Asset and Liability Management. The Corporation... -

Page 53

... Finance Committee of the Board of Directors. The Corporation's main sources of funds to meet its liquidity requirements are access to the capital markets, sale of liquid assets, secured advances from the Federal Home Loan Bank, its core deposit base and the capability to securitize assets for sale... -

Page 54

... events. Loan commitments are reported net of participations, assignments and syndications. (b) Equity Management funding commitments. TRADING ACTIVITIES Most of PNC's trading activities are designed to provide capital markets services to customers and not to position the Corporation's portfolio... -

Page 55

... rate swaps Receive fixed Pay fixed Basis swaps Interest rate caps Interest rate floors Futures contracts Total interest rate risk management Commercial mortgage banking risk management Interest rate swaps Total rate of return swaps Total commercial mortgage banking risk management Student lending... -

Page 56

... rate conversion Total interest rate risk management Commercial mortgage banking risk management Pay fixed interest rate swaps designated to loans held for sale (a) Pay total rate of return swaps designated to loans held for sale (a) Total commercial mortgage banking risk management Total financial... -

Page 57

... banking risk management Pay fixed interest rate swaps designated to securities held for sale (a) Pay fixed interest rate swaps designated to loans held for sale (a) Pay total rate of return swaps designated to loans held for sale (a) Total commercial mortgage banking risk management Student lending... -

Page 58

....sec.gov; PFPC processes mutual fund transactions, provides securities lending services and maintains custody of certain fund assets; PNC Advisors provides trust services and holds assets for personal and institutional customers; Hilliard Lyons maintains brokerage assets of customers; and Columbia... -

Page 59

... it received related fees of $11.7 million and $10.7 million for the years ended December 31, 2001 and 2000, respectively. SECURITIZATIONS From time to time the Corporation has sold loans in secondary market securitization transactions. The Corporation uses securitizations to manage various balance... -

Page 60

... management and commercial mortgage servicing fees that were partially offset by a lower level of commercial mortgage-backed securitization gains due to the impact of weaker capital market conditions. Equity management income was $133 million for 2000 compared to $100 million in the prior year. Net... -

Page 61

... at year-end 1999. Funding Sources Total funding sources were $59.4 billion at December 31, 2000 and $60.0 billion at December 31, 1999. Increases in demand and money market deposits allowed PNC to reduce higher-costing funding sources including deposits in foreign offices, Federal Home Loan Bank... -

Page 62

... allowance for credit losses; a reduction in demand for credit or fee-based products and services, net interest income, value of assets under management and assets serviced, value of venture capital investments and of other debt and equity investments, value of loans held for sale or value of other... -

Page 63

..., and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2001. These financial statements are the responsibility of The PNC Financial Services Group, Inc.'s management. Our responsibility is to express an... -

Page 64

... Net interest income less provision for credit losses NONINTEREST INCOME Asset management Fund servicing Service charges on deposits Brokerage Consumer services Corporate services Equity management Net securities gains Sale of subsidiary stock Other Total noninterest income NONINTEREST EXPENSE Staff... -

Page 65

... par value ASSETS Cash and due from banks Short-term investments Loans held for sale Securities Loans, net of unearned income of $1,164 and $999 Allowance for credit losses Net loans Goodwill and other amortizable assets Investment in discontinued operations Other Total assets LIABILITIES Deposits... -

Page 66

... Stock In millions Total Balance at January 1, 1999 Net income Net unrealized securities losses Minimum pension liability adjustment Other Comprehensive income Cash dividends declared Common Preferred Treasury stock activity (11.0 net shares purchased) Tax benefit of ESOP and stock option plans... -

Page 67

...of year Cash and due from banks at end of year CASH PAID FOR Interest Income taxes NON-CASH ITEMS Transfer of mortgage loans to securities Transfer to (from) loans from (to) loans held for sale Transfer from loans to other assets See accompanying Notes to Consolidated Financial Statements. (3,378... -

Page 68

... Group, Inc. ("Corporation" or "PNC") is one of the largest diversified financial services companies in the United States, operating businesses engaged in regional community banking, corporate banking, real estate finance, asset-based lending, wealth management, asset management and global fund... -

Page 69

... allocation between the loans sold and the retained interests, based on their relative fair market values at the date of transfer. The Corporation generally estimates fair value based on the present value of future expected cash flows using assumptions as to discount rates, prepayment speeds, credit... -

Page 70

... of loans, the total reserve is available for all credit losses. EQUITY MANAGEMENT ASSETS Equity management assets are included in other assets and are comprised of limited partnerships and direct investments. Investments in limited partnerships are valued based on the financial statements received... -

Page 71

... interest rate and total rate of return swaps, caps, floors and interest rate futures derivative contracts to hedge designated commercial mortgage loans held for sale, securities available for sale, commercial loans, bank notes, senior debt and subordinated debt for changes in fair value primarily... -

Page 72

... assets under management and performance fees based on a percentage of the returns on such assets. Fund servicing fees are primarily based on a percentage of the fair value of the assets, and the number of shareholder accounts, administered by the Corporation. INCOME TAXES Income taxes are accounted... -

Page 73

... options are granted at exercise prices not less than the fair market value of common stock on the date of grant. No compensation expense is recognized on such stock options. RECENT ACCOUNTING PRONOUNCEMENTS As stated previously, the Corporation adopted SFAS No. 133 effective January 1, 2001. As... -

Page 74

... for sale Securities available for sale Loans, net of unearned income Goodwill and other amortizable assets All other assets Total assets Deposits Borrowed funds Other liabilities Total liabilities Net assets The notional and fair value of financial derivatives used for residential mortgage banking... -

Page 75

... of PNC's trading activities are designed to provide capital markets services to customers and not to position the Corporation's portfolio for gains from market movements. PNC participates in derivatives and foreign exchange trading as well as underwriting and "market making" in equity securities as... -

Page 76

...-down of an equity investment. Net securities losses of $3 million in 2001 and net securities gains of $9 million and $3 million in 2000 and 1999, respectively, related to commercial mortgage banking activities were included in corporate services revenue. Information relating to securities sold is... -

Page 77

... (412) $54,235 Commercial Commercial real estate Consumer Residential mortgage Lease financing Credit card Other Total loans Unearned income Total loans, net of unearned income Loans outstanding and related unfunded commitments are concentrated in PNC's primary geographic markets. At December 31... -

Page 78

... 1,700 $31,702 Commercial Commercial real estate Consumer Lease financing Other Institutional lending repositioning Total Commitments to extend credit represent arrangements to lend funds subject to specified contractual conditions. At December 31, 2001, commercial commitments are reported net of... -

Page 79

... Goodwill Purchased credit cards Commercial mortgage servicing rights Other Total 27 (12) $132 18 (6) $128 In addition, write-downs of $11 million related to impairment of goodwill for the year ended December 31, 2001 resulted from PNC's decision to discontinue its vehicle leasing business. 77 -

Page 80

... used in measuring the fair value of the interest-only strips and servicing rights at the date of the securitization resulting from securitizations completed during the year and related information were as follows: Key Economic Assumptions Dollars in millions Quantitative information about managed... -

Page 81

... Student Mortgage Loans $29 $52 .8 2.0 7.50% 4.40% $(.2) (.3) 50.0% $(1.9) (3.5) $(2.2) (3.3) 13.7% $(.8) (1.3) Other $2 1.8 4.14% Fair value of retained interest (carrying value) Weighted-average life (in years) Residual cash flows discount rate Impact on fair value of 10% adverse change... -

Page 82

...all of the obligations of the Trusts under the Capital Securities. For a discussion of certain dividend restrictions, see Note 19 Regulatory Matters. NOTE 18 SHAREHOLDERS' EQUITY Information related to preferred stock is as follows: Liquidation Value per Share Preferred Shares 2001 17,172 $40 40 20... -

Page 83

... to and cost of funding new business initiatives including acquisitions, the ability to pay dividends, deposit insurance costs, and the level and nature of regulatory oversight depend, in large part, on a financial institution's capital strength. The minimum regulatory capital ratios are 4% for Tier... -

Page 84

... date. 82 Plan assets primarily consist of listed common stocks, U.S. government and agency securities and various mutual funds managed by BlackRock from which BlackRock and PFPC receive compensation for providing investment advisory, custodial and transfer agency services. Plan assets are managed... -

Page 85

...-point change in assumed health care cost trend rates would have the following effects: Year ended December 31, 2001 - in millions Increase Decrease $1 9 $(1) (9) Effect on total service and interest cost Effect on post-retirement benefit obligation INCENTIVE SAVINGS PLAN The Corporation... -

Page 86

... on the number of ESOP shares allocated. Compensation expense related to these plans was $28 million, $30 million and $17 million for 2001, 2000 and 1999, respectively. NONQUALIFIED STOCK OPTIONS Options are granted at exercise prices not less than the market value of common stock on the date of... -

Page 87

...'s employee stock purchase plan ("ESPP") has approximately 2.6 million shares available for issuance. Persons who have been continuously employed for at least one year are eligible to participate. Participants purchase the Corporation's common stock at 85% of the lesser of fair market value on... -

Page 88

... tax assets Allowance for credit losses Compensation and benefits Net unrealized securities losses Loan valuations related to institutional lending repositioning Other Total deferred tax assets Deferred tax liabilities Leasing Depreciation Other Total deferred tax liabilities Net deferred tax... -

Page 89

...of accounting change applicable to diluted earnings per common share Net income applicable to diluted earnings per common share Basic weighted-average common shares outstanding (in thousands) Weighted-average common shares to be issued using average market price and assuming: Conversion of preferred... -

Page 90

... loan servicing and technology to the commercial real estate finance industry, and national syndication of affordable housing equity through Columbia Housing Partners, LP. PNC Business Credit provides asset-based lending, capital markets and treasury management products and services to middle market... -

Page 91

Results Of Businesses Year ended December 31 In millions Regional Community Banking Corporate Banking PNC Real Estate Finance PNC Business Credit PNC Advisors BlackRock PFPC Other Consolidated 2001 INCOME STATEMENT Net interest income Noninterest income Total revenue Provision for credit losses ... -

Page 92

... of unrealized gains or losses on securities available for sale and cash flow hedge derivatives and minimum pension liability adjustments. The income effects allocated to each component of other comprehensive income (loss) are as follows: Tax Benefit After-tax (Expense) Amount $30 3 27 2 (36) 19... -

Page 93

... held for sale Net loans (excludes leases) Commercial mortgage servicing rights Financial derivatives (a) Interest rate risk management Commercial mortgage banking risk management Customer/other derivatives Liabilities Demand, savings and money market deposits Time deposits Borrowed funds Financial... -

Page 94

...life of the related commercial loans. DEPOSITS The carrying amounts of noninterest-bearing demand and interest-bearing money market and savings deposits approximate fair values. For time deposits, which include foreign deposits, fair values are estimated based on the discounted value of expected net... -

Page 95

... (used) by operating activities: Equity in undistributed net earnings of subsidiaries Other Net cash provided by operating activities INVESTING ACTIVITIES Net change in short-term investments with subsidiary bank Net capital (contributed to) returned from subsidiaries Securities available for sale... -

Page 96

... sale price and carrying value was recorded as charge-offs for portfolio loans and SELECTED QUARTERLY FINANCIAL DATA Dollars in millions, except per share data as valuation adjustments in noninterest income for loans previously held for sale. Subsequent to the date of sale, lower of cost or market... -

Page 97

... Commercial Commercial real estate Consumer Residential mortgage Lease financing Credit card Other Total loans, net of unearned income Other Total interest-earning assets INTEREST-BEARING LIABILITIES Interest-bearing deposits Demand and money market Savings Retail certificates of deposit Other time... -

Page 98

... government agencies and corporations Other debt Other Total securities available for sale Securities held to maturity Total securities Loans, net of unearned income Commercial Commercial real estate Consumer Residential mortgage Lease financing Credit card Other Total loans, net of unearned income... -

Page 99

1999 Average Balances Interest Average Yields/Rates Average Balances 1998 Interest Average Yields/Rates Average Balances 1997 Interest Average Yields/Rates $1,392 $104 7.47% $436 $31 7.11% $24 $2 8.33% 1,970 3,441 673 6,084 6,084 23,082 3,362 10,310 12,258 2,564 672 532 52,780 1,... -

Page 100

...Commercial real estate Commercial mortgage Real estate project Consumer Residential mortgage Lease financing Credit card Other Total recoveries Net charge-offs Provision for credit losses (Divestitures)/acquisitions Allowance at end of year Allowance as a percent of period-end Loans Nonaccrual loans... -

Page 101

... Less 5 Years After 5 Years Gross Loans Commercial Real estate project Total Loans with Predetermined rate Floating rate Total $6,764 801 $7,565 $838 6,727 $7,565 $7,168 887 $8,055 $1,209 6,846 $8,055 $1,273 $15,205 92 1,780 $1,365 $16,985 $579 $2,626 786 14,359 $1,365 $16,985 TIME DEPOSITS OF... -

Page 102

EXECUTIVE MANAGEMENT THE PNC FINANCIAL SERVICES GROUP, INC. JAMES E. ROHR (1) Chairman, President and Chief Executive Officer 29 years of service BUSINESS EXECUTIVES LAURENCE D. FINK Chairman and Chief Executive Officer BlackRock 7 years of service JOSEPH C. GUYAUX (1) Group Executive Regional ... -

Page 103

... low sale and quarter-end closing prices for The PNC Financial Services Group, Inc. common stock and the cash dividends declared per common share. High Low Cash Dividends Close Declared STOCK LISTING The PNC Financial Services Group, Inc. common stock is listed on the New York Stock Exchange under... -

Page 104

The PNC Financial Services Group, Inc. One PNC Plaza 249 Fifth Avenue Pittsburgh, PA 15222-2707