Occidental Petroleum 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

þAnnual Report Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

¨ Transition Report Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

For the fiscal year ended December 31, 2015

For the transition period from to

Commission File Number 1-9210

Occidental Petroleum Corporation

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization

Delaware

I.R.S. Employer Identification No.

95-4035997

Address of principal executive offices

5 Greenway Plaza, Suite 110, Houston, Texas

Zip Code

77046

Registrant's telephone number, including area code

(713) 215-7000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

Name of Each Exchange on Which Registered

9 1/4% Senior Debentures due 2019

New York Stock Exchange

Common Stock, $0.20 par value

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

þ¨

¨þ

þ¨

þ¨

þ

þ ¨

¨ ¨

¨þ

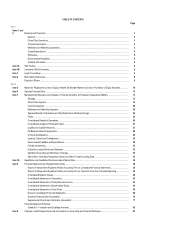

Table of contents

-

Page 1

... fiscal year ended December 31, 2015 Commission File Number 1-9210 Occidental Petroleum Corporation (Exact name of registrant as specified in its charter) State or other jurisdiction of incorporation or organization I.R.S. Employer Identification No. Address of principal executive offices Zip Code... -

Page 2

... (MD&A)...Strategy...Oil and Gas Segment...Chemical Segment...Midstream and Marketing Segment...Segment Results of Operations and Significant Items Affecting Earnings...Taxes...Consolidated Results of Operations...Consolidated Analysis of Financial Position...Liquidity and Capital Resources...Off... -

Page 3

...and Report on Internal Control Over Financial Reporting...Disclosure Controls and Procedures... 93 93 93 93 94 94 94 94 94 94 Item 9B Part III Item 10 Item 11 Item 12 Item 13 Item 14 Part IV Item 15 Other Information...Directors, Executive Officers and Corporate Governance...Executive Compensation... -

Page 4

... located in New Mexico and Texas. International operations are located in Bolivia, Colombia, Oman, Qatar and the United Trab Emirates (UTE). Proved Reserves and Sales Volumes The table below shows Occidental's total oil, NGLs and natural gas proved reserves and sales volumes in 2015, 2014 and 2013... -

Page 5

... chemical producers. OxyChem's market position was first or second in the United States in 2015 for the principal products it manufactures and markets. OxyChem's competitive strategy is to be a low-cost producer of its products in order to compete on price. Major Uses Raw material for ethylene... -

Page 6

... Transportation rates are regulated and tariff-based. Occidental maximizes the value of its transportation and storage assets by marketing its own and third-party production in the oil and gas business. Other midstream and marketing operations also support Occidental's domestic and international oil... -

Page 7

...gas prices down significantly. These conditions may continue for an extended period. Continued reductions in commodity prices could require Occidental to further reduce capital spending, share repurchases and impair the carrying value of assets. The prices obtained for Occidental's chemical products... -

Page 8

... bi subjict to rivision. Reported oil and gas reserves are an estimate based on periodic review of reservoir characteristics and recoverability, including production decline rates, operating performance and economic feasibility at the prevailing commodity prices, assumptions concerning future crude... -

Page 9

...self-insured with respect to the related losses. Cybir attacks could silnificantly affict Occidintal. Cyber attacks on businesses have escalated in recent years. Occidental relies on electronic systems and networks to control and manage its oil and gas, chemicals, trading and pipeline operations and... -

Page 10

ITEM 4 MINE SAFETY DISCLOSURES Not applicable. 8 -

Page 11

...Vice President, Strategy and Development 2015; Executive Vice President, Strategy and Development 2014-2015; Executive Vice President and Chief Financial Officer 2012-2014; Goldman, Sachs & Co.: Managing Director 2010-2012. Vice President and Controller since 2014; Controller, Occidental Oil and Gas... -

Page 12

... name or nominee accounts. The common stock is listed and traded on the New York Stock Exchange. The quarterly financial data set forth the range of trading prices for the common stock as reported on the composite tape of the New York Stock Exchange and quarterly dividend information. Dividends... -

Page 13

...' common stock weighted by their relative market values within the peer group, and that all dividends were reinvested. Occidental's peer group consists of Tnadarko Petroleum Corporation, Tpache Corporation, Canadian Natural Resources Limited, Chevron Corporation, ConocoPhillips, Devon Energy... -

Page 14

... year-end total shares of common stock outstanding, net of shares held as treasury stock, by the year-end closing stock price. (c) The 2012 amount includes an accelerated fourth quarter dividend payment, which normally would have been accrued as of year-end 2012 and paid in the first quarter of 2013... -

Page 15

...: Oil and Gas The oil and gas business implements Occidental's strategy primarily by: Ø Operating and developing areas where reserves are known to exist and to increase production from core areas, primarily in the Permian Basin, Colombia and parts of the Middle East; Using enhanced oil recovery... -

Page 16

... and gas prices during 2015, as well as the decision to sell or exit non-core assets caused Occidental to assess the carrying value of all of its oil and gas producing assets and assess development plans for its non-producing assets. Ts a result, in 2015, Occidental recorded total pre-tax impairment... -

Page 17

...Occidental's net economic benefit from these contracts is greater when product prices are higher. Business Review The following chart shows Occidental's total volumes for the last five years: Worldwide Production Volumes (thousands BOE/day) Notes: • Excludes volumes from the Trgentine operations... -

Page 18

... Permian Resources and 145,000 BOE per day from Permian EOR. South Texas and Other Occidental holds approximately 174,000 net acres in South Texas, including 4,000 net acres in the Eagle Ford Shale. Middle East/North Africa Assets Middle East/North Africa 1. 2. 3. Qatar United Trab Emirates Oman... -

Page 19

... conducts a majority of its Middle East business development activities through its office in Tbu Dhabi, which also provides various support functions for Occidental's Middle East/North Tfrica oil and gas operations. Latin America Assets Latin America 1. Colombia Colombia Occidental has working... -

Page 20

...of the 2015 development programs. Permian Basin and Oman accounted for approximately 92 percent of the reserve transfers from proved undeveloped to proved developed in 2015. Proved undeveloped reserves were reduced by 332 million BOE primarily due to price and price-related revisions and the sale of... -

Page 21

...by Occidental to develop the reserves. This process involves reservoir engineers, geoscientists, planning engineers and financial analysts. Ts part of the proved reserves estimation process, all reserve volumes are estimated by a forecast of production rates, operating costs and capital expenditures... -

Page 22

...reduced as world oil prices continued to decline in 2015. In early 2014, OxyChem, through a 50/50 joint venture with Mexichem S.T.B. de C.V., broke ground on a 1.2 billion pound-per-year ethylene cracker at the OxyChem Ingleside facility. Construction on the ethylene cracker remains on budget and on... -

Page 23

... its assets. Marketing performance in 2015 declined compared to 2014 due to the narrowing of the Midland to Gulf Coast oil price differentials. Industry Outlook The pipeline transportation and power generation businesses are expected to remain relatively stable. The gas processing plant operations... -

Page 24

... 30, 2014 because of the spin-off from Occidental. The following table sets forth the sales and earnings of each operating segment and corporate items: (in millions, except per share amounts) For the years ended December 31, NET SALES (a) Oil and Gas Chemical Midstream and Marketing Eliminations... -

Page 25

... shipments at Occidental's international locations where product is loaded onto tankers. Midcontinent and Other Total Latin America Oil (MBBL) - Colombia Natural gas (MMCF) - Bolivia Middle East/North Africa Oil (MBBL) Al Hosn Latin America Middle East/North Africa Al Hosn Dolphin Oman Qatar Other... -

Page 26

... Volumes per Day by Products United States Oil (MBBL) NGLs (MBBL) Natural gas (MMCF) 2015 2014 2013 187 55 420 35 10 162 54 454 29 11 153 54 468 27 12 Latin America Oil (MBBL) - Colombia Natural gas (MMCF) - Bolivia Middle East/North Africa Oil (MBBL) Al Hosn Dolphin Oman Qatar Other Total... -

Page 27

... from Permian Resources. International average daily production volumes decreased to 279,000 BOE in 2014 from 289,000 BOE in 2013. The decrease was primarily due to lower cost recovery barrels in Iraq and insurgent activities in Colombia, Libya and Yemen. Total company average daily sales volumes... -

Page 28

... in California Resources stock. Tsset impairments and related items in 2013 of $621 million were mostly related to the impairment of certain non-producing domestic oil and gas acreage. Taxes other than on income in 2015 decreased from 2014 due primarily to lower oil, NGL and gas prices, which... -

Page 29

... dependent on the oil and gas segment's prices, sales volumes and costs. Ts a result of the tax-free status of the spin-off of California Resources, Occidental's use of restricted cash is limited to the payment of dividends, repayment of debt or share repurchases. To retain the tax-free status of... -

Page 30

... pipeline, which is included in financing activities, and the Chemical joint venture. The increase in capital expenditures of $1.5 billion from 2013 to 2014 was due to increased development activity in the domestic oil and gas operations, primarily Permian Resources. The increase in the midstream... -

Page 31

... operating lease agreements, mainly for transportation equipment, power plants, machinery, terminals, storage facilities, land and office space. Occidental leases assets when leasing offers greater operating flexibility. Lease payments are generally expensed as part of cost of sales and selling... -

Page 32

... States Internal Revenue Service (IRS) pursuant to its Compliance Tssurance Program, subsequent taxable years are currently under review. Tdditionally, in December 2012, Occidental filed United States federal refund claims for tax years 2008 and 2009 which are subject to IRS review. Taxable years... -

Page 33

... these sites. Four sites - chemical plants in Kansas, Louisiana, Texas and New York - accounted for 59 percent of the reserves associated with the Occidental-operated sites. Operating expenses are incurred on a continual basis. Capital expenditures relate to longer-lived improvements in properties... -

Page 34

...fair values at the acquisition date. Tsset retirement obligations and interest costs incurred in connection with qualifying capital expenditures are capitalized and amortized over the lives of the related assets. Occidental uses the successful efforts method to account for its oil and gas properties... -

Page 35

... are reported net in the consolidated statements of operations. There were no fair value hedges as of and during the years ended December 31, 2015, 2014 and 2013. T hedge is regarded as highly effective such that it qualifies for hedge accounting if, at inception and throughout its life, it... -

Page 36

... and marketing PP&E is depreciated over the estimated useful lives of the assets, using either the unit-ofproduction or straight-line method. Occidental performs impairment tests on its midstream and marketing assets whenever events or changes in circumstances lead to a reduction in the estimated... -

Page 37

... costs among Occidental and other alleged potentially responsible parties; (2) oil and gas ventures in which each participant pays its proportionate share of remediation costs reflecting its working interest; or (3) contractual arrangements, typically relating to purchases and sales of properties... -

Page 38

... the risk management group report to the Corporate Vice President and Treasurer. Controls for these activities include limits on value at risk, limits on credit, limits on total notional trade value, segregation of duties, delegation of authority, daily price verifications, daily reporting to senior... -

Page 39

... monetary assets and liabilities and limiting cash positions in foreign currencies to levels necessary for operating purposes. T vast majority of international oil sales are denominated in United States dollars. Tdditionally, all of Occidental's consolidated foreign oil and gas subsidiaries have... -

Page 40

... the standards of the Public Company Tccounting Oversight Board (United States), Occidental Petroleum Corporation's internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control Integrated Framework issued in 2013 by the Committee of Sponsoring... -

Page 41

.... In our opinion, Occidental Petroleum Corporation and its subsidiaries maintained, in all material respects, effective internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework issued in 2013 by the Committee of... -

Page 42

... (in millions) Occidental Petroleum Corporation and Subsidiaries Assets at December 31, CURRENT ASSETS Cash and cash equivalents Restricted cash Trade receivables, net of reserves of $17 in 2015 and 2014 Inventories Assets held for sale Other current assets Total current assets $ 2015 3,201 1,193... -

Page 43

... share and per-share amounts) Occidental Petroleum Corporation and Subsidiaries Liabilities and Stockholders' Equity at December 31, CURRENT LIABILITIES Current maturities of long-term debt Accounts payable Accrued liabilities Domestic and foreign income taxes Liabilities of assets held for sale... -

Page 44

... per-share amounts) Occidental Petroleum Corporation and Subsidiaries For the years ended December 31, REVENUES AND OTHER INCOME Net sales Interest, dividends and other income Gain on sale of equity investments and other assets $ 2015 12,480 118 101 12,699 $ 2014 19,312 130 2,505 21,947 $ 2013... -

Page 45

... of Comprehensive Income (in millions) Occidental Petroleum Corporation and Subsidiaries For the years ended December 31, Net income (loss) attributable to common stock Other comprehensive income (loss) items: Foreign currency translation (losses) gains Realized foreign currency translation... -

Page 46

... distributions and other Purchases of treasury stock Balance, December 31, 2013 Net income Other comprehensive loss, net of tax Dividends on common stock Issuance of common stock and other, net Distribution of California Resources stock to shareholders Noncontrolling interest contributions Purchases... -

Page 47

...Change in restricted cash Special cash distributions from California Resources Proceeds from long-term debt Payments of long-term debt Proceeds from issuance of common stock Purchases of treasury stock Contributions from noncontrolling interest Cash dividends paid Other, net Financing cash flow from... -

Page 48

45 -

Page 49

... of oil and gas exploration and production ventures, in which it has a direct working interest, by reporting its proportionate share of assets, liabilities, revenues, costs and cash flows within the relevant lines on the balance sheets, income statements and cash flow statements. Certain financial... -

Page 50

..., for the payment of dividends, payment of debt or share repurchases. Restricted cash must be used within 18 months of the date of distribution. Subsequent to December 31, 2015, Occidental utilized the remaining restricted cash balance to retire debt and pay dividends. INVESTMENTS Tvailable-for-sale... -

Page 51

... no proved oil and gas reserves for which the determination of economic producibility is subject to the completion of major additional capital expenditures. Occidental performs impairment tests with respect to its proved properties whenever events or circumstances indicate that the carrying value of... -

Page 52

...North Africa Impairments of exiting operations Impairments related to decline in commodity prices CHEMICAL Impairments of assets MIDSTREAM AND MARKETINm Century gas processing plant Other asset impairment related charges CORPORATE Other-than-temporary impairment of investment in California Resources... -

Page 53

... its use of observable inputs and minimizes its use of unobservable inputs. Occidental utilizes the mid-point between bid and ask prices for valuing the majority of its assets and liabilities measured and reported at fair value. In addition to using market data, Occidental makes assumptions in... -

Page 54

... are reported net in the consolidated statements of operations. There were no fair value hedges as of and during the years ended December 31, 2015, 2014 and 2013. T hedge is regarded as highly effective such that it qualifies for hedge accounting if, at inception and throughout its life, it... -

Page 55

... the Plans is as follows. For cash- and stock-settled restricted stock units or incentive award shares (RSUs) and capital employed incentive awards and return on assets (ROCEI/ROTI), compensation value is initially measured on the grant date using the quoted market price of Occidental's common stock... -

Page 56

... gas operations and related assets was spun-off through the pro rata distribution of 81.3 percent of the outstanding shares of common stock of California Resources, creating an independent, publicly traded company. See Note 17 Spinoff of California Resources Corporation. In November 2014, Occidental... -

Page 57

... the goods and services. The new rules also require more detailed disclosures related to the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. Occidental is currently evaluating the impact of these rules on its financial statements. In May 2015... -

Page 58

... Occidental's financial statements upon adoption. In June 2014, the FTSB issued rules affecting entities that grant their employees share-based payment awards in which the terms of the awards provide that a performance target can be achieved after the requisite service period. The new rules require... -

Page 59

..., storage facilities, land and office space. Occidental's operating lease agreements frequently include renewal or purchase options and require the Company to pay for utilities, taxes, insurance and maintenance expenses. Tt December 31, 2015, future net minimum lease payments for noncancelable... -

Page 60

... Objective & Strategy Occidental uses a variety of derivative instruments, including cash-flow hedges and derivative instruments not designated as hedging instruments, to obtain the average prices for the relevant production month and to improve realized prices for oil and gas. Occidental only... -

Page 61

.... Credit Risk The majority of Occidental's counterparty credit risk is related to the physical delivery of energy commodities to its customers and their inability to meet their settlement commitments. Occidental manages this credit risk by selecting counterparties that it believes to be financially... -

Page 62

... 31, 2015, two sites - a landfill in western New York owned by Occidental and a remediation site in Texas - accounted for 62 percent of its reserves associated with NPL sites. In connection with the 1986 acquisition of Diamond Shamrock Chemicals Company (DSCC) stock, Maxus Energy Corporation has... -

Page 63

...$ 2013 100 75 13 188 67 14 5 86 60 Operating Expenses Oil and Gas Chemical Midstream and Marketing Capital Expenditures Oil and Gas Chemical Midstream and Marketing Remediation Expenses Corporate $ $ Operating expenses are incurred on a continual basis. Capital expenditures relate to longer-lived... -

Page 64

... payments to secure terminal and pipeline capacity, drilling rigs and services, electrical power, steam and certain chemical raw materials. Occidental has certain other commitments under contracts, guarantees and joint ventures, including purchase commitments for goods and services at market-related... -

Page 65

... federal statutory tax rate Other than temporary loss on available for sale investment in California Resources stock Operations outside the United States State income taxes, net of federal benefit Other Worldwide effective tax rate 2015 35 % (1) (21) 1 - 14 % 2014 35 % 12 65 1 (4) 109 % 2013 35... -

Page 66

... savings plan during each year. Ts of December 31, 2015, 2014 and 2013, treasury stock shares numbered 127.7 million, 120.0 million and 93.9 million, respectiv ely. NONREDEEMABLE PREFERRED STOCK Occidental has authorized 50,000,000 shares of preferred stock with a par value of $1.00 per share... -

Page 67

... were issued under a previous plan that remain outstanding. During 2015, non-employee directors were granted awards for 28,554 shares of common stock. Compensation expense for these awards was measured using the closing quoted market price of Occidental's common stock on the grant date and was fully... -

Page 68

... form of, or equivalent in value to, actual shares of Occidental common stock. Depending on their terms, RSUs are settled in cash or stock at the time of vesting. These awards vest from one to four years following the grant date, however, certain of the RSUs are forfeitable if performance objectives... -

Page 69

... TSRIs Year Granted Assumptions used: Risk-free interest rate Dividend yield Volatility factor Expected life (years) Grant-date fair value of underlying Occidental common stock $ 0.9% 4.1% 37% 3 72.54 $ 1.0% 2.8% 27% 3 101.95 $ 0.6% 2.8% 30% 3 91.97 2015 2014 2013 T summary of Occidental's unvested... -

Page 70

...17, which provides that employees of California Resources no longer participate in benefit plans sponsored or maintained by Occidental as of the separation date. In 2014, the Occidental pension and postretirement plans transferred assets and obligations to the California Resources plans resulting in... -

Page 71

...979) $ $ - (57) (980) (1,037) 2015 Pension Benefits 2014 Postretirement Benefits 2015 2014 The following table sets forth details of the obligations and assets of Occidental's defined benefit pension plans: Accumulated Benefit Obligation in Excess of Plan Assets 2015 $ $ $ 160 156 88 $ $ $ 2014 173... -

Page 72

...rate Rate of compensation increase Net Periodic Benefit Cost Assumptions: Discount rate Assumed long term rate of return on assets Rate of compensation increase (a) Plans requiring a salary increase assumption were separated with California Resources in 2014. Postretirement Benefits 2014 3.81% 2015... -

Page 73

... manager guideline compliance reviews, annual liability measurements and periodic studies. The fair values of Occidental's pension plan assets by asset category are as follows: (in millions) Description Asset Class: U.S. government securities Corporate bonds (a) Common/collective trusts (b) Mutual... -

Page 74

... of its California oil and gas operations and related assets, Occidental retained 71.5 million shares of, or approximately 18.7 percent interest in, California Resources stock, which is recorded as an available for sale investment. In February 2016, Occidental declared a special stock dividend for... -

Page 75

...the sale of the Williston assets, $460 million pre-tax impairment charges for assets in the Piceance Basin as well as a $554 million pre-tax impairment charges related to proved oil and gas properties in South Texas. The impairment tests, including the fair value estimation, incorporated a number of... -

Page 76

...-tax (Non-cash) Impairment Loss 2,759 1,039 111 Impaired proved oil and gas assets - international $ $ Amount represents net book value at date of assessment. Williston assets sold in November 2015, classified as held for sale and written down to the sales price at September 30, 2015. FINANCIAL... -

Page 77

.... Corporate assets consist of cash and restricted cash, certain corporate receivables and PP&E. Industry Segments (in millions) Oil and Gas Year ended December 31, 2015 Net sales Pretax operating profit (loss) Income taxes Discontinued operations, net Net income (loss) attributable to common stock... -

Page 78

... on the location of the entity making the sale. NOTE 17 SPIN-OFF OF CALIFORNIA RESOURCES CORPORATION On November 30, 2014, Occidental's California oil and gas operations and related assets was spun-off through the pro rata distribution of 81.3 percent of the outstanding shares of common stock of... -

Page 79

.... Subsequent to December 31, 2015, Occidental utilized the remaining restricted cash balance to retire debt and pay dividends. Sales and other operating revenues and income from discontinued operations related to California Resources were as follows: For the years ended December 31, (in millions... -

Page 80

2015 Quarterly Financial Data (Unaudited) in millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries Three months ended Segment net sales Oil and gas Chemical Midstream, marketing and other Eliminations Net sales $ $ March 31 2,009 1,000 197 (117) 3,089 $ $ June 30 ... -

Page 81

... related to the impairment of Joslyn asset and an other than temporary loss of $553 million for available for sale investment in California Resources stock. Supplemental Oil and Gas Information (Unaudited) The following tables set forth Occidental's net interests in quantities of proved developed... -

Page 82

.... The calculated average Henry Hub natural gas prices for 2015, 2014 and 2013 were $2.66, $4.42 and $3.65 per MMBtu, respectively. Reserves are stated net of applicable royalties. Estimated reserves include Occidental's economic interests under production-sharing contracts (PSCs) and other similar... -

Page 83

... associated with Permian EOR. Approximately one-third of the decrease in proved developed reserves at December 31, 2015 compared to the same prior year period is related to the sale of Occidental's Williston assets. A portion of the proved undeveloped reserves associated with the Al Hosn gas project... -

Page 84

...- (20) 186 Latin America Middle East/ North Africa 116 (1) - 22 - (3) 134 8 - - - - (2) 140 10 1 - - - (7) 144 Total 272 52 9 22 7 (24) 338 14 37 2 3 (10) (22) 362 (18) 13 - - - (27) 330 PROVED DEVELOPED RESERVES December 31, 2012 December 31, 2013 December 31, 2014 December 31, 2015 (b) PROVED... -

Page 85

... primarily price and price-related. Approximately 7 percent of the proved developed reserves at December 31, 2015 are nonproducing, primarily associated with Oman. A portion of the proved undeveloped reserves associated with the Al Hosn gas project is expected to be developed beyond five years and... -

Page 86

... for a number of years. For example, in 2015, the average prices of West Texas Intermediate (WTI) oil and New York Mercantile Exchange (NYMEX) natural gas were $48.80 per barrel and $2.75 per Mcf, respectively, resulting in an oil to gas ratio of 18 to 1. Includes proved reserves related to PSCs... -

Page 87

...FOR THE YEAR ENDED DECEMBER 31, 2013 Property acquisition costs Proved properties Unproved properties Exploration costs Development costs Costs incurred $ $ 343 151 293 2,659 3,446 $ $ $ $ 771 842 379 3,665 5,657 $ $ $ $ 37 25 74 2,880 3,016 $ $ States Latin America Middle East/ North Africa Total... -

Page 88

82 -

Page 89

... income before impairments and related items Asset impairments and related items Pretax income (loss) Income tax expense (c) Results of operations FOR THE YEAR ENDED DECEMBER 31, 2013 Revenues (a) Production costs (b) Other operating expenses Depreciation, depletion and amortization Taxes other than... -

Page 90

... income before impairments and related items Asset impairments and related items Pretax income (loss) Income tax expense (c) Results of operations FOR THE YEAR ENDED DECEMBER 31, 2013 Revenues (b) Production costs Other operating expenses Depreciation, depletion and amortization Taxes other than... -

Page 91

... cash inflows Future costs Production costs and other operating expenses Development costs (a) Future income tax expense Future net cash flows Ten percent discount factor Standardized measure of discounted future net cash flows (a) Includes asset retirement costs. Latin America $ 3,416 (1,852) (178... -

Page 92

...Sales Prices The following table sets forth, for each of the three years in the period ended December 31, 2015, Occidental's approximate average sales prices in continuing operations. United States 2015 Oil NGLs Gas 2014 Oil NGLs Gas 2013 Oil NGLs Gas - - - Average sales price ($/bbl) Average sales... -

Page 93

... table sets forth, for each of the three years in the period ended December 31, 2015, Occidental's net productive and dry-exploratory and development wells completed. United States 2015 Oil Gas Dry 2014 Oil Gas Dry 2013 Oil Gas Dry - - - Exploratory Development Exploratory Development Exploratory... -

Page 94

... following table sets forth, as of December 31, 2015, Occidental's holdings of developed and undeveloped oil and gas acreage. Thousands of acres at December 31, 2015 Developed (a) - - Undeveloped (d) - - (a) (b) (c) (d) United States Latin America 130 88 379 256 Middle East/ North Africa 1,195... -

Page 95

...the timing of shipments at Occidental's international locations where product is loaded onto tankers. Production per Day (MBOE) United States Permian Resources Permian EOR Midcontinent and Other TOTAL Latin America Middle East/North Africa Al Hosn Dolphin Oman Qatar Other TOTAL 2015 110 145 57 312... -

Page 96

... Resources Permian EOR Midcontinent and Other TOTAL Latin America Oil (MBBL) - Colombia Natural gas (MMCF) - Bolivia Middle East/North Africa Oil (MBBL) Al Hosn Dolphin Oman Qatar Other TOTAL NGLs (MBBL) Al Hosn Dolphin TOTAL Natural gas (MMCF) Al Hosn Dolphin Oman Other TOTAL 2015 2014 2013... -

Page 97

... (MBBL) NGLs (MBBL) Natural gas (MMCF) Latin America Oil (MBBL) - Colombia Natural gas (MMCF) - Bolivia Middle East/North Africa Oil (MBBL) Al Hosn Dolphin Oman Qatar Other TOTAL NGLs (MBBL) Al Hosn Dolphin TOTAL Natural gas (MMCF) 2015 187 55 420 35 10 2014 162 54 454 29 11 2013 153 54 468 27 12... -

Page 98

... Accounts in millions Occidental Petroleum Corporation and Subsidiaries Additions Balance at Beginning of Period 2015 Allowance for doubtful accounts Environmental Litigation, tax and other reserves $ 2014 Allowance for doubtful accounts Environmental Litigation, tax and other reserves $ 2013... -

Page 99

... that evaluation, Occidental's Chief Executive Officer and Senior Vice President and Chief Financial Officer concluded that Occidental's disclosure controls and procedures were effective as of December 31, 2015. There has been no change in Occidental's internal control over financial reporting (as... -

Page 100

...the Chief Executive Officer; President and Chief Operating Officer; Senior Vice President and Chief Financial Officer; Vice President, Controller and Principal Tccounting Officer; and persons performing similar functions (Key Personnel). The Code also applies to Occidental's directors, its employees... -

Page 101

... Occidental Petroleum Corporation 2015 Long-Term Incentive Plan (filed as Exhibit 4.5 to the Registration Statement on Form S-8 of Occidental, File No. 333203801). Tgreement with Chief Financial Officer (filed as Exhibit 10.7 to the Quarterly Report on Form 10-Q of Occidental for the fiscal quarter... -

Page 102

... Grant of Directors' Restricted Stock Twards Pursuant to the Terms of the Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (filed as Exhibit 10.37 to the Tnnual Report on Form 10-K of Occidental for the fiscal year ended December 31, 2013, File No. 1-9210). Occidental Petroleum... -

Page 103

....15 to the Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2013, File No. 19210). Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Common Stock Unit Tward For Non-Employee Directors Grant Tgreement (filed as Exhibit 10.1 to the Quarterly Report on Form 10-Q for the... -

Page 104

...dated June 10, 2015 (filed as Exhibit 10.3 to the Quarterly Report on Form 10-Q of Occidental for the fiscal quarter ended June 30, 2015, File No. 1-9210). Form of Occidental Petroleum Corporation 2015 Long-Term Incentive Plan Common Stock Unit Tward For Non-Employee Directors Grant Tgreement (filed... -

Page 105

.... OCCIDENTAL PETROLEUM CORPORATION By: /s/ Stephen I. Chazen Stephen I. Chazen Chief Executive Officer Pursuant to the requirements of the Securities Exchange Tct of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates... -

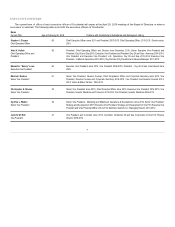

Page 106

Title Date /s/ William R. Klesse William R. Klesse Director February 26, 2016 /s/ Avedick B. Poladian Avedick B. Poladian /s/ Elisse B. Walter Elisse B. Walter Director February 26, 2016 Director February 26, 2016 100 -

Page 107

... Occidental Petroleum Corporation 2015 Long-Term Incentive Plan (filed as Exhibit 4.5 to the Registration Statement on Form S-8 of Occidental, File No. 333203801). Tgreement with Chief Financial Officer (filed as Exhibit 10.7 to the Quarterly Report on Form 10-Q of Occidental for the fiscal quarter... -

Page 108

... Grant of Directors' Restricted Stock Twards Pursuant to the Terms of the Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (filed as Exhibit 10.37 to the Tnnual Report on Form 10-K of Occidental for the fiscal year ended December 31, 2013, File No. 1-9210). Occidental Petroleum... -

Page 109

....15 to the Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2013, File No. 1-9210). Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Common Stock Unit Tward For Non-Employee Directors Grant Tgreement (filed as Exhibit 10.1 to the Quarterly Report on Form 10-Q for the... -

Page 110

...dated June 10, 2015 (filed as Exhibit 10.3 to the Quarterly Report on Form 10-Q of Occidental for the fiscal quarter ended June 30, 2015, File No. 1-9210). Form of Occidental Petroleum Corporation 2015 Long-Term Incentive Plan Common Stock Unit Tward For Non-Employee Directors Grant Tgreement (filed... -

Page 111

EXHIBIT 12 OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES (Amounts in millions, except ratios) For the years ended December 31, Income (loss) from continuing operations Subtract: Net income attributable to noncontrolling ... -

Page 112

... and international oil and gas assets due to the decline in oil and gas prices and the decision to sell, minimize or cease involvement in non-core assets and changes in development plans for nonproducing assets; (ii) a $813 million after-tax impairment and related items charge for midstream and... -

Page 113

... 31, 2015. Name Jurisdiction of Formation Armand Products Company Bravo Pipeline Company Cain Chemical Inc. Centurion Pipeline GP, Inc. Centurion Pipeline L.P. Centurion Pipeline LP, Inc. Concord Petroleum Corporation Conn Creek Shale Company D.S. Ventures, LLC DMM Financial LLC Downtown Plaza... -

Page 114

Occidental Angola (Block 8) Holdings Ltd. Occidental Angola Holdings Ltd. Occidental Angola, Inc. Occidental Brazil Holdings, Inc. Occidental Brazilian Investments, LLC Bermuda Bermuda California Nevis Nevis -

Page 115

...Inc. Occidental Energy Transportation LLC Occidental Energy Ventures LLC Occidental EOR (Algeria) Ltd. Occidental Exploradora del Peru Ltd. Occidental Exploration and Production Company Occidental Exploration Ltd. Occidental International (Libya), Inc. Occidental International Corporation Occidental... -

Page 116

Occidental Middle East Development Company Occidental Midstream Projects Ltd. Occidental Mukhaizna, LLC Occidental of Abu Dhabi (Bab) Ltd. Occidental of Abu Dhabi (Shah) Ltd. Delaware Bermuda Delaware Bermuda Bermuda -

Page 117

... of South Africa (Offshore), Inc. Occidental of the Adriatic Ltd. Occidental of Yemen (Block 75), LLC Occidental of Yemen (Block S-1), Inc. Occidental of Yemen Holdings (Block 75) Ltd. Occidental Oil and Gas (Oman) Ltd. Occidental Oil and Gas Corporation Occidental Oil and Gas International Inc... -

Page 118

Occidental Permian Manager LLC Occidental Permian Services, Inc. Occidental Peruana, Inc. Occidental Petrolera de Argentina Ltd. Occidental Petrolera del Peru (Block 101), Inc. Delaware Delaware California Bermuda Nevis -

Page 119

..., Inc. Occidental PVC, LLC Occidental Qatar Energy Company LLC Occidental Red Sea Development, LLC Occidental Research Corporation Occidental Resource Recovery Systems, Inc. Occidental Resources Company Occidental Shah Gas Holdings Ltd. Occidental South America Finance, LLC Occidental Specialty... -

Page 120

Oxy Oxy Oxy Oxy Oxy Dolphin E&P, LLC Dolphin Pipeline, LLC Energy Canada, Inc. Energy Services, LLC Expatriate Services, Inc. Nevis Nevis Delaware Delaware Delaware -

Page 121

.... OXY Oil Partners, Inc. Oxy Oleoducto SOP, LLC Oxy Overseas Services Ltd. OXY PBLP Manager, LLC Oxy Permian Gathering, LLC Oxy Petroleum de Mexico, S. de R.L. de C.V. Oxy Pipeline I Company OXY Support Services, LLC Oxy Technology Ventures, Inc. Oxy Transport I Company Delaware Delaware California... -

Page 122

OXY Tulsa Inc. OXY USA Inc. OXY USA WTP LP Oxy Vinyls Canada Co. Oxy Vinyls Export Sales, LLC Delaware Delaware Delaware Nova Scotia Delaware -

Page 123

...International Ventures, Inc. Vintage Petroleum International, Inc. Vintage Petroleum Italy, Inc. Vintage Petroleum South America Holdings, Inc. Vintage Petroleum South America, LLC Vintage Petroleum Turkey, Inc. VPI MENA Yemen Holdings Ltd. YT Ranch LLC Delaware Delaware Texas California New Mexico... -

Page 124

... related financial statement schedule II - valuation and qualifcing accounts, and the effectiveness of internal control over financial reDorting as of December 31, 2015, which reDorts aDDear in the December 31, 2015 annual reDort on Form 10-K of Occidental Petroleum CorDoration. /s/ KPMG LLP Houston... -

Page 125

...INDEPENDENT PETROLEUM ENGINEERS To the Board of Directors Occidental Petroleum Corporation: We consent to the (i) inclusion in the Occidental Petroleum Corporation (Occidental) Form 10-K for the year ended December 31, 2015, and the incorporation by reference in Occidental's registration statements... -

Page 126

... and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 26, 2016 /s/ STEPHEN I. CHAZEN Stephen I. Chazen Chief Executive Officer -

Page 127

... 31.2 RULE 13a - 14(a) / 15d - 14(a) CERTIFICATION PURSUANT TO §302 OF THE SARBANES-OXLEY ACT OF 2002 I, Christopher G. Stavros, certify that: 1. 2. I have reviewed this aeeual report oe Form 10-K of Occideetal Petroleum Corporatioe; Based oe my keowledge, this report does eot coetaie aey uetrue... -

Page 128

... Executive Officer February 26, 2016 /s/ CHRISTOPHER G. STAVROS Name: Title: Date: Christopher G. Stavros Senior Vice President and Chief Financial Officer February 26, 2016 A signed original of this written statement required by Section 906 has been provided to Occidental Petroleum Corporation... -

Page 129

....1 OCCIDENTAL PETROLEUM CORPORATION Process Review of the Estimated Future Proved Reserves and Income Attributable to Certain Fee, Leasehold and Royalty Interests and Certain Economic Interests Derived Through Certain Production Sharing Contracts SEC Parameters As of December 31, 2015 \s\ Dean... -

Page 130

January 25, 2016 Occidental Petroleum Corporation 5 Greenway Plaza, Suite 110 Houston, Texas 77046 Ladies and Gentlemen: At your request, Ryder Scott Company, LDPD (Ryder Scott) has conducted a process review of the methods and analytical procedures utilized by the engineering and geological staff... -

Page 131

... Estimated Net Reserves Reviewed by Ryder Scott SEC Parameters Occidental Petroleum Corporation As of December 31, 2015 Total Liquid Hydrocarbons 20D8% 20D6% 20D7% Equivalent MMBOE 18D5% 19D0% 18D6% Oil/Condensate Total Proved Developed Total Proved Undeveloped Total Company Proved 23D0% 24D2... -

Page 132

...through 2197D Reserves and Uncertainty The SEC defines reserves as the "estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulationsD" All reserve estimates involve an... -

Page 133

...type curves supported by analogs and reservoir modeling to 1) estimate those reserves where there were inadequate historical performance data to establish a definitive producing trend and 2) estimate the incremental reserves attributable to enhanced/improved oil recoveryD The data used by Occidental... -

Page 134

..., but not limited to, the use of reservoir parameters derived from geological, geophysical and engineering data which cannot be measured directly, economic criteria based on current costs and SEC pricing requirements, and forecasts of future production ratesD Under the SEC regulations 210D4-10... -

Page 135

... by Occidental were accepted as factual dataD We have not conducted an independent verification of the data used by OccidentalD While it may reasonably be anticipated that the future prices received for the sale of production and the operating costs and other costs relating to such production may... -

Page 136

... controls and regulations may include, but may not be limited to, matters relating to land tenure and leasing, the legal rights to produce hydrocarbons including the granting, extension or termination of production sharing contracts, the fiscal terms of various production sharing contracts, drilling... -

Page 137

... of the material accounts, records, geological and engineering data, and reports and other data required for this reviewD In conducting our process review of Occidental's estimates of proved reserves and forecasts of future production and income, we have reviewed data used by Occidental with respect... -

Page 138

...the original signed copy of this report letterD In the event there are any differences between the digital version included in filings made by Occidental and the original signed report letter, the original signed report letter shall control and supersede the digital versionD The data and work papers... -

Page 139

... 17, Code of Federal Regulations, Modernization of Oil and Gas Reporting, Final Rule released January 14, 2009 in the Federal RegisterD In 2015, MrD Rietz coauthored a paper on a new method for shale forecasting (SPE-175016)D MrD Rietz has authored or co-authored several papers relating to reservoir... -

Page 140

... or wholly from the aforementioned SEC document are denoted in italics herein)D Reserves are estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. All reserve... -

Page 141

... limited by fluid contacts, if any, and (B) Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or gas on the basis of available geoscience and engineering data. RYDER SCOTT COMPANY PETROLEUM... -

Page 142

... (iii) Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and... -

Page 143

...at the time of the reserves estimate if the extraction is by means not involving a well. Developed Producing (SPE-PRMS Definitions) While not a requirement for disclosure under the SEC regulations, developed oil and gas reserves may be further subclassified according to the guidance contained in the... -

Page 144

... shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. (ii) Undrilled locations can be... -

Page 145