MoneyGram 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

¨

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

(Zip Code)

(Address of principal executive offices)

¨

¨

¨

¨

¨ ¨ ¨

¨

Table of contents

-

Page 1

... Dallas, Texas (Address of principal executive offices) 75201 (Zip Code) Registrant's telephone number, including area code (214) 999-7552 Securities registered pursuant to Section 12(b) of the Tct: Title of each class Name of each exchange on which registered Common stock, $0.01 par value New... -

Page 2

...Global Funds Transfer Segment Financial Paper Products Segment Product and Infrastructure Development and Enhancements Sales and Marketing Competition .egulation Clearing and Cash Management Bank .elationships Intellectual Property Employees Executive Officers of the .egistrant Available Information... -

Page 3

... world to transfer money and pay bills, helping them meet the financial demands of their daily lives. Our bill payment services also help businesses operate more efficiently and cost-effectively. Our principal executive offices are located at 2828 N. Harwood Street, Suite 1500, Dallas, Texas 75201... -

Page 4

... our extensive global network of agents and through a number of Company-owned retail locations in the U.S. and Western Europe. We also offer our money transfer services through the Internet, agent websites, mobile phones, kiosks, ATMs, payment cards and directto-bank account products in various... -

Page 5

... use our ExpressPayment service to load or reload funds to over 200 different prepaid debit cards. We also derive revenue from our financial paper products with our money order and official check services. We provide money orders through retail agents and financial institutions located throughout... -

Page 6

... management, prepaid card and collections industries. Financial Paper Products Segment Our Financial Paper Products segment provides money orders to consumers through our retail and financial institution agent locations in the U.S. and Puerto .ico, and provides official check services for financial... -

Page 7

...United Kingdom, and Germany and through agent websites in the U.S., Italy, Saudi Arabia and Japan. Through our MoneyGram Online service, consumers have the ability to send money from the convenience of their own home to any of our agent locations worldwide through a debit or credit card or three day... -

Page 8

... to send and receive money and to pay bills in a variety of ways, we will face increasing competition. These emerging technologies include online payment services, card-based services such as ATM cards, stored-value cards, bank-to-bank money transfers and mobile telephone payment services. In... -

Page 9

... policies and procedures to make our business practices flexible, so we can comply with the most current legal requirements. We offer our money transfer services primarily through third-party agents with whom we contract and do not directly control. As a money services business, we and our agents... -

Page 10

... cash management banks are critical to an efficient and reliable global funding network. In the United States, we employ four banks to clear our official checks and three banks to clear our retail money orders. We believe that this network of banks provides sufficient capacity to handle the current... -

Page 11

... & Coloring Global Business Unit of Newell .ubbermaid. Mr. Agualimpia has 20 years of leadership experience in marketing, brand management, customer relationship management and product development. Jeffrey J. Allback, age 50, has served as Executive Vice President and Chief Information Officer since... -

Page 12

... retail Point of Sale systems from May 2011 to December 2012. He served as Managing Director of First Data Corporation's ANZ business, a global payment processing company, from September 2008 to February 2011. Mr. Lines served as Senior Vice President of First Data's Strategic Business Development... -

Page 13

... to our existing and prospective official check customers. There can be no assurance that growth in consumer money transfer transactions, bill payment transactions and financial paper products will continue. In addition, consolidation among payment service companies has occurred and could continue... -

Page 14

..., our business, financial condition and results of operations could be adversely affected. .evenue from our money transfer and bill payment services is derived from transactions conducted through our retail agent and biller networks. Many of our high volume agents are in the check cashing industry... -

Page 15

...-money-laundering laws could have an adverse effect on our business, financial condition and results of operations. The Dodd-Frank Act increases the regulation and oversight of the financial services industry. The Dodd-Frank Act addresses, among other things, systemic risk, capital adequacy, deposit... -

Page 16

...increase our operating costs and could result in, among other things, revocation of required licenses or registrations, loss of approved status, termination of contracts with banks or retail representatives, administrative enforcement actions and fines, class action lawsuits, cease and desist orders... -

Page 17

... transfer transactions through agents in some regions that are politically volatile or, in a limited number of cases, are subject to certain OFAC restrictions. It is possible that our money transfer services or other products could be used by wrong-doers in contravention of U.S. law or regulations... -

Page 18

... or short-term borrowing would increase our costs. Any delay or inability to settle our payment instruments, pay money transfers or make related settlements with our agents could adversely impact our business, financial condition and results of operations. • Clearing and cash management banks that... -

Page 19

...cash deposits. A breach of security of our systems could adversely affect our business, financial condition and results of operations. We obtain, transmit and store confidential customer, employer and agent information in connection with certain of our services. These activities are subject to laws... -

Page 20

...to enhance our existing services and offer new services, is dependent on our information technology systems. If we are unable to effectively manage the technology associated with our business, we could experience increased costs, reductions in system availability and loss of agents or consumers. Any... -

Page 21

...our business, financial condition and results of operations. We face credit risks from our retail agents and financial institution customers. The vast majority of our money transfer, bill payment and money order business is conducted through independent agents that provide our products and services... -

Page 22

..., financial condition and results of operations could be adversely affected. Our future growth will depend, in part, on our ability to continue to develop and successfully introduce new and enhanced methods of providing money transfer, money order, official check, bill payment and related services... -

Page 23

... the value of our revenues denominated in foreign currencies. Fluctuations in foreign currency exchange rates could adversely affect our financial condition. See "Enterprise Risk Management-Foreign Currency Risk " in Item 7A of this Annual .eport on Form 10-K for more information. If we are unable... -

Page 24

...registration statement also permits us to offer and sell up to $500 million of our common stock, preferred stock, debt securities or any combination of these securities, from time to time, subject to market conditions and our capital needs. Sales of a substantial number of shares of our common stock... -

Page 25

... U.S. based office locations in Arkansas, Florida, and New York, as well as smaller international office locations in France, Germany, Italy, Spain and the United Kingdom. Additionally, we have small sales and marketing offices in Australia, China, Greece, India, Indonesia, Italy, Mexico, Morocco... -

Page 26

.... The 2011 .ecapitalization was completed on May 18, 2011. The plaintiffs sought to recover damages of some or all of the cash and stock payments made to THL and Goldman Sachs by the Company in connection with the 2011 .ecapitalization. On October 10, 2012, the Delaware Court approved the terms of... -

Page 27

... and who will have authority to review the effectiveness of the internal controls, policies and procedures of the Company's anti-fraud and anti-money laundering programs, the Company's overall compliance with the Bank Secrecy Act, the Company's maintenance of the remedial measures already undertaken... -

Page 28

...Mortgage Backed Securities and Collateral Debt Obligations that Goldman Sachs sold to MoneyGram during the 2005 through 2007 timeframe. The Company alleges, among other things, that Goldman Sachs made material misrepresentations and omissions in connection with the sale of these products, ultimately... -

Page 29

... PURCHTSES OF EQUITY SECURITIES Our common stock is traded on the New York Stock Exchange under the symbol "MGI". No dividends on our common stock were declared by our Board of Directors in 2012 or 2011. See Note 11 - Stockholders' Deficit of the Notes to the Consolidated Financial Statements. As of... -

Page 30

... Inc., Fidelity National Information Services, Inc., Fiserv, Inc., Global Payments Inc., MasterCard, Inc., Online .esources Corporation, Total System Services, Inc., Visa, Inc. and The Western Union Company. The graph assumes the investment of $100 in each of our common stock, our Peer Group... -

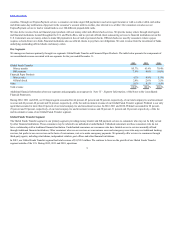

Page 31

... Other Selected Data Capital expenditures Depreciation and amortization Cash dividends declared per share Average investable balances (5) Net investment margin (6) Approximate number of countries and territories served Number of agent money order locations (7) Number of money transfer locations... -

Page 32

... 1, Item 1A of this Annual .eport on Form 10-K. OVERVIEW MoneyGram is a leading global money transfer and payment services company. Our major products include global money transfers, bill payment solutions and financial paper products. We help people and businesses by providing affordable, reliable... -

Page 33

...our cost recovery securities. • Total commissions expense increased in 2012 due to money transfer volume growth, partially offset by a lower euro valuation against the U.S dollar and a decline in fee and other revenue related to bill payment products. • Total operating expenses increased in 2012... -

Page 34

... the products into Canada during 2012. Walmart Renewal - On September 30, 2012, the Company and Walmart entered into the New Agreement, pursuant to which the Company will provide certain money transfer services, bill payment services and money order services for customers in Walmart stores located... -

Page 35

...in which the transaction will be completed. Money order, bill payment and official check transaction fees are fixed per transaction. Foreign exchange revenue is derived from the management of currency exchange spreads on money transfer transactions involving different "send" and "receive" currencies... -

Page 36

...In 2012, fee and other revenue growth of $97.7 million, or eight percent, was primarily driven by money transfer transaction volume growth, partially offset by a lower euro valuation against the U.S dollar, changes in corridor mix and a lower average face value per transaction. Bill payment products... -

Page 37

... due to money transfer volume growth, a higher euro exchange rate and increased signing bonus amortization, partially offset by lower bill payment and money order volumes. Signing bonus amortization increased due to the signing of new agents. Commissions expense grew at a faster rate than revenue... -

Page 38

..., market development and compliance functions and higher sales incentives, partially offset by decreased incentive compensation and a reduction in temporary help. Other employee benefits increased due to executive severance, higher insurance costs and increased benefit plan expense. Employee stock... -

Page 39

... processes and systems that support our infrastructure. • Foreign exchange losses became foreign exchange gains due to the impact of foreign currency exchange rates on our growing current assets and current liabilities not denominated in the U.S. dollar. In 2011, transaction and operations support... -

Page 40

... in 2011. During 2011, the Company increased its investment in marketing as a percent of revenue to return to historic levels and support growth in money transfer. • Consultant fees and outsourcing costs increased primarily due to the outsourcing of certain transactional support and information... -

Page 41

... other costs, net 0.3 $ 6.4 - 1.0 0.1 - $ 0.4 4.5 $11.9 $- - - - $- Capital transactions costs relate to the 2011 .ecapitalization and the secondary offering. Losses on asset dispositions relate to land sold as part of our global business transformation and a former bill payment service. Asset... -

Page 42

... of ongoing business operations, including our ability to service debt and fund capital expenditures, acquisitions and operations. These calculations are commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare the operating performance and value of... -

Page 43

... Amortization of agent signing bonuses $ (8.9) 70.9 44.3 33.6 EBITDA Significant items impacting EBITDA: Net securities gains Severance and related costs (1) .eorganization and restructuring costs Capital transaction costs (2) Asset impairment charges (3) Contribution from investors (4) Debt... -

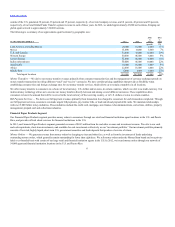

Page 44

...We primarily manage our business through two reporting segments, Global Funds Transfer and Financial Paper Products. The Global Funds Transfer segment provides global money transfers and bill payment services to consumers through a network of agents and, in select markets, company-operated locations... -

Page 45

... Global Funds Transfer segment consists primarily of fees on money transfers and bill payment transactions. For 2012 and 2011, Global Funds Transfer total revenue increased $102.5 million and $99.4 million, respectively, driven by money transfer volume growth, partially offset by a decline in bill... -

Page 46

... fees from the $50 price band in the U.S. Money Transfer Transactions and Agent Locations The following table displays year over year money transfer transaction growth: 2012 vs. 2011 vs. YETR ENDED DECEMBER 31, 2011 2010 Total transactions Transactions originating outside of the United States... -

Page 47

... of fees paid to our third-party agents for money transfer and bill payment services, as well as the amortization of capitalized agent signing bonuses. In 2012 and 2011, signing bonus expense increased due to new agent signings. Operating Margin The Global Funds Transfer segment operating margin... -

Page 48

... expense in the Financial Paper Products segment includes payments made to financial institution customers based on amounts generated by the sale of official checks times short-term interest rate indices, payments on money order transactions and amortization of signing bonuses. Commissions expense... -

Page 49

... Tesco Bank to provide MoneyGram money transfer services, on an exclusive basis, in up to 800 Tesco store locations across the U.K. and the .epublic of Ireland. Agent expansion and increasing productivity in our existing agent locations through marketing support, customer acquisition and new product... -

Page 50

...our cash and cash equivalent and short-term investment balances, proceeds from our investment portfolio and credit capacity under our credit facilities. Our primary operating liquidity needs relate to the settlement of payment service obligations to our agents and financial institution customers, as... -

Page 51

... our global cash management requirements on a timely basis. We have agreements with ten clearing banks that provide clearing and processing functions for official checks, money orders and other draft instruments. We have nine official check clearing banks, of which five banks are currently operating... -

Page 52

... Financial Statements for further information. Following is a summary of principal payments and debt issuance from January 1, 2010 to December 31, 2012: 2008 Senior Facility 2011 Credit Tgreement Revolving facility (Amounts in millions) Tranche T Tranche B Term loan Incremental term... -

Page 53

..., debt securities or any combination of these, from time to time, subject to market conditions and the Company's capital needs. In December 2011, the Company completed the secondary offering pursuant to which the Investors sold an aggregate of 10,237,524 shares of Company common stock at a price of... -

Page 54

... defined by each state, for our regulated payment instruments, namely teller checks, agent checks, money orders and money transfers. The regulatory requirements do not require us to specify individual assets held to meet our payment service obligations, nor are we required to deposit specific assets... -

Page 55

...leases for buildings and equipment used in our business. Signing bonuses are payments to certain agents and financial institution customers as an incentive to enter into long-term contracts. Marketing represents contractual marketing obligations with certain agents and billers. Other obligations are... -

Page 56

...activities, while investments in short-term and available-for-sale investment securities are presented as part of investing activities. To understand the cash flow activity of our core business, the cash flows from operating activities relating to the payment service assets and obligations should be... -

Page 57

... the sale of the corporate airplane, partially offset by the purchase of $40.2 million of capital. Cash Flows from Financing Activities YETR ENDED DECEMBER 31, 2012 2011 2010 (Amounts in millions) Proceeds from issuance of debt Transaction costs for issuance and amendment of debt Payments on... -

Page 58

... to service debt and fund operations, capital expenditures and acquisitions. These calculations are commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare the operating performance and value of companies within our industry. Free Cash Flow is a financial... -

Page 59

... testing are consistent with our internal forecasts and operating plans. Our discount rate is based on our debt and equity balances, adjusted for current market conditions and investor expectations of return on our equity. If the fair value of a reporting unit exceeds its carrying amount, there... -

Page 60

.... Our pension plan asset allocations are reviewed annually and are based upon plan obligations, an evaluation of market conditions, tolerance for risk and cash requirements for benefit payments. The discount rates for the 2012, 2011 and 2010 net periodic benefit cost pension plans were 4.90... -

Page 61

... tax laws and generally accepted accounting principles. We file tax returns in multiple states within the U.S. and various countries. Our tax filings for all periods are subject to audit by tax authorities; the U.S. federal income tax filings for fiscal years 2005 through 2011 are currently subject... -

Page 62

... require management to make assumptions regarding the likelihood of achieving market and performance goals. Assumptions used in our assessment are consistent with our internal forecasts and operating plans and assume achievement of performance conditions at target. Recent Tccounting Developments... -

Page 63

... to manage credit risks from our retail agents and official check financial institution customers; • our ability to retain partners to operate our official check and money order businesses; • our ability to successfully develop and timely introduce new and enhanced products and services and... -

Page 64

... was primarily comprised of cash, U.S. government money market funds, bank deposits and bank time deposits. Based on investment policy restrictions in the indenture governing the Company's second lien notes, investments are limited to U.S. Government Securities and securities of agencies of the... -

Page 65

...collect funds from customers who are transferring money or buying money orders, and agents who receive proceeds from us in anticipation of payment to the recipients of money transfers. The Company has a credit risk management function that conducts the underwriting of credit on new agents as well as... -

Page 66

... 3,540 agents, of which one agent owed us in excess of $15.0 million. Credit risk management is complimented through functionality within our point of sale system, which can enforce credit limits on a real-time basis and monitor for suspicious and unauthorized transactions. The system also permits... -

Page 67

...order and official check businesses. We are invested primarily in interest-bearing cash accounts, deposit accounts, time deposits and certificates of deposit, and U.S. government money market funds. These types of investments have minimal risk of declines in fair value from changes in interest rates... -

Page 68

...Business managers maintain a system of controls to provide transaction authorization and execution, safeguarding of assets from misuse or theft, and to ensure the quality of financial and other data. Our Business .esiliency group works with each business function to develop plans to support business... -

Page 69

... accounting firm, Deloitte & Touche LLP, regarding the Company's internal control over financial reporting is provided on page F-3 of this Annual .eport on Form 10-K. Item 9B. OTHER INFORMTTION None. PTRT III Item 10. DIRECTORS, EXECUTIVE OFFICERS TND CORPORTTE GOVERNTNCE The information called... -

Page 70

... FEES TND SERVICES The information called for by this Item is contained in our definitive Proxy Statement for our 2013 Annual Meeting of Stockholders, and is incorporated herein by reference. PTRT IV Item 15. EXHIBITS TND FINTNCITL STTTEMENT SCHEDULES (a) (1) The financial statements listed... -

Page 71

... authorized. MoneyGram International, Inc. (.egistrant) Date: March 4, 2013 By: /S / PAMELA H. PATSLEY Pamela H. Patsley Chairman and Chief Executive Officer (Principal Executive Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by... -

Page 72

... MoneyGram International, Inc., MoneyGram Payment Systems Worldwide, Inc., the other guarantors party thereto and Deutsche Bank Trust Company Americas, a New York banking corporation, as trustee and collateral agent (Incorporated by reference from Exhibit 4.1 to .egistrant's Current .eport on Form... -

Page 73

...by and among MoneyGram International, Inc., certain affiliates and co-investors of Thomas H. Lee Partners, L.P., and certain affiliates of Goldman, Sachs & Co. (Incorporated by reference from Exhibit 4.1 to .egistrant's Current .eport on Form 8-K filed May 23, 2011). Exchange and .egistration .ights... -

Page 74

..., Inc., MoneyGram Payment Systems, Inc., FSMC, Inc., CAG Inc., MoneyGram Payment Systems Worldwide, Inc., PropertyBridge, Inc., MoneyGram of New York LLC, and Deutsche Bank Trust Company Americas, as collateral agent (Incorporated by reference from Exhibit 10.9 to .egistrant's Current .eport on Form... -

Page 75

...GS Capital Partners VI Parallel, L.P., and THL Managers VI, LLC (Incorporated by reference from Exhibit 10.4 to .egistrant's Current .eport on Form 8-K filed on March 18, 2008). Second Amended and .estated Note Purchase Agreement, dated as of March 24, 2008, among MoneyGram Payment Systems Worldwide... -

Page 76

... 16, 2009). MoneyGram International, Inc. Performance Unit Incentive Plan, as amended and restated May 9, 2007 (Incorporated by reference from Exhibit 99.02 to .egistrant's Current .eport on Form 8-K filed on May 14, 2007). Form of MoneyGram International, Inc. Executive Compensation Trust Agreement... -

Page 77

...99.05 to .egistrant's Current .eport on Form 8-K filed on November 22, 2005). Money Services Agreement between Wal-Mart Stores, Inc. and MoneyGram Payment Systems, Inc. dated February 1, 2005 as amended (Incorporated by reference from Exhibit 10.71 to .egistrant's Annual .eport on Form 10-K filed on... -

Page 78

...'s Current .eport on Form 8-K filed May 23, 2011). Security Agreement, dated as of May 18, 2011, among MoneyGram International, Inc., MoneyGram Payment Systems Worldwide, Inc., MoneyGram Payment Systems, Inc., MoneyGram of New York LLC, and Bank of America, N.A., as collateral agent (Incorporated... -

Page 79

... Worldwide, Inc., MoneyGram Payment Systems, Inc., MoneyGram of New York LLC, the Lenders and Bank of America, N.A., as administrative agent (Incorporated by reference from Exhibit 10.1 to .egistrant's Current .eport on Form 8-K filed November 22, 2011) Form of MoneyGram International, Inc. 2005... -

Page 80

... Financial Statements, tagged as blocks of text. The information in Exhibit 101 is "furnished" and not "filed" as provided in .ule 406T of .egulation S-T. * †+ Filed herewith. Indicates management contract or compensatory plan or arrangement required to be filed as an exhibit to this report... -

Page 81

... Contents MoneyGram International, Inc. Tnnual Report on Form 10-K Items 8 and 15(a) Index to Financial Statements Management's .esponsibility Statement .eports of Independent .egistered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2012 and 2011 Consolidated Statements of... -

Page 82

...in the United States of America using, where appropriate, management's best estimates and judgments. The financial information presented throughout the Annual .eport is consistent with that in the consolidated financial statements. Management is also responsible for maintaining a system of internal... -

Page 83

... Statement. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan... -

Page 84

... of MoneyGram International, Inc. and subsidiaries at December 31, 2012 and 2011, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2012, in conformity with accounting principles generally accepted in the United States of America... -

Page 85

...benefits Accounts payable and other liabilities Total liabilities 149.2 5,285.8 COMMITMENTS TND CONTINGENCIES (NOTE 14) STOCKHOLDERS' DEFICIT Participating Convertible Preferred Stock - Series D, $0.01 par value, 200,000 shares authorized, 109,239 issued at December 31, 2012 and December 31, 2011... -

Page 86

... expense Compensation and benefits Transaction and operations support Occupancy, equipment and supplies Depreciation and amortization Total operating expenses OPERTTING INCOME Other (income) expense Net securities gains Interest expense Debt extinguishment costs Other costs Total other expenses, net... -

Page 87

...holding gains arising during the year, net of tax expense of $1.4, $0.6 and $0.0 .eclassification adjustment for net realized (gains) losses included in net (loss) income, net of tax expense of $0.0, $0.0 and $0.0 Pension and postretirement benefit plans: Amortization of prior service (credit) costs... -

Page 88

... in receivables, net (substantially restricted) Change in payment service obligations Net cash (used in) provided by operating activities CTSH FLOWS FROM INVESTING TCTIVITIES: Proceeds from sale of investments classified as available-for-sale (substantially restricted) Proceeds from maturities of... -

Page 89

... benefit plans, net of tax Unrealized foreign currency translation adjustment, net of tax December 31, 2011 Net loss Employee benefit plans Capital contribution from investors Net unrealized gain on available-for-sale securities, net of tax Amortization of prior service cost for pension and... -

Page 90

... transfer services and bill payment services to consumers through a network of agents. The Financial Paper Products segment provides official check outsourcing services and money orders through financial institutions and agents. The Company's headquarters is located in Dallas, Texas, United States... -

Page 91

...financial statements of MoneyGram are prepared in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The Consolidated Balance Sheets are unclassified due to the short-term nature of the settlement obligations, contrasted with the ability to invest cash... -

Page 92

... Balance Sheets under "Payment service obligations." The investment revenue generated by the assets of the SPEs is allocated to the Financial Paper Products segment in the Consolidated Statements of (Loss) Income. For the years ending December 31, 2012 and 2011, the Company's SPEs had cash and cash... -

Page 93

...exceeding payment service obligations are generally available; however, management considers a portion of these amounts as providing additional assurance that business needs and regulatory requirements are maintained during the normal fluctuations in the value of the Company's payment service assets... -

Page 94

... Instruments - The Company recognizes derivative financial instruments in the Consolidated Balance Sheets at fair value. The accounting for changes in the fair value is recognized through the "Transaction and operations support" line in the Consolidated Statements of (Loss) Income in the period... -

Page 95

...the asset is reduced to the estimated fair value. Payments on Long-Term Contracts - The Company makes payments to certain agents and financial institution customers as an incentive to enter into long-term contracts. The payments, or signing bonuses, are generally required to be refunded pro rata in... -

Page 96

... the locations in which these money transfers originate and to which they are sent. The official check, money order and bill payment transaction fees are fixed fees charged on a per item basis. Transaction fees are recognized at the time of the transaction or sale of the product. • Service revenue... -

Page 97

...Management will continue to evaluate breakage under the current program and will record a reduction of the liability when sufficient data is available. Fee and Other Commissions Expense - The Company pays fee commissions to third-party agents for money transfer and bill payment products. In a money... -

Page 98

... and restructuring costs recorded in the "Transaction and operations support" line and facilities and certain related asset write-off charges recorded in the "Occupancy, equipment and supplies" line in the operating expense section of the Consolidated Statements of (Loss) Income. During 2011, the... -

Page 99

... Consolidated Financial Statements. In September 2011, the FASB issued ASU No. 2011-08, Testing Goodwill for Impairment ("ASU 2011-08"). ASU 2011-08 provides entities an option of assessing qualitative factors when testing goodwill for impairment before calculating the fair value of a reporting unit... -

Page 100

... the "Transaction and operations support" line in the Consolidated Statements of (Loss) Income. Note 4 - Fair Value Measurement Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability, or the exit price, in an orderly transaction between market... -

Page 101

... and market data. Accordingly, these securities are classified as Level 2 financial instruments. The Company periodically corroborates the valuations provided by the pricing service through internal valuations utilizing externally developed cash flow models, comparison to actual transaction prices... -

Page 102

... where available, credit ratings, observable market indices and other market data (Level 2). At December 31, 2012 and 2011, the fair value and carrying value of the debt are: Fair Value Carrying Value (Amounts in millions) 2012 2011 2012 2011 Senior secured credit facility and incremental term... -

Page 103

... fair values of Pension Plan investments are determined by the trustee based on the current market values of the underlying assets. In instances where market prices are not available, market values are determined by using bid quotations obtained from major market makers or security exchanges or bid... -

Page 104

...-for-sale investments are as follows at December 31: 2012 Gross Gross Unrealized (Amounts in millions, except net average price) Tmortized Cost Unrealized Gains Losses Fair Value Net (1) Tverage Price .esidential mortgage-backed securities -agencies Other asset-backed securities United States... -

Page 105

...Company used the lowest rating from the rating agencies in the information presented above, there would be a less than a $0.1 million change to investments rated A or better as of December 31, 2012 and 2011. Contractual Maturities - The amortized cost and fair value of available-for-sale securities... -

Page 106

..., used internal pricing. Assessment of Unrealized Losses - At December 31, 2012 and 2011, the Company had no unrealized losses in its available-for-sale portfolio. Note 6 - Derivative Financial Instruments The Company uses forward contracts to manage its foreign currency needs and foreign currency... -

Page 107

... with its decision to sell its corporate airplane, the Company recognized a $1.5 million impairment charge in 2010. The sale was completed in the third quarter of 2010. The impairment charge was included in the "Transaction and operations support" line in the Consolidated Statements of (Loss) Income... -

Page 108

... is a roll-forward of goodwill by reporting segment: (Amounts in millions) Global Funds Transfer Financial Paper Products Other Total Balance as of December 31, 2010 Balance as of December 31, 2011 Balance as of December 31, 2012 $ $ $ 428.7 428.7 428.7 $ $ $ - - - $- $- $- $ 428.7 $ 428... -

Page 109

...(Loss) Income during 2011. 2011 Credit Agreement - On May 18, 2011, Moneygram Payment Systems Worldwide, Inc. ("Worldwide") entered into the 2011 Credit Agreement of $540.0 million with Bank of America ("BOA") as Administrative Agent for a group of lenders. The 2011 Credit Agreement is comprised of... -

Page 110

... acquisitions; sell assets or subsidiary stock; pay dividends and other restricted payments; invest in certain assets; and effect loans, advances and certain other transactions with affiliates. In addition, the 2011 Credit Agreement has a covenant that places limitations on the use of proceeds... -

Page 111

... credit facility 2011 Credit Tgreement Senior secured credit facility Senior secured incremental Second (Amounts in millions) Balance at January 1, 2010 Amortization of deferred financing costs Write-off of deferred financing costs B Loan term $ $ Balance at December 31, 2010 Capitalized... -

Page 112

... by the plan participants. Cash accumulation accounts continue to be credited with interest credits until participants withdraw their money from the Pension Plan. It is the Company's policy to fund the minimum required contribution each year. Supplemental Executive Retirement Plans - The Company... -

Page 113

...the price per unit held as of the end of a period as determined by the trustee in accordance with their valuation methodology. • Real estate - The Pension Plan trust holds an investment in a real estate development project. The fair value of this investment represents the estimated market value of... -

Page 114

...the following components for the years ended December 31: Pension and SERPs Postretirement Benefits (Amounts in millions) 2012 2011 2010 2012 2011 2010 Interest cost Expected return on plan assets Amortization of prior service cost (credit) .ecognized net actuarial loss Net periodic benefit... -

Page 115

...prior service cost for the Pension Plan and SE.Ps that will be amortized from "Accumulated other comprehensive loss" into "Net periodic benefit expense" during 2013 is $7.8 million ($4.8 million net of tax) and less than $0.1 million, respectively. The estimated net loss and prior service credit for... -

Page 116

...245.7 2012 (12.7) $ 223.6 2011 $ 2.5 2012 Pension and SERPs Postretirement Benefits Change in plan assets: Fair value of plan assets at the beginning of the year Actual return on plan assets Employer contributions Benefits paid Fair value of plan assets at the end of the year Unfunded status at... -

Page 117

.... At December 31, 2012 and 2011, the Company had a liability related to the deferred compensation plans of $2.5 million and $3.4 million, respectively, recorded in the "Accounts payable and other liabilities" line in the Consolidated Balance Sheets. The rabbi trust had a market value of $8.6 million... -

Page 118

... to offer and sell up to $500 million of its common stock, preferred stock, debt securities or any combination of these, from time to time, subject to market conditions and the Company's capital needs. The registration statement was declared effective by the SEC on July 7, 2011. Secondary Offering... -

Page 119

...995,184 shares. The calculated fair value of share-based awards is recognized as compensation cost using the straight-line method over the vesting or service period in the Company's financial statements. Stock-based compensation is recognized only for those options, restricted stock units and stock... -

Page 120

... Company's common stock does not trade on a U.S. exchange or trading market, resulting in the Company's common stock meeting pre-defined equity values. All options granted in 2010, 2011 and 2012 have a term of 10 years. Beginning in the fourth quarter of 2011, all options issued are time-based and... -

Page 121

... a more refined estimate than the use of the simplified method. (4) A summary of the Company's stock option activity for the year ended December 31, 2012 is as follows: WeightedTverage Exercise Price WeightedTverage Remaining Contractual Term Shares Tggregate Intrinsic Value ($000,000) Options... -

Page 122

...Transaction and operations support" line in the Consolidated Statements of (Loss) Income using the straight-line method over the vesting period. A summary of the Company's unvested restricted stock unit activity for the year ended December 31, 2012 is as follows: Total Shares Weighted Tverage Price... -

Page 123

... recognize revenue based solely on services agreements with the primary U.S. operating subsidiary. Income tax expense (benefit) is as follows for the years ended December 31 are as follows: (Amounts in millions) 2012 2011 2010 Current: Federal State Foreign Current income tax expense Deferred... -

Page 124

... income tax position in the future. Net permanent differences in 2011 include a benefit of $9.7 million from the sale of assets, partially offset by the effect of non-deductible capital transaction costs and reorganization and restructuring expenses of $2.1 million and $0.9 million, respectively... -

Page 125

.... The Company is subject to foreign, U.S. federal and certain state income tax examinations for 2005 through 2010. The I.S has completed its examination of the Company's consolidated income tax returns through 2009. The I.S issued a Notice of Deficiency for 2005-2007 in April 2012 and a Notice of... -

Page 126

... rent in "Accounts payable and other liabilities" in the Consolidated Balance Sheets. Cash or lease incentives received under certain leases are recorded as deferred rent when the incentive is received and amortized as a reduction to rent over the term of the lease using the straight-line method... -

Page 127

... "Accounts payable and other liabilities" line in the Consolidated Balance Sheets as of December 31, 2012 and 2011, respectively. A charge of $108.8 million and $1.9 million and a net gain of $12.7 million were recorded in the "Transaction and operations support" line in the Consolidated Statements... -

Page 128

... chief executive officer of the Company have taken place. The U.S. Department of the Treasury Financial Crimes Enforcement Network, or FinCEN, also requested information, which information was subsequently provided by MoneyGram, concerning MoneyGram's reporting of fraudulent transactions during... -

Page 129

... and who will have authority to review the effectiveness of the internal controls, policies and procedures of the Company's anti-fraud and anti-money laundering programs, the Company's overall compliance with the Bank Secrecy Act, the Company's maintenance of the remedial measures already undertaken... -

Page 130

... primarily manages its business through two reporting segments, Global Funds Transfer and Financial Paper Products. The Global Funds Transfer segment provides global money transfers and bill payment services to consumers through a network of agents and, in select markets, company-operated locations... -

Page 131

..., capital expenditures and assets by segment for the years ended December 31: (Amounts in millions) 2012 2011 2010 .evenue Global Funds Transfer: Money transfer Bill payment Total Global Funds Transfer Financial Paper Products: Money order Official check Total Financial Paper Products Other... -

Page 132

...) 2012 2011 Assets: Global Funds Transfer Financial Paper Products Other Total assets $ 1,448.3 3,395.1 307.2 $ 1,247.4 3,683.4 244.8 $5,150.6 $5,175.6 Geographic areas - International revenues are defined as revenues generated from money transfer transactions originating in a country other... -

Page 133

...: MoneyGram Payment Systems Worldwide, Inc.; MoneyGram Payment Systems, Inc.; and MoneyGram of New York LLC (collectively, the "Guarantors"). The following information represents condensed, consolidating Balance Sheets as of December 31, 2012 and 2011, along with condensed, consolidating Statements... -

Page 134

..., 2012 (Amounts in millions) Parent Subsidiary Guarantors NonGuarantors Eliminations Consolidated TSSETS Cash and cash equivalents Cash and cash equivalents (substantially restricted) .eceivables, net (substantially restricted) Short-term investments (substantially restricted) Available-for-sale... -

Page 135

... commissions expense Compensation and benefits Transaction and operations support Occupancy, equipment and supplies Depreciation and amortization Total operating expenses OPERTTING (LOSS) INCOME Other expense (income) Net securities gains Interest expense Other costs Total other expenses, net (Loss... -

Page 136

...-for-sale securities: Net holding (losses) gains arising during the year, net of tax expense of $1.4 .eclassification adjustment for net realized gains included in net (loss) income, net of tax expense of $0.0 Pension and postretirement benefit plans: Amortization of prior service (credit) costs for... -

Page 137

...short-term investments (substantially restricted) Purchases of property and equipment Proceeds from disposal of assets and businesses Dividends to parent/Capital contribution from subsidiary guarantors Net cash provided by (used in) investing activities CTSH FLOWS FROM FINTNCING TCTIVITIES: Payments... -

Page 138

....3 428.7 213.5 - - $5,175.6 $ 4,205.4 810.9 120.3 $ LITBILITIES TND STOCKHOLDERS' (DEFICIT) EQUITY Payment service obligations Debt Pension and other postretirement benefits Accounts payable and other liabilities Intercompany liabilities Total liabilities Total stockholders' (deficit) equity Total... -

Page 139

... Compensation and benefits Transaction and operations support Occupancy, equipment and supplies Depreciation and amortization Total operating expenses OPERTTING (LOSS) INCOME Other expense (income) Net securities gains Interest expense Debt extinguishment costs Other costs Total other expenses... -

Page 140

...) INCOME Net unrealized gains on available-for-sale securities: Net holding gains (losses) arising during the year, net of tax expense of $0.6 Pension and postretirement benefit plans: Amortization of prior service (credit) costs for pension and postretirement benefit plans recorded to net income... -

Page 141

... of short-term investments (substantially restricted) Purchases of property and equipment Proceeds from disposal of assets and businesses Cash paid for acquisitions, net of cash acquired Dividends to parent/Capital contribution from subsidiary guarantors Net cash provided by (used in) investing... -

Page 142

... Eliminations Consolidated REVENUE Fee and other revenue Investment...Transaction and operations support Occupancy, equipment and supplies Depreciation and amortization Total operating expenses OPERTTING (LOSS) INCOME Other expense (income) Net securities gains Interest expense Other costs... -

Page 143

...for-sale securities: Net holding gains (losses) arising during the year, net of tax expense of $0.0 .eclassification adjustment for net realized losses included in net income (loss), net of tax expense of $0.0 Pension and postretirement benefit plans: Amortization of prior service costs (credit) for... -

Page 144

... of short-term investments (substantially restricted) Purchases of property and equipment Proceeds from disposal of assets and businesses Cash paid for acquisitions, net of cash acquired Dividends to parent/Capital contribution from subsidiary guarantors Net cash provided by (used in) investing... -

Page 145

... receive a restricted stock unit ("RSU") covering shares of common stock the fair market value of which shall be equal to $90,000, as determined by the per share closing price of the common stock on the New York Stock Exchange, as reported in the consolidated transaction reporting system, on the... -

Page 146

... International Holdings Limited (United Kingdom) MoneyGram International Limited (Jordan) MoneyGram International Limited (United Kingdom) MoneyGram International Payment Systems, Inc. (Delaware) MoneyGram International Pte. Ltd (Singapore) MoneyGram Mexico S.A. de C.V. MoneyGram of New York... -

Page 147

... statements of MoneyGram International, Inc. and subsidiaries (the "Company"), and the effectiveness of the Company's internal control over financial reporting, appearing in this Annual Report on Form 10-K of the Company for the year ended December 31, 2012. /s/ DELOITTE & TOUCHE LLP Dallas, Texas... -

Page 148

...true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign MoneyGram International, Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, and any... -

Page 149

... the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules... -

Page 150

... the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules... -

Page 151

...In connection with the Annual Report on Form 10-K (the "Report"), of MoneyGram International, Inc. (the "Company") for the period ended December 31, 2012, as filed with the Securities and Exchange Commission on the date hereof I, Pamela H. Patsley, Chairman and Chief Executive Officer of the Company... -

Page 152

... with the Annual Report on Form 10-K (the "Report"), of MoneyGram International, Inc. (the "Company") for the period ended December 31, 2012, as filed with the Securities and Exchange Commission on the date hereof I, W. Alexander Holmes, Executive Vice President and Chief Financial Officer of the... -

Page 153