Medtronic 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

SEC 10-K Filing for Fiscal Year 2015

Fiscal Year 2015

Table of contents

-

Page 1

Annual Report SEC 10-K Filing for Fiscal Year 2015 Fiscal Year 2015 -

Page 2

... healthcare by developing new value-based offerings and partnering with key stakeholders to drive new, transformative business models and solutions. Detailed financial plans have been developed and built into the operating plans of our groups and regions. We have specific cost saving plans that are... -

Page 3

...Room Managed Services pilot, combining our existing capabilities in the cath lab with Covidien's breadth of operating room technology and expertise. Cardiocom also continued to grow both in the number of accounts as well as capability. We added heart failure data generated by our implantable devices... -

Page 4

... that no other company can. Our industry-leading products, clinical and economic expertise, global footprint, and financial strength position us to be the preferred partner for physicians, hospital systems, patients, payers, and governments around the world. Medtronic has changed in many ways, and... -

Page 5

... in January 2015, the U.S. Health and Human Services (HHS) set a goal of tying 30 percent of traditional, or feefor-service, Medicare payments to quality or value through alternative payment models, such as Accountable Care Organizations (ACOs) or bundled payment arrangements by the end of 2016, and... -

Page 6

... growth, a non-GAAP financial measure, measures the change in revenue between current and prior year periods using average exchange rates in effect during the applicable prior year period. Represents the decrease in Covidien revenue for the nine months ended January 23, 2015 as compared to Covidien... -

Page 7

... Fiscal year ended April 25, 2014 Operating Profit Net Sales Operating Profit Percent As reported Impact of inventory step-up(4) Impact of product technology upgrade commitment(5) Special (gains) charges, net(6) Restructuring charges, net(7) Certain litigation charges, net(8) Acquisition-related... -

Page 8

... 2014, based on the closing price of $66.56, as reported on the New York Stock Exchange: approximately $65.4 billion. Number of Ordinary Shares outstanding on June 16, 2015: 1,416,351,117 DOCUMENTS INCORPORATED BY REFERENCE Portions of Registrant's Proxy Statement for its 2015 Annual General Meeting... -

Page 9

...PART III Directors, Executive Officers, and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services PART... -

Page 10

... Dublin 2, Ireland. The record date for the 2015 Annual Meeting is October 12, 2015 and all shareholders of record at the close of business on that day will be entitled to vote at the 2015 Annual Meeting. Medtronic Website Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current... -

Page 11

... governmental health care programs and group purchasing organizations (GPOs). On January 26, 2015 (Acquisition Date), Medtronic completed the acquisition of Covidien plc, a public limited company organized under the laws of Ireland (Covidien) in a cash and stock transaction valued at approximately... -

Page 12

... (Fiscal year 2015 net sales of $1.762 billion) • Intensive Insulin Management • Non-Intensive Diabetes Therapies • Diabetes Services & Solutions CARDIAC AND VASCULAR GROUP Cardiac Rhythm & Heart Failure Disease Management (CRHF) Our CRHF division develops, manufactures, and markets products... -

Page 13

... peripheral stents such as the Complete SE Vascular Stent and the Assurant Cobalt Iliac Stent and directional atherectomy products such as the TurboHawk plaque excision system, and other products to support procedures. MINIMALLY INVASIVE THERAPIES GROUP Surgical Solutions Surgical Solutions develops... -

Page 14

... other medical products companies. Under our Medi-Trace brand, we offer a comprehensive line of monitoring, diagnostic, and defibrillation electrodes. RESTORATIVE THERAPIES GROUP Spine Our Spine division develops, manufactures, and markets a comprehensive line of medical devices and implants used in... -

Page 15

... division develops, manufactures, and markets image-guided surgery and intra-operative imaging systems that facilitate surgical planning during precision cranial, spinal, sinus, and orthopedic surgeries. Our Advanced Energy business includes products in the emerging field of advanced energy surgical... -

Page 16

... Lifesciences Corporation (Edwards), C.R. Bard Inc. (Bard), and Abbott Laboratories (Abbott). Minimally Invasive Therapies Group The products and therapies of this group are used primarily by hospitals, physicians' offices, and ambulatory care centers, as well as other alternate site healthcare... -

Page 17

... dated as of June 15, 2014 (the Transaction Agreement), Medtronic, Inc. and Covidien became subsidiaries of the Company. The total cash and stock value of the Covidien acquisition was approximately $50 billion. The operating results for Covidien are included in the Minimally Invasive Therapies Group... -

Page 18

...sales representatives and independent distributors in markets outside the U.S. For certain portions of our business acquired through the Covidien acquisition, we also sell through distributors in the U.S. Our medical supplies products are used primarily in hospitals, surgi-centers and alternate care... -

Page 19

... increased emphasis on cost-effectiveness in health care delivery, the current trend among hospitals and other customers is to consolidate into larger purchasing groups to enhance purchasing power. This enhanced purchasing power may lead to pressure on pricing and increased use of preferred vendors... -

Page 20

... device or technology before we can commercially distribute the new medical device or technology. Modifications to cleared medical devices or technologies can be made without using the 510(k) process if the changes do not significantly affect safety or effectiveness. Covidien products are generally... -

Page 21

... generally in the form of their ministries or departments of health, oversee the clinical research for medical devices and are responsible for market surveillance of products once they are placed on the market. We are required to report device failures and injuries potentially related to product use... -

Page 22

... Federal Trade Commission, the Office of the Inspector General of the Department of Health and Human Services, the Department of Justice (DOJ), and various state Attorneys General) monitor the manner in which we promote and advertise our products. Although surgeons are permitted to use their medical... -

Page 23

... affected us indirectly. Medtronic is generally not a Covered Entity, except for a few units such as our Diabetes business, Medtronic Monitoring, Inc. and our health insurance plans. Medtronic only operates as a Business Associate to Covered Entities in a limited number of instances. In those... -

Page 24

... Initiatives Government and private sector initiatives to limit the growth of health care costs, including price regulation, competitive pricing, bidding and tender mechanics, coverage and payment policies, comparative effectiveness of therapies, technology assessments, and managed-care arrangements... -

Page 25

...and health care goods and services could adversely affect our reputation, business, financial condition and cash flows. Our profitability and operations are subject to risks relating to changes in U.S. and foreign legislative, regulatory and reimbursement policies and decisions as well as changes to... -

Page 26

... directly or indirectly by the Iranian government, resulted in approximately $4 million in gross revenues and approximately $3 million in net profits (excluding selling, general, and administrative expenses and allocations) in fiscal year 2015. At the time of these sales, the Company believed... -

Page 27

... and Group President of Covidien for the Surgical Solutions business from July 2011 to October 2013; and President of Covidien's Energy-based Devices business from July 2006 to June 2011. Mr. Hanson held several other positions of increasing responsibility in sales, marketing and general management... -

Page 28

... alternative medical therapies such as pharmaceutical companies. Competitive factors include: product reliability, product performance, product technology, product quality, breadth of product lines, product services, customer support, price, and reimbursement approval from health care insurance... -

Page 29

... effectively marketing and selling our products and limit our ability to obtain future pre-market clearances or approvals, and could result in a substantial modification to our business practices and operations. In addition, device manufacturers are permitted to promote products solely for the uses... -

Page 30

... condition and cash flows. Our devices, products and therapies are purchased principally by hospitals or physicians that typically bill various third-party payors, such as governmental programs (e.g., Medicare, Medicaid and comparable foreign programs), private insurance plans and managed care plans... -

Page 31

...claim to be filed under the federal Racketeer Influenced and Corrupt Organizations Act, RICO. Our profitability and international operations are subject to risks relating to changes in U.S. and foreign medical government and private reimbursement programs and policies and changes in U.S. and foreign... -

Page 32

... or product recalls in the future, regardless of their ultimate outcome, could harm our reputation and have a material adverse effect on our business, results of operations, financial condition, and cash flows. Health care policy changes, including U.S. health care reform legislation, signed in 2010... -

Page 33

...our results of operations will suffer. We may experience decreasing prices for our goods and services due to pricing pressure experienced by our customers from managed care organizations and other third-party payers, increased market power of our customers as the medical device industry consolidates... -

Page 34

... our results of operations if, for example, our profits earned abroad are subject to U.S. income tax, or we are otherwise disallowed deductions as a result of these profits. Finally, changes in foreign currency exchange rates may reduce the reported value of our foreign currency revenues, net of... -

Page 35

... care providers to whom our customers supply medical devices, rely on third-party payers, including government programs and private health insurance plans, to reimburse some or all of the cost of the procedures in which medical devices that incorporate components we manufacture or assemble are used... -

Page 36

... of the professionals who use and support our products, which could cause a decline in our earnings and profitability. The research, development, marketing, and sales of many of our new and improved products is dependent upon our maintaining working relationships with health care professionals. We... -

Page 37

... and our business, financial condition, and results of operations. Failure to integrate acquired businesses into our operations successfully could adversely affect our business. As part of our strategy to develop and identify new products and technologies, we have made several acquisitions in recent... -

Page 38

... earnings and financial condition. Additionally, changes in tax laws or tax rulings could materially impact our effective tax rate. For example, legislation in 2010 imposed a 2.3 percent excise tax on medical device manufacturers for U.S. sales of medical devices beginning in January 2013. Proposals... -

Page 39

... February 3, 2015 and ended on March 12, 2015. The Company expects a ruling from the Tax Court during fiscal year 2017. Examination and audits by tax authorities, and Covidien's tax sharing agreement with Tyco International plc and TE Connectivity Ltd., could result in additional tax payments, which... -

Page 40

... adverse effect on our business, results of operations, financial condition and cash flows. If the distribution of Mallinckrodt ordinary shares to Covidien shareholders in 2013, the distribution of Covidien and TE Connectivity common shares by Tyco International to its shareholders in 2007 or... -

Page 41

...operation and Development has released several components of its comprehensive plan to create an agreed set of international rules for fighting base erosion and profit shifting. As a result, the tax laws in the U.S., Ireland and other countries in which we and our affiliates do business could change... -

Page 42

... business, financial condition and results of operations. In addition, even if the operations of the businesses of Medtronic, Inc. and Covidien are integrated successfully, we may not realize the full benefits of the transaction, including the synergies, cost savings or sales or growth opportunities... -

Page 43

... Code, Medtronic, Inc.'s shareholders received approximately 70% of our ordinary shares (by both vote and value) by reason of holding stock in Medtronic, Inc. Therefore, under current law, we should not be treated as a U.S. corporation for U.S. federal income tax purposes. However, there is limited... -

Page 44

...develop, manufacture, and market our products. Our facilities are in good operating condition, suitable for their respective uses, and adequate for current needs. We currently are evaluating our properties for additional cost savings and efficiencies, due to the acquisition of Covidien during fiscal... -

Page 45

PART II Item 5. Market for Medtronic's Common Equity, Related Shareholder Matters, and Issuer Purchases of Equity Securities The Company's ordinary shares are listed on the New York Stock Exchange under the symbol "MDT." In January 2015, the Company's Board of Directors authorized, subject to the ... -

Page 46

... shareholder return on Medtronic's ordinary shares with the cumulative total shareholder return on the Standard & Poor's (S&P) 500 Index and the S&P 500 Health Care Equipment Index for the last five fiscal years. The graph assumes that $100 was invested at market close on April 30, 2010 in Medtronic... -

Page 47

... hold Medtronic shares through a branch or agency in Ireland through which a trade is carried on generally will not have any Irish income tax liability on a dividend paid by Medtronic. In addition, if a U.S. shareholder is subject to the dividend withholding tax, the withholding payment discharges... -

Page 48

Item 6. Selected Financial Data 2015(1) (in millions, except per share data and additional information) 2014 Fiscal Year 2013 2012 2011 Operating Results for the Fiscal Year: Net sales Cost of products sold Research and development expense Selling, general, and administrative expense Special (gains... -

Page 49

...newly issued ordinary share of the Company. The total cash and stock value of the Transactions was approximately $50 billion. This Annual Report on Form 10-K relates to Medtronic's fiscal year ended April 24, 2015. Due to the timing of the Transactions, the results of operations of Covidien are only... -

Page 50

... conditions. As a result of the Covidien acquisition, our products were expanded to include advanced and general surgical care and patient care products, including respiratory and monitoring solutions. Net income for the fiscal year ended April 24, 2015 was $2.675 billion, $2.41 per diluted share... -

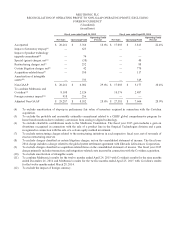

Page 51

...discussion in the "Cost and Expenses" section of this management's discussion and analysis for more information on these reconciling items. Fiscal year ended April 24, 2015 Cost of Income from Products Operating Operations Sold Profit Before Taxes (in millions) Net Sales Net Income GAAP Non-GAAP... -

Page 52

..., customer relationships, purchased technology, and IPR&D. When we acquire a business, the assets acquired and liabilities assumed are recorded at their respective fair values as of the acquisition date. IPR&D represents the fair value of those R&D projects for which the related products have... -

Page 53

... Rhythm & Heart Failure, Coronary & Structural Heart and Aortic & Peripheral Vascular businesses), the Minimally Invasive Therapies Group (composed of Surgical Solutions and Patient Monitoring & Recovery), the Restorative Therapies Group (composed of the Spine, Neuromodulation, Surgical Technologies... -

Page 54

... Sales Fiscal Year 2014 2013 (dollars in millions; NM - Not Meaningful) % Change % Change Cardiac Rhythm & Heart Failure Coronary & Structural Heart Aortic & Peripheral Vascular TOTAL CARDIAC AND VASCULAR GROUP Surgical Solutions Patient Monitoring & Recovery TOTAL MINIMALLY INVASIVE THERAPIES... -

Page 55

... management products in emerging markets. Growth was also driven by a strong initial U.S. launch of CoreValve transcatheter aortic heart valves for extreme risk patients in the fourth quarter of fiscal year 2014. The increase in net sales was also due to worldwide share gains in drug-eluting stents... -

Page 56

...enter into longterm contracts with hospitals, both within Europe and in certain other regions around the world, to upgrade and more effectively manage their cath lab and hybrid operating rooms. As of the end of fiscal year 2015, we had fifty agreements. We expect net sales trends to also be impacted... -

Page 57

... care; and medical surgical products, including operating room supply products, electrodes, needles, syringes, and sharps disposals. Minimally Invasive Therapies Group's net sales from January 26, 2015, the date of the Covidien acquisition, through April 24, 2015 were $2.387 billion. Revenue growth... -

Page 58

... advanced energy surgical instruments. Additionally, this group manufactures and sells image-guided surgery and intra-operative imaging systems. With the addition of the Neurovascular division through the January 2015 Covidien acquisition, the group manufactures and markets products and therapies... -

Page 59

... of other biologics products. The global Core Spine markets were relatively flat on a year-over-year basis. During fiscal year 2014, Core Spine benefited from our focus on enabling technologies, including the O-Arm imaging system, StealthStation navigation, and Powerease powered surgical instruments... -

Page 60

..., urinary retention, and bowel incontinence. Continued growth from Advanced Energy products and strategies to focus on its four core markets of orthopedic, spine, breast surgery, and CRDM replacements. Continued acceptance of the Surgical Technologies StealthStation S7 and O-Arm Imaging Systems. 50... -

Page 61

... Embolization Devices, endovascular treatments for large or giant wide-necked brain aneurysms. • • • Diabetes Group The Diabetes Group products include insulin pumps, CGM systems, insulin pump consumables, and therapy management software. The Diabetes Group's net sales for fiscal year 2015... -

Page 62

... for fiscal years 2015 and 2014: Fiscal Year 2015 Non-U.S. Developed Markets Fiscal Year 2014 Non-U.S. Developed Markets (in millions) U.S. Emerging Markets U.S. Emerging Markets Cardiac and Vascular Group Minimally Invasive Therapies Group Restorative Therapies Group Diabetes Group Total... -

Page 63

...fiscal year 2014 related to the fiscal year 2014 restructuring initiative for inventory write-offs of discontinued product lines. Research and Development During fiscal year 2015, we continued to invest in new technologies to drive future growth. Research and development expense for fiscal year 2015... -

Page 64

... Covidien acquisition include $275 million of professional services and integration costs, $189 million of accelerated or incremental stock compensation expense, and $69 million of incremental officer and director excise tax. During fiscal year 2014, we recorded net charges from acquisition-related... -

Page 65

... In fiscal year 2015, we recorded certain tax adjustments of $349 million, of which $329 million related to the expected resolution of the Kyphon Inc. (Kyphon) acquisition-related issues with the U.S. Internal Revenue Service (IRS). We are currently working with the IRS on a closing agreement to... -

Page 66

... the Covidien acquisition, operational tax benefits, and year-over-year changes in operational results by jurisdiction. During fiscal year 2015, we recorded $33 million in operational tax benefits. The retroactive renewal and extension of the U.S. federal research and development tax credit resulted... -

Page 67

... Financial Statements and Supplementary Data" in this Annual Report on Form 10-K for additional information regarding the Company's long-term debt. Rating for Fiscal Year Ended(1) April 24, 2015 April 25, 2014 Standard & Poor's (S&P) Ratings Services Long-term debt Short-term debt Moody's Investors... -

Page 68

... closing of our acquisition of Covidien, on January 26, 2015 and January 27, 2015, S&P Ratings Services and Moody's, respectively, lowered Medtronic's short-term debt rating and long-term debt rating, due to the increase in net leverage as a result of the Covidien transaction and related financing... -

Page 69

... Covidien acquisition impacts, including acquisition-related items, accrued liabilities, and deferred income taxes, offset by the $750 million settlement payment made to Edwards in May 2014. Our net cash provided by operating activities was $4.959 billion for the fiscal year ended April 25, 2014... -

Page 70

... on returning value to our shareholders, shares are repurchased from time to time. In January 2015, the Company's Board of Directors authorized, subject to the ongoing existence of sufficient distributable reserves, the adoption of the existing Medtronic, Inc. share redemption program. During fiscal... -

Page 71

... to meet our long-term financing needs. We use the net proceeds from the sale of the Senior Notes primarily for working capital and general corporate purposes and in the case of Senior Notes issued on December 10, 2014, to finance the Covidien acquisition and related expenses. Long-term debt as... -

Page 72

...consolidated financial statements in "Item 8. Financial Statements and Supplementary Data" in this Annual Report on Form 10-K for additional information regarding accrued income tax obligations, which are not reflected in the table below. Maturity by Fiscal Year 2018 2019 (in millions) Total 2016... -

Page 73

...this Annual Report on Form 10-K, as well as those related to competition in the medical device industry, reduction or interruption in our supply, quality problems, liquidity, decreasing prices, changes in applicable tax rates, adverse regulatory action, litigation results, self-insurance, commercial... -

Page 74

... a number of factors, including, among others, those discussed in the section entitled "Item 1A. Risk Factors" in this Annual Report on Form 10-K. It is not possible to foresee or identify all such factors. As such, investors should not consider any list of such factors to be an exhaustive statement... -

Page 75

... an otherwise constant currency exchange rate environment. We use operational and economic hedges, as well as currency exchange rate derivative instruments, to manage the impact of currency exchange rate fluctuations on earnings and cash flows. In order to minimize earnings and cash flow volatility... -

Page 76

... the policies or procedures may deteriorate. As described in Management's Annual Report on Internal Control over Financial Reporting, management has excluded Covidien plc from its assessment of internal control over financial reporting as of April 24, 2015 because it was acquired by the Company in... -

Page 77

Medtronic plc Consolidated Statements of Income 2015 (in millions, except per share data) Fiscal Year 2014 2013 Net sales Costs and expenses: Cost of products sold Research and development expense Selling, general, and administrative expense Special (gains) charges, net Restructuring charges, net ... -

Page 78

Medtronic plc Consolidated Statements of Comprehensive Income 2015 (in millions) Fiscal Year 2014 2013 Net income Other comprehensive loss, net of tax: Unrealized gain (loss) on available-for-sale securities, net of tax expense (benefit) of $11, $(58), and $(19), respectively Translation adjustment... -

Page 79

... current assets Property, plant, and equipment, net Goodwill Other intangible assets, net Long-term tax assets Other assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued compensation Accrued income taxes Deferred tax liabilities... -

Page 80

... income Other comprehensive loss Ordinary shares issued in connection with the Covidien plc acquisition, net of taxes Result of contribution of Medtronic, Inc. to Medtronic plc Dividends to shareholders Issuance of shares under stock purchase and award plans Repurchase of ordinary shares Tax benefit... -

Page 81

... (maturities greater than 90 days) Issuance of long-term debt Payments on long-term debt Dividends to shareholders Issuance of ordinary shares Repurchase of ordinary shares Other financing activities Net cash provided by (used in) financing activities Effect of exchange rate changes on cash and cash... -

Page 82

...Policies Nature of Operations Medtronic plc (Medtronic plc, Medtronic or the Company), the successor registrant to Medtronic, Inc., a Minnesota corporation, was incorporated in Ireland on June 12, 2014 as a private limited company, and was re-registered effective January 26, 2015 as a public limited... -

Page 83

... recognized in fiscal years 2015, 2014, and 2013, respectively. Goodwill and Intangible Assets Goodwill is the excess of the purchase price over the estimated fair value of net assets of acquired businesses. In accordance with U.S. GAAP, goodwill is not amortized. The Company assesses the impairment... -

Page 84

Medtronic plc Notes to Consolidated Financial Statements (Continued) At the time of acquisition, the Company expects that all acquired IPR&D will reach technological feasibility, but there can be no assurance that the commercial viability of these products will actually be achieved. The nature of ... -

Page 85

Medtronic plc Notes to Consolidated Financial Statements (Continued) forward starting interest rate derivative instruments that are designated and qualify as cash flow hedges are reported as a component of accumulated other comprehensive loss. Beginning in the period in which the planned debt ... -

Page 86

... expected return on plan assets. Post-retirement medical benefit costs include assumptions for the discount rate, retirement age, expected return on plan assets, and health care cost trend rate assumptions. Revenue Recognition The Company sells its products through direct sales representatives and... -

Page 87

... met. A portion of the Company's revenue is generated from inventory maintained at hospitals or with field representatives. For these products, revenue is recognized at the time the product has been used or implanted. The Company records estimated sales returns, discounts, and rebates as a reduction... -

Page 88

Medtronic plc Notes to Consolidated Financial Statements (Continued) their respective fair values as of the Acquisition Date. Each reporting period, the Company evaluates the potential loss that it believes is probable. This guarantee currently has not been amortized into income because there has ... -

Page 89

... plans and shares committed to be purchased under the employee stock purchase plan. The table below sets forth the computation of basic and diluted earnings per share: (in millions, except per share data) 2015 Fiscal Year 2014 2013 Numerator: Net income attributable to ordinary shareholders... -

Page 90

...for the fiscal years ended April 24, 2015, April 25, 2014, or April 26, 2013. The results of operations related to each company acquired have been included in the Company's consolidated statements of income since the date each company was acquired. Fiscal Year 2015 Covidien public limited company On... -

Page 91

... Covidien as a business combination using the acquisition method of accounting. The assets acquired and liabilities assumed were recorded at their respective fair values as of the Acquisition Date. Based upon a preliminary acquisition valuation, the Company acquired $18.3 billion of customer-related... -

Page 92

... gives effect to Medtronic's acquisition of Covidien as if the acquisition had occurred on April 27, 2013, the first day of fiscal year 2014, and had been included in the Company's consolidated statements of income for fiscal years 2015 and 2014. (in millions) 2015 2014 Pro forma net sales Pro... -

Page 93

... life of 13 years at the time of the acquisition, $2 million of IPR&D, and $5 million of goodwill. The acquired goodwill is not deductible for tax purposes. Diabeter On March 26, 2015, the Company acquired Diabeter, an innovative Netherlands-based diabetes clinic and research center dedicated to... -

Page 94

.... During fiscal year 2015, the Company recorded charges from acquisition-related items of $550 million, primarily related to costs incurred in connection with the Covidien acquisition. The charges incurred in connection with the Covidien acquisition include $275 million of professional services and... -

Page 95

...milestones, and the revenue-based contingent consideration payments equal TYRX's actual annual revenue growth for the Company's fiscal years 2015 and 2016. Based upon the acquisition valuation, the Company acquired $94 million of technology-based intangible assets with an estimated useful life of 14... -

Page 96

... as business combinations during fiscal year 2013 are as follows: (in millions) China Kanghui Holdings Current assets Property, plant, and equipment Intangible assets Goodwill Other assets Total assets acquired Current liabilities Long-term deferred tax liabilities, net Other long-term liabilities... -

Page 97

... product lines and production-related asset impairments, and therefore, was recorded within cost of products sold in the consolidated statements of income. The fiscal year 2015 initiative primarily relates to the Covidien acquisition, strategic alignment of certain manufacturing processes... -

Page 98

... corporate expenses, expanding shared services, consolidating manufacturing locations, and optimizing distribution centers. The Covidien restructuring initiative is scheduled to be substantially complete by the end of fiscal year 2018. In the fourth quarter of fiscal year 2015, the Company recorded... -

Page 99

... U.S. medical device excise tax. In the fourth quarter of fiscal year 2013, the Company recorded a $192 million restructuring charge, which consisted of employee termination costs of $150 million, asset write-downs of $13 million, contract termination costs of $18 million, and other related costs of... -

Page 100

Medtronic plc Notes to Consolidated Financial Statements (Continued) During fiscal year 2014, the Company recorded certain litigation charges, net of $770 million, which primarily includes the global patent settlement agreement with Edwards Lifesciences Corporation (Edwards) of $589 million, ... -

Page 101

... 97 28 46 - - 221 $ (3) (12) (1) (2) - - (18) $ $ $ Activity related to the Company's investment portfolio is as follows: 2015 (in millions) Debt(a) Equity(b)(c) Debt(a) Fiscal Year 2014 Equity(b) 2013 Debt(a) Equity(b) Proceeds from sales Gross realized gains Gross realized losses Impairment... -

Page 102

... identified events or changes in circumstances that may have a material adverse effect on the fair value of the investment. Gains and losses realized on trading securities and available-for-sale debt securities are recorded in interest expense, net in the consolidated statements of income. Gains and... -

Page 103

... millions) Fair Value as of April 25, 2014 Level 1 Fair Value Measurements Using Inputs Considered as Level 2 Level 3 Assets: Corporate debt securities Auction rate securities Mortgage-backed securities U.S. government and agency securities Foreign government and agency securities Certificates... -

Page 104

... are accounted for using the cost or equity method, goodwill and IPR&D, intangible assets, and property, plant, and equipment are measured at fair value when there is an indicator of impairment and recorded at fair value only when impairment is recognized. The Company holds investments in equity and... -

Page 105

... performed, the fair value of each reporting unit's goodwill was deemed to be greater than the carrying value. The Company did not record any goodwill impairments during fiscal years 2015, 2014, or 2013. The Company assesses IPR&D for impairment annually in the third quarter and whenever an event... -

Page 106

... terms of the related debt and exclude the impacts of debt discounts and derivative/hedging activity. 7. Goodwill and Other Intangible Assets, Net The changes in the carrying amount of goodwill for fiscal years 2015 and 2014 are as follows: (in millions) Minimally Invasive Cardiac and Vascular Group... -

Page 107

... the Covidien acquisition, the Company acquired $18.3 billion of customer-related intangible assets, $7.1 billion of technology-based intangible assets, $0.5 billion of tradenames, and $0.4 billion of IPR&D. Refer to Note 2 for additional information. Amortization expense for fiscal years 2015, 2014... -

Page 108

...Revolving Credit Agreement. As of April 24, 2015, no amounts were outstanding on the committed line of credit. Interest rates are determined by a pricing matrix, based on the Company's long-term debt ratings, assigned by Standard & Poor's Ratings Services and Moody's Investors Service. Facility fees... -

Page 109

... rate obligation related to the Company's $1.250 billion 3.000 percent 2010 Senior Notes, which were due during fiscal year 2015. For additional information regarding the interest rate swap agreements, refer to Note 9. Term Loan On January 26, 2015, Medtronic, Inc. borrowed $3.000 billion for a term... -

Page 110

... statements of income related to derivative instruments, not designated as hedging instruments, for fiscal years 2015, 2014, and 2013 are as follows: (in millions) Derivatives Not Designated as Hedging Instruments Location 2015 Fiscal Year 2014 2013 Foreign currency exchange rate contracts... -

Page 111

... cash payments of $8 million. As of April 24, 2015, the Company had $800 million of fixed pay, forward starting interest rate swaps with a weighted average fixed rate of 2.99 percent in anticipation of planned debt issuances. For the fiscal years ended April 24, 2015 and April 25, 2014, the Company... -

Page 112

... with the offsets recorded in long-term debt and short-term borrowings on the consolidated balance sheets. No significant hedge ineffectiveness was recorded as a result of these fair value hedges for fiscal year 2015, 2014, and 2013. During fiscal years 2015, 2014, and 2013, the Company did not have... -

Page 113

Medtronic plc Notes to Consolidated Financial Statements (Continued) Asset Derivatives (in millions) Balance Sheet Location Fair Value Liability Derivatives Balance Sheet Location Fair Value Derivatives not designated as hedging instruments Foreign currency exchange rate contracts Total derivatives... -

Page 114

Medtronic plc Notes to Consolidated Financial Statements (Continued) The Company has elected to present the fair value of derivative assets and liabilities within the consolidated balance sheets on a gross basis even when derivative transactions are subject to master netting arrangements and may ... -

Page 115

... from time to time to support the Company's stock-based compensation programs and to return capital to shareholders. In January 2015, the Company's Board of Directors authorized, subject to the ongoing existence of sufficient distributable reserves, the adoption of the existing Medtronic, Inc. share... -

Page 116

... limit under the U.S. Internal Revenue Code toward the purchase the Company's ordinary shares at 85 percent of its market value at the end of the calendar quarter purchase period. Employees purchased 1 million shares at an average price of $57.66 per share in the fiscal year ended April 24, 2015... -

Page 117

... traded options of the Company's ordinary shares. Dividend yield: The dividend yield rate is calculated by dividing the Company's annual dividend, based on the most recent quarterly dividend rate, by the closing stock price on the grant date. Stock-Based Compensation Expense Under the fair value... -

Page 118

...and 2013: (in millions) 2015 Fiscal Year 2014 2013 Stock options Restricted stock awards Employees stock purchase plan Total stock-based compensation expense Cost of products sold Research and development expense Selling, general, and administrative expense Restructuring charges Acquisition-related... -

Page 119

...income before income taxes reported for financial statement purposes. The components of income from continuing operations before income taxes, based on tax jurisdiction, are as follows: (in millions) 2015 Fiscal Year 2014 2013 U.S. International Income from continuing operations before income taxes... -

Page 120

... assets" and "deferred tax liabilities." Deferred tax assets generally represent items that can be used as a tax deduction or credit in a tax return in future years for which the Company has already recorded the tax benefit in the consolidated statements of income. The Company establishes valuation... -

Page 121

...Company's effective income tax rate from continuing operations varied from the U.S. federal statutory tax rate as follows: 2015 Fiscal Year 2014 2013 U.S. federal statutory tax rate Increase (decrease) in tax rate resulting from: U.S. state taxes, net of federal tax benefit Research and development... -

Page 122

...rate favorably impacted earnings per diluted share by $0.37 in fiscal year 2015, $0.42 in fiscal year 2014, and $0.42 in fiscal year 2013. Unless these grants are extended, they will expire between fiscal years 2016 and 2027. The Company's historical practice has been to renew, extend, or obtain new... -

Page 123

... medical plans (post-retirement benefits), defined contribution savings plans, and termination indemnity plans, covering substantially all U.S. employees and many employees outside the U.S. The expense related to these plans was $433 million, $419 million, and $419 million in fiscal years 2015, 2014... -

Page 124

... year Actual return on plan assets Plan assets acquired in Covidien acquisition Employer contributions Employee contributions Plan settlements Benefits paid Foreign currency exchange rate changes Fair value of plan assets at end of year Funded status at end of year: Fair value of plan assets Benefit... -

Page 125

... fair value The net periodic benefit cost of the plans include the following components: U.S. Pension Benefits Fiscal Year 2014 $ 4,319 3,086 $ 2,864 2,419 (in millions) 2015 2013 Non-U.S. Pension Benefits Fiscal Year 2015 2014 2013 Service cost Interest cost Expected return on plan assets... -

Page 126

... expectations of long-term returns. Retirement Benefit Plan Investment Strategy The Company has an account that holds the assets for both the U.S. pension plan and other U.S. post-retirement benefits, primarily retiree medical benefits. For investment purposes, the plans are managed in an identical... -

Page 127

... used for retirement benefit plan assets measured at fair value. Short-term investments: Valued at the closing price reported in the active markets in which the individual security is traded. U.S. government securities: Certain U.S. government securities are valued at the closing price reported... -

Page 128

... fiscal years 2015, 2014, or 2013. The following tables provide information by level for the retirement benefit plan assets that are measured at fair value, as defined by U.S. GAAP. See Note 1 for discussion of the fair value measurement terms of Levels 1, 2, and 3. U.S. Pension Benefits Fair Value... -

Page 129

... loss Purchases and sales, net Foreign currency exchange Balance as of April 25, 2014 $ 18 1 1 1 21 $ 10 - - 1 11 $ 8 1 1 - 10 $ $ $ Retirement Benefit Plan Funding It is the Company's policy to fund retirement costs within the limits of allowable tax deductions. During fiscal year 2015... -

Page 130

...50 million in fiscal years 2015, 2014, and 2013, respectively. 14. Leases The Company leases office, manufacturing, and research facilities and warehouses, as well as transportation, data processing, and other equipment under capital and operating leases. A substantial number of these leases contain... -

Page 131

Medtronic plc Notes to Consolidated Financial Statements (Continued) Future minimum payments under capitalized leases and non-cancelable operating leases at April 24, 2015 are: (in millions) Fiscal Year Capitalized Leases Operating Leases 2016 2017 2018 2019 2020 Thereafter Total minimum lease ... -

Page 132

... are involved in a number of legal actions involving product liability, intellectual property disputes, shareholder related matters, environmental proceedings, income tax disputes, and other matters. The outcomes of these legal actions are not within the Company's complete control and may not... -

Page 133

.... Shareholder Related Matters INFUSE On March 12, 2012, Charlotte Kokocinski filed a shareholder derivative action against both Medtronic, Inc. and certain of its current and former officers and members of its Board of Directors in the U.S. District Court for the District of Minnesota, setting forth... -

Page 134

...June 9, 2015, the Company provided notice of the Court's order in a Form 8-K filing. On September 26, 2014, Richard Hockstein filed an INFUSE-related shareholder derivative action against both Medtronic, Inc. and certain of its current and former officers and members of its Board of Directors in the... -

Page 135

...is responsible for the costs of completing an environmental site investigation as required by the Maine Department of Environmental Protection (MDEP). MDEP served a compliance order on Mallinckrodt LLC and United States Surgical Corporation in December 2008. The compliance order included a directive... -

Page 136

... key manufacturing sites. The Tax Court proceeding with respect to this issue began on February 3, 2015 and ended on March 12, 2015. The Company expects a ruling from the Tax Court sometime during fiscal year 2017. In October 2011, the IRS issued its audit report on Medtronic, Inc. for fiscal years... -

Page 137

... fiscal years 2012 through 2014. Covidien and the IRS have concluded and reached agreement on its audit of Covidien's U.S. federal income tax returns for the 2008 and 2009 tax years. The IRS continues to audit Covidien's U.S. federal income tax returns for the years 2010 through 2012. Open periods... -

Page 138

...obligated to pay amounts in excess of the Company's agreed upon share of Covidien's, Tyco International's and TE Connectivity's tax liabilities. The Company has used available information to develop its best estimates for certain assets and liabilities related to periods prior to the 2007 separation... -

Page 139

... & Heart Failure, Coronary & Structural Heart, and Aortic & Peripheral Vascular. The primary products sold by this operating segment include those for cardiac rhythm disorders and cardiovascular disease. The Company's Minimally Invasive Therapies Group consists of two divisions: Surgical Solutions... -

Page 140

... include end-customer revenues from the sale of products they each develop and manufacture or distribute. Net sales and income before income taxes by reportable segment are as follows: (in millions) 2015 Fiscal Year 2014 2013 Cardiac and Vascular Group Minimally Invasive Therapies Group Restorative... -

Page 141

... Ireland in fiscal years 2015, 2014, and 2013, respectively. No single customer represented over 10 percent of the Company's consolidated net sales in fiscal years 2015, 2014, or 2013. 19. Guarantor Financial Information On January 26, 2015, Medtronic plc ("Parent Company Guarantor") and Medtronic... -

Page 142

... Income Fiscal Year Ended April 24, 2015 Medtronic 2015 Senior Notes and Medtronic Outstanding Notes Parent Company Guarantor (Medtronic plc) Subsidiary Issuer (Medtronic, Inc.) (in millions) Subsidiary Guarantors Subsidiary Nonguarantors Consolidating Adjustments Total Net sales Costs... -

Page 143

Medtronic plc Notes to Consolidated Financial Statements (Continued) Consolidating Statement of Comprehensive Income Fiscal Year Ended April 25, 2014 Medtronic 2015 Senior Notes and Medtronic Outstanding Notes Parent Company Guarantor (Medtronic plc) Subsidiary Issuer (Medtronic, Inc.) (in millions... -

Page 144

... Income Fiscal Year Ended April 26, 2013 Medtronic 2015 Senior Notes and Medtronic Outstanding Notes Parent Company Guarantor (Medtronic plc) Subsidiary Issuer (Medtronic, Inc.) (in millions) Subsidiary Guarantors Subsidiary Nonguarantors Consolidating Adjustments Total Net sales Costs... -

Page 145

... plc Notes to Consolidated Financial Statements (Continued) Condensed Consolidating Balance Sheet Fiscal Year Ended April 24, 2015 Medtronic 2015 Senior Notes and Medtronic Outstanding Notes Parent Company Guarantor (Medtronic plc) Subsidiary Issuer (Medtronic, Inc.) (in millions) ASSETS Current... -

Page 146

... Balance Sheet Fiscal Year Ended April 25, 2014 Medtronic 2015 Senior Notes and Medtronic Outstanding Notes Parent Company Guarantor (Medtronic plc) (in millions) ASSETS Current assets: Cash and cash equivalents Investments Accounts receivable, net Inventories Intercompany receivable Tax assets... -

Page 147

... Statement of Cash Flows Fiscal Year Ended April 24, 2015 Medtronic 2015 Senior Notes and Medtronic Outstanding Notes Parent Company Subsidiary Guarantor Issuer Subsidiary (Medtronic (Medtronic, Subsidiary NonConsolidating plc) Inc.) Guarantors guarantors Adjustments (in millions) Total Operating... -

Page 148

... Consolidating Statement of Cash Flows Fiscal Year Ended April 25, 2014 Medtronic 2015 Senior Notes and Medtronic Outstanding Notes Parent Company Guarantor (Medtronic plc) Subsidiary Issuer (Medtronic, Inc.) (in millions) Operating Activities: Net cash provided by operating activities Investing... -

Page 149

... Consolidated Financial Statements (Continued) Condensed Consolidating Statement of Cash Flows Fiscal Year Ended April 26, 2013 Medtronic 2015 Senior Notes and Medtronic Outstanding Notes Parent Company Guarantor (Medtronic plc) Subsidiary Issuer (Medtronic, Inc.) (in millions) Operating Activities... -

Page 150

... Statement of Comprehensive Income Fiscal Year Ended April 24, 2015 CIFSA Senior Notes Parent Company Guarantor (Medtronic plc 108) 108 - - - (2,578) 2,686 11 2,675 (587) $ 2,088 $ (in millions) Net sales Costs and expenses: Cost of products sold Research and development expense Selling, general... -

Page 151

... Statements (Continued) Condensed Consolidating Balance Sheet Fiscal Year Ended April 24, 2015 CIFSA Senior Notes Parent Company Guarantor Subsidiary (Medtronic Issuer Subsidiary plc) (CIFSA) Guarantors (in millions) Subsidiary Nonguarantors Consolidating Adjustments Total ASSETS Current... -

Page 152

... long-term debt Payments on long-term debt Dividends to shareholders Issuance of ordinary shares Repurchase of ordinary shares Net intercompany loan borrowings (repayments) Intercompany dividend paid Other financing activities Net cash provided by financing activities Effect of exchange rate changes... -

Page 153

... and Supplementary Data" in this Annual Report on Form 10-K. On January 26, 2015, the Company completed the acquisition of Covidien plc. As a result, management has excluded Covidien plc from our assessment of internal control over financial reporting. Covidien plc is a wholly-owned subsidiary whose... -

Page 154

... and Financial Experts," "Governance of Medtronic - Nominating and Corporate Governance Committee," and "Share Ownership Information - Section 16(a) Beneficial Ownership Reporting Compliance" in our Proxy Statement for our 2015 Annual Shareholders' Meeting, which will be filed no later than 120 days... -

Page 155

... II Limited, Aviation Acquisition Co., Inc., and Aviation Merger Sub, LLC (incorporated by reference to Exhibit 2.1 to Medtronic plc's Amendment No. 5 to the Registration Statement on Form S-4, filed on November 20, 2014, File No. 333-197406). Appendix III to the Rule 2.5 Announcement (Conditions... -

Page 156

... among Medtronic Global Holdings S.C.A. and Wells Fargo Bank, National Association (incorporated by reference to Exhibit 4.4 to Medtronic plc's Current Report on Form 8-K12B, filed on January 27, 2015, File No. 001-36820). Indenture, dated as of October 22, 2007, by and among Covidien International... -

Page 157

... Covidien public limited company, Covidien International Finance S.A., Covidien Ltd. and Deutsche Bank Trust Company Americas (incorporated by reference to Exhibit 4.5 to Medtronic plc's Current Report on Form 8-K12B, filed on January 27, 2015, File No. 001-36820). Registration Rights Agreement... -

Page 158

... Medtronic, Inc.'s Annual Report on Form 10-K for the year ended April 26, 2002, filed on July 19, 2002, File No. 001-07707). Amendment to the 1979 Nonqualified Stock Option Plan (incorporated by reference to Exhibit 10.6 to Medtronic plc's Current Report on Form 8-K, filed on January 27, 2015, File... -

Page 159

...to Medtronic plc's Current Report on Form 8-K, filed on January 27, 2015, File No. 001-36820). Form of Initial Option Agreement under the 1998 Outside Director Stock Compensation Plan (incorporated by reference to Exhibit 10.17 to Medtronic, Inc.'s Annual Report on Form 10-K for the year ended April... -

Page 160

... Report on Form 10-Q for the quarter ended October 26, 2007, filed on December 4, 2007, File No. 001-07707). Form of Non-Qualified Stock Option Agreement under 2003 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.39 to Medtronic, Inc.'s Annual Report on Form 10-K for the year ended... -

Page 161

....'s Annual Report on Form 10-K for the year ended April 27, 2012, filed on June 26, 2012, File No. 001-07707). Form of Non-Employee Director Initial Option Agreement under 2008 Stock Award and Incentive Plan (incorporated by reference to Exhibit 10.1 to Medtronic, Inc.'s Quarterly Report on Form 10... -

Page 162

...001-36820). Medtronic plc Supplemental Executive Retirement Plan (as restated generally effective January 26, 2015) (incorporated by reference to Exhibit 10.15 to Medtronic plc's Current Report on Form 8-K, filed on January 27, 2015, File No. 001-36820). Medtronic plc Savings and Investment Plan (as... -

Page 163

...Retirement Plan, as amended and restated (incorporated by reference to Exhibit 10.1 to Covidien plc's Quarterly Report on Form 10-Q filed on January 26, 2010, File No. 001-33259). Form of Non-Competition, Non-Solicitation and Confidentiality Agreement for executive officers and certain key employees... -

Page 164

MEDTRONIC PLC AND SUBSIDIARIES SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS (in millions) Additions Balance at Beginning of Fiscal Year Charges to Income Charges to Other Accounts Deductions Other Changes (Debit) Credit Balance at End of Fiscal Year Allowance for doubtful accounts: Year ended 4/... -

Page 165

...of 1934, the report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. MEDTRONIC PUBLIC LIMITED COMPANY Dated: June 23, 2015 By: /s/ Omar Ishrak Omar Ishrak Chairman and Chief Executive Officer (Principal Executive Officer) By... -

Page 166

MEDTRONIC PUBLIC LIMITED COMPANY Principal Executive Office 20 On Hatch, Lower Hatch Street Dublin 2, Ireland +353 1 438-1700 www.medtronic.com UC201601143 EN ©2015 Medtronic plc All Rights Reserved Printed in USA