Mattel 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

Table of contents

-

Page 1

-

Page 2

-

Page 3

... books, dolls and accessories. Last fall we opened the second American Girl Place® retail location, on New York's Fifth Avenue, to give girls a venue and a brand experience unlike any other in their world. Girls responded by making the New York location an even bigger success than our Chicago store...

-

Page 4

-

Page 5

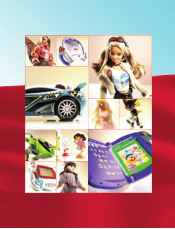

... toys for the best children's licensed entertainment programming in the business, including Harry PotterTM, BatmanTM, Yu-Gi-Oh! TM, Dora the ExplorerTM, Sesame Street ® and many more.

More than a doll, Barbie® is the strongest girls brand in the world. With $3.6 billion in retail sales worldwide...

-

Page 6

-

Page 7

... channel-specific products and customized promotional programs, our goal is to help retailers enjoy profitable growth. It's good for their business, and ours. We will also continue our leadership position in our communities. In celebration of the 25th anniversary of the Mattel Children's Foundation...

-

Page 8

... intently focused on addressing the top-line by invigorating the Barbie® brand and by capitalizing on the positive momentum of our electronic learning strategy. We are also managing and controlling costs while we continue to improve productivity and processes. We are working on ways to strengthen...

-

Page 9

Mattel, Inc.

FORM 10-K

2003

-

Page 10

... Number 001-05647

(Exact name of registrant as specified in its charter)

MATTEL, INC.

333 Continental Boulevard El Segundo, CA 90245-5012

(Address of principal executive offices)

Delaware

(State or other jurisdiction of incorporation or organization)

95-1567322

(I.R.S. Employer Identification...

-

Page 11

... 14. Part IV Item 15. Exhibits, Financial Statement Schedules and Reports on Form 8-K. Directors and Executive Officers of the Registrant. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management. Certain Relationships and Related Transactions. Principal Accounting Fees...

-

Page 12

PART I Item 1. Business. Mattel, Inc. ("Mattel") designs, manufactures, and markets a broad variety of toy products worldwide through sales to retailers and directly to consumers. Mattel's vision is: The World's Premier Toy Brands-Today and Tomorrow. Management has set five key company strategies: ...

-

Page 13

...with the exception of American Girl Brands, are generally the same as those developed and marketed by the Domestic segment, although some are developed or adapted for particular international markets. Mattel's products are sold directly to retailers and wholesalers in Canada and most European, Asian...

-

Page 14

..., economic instability, changes in government policies and other risks, Mattel produces many of its key products in more than one facility. In 2003, Mattel substantially completed the consolidation of two manufacturing facilities in Monterrey, Mexico. See Item 7 "Management's Discussion and Analysis...

-

Page 15

...-term agreements in place with major suppliers that allow the suppliers to pass on only their actual raw material cost increases. Competition and Industry Background Competition in the toy industry is intense and is based primarily on price, quality and play value. The Mattel Brands US and Fisher...

-

Page 16

...and New York City, each of which features children's products from the American Girl Brands segment. Mattel also has several other smaller retail outlets at its corporate headquarters and distribution centers as a service to its employees and as an outlet for excess product. American Girl Brands has...

-

Page 17

... as Winnie the Pooh and the Disney Princesses; Sesame Workshop relating to its Sesame Street® properties; Viacom International, Inc. relating to its Nickelodeon® properties including SpongeBob SquarePants™ and Dora the Explorer™; Nihon Ad Systems Inc. for the master toy license to the Yu-Gi-Oh...

-

Page 18

... Statements." To finance seasonal working capital requirements of certain foreign subsidiaries, Mattel avails itself of individual short-term foreign credit lines with a number of banks. As of year end 2003, Mattel's foreign credit lines total approximately $320 million, a portion of which are...

-

Page 19

... receivables facility, Mattel Sales Corp. and Fisher-Price, Inc. (which are wholly-owned subsidiaries of Mattel) can sell eligible trade receivables from Wal-Mart and Target to Mattel Factoring, Inc. ("Mattel Factoring"), a Delaware corporation and wholly-owned, consolidated subsidiary of Mattel...

-

Page 20

...Officer President, Mattel Brands President, American Girl and Executive Vice President Executive Vice President, Worldwide Operations Chief Information Officer Chief Financial Officer President, Fisher-Price Brands Senior Vice President, Human Resources Senior Vice President and Corporate Controller...

-

Page 21

...a compensation consulting firm and for 12 years with IBM in various Human Resources positions. Mr. Kerner has been Senior Vice President and Corporate Controller since April 2001, when he joined Mattel. From 1998 to 2001, he served as Executive Vice President, Finance, of Premier Practice Management...

-

Page 22

..., IL and New York City, NY for its American Girl Place® stores and leased retail space in Oshkosh, WI, which are used by the American Girl Brands segment. Mattel also has leased office space in Florida, which is used by the International segment. Mattel leases a computer facility in Phoenix, AZ...

-

Page 23

... fiscal year covered by this report.

PART II Item 5. Market for the Registrant's Common Equity and Related Stockholder Matters.

For information regarding the markets in which Mattel's common stock, par value $1.00 per share, is traded, see the cover page hereof. For information regarding the high...

-

Page 24

... sheets or cash flows. The following table provides the quantification of close out sales by year (in thousands):

2003 2002 For the Year Ended 2001 2000 1999

$57,328 $112,673 $163,388 $98,378 $95,742 (d) Per share data reflect the retroactive effect of the merger with Learning Company in 1999. 15

-

Page 25

...reflect these changes. Overview Mattel designs, manufactures, and markets a broad variety of toy products worldwide through sales to retailers and wholesalers (i.e., "customers") and directly to consumers. Mattel's business is dependent in great part on its ability each year to redesign, restyle and...

-

Page 26

... core brand categories, extending product lines, initiating core brand promotional programs and targeting profitable licensing arrangements. • Channels-strengthening relationships with retailers, developing new retail channels, providing quality service to customers and optimizing its supply chain...

-

Page 27

... in accounting principles resulting from the transitional impairment test of the American Girl Brands goodwill. In the third quarter of 2002, Mattel recorded a $27.3 million after-tax gain from discontinued operations related to the sale of Learning Company. In 2002, Mattel also incurred a pre-tax...

-

Page 28

... Sales of licensed character brands increased in 2003 compared to 2002 in both domestic and international markets. Additionally, Mattel benefited in 2003 from new product launches in its interactive learning category, which includes PowerTouchâ„¢ and other learning toys. Gross sales of American Girl...

-

Page 29

.... Mattel intends to invigorate the American Girl Brands category in 2004 through initiatives such as a made for TV movie scheduled to air in the fall of 2004 featuring Samantha Parkington®, a classic American Girl character. Additionally, the American Girl Place® in New York City, which opened in...

-

Page 30

...the interactive learning category. Fisher-Price Brands US segment income decreased 4% to $180.1 million in 2003, primarily due to lower volume and increased overhead costs to support development of new product lines, partially offset by higher gross profit. American Girl Brands gross sales decreased...

-

Page 31

... in accounting principles resulting from the transitional impairment test of the American Girl Brands goodwill. In the third quarter of 2002, Mattel recorded a $27.3 million after-tax gain from discontinued operations related to the sale of Learning Company. In 2002, Mattel also incurred a pre-tax...

-

Page 32

... Data-Notes 1, 11 and 12 to the Consolidated Financial Statements." Worldwide gross sales of Mattel Brands increased 5% to $3.2 billion in 2002 compared to 2001, including a 1 percentage point benefit from changes in currency exchange rates. Domestic gross sales decreased 2% and international...

-

Page 33

... sales. The growth in international gross sales of core Fisher-Price® included a 4 percentage point benefit from changes in currency exchange rates. Sales of licensed character brands decreased in 2002 compared to 2001 in both domestic and international markets. Gross sales of American Girl Brands...

-

Page 34

...®, Yu-Gi-Oh!™ and SpongeBob SquarePants™. Mattel Brands US segment income increased 10% to $446.0 million in 2002, primarily due to gross profit improvement, lower advertising and selling and administrative costs, partially offset by lower volume. Fisher-Price Brands US gross sales increased...

-

Page 35

... product lines, including Barbie®, Hot Wheels® and core Fisher-Price®. International segment income increased 54% to $305.0 million in 2002, mainly due to increased volume and gross profit improvement. Financial Realignment Plan In 2003, Mattel completed its financial realignment plan, originally...

-

Page 36

... product lines that do not meet required levels of profitability; • Improve supply chain performance and economics; • Implement an information technology strategy aimed at achieving operating efficiencies; • Eliminate positions at US-based headquarters locations in El Segundo, Fisher-Price...

-

Page 37

... of positions at its US-based headquarters locations in El Segundo, Fisher-Price and American Girl, implementation of the North American Strategy, closure of certain international offices, and consolidation of facilities. From the inception of the plan through year end 2003, a total of $59.5 million...

-

Page 38

... three years in tooling to support existing and new products, its long-term information technology strategy, certain financial realignment plan initiatives (including the expansion of certain North American manufacturing facilities) and construction of the new American Girl Place® in New York City...

-

Page 39

...adversely affected. To finance seasonal working capital requirements of certain foreign subsidiaries, Mattel avails itself of individual short-term foreign credit lines with a number of banks. As of year end 2003, Mattel's foreign credit lines total approximately $320 million, a portion of which are...

-

Page 40

... receivables facility, Mattel Sales Corp. and Fisher-Price, Inc. (which are wholly-owned subsidiaries of Mattel) can sell eligible trade receivables from Wal-Mart and Target to Mattel Factoring, a Delaware corporation and wholly-owned, consolidated subsidiary of Mattel. Mattel Factoring is a special...

-

Page 41

...low level of accounts receivables and inventories at year end 2002. Management believes that the quality of its inventory at year end 2003 is better than at year end 2002. Additionally, based on Mattel's analysis of point of sale information, management believes that its inventory at retail is lower...

-

Page 42

...enterprise value at the end of five years. In 2001, Mattel received proceeds totaling $10.0 million from Gores Technology Group as a result of liquidation events related to Gores Technology Group's sale of the entertainment and education divisions of the former Learning Company. Mattel also incurred...

-

Page 43

... as part of the settlement described below. In November 2002, the parties to the federal cases negotiated and thereafter memorialized in a final settlement agreement a settlement of all the federal lawsuits in exchange for payment of $122.0 million and Mattel's agreement to adopt certain corporate...

-

Page 44

... Department of Environmental Quality and the Oregon Health Division. Mattel also implemented a community outreach program to employees, former employees and surrounding landowners. Prior to 2003, Mattel recorded pre-tax charges totaling $19.0 million related to this property. During 2003, Mattel...

-

Page 45

... future economic factors in relation to its customers' ability to pay amounts owed to Mattel. Mattel's products are sold throughout the world. Products within the Domestic segment are sold directly to large retailers, including discount and free-standing toy stores, chain stores, department stores...

-

Page 46

... However, as described above, Mattel's business is greatly dependent on a small number of customers. Should one or more of Mattel's major customers experience liquidity problems, then the allowance for doubtful accounts of $27.5 million, or 4.8% of trade accounts receivable, at year end 2003 may not...

-

Page 47

...affect the sales of Mattel's products and its corresponding inventory levels, which would potentially impact the valuation of its inventory. At the end of each quarter, management within each business segment, Mattel Brands US, Fisher-Price Brands US, American Girl Brands and International, performs...

-

Page 48

... of return on high quality, corporate bond indices. Assuming all other benefit plan assumptions remain constant, the decrease in the discount rate from 6.5% to 6.0% will result in an increase in benefit plan expense during 2004 of approximately $2 million. The rate of future compensation increases...

-

Page 49

..., Mattel Brands US Boys division, Fisher-Price Brands US, American Girl Brands and International. Goodwill is allocated to Mattel's reporting units based on an allocation of brand-specific goodwill to the reporting units selling those brands. As a result of implementing SFAS No. 142, Mattel recorded...

-

Page 50

... business can be expected to generate in the future (Income Approach) to test for impairment. The Income Approach valuation method requires Mattel to make projections of revenue, operating costs and working capital investment for the reporting unit over a multi-year period. Additionally, management...

-

Page 51

... the most directly comparable GAAP financial measure, net sales, is as follows (in millions):

2003 For the Year 2002 2001

Domestic: Mattel Brands US ...Fisher-Price Brands US ...American Girl Brands ...Total Domestic ...International ...Gross sales ...Sales adjustments ...Net sales from continuing...

-

Page 52

... use of high technology in toys. In addition, Mattel competes with many other companies, both large and small, which means that Mattel's market position is always at risk. Mattel's ability to maintain its current market share, and increase its market share or establish market share in new product...

-

Page 53

... large customers engaged in price cutting of toy products during the holiday season, which, if it continues, could have a long-term impact on Mattel's gross profit, profitability and consumers' perception of the brand equity of Mattel's products. Rationalization of Mass Market Retail Channel and...

-

Page 54

... insurance in the future. Recalls, post-manufacture repairs of Mattel products, absence or cost of insurance and administrative costs associated with recalls could harm Mattel's reputation, increase costs or reduce sales. Protection of Intellectual Property Rights The value of Mattel's business...

-

Page 55

...Success of New Initiatives Mattel has announced initiatives to improve the execution of its core business, globalize and extend Mattel's brands, catch new industry trends and develop people, including a supply chain initiative, a long-term information technology strategy and new initiatives designed...

-

Page 56

...a result of new developments or otherwise. Item 7A. Quantitative and Qualitative Disclosures About Market Risk. Risk Management Foreign currency exchange rate fluctuations may impact Mattel's results of operations and cash flows. Inventory purchase transactions denominated in the Euro, British pound...

-

Page 57

... the US dollar detailed in the above table, Mattel also had contracts to sell British pound sterling for the purchase of Euro. As of year end 2003, these contracts had a notional amount of $88.8 million and a fair value of $87.9 million. Had Mattel not entered into hedges to limit the effect of...

-

Page 58

... Supplementary Data. REPORT OF INDEPENDENT AUDITORS To the Board of Directors and Stockholders of Mattel, Inc. In our opinion, the consolidated financial statements listed in the index appearing under Item 15(a)(1) on page 92 present fairly, in all material respects, the financial position of Mattel...

-

Page 59

... Cash and short term investments ...Accounts receivable, less allowances of $27.5 million and $23.3 million in 2003 and 2002, respectively ...Inventories ...Prepaid expenses and other current assets ...Total current assets ...Property, Plant and Equipment Land ...Buildings ...Machinery and equipment...

-

Page 60

MATTEL, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (continued)

December 31, December 31, 2003 2002 (In thousands, except share data)

LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Short-term borrowings ...Current portion of long-term debt ...Accounts payable ...Accrued liabilities ...

-

Page 61

MATTEL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS

For the Year 2003 2002 2001 (In thousands, except per share amounts)

Net Sales (See Note 1) ...Cost of sales (See Note 1) ...Gross Profit ...Advertising and promotion... accounting principles ...Net income ...Weighted average number ...

-

Page 62

... compensation and other retirement plans ...Other, net ...Net cash flows from operating activities of continuing operations ...Cash Flows From Investing Activities: Purchases of tools, dies and molds ...Purchases of other property, plant and equipment ...Proceeds from sale of investments ...Payment...

-

Page 63

... pension liability adjustments ...Currency translation adjustments ...Comprehensive income ...Purchase of treasury stock ...Issuance of common stock for exercise of stock options ...Tax benefit of stock option exercises ...Tax benefit of prior year stock warrant exercise ...Compensation cost related...

-

Page 64

... other companies are accounted for by the equity method or cost basis, depending upon the level of the investment and/or Mattel's ability to exercise influence over operating and financial policies. Mattel does not have any minority stock ownership interests in which it has a controlling financial...

-

Page 65

... level or one reporting level below the operating segment. Mattel's reporting units for purposes of applying the provisions of SFAS No. 142 are: Mattel Brands US Girls division, Mattel Brands US Boys division, Fisher-Price Brands US, American Girl Brands and International. Mattel tests its goodwill...

-

Page 66

... of an agreement exists documenting the specific terms of the transaction; the sales price is fixed or determinable; and collectibility is reasonably assured. Management assesses the business environment, customers' financial condition, historical collection experience, accounts receivable aging and...

-

Page 67

... 2001

Options granted at market price Expected life (in years) ...Risk-free interest rate ...Volatility factor ...Dividend yield ...

6.13 3.71% 34.32% 0.67%

6.16 2.94% 30.09% 1.07%

5.50 4.42% 16.76% 0.86%

The weighted average fair value of Mattel options granted at market price during 2003, 2002...

-

Page 68

... stock options granted at: Market price ...Above market price ...Warrants ...

16,117 19,547 13,778 - - 15,227 - - 3,000 16,117 19,547 32,005

Derivative Instruments Mattel uses foreign currency forward exchange and option contracts as cash flow hedges to hedge its forecasted purchases and sales...

-

Page 69

... accounting for these contracts. Changes in fair value of these derivatives were not significant to the results of operations during any year. As a result of adopting SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, Mattel recorded a transition adjustment of $12.0 million...

-

Page 70

..., thereby causing foreign currency translation impact to the US reporting units (in thousands).

Mattel Brands US Girls Division Mattel Brands US Boys Division Fisher-Price Brands US American Girl Brands Int'l Total

Balance at year end 2001 ...Impairment charge ...Impact of currency exchange rate...

-

Page 71

...operating loss carryforwards, research and development expenses, certain reserves, depreciation, employee compensation-related expenses, and certain other expenses that are recognized in different years for financial statement and income tax purposes. Mattel's deferred income tax assets (liabilities...

-

Page 72

..., $4.2 million and $6.0 million, respectively. Stock warrants exercised in 2002 resulted in credits to additional paid-in capital during 2003 and 2002 of $4.3 million and $5.7 million, respectively. The IRS has completed its examination of the Mattel, Inc. federal income tax returns through year end...

-

Page 73

...in which the subsidiaries are located. The status of Mattel's defined benefit pension plans is as follows (in thousands):

As of Year End 2003 2002

Change in Plan Assets Plan assets at fair value, beginning of year ...Actual return on plan assets ...Company contributions ...Participant contributions...

-

Page 74

... million for year end 2003 and 2002, respectively. The components of net pension expense (income) for Mattel's defined benefit pension plans are as follows (in thousands):

2003 For the Year Ended 2002 2001

Service cost ...$ 7,162 $ 6,996 $ 5,395 Interest cost ...21,019 20,120 16,517 Expected return...

-

Page 75

...expected long-term rate-of-return on plan assets of 8.0% is reasonable based on historical returns, with an actual return on market value of plan assets of approximately 11% over the last ten years. During 1999, Mattel amended the Fisher-Price Pension Plan to convert it from a career-average plan to...

-

Page 76

... benefit plan cost ...$5,044 $4,966 $3,535

The assumptions used in determining the accumulated postretirement benefit obligation are as follows:

As of Year End 2003 2002

Discount rate ...Rate of future compensation increases ...Health care cost trend rate: ...Pre-65 ...Post-65 ...Ultimate...

-

Page 77

...included in other long-term liabilities in the consolidated balance sheets. Mattel has purchased group trust-owned life insurance contracts designed to assist in funding these programs. The cash surrender value of these policies, valued at $60.4 million and $59.3 million as of year end 2003 and 2002...

-

Page 78

... of 3.50 to 1). To finance seasonal working capital requirements of certain foreign subsidiaries, Mattel avails itself of individual short-term foreign credit lines with a number of banks. As of year end 2003, foreign credit lines total approximately $320 million, a portion of which are used to...

-

Page 79

... receivables facility, Mattel Sales Corp. and Fisher-Price, Inc. (which are wholly-owned subsidiaries of Mattel) can sell eligible trade receivables from Wal-Mart and Target to Mattel Factoring, a Delaware corporation and wholly-owned, consolidated subsidiary of Mattel. Mattel Factoring is a special...

-

Page 80

... none is currently outstanding. Special Voting Preferred Stock and Related Exchangeable Shares Mattel is authorized to issue one share of $1.00 par value Special Voting Preferred Stock, which was issued in exchange for one share of Learning Company special voting stock in connection with the May...

-

Page 81

... issued Disney Enterprises, Inc. a warrant to purchase 3.0 million shares of Mattel's common stock at an exercise price of $27.375 per share. This warrant expired unexercised on October 2, 2002. The fair value of both of these warrants is amortized as a component of royalty expense when the related...

-

Page 82

... 100% of the fair market value of Mattel's common stock on the date of grant. Options granted to employees at market price usually expire within ten years from the date of grant and vest on a schedule determined by the Compensation Committee of the board of directors, generally semi-annually over...

-

Page 83

... provided benefits for eligible employees and non-employee directors. Effective with the 1999 merger, each option outstanding under these plans was converted into an option to purchase 1.2 shares of Mattel common stock. The exercise price of such options was adjusted by dividing the Learning Company...

-

Page 84

... fluctuations in the fair value of the securities received as part of the sale of CyberPatrol on its results of operations. During the first quarter of 2001, Mattel recorded a pre-tax loss of $5.5 million in other non-operating expense, net related to the decrease in fair value of the derivative. In...

-

Page 85

... operations over the life of the contracts, generally 18 months or less. As of year end, Mattel held the following foreign exchange risk management contracts (in millions):

2003 Notional Exposure Amount Hedged 2002 Notional Exposure Amount Hedged

Foreign exchange forwards ...Fair Value of Financial...

-

Page 86

... 0.9 0.4 0.5 0.4

The Mattel Brands US and Fisher-Price Brands US segments sell products to each of Mattel's three largest customers. The International segment sells products to Wal-Mart and Toys "R" Us. The American Girl Brands segment sells its children's publications to Wal-Mart and Target. Note...

-

Page 87

... $2.0 million of product liability risks. Various insurance companies, that have an "A" or better AM Best rating at the time the policies are purchased, reinsure Mattel's risk in excess of the amounts insured by Far West. Mattel's liability for reported and incurred but not reported claims at year...

-

Page 88

... as part of the settlement described below. In November 2002, the parties to the federal cases negotiated and thereafter memorialized in a final settlement agreement a settlement of all the federal lawsuits in exchange for payment of $122.0 million and Mattel's agreement to adopt certain corporate...

-

Page 89

... Department of Environmental Quality and the Oregon Health Division. Mattel also implemented a community outreach program to employees, former employees and surrounding landowners. Prior to 2003, Mattel recorded pre-tax charges totaling $19.0 million related to this property. During 2003, Mattel...

-

Page 90

... of positions at its US-based headquarters locations in El Segundo, Fisher-Price and American Girl, implementation of the North American Strategy, closure of certain international offices, and consolidation of facilities. From the inception of the plan through year end 2003, a total of $59.5 million...

-

Page 91

... products. The Fisher-Price Brands US segment includes Fisher-Price®, Power Wheels®, Sesame Street®, Little People®, Disney preschool and plush, Winnie the Pooh, Rescue Heroes™, Barney™, See 'N Say®, Dora the Explorer™, PowerTouch™ and other preschool products. The American Girl Brands...

-

Page 92

... corporate headquarters functions managed on a worldwide basis. Segment assets are comprised of accounts receivable and inventories, net of applicable reserves and allowances.

2003 For the Year 2002 (In thousands) 2001

Revenues Domestic: Mattel Brands US ...Fisher-Price Brands US ...American Girl...

-

Page 93

... 46,121 25,132 $262,508

2003

As of Year End 2002 (In thousands)

2001

Assets Domestic: Mattel Brands US ...Fisher-Price Brands US ...American Girl Brands ...Total Domestic ...International ...Corporate and other ...Accounts receivable and inventories from continuing operations ...

$243,934 $194...

-

Page 94

... $1,606,664

$ 934,854 622,688 $1,557,542

$1,406,467 576,809 $1,983,276

(a) Decrease in 2002 compared to 2001 is due to a pre-tax transition adjustment of $400.0 million resulting from the transitional impairment test of American Girl Brands goodwill as a result of implementing SFAS No. 142.

85

-

Page 95

...close out sales by segment, worldwide and geographic area:

2003 (a) For the Year 2002 (In thousands) 2001

Segment Domestic: Mattel Brands US ...Fisher-Price Brands US ...American Girl Brands ...Total Domestic ...International ...Worldwide Mattel Brands ...Fisher-Price Brands ...American Girl Brands...

-

Page 96

Note 12-Quarterly Financial Information (Unaudited)

First Second Third Fourth Quarter Quarter Quarter Quarter (In thousands, except per share amounts)

Year Ended December 31, 2003 Net sales (a) ...$745,283 Gross profit ...368,006 Advertising and promotion expenses ...83,806 Other selling and ...

-

Page 97

... of operations. Close out sales are sales of certain products that are no longer included in current product lines. These sales were previously classified as a reduction of cost of sales. Commencing October 1, 2003, close out sales are reported as net sales in Mattel's consolidated statements...

-

Page 98

...,144 8,419

In May 1999, Mattel merged with Learning Company, with Mattel being the surviving corporation. This transaction was accounted for as a pooling of interests. On March 31, 2000, Mattel's board of directors resolved to dispose of its Consumer Software segment, which was comprised primarily...

-

Page 99

...enterprise value at the end of five years. In 2001, Mattel received proceeds totaling $10.0 million from Gores Technology Group as a result of liquidation events related to Gores Technology Group's sale of the entertainment and education divisions of the former Learning Company. Mattel also incurred...

-

Page 100

... employees (the "finance code of ethics"). The Code of Conduct is publicly available on Mattel's corporate website at www.mattel.com. A copy may also be obtained free of charge by mailing a request in writing to: Secretary, Mail Stop M1-1516, Mattel, Inc., 333 Continental Blvd., El Segundo, CA...

-

Page 101

... 50 52 53 54 55

Agreement and Plan of Merger, dated as of December 13, 1998, between Mattel and The Learning Company, Inc. (incorporated by reference to Exhibit 2.1 to Mattel's Current Report on Form 8-K dated December 15, 1998) Sale and Purchase Agreement between Mattel and Alec E. Gores, Trustee...

-

Page 102

...Executive Compensation Plans and Arrangements of Mattel 10.7 Form of Indemnity Agreement between Mattel and its directors and certain of its executive officers (incorporated by reference to Exhibit 10.9 to Mattel's Annual Report on Form 10-K for the year ended December 31, 2000) Executive Employment...

-

Page 103

...) Amendment to Employment Agreement and Stock Option Grant Agreements between Mattel and Matthew C. Bousquette dated February 10, 2000 (incorporated by reference to Exhibit 10.11 to Mattel's Annual Report on Form 10-K for the year ended December 31, 1999) Executive Employment Agreement dated January...

-

Page 104

...49 to Mattel's Annual Report on Form 10-K for the year ended December 31, 2001) Amendment No. 1 to the 1990 Plan (incorporated by reference to the information under the heading "Amendment to Mattel 1990 Stock Option Plan" on page F-1 of the Joint Proxy Statement/Prospectus of Mattel and Fisher-Price...

-

Page 105

... to Exhibit 10.60 to Mattel's Annual Report on Form 10-K for the year ended December 31, 2000) Notice of Grant of Stock Options and Grant Agreement under the 1990 Plan (incorporated by reference to Exhibit 10.61 to Mattel's Annual Report on Form 10-K for the year ended December 31, 2000) Grant...

-

Page 106

...ended December 31, 2000) Amendment No. 3 to the 1999 Plan (incorporated by reference to Exhibit 99.2 to Mattel's Quarterly Report on Form 10-Q for the quarter ended June 30, 2002) Form of Option Grant Agreement (Three Year Vesting) under the 1999 Plan, as amended Computation of Income per Common and...

-

Page 107

... to stockholders of Mattel without charge. Copies of other exhibits can be obtained by stockholders of Mattel upon payment of twelve cents per page for such exhibits. Written requests should be sent to: Secretary, Mail Stop M1-1516, Mattel, Inc., 333 Continental Boulevard, El Segundo, CA 90245-5012...

-

Page 108

....

Signature Title Date

/s/

ROBERT A. ECKERT Robert A. Eckert KEVIN M. FARR Kevin M. Farr

Chairman of the Board and Chief Executive Officer Chief Financial Officer (principal financial officer) Senior Vice President and Corporate Controller (principal accounting officer) Director

March 12...

-

Page 109

Signature

Title

Date

/s/

TULLY M. FRIEDMAN Tully M. Friedman RONALD M. LOEB Ronald M. Loeb ANDREA L. RICH Andrea L. Rich

Director

March 12, 2004

/s/

Director

March 12, 2004

/s/

Director

March 12, 2004

/s/

CHRISTOPHER A. SINCLAIR Christopher A. Sinclair /s/ G. CRAIG SULLIVAN G. Craig ...

-

Page 110

... II MATTEL, INC. AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS AND ALLOWANCES

Balance at Beginning of Year Additions Charged to Net Operations Deductions (In thousands) Balance at End of Year

Allowance for Doubtful Accounts Year ended December 31, 2003 ...Year ended December 31, 2002 ...Year...

-

Page 111

...May 1999 merger with The Learning Company, Inc. ("Learning Company"), accounted for as a pooling of interests. As more fully described in Note 14 to the consolidated financial statements, the Consumer Software segment, which was comprised primarily of Learning Company, was reported as a discontinued...

-

Page 112

... the May 1999 merger with Learning Company, accounted for as a pooling of interests. As more fully described in Note 14 to the consolidated financial statements, the Consumer Software segment, which was comprised primarily of Learning Company, was reported as a discontinued operation effective March...

-

Page 113

... 3.53X $168,234 2.34X

(a) Although Mattel merged with The Learning Company, Inc. ("Learning Company") in May 1999, the results of operations of Learning Company have not been included in this calculation since the Consumer Software segment was reported as a discontinued operation effective March 31...

-

Page 114

... $148,090

8.63X

5.76X

3.53X

2.34X

2.12X

(a) Although Mattel merged with Learning Company in May 1999, the results of operations of Learning Company have not been included in this calculation since the Consumer Software segment was reported as a discontinued operation effective March 31, 2000...

-

Page 115

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who...

-

Page 116

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who...

-

Page 117

...

Managing Director, Manticore Partners, LLC and Chairman, Scandent Group Holdings, Mauritius

Ellen L. Brothers

President, American Girl and Executive Vice President

G. Craig Sullivan (2) (6)

Former Chairman and Chief Executive Officer, The Clorox Company

Neil B. Friedman

President, Fisher-Price...

-

Page 118