Occidental Petroleum 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

R

£

For the fiscal year ended December 31, 2011 For the transition period from to

Commission File Number 1-9210

Occidental Petroleum Corporation

Delaware

95-4035997

10889 Wilshire Blvd., Los Angeles, CA

90024

(310) 208-8800

Title of Each Class Name of Each Exchange on Which Registered

R£

£R

R£

R£

R

R £

£ £

£R

Table of contents

-

Page 1

... of principal executive offices Zip Code Registrant's telephone num(er, including area code Delaware 95-4035997 10889 Wilshire Blvd., Los Angeles, CA 90024 (310) 208-8800 Securities registered pursuant to Section 12(() of the Act: Title of Each Class 9 1/4% Senior De(entures due 2019 Common Stock... -

Page 2

... General Oil and Gas Operations Chemical Operations Midstream, Marketing and Other Operations Capital Expenditures Employees Environmental Regulation Tvailable Information Risk Factors Unresolved Staff Comments Legal Proceedings Executive Officers Market for Registrant's Common Equity, Related... -

Page 3

-

Page 4

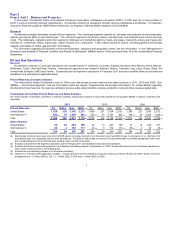

.... Oil and Gas Operations General Occidental's domestic oil and gas operations are located mainly in California, Colorado, Kansas, Montana, New Mexico, North Dakota, Oklahoma, Texas, Utah and West Virginia. International operations are located in Bahrain, Bolivia, Colombia, Iraq, Libya, Oman, Qatar... -

Page 5

... its worldwide oil and gas reserves cost-effectively and obtain the required labor and services. Chemical Operations OxyChem owns and operates manufacturing plants at 22 domestic sites in Tlabama, Georgia, Illinois, Kansas, Louisiana, Michigan, New 9ersey, New York, Ohio, Pennsylvania and Texas and... -

Page 6

... California, Texas and Louisiana Trades around its assets and purchases, markets and trades oil, gas, power and other commodities Occidental-operated power and steam generation facilities Not applicable 1,800 megawatts per hour and 1.6 million pounds of steam per hour (a) (b) Capacity requires... -

Page 7

... regulations, or interpretations of such laws and regulations, including those related to labor and employment, taxes, royalty rates, permitted production rates, drilling, manufacturing or production processes (including hydraulic fracturing), entitlements, import, export and use of equipment, use... -

Page 8

...-2009, Executive Vice President - Oxy Oil & Gas, International Production and Engineering; 2008, Executive Vice President - Oxy Oil & Gas, Major Projects; Dolphin Energy Ltd.: 2002-2007, Executive Vice President and General Manager. Vice President, Controller and Principal Tccounting Officer since... -

Page 9

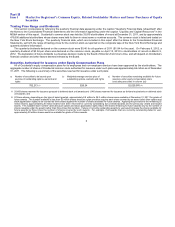

... the Consolidated Financial Statements, set forth the range of trading prices for the common stock as reported on the composite tape of the New York Stock Exchange and quarterly dividend information. The quarterly dividends declared on the common stock were $0.46 for all quarters of 2011 ($1.84 for... -

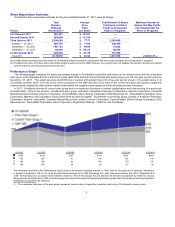

Page 10

... (iii) in each of the current and prior peer group companies' common stock weighted by their relative market values within the respective peer groups and that all dividends were reinvested. In 2011, Occidental revised its current peer group due to a significant decrease in market capitalization and... -

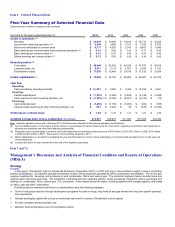

Page 11

... Grow oil and gas production through development programs focused on large, long-lived oil and gas assets with long-term growth potential, and acquisitions; Tllocate and deploy capital with a focus on achieving returns well in excess of Occidental's cost-of-capital; Provide consistent dividend... -

Page 12

10 -

Page 13

... of oil and gas production by holding large, long-lived "legacy" oil and gas assets, like those in California and the Permian Basin, that tend to have enhanced secondary and tertiary recovery opportunities and economies of scale that lead to cost-effective production. Capital is employed to operate... -

Page 14

In addition, Occidental continues to deploy significant capital to its core operations in the Permian Basin and California, as well as in Iraq, Oman and Qatar, to increase production from these assets. Chemical Segment Earnings ($ millions) OxyChem's strategy is to be a low-cost producer in order... -

Page 15

....2% The ROE and ROCE for 2011 were calculated by dividing Occidental's 2011 net income attributable to common stock (taking into account after-tax cost of capital for ROCE) by its average equity and capital employed, respectively, during 2011. The three-year average ROE and ROCE were calculated by... -

Page 16

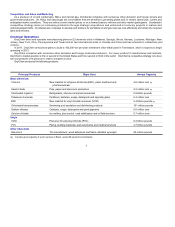

... mineral rights. Production-Sharing Contracts (PSC) Occidental has interests in Bahrain, Iraq, Libya, Oman, Yemen and Qatar, including Dolphin, that are operated under PSCs or similar contracts. Under such contracts, Occidental receives a share of production and reserves to recover its costs and an... -

Page 17

... 1. Permian 2. Elk Hills and other California interests 3. Midcontinent and Other Interests Permian Occidental's Permian production is diversified across a large number of producing areas in the Permian Basin. The Permian Basin extends throughout southwest Texas and southeast New Mexico and is one... -

Page 18

... drilled approximately 270 wells and produced approximately 92,000 BOE per day in 2011. Occidental expects to reduce drilling activity for gas wells in 2012. Middle East/North Africa Assets Middle East/North Africa 1. 2. 3. 4. 5. 6. 7. Bahrain Iraq Libya Oman Qatar United Trab Emirates Yemen... -

Page 19

... 2016 and maintain this level of production for seven years. Occidental's share of production in Iraq was approximately 7,000 BOE per day in 2011. Libya Occidental, under agreements with the Libyan National Oil Corporation, participates in Sirte Basin producing operations. These agreements continue... -

Page 20

... Field expired in December 2011. Occidental's share of production from the Yemen properties was approximately 27,000 BOE per day in 2011, which included nearly 11,000 BOE per day from the Masila Field. Latin America Assets Latin America 1. Bolivia 2. Colombia Bolivia Occidental holds working... -

Page 21

...from lower gas prices during the year. International reserves had negative price adjustments due to high oil prices. Price adjustments for the company as a whole were negative. If the currently prevailing natural gas prices stay at depressed levels for an extended period, domestic gas reserves could... -

Page 22

... process involves reservoir engineers, geoscientists, planning engineers and financial analysts. Ts part of the proved reserves estimation process, all reserves volumes are estimated by a forecast of production rates, operating costs and capital expenditures. Price differentials between benchmark... -

Page 23

... of senior corporate officers to monitor, review and approve Occidental's oil and gas reserves. The Reserves Committee reports to the Tudit Committee of Occidental's Board of Directors during the year. Since 2003, Occidental has retained Ryder Scott Company, L.P. (Ryder Scott), independent petroleum... -

Page 24

...'s 2011 earnings from these facilities were flat compared to 2010. On December 31, 2010, Occidental completed its acquisition of the remaining 50percent joint-venture interest in Elk Hills Power, LLC (EHP), a limited liability company that operates a gas-fired power-generation plant in California... -

Page 25

... sales eliminate upon consolidation and are generally made at prices approximately equal to those that the selling entity would be able to obtain in third-party transactions. Oil and gas segment earnings, income from continuing operations and net income represent amounts attributable to common... -

Page 26

Natural gas (MMCF) California Permian Midcontinent and Other Total 260 157 365 280 199 198 677 37 250 199 186 635 45 782 (a) Latin America Oil (MBBL) - Colombia (b) Natural gas (MMCF) - Bolivia 29 15 16 16 Middle East/North Africa Oil (MBBL) Bahrain Dolphin Iraq Libya Oman Qatar Yemen ... -

Page 27

... (MBBL) NGLs (MBBL) Natural gas (MMCF) 2011 230 69 2010 2009 219 52 677 36 223 48 635 45 782 29 Latin America (a) Oil (MBBL) - Colombia (b) Natural gas (MMCF) - Bolivia 15 16 16 Middle East/North Africa Oil (MBBL) Bahrain Dolphin Iraq Libya Oman Qatar Yemen Total 4 9 3 3 4 69 73 12... -

Page 28

...in Colombia. Production was negatively impacted in the Middle East/North Tfrica, Long Beach and Colombia by higher yearover-year average oil prices affecting PSCs by 16,000 BOE per day. Daily sales volumes were 705,000 BOE in the twelve months of 2010, compared with 678,000 BOE for 2009. Oil and gas... -

Page 29

... and events affecting Occidental's earnings that vary widely and unpredictably in nature, timing and amount: Significant Items Affecting Earnings Benefit (Charge) (in millions) 2011 $ (35) $ 2010 2009 oil and gas Libya exploration write-off Gains on sale of Colombian pipeline interest... -

Page 30

... Net sales 19,045 $ Interest, dividends and other income 165 $ 111 $ 14,814 118 The increase in net sales in 2011, compared to 2010, was due to higher oil and NGL prices, higher oil and gas segment volumes and higher sales, including higher export sales, across most chemical products. Price... -

Page 31

... to higher oil and gas production costs, partly resulting from the effects of fully expensing CO 2 costs in 2010, as well as higher field operating, workover and well maintenance costs, and higher volumes; and higher chemical volumes, energy and feedstock costs. Selling, general and administrative... -

Page 32

... 2,440 110 93 4,646 2,397 170 612 $ $ $ $ $ $ 7,947 $ $ $ $ $ $ 7,825 Long-term debt, net Deferred credits and other liabilities-income taxes Deferred credits and other liabilities-other Long-term liabilities of discontinued operations Stockholders' equity 5,871 4,846 3,662 98 37,620 5,111... -

Page 33

... NGL production accounted for 71 percent of its total net sales. In 2011, oil volumes increased, compared to 2010, mainly due to acquisitions in California and the Williston Basin, including the effect of post-acquisition capital investment, and higher production in Oman's Mukhaizna Field and Iraq... -

Page 34

... 2010 to 2011 was mainly due to the $3.0 billion increase in oil and gas expenditures, which reflected Occidental's share of development costs in Oman and Bahrain, and higher spending in domestic properties in California, the Permian Basin, South Texas and the Williston Basin. Occidental's United... -

Page 35

... 31, 2011, Occidental's guarantees were not material and a substantial majority consisted of limited recourse guarantees on $300 million of Dolphin's debt, for which the fair value was immaterial. See "Oil and Gas Segment - Business Review - Qatar" and "Segment Results of Operations" for further... -

Page 36

...third-party sites - a former copper mining and smelting operation in Tennessee and a containment and removal project in Tennessee - accounted for 44 percent of Occidental's reserves associated with these sites. Four sites - chemical plants in Kansas, Louisiana and New York and a group of oil and gas... -

Page 37

... 31, 2011, net sales outside North Tmerica totaled $8.7 billion, or approximately 36 percent of total net sales. Critical Accounting Policies and Estimates The process of preparing financial statements in accordance with GTTP requires the management of Occidental to make informed estimates and... -

Page 38

28 -

Page 39

... prices, which Occidental bases on forward price curves and, where applicable, contractual prices, estimates of oil and gas reserves and estimates of future expected operating and development costs. Fluctuations in commodity prices and production and development costs could cause management's plans... -

Page 40

... for identical assets or liabilities; Level 2 - using observable inputs other than quoted prices for identical assets or liabilities; and Level 3 - using unobservable inputs. Transfers between levels, if any, are reported at the end of each reporting period. Fair Values - Recurring Occidental... -

Page 41

...of remediation costs among Occidental and other alleged potentially responsible parties; (2) oil and gas ventures in which each participant pays its proportionate share of remediation costs reflecting its working interest; or (3) contractual arrangements, typically relating to purchases and sales of... -

Page 42

...-average prices that will be received by Occidental as of December 31, 2011: Natural Gas - Swaps 9anuary 2012 ― March 2012 Daily Volume (cubic feet) 50 million Tverage Price $6.07 Occidental's marketing and trading operations store natural gas purchased from third parties at Occidental's North... -

Page 43

32 -

Page 44

... only as of the date of this report. Unless legally required, Occidental does not undertake any obligation to update any forward-looking statements as a result of new information, future events or otherwise. Factors that may cause Occidental's results of operations and financial position to differ... -

Page 45

Item 8 Financial Statements and Supplementary Data Management's Annual Assessment of and Report on Internal Control Over Financial Reporting The management of Occidental Petroleum Corporation and subsidiaries (Occidental) is responsible for establishing and maintaining adequate internal control ... -

Page 46

... of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting To the Board of Directors and Stockholders Occidental Petroleum Corporation: We have audited Occidental Petroleum Corporation and subsidiaries' internal control over financial reporting as of December 31... -

Page 47

... Petroleum Corporation and Subsidiaries 2011 2010 Tssets at December 31, current assets Cash and cash equivalents Trade receivables, net of reserves of $16 in 2011 and $19 in 2010 $ 3,781 5,395 $ 2,578 5,032 900 Marketing and trading assets and other Tssets of discontinued operations... -

Page 48

Consolidated Balance Sheets In millions, except share and per-share amounts Occidental Petroleum Corporation and Subsidiaries 2011 2010 Liabilities and Stockholders' Equity at December 31, current liabilities Tccounts payable $ 5,304 $ 4,646 2,397 170 612 Tccrued liabilities Domestic and ... -

Page 49

... of Income In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries 2011 2010 2009 For the years ended December 31, revenues and other income Net sales Interest, dividends and other income Gains on disposition of assets, net $ 23,939 165 15 24,119 $ 19... -

Page 50

...) 29,159 4,602 72 (1,196) (86) (67) 32,484 6,771 41 (1,497) 95 (274) 37,620 On December 31, 2010, Occidental restructured its Colombian operations to take a direct working interest in the related assets. The accompanying notes are an integral part of these consolidated financial statements. 39 -

Page 51

... Statements of Cash Flows In millions Occidental Petroleum Corporation and Subsidiaries 2011 2010 2009 For the years ended December 31, cash flow from operating activities Net income Tdjustments to reconcile net income to net cash provided by operating activities: Discontinued operations, net... -

Page 52

... undivided interests in oil and gas exploration and production ventures. Occidental accounts for its share of oil and gas exploration and production ventures, in which it has a direct working interest, by reporting its proportionate share of assets, liabilities, revenues, costs and cash flows within... -

Page 53

... financial statements include assets of approximately $11 billion as of December 31, 2011, and net sales of approximately $8.7 billion for the year ended December 31, 2011, relating to Occidental's operations in countries outside North Tmerica. Occidental operates some of its oil and gas business... -

Page 54

... prices, which Occidental bases on forward price curves and, where applicable, contractual prices, estimates of oil and gas reserves and estimates of future expected operating and development costs. Fluctuations in commodity prices and production and development costs could cause management's plans... -

Page 55

... or prescribed allocation of remediation costs among Occidental and other alleged potentially responsible parties; (2) oil and gas ventures in which each participant pays its proportionate share of remediation costs reflecting its working interest; or (3) contractual arrangements, Environmental... -

Page 56

...of the costs to operate and maintain remedial systems. If remedial systems are modified over time in response to significant changes in site-specific data, laws, regulations, technologies or engineering estimates, Occidental reviews and adjusts its reserves accordingly. Asset Retirement Obligations... -

Page 57

... of Occidental's accounting policy under each type of award issued under the Plans follows below. For cash- and stock-settled restricted stock units or incentive award shares (RSUs), compensation value is initially measured on the grant date using the quoted market price of Occidental's common stock... -

Page 58

...Plains Pipeline) for approximately $430 million, and now owns approximately 35 percent of the General Partner. In December 2010, Occidental also completed its acquisition of the remaining 50-percent joint venture interest in Elk Hills Power, LLC (EHP), a limited liability company that operates a gas... -

Page 59

... bank credit facility (2006 Credit Facility), which was scheduled to expire in September 2012. The 2011 Credit Facility provides for the termination of the loan commitments and requires immediate repayment of any outstanding amounts if certain events of default occur or if Occidental files for... -

Page 60

... for transportation equipment, power plants, machinery, terminals, storage facilities, land and office space. Occidental's operating lease agreements frequently include renewal or purchase options and require it to pay for utilities, taxes, insurance and maintenance expense. Tt December 31, 2011... -

Page 61

... oil and gas supply is located near its midstream and marketing assets, such as pipelines, processing plants and storage facilities. These purchases allow Occidental to aggregate volumes to maximize prices received for Occidental's production. The third-party marketing and trading purchase and sales... -

Page 62

... not designated as hedging instruments as of December 31, 2011 and 2010: Commodity Volumes 2011 Sales contracts related to Occidental's production Oil (million barrels) 9 2010 8 Third-party marketing and trading activities Purchase contracts Oil (million barrels) Natural gas (billion cubic feet... -

Page 63

... balancing monetary assets and liabilities and maintaining cash positions in foreign currencies only at levels necessary for operating purposes. Most international oil sales are denominated in United States dollars. Tdditionally, all of Occidental's consolidated foreign oil and gas subsidiaries have... -

Page 64

...third-party sites - a former copper mining and smelting operation in Tennessee and a containment and removal project in Tennessee - accounted for 44 percent of Occidental's reserves associated with these sites. Four sites - chemical plants in Kansas, Louisiana and New York and a group of oil and gas... -

Page 65

... terminal and pipeline capacity, drilling rigs and services, electrical power, steam and certain chemical raw materials. Occidental has certain other commitments under contracts, guarantees and joint ventures, including purchase commitments for goods and services at market-related prices and certain... -

Page 66

...-tax income: For the years ended December 31, United States federal statutory tax rate Operations outside the United States State income taxes, net of federal benefit Other Tax rate provided by Occidental 2011 35% 4 1 ( 1) 39% 2010 35% 5 1 (1) 40% 2009 35% 5 1 (1) 40% The tax effects of temporary... -

Page 67

... operating loss carryforwards. T deferred tax liability has not been recognized for temporary differences related to unremitted earnings of certain consolidated foreign subsidiaries aggregating approximately $5.5 billion at December 31, 2011, as it is Occidental's intention, generally, to reinvest... -

Page 68

... for grants of future awards. During 2011, non-employee directors were granted awards for 64,800 shares of restricted stock that fully vested on the grant date. Compensation expense for these awards was measured using the quoted market price of Occidental's common stock on the grant date and... -

Page 69

...shares of Occidental common stock but are paid in cash at the time of vesting. These awards vest either in total over two years or ratably over three years after the grant date and can be forfeited or accelerated under certain conditions. For those awards which vest in total over two years, dividend... -

Page 70

... Monte Carlo simulation models for the estimated payout level of TSRIs were as follows: TSRIs 2010 Year Granted Assumptions used: Risk-free interest rate Dividend yield Volatility factor Expected life (years) Grant-date fair value of underlying Occidental common stock 2011 0.6% 1.8% 33% 3 $ 102.97... -

Page 71

... contribution and supplemental retirement plans. Defined Contribution Plans Participation in defined benefit plans is limited and approximately 1,000 domestic and 1,600 foreign national employees, mainly union, nonunion hourly and certain employees that joined Occidental from acquired operations... -

Page 72

... - end of year Changes in plan assets: Fair value of plan assets - beginning of year Tctual return on plan assets Foreign currency exchange rate gain (loss) Employer contributions Settlements Benefits paid Fair value of plan assets - end of year Unfunded status: 2011 $ 624 12 29 49 ( 5) (51... -

Page 73

...% 6.50% ― For domestic pension plans and postretirement benefit plans, Occidental based the discount rate on the Ton/Hewitt TT-TTT Universe yield curve in 2011 and the Hewitt Bond Universe yield curve in 2010. The weighted-average rate of increase in future compensation levels is consistent with... -

Page 74

... portfolio and manager guideline compliance reviews, annual liability measurements, and periodic studies. The fair values of Occidental's pension plan assets by asset category are as follows (in millions): Fair Value Measurements at December 31, 2011 Using Level 1 Level 2 Level 3 Total $ ― 22... -

Page 75

... ended December 31, (in millions) 2012 2013 2014 2015 2016 2017 - 2021 Pension Benefits $ 46 $ 46 $ 47 $ 43 $ 48 $ 231 Postretirement Benefits $ 50 $ 50 $ 51 $ 52 $ 54 $ 294 Note 14 Investments and Related-Party Transactions Ts of December 31, 2011 and 2010, investments in unconsolidated entities... -

Page 76

... Pipeline accounted for 76 percent, 50 percent and 26 percent of these totals, respectively. Tdditionally, Occidental conducts marketing and trading activities with Plains Pipeline for oil and NGLs. These transactions are reported in Occidental's income statement on a net margin basis. The sales... -

Page 77

... markets basic chemicals and vinyls. The midstream and marketing segment gathers, treats, processes, transports, stores, purchases and markets oil, condensate, NGLs, natural gas, CO 2 and power. It also trades around its assets, including pipelines and storage capacity, and trades oil, NGLs, gas and... -

Page 78

Industry Segments In millions Oil and Gas Chemical Midstream, Marketing and Other 1,447 (c) 448 ― ― 448 1,812 1,120 173 11,962 Corporate and Eliminations Total YEAR ENDED DECEMBER 31, 2011 Net sales $ $ 18,419 (a) $ 10,241 (d) $ ― ― 10,241 (d) $ 128 6,192 3,064 4,815 (b) $ 861 ― ... -

Page 79

... assets held for sale for 2010 and 2009. Geographic Areas In millions For the years ended December 31, United States Foreign Qatar Oman Colombia Yemen United Trab Emirates Libya Other Foreign Total Foreign Total (a) 2011 $ Net sales 2010 (a) 2009 Property, plant and equipment, net 2011... -

Page 80

-

Page 81

2011 Quarterly Financial Data (Unaudited) In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries March 31 $ 4,367 1,165 412 ( 2 1 8) Three months ended Segment net sales Oil and gas Chemical Midstream, marketing and other Eliminations Net sales June 30 $ 4,591 1,... -

Page 82

2010 Quarterly Financial Data (Unaudited) In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries March 31 $ 3,491 956 369 Three months ended Segment net sales Oil and gas Chemical Midstream, marketing and other Eliminations Net sales 9une 30 $ 3,518 1,013 236 (... -

Page 83

... volumes while its revenues reflected pre-tax sales. This difference was caused by Occidental's PSCs in the Middle East/North Tfrica where production is immediately taken and sold to pay the local income tax. Occidental had historically reported these volumes as additional revenues and income taxes... -

Page 84

... interest of a Colombian subsidiary. On December 31, 2010, Occidental restructured its Colombian operations to take a direct working interest in the related assets. Ts a result, the December 31, 2010 and 2011 proved reserves amounts exclude the noncontrolling interest. (b) Excludes proved... -

Page 85

...(c) Proved reserve amounts relate to PSCs and other similar economic arrangements. Tpproximately 6 percent of the proved developed reserves at December 31, 2011 are nonproducing, the majority of which are located in the United States and Libya. The amount of Occidental's proved undeveloped reserves... -

Page 86

.... (b) Proved reserve amounts relate to PSCs and other similar economic arrangements. (c) Tpproximately 2 percent of the proved developed reserves at December 31, 2011 are nonproducing, the majority of which are located in the United States. (d) The amount of Occidental's proved undeveloped reserves... -

Page 87

... 31, 2011 (a) (g) 606 27 131 Natural gas volumes have been converted to barrels of oil equivalent (BOE) based on energy content of six thousand cubic feet (Mcf) of gas to one barrel of oil. Barrels of oil equivalence does not necessarily result in price equivalence. The price of natural gas on... -

Page 88

... 2011, 2010 and 2009 amounts primarily consist of Midcontinent and Other, Permian, California and Libya. Includes costs related to leases, exploration costs, lease and well equipment, other equipment, capitalized interest, asset retirement obligations and other costs. Costs incurred in oil and gas... -

Page 89

-

Page 90

... 2011 and classified as discontinued operations. (c) Revenues from net production exclude royalty payments and other adjustments. (d) Production costs are the costs incurred in lifting the oil and gas to the surface and include gathering, treating, primary processing, field storage and insurance... -

Page 91

... per Unit of Production for Continuing Operations United States Latin Tmerica (a,b) Middle East/ North Tfrica Total (c) for the year ended december 31, 2011 Revenues from net production barrel of oil equivalent ($/bbl.) (d,e) Production costs Other operating expenses Depreciation, depletion... -

Page 92

... asset retirement costs. C HANGES IN THE STANDARDIZED MEASURE OF DISCOUNTED FUTURE NET CASH FLOWS FROM PROVED RESERVE QUANTITIES In millions For the years ended December 31, Beginning of year Sales and transfers of oil and gas produced, net of production costs and other operating expenses Net... -

Page 93

... December 31, 2011, Occidental's approximate average sales prices for continuing operations. United States 2011 Oil NGLs Gas 2010 Oil NGLs Gas 2009 Latin Tmerica $ $ $ $ $ $ $ $ $ (a) Middle East/ North Tfrica $ $ $ $ $ $ $ $ $ Total - Tverage sales price ($/bbl.) - Tverage sales price ($/bbl... -

Page 94

... wells (both producing and capable of production). Wells at December 31, 2011 (a) Oil - Gross (b) Net (c) Gas - Gross (b) Net (c) (a) (b) (c) United States 31,538 (1,426) 21,052 (1,101) 6,933 (1,388) 5,470 (1,012) Latin Tmerica 1,277 633 29 27 Middle East/ North Tfrica 2,201 1,196 120 62 (570... -

Page 95

... and Other TOTTL Natural gas (MMCF) California Permian Midcontinent and Other TOTTL Latin America (a) Oil (MBBL) ― Colombia Middle East/North Africa Oil (MBBL) Bahrain Dolphin Iraq Libya Oman Qatar Yemen TOTTL NGLs (MBBL) Dolphin Libya TOTTL Natural gas (MMCF) Bahrain Dolphin Oman TOTTL (b) 16 29... -

Page 96

Sales Volumes per Day United States Oil (MBBL) 2011 230 69 2010 219 2009 223 48 NGLs (MBBL) Natural gas (MMCF) Latin America (a) Oil (MBBL) ― Colombia Middle East/North Africa Oil (MBBL) Bahrain Dolphin Iraq Libya Oman Qatar Yemen TOTTL NGLs (MBBL) Dolphin Libya TOTTL Natural gas (MMCF) (b) ... -

Page 97

Schedule II - Valuation and Qualifying Accounts In millions Occidental Petroleum Corporation and Subsidiaries Balance at Beginning of Period Tdditions Charged to Charged to Other Costs and Tccounts Expenses Deductions (a) Balance at End of Period 16 360 2011 Tllowance for doubtful accounts $... -

Page 98

..."General Information - Nominations for Directors for Term Expiring in 2014" in Occidental's definitive proxy statement filed in connection with its May 4, 2012, Tnnual Meeting of Stockholders (2012 Proxy Statement). The list of Occidental's executive officers and related information under "Executive... -

Page 99

... and Financial Statement Schedule Reference is made to Item 8 of the Table of Contents of this report, where these documents are listed. (a) (3). Exhibits 2 . 1* Tgreement and Plan of Merger among Occidental Petroleum Corporation, Occidental Transaction 1, LLC and Vintage Petroleum, Inc., dated as... -

Page 100

... Occidental Petroleum Corporation 1996 Restricted Stock Plan for NonEmployee Directors (filed as Exhibit 10.2 to the Quarterly Report on Form 10-Q of Occidental for the quarterly period ended September 30, 2007, File No. 1-9210). Form of Occidental Petroleum Corporation Supplemental Retirement Plan... -

Page 101

....45* 10.46* 10.47* Occidental Petroleum Corporation Executive Incentive Compensation Plan (filed as Exhibit 10.69 to the Tnnual Report on Form 10K of Occidental for the fiscal year ended December 31, 2005, File No. 1-9210). Description of financial counseling program (filed as Exhibit 10.50 to the... -

Page 102

... Equity Incentive Tward Grant Tgreement (filed as Exhibit 10.1 to the Current Report on Form 8-K of Occidental dated 9uly 13, 2011 (date of earliest event reported), filed 9uly 18, 2011, File No. 1-9210). Form of Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Total Shareholder Return... -

Page 103

...(Cash-Based, Cash- Settled Tward) (filed as Exhibit 10.6 to the Quarterly Report on Form 10-Q of Occidental for the fiscal quarter ended 9une 30, 2011, File No. 1-9210). Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Occidental Oil and Gas Corporation Return on Tssets Incentive Tward... -

Page 104

... of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. OCCIDENTAL PETROLEUM CORPORATION Fe(ruary 23, 2012 By: /s/ Stephen I. Chazen Stephen I. Chazen President and Chief Executive Officer Pursuant to the requirements of the... -

Page 105

... 23, 2012 /s/ Aziz D. Syriani Aziz D. Syriani Director Fe(ruary 23, 2012 /s/ Rosemary Tomich Rosemary Tomich Director Fe(ruary 23, 2012 /s/ Walter L. Weisman Walter L. Weisman Director Fe(ruary 23, 2012 This report was printed on recycled paper. © 2012 Occidental Petroleum Corporation 92... -

Page 106

... Occidental Petroleum Corporation Supplemental Retirement Plan II (Effective Ts of 9anuary 1, 2005, Tmended and Restated Ts of November 1, 2008). Statement regarding computation of total enterprise ratios of earnings to fixed charges for each of the five years in the period ended December 31, 2011... -

Page 107

... or the THUMS Long Beach Company Pension Plan in 2008; and Individuals who are employed by Tidelands Oil Production Company on December 31, 2010. "An individual described in (1) or (2) above shall be eligible to participate in this Plan if he or she meets the applicable requirements under Section... -

Page 108

... sentence is added at the end of Section 5.2(a)(1) of the Plan: "An Employee who is employed by Tidelands Oil Production Company on December 31, 2010 and is scheduled to become a Participant on January 1, 2011 shall make such elections by December 31, 2010." 5. Except as amended above, the terms of... -

Page 109

... 1, 2008 The Occidental Petroleum Corporation Supplemental Retirement Plan II (Effective as of January 1, 2005, Amended and Restated as of November 1, 2008) is hereby amended as of January 1, 2012, as follows: 1. Effective January 1, 2012, a new section 2.1(d), relating to "Annual Bonus," is added... -

Page 110

... be equal to the dollar limit in effect for the Plan Year under Code section 415(c)(1)(A) minus any Retirement Plan allocations to date, minus the sum of the following:" 5. The last paragraph of Section 4.1(b)(2) is amended to add the word "Paid" after the phrase "Annual Bonus" so that it reads as... -

Page 111

..., section 4.2(a) is renamed as "Eligibility for Allocations Relating to Limits Under Code section 401(a)(17)." 8. Effective January 1, 2012, section 4.3(a)(1), relating to "Eligibility" for "Retirement Plan" and "Allocations Relating to the Deferred Compensation Plan" is amended to read as follows... -

Page 112

EXHIBIT 12 OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES (Amounts in millions, except ratios) For the years ended December 31, 2011 2010 2009 2008 2007 Income from continuing operations Subtract: Net income attributable ... -

Page 113

... Armand Products Company Bravo Pipeline Company Carbocloro S.A. Industrias Quimicas Centurion Pipeline GP, Inc. Centurion Pipeline L.P. Centurion Pipeline LP, Inc. D.S. Ventures, Inc. DMM Financial LLC EHPP Holdings Inc. Elk Hills Power, LLC Glenn Springs Holdings, Inc. INDSPEC Chemical Corporation... -

Page 114

..., LLC Occidental Qatar Energy Company LLC Occidental Quimica do Brasil Ltda. Occidental Resources Company Occidental Shah Gas Holdings Ltd. Occidental Tower Corporation Occidental Transportation Holding Corporation Occidental Yemen Ltd. OOG Partner LLC OOOI Chem Sub, LLC OOOI Chemical International... -

Page 115

...'d) Name OOOI Oil and Gas Management, Inc. OOOI Oil and Gas Sub, LLC Oxy Cogeneration Holding Company, Inc. Oxy Colombia Holdings, Inc. OXY CV Pipeline LLC Oxy Dolphin E&P, LLC Oxy Dolphin Pipeline, LLC Oxy Energy Canada, Inc. Oxy Energy Services, Inc. Oxy Holding Company (Pipeline), Inc. OXY Libya... -

Page 116

...Long Beach Company Turavent Oil AG Vintage Petroleum Boliviana, Ltd. Vintage Petroleum International Finance B.V. Vintage Petroleum International Holdings, Inc. Vintage Petroleum International Ventures, Inc. Vintage Petroleum International, Inc. Vintage Petroleum South America Holdings, Inc. Vintage... -

Page 117

...the related financial statement schedule, and the effectiveness of internal control over financial reporting as of December 31, 2011, which reports appear in the December 31, 2011 annual report on Form 10-K of Occidental Petroleum Corporation. /s/ KPMG LLP Los Angeles, California February 23, 2012 -

Page 118

..., 333-142705 and 333-176308) (the "Registration Statements"), of references to our name and to our letter dated February 2, 2012, relating to our review of the methods and procedures used by Occidental for estimating its oil and gas proved reserves (our "Letter"), (ii) filing of our Letter with the... -

Page 119

... and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 23, 2012 /s/ STEPHEN I. CHAZEN Stephen I. Chazen President and Chief... -

Page 120

... report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 23, 2012 /s/ JAMES M. LIENERT James M. Lienert Executive Vice President... -

Page 121

... Chief Executive Officer Date: February 23, 2012 /s/ JAKES K. LIENERT Name: James K. Lienert Title: Executive Vice President and Chief Financial Officer Date: February 23, 2012 A signed original of this written statement required by Section 906 has been provided to Occidental Petroleum Corporation... -

Page 122

... 99.1 OCCIDENTAL PETROLEUM CORPORATION Process Review of the Estimated Future Reserves and Income Attributable to Certain Fee, Leasehold and Royalty Interests and Certain Economic Interests Derived Through Certain Production Sharing Contracts SEC Parameters As of December 31, 2011 /s/ JOHN... -

Page 123

... states of California, Colorado, New Mexico, Texas and Btah and derived through Occidental's economic interest as defined in certain production sharing and similar contracts for certain properties located in the Middle East in the countries of Bahrain, Libya and Oman. The properties reviewed herein... -

Page 124

... 2, 2012 Page 2 Percentage of Total Company Estimated Net Reserves Reviewed by Ryder Scott SEC Parameters Occidental Petroleum Corporation As of December 31, 2011 Oil/Condensate Total Proved Developed Total Proved Bndeveloped Total Company Proved NGL 13% 9% 12% Total Liquid Hydrocarbons Gas 19... -

Page 125

...based on their individual level of uncertainty. At Occidental's request, this reserves process review addresses only the proved reserves attributable to the properties reviewed herein. Reserves estimates will generally be revised only as additional geologic or engineering data become available or as... -

Page 126

... Petroleum Corporation February 2, 2012 Page 4 Reserves Process Review Procedure Certain technical personnel responsible for the preparation of Occidental's proved reserves estimates presented the data, methods and procedures used in 1) estimating the reserves volumes as of December 31, 2011... -

Page 127

..., but not limited to, the use of reservoir parameters derived from geological, geophysical and engineering data which cannot be measured directly, economic criteria based on current costs and SEC pricing requirements, and forecasts of future production rates. Bnder the SEC regulations 210.4-10... -

Page 128

... of Petroleum Accounting Societies overhead costs that are allocated directly to the leases and wells under terms of operating agreements. The operating costs used by Occidental were accepted as factual data and reviewed by us for their reasonableness; however, we have not conducted an independent... -

Page 129

... of the material accounts, records, geological and engineering data, and reports and other data required for this review. In conducting our process review of Occidental's estimates of proved reserves, forecasts of future production and income, we have reviewed data used by Occidental with respect to... -

Page 130

... of reserves quantities reported by Occidental. Standards of Independence and Professional Qualification Ryder Scott is an employee owned independent petroleum engineering consulting firm. We do not serve as officers or directors of any privately-owned or publicly-traded oil and gas company and are... -

Page 131

... in filings made by Occidental and the original signed report letter, the original signed report letter shall control and supersede the digital version. The data and work papers used in the preparation of this report are available for examination by authorized parties in our offices. Please contact... -

Page 132

... Group. Mr. Hodgin is responsible for coordinating and supervising staff and consulting engineers and geoscientists of the company in ongoing reservoir evaluation studies worldwide. He served as a coordinator or as a member of the internal reserves audit teams of ConocoPhillips, Occidental Petroleum... -

Page 133