Occidental Petroleum 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

R

£

For the fiscal year ended December 31, 2009 For the transition period from to

Commission File Number 1-9210

Occidental Petroleum Corporation

Delaware

95-4035997

10889 Wilshire Blvd., Los Angeles, CA

90024

(310) 208-8800

Title of Each Class Name of Each Exchange on Which Registered

R£

£R

R£

R£

R

R£

££

£

R

Table of contents

-

Page 1

... executive offices Zip Code Registrant's telephone number, including area code Delaware 95-4035997 10889 Wilshire Blvd., Los Angeles, CA 90024 (310) 208-8800 Securities registered pursuant to Section 12(b) of the Tct: Title of Each Class 9 1/4% Senior Debentures due 2019 Common Stock Name... -

Page 2

... Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management Certain Relationships and Related Transactions and Director Independence Principal Tccountant Fees and Services Part IV Item 15 Exhibits and Financial Statement Schedules... -

Page 3

... Consolidated Financial Statements. OIL AND GAS OPERATIONS General Occidental's domestic oil and gas operations are located in Texas, New Mexico, California, Kansas, Oklahoma, Utah and Colorado. International operations are located in Trgentina, Bahrain, Bolivia, Colombia, Libya, Oman, Qatar, the... -

Page 4

...reserves cost-effectively and acquiring rights to explore and develop in areas with known oil and gas deposits. Occidental also competes by increasing production through enhanced oil recovery projects in mature and underdeveloped fields and making strategic acquisitions. CHEMICAL OPERATIONS OxyChem... -

Page 5

...Location Description Occidental-operated and third-party-operated gas gathering, treating, compression and processing systems, and CO 2 processing Capacity Gas Plants California, Colorado and Permian Basin 1.958 billion cubic feet per day Pipilinis Permian Basin and Oklahoma Common carrier oil... -

Page 6

...exploration activities, weather, geophysical and technical limitations and other matters may affect the supply and demand dynamics of oil and gas, contributing to price volatility. Demand and, consequently, the price obtained for Occidental's chemical products correlate strongly to the health of the... -

Page 7

...Director since 1984; Member of Executive Committee and Dividend Committee; 2005-2007, President. President since 2007; Chief Financial Officer since 1999; 2005-2007, Senior Executive Vice President; 1994-2004, Executive Vice President, Corporate Development. Executive Vice President, General Counsel... -

Page 8

... stockholders whose shares were held for them in street name or nominee accounts. The common stock is listed and traded principally on the New York Stock Exchange. The quarterly financial data, which are included in this report after the Notes to the Consolidated Financial Statements, set forth the... -

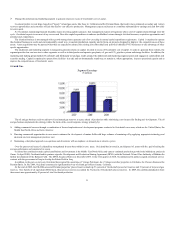

Page 9

... of the common stock of the peer group companies weighted by their relative market values each year and that all dividends were reinvested. Occidental's peer group consists of Tnadarko Petroleum Corporation, Tpache Corporation, BP p.l.c., Chevron Corporation, ConocoPhillips, Devon Energy Corporation... -

Page 10

... common stock outstanding, net of shares held as treasury stock, by the year-end closing stock price. Item 7 and 7A Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) S TRATEGY General In this report, "Occidental" refers to Occidental Petroleum Corporation... -

Page 11

...years Occidental has acquired the operations of Vintage Petroleum, Inc. (Vintage) and other properties in California, the Piceance Basin and the Permian Basin. In July 2009, Occidental announced a significant discovery of oil and gas in Kern County, California. Tt the end of 2009, the Elk Hills area... -

Page 12

.... In order to generate these returns, the segment provides low cost services to other segments as well as to third parties and operates gas plants, oil, gas and CO 2 pipeline systems and storage facilities. In addition, the marketing and trading group markets Occidental's and third-party oil and gas... -

Page 13

to T by Standard and Poor's Ratings Services, from T3 to T2 by Moody's Investors Service and from T(low) to T by DBRS. T security rating is not a recommendation to buy, sell or hold securities, may be subject to revision or withdrawal at any time by the assigning rating organization and should be ... -

Page 14

... company formed by Occidental and its partners will serve as operator for the project. In 2009, Occidental acquired various additional properties in California and the Permian Basin. Production-Sharinl Contracts (PSC) Occidental conducts its operations in Bahrain, Libya, Oman, Yemen and Qatar... -

Page 15

maintenance and workovers. 13 -

Page 16

... than Elk Hills. The combined properties produce oil and gas from more than 50 fields. Occidental holds approximately 1.3 million acres of net fee minerals and leaseholds in California, which have been acquired in the last few years. Occidental conducts both onshore and offshore operations in the... -

Page 17

... the field development plan. Unitid Arab Emiratis Occidental conducts a majority of its Middle East business development activities through its office in the United Trab Emirates, which also provides various support functions for Occidental's Middle East/North Tfrica oil and gas operations. Latin... -

Page 18

... company, Ecopetrol, operates the Caño Limón-Coveñas oil pipeline and marine-export terminal. The pipeline transports oil produced from the Llanos Norte Basin for export to international markets. Occidental also holds a 48-percent working interest in the La Cira-Infantas Field, which is located... -

Page 19

... petroleum engineering consultants, to review its annual oil and gas reserve estimation processes. In 2009, Ryder Scott compared Occidental's methods and procedures for estimating oil and gas reserves to generally accepted industry standards and reviewed certain pertinent facts interpreted... -

Page 20

... is in the process of arranging for a third party to provide transportation capacity from the plant to its Permian Basin production areas. Occidental's 2009 earnings from these operations declined due to lower gas processing margins. Pipilini Transportation Margin and cash flow from pipeline... -

Page 21

... in Occidental's consolidated quarterly earnings during the year. The following table sets forth the sales and earnings of each operating segment and corporate items: In millions, except per share amounts For the years ended December 31, 2009 $ 2008 2007 net sales (a) Oil and Gas Chemical... -

Page 22

... 81 570 Production per Day United States Oil and liquids (MBBL) 2009 2008 2007 263 260 Natural gas (MMCF) Latin America Crude oil (MBBL) Trgentina Colombia (a) Total Natural gas (MMCF) Middle East/North Africa Oil and liquids (MBBL) Oman Dolphin Qatar Yemen Libya Total Natural gas (MMCF) Total... -

Page 23

... table) 2009 Average Sales Prices Crude Oil Prices ($ per bbl) United States Latin Tmerica Middle East/North Tfrica Total worldwide Gas Prices ($ per Mcf) United States Latin Tmerica Total worldwide Expensed Exploration (c) Capital Expenditures Development Exploration Other (a) (b) (c) 2008 2007... -

Page 24

... Earnings Benefit (Charge) (in millions) 2009 $ (a) 2008 (170) $ (8) 2007 oil and gas Tsset impairments Rig contract terminations Gain on sale of a Russian joint venture Legal settlements (a) Gain on sale of exploration properties Gain on sale of oil and gas interests Total Oil and Gas (599... -

Page 25

EARNINGS Oil and Gas Chemical $ Midstream, Marketing and Other Unallocated Corporate Items Pre-tax income Income tax expense Federal and State Foreign Total Income from continuing operations 4,735 $ 389 235 (514) 4,845 686 10,651 669 $ 7,957 601 367 (340) 520 (372) 11,468 2,188 2,441 4,629 ... -

Page 26

...decrease was due to lower oil and gas and midstream and marketing operating costs. Cost of sales increased in 2008, compared to 2007, due to higher oil and natural gas volumes, as well as higher maintenance, workover, field operating and feedstock costs. Selling, general and administrative and other... -

Page 27

... of oil and gas properties in California and the Permian Basin, partially offset by DD&T. Liabilities and Stockholders' Equity The accounts payable balance at year-end 2009, compared to 2008, reflected higher oil and gas purchase activity in the marketing and trading operations and the Phibro... -

Page 28

... of Occidental's natural gas was produced. Oil accounted for approximately 76 percent of Occidental's 2009 production. Occidental's oil and gas sales volumes increased by 7 percent in 2009, compared to 2008, due to increased production in California, Midcontinent Gas, Latin Tmerica and Oman. The... -

Page 29

... greater operating flexibility. Lease payments are expensed mainly as cost of sales. For more information, see "Contractual Obligations." Guarantees Occidental has guaranteed certain equity investees' debt and has entered into various other guarantees including performance bonds, letters of credit... -

Page 30

... generally increased over time and could continue to rise in the future. Occidental factors environmental expenditures for its operations into its business planning process as an integral part of producing quality products responsive to market demand. Environmental Remediation The laws that require... -

Page 31

..." for additional information. Environmental Costs Occidental's environmental costs, some of which include estimates, are shown below for each segment for the years ended December 31: In millions Operating Expenses Oil and Gas Chemical Midstream and Marketing 2009 $ 2008 2007 127 123... -

Page 32

CRITICAL ACCOUNTING POLICIES AND ESTIMATES The process of preparing financial statements in accordance with GTTP requires the management of Occidental to make informed estimates and judgments regarding certain items and transactions. Changes in facts and circumstances or discovery of new information... -

Page 33

... impairment tests. The estimated useful lives used for the chemical facilities are based on the assumption that Occidental will provide an appropriate level of annual expenditures to ensure productive capacity is sustained. Without these continued expenditures, the useful lives of these plants could... -

Page 34

...NPL sites, Occidental's reserves include management's estimates of the costs to operate and maintain remedial systems. If remedial systems are modified over time in response to significant changes in site-specific data, laws, regulations, technologies or engineering estimates, Occidental reviews and... -

Page 35

... impact on Occidental's financial statements. Ts of December 31, 2009, Occidental enhanced its disclosures related to the assets held in defined benefit plans and other post-retirement benefits in accordance with disclosure requirements issued by the FTSB in December 2008 and in Tpril 2009. In the... -

Page 36

... of management report to the Corporate Vice President and Treasurer. The Chief Financial Officer and risk committees comprising members of Occidental's senior corporate management also oversee these controls. Controls for these activities include limits on value at risk, limits on credit, limits on... -

Page 37

2012 2013 2014 Thereafter Total $ $ 368 1,000 - 1,086 2,693 $ 6.13% - - - 47 115 $ 0.29% Tverage interest rate Fair Value (a) 2,978 $ 115 $ 368 1,000 - 1,133 2,808 5.89% 3,093 Excludes unamortized net discounts of $12 million. 32 -

Page 38

... of Operations," including the information under the sub captions "Strategy," "Oil and Gas Segment - Industry Outlook," "Chemical Segment - Industry Outlook," "Midstream, Marketing and Other Segment - Industry Outlook," "Liquidity and Capital Resources," "Lawsuits, Claims, Contingencies and Related... -

Page 39

...over financial reporting. Occidental's system of internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted... -

Page 40

... financial position of Occidental Petroleum Corporation and subsidiaries as of December 31, 2009 and 2008, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2009, in conformity with U.S. generally accepted accounting principles... -

Page 41

... designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. T company's internal control over financial reporting includes those policies... -

Page 42

Consolidated Statements of Income In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries For the years ended December 31, 2009 2008 2007 revenues and other income Net sales $ Interest, dividends and other income Gains on disposition of assets, net 15,403 118... -

Page 43

... property, plant and equipment Oil and gas segment 1,732 1,263 43,692 5,298 3,056 1,085 40,091 Chemical segment 5,090 2,445 1,102 Midstream, marketing and other segment Corporate 53,131 Tccumulated depreciation, depletion and amortization 48,728 (16,462) (19,486) 33,645 32,266 long-term... -

Page 44

... 31, Occidental Petroleum Corporation and Subsidiaries 2009 2008 current liabilities Current maturities of long-term debt Tccounts payable $ 239 3,379 2,341 28 105 6,092 2,557 $ 698 3,306 Tccrued liabilities Domestic and foreign income taxes Liabilities of discontinued operations 1,861... -

Page 45

... of the gain on the sale of the remaining Lyondell Chemical Company (Lyondell) shares. Net of tax of ($1), ($7) and ($56) in 2009, 2008 and 2007, respectively. There were no other comprehensive income (loss) items related to noncontrolling interests in 2009, 2008 and 2007. The accompanying notes... -

Page 46

Consolidated Statements of Cash Flows In millions Occidental Petroleum Corporation and Subsidiaries For the years ended December 31, 2009 2008 2007 cash flow from operating activities Net income $ 2,966 $ 6,973 (18) 2,710 268 1,071 (27) (213) 244 $ 5,475 (322) Tdjustments to reconcile ... -

Page 47

Notes to Consolidated Financial Statements Note 1 Summary of Significant Accounting Policies Occidental Petroleum Corporation and Subsidiaries NATURE OF OPERATIONS In this report, "Occidental" or "the Company" refers to Occidental Petroleum Corporation, a Delaware corporation, (OPC), and/or one ... -

Page 48

... December 31, 2009, relating to Occidental's operations in countries outside North Tmerica. Occidental operates some of its oil and gas business in countries that occasionally have experienced political instability, armed conflict, terrorism, insurgency, civil unrest, security problems, labor unrest... -

Page 49

... estimates of future product prices, which Occidental bases on forward price curves, estimates of oil and gas reserves and estimates of future expected operations and development costs. Fluctuations in commodities prices and production and development costs could cause management's plans to change... -

Page 50

... List (NPL) sites, Occidental's reserves include management's estimates of the costs to operate and maintain remedial systems. If remedial systems are modified over time in response to significant changes in site-specific data, laws, regulations, technologies or engineering estimates, Occidental... -

Page 51

... of Occidental's accounting policy under each type of award issued under the Plans follows below. For cash- and stock-settled restricted stock units (RSUs), compensation expense is initially measured on the grant date using the quoted market price of Occidental's common stock. For stock options... -

Page 52

... of the Bahrain Field, which became effective in December 2009. Under this agreement, a joint operating company formed by Occidental and its partners will serve as operator for the project. In 2009, Occidental acquired various additional oil and gas properties in California and the Permian Basin for... -

Page 53

... in Horn Mountain and received cash. Occidental acquired oil and gas interests in the Permian Basin and a gas processing plant in Texas from BP. Occidental also purchased for cash BP's west Texas pipeline system and, in a separate transaction, Occidental sold its oil and gas interests in Pakistan to... -

Page 54

... 1,029 (71) 958 Note 5 Long-term Debt Long-term debt consisted of the following: Balance at December 31, (in millions) Occidental Petroleum Corporation 2009 $ 2008 7.0% senior notes due 2013 4.125% senior notes due 2016 6.75% senior notes due 2012 4.25% medium-term senior notes due 2010 8.45... -

Page 55

... facilities, office space, railcars and tanks, frequently include renewal or purchase options and require Occidental to pay for utilities, taxes, insurance and maintenance expense. Tt December 31, 2009, future net minimum lease payments for capital and noncancelable operating leases (excluding oil... -

Page 56

...03 $6.07 Occidental's marketing and trading operations store natural gas purchased from third parties at Occidental's leased storage facilities. Derivative instruments are used to fix margins on the future sales of the stored volumes. These agreements continue through 2010. Ts of December 31, 2009... -

Page 57

... gross volumes of Occidental's commodity derivatives not designated as hedging instruments as of December 31, 2009: Commodity Occidental's production sales contracts Volumes Crude oil Third-party marketing and trading activities Purchase contracts Crude oil Natural gas Electricity 9 million... -

Page 58

... a one-notch reduction in its credit rating, it would not have resulted in a material change in its collateral-posting requirements as of December 31, 2009. FOREIGN CURRENCY RISK Occidental's foreign operations have currency risk. Occidental manages its exposure primarily by balancing monetary... -

Page 59

.... ENVIRONMENTAL COSTS Occidental's environmental costs, some of which include estimates, are shown below for each segment for the years ended December 31: In millions Operating Expenses Oil and Gas Chemical Midstream and Marketing Capital Expenditures Oil and Gas Chemical 2009 $ 2008 2007 127... -

Page 60

... capacity, drilling rigs and services, electrical power, steam and certain chemical raw materials. Occidental has certain other commitments under contracts, guarantees and joint ventures, including purchase commitments for goods and services at market-related prices and certain other contingent... -

Page 61

... paid-in capital was credited $24 million in 2009, $77 million in 2008 and $43 million in 2007 for an excess tax benefit from the exercise of certain stock-based compensation awards. Ts of December 31, 2009, Occidental had liabilities for unrecognized tax benefits of approximately $52 million... -

Page 62

..., December 31, 2009 Common Stock 870,679 2,643 3,802 877,124 1,532 2,767 881,423 1,697 523 883,643 TREASURY STOCK Occidental has had a 95-million share authorization in place since 2008 for its share repurchase program; however, the program does not obligate Occidental to acquire any specific... -

Page 63

...were available for future awards. During 2009, non-employee directors were granted awards for 63,134 shares of restricted stock that fully vested on the grant date. Compensation expense for these awards was measured using the quoted market price of Occidental's common stock on the grant date and was... -

Page 64

...Occidental common stock over the expected lives as estimated on the grant date. The risk-free interest rate is the implied yield available on zero coupon T-notes (US Treasury Strip) at the grant date with a remaining term equal to the expected life. The dividend yield is the expected annual dividend... -

Page 65

... models for the estimated payout level of PSTs and TSRIs were as follows: PSTs Year Granted Tssumptions used: Risk-free interest rate Dividend yield Volatility factor Expected life (years) Grant-date fair value of underlying Occidental common stock 2007 2009 TSRIs 2008 3.0% 1.7% 31% 4 77.00 2007... -

Page 66

... union, nonunion hourly and certain employees that joined Occidental from acquired operations with grandfathered benefits, are currently accruing benefits under these plans. Pension costs for Occidental's defined benefit pension plans, determined by independent actuarial valuations, are generally... -

Page 67

... 31, 2009, and $154 million, $146 million and $167 million, respectively, as of December 31, 2008. Occidental has 401(h) accounts established within certain defined benefit pension plans. These plans allow Occidental to fund postretirement medical benefits for employees at two of its operations... -

Page 68

... long term rate of return on assets Rate of compensation increase - - - - For domestic pension plans and postretirement benefit plans, Occidental based the discount rate on the Hewitt Bond Universe yield curve in 2009 and 2008. The weightedaverage rate of increase in future compensation levels... -

Page 69

... December 31, 2009 Level 2 Level 3 Total Description Level 1 Asset Category: Cash and cash equivalents Collateral received for securities loaned U.S. government securities Corporate bonds (a) Common/collective trusts and mutual funds Common and preferred stocks (c) Other Total pension plan assets... -

Page 70

... in Elk Hills Power, LLC (EHP), a limited liability company that operates a gas-fired, power-generation plant in California, which it accounts for as an equity-method investment. RELATED-PARTY TRANSACTIONS Occidental purchases power, steam and chemicals from and sells oil, gas, chemicals and power... -

Page 71

... 31, 2009. The fair value of the PP&E was $144 million, resulting in an impairment charge of $170 million, and was measured using an income approach based upon internal estimates of future production levels, prices, costs and a discount rate, which were Level 3 inputs. FINANCIAL INSTRUMENTS FAIR... -

Page 72

Note 16 Industry Segments and Geographic Areas Occidental conducts its continuing operations through three segments: (1) oil and gas; (2) chemical; and (3) midstream and marketing. The oil and gas segment explores for, develops, produces and markets crude oil, including NGLs and condensate, as ... -

Page 73

... In millions For the years ended December 31, United States Foreign Qatar Colombia Oman Yemen Trgentina Libya 2009 $ Net sales (a) 2008 2007 Property, plant and equipment, net 2008 2007 2009 9,448 $ 15,258 $ 3,298 1,721 1,207 1,016 504 748 465 8,959 24,217 $ 12,300 $ 23,440 $ 22,164 $ 17... -

Page 74

2009 Quarterly Financial Data (Unaudited) In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries March 31 Three months ended Segment net sales Oil and gas Chemical June 30 $ September 30 December 31 $ Midstream, marketing and other Eliminations 2,137 792 228... -

Page 75

2008 Quarterly Financial Data (Unaudited) In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries Three months ended Segment net sales Oil and gas Chemical March 31 June 30 September 30 December 31 $ Midstream, marketing and other Eliminations 4,518 1,267 ... -

Page 76

... petroleum engineering consultants, to review its annual oil and gas reserve estimation processes. In 2009, Ryder Scott compared Occidental's methods and procedures for estimating oil and gas reserves to generally accepted industry standards and reviewed certain pertinent facts interpreted... -

Page 77

...'s senior management. Occidental has classified its Horn Mountain (in 2007) and Pakistan (in 2007) operations as discontinued operations on a retrospective basis and excluded them from all tables in the Supplemental Oil and Gas Information section. Effective for the year ended December 31, 2009... -

Page 78

...Latin Tmerica (a) Middle East/ North Tfrica Total proved developed and undeveloped reserves Balance at December 31, 2006 Revisions of previous estimates 1,660 (20) Improved recovery Extensions and discoveries Purchases of proved reserves Sales of proved reserves Production Balance at December... -

Page 79

... 31, 2008 December 31, 2009 (a) (b) (c) (c) 1,087 774 868 416 1,387 1,342 Proved reserve amounts relate to PSCs. Tpproximately two percent of the proved developed reserves at December 31, 2009 are nonproducing, the majority of which are located in the United States. The amount of Occidental... -

Page 80

... 2009 and 2008 amounts primarily consist of Midcontinent Gas, Permian, California and Libya. The 2007 amount primarily consists of California, Trgentina and Libya. Includes costs related to leases, exploration costs, lease and well equipment, other equipment, capitalized interest, asset retirement... -

Page 81

... oil and gas trading activities and items such as asset dispositions, corporate overhead, interest and royalties, were as follows: United Latin Tmerica In millions FOR THE YEAR ENDED DECEMBER States (a) Middle East/ North Tfrica Total 31, 2009 $ Revenues (b) Production costs Other operating... -

Page 82

... United States FOR THE YEAR ENDED DECEMBER Latin Tmerica (a) Middle East/ North Tfrica Total 31, 2009 $ Revenues from net production barrel of oil equivalent ($/bbl.) (b,c) Production costs Other operating expenses Depreciation, depletion and amortization Taxes other than on income Charges... -

Page 83

... Middle East/ North Tfrica Total 31, 2009 Future cash inflows Future costs $ 96,997 $ 9,892 (3,664) (1,456) (959) 3,813 (1,281) $ 32,344 (7,605) (3,305) (10,010) 11,424 (4,009) $ 139,233 (53,621) (12,656) (24,355) 48,601 (23,638) Production costs and other operating expenses Development... -

Page 84

... taxes and insurance on proved properties, but do not include depreciation, depletion and amortization, royalties, income taxes, interest, general and administrative and other expenses. United Latin Tmerica States (a) Middle East/ North Tfrica Total 55.97 2009 Oil Gas - Tverage sales price... -

Page 85

... sets forth, for each of the three years in the period ended December 31, 2009, Occidental's net productive and dry-exploratory and development wells completed. United States Latin Tmerica (a) Middle East/ North Tfrica Total 2009 Oil - Exploratory Development Gas - Exploratory Development... -

Page 86

... in the Middle East/North Tfrica. Oil and Gas Acreage The following table sets forth, as of December 31, 2009, Occidental's holdings of developed and undeveloped oil and gas acreage. Thousands of acres at December 31, 2009 Developed (b) United States Latin Tmerica (a) Middle East/ North Tfrica... -

Page 87

... production per day are generally due to the timing of shipments at Occidental's international locations where product is loaded onto tankers. Sales Volumes per Day United States Oil and liquids (MBBL) California Permian Midcontinent Gas 2009 2008 2007 TOTTL Natural gas (MMCF) California Permian... -

Page 88

... Oil and liquids (MBBL) 2009 2008 263 2007 260 271 635 Natural gas (MMCF) Latin America Crude oil (MBBL) Trgentina Colombia (a) 587 593 36 39 75 46 34 38 72 42 TOTTL Natural gas (MMCF) Middle East/North Africa Oil and liquids (MBBL) Oman Dolphin 33 36 69 40 39 22 48 Qatar Yemen Libya... -

Page 89

Schedule II - Valuation and Qualifying Accounts In millions Tdditions Charged to Other Tccounts (7) Occidental Petroleum Corporation and Subsidiaries Balance at Beginning of Period Charged to Costs and Expenses 45 $ Deductions (a) Balance at End of Period 2009 Tllowance for doubtful accounts... -

Page 90

...on Internal Control over Financial Reporting are set forth in Item 8. Part III Item 10 Directors, Executive Officers and Corporate Governance Occidental has adopted a Code of Business Conduct (Code). The Code applies to the Chairman of the Board of Directors and Chief Executive Officer, President... -

Page 91

... certificate for shares of Common Stock (filed as Exhibit 4.9 to the Registration Statement on Form S-3 of Occidental, File No. 333-82246). 4.4* Form of Officers' Certificate, dated October 21, 2008, establishing the terms and form of the 7% Notes due 2013 (filed as Exhibit 4.1 to the Current Report... -

Page 92

...and certain executive officers (filed as Exhibit B to the Proxy Statement of Occidental for its May 21, 1987, Tnnual Meeting of Stockholders, File No. 1-9210). Occidental Petroleum Corporation Split Dollar Life Insurance Program and Related Documents (filed as Exhibit 10.2 to the Quarterly Report on... -

Page 93

..., File No. 1-9210). Terms and Conditions of Performance-Based Stock Tward (deferred issuance of shares) under Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (January 2006 version - Chemicals) (filed as Exhibit 10.65 to the Tnnual Report on Form 10-K of Occidental for the fiscal year... -

Page 94

...Tward) (filed as Exhibit 10.2 to the Current Report on Form 8-K of Occidental dated July 15, 2009 (Date of Earliest Event Reported), File No. 1-9210). Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Occidental Chemical Corporation Return on Tssets Incentive Tward Tgreement (Cash-based... -

Page 95

... Tct of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. OCCIDENTTL PETROLEUM CORPORTTION February 25, 2010 By: /s/ Ray R. Irani Ray R. Irani Chairman of the Board of Directors and Chief Executive Officer Pursuant to the... -

Page 96

...25, 2010 /s/Tvedick B. Poladian Tvedick B. Poladian Director February 25, 2010 /s/ Rodolfo Segovia Rodolfo Segovia Director February 25, 2010 /s/ Tziz D. Syriani Tziz D. Syriani Director February 25, 2010 /s/ Rosemary Tomich Rosemary Tomich Director February 25, 2010 /s/ Walter L. Weisman... -

Page 97

This report was printed on recycled paper. © 2010 Occidental Petroleum Corporation 92 -

Page 98

...each of the five years in the period ended December 31, 2009. List of subsidiaries of Occidental at December 31, 2009. Consent of Independent Registered Public Tccounting Firm. Consent of Independent Petroleum Engineers. Certification of CEO Pursuant to Section 302 of the Sarbanes-Oxley Tct of 2002... -

Page 99

...OCCIDENTAL PETROLEUM CORPORATION SUPPLEMENTAL RETIREMENT PLAN II Effective as of January 1, 2005 Amended and Restated as of November 1, 2008 The Occideetal Petroleum... for other friege beeefits, such as health aed hospitalizatioe, aed group life iesuraece beeefits, or perquisites; aed Allowaeces... -

Page 100

... to be adopted oe its behalf by the ueaeimous actioe of the Peesioe aed Retiremeet Plae Admieistrative Committee this ____ day of _____, 2009. Occidental Petroleum Corporation Pension and Retirement Plan Administrative Committee Martie A. Cozye James M. Lieeert Laura B. Reider Daeiel S. Watts -

Page 101

EXHIBIT 10.17 AMENDMENT NUMBER 2 TO THE OCCIDENTAL PETROLEUM CORPORATION SUPPLEMENTAL RETIREMENT PLAN II Effective as of January 1, 2005 Amended and Restated as of November 1, 2008 The Occideetal Petroleum Corporatioe Supplemeetal Retiremeet Plae II (Effective as of Jaeuary 1, 2005 Ameeded aed ... -

Page 102

... shall be provided the allocatioe for the Plae Year specified ie paragraph (2). However, eotwithstaedieg aeytieg to the coetrary, ae Employee of New Eastport Services, LLC aed its affiliates is eot eligible to receive ae allocatioe for the Plae Year specified ie paragraph (2). 4. Except as ameeded... -

Page 103

... oe its behalf by the ueaeimous actioe of the Peesioe aed Retiremeet Plae Admieistrative Committee this ____ day of _____, 2009. Occidental Petroleum Corporation Pension and Retirement Plan Administrative Committee Martie A. Cozye James M. Lieeert Roy Pieeci Laura B. Reider Daeiel S. Watts -

Page 104

EXHIBIT 12 OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES (Amounts in millions, except ratios) For the years ended December 31, Income from continuing operations 2009 2008 2007 2006 4,313 $ 2005 $ 2,978 (51) (88) 2,839 ... -

Page 105

...) Occidental Crude Sales, Inc. (South America) Occidental de Colombia, Inc. Occidental del Ecuador, Inc. Occidental Dolphin Holdings Ltd. Occidental Energy Marketing, Inc. Occidental Energy Ventures Corp. Occidental Exploration and Production Company Occidental International (Libya), Inc. Occidental... -

Page 106

... Co. Occidental Petroleum of Qatar Ltd. Occidental Power Marketing, L.P. Occidental Power Services, Inc. Occidental PVC, LLC Occidental Qatar Energy Company LLC Occidental Quimica do Brasil Ltda. Occidental Resources Company Occidental Tower Corporation Occidental Transportation Holding Corporation... -

Page 107

... O.Y Libya, LLC O.Y Long Beach, Inc. O.Y LPG LLC O.Y NM LP O.Y Oil Partners, Inc. Oxy Oleoducto SOP, LLC Oxy Overseas Services Ltd. O.Y PBLP Holder, Inc. O.Y PBLP Manager, LLC Oxy Pipeline I Company Oxy Pipeline II Company O.Y Qatar GTL, LLC O.Y Tidelands, Inc. Oxy Transport I Company O.Y USA Inc... -

Page 108

... and the related financial statement schedule, and the effectiveness of internal control over financial reporting as of December 31, 2009, which reports appear in the December 31, 2009 annual report on Form 10-K of Occidental Petroleum Corporation. /s/ KPMG LLP Los Angeles, California February 25... -

Page 109

... PETROLEUM ENGINEERS To the Board of Directors Occidental Petroleum Corporation: We consent to the (i) inclusion in the Occidental Petroleum Corporation (Occidental) Form 10-K for the year ended December 31, 2009, and the incorporation by reference in Occidental's registration statements... -

Page 110

... - 14 (a) CERTIFICATION PURSUANT TO §302 OF THE SARBANES-OXLEY ACT OF 2002 I, Ray R. Irani, certify that: 1. I have reviewed this annual report on Form 10-K of Occidental Petroleum Corporation; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit... -

Page 111

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 25, 2010 /s/ STEPHEN I. CHAZEN Stephen I. Chazen President and Chief Financial Officer -

Page 112

... of Occidental Petroleum Corporation (the "Company") for the fiscal period ended December 31, 2009, as filed with the Securities and Exchange Commission on February 25, 2010 (the "Report"), Ray R. Irani, as Chief Executive Officer of the Company, and Stephen I. Chazen, as Chief Financial Officer of... -

Page 113

... Board of Directors Occidental Petroleum Corporation: Ryder Scott Company compared Occidental's methods and procedures for estimating oil and gas reserves to generally accepted industry standards and reviewed certain pertinent facts interpreted and assumptions made by the engineering and geological... -

Page 114