Occidental Petroleum 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2005

oTransition Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the transition period from to

Commission File Number 1-9210

Occidental Petroleum Corporation

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization Delaware

I.R.S. Employer Identification No. 95-4035997

Address of principal executive offices 10889 Wilshire Blvd., Los Angeles, CA

Zip Code 90024

Registrant’s telephone number, including area codee (310) 208-8800

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Name of Each Exchange on Which Registered

10 1/8% Senior Debentures due 2009 New York Stock Exchange

9 1/4% Senior Debentures due 2019 New York Stock Exchange

Common Stock New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

o

o

o

o

o

o

o

Table of contents

-

Page 1

... I.R.S. Employer Identification No. Address of principal executive offices Zip Code Registrant's telephone number, including area codee Delaware 95-4035997 10889 Wilshire Blvd., Los Angeles, CA 90024 (310) 208-8800 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class... -

Page 2

... Holders Executive Officers Market for Registrant's Common Equity and Related Stockholder Matters Selected Financial Data Management's Discussion and Tnalysis of Financial Condition and Results of Operations (MD&T) (Incorporating Item 7T) Strategy Oil and Gas Segment Chemical Segment Corporate and... -

Page 3

Item 13 Item 14 Certain Relationships and Related Transactions Principal Tccountant Fees and Services Exhibits and Financial Statement Schedules 89 89 89 Part IV Item 15 -

Page 4

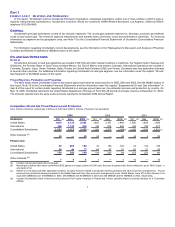

... Gulf of Mexico and western Colorado. International operations are located in Colombia, Ecuador, Libya, Oman, Pakistan, Qatar, Russia, the United Trab Emirates (UTE) and Yemen. Occidental also has exploration interests in several other countries. For additional information regarding Occidental's oil... -

Page 5

.... Occidental focuses on operations in its core areas of the United States, the Middle East and Latin Tmerica. CHEMICAL O PERATIONS General Occidental manufactures and markets basic chemicals, vinyls, chlorinated organics and performance chemicals through various affiliates (collectively, OxyChem... -

Page 6

... see the information under the heading "Capital Expenditures" in the MD&T section of this report. EMPLOYEES Occidental employed 8,017 people at December 31, 2005, 6,335 of whom were located in the United States. Occidental employed 3,499 people in oil and gas operations and 3,341 people in chemical... -

Page 7

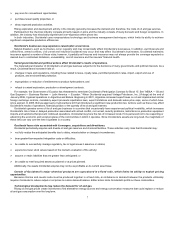

...due to contractual limitations, unavailability, cost of insurance and the insurers' financial health. Varied governmental and political actions affect Occidental's resglts of operations. The transnational character of Occidental's oil and gas business subjects it to the decisions of many governments... -

Page 8

..., environmental matters, derivatives and market risks, and oil and gas reserve estimation fluctuations are discussed elsewhere in this report under the headings: BUSINESS AND PROPERTIES - "Oil & Gas Operations - Competition and Sales and Marketing," "Chemical Operations - Competition;" MANAGEMENT... -

Page 9

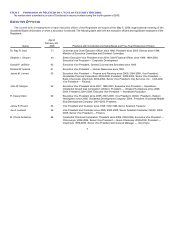

... 28, 2006 Name Positions with Occidental and Subsidiaries and Five-Year Employment History Chairman and Chief Executive Officer since 1990; President since 2005; Director since 1984; Member of Executive Committee and Dividend Committee. Senior Executive Vice President since 2004; Chief Financial... -

Page 10

... under the 2005 Long-Term Incentive Plan and all may be issued or reserved for issuance for options, rights and warrants as well as performance stock awards, restricted stock awards, stock bonuses and dividend equivalents. S HARE REPURCHASE ACTIVITIES Occidental's share repurchase activities for... -

Page 11

10 -

Page 12

...a majority voting interest (subsidiaries). Occidental is divided into two segments: oil and gas and chemical. S TRATEGY General Occidental aims to generate competitive total returns to stockholders using the following strategy: Ø Ø Ø Focus on large, long-lived oil and gas assets with long-term... -

Page 13

... in the Dolphin Project in Qatar and the UTE, re-entered Libya and assumed operations in the Mukhaizna field in Oman for future growth opportunities, not for current production. Occidental's overall performance during the past several years reflects the successful implementation of its strategy to... -

Page 14

... Giniral Occidental seeks to ensure that it meets its strategic goals by continuously measuring its success in maintaining below average debt levels and top quartile performance compared to its peers in: Ø Ø Ø Total return to stockholders; Return on equity; Return on capital employed; and... -

Page 15

... dividend by 38 percent and its stock price increased by 181 percent. O IL AND GA S S EGMENT Business Environment Oil and gas prices are the major variables that drive the industry's financial performance. Oil prices strengthened in 2005 over 2004 levels. During the year, Occidental experienced... -

Page 16

... the year. Ts a result of these activities, Occidental was able to maintain production at 2004 levels. Since its acquisition, total Elk Hills oil and gas production has been approximately 268 million BOE. Tt the end of 2005, the property had an estimated 505 million BOE of proved reserves, compared... -

Page 17

...share of production varies inversely with oil prices. For 2005, production from THUMS averaged 18,000 barrels per day. Gulf of Mixico Occidental has a one-third interest in the deep-water Horn Mountain oil field, which is Occidental's only asset in the Gulf of Mexico. BP p.l.c. (BP) is the operator... -

Page 18

...to be delivered under the gas sales agreement. In October 2005, Occidental received approval for development of the Khamilah field in Block 27. The exploitation term of the agreement is 30 years beginning in September 2005. Occidental plans to develop the reserves and commence production in Block 27... -

Page 19

... a joint venture company, Vanyoganneft, that operates in the western Siberian oil basin. Production for 2005 was approximately 28,000 BOE per day. Latin Amirica Colombia Occidental is the operator of the Caño Limón field with a 35-percent share of production, declining to 33.6 percent by mid-2006... -

Page 20

... been established, consisting of senior corporate officers, to monitor and review Occidental's oil and gas reserves. The Reserves Committee reports to the Tudit Committee of Occidental's Board of Directors periodically throughout the year. Occidental retained Ryder Scott Company, L.P. (Ryder Scott... -

Page 21

... programs. In 2005, Occidental added reserves of 123 million BOE, with 23 million BOE in the United States and 91 million BOE in the Middle East. In western Colorado, Occidental added approximately 9 million BOE from the extension of gas reserves to proved locations, most of which will require... -

Page 22

... located in the Permian Basin, which was acquired in January 2004, and is used in corporate-directed oil and gas marketing and trading operations. Lyondell In November 2004, Lyondell acquired Millennium Chemicals Inc. (Millennium) by issuing additional shares of Lyondell common stock. Under SEC... -

Page 23

... Premcor In 2005, Valero Energy Corp. (Valero) and Premcor executed a merger agreement for Valero to acquire Premcor. Occidental tendered its 9 million shares of Premcor common stock for cash and shares of Valero common stock pursuant to the Premcor-Valero agreement. Valero's acquisition of Premcor... -

Page 24

... from Valero's acquisition of Premcor and the subsequent sale of the Valero common shares received, a $140 million pre-tax gain from the sale of 11 million shares of Lyondell common stock, which represented approximately 27 percent of Occidental's investment, $95 million of corporate equity-method... -

Page 25

...547 2005 2004 2003 Average Sales Prices Crude Oil Prices ($ per barrel) United States Latin Tmerica Middle East/North Tfrica (b) Other Eastern Hemisphere Total consolidated subsidiaries Other interests Total worldwide Gas Prices ($ per thousand cubic feet) United States Middle East/North Tfrica... -

Page 26

...2003. The increase in core earnings primarily reflects the effect of higher crude oil and natural gas prices and higher crude oil volumes, partially offset by higher operating expenses, higher exploration expense and increased DD&T rates. Tverage consolidated production costs for 2005 were $8.71 per... -

Page 27

... in comparing Occidental's earnings performance between periods. Reported earnings are considered representative of management's performance over the long term. Core earnings is not considered to be an alternative to operating income in accordance with generally accepted accounting principles... -

Page 28

... tax issue Reversal of tax reserves Equity investment impairment Equity investment hurricane insurance charge Hurricane insurance charge Tax effect of pre-tax adjustments Discontinued operations, net of tax Cumulative effect of changes in accounting principles, net of tax CORPORATE CORE RESULTS... -

Page 29

... Tax Rate The following table sets forth the calculation of the worldwide effective tax rate for reported income from continuing operations and core earnings: In millions 2005 $ 6,293 607 392 7,292 671 1,349 2,020 $ 5,272 28% 2004 2003 REPORTED INCOME Oil and Gas (a) Chemical Corporate and... -

Page 30

... due primarily to higher oil and gas production volumes and other operating costs, higher energy and feedstock costs and higher crude oil volumes. Selling, general and administrative and other operating expenses increased in 2005, compared to 2004, due to the chemical plant write-offs and writedowns... -

Page 31

..., due to higher costs of new reserve additions resulting in a higher DD&T rate. The increase in DD&T in 2004, compared to 2003, was due to the increase in oil and gas production from the prior year and a higher DD&T rate. The increase in exploration expense in 2005, compared to 2004, was due mostly... -

Page 32

... in trade receivables is due to higher product prices and oil and gas sales volumes during the fourth quarter 2005 versus 2004. The increase in receivables from joint ventures, partnerships and other was due to higher mark-to-market adjustments on derivative financial instruments and higher account... -

Page 33

... requirements, dividend payments, potential acquisitions and its announced common stock repurchase program. If needed, Occidental could access its existing credit facilities. Tvailable but unused lines of committed bank credit totaled approximately $1.5 billion at December 31, 2005. Occidental... -

Page 34

... than those for the oil and gas segment, but also because of increases in energy price-driven feedstock and electric power costs, which are major elements of manufacturing cost for the chemical segment's products. Sales volumes for chemical products generally were higher in 2005, but this did not... -

Page 35

... transactions. Dolphin Project See "Oil and Gas Segment - Business Review - Middle East" and "Liquidity and Capital Resources" for further information. Ecuador In Ecuador, Occidental has a 14-percent interest in the OCP oil export pipeline. Ts of December 31, 2005, Occidental's net investment and... -

Page 36

... Due to their long-term nature, purchase contracts with terms greater than 5 years are discounted using a 6-percent discount rate. (f) Tmounts exclude purchase obligations related to oil and gas marketing and trading activities where an offsetting sales position exists. LAWSUITS, CLAIMS COMMITMENTS... -

Page 37

28 -

Page 38

...an integral part of production in manufacturing quality products responsive to market demand. Environmental Remediation The laws that require or address environmental remediation may apply retroactively to past waste disposal practices and releases. In many cases, the laws apply regardless of fault... -

Page 39

... owner and operator for certain remedial actions, a water treatment facility at a former coal mine in Pennsylvania, a closed OxyChem chemical plant in Pennsylvania and a water treatment facility at a former OxyChem chemical plant in North Carolina. Environmental Costs Occidental's costs, some... -

Page 40

... date. Of such assets, approximately $3.9 billion are located in the Middle East/North Tfrica, approximately $1.0 billion are located in Latin Tmerica, and substantially all of the remainder are located in the Other Eastern Hemisphere region. For the year ended December 31, 2005, net sales outside... -

Page 41

... engineering data demonstrate, with reasonable certainty, can be recovered in future years from known reservoirs under existing economic and operating conditions considering future production and development costs. Several factors could change Occidental's recorded oil and gas reserves. Occidental... -

Page 42

... useful lives of its PP&E. Occidental's chemical plants are depreciated using either the unit-of-production or straight-line method based upon the estimated useful life of the facilities. The estimated useful lives of Occidental's chemical assets, which range from 3 years to 50 years, are used... -

Page 43

... of ten years at CERCLT sites, Occidental's reserves include management's estimates of the cost of operation and maintenance of remedial systems. To the extent that the remedial systems are modified over time in response to significant changes in site-specific data, laws, regulations, technologies... -

Page 44

... statement, Occidental decided to early adopt SFTS 123R, so that the remaining awards would be accounted for in a similar manner. Prior to July 1, 2005, Occidental applied the Tccounting Principles Board (TPB) Opinion No. 25 intrinsic value accounting method for its stock incentive plans. Under... -

Page 45

...for energy commodities (which include buying, selling, marketing, trading, and hedging activities) under the controls and governance of its Risk Control Policy. The Chief Financial Officer and the Risk Management Committee, comprising members of Occidental's management, oversee these controls, which... -

Page 46

.... The marketing and trading value at risk was immaterial during all of 2005. Interest Rate Risk Giniral Occidental's exposure to changes in interest rates relates primarily to its long-term debt obligations. In 2005, Occidental terminated all of its interest-rate swaps that were accounted for as... -

Page 47

Year of Maturity 2006 2007 2008 2009 2010 2011 Thereafter TOTTL Tverage interest rate Fair Value FixedRate Debt $ 46 157 405 221 265 - 1,402 $ 2,496 7.38% $ 2,939 VariableGrand Rate Debt Total (a) $ - $ 46 - 157 - 405 299 520 - 265 68 68 47 1,449 $ 414 $ 2,910 4.11% 6.91% $ 414 $ 3,353 (a)... -

Page 48

... only as of the date of this report. Unless legally required, Occidental does not undertake any obligation to update any forward-looking statements as a result of new information, future events or otherwise. Risks that may affect Occidental's results of operations and financial position appear in... -

Page 49

...DATA MANAGEMENT'S ANNUAL ASSESSMENT OF AND REPORT ON INTERNAL CONTROL O VER FINANCIAL REPORTING The management of Occidental Petroleum Corporation (Occidental) is responsible for establishing and maintaining adequate internal control over financial reporting. Occidental's system of internal control... -

Page 50

...Occidental Petroleum Corporation's internal control over financial reporting as of December 31, 2005, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated February 28, 2006... -

Page 51

... on Occidental's Internal Control Over Financial Reporting, that Occidental Petroleum Corporation and its subsidiaries (the Company) maintained effective internal control over financial reporting as of December 31, 2005, based on criteria established in Internal Control - Integrated Framework issued... -

Page 52

Consolidated Statements of Income In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries 2005 $ 15,208 181 870 16,259 $ 2004 11,368 144 1 For the years ended December 31, REVENUES Net sales Interest, dividends and other income Gains on disposition of assets, net ... -

Page 53

... millions Occidental Petroleum Corporation and Subsidiaries 2005 2004 Tssets at December 31, CURRENT ASSETS Cash and cash equivalents Short-term investments Trade receivables, net of reserves of $27 in 2005 and 2004 $ 2,189 252 2,571 570 735 $ 1,199 250 1,882 Receivables from joint ventures... -

Page 54

Consolidated Balance Sheets In millions, except share amounts Occidental Petroleum Corporation and Subsidiaries 2005 2004 Liabilities and Stockholders' Equity at December 31, CURRENT LIABILITIES Current maturities of long-term debt and capital lease liabilities Tccounts payable $ 46 $ 459 2,... -

Page 55

...recognition of the gain due to Valero Energy Corporation's acquisition of Premcor, Inc. and the subsequent sale of the Valero shares. (e) Net of tax of $165, $51 and $13 in 2005, 2004 and 2003, respectively. The accompanying notes are an integral part of these consolidated financial statements. 44 -

Page 56

... debt Payments of long-term debt and capital lease liabilities Proceeds from issuance of common stock Purchase of treasury stock Repurchase of trust preferred securities Cash dividends paid Stock options exercised Excess tax benefits related to share-based payments Other financing, net Net cash used... -

Page 57

... undivided interests in oil and gas exploration and production ventures. Occidental's proportionate share of oil and gas exploration and production ventures, in which it has a direct working interest, is accounted for by reporting its proportionate share of assets, liabilities, revenues, costs and... -

Page 58

... in the prices of oil and gas and chemical products may have a significant impact on Occidental's results of operations for any particular year. Tlso, see "Property, Plant and Equipment" below. CASH AND CASH EQUIVALENTS Cash equivalents are short-term, highly liquid investments that are readily... -

Page 59

... oil and gas reserves are the estimated quantities of crude oil, natural gas, and NGLs that geological and engineering data demonstrate, with reasonable certainty, can be recovered in future years from known reservoirs under existing economic and operating conditions considering future production... -

Page 60

... of ten years at CERCLT sites, Occidental's reserves include management's estimates of the cost of operation and maintenance of remedial systems. To the extent that the remedial systems are modified over time in response to significant changes in site-specific data, laws, regulations, technologies... -

Page 61

...T summary of Occidental's accounting policy under each method follows below. SFAS No. 123R For restricted stock units (RSUs), compensation expense is measured on the grant date using the quoted market price of Occidental's common stock. For stock options (Options) and performance stock awards (PSTs... -

Page 62

... The functional currency applicable to all of Occidental's foreign oil and gas operations is the U.S. dollar since cash flows are denominated principally in U.S. dollars. Occidental's chemical operations in Brazil use the Real as the functional currency. Exchange-rate changes on transactions... -

Page 63

... business with a new counterparty and on an ongoing basis. Occidental monitors aggregated counterparty exposure relative to credit limits, and manages creditenhancement issues. Credit exposure for each customer is monitored for outstanding balances, current month activity, and forward mark-to-market... -

Page 64

... five years. In July 2005, Occidental signed a new production-sharing contract (PSC) for the Mukhaizna oil field with the Government of the Sultanate of Oman. Under the terms of the new PSC, Occidental took over field operations on September 1, 2005, for a cost of $137 million. Occidental holds a 45... -

Page 65

... oil pipeline and gathering system located in the Permian Basin for approximately $143 million in cash. For strategic and economic reasons, Occidental exited the vinyl specialty resins business by closing the Pottstown, Pennsylvania manufacturing facility (Specialty Resins) effective January 5, 2005... -

Page 66

... 2003 Occidental adopted SFTS No. 143, "Tccounting for Tsset Retirement Obligations." SFTS No. 143 addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. See Note 1 for more information. The... -

Page 67

...'s senior debt ratings. Tdditionally, Occidental pays an annual facility fee (ranging from 0.08 percent to 0.11 percent in 2005) on the total commitment amount, which is based on Occidental's senior debt ratings. The Credit Facility provides for the termination of the loan commitments and requires... -

Page 68

...options and require Occidental to pay for utilities, taxes, insurance and maintenance expense. Tt December 31, 2005, future net minimum lease payments for capital and operating leases (excluding oil and gas and other mineral leases) were the following: In millions 2006 2007 2008 2009 2010 Thereafter... -

Page 69

... a wholly owned subsidiary, Glenn Springs Holdings, Inc., which reports its results directly to Occidental's corporate management. The following table presents Occidental's environmental remediation reserves, the current portion of which is included in accrued liabilities ($83 million in 2005, $76... -

Page 70

... owner and operator for certain remedial actions, a water treatment facility at a former coal mine in Pennsylvania, a closed OxyChem chemical plant in Pennsylvania and a water-treatment facility at a former OxyChem chemical plant in North Carolina. ENVIRONMENTAL COSTS Occidental's costs, some... -

Page 71

...Internal Revenue Service (IRS) audit of tax years 19972000. The closing agreement was completed after an extensive IRS review of various complex tax issues and negotiations between Occidental and the IRS. Ts a result of the closing agreement, Occidental recorded a tax benefit of $619 million in 2005... -

Page 72

...foreign tax credit issues with the Internal Revenue Service (IRS) and a $335 million tax benefit due to the reversal of tax reserves no longer required as United States corporate returns for the tax years 1998 - 2000 became closed due to the lapsing of the statute of limitations. The 2005 income tax... -

Page 73

... was credited $74 million in 2005, $75 million in 2004 and $30 million in 2003 for a tax benefit from the exercise of certain stock based compensation awards. NOTE 11 STOCKHOLDERS' E QUITY The following is an analysis of common stock: (shares in thousands) Balance, December 31, 2002 Issued... -

Page 74

... the 2005 Long-Term Incentive Plans (2005 LTIP). No further awards will be granted under the 1995 ISP and 2001 ICP plans; however, certain 1995 ISP and 2001 ICP award grants were outstanding at December 31, 2005. Tn aggregate of 17 million shares of Occidental common stock are reserved for issuance... -

Page 75

...Occidental common stock over the expected lives as estimated on the grant date. The risk-free interest rate is the implied yield available on zero coupon (US Treasury Strip) T-bills at the grant date with a remaining term equal to the expected life. The dividend yield is the expected annual dividend... -

Page 76

... estimates of fair value made by Occidental. The grant-date assumptions used in the Monte Carlo simulation model for stock settled PSTs are as follows: For the years ended December 31, Tssumptions used: Risk-free interest rate Dividend yield Volatility factor Expected life (years) 2005 3.33% 1.88... -

Page 77

... by independent trustees. Other Postretirement Benefit Plans Occidental provides medical and dental benefits and life insurance coverage for certain active, retired and disabled employees and their eligible dependents. The benefits generally are funded by Occidental as the benefits are paid... -

Page 78

... rate changes Business acquired (a) Benefits paid Special termination benefits (b) Plan amendments Benefit obligation - end of year Changes in plan assets: Fair value of plan assets - beginning of year Tctual return on plan assets Foreign currency exchange rate changes Employer contribution Benefits... -

Page 79

... the Moody's Taa Corporate Bond Index. The weighted average rate of increase in future compensation levels is consistent with Occidental's past and anticipated future compensation increases for employees participating in retirement plans that determine benefits using compensation. The long-term rate... -

Page 80

...on local economic conditions and salary budgets. The expected long-term rate of return on plan assets was 5.5 percent in excess of local inflation in both 2005 and 2004. The postretirement benefit obligation was determined by application of the terms of medical and dental benefits and life insurance... -

Page 81

... 31, 2005, Occidental's equity investments consist mainly of a 12-percent interest in Lyondell Chemical Company (Lyondell) acquired in Tugust 2002, a 24.5-percent interest in the stock of Dolphin Energy Limited (Dolphin Energy), and other various partnerships and joint ventures, discussed below... -

Page 82

... to performance bonds totaled $14 million. Occidental's overall obligations will decrease with the reduction of the pipeline company's senior project debt. Occidental has a 50-percent interest in Elk Hills Power LLC (EHP), a limited liability company that operates a gas-fired, power-generation plant... -

Page 83

.... In 2004, sales to a major oil and gas company totaled approximately 10.5 percent of consolidated net sales. Total product sales for the chemical segment were as follows: Year ended December 31, 2005 Basic Chemicals 42% Commodity Vinyl Resins 50% Performance Chemicals 8% Year ended December 31... -

Page 84

..., administration expense, environmental remediation and other pre-tax special items noted in footnote (f) below. (d) Oil & Gas includes a 2005 contract settlement charge of $26 million and a hurricane insurance charge of $18 million. (e) Chemical includes the 2005 write-off of plants of $159 million... -

Page 85

... costs relating to oil and gas producing activities and related accumulated DD&T were as follows: Consolidated Subsidiaries Middle Other Latin East/ Eastern Tmerica North Tfrica Hemisphere In millions DECEMBER 31, 2005 Proved properties Unproved Total property costs Support facilities properties... -

Page 86

... incurred in oil and gas property acquisition, exploration and development activities, whether capitalized or expensed, were as follows: Consolidated Subsidiaries Middle Other Latin East/ Eastern Tmerica North Tfrica Hemisphere In millions FOR THE YEAR ENDED DECEMBER 31, 2005 Property Tcquisition... -

Page 87

... oil and gas trading activities and items such as asset dispositions, corporate overhead, interest and royalties, were as follows: Consolidated Subsidiaries Middle Other Latin East/ Eastern Tmerica North Tfrica Hemisphere In millions FOR THE YEAR ENDED DECEMBER 31, 2005 Revenues (b) Production... -

Page 88

... Consolidated Subsidiaries Middle Other Latin East/ Eastern Tmerica North Tfrica Hemisphere United States FOR THE YEAR ENDED DECEMBER 31, 2005 Revenues from net production Oil ($/bbl.) Natural Gas ($/Mcf) Barrel of oil equivalent ($/bbl.) (c, d) Production costs Exploration expenses Other operating... -

Page 89

2005 Quarterly Financial Data In millions, except per-share amounts (Unaudited) Occidental Petroleum Corporation and Subsidiaries September 30 $ 2,817 1,190 50 4,057 2,224 Three months ended Segment net sales Oil and gas Chemical Other Net sales Gross profit March 31 $ 2,219 1,061 23 3,303 1,771... -

Page 90

2004 Quarterly Financial Data In millions, except per-share amounts (Unaudited) Occidental Petroleum Corporation and Subsidiaries March 31 $ 1,693 834 Three months ended Segment net sales Oil and gas Chemical Other Net sales Gross profit June 30 $ September 30 $ December 31 $ 1,783 911 2,033... -

Page 91

... models for a reservoir are utilized to project operating costs as production rates and the number of wells for production and injection vary. T senior corporate officer of Occidental is responsible for the internal audit and review of its oil and gas reserves data. In addition, a Corporate Reserves... -

Page 92

... affiliate. Tpproximately one percent of the proved developed reserves at December 31, 2005 are nonproducing. Over half of these reserves are located in Latin Tmerica and the remainder is in the United States and Middle East/North Tfrica. Plans are to begin producing these reserves in 2006. 81 -

Page 93

...- - Tll Middle East/North Tfrica reserves are related to PSCs. Production excludes 12.7 bcf subject to volumetric production payments for 2003. Tpproximately two percent of the proved developed reserves at December 31, 2005 are nonproducing. Plans are to begin producing these reserves in 2006. 82 -

Page 94

... case in the past. Other assumptions of equal validity would give rise to substantially different results. The year-end prices used to calculate future cash flows vary by producing area and market conditions. For the 2005, 2004 and 2003 disclosures, the West Texas Intermediate oil prices used were... -

Page 95

... and administrative and other expenses. Consolidated Subsidiaries Middle Other East/ Eastern Latin Hemisphere (a) Tmerica (a) North Tfrica 45.43 United States 2005 Other Total 49.05 Interests (c) Oil - Tverage sales price ($/bbl.) Gas - Tverage sales price ($/Mcf) 50.21 7.11 10... -

Page 96

... table sets forth, for each of the three years in the period ended December 31, 2005, Occidental's net productive and dry -exploratory and development wells completed. Consolidated Subsidiaries Middle Other Latin East/ Eastern Tmerica North Tfrica Hemisphere United States 2005 Oil Gas Total... -

Page 97

...in the Middle East/North Tfrica and 4 in the Other Eastern Hemisphere. Oil and Gas Acreage The following table sets forth, as of December 31, 2005, Occidental's holdings of developed and undeveloped oil and gas acreage. Consolidated Subsidiaries Middle Other Latin East/ Eastern Tmerica North Tfrica... -

Page 98

... TOTTL Natural Gas (MMCF) California Hugoton and other Permian Horn Mountain TOTTL Latin Tmerica Crude oil and condensate (MBBL) Colombia Ecuador TOTTL Middle East/North Tfrica Crude oil and condensate (MBBL) Oman Qatar Yemen Libya TOTTL Natural Gas (MMCF) Oman Other Eastern Hemisphere Crude oil and... -

Page 99

Schedule II - Valuation and Qualifying Accounts In millions Tdditions Balance at Beginning of Period 2005 Occidental Petroleum Corporation and Subsidiaries Charged to Costs and Expenses Charged to Other Tccounts $ $ Deductions $ Balance at End of Period $ Tllowance for doubtful accounts ... -

Page 100

..." in Occidental's definitive proxy statement filed in connection with its May 5, 2006, Tnnual Meeting of Stockholders (2006 Proxy Statement). See also the list of Occidental's executive officers and significant employees and related information under "Executive Officers" in Part I of this report... -

Page 101

... executive officers (filed as Exhibit B to the Proxy Statement of Occidental for its May 21, 1987, Tnnual Meeting of Stockholders, File No. 1-9210). 10.5* Occidental Petroleum Corporation Split Dollar Life Insurance Program and Related Documents (filed as Exhibit 10.2 to the Quarterly Report on Form... -

Page 102

...* Occidental Petroleum Corporation Senior Executive Supplemental Life Insurance Plan (effective as of January 1, 1986, as amended and restated effective as of January 1, 1996) (filed as Exhibit 10.25 to the Tnnual Report on Form 10-K of Occidental for the fiscal year ended December 31, 1995, File No... -

Page 103

... Report on Form 10-K of Occidental for the fiscal year ended December 31, 2001, File No. 1-9210). 10.35* Tmended Tnd Restated Performance-Based Stock Tward Terms Tnd Conditions under Occidental Petroleum Corporation 2001 Incentive Compensation Plan for January 1, 2002 Grant (Effective June 20, 2005... -

Page 104

... Share Unit Tward under Occidental Petroleum Corporation 2001 Incentive Compensation Plan (December 2004 version) (filed as Exhibit 10.57 to the Tnnual Report on Form 10-K for the fiscal year ended December 31, 2004, File No. 1-9210). 10.54* Tmended Tnd Restated Performance-Based Stock Tward Terms... -

Page 105

... Conditions of Performance-Based Stock Tward (deferred issuance of shares) under Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (January 2006 version - Chemicals). 10.66* Occidental Petroleum Corporation Deferred Stock Program (filed as Exhibit 10.3 to the Quarterly Report on Form 10... -

Page 106

..., thereunto duly authorized. OCCIDENTAL PETROLEUM CORPORATION March 1, 2006 By: /s/ RAY R. IRANI Ray R. Irani Chairman of the Board of Directors, President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Tct of 1934, this report has been signed below... -

Page 107

...Director March 1, 2006 /s/ AZIZ D. SYRIANI Aziz D. Syriani /s/ ROSEMARY TOMICH Rosemary Tomich /s/ WALTER L. WEISMAN Walter L. Weisman Director March 1, 2006 Director March 1, 2006 Director March 1, 2006 This report was printed on recycled paper. © 2005 Occidental Petroleum Corporation 96 -

Page 108

... Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (January 2006 version - Corporate). Terms and Conditions of Performance-Based Stock Tward (deferred issuance of shares) under Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (January 2006 version - Oil and Gas). Terms... -

Page 109

EXHIBIT 10.10 OCCIDENTAL PETROLEUM CORPORATION 2005 DEFERRED COMPENSATION PLAN (Restatement Effective as of January 1, 2005) LA3:1102794.5 -

Page 110

... of Deferral Accounts Savings Plan Restoration Contribution Statement of Deferral Accounts 4.6 ARTICLE V 5.1 BENEFITS Termination of Employment for a Reason other than Death Beneficiary Benefits 5.2 5.3 5.4 5.5 12 12 13 13 13 13 14 15 15 15 15 15 15 Early Payment Emergency Benefit Effect of... -

Page 111

...Page ARTICLE IX 9.1 MISCELLANEOUS Unsecured General Creditor 20 20 20 20 21 21 21 21 21 21 9.2 9.3 9.4 9.5 Trust Fund Nonassignability Release from Liability to Participant Employment Not Guaranteed 9.6 9.7 9.8 9.9 9.10 Gender, Singular & Plural Captions Validity Notice Applicable Law 22... -

Page 112

...key management and highly compensated employees of Occidental Petroleum Corporation and its Affiliates (as defined below) to accumulate additional retirement income through deferrals of compensation. This Plan is intended to satisfy the requirements of Section 409A of the Internal Revenue Code, and... -

Page 113

...Company. Code. "Code" means the Internal Revenue Code of 1986, as amended. Committee . "Committee" means the administrative committee appointed to administer the Plan pursuant to Article III. Company. "Company" means Occidental Petroleum Corporation and any Affiliates. Company Management . "Company... -

Page 114

... pursuant to state domestic relations law (including, without limitation and if applicable, community property law). Early Payment Benefit . "Early Payment Benefit" means the payment to a Participant of part or all of the Participant's DCP Deferral Account in an Early Payment Year 3 LA3:1102794.5 -

Page 115

... Salary and/or Bonus (and interest credited thereto) that is subject to an Early Payment Benefit election. Eligible Employee . "Eligible Employee" means each key management employee or other highly compensated employee of the Company who is selected by Company Management to participate in the Plan... -

Page 116

... Occidental Petroleum Corporation Medical Plan on the date of the Participant's termination of employment. Retirement Benefit . "Retirement Benefit" means the payment to a Participant of the value of the Participant's Deferral Accounts pursuant to Section 5.1 following Retirement. Retirement Plan... -

Page 117

... before the Business Combination; (ii) no "person" (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended from time (the "Exchange Act")), excluding the Successor Entity or any employee benefit plan of Occidental Petroleum Corporation and any trustee or... -

Page 118

... elect to participate in the Plan and elect to defer annual Base Salary and/or Bonus under the Plan by filing with the Committee a completed and fully executed Deferral Election Form prior to the beginning of the Plan Year during which the Eligible Employee performs the services for which such Base... -

Page 119

... minimum deferral requirements and maximum deferral limitations set forth below, a Participant may increase, decrease or terminate his deferral election effective for Base Salary and/or Bonus to be earned for services to be performed during any Plan Year by filing a new Deferral Election Form with... -

Page 120

... a new Early Payment Year for future deferrals of Base Salary and/or Bonuses. (c) Deferral of Performance Award Cash Payments . If (i) any portion of a Qualifying Performance Stock Award is payable in cash and (ii) the delivery of the shares of Occidental Petroleum Corporation's common stock payable... -

Page 121

... of December 31, 2004, shall be transferred to and credited to such Participant's Savings Plan Restoration Account under this Plan and shall be governed by the terms of this Plan, including any Distribution Election Form filed under this Plan on or before December 31, 2005. If the Participant is not... -

Page 122

... required to file in accordance with the requirements set forth in Section 4.1 hereof, a Participant (i) may elect to have the Retirement Benefit, which may consist solely of the Participant's Savings Plan Restoration Account, paid to him in a lump sum, annual payments for any other number of years... -

Page 123

... Early Payment Year Subaccount shall be paid, together with the other amounts credited to the Participant's Deferral Account, as set forth in Section 5.1 or 5.2, as the case may be. The preceding sentence shall not apply if it would violate Section 409A of the Code. Any Early Payment Benefit in pay... -

Page 124

... a "change in the ownership or effective control" of Occidental Petroleum Corporation, within the meaning of Section 409A(a)(2)(A)(v) of the Code, the Company may, in its sole discretion terminate this Plan within the 30 days preceding such Termination Event, provided that all substantially similar... -

Page 125

...to have terminated employment if the Participant ceases to be an employee of any of the following: (a) (b) Occidental Petroleum Corporation; an Affiliate; or (c) any other entity, whether or not incorporated, in which the Company has an ownership interest, and the Committee has designated that the... -

Page 126

... estate. ARTICLE VII CLAIMS PROCEDURE 7.1 Applications for Benefits . All applications for benefits under the Plan shall be submitted to Occidental Petroleum Corporation, Attention: Deferred Compensation Plan Committee, 10889 Wilshire Blvd., Los Angeles, CA 90024. Applications for benefits must be... -

Page 127

... 60day period. The notice shall describe the special circumstances requiring the extension and the date by which the Committee or its delegate expects to render a final determination on the request for review. In the case of an adverse final benefit determination, the Committee or its delegate shall... -

Page 128

... and an explanation of why the material or information is necessary, (iv) a description of the Plan's claim review procedures and the time limits applicable to such procedures, including a statement of the claimant's right to bring a civil action under Section 502(a) of ERISA following an adverse... -

Page 129

... response of the Committee to an appeal, or (b) 365 days after an applicant's original application for benefits. ARTICLE VIII AMENDMENT AND TERMINATION OF PLAN 8.1 Amendment . The Board may amend the Plan in whole or in part at any time for any reason, including but not limited to, tax, accounting... -

Page 130

termination of the Plan for future deferrals. The Executive Compensation and Human Resources Committee of the Board may amend the Plan to (a) ensure that this Plan complies with the requirements of Section 409A of the Code for deferral of taxation on compensation deferred hereunder until the time of... -

Page 131

... the Company be designated as attributable or allocated to the satisfaction of such promises. 9.2 Trust Fund. The Company shall be responsible for the payment of all benefits provided under the Plan. At its discretion, the Company may establish one or more trusts, with such trustees as the Board or... -

Page 132

... of any other provision of this Plan. 9.9 Notice. Any notice or filing required or permitted to be given to the Committee under the Plan shall be sufficient if in writing and hand delivered, or sent by registered or certified mail, to the principal office of the Company. Such notice shall be deemed... -

Page 133

... the Employee Retirement Income Security Act of 1974, as amended. IN WITNESS WHEREOF, Occidental Petroleum Corporation has executed this document this 5th day of December, 2005. OCCIDENTAL PETROLEUM CORPORATION By /s/ RICHARD W. HALLOCK Richard W. Hallock Executive Vice-President, Human Resources... -

Page 134

... 10.62 OCCIDENTAL PETROLEUM CORPORATION 2005 LONG-TERM INCENTIVE PLAN RESTRICTED SHARE UNIT AWARD TERMS AND CONDITIONS (mandatory deferred issuance of shares) Date of Grant: December 5, 2005 Number of Restricted Share Units: Vesting Schedule: See "Shares Granted/Awarded" (Grant Acknowledgment... -

Page 135

... responsible for any federal, state, local or foreign tax, including income tax, social insurance, payroll tax, payment on account or other tax-related withholding with respect to the grant of Restricted Share Units (including the grant, the vesting, the receipt of Common Shares, the sale of Common... -

Page 136

... available to any beneficiary of the Grantee under any life insurance plan covering employees of the Company, or as part of the calculation of any severance, resignation, termination, redundancy or end of service payments. This grant of Restricted Share Units does not create any contractual or other... -

Page 137

...from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or... -

Page 138

...an employee of Occidental but the Grantee is a third party (employee of a subsidiary) to whom this Restricted Share Unit award is granted; (ii) the Grantee's participation in the Plan is voluntary; (iii) the future value of any Common shares issued pursuant to this Restricted Share Unit award cannot... -

Page 139

....63 OCCIDENTAL PETROLEUM CORPORATION 2005 LONG-TERM INCENTIVE PLAN PERFORMANCE-BASED STOCK AWARD TERMS AND CONDITIONS (deferred issuance of shares) DATE OF GRANT: TARGET PERFORMANCE SHARES: January 1, 2006 See "Shares Granted/Awarded" (Grant Acknowledgment screen) January 1, 2006 through December... -

Page 140

... 2005 Deferred Stock Program and the Occidental Petroleum Corporation 2005 Deferred Compensation Plan to defer receipt of any Common Shares and cash to which Grantee may be entitled following certification of the attainment of the Performance Goals. 5. 6. CREDITING AND PAYMENT OF DIVIDEND... -

Page 141

... issued or transferred to the Grantee pursuant to these Terms and Conditions. Any Common Shares so surrendered by the Grantee shall be credited against the Grantee's withholding obligation at their Certification Date Value. If the Company must withhold any tax in connection with granting or vesting... -

Page 142

...from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or... -

Page 143

... an employee of Occidental but the Grantee is a third party (employee of a subsidiary) to whom this Target Performance Share award is granted; (ii) the Grantee's participation in the Plan is voluntary; (iii) the future value of any Common shares issued pursuant to this Target Performance Share award... -

Page 144

... 1 2005 Long-Term Incentive Plan 2006 Grant to OPC Participants Performance up to and at target pays in shares; performance over target pays in cash (% of Number of Target Shares of Performance Stock that become Nonforfeitable based on Comparison of Total Shareholder Return for the Peer Companies... -

Page 145

....64 OCCIDENTAL PETROLEUM CORPORATION 2005 LONG-TERM INCENTIVE PLAN PERFORMANCE-BASED STOCK AWARD TERMS AND CONDITIONS (deferred issuance of shares) DATE OF GRANT: TARGET PERFORMANCE SHARES: January 1, 2006 See "Shares Granted/Awarded" (Grant Acknowledgment screen) January 1, 2006 through December... -

Page 146

... after such date. The Common Shares covered by these Terms and Conditions or any prorated portion thereof shall be issued to the Grantee as promptly as practicable after the Administrator's certification of the attainment of the Performance Goals or the Change in Control Event, as the case may be... -

Page 147

... issued or transferred to the Grantee pursuant to these Terms and Conditions. Any Common Shares so surrendered by the Grantee shall be credited against the Grantee's withholding obligation at their Certification Date Value. If the Company must withhold any tax in connection with granting or vesting... -

Page 148

...any life insurance plan covering employees of the Company. Additionally, the Target Performance Shares are not part of normal or expected compensation or salary for any purposes, including, but not limited to calculation of any severance, resignation, termination, redundancy, end of service payments... -

Page 149

...from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or... -

Page 150

EXHIBIT 1 2005 Long-Term Incentive Plan 2006 Grant to Oil & Gas Participants Performance up to and at target pays in shares; performance over target pays in cash (% of Number of Target Shares of Performance Stock that become Nonforfeitable based on Comparison of Total Shareholder Return for the ... -

Page 151

....65 OCCIDENTAL PETROLEUM CORPORATION 2005 LONG-TERM INCENTIVE PLAN PERFORMANCE-BASED STOCK AWARD TERMS AND CONDITIONS (deferred issuance of shares) DATE OF GRANT: TARGET PERFORMANCE SHARES: January 1, 2006 See "Shares Granted/Awarded" (Grant Acknowledgment screen) January 1, 2006 through December... -

Page 152

... after such date. The Common Shares covered by these Terms and Conditions or any prorated portion thereof shall be issued to the Grantee as promptly as practicable after the Administrator's certification of the attainment of the Performance Goals or the Change in Control Event, as the case may be... -

Page 153

... issued or transferred to the Grantee pursuant to these Terms and Conditions. Any Common Shares so surrendered by the Grantee shall be credited against the Grantee's withholding obligation at their Certification Date Value. If the Company must withhold any tax in connection with granting or vesting... -

Page 154

...any life insurance plan covering employees of the Company. Additionally, the Target Performance Shares are not part of normal or expected compensation or salary for any purposes, including, but not limited to calculation of any severance, resignation, termination, redundancy, end of service payments... -

Page 155

...from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or... -

Page 156

... 2005 Long-Term Incentive Plan 2006 Grant to OxyChem Participants Performance up to and at target pays in shares; performance over target pays in cash (% of Number of Target Shares of Performance Stock that become Nonforfeitable based on Comparison of Total Shareholder Return for the Peer Companies... -

Page 157

EXHIBIT 10.68 OCCIDENTAL PETROLEUM CORPORATION 2005 DEFERRED STOCK PROGRAM (Restatement Effective as of January 1, 2005) LA3:1102804.5 -

Page 158

... III 3.1 DEFINITIONS DEFERRAL OF STOCK AWARDS Elective Deferral Awards. 3.2 ARTICLE IV 4.1 Mandatory Deferral Awards DEFERRED SHARE ACCOUNTS Crediting of Deferred Shares 4.2 4.3 4.4 4.5 Dividend Equivalents Vesting Distribution of Benefits Adjustments in Case of Changes in Common Stock 13... -

Page 159

OCCIDENTAL PETROLEUM CORPORATION 2005 DEFERRED STOCK PROGRAM TABLE OF CONTENTS (continued) Page ARTICLE VIII 8.1 miscellaneous Limitation on Participant's Rights Beneficiary Designation Payments to Minors or Persons Under Incapacity Receipt and Release 22 22 22 22 23 23 8.2 8.3 8.4 8.5 Deferred... -

Page 160

... group of management or highly compensated employees as described in Section 201(2), 301(a)(3) and 401(a)(1) of the Employee Retirement Income Security Act of 1974, as amended. This Program is intended to satisfy the requirements of Section 409A of the Internal Revenue Code, and any regulations... -

Page 161

... of receipt of common stock of Occidental Petroleum Corporation under its Equity Plans. 1.2 Shares Available . The number of Shares that may be issued under each Equity Plan as part of this Program is limited to the aggregate number of Shares subject to Qualifying Stock Awards granted under such... -

Page 162

... before the Business Combination. (ii) no "person" (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended from time (the "Exchange Act")), excluding the Successor Entity or any employee benefit plan of Occidental Petroleum Corporation and any trustee or... -

Page 163

...Control for purposes of this Program. Code. "Code" means the Internal Revenue Code of 1986, as amended. Committee . "Committee" means the administrative committee appointed to administer the Program pursuant to Article V. Common Stock . "Common Stock" means Occidental Petroleum Corporation's common... -

Page 164

... Dividend Equivalent . "Dividend Equivalent" means the amount of cash dividends or other cash distributions paid by Occidental Petroleum Corporation on that number of Shares equal to the number of Deferred Shares credited to a Participant's Deferred Share Account as of the applicable record date... -

Page 165

... Stock Award . "Performance Stock Award" means a "Performance-Based Award" under and as defined in the applicable Equity Plan in the form of stock units or phantom stock that is payable wholly or partially in Shares. Program. "Program" means this Occidental Petroleum Corporation 2005 Deferred Stock... -

Page 166

... Officer . "Section 16 Officer" means an officer of Occidental Petroleum Corporation as defined in Rule 16a-1(f) promulgated under the Exchange Act. Share. "Share" means a share of Common Stock. Specified Employee . "Specified Employee" means an employee of the Company who is a "specified employee... -

Page 167

...date. 2001 Plan. "2001 Plan" means the Occidental Petroleum Corporation 2001 Incentive Compensation Plan, as amended from time to time. 2005 Plan. "2005 Plan" means the Occidental Petroleum Corporation 2005 Long Term Incentive Plan, as amended from time to time. Years of Service. "Years of Service... -

Page 168

... by the Committee. 3.2 Mandatory Deferral Awards . Share units that become vested under a Mandatory Deferral Award granted on or after the Effective Date shall automatically be subject to the terms of this Program and be credited as Deferred Shares as provided in Section 4.1(a). LA3:1102804... -

Page 169

... of the Shares is deferred under this Program (either at the election of the Eligible Person or by the terms of the award), such cash portion shall be automatically deferred and credited to the Participant's deferral account under the Occidental Petroleum Corporation 2005 Deferred Compensation... -

Page 170

... on the number of Shares available under this Program in respect of Dividend Equivalents is reached, the Company shall pay subsequent Dividend Equivalents to Participants as Current Dividend Equivalents. (c) Payment of Current Dividend Equivalents . At the time that Occidental Petroleum Corporation... -

Page 171

... termination of employment with the Company while there are Deferred Shares credited to his Deferred Share Account, the Committee shall distribute the benefits in respect of such remaining Deferred Shares to the Participant's Beneficiary in a lump sum during the first 90 days of the calendar year... -

Page 172

... are distributed with respect to such Shares or other securities, through merger, consolidation, sale of all or substantially all of the assets of Occidental Petroleum Corporation, reorganization, recapitalization, stock dividend, stock split, reverse stock split or similar change in capitalization... -

Page 173

...to have terminated employment if the Participant ceases to be an employee of any of the following: (a) (b) Occidental Petroleum Corporation. an Affiliate. or (c) any other entity, whether or not incorporated, in which the Company has an ownership interest, and the Committee has designated that the... -

Page 174

... . The Committee hereunder shall consist of (i) the members of the Executive Compensation and Human Resources Committee of the Board who are Non-Employee Directors within the meaning of Rule 16b-3 and "outside directors" for purposes of Section 162(m) of the Code, or (ii) such other committee of the... -

Page 175

... and in full accordance with any and all laws applicable to this Program. In performing its duties, the Committee shall be entitled to rely on information, opinions, reports or statements prepared or presented by (i) officers or employees of the Company whom the Committee believes to be reliable and... -

Page 176

ARTICLE VI CLAIMS PROCEDURE 6.1 Applications for Benefits . All applications for benefits under the Program shall be submitted to Occidental Petroleum Corporation, Attention: Corporate Secretary, 10889 Wilshire Blvd., Los Angeles, CA 90024. Applications for benefits must be in writing on the forms ... -

Page 177

... 60day period. The notice shall describe the special circumstances requiring the extension and the date by which the Committee or its delegate expects to render a final determination on the request for review. In the case of an adverse final benefit determination, the Committee or its delegate shall... -

Page 178

... 45day period. The notice shall describe the special circumstances requiring the extension and the date by which the Committee or its delegate expects to render a final determination on the request for review. In the case of an adverse final benefit determination, the Committee or its delegate shall... -

Page 179

...following statement: "You and your plan may have other voluntary alternative dispute resolution options, such as mediation. One way to find out what may be available is to contact your local U.S. Department of Labor Office and your State insurance regulatory agency." 6.4 Limitations on Actions . No... -

Page 180

... time or may at any time suspend or terminate this Program. The Executive Compensation and Human Resources Committee of the Board may amend this Program to (a) ensure that this Program complies with the provisions of Section 409A of the Code for the deferral of taxation on amounts deferred hereunder... -

Page 181

...right to receive the Common Stock (and any cash as expressly provided herein) or the value thereof as a general unsecured creditor in respect of their Deferred Share Accounts. 8.2 Beneficiary Designation . Upon forms provided by and subject to conditions imposed by the Company, each Participant may... -

Page 182

... Program shall, to the extent thereof, be in full satisfaction of all claims against the Board, the Committee, and the Company. The Committee may require such Participant or Beneficiary, as a condition precedent to such payment, to execute a receipt and release to such effect. 8.5 Deferred Shares... -

Page 183

... hereof. IN WITNESS WHEREOF , Occidental Petroleum Corporation has caused its duly authorized officer to execute this document this 5th day of December, 2005. OCCIDENTAL PETROLEUM CORPORATION By /s/ RICHARD W. HALLOCK Richard W. Hallock Executive Vice-President, Human Resources LA3:1102804.5 24 -

Page 184

... This Plan is designed to provide selected employees with annual cash incentive opportunities. Awards are based on the achievement of specific objectives that reflect business success and generate stockholder value. The Plan directly links Participants' incentive compensation with the performance of... -

Page 185

... to business priorities. AWARDS Awards under the Plan shall be determined by evaluating performance against Financial Objectives and Personal Objectives. Actual Awards may be higher or lower than the Target Award. Each Division President, or the most senior executive in each staff in the case of... -

Page 186

... terminate this Plan at any time by the action of the Committee in its sole discretion. DEFINITION OF TERMS Award - A cash incentive based on the achievement of specific financial and individual objectives expressed as a percentage of year-end base salary. Company - Occidental Petroleum Corporation... -

Page 187

... Any entity controlled by Occidental Petroleum Corporation that the Committee determines has employees eligible to participate in the Plan. Financial Objectives - One or more financial goals established each year which reflect current business priorities and against which Company performance will be... -

Page 188

EXHIBIT 12 OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES (Amounts in millions, except ratios) For the years etded December 31, 2005 $ 2004 $ 2003 $ 2002 $ 2001 $ Itcome from cottituitg operatiots Add: Mitority itterest ... -

Page 189

... Chemical Nevis, Inc. Occidental Chile Investments, LLC Occidental Crude Sales, Inc. (International) Occidental de Colombia, Inc. Occidental del Ecuador, Inc. Occidental Dolphin Holdings Ltd. Occidental Energy Marketing, Inc. Occidental Exploration and Production Company Occidental Gas de Mexico LLC... -

Page 190

... International, LLC OOOI Chemical Management, Inc. OOOI Chile Holder, Inc. OOOI Oil and Gas Management, Inc. OOOI Oil and Gas Sub, LLC OXYMAR Oxy CH Corporation Oxy Chemical Corporation OXY Dolphin E&P, LLC OXY Dolphin Pipeline, LLC Oxy Energy Canada, Inc. Oxy Energy Services, Inc. OXY Long Beach... -

Page 191

... statement schedule, management's assessment of the effectiveness of internal control over financial reeorting as of December 31, 2005 and the effectiveness of internal control over financial reeorting as of December 31, 2005, which reeorts aeeear in the December 31, 2005 annual reeort on Form... -

Page 192

..., 333-115099 and 333-124732), of references to our name and to our letter dated February 7, 2006, relating to our review of the Drocedures and methods used by Occidental in its oil and gas estimation Drocess. /s/ RYDER SCOTT COMPANY, L.P. RTDER SCOTT COMPANT, L.P. Houston, Texas February 7, 2006 -

Page 193

...(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 1, 2006 /s/ RAY R. IRANI Ray R. Irani Chairman of the Board of Directors, President and Chief Executive Officer -

Page 194

... and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 1, 2006 /s/ STEPHEN I.CHAZEN Stephen I. Chazen Senior Executive Vice President and Chief Financial Officer -

Page 195

...Chief Executive Officer Date: March 1, 2006 /s/ STEPHEN I. CHAZEN Name: Stephen I. Chazen Title: Senior Executive Vice President and Chief Financial Officer Date: March 1, 2006 A signed original of this written statement required by Section 906 has been provided to Occidental Petroleum Corporation...