Nike 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

ÍANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2003

or

‘TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File No. 1-10635

NIKE, Inc.

(Exact name of Registrant as specified in its charter)

Oregon 93-0584541

(State or other jurisdiction

of incorporation)

(IRS Employer

Identification No.)

One Bowerman Drive (503) 671-6453

Beaverton, Oregon 97005-6453 (Registrant’s Telephone Number, Including Area Code)

(Address of principal executive offices) (Zip Code)

Securities registered pursuant to Section 12(b) of the Act:

Class B Common Stock New York Stock Exchange

(Title of each class) (Name of each exchange on which registered)

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90

days. Yes ÍNo ‘

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of

this chapter) is not contained herein, and will not be contained to the best of Registrant’s knowledge, in definitive

proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ‘

Indicate by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the

Securities Exchange Act of 1934. Yes ÍNo ‘

As of November 29, 2002, the aggregate market value of the Registrant’s Class A Common Stock held by

nonaffiliates of the Registrant was $153,576,324 and the aggregate market value of the Registrant’s Class B

Common Stock held by nonaffiliates of the Registrant was $7,395,856,426.

As of July 25, 2003, the number of shares of the Registrant’s Class A Common Stock outstanding was

97,816,966 and the number of shares of the Registrant’s Class B Common Stock outstanding was 165,916,126.

DOCUMENTS INCORPORATED BY REFERENCE:

Parts of Registrant’s Proxy Statement for the annual meeting of shareholders to be held on September 22,

2003 are incorporated by reference into Part III of this Report.

Table of contents

-

Page 1

... Bowerman Drive Beaverton, Oregon 97005-6453 (Address of principal executive offices) (Zip Code) (503) 671-6453 (Registrant's Telephone Number, Including Area Code) Securities registered pursuant to Section 12(b) of the Act: Class B Common Stock (Title of each class) New York Stock Exchange (Name... -

Page 2

... and Executive Officers of the Registrant ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management ...Certain Relationships and Related Transactions ...Principal Accountant Fees and Services ...PART IV Exhibits, Financial Statement Schedules and Reports on Form... -

Page 3

... 15(d) of the Securities and Exchange Act of 1934. All such filings on our NIKE Corporate web site are available free of charge. Our principal business activity involves the design, development and worldwide marketing of high quality footwear, apparel, equipment, and accessory products. NIKE is the... -

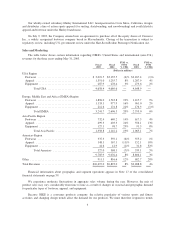

Page 4

...information regarding NIKE's United States and international (non-U.S.) revenues for the three years ending May 31, 2003. Fiscal 2003 FY03 vs. Fiscal FY02 Fiscal 2002 % CHG 2001 (Dollars in millions) FY02 vs. FY01 % CHG USA Region Footwear ...Apparel ...Equipment ...Total USA ...Europe, Middle East... -

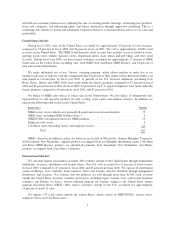

Page 5

... factory and employee stores) ...Total ... 75 4 13 4 65 161 NIKE's domestic distribution centers for footwear are located in Wilsonville, Oregon, Memphis, Tennessee, and Greenland, New Hampshire. Apparel products are shipped from our Memphis distribution center. Cole Haan and Bauer NIKE Hockey... -

Page 6

... located in 35 countries. Most of this apparel production occurred in Bangladesh, Bulgaria, China, Hong Kong, India, Indonesia, Malaysia, Mexico, Pakistan, The Philippines, Sri Lanka, Taiwan, Thailand, and Turkey. Substantially all of our apparel production for sale to the international market... -

Page 7

... in the cost of our products generally and might adversely affect the sales or profitability of NIKE and the imported footwear and apparel industry as a whole. Since 1972, Nissho Iwai American Corporation ("NIAC"), a subsidiary of Nissho Iwai Corporation, a large Japanese trading company, has... -

Page 8

...factors in our operations. NIKE is the largest seller of athletic footwear and athletic apparel in the world. Performance and reliability of shoes, apparel, and equipment, new product development, price, product identity through marketing and promotion, and customer support and service are important... -

Page 9

... the Company, primarily in research, design, development and marketing. Dr. Clarke holds a doctorate degree in biomechanics. Wesley A. Coleman, Vice President, Global Human Resources - Mr. Coleman, 53, has been employed by Nike since 2002 in his current role. Prior to joining Nike, he held a number... -

Page 10

... of Global Sales in 1996, Vice President and General Manager of Asia Pacific in March 1997, and President of USA Operations in March 2001. Trevor Edwards, Vice President, Global Brand Management - Mr. Edwards, 40, joined the Company in 1992. He was appointed Marketing Manager, Strategic Accounts... -

Page 11

...: Beaverton, Oregon (10 locations) - 9 leased Memphis, Tennessee (2 locations) - 1 leased Yarmouth, Maine Charlotte, North Carolina - leased Greenland, New Hampshire - leased Costa Mesa, California - leased International Administrative Offices: Europe (30 locations) - 29 leased Africa - leased Asia... -

Page 12

... in a lawsuit, Kasky v. NIKE, Inc. et al., No. 994446, filed in 1998 in San Francisco County Superior Court. Plaintiff brought the action under the California Business and Professions Code alleging that statements made by the Company in response to criticism about labor practices in factories making... -

Page 13

... 31, 2002. The Company petitioned the United States Supreme Court for certiorari, which was granted. The United States Supreme Court recently dismissed our petition for review, causing the case to return to the California Superior Court. The Court stated that further development of the case before... -

Page 14

...Item 5. Market for Registrant's Common Equity and Related Stockholder Matters NIKE's Class B Common Stock is listed on the New York Stock Exchange and the Pacific Stock Exchange and trades under the symbol NKE. At July 25, 2003, there were 19,198 holders of record of our Class B Common Stock and 23... -

Page 15

...Total assets ...Long-term debt ...Redeemable Preferred Stock ...Shareholders' equity ...Year-end stock price ...Market capitalization ...Financial Ratios: Return on equity ...Return on assets ...Inventory turns ...Current ratio at May 31 ...Price/Earnings ratio at May 31 (Diluted before accounting... -

Page 16

... earnings per common share before accounting change ...Diluted earnings per common share before accounting change ...Net income (loss) ...Average common shares outstanding ...Diluted average common shares outstanding . . Cash dividends declared per common share ...Price range of common stock High... -

Page 17

... passed to the customer, based on the terms of sale. Title passes generally upon shipment or upon receipt by the customer depending on the country of the sale and the agreement with the customer. Retail store revenues are recorded at the time of sale. In some instances, we ship product directly from... -

Page 18

... We expense these payments in cost of sales as the related sales are made. In certain contracts, we offer minimum guaranteed royalty payments. For contractual obligations for which we estimate that we will not meet the minimum guaranteed amount of royalty fees through sales of product, we record the... -

Page 19

...revised anticipated transaction. Taxes We record valuation allowances against our deferred tax assets, when necessary, in accordance with SFAS No. 109, "Accounting for Income Taxes." Realization of deferred tax assets (such as net operating loss carryforwards) is dependent on future taxable earnings... -

Page 20

... so that the year-to-date provision equals the expected annual rate. Other Contingencies In the ordinary course of business, we are involved in legal proceedings regarding contractual and employment relationships, product liability claims, trademark rights, and a variety of other matters. We record... -

Page 21

...largest international region, Europe, Middle East and Africa (EMEA), reported 20% revenue growth in fiscal 2003 compared to fiscal 2002. This growth reflected a 15 percentage point improvement due to changes in currency exchange rates. Growth in the emerging markets in Central and Eastern Europe was... -

Page 22

... gross margins. Other revenues include revenues from Bauer NIKE Hockey, Inc., Cole Haan Holdings, Inc., Hurley International LLC, and NIKE Golf. In fiscal 2003, we began managing the NIKE Golf operations in our largest golf markets separately from our regional businesses. As a result, beginning... -

Page 23

...in Note 17 - Operating Segments and Related Information in the attached Notes to Consolidated Financial Statements, certain corporate costs are not included in pre-tax income of our operating segments. Worldwide futures and advance orders for our footwear and apparel scheduled for delivery from June... -

Page 24

... development of systems and processes supporting our worldwide supply chain, (primarily reflected in the corporate line in our segment presentation of pre-tax income in Note 17 - Operating Segments and Related Information), investments in headcount for our NIKE Golf business, the addition of Hurley... -

Page 25

...effective rate of 34.3%. Included in fiscal 2003 net income was a $266.1 million charge for the cumulative effect of implementing FAS 142. This charge related to the impairment of goodwill and trademarks associated with Bauer NIKE Hockey and the goodwill of Cole Haan, reflecting that the fair values... -

Page 26

... of close-out sales in the last half of fiscal 2001 due to supply chain system disruptions. As in the apparel business, sales of NIKE brand and Brand Jordan basketball footwear products were the primary drivers of increased wholesale sales of in-line footwear during the year. Despite revenues and... -

Page 27

... product costs and lower transportation costs, as a result of both effective negotiations with shippers and lower air freight costs incurred. Relatively higher air freight costs were incurred in fiscal 2001 due to supply chain system problems. (3) A higher mix of in-line sales versus close-out sales... -

Page 28

... to Consolidated Financial Statements. At this time, we plan to continue to account for stock-based compensation using the intrinsic method prescribed in Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," rather than change to the FAS 123 fair value method. In... -

Page 29

... incurred over a period of time and are not necessarily tracked separately from similar costs incurred for products sold to customers. An outsourcing contractor provides us with information technology operations management services through 2006. The amount of the payments in future years depends on... -

Page 30

... to Consolidated Financial Statements (Note 6 - Short-term Borrowings and Credit Lines) for further description and interest rates related to the short-term debt obligations listed below. Outstanding as of May 31, 2003 (In millions) Notes payable, due at mutually agreed-upon dates, generally ninety... -

Page 31

... and Qualitative Disclosures about Market Risk In the normal course of business and consistent with established policies and procedures, we employ a variety of financial instruments to manage exposure to fluctuations in the value of foreign currencies and interest rates. It is our policy to utilize... -

Page 32

...foreign currency forward and foreign currency option derivative instruments only. The VaR determines the maximum potential one-day loss in the fair value of these foreign exchange rate-sensitive financial instruments. The VaR model estimates assume normal market conditions and a 95% confidence level... -

Page 33

... rate swap agreement, the subsidiary pays fixed interest payments at 0.8% and receives variable interest payments based on 3-month LIBOR plus a spread based on a notional amount of 8 billion Japanese yen. This interest rate swap is not accounted for as a hedge, accordingly changes in the fair value... -

Page 34

...be indicative of future revenues due to the changing mix of futures and at-once orders; the ability of NIKE to sustain, manage or forecast its growth and inventories; the size, timing and mix of purchases of NIKE's products; new product development and introduction; the ability to secure and protect... -

Page 35

... information in this report is consistent with these financial statements. Our accounting systems include controls designed to reasonably assure that assets are safeguarded from unauthorized use or disposition and which provide for the preparation of financial statements in conformity with generally... -

Page 36

... provide a reasonable basis for our opinion. As discussed in Note 4 to the consolidated financial statements, effective June 1, 2002, the Company changed its method of accounting for goodwill and intangible assets in accordance with the Statement of Financial Accounting Standards No. 142, "Goodwill... -

Page 37

NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME Year Ended May 31, 2003 2002 2001 (In millions, except per share data) Revenues ...Cost of sales ...Gross Margin ...Selling and administrative ...Interest expense (Notes 6 and 7) ...Other income/expense, net (Notes 1, 12 and 13) ...Income before income ... -

Page 38

...Preferred Stock (Note 9) ...Shareholders' Equity: Common Stock at stated value (Note 10): Class A convertible - 97.8 and 98.1 shares outstanding ...Class B - 165.8 and 168.0 shares outstanding ...Capital in excess of stated value ...Unearned stock compensation ...Accumulated other comprehensive loss... -

Page 39

......Income tax benefit from exercise of stock options ...Changes in certain working capital components: Increase in accounts receivable ...(Increase) decrease in inventories ...Decrease in other current assets and income taxes receivable ...Increase (decrease) in accounts payable, accrued liabilities... -

Page 40

NIKE, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Capital in Accumulated Excess of Unearned Other Stated Stock Comprehensive Retained Shares Amount Shares Amount Value Compensation Income (Loss) Earnings Class A Class B (In millions, except per share data) Common Stock Total Balance at ... -

Page 41

... the terms of sale. Title passes generally upon shipment or upon receipt by the customer depending on the country of the sale and the agreement with the customer. Retail store revenues are recorded at the time of sale. Provisions for sales discounts and returns are made at the time of sale. Shipping... -

Page 42

... of shareholders equity) or net income depending on whether the derivative is being used to hedge changes in cash flows or fair value. In accordance with the transition provisions, the Company recorded a one-time transition adjustment as of June 1, 2001 on both the consolidated statement of income... -

Page 43

... (APB) Opinion No. 25, "Accounting for Stock Issued to Employees" as permitted by Statement of Financial Accounting Standards (SFAS) No. 123 "Accounting for Stock-Based Compensation" (FAS 123). The Company's policy is to grant stock options with an exercise price equal to the market value at the... -

Page 44

NIKE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) If the Company had accounted for these stock options issued to employees in accordance with FAS 123, the Company's pro forma net income and pro forma earnings per share (EPS) would have been reported as follows: Year Ended May 31, ... -

Page 45

... to account for stock-based employee compensation and the effect of the method on reported results in both annual and interim financial statements. The disclosure provisions are effective for the Company beginning with this annual report on Form 10-K. The annual impact of a change to the fair value... -

Page 46

... the applicable disclosures in this report are here in Note 1 and Note 10. At this time, the Company plans to continue to account for stock-based compensation using the intrinsic value method prescribed in Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," rather... -

Page 47

... the Bauer NIKE Hockey ("Bauer") and Cole Haan reporting units. These reporting units are reflected in the Company's "Other" operating segment. Since the Company's purchase of Bauer in 1995, the hockey equipment and apparel markets have not grown as fast as expected and the in-line skate market has... -

Page 48

... and benefits ...Accrued tax ...Accrued endorser compensation ...Other ... $ 313.1 254.9 79.0 70.2 337.0 $1,054.2 $123.8 215.2 47.2 66.5 312.6 $765.3 Note 6 - Short-Term Borrowings and Credit Lines: Commercial paper outstanding, notes payable to banks, and interest-bearing accounts payable to... -

Page 49

... was outstanding under our commercial paper program. The Company purchases through NIAC certain athletic footwear and apparel it acquires from non-U.S. suppliers. These purchases are for the Company's operations outside of the U.S., Europe, and Japan. Accounts payable to NIAC are generally due... -

Page 50

...and pays variable interest payments based on the three-month LIBOR plus a spread. The interest rates payable on these swap agreements were approximately 2.7% and 3.3% at May 31, 2003 and 2002, respectively. We have an effective shelf registration statement with the Securities and Exchange Commission... -

Page 51

... 2002 (In millions) Deferred tax assets: Allowance for doubtful accounts ...Inventory reserves ...Sales return reserves ...Deferred compensation ...Reserves and accrued liabilities ...Tax basis inventory adjustment ...Property, plant, and equipment ...Foreign loss carryforwards ...Hedges ...Other... -

Page 52

..., on merger, consolidation, liquidation or dissolution of the Company or on the sale or assignment of the NIKE trademark for athletic footwear sold in the United States. Note 10 - Common Stock The authorized number of shares of Class A Common Stock, no par value, and Class B Common Stock, no par... -

Page 53

...the awards. As of May 31, 2003, the committee has granted substantially all nonstatutory stock options at 100% of fair market value on the date of grant under the 1990 Plan. From time to time, the Company grants restricted stock and unrestricted stock to key employees under the 1990 plan. The number... -

Page 54

NIKE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following summarizes the stock option transactions under plans discussed above: Weighted Average Option Price Shares (In thousands) Options outstanding May 31, 2000 ...Exercised ...Surrendered ...Granted ...Options outstanding... -

Page 55

... market price of the common shares and, therefore, the effect would be antidilutive. Year Ended May 31, 2003 2002 2001 (In millions, except per share data) Determination of shares: Average common shares outstanding ...Assumed conversion of dilutive stock options and awards ...Diluted average common... -

Page 56

....4 million, respectively. These letters of credit were issued primarily for the purchase of inventory. In the ordinary course of its business, the Company is involved in legal proceedings involving contractual and employment relationships, product liability claims, trademark rights, and a variety of... -

Page 57

...including revenues, product costs, selling and administrative expenses, and intercompany transactions, including intercompany borrowings, will be adversely affected by changes in exchange rates. It is the Company's policy to utilize derivatives to reduce foreign exchange risks where internal netting... -

Page 58

.... The Company assesses effectiveness on options based on the total cash flows method and records total changes in the options' fair value to other comprehensive income to the degree they are effective. As of May 31, 2003, $171.9 million of deferred net losses (net of tax) on both outstanding and... -

Page 59

... exposure to any one financial institution. The Company considers its concentration risk related to accounts receivable to be mitigated by the Company's credit policy, the significance of outstanding balances owed by each individual customer at any point in time and the geographic dispersion of... -

Page 60

... segment operates predominantly in one industry: the design, production, marketing and selling of sports and fitness footwear, apparel, and equipment. The "Other" category shown below represents activities of Cole Haan Holdings, Inc., Bauer NIKE Hockey, Inc., Hurley International LLC, NIKE Golf... -

Page 61

...NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Accounts receivable, inventory and property, plant and equipment for operating segments are regularly reviewed by management and are therefore provided below. 2003 Year Ended May 31, 2002 (In millions) 2001 Net Revenue United States ...Europe... -

Page 62

... Product Lines. Revenues to external customers for NIKE brand products are attributable to sales of footwear, apparel, and equipment. Other revenues to external customers primarily include external sales by Cole Haan Holdings, Inc., Bauer NIKE Hockey Inc., Hurley International LLC, and NIKE Golf... -

Page 63

...%, respectively of the Company's consolidated revenues. Sales to this customer are included in all segments of the Company participating in NIKE brand sales activity. Note 18-Subsequent Event On July 9, 2003, the Company entered into an agreement to purchase all of the equity shares of Converse Inc... -

Page 64

... of accounting principles or practices or financial statement disclosure required to be reported under this Item. Item 9A. Controls and Procedures The Company maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Company's Exchange... -

Page 65

... herein by reference. Item 12. Security Ownership of Certain Beneficial Owners and Management The information required by this Item is included under "Stock Holdings of Certain Owners and Management" and under "Equity Compensation Plans" in the definitive Proxy Statement for our 2003 Annual Meeting... -

Page 66

...' Equity for each of the three years ended May 31, 2003 ...Notes to Consolidated Financial Statements ...FINANCIAL STATEMENT SCHEDULE: II - Valuation and Qualifying Accounts ... 35 36 37 38 39 40 F-1 All other schedules are omitted because they are not applicable or the required information is... -

Page 67

... March 17, 2003.* NIKE, Inc. Foreign Subsidiary Employee Stock Purchase Plan (incorporated by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q for the fiscal quarter ended February 28, 2003).* Covenant Not to Compete and Non-Disclosure Agreement between NIKE, Inc. and Charles... -

Page 68

... 601(b)(4)(iii) of Regulation S-K, that it will furnish a copy of any such instrument to the SEC upon request. Upon written request to Investor Relations, NIKE, Inc., One Bowerman Drive, Beaverton, Oregon 970056453, NIKE will furnish shareholders with a copy of any Exhibit upon payment of $.10 per... -

Page 69

SCHEDULE II VALUATION AND QUALIFYING ACCOUNTS Balance at Beginning of Period Charged to Costs and Expenses Charged to Other Accounts (In millions) Write-Offs Net of Recoveries Balance at End of Period Description For the year ended May 31, 2001: Allowance for doubtful accounts ...For the year ... -

Page 70

... OF INDEPENDENT ACCOUNTANTS We hereby consent to the incorporation by reference in the documents listed below of our report dated June 26, 2003, except for footnote 18, as to which the date is July 9, 2003, relating to the financial statements and financial statement schedule of NIKE, Inc., which... -

Page 71

... by the undersigned, thereunto duly authorized. NIKE, INC. By: PHILIP H. KNIGHT Philip H. Knight Chairman of the Board, Chief Executive Officer and President /s/ Date: August 7, 2003 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 72

Signature Title Date /s/ DOUGLAS G. HOUSER Douglas G. Houser JEANNE P. JACKSON Jeanne P. Jackson /s/ JOHN E. JAQUA John E. Jaqua Director August 7, 2003 /s/ Director August 7, 2003 Director August 7, 2003 /s/ CHARLES W. ROBINSON Charles W. Robinson A. MICHAEL SPENCE A. Michael Spence ... -

Page 73

EXHIBIT 12.1 NIKE, INC. COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES 2003 Year Ended May 31, 2002 2001 (In millions) Net income ...Income taxes ...Cumulative change in accounting principle ...Income before income taxes and cumulative change ...Add fixed charges Interest expense (A) ...Interest... -

Page 74

...the same line of business, namely the design, marketing, distribution and sale of athletic and leisure footwear, apparel, accessories, and equipment. NIKE IHM, Inc., a Missouri corporation, manufactures plastics and Air-Sole shoe cushioning components. Triax Insurance, Inc., a Hawaii corporation, is...