Lockheed Martin 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOCKHEED MARTIN CORPORATION

2013 ANNUAL REPORT

LOCKHEED MARTIN CORPORATION

2013 Annual Report

Table of contents

-

Page 1

LOCKHEED MARTIN CORPORATION 2013 ANNUAL REPORT LOCKHEED MARTIN CORPORATION 2013 Annual Report -

Page 2

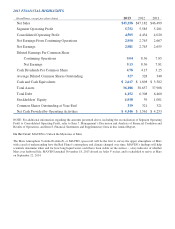

...Per Common Share Continuing Operations Net Earnings Cash Dividends Per Common Share Average Diluted Common Shares Outstanding Cash and Cash Equivalents Total Assets Total Debt Stockholders' Equity Common Shares Outstanding at Year-End Net Cash Provided by Operating Activities 2013 2012 2011 $45,358... -

Page 3

... into higher operating margins, stronger cash flows and a record backlog. In short, we created value for our stockholders, delivered cutting-edge products for our customers, and positioned Lockheed Martin for the future. Our Leadership Team: From left to right: Orlando P. Carvalho, Executive Vice... -

Page 4

... stock closed the year at $148.66 per share, up from $92.29 per share at the close of 2012 - a 61 percent increase. In total, we generated a 68 percent total stockholder return, a result of continued outstanding financial performance and a strong dividend yield. Financial highlights include Sales... -

Page 5

... success. Our major areas of focus are growing internationally, improving our affordability and innovating for growth. Growing Internationally: Lockheed Martin is a global company. We do business in 70 nations around the world and have more than 1,000 global partnerships. III 2013 AnnuAl RepoRt -

Page 6

...We acquired the Amor Group, a United Kingdom-based company that expands our capabilities in information technology solutions for the energy, transport and public services sectors. And we won a number of international contracts, including the renewal of our air traffic control work in the UK, C-130Js... -

Page 7

... potential for producing energy. In 2013 we signed a contract with Reignwood Group to develop and build a 10-megawatt OTEC power plant. This plant will be the largest OTEC project developed to date, and represents a new adjacent market growth opportunity for the Corporation. For our ongoing... -

Page 8

... Sondra L. Barbour Executive Vice President Information Systems & Global Solutions Dale P. Bennett Executive Vice President Mission Systems and Training Orlando P. Carvalho Executive Vice President Aeronautics Patrick M. Dewar Executive Vice President Lockheed Martin International Richard H. Edwards... -

Page 9

... ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 Commission file number 1-11437 LOCKHEED MARTIN CORPORATION (Exact name of registrant as specified in its charter) Maryland (State or other jurisdiction of incorporation... -

Page 10

... and Financial Statement Schedules ...90 95 Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence... -

Page 11

...a global security and aerospace company principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. We also provide a broad range of management, engineering, technical, scientific, logistic, and information... -

Page 12

... systems and expertise, integrated information technology solutions, and management services across a broad spectrum of applications for civil, defense, intelligence, and other government customers. In addition, IS&GS supports the needs of customers in data analytics, cyber security, air traffic... -

Page 13

...logistics support services to the special operations forces of the U.S. military. MFC's technical services business provides a comprehensive portfolio of technical and sustainment services to enhance our customers' mission success, with core markets in engineering services; global aviation solutions... -

Page 14

... include the value of our products and services to the customer; technical and management capability; the ability to develop and implement complex, integrated system architectures; financing and total cost of ownership; our demonstrated ability to execute and perform against contract requirements... -

Page 15

... products, services, and technical data; and require the review and approval of contractor business systems, defined in the regulations as: (i) Accounting System; (ii) Estimating System; (iii) Earned Value Management System, for managing cost and schedule performance on certain complex programs... -

Page 16

... in 2013, $616 million in 2012, and $585 million in 2011. See "Research and development and similar costs" in "Note 1 - Significant Accounting Policies" of our consolidated financial statements. Employees At December 31, 2013, we had approximately 115,000 employees, about 95% of whom were located in... -

Page 17

...disruption of operating activities. Management considers employee relations to be good. Available Information We are a Maryland corporation and were formed in 1995 by combining the businesses of Lockheed Corporation and Martin Marietta Corporation. Our principal executive offices are located at 6801... -

Page 18

..., changes in security, defense, and intelligence priorities, the affordability of our products and services, general economic conditions and developments, and other factors may affect a decision to fund or the level of funding for existing or proposed programs. The Budget Control Act of 2011 (Budget... -

Page 19

... of Financial Condition and Results of Operations. Based upon our diverse range of defense, homeland security, and information technology products and services, we believe that this makes it less likely that cuts in any specific contract or program will have a long-term effect on our business... -

Page 20

...contracts and programs, our performance, our ability to control costs, and evolving U.S. Government procurement policies. Our profitability and cash flow may vary materially depending on the types of long-term government contracts undertaken, the nature of the products produced or services performed... -

Page 21

...level of allowable employee compensation, which will reduce our operating profit. Other policies could negatively impact our working capital and cash flow. For example, the government has expressed a preference for requiring progress payments rather than performance based payments on new fixed-price... -

Page 22

... our control. Our business involves significant risks and uncertainties that may not be covered by indemnity or insurance. A significant portion of our business relates to designing, developing, and manufacturing advanced defense and technology products and systems. New technologies may be untested... -

Page 23

... the affordability of our products and services. Many of our employees are covered by defined benefit pension plans, and we provide certain health care and life insurance benefits to eligible retirees. The impact of these plans on our U.S. generally accepted accounting principles (GAAP) earnings may... -

Page 24

... resources. We have an ongoing comprehensive program to reduce the effects of our operations on the environment. We manage various government-owned facilities on behalf of the government. At such facilities, environmental compliance and remediation costs historically have been the responsibility of... -

Page 25

..." of our consolidated financial statements. In order to be successful, we must attract and retain key employees and manage leadership transitions effectively. Our business has a continuing need to attract and retain large numbers of skilled personnel, including personnel holding security clearances... -

Page 26

... profitability and cash flows. For example, proposals to lower the U.S. corporate income tax rate would require us to reduce our net deferred tax assets upon enactment of the related tax legislation, with a corresponding material, one-time increase to income tax expense, but our income tax expense... -

Page 27

...2013; President, Information Systems & Global Solutions Security from January 2011 to June 2012; and Vice President and General Manager, Space Systems - Surveillance and Navigations Systems from January 2008 to December 2010. Sondra L. Barbour (age 51), Executive Vice President - Information Systems... -

Page 28

... 2011 to March 2012; President, Mission Systems & Sensors from January 2010 to July 2011; and Vice President and General Manager, Surface Systems Ballistic Missile Defense Programs from January 2006 to January 2010. Patrick M. Dewar (age 53), Executive Vice President - Lockheed Martin International... -

Page 29

... 31, 2014, there were 33,547 holders of record of our common stock. The following table sets forth the high and low intra-day trading prices of our common stock as reported on the NYSE and cash dividends paid each quarter within the past two years. Dividends Paid Per Share 2013 2012 $1.15 $1.00... -

Page 30

... make purchases under the Program pursuant to a Rule 10b5-1 plan. The Program does not have an expiration date. During the quarter ended December 31, 2013, the total number of shares purchased included 58,627 shares that were transferred to us by employees in satisfaction of minimum tax withholding... -

Page 31

... flows and cash balance between each of those years. Fluctuations in our total assets, total liabilities, and stockholders' equity between years from 2010 to 2013 primarily were due to the annual measurement of the funded status of our postretirement benefit plans at the end of 2013, 2012, and 2011... -

Page 32

...a global security and aerospace company principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. We also provide a broad range of management, engineering, technical, scientific, logistic, and information... -

Page 33

... to finance all activities through September 30, 2014, the end of its current fiscal year, after operating under continuing resolution temporary funding measures from October 1, 2013 to January 18, 2014. The budget provides discretionary defense spending at levels consistent with the planned defense... -

Page 34

... our eight international partners and two international customers; as well as expressions of interest from other countries. On the development contract, the U.S. Government continues to complete various operational tests, including ship trials, mission system evaluations, and weapons testing, with... -

Page 35

... We paid $269 million and $259 million in 2013 and 2012 for acquisition activities, primarily related to the acquisition of businesses. In 2013, we acquired Amor Group, a United Kingdom-based company specializing in information technology, civil government services, and the energy market. This... -

Page 36

... operating margins of our "Business Segment Results of Operations" but are excluded from the consolidated net sales and cost of sales tables below. Net Sales Products sales are predominantly generated in our Aeronautics, MFC, MST, and Space Systems business segments, and most of our services sales... -

Page 37

... technical services programs due to lower volume, partially offset by various fire control programs (primarily Special Operations Forces Contractor Logistics Support Services (SOF CLSS)) due to higher volume. Services sales for 2013 were comparable to 2012 at both MST and Space Systems. Our services... -

Page 38

... Hanford contracts in 2011. Goodwill Impairment Charge In the fourth quarter of 2013, we recorded a non-cash goodwill impairment charge of $195 million, net of state tax benefits, which reduced our net earnings by $176 million ($.54 per share). The charge related to the Technical Services reporting... -

Page 39

.../CAS pension expense, stock-based compensation, and other corporate costs. These costs are not allocated to the business segments and, therefore, are excluded from the costs of products and services sales (see "Note 4 - Information on Business Segments" of our consolidated financial statements for... -

Page 40

... Expense Our effective income tax rate from continuing operations was 29.0% for 2013, 32.6% for 2012, and 26.5% for 2011. The rates generally benefit from tax deductions for U.S. manufacturing activities and tax deductions for dividends paid to our defined contribution plans with an employee stock... -

Page 41

... our book basis. This tax benefit was largely offset by operating losses and other adjustments. For more information, see "Note 14 - Acquisitions and Divestitures" of our consolidated financial statements. Business Segment Results of Operations We operate in five business segments: Aeronautics, IS... -

Page 42

...Mission Systems and Training Space Systems Total net sales Operating profit Aeronautics Information Systems & Global Solutions Missiles and Fire Control Mission Systems and Training Space Systems Total business segment operating profit Unallocated expenses, net FAS/CAS pension adjustment FAS pension... -

Page 43

... operating margins may be impacted by changes in profit booking rates on our contracts accounted for using the percentage-of-completion method of accounting. Increases in the profit booking rates, typically referred to as risk retirements, usually relate to revisions in the total estimated costs... -

Page 44

Aeronautics Our Aeronautics business segment is engaged in the research, design, development, manufacture, integration, sustainment, support, and upgrade of advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles, and related technologies. Aeronautics' major ... -

Page 45

... net sales from F-35 production contracts. Operating profit is expected to increase slightly from 2013, resulting in a slight decrease in operating margins between the years due to program mix. Information Systems & Global Solutions Our IS&GS business segment provides advanced technology systems and... -

Page 46

... tactical missiles and air-to-ground precision strike weapon systems; logistics and other technical services; fire control systems; mission operations support, readiness, engineering support, and integration services; and manned and unmanned ground vehicles. MFC's major programs include PAC-3, THAAD... -

Page 47

... in expected risk retirements in 2014. Accordingly, operating profit margin is expected to slightly decline from 2013. Mission Systems and Training Our MST business segment provides ship and submarine mission and combat systems; mission systems and sensors for rotary and fixed-wing aircraft; sea and... -

Page 48

...incremental costs related to the November 2013 restructuring plan as described in the "Consolidated Results of Operations" section above, resulting in a decline in operating margins between the years. Space Systems Our Space Systems business segment is engaged in the research and development, design... -

Page 49

...Alliance (ULA), which provides expendable launch services to the U.S. Government. Space Systems' operating results included the following (in millions): Net sales Operating profit Operating margins Backlog at year-end 2013 compared to 2012 Space Systems' net sales for 2013 decreased $389 million, or... -

Page 50

... expense and incremental costs related to the November 2013 restructuring plan as described in the "Consolidated Results of Operations" section above, and lower equity earnings. As a result, operating margins are expected to decline between the years. Liquidity and Cash Flows We have a balanced cash... -

Page 51

... reduce leased facilities. We also incur capital expenditures for information technology to support programs and general enterprise information technology infrastructure, inclusive of costs for development or purchase of internal-use software. The following table provides a summary of our cash flow... -

Page 52

... outstanding during the year ended December 31, 2013. If we were to issue commercial paper, the borrowings would be supported by the credit facility. We also have an effective shelf registration statement on Form S-3 on file with the U.S. Securities and Exchange Commission through August 2014... -

Page 53

... under our share repurchase program, additional paid-in capital was reduced to zero, with the remainder of the excess purchase price over par value of $434 million recorded as a reduction of retained earnings. Contractual Commitments and Off-Balance Sheet Arrangements At December 31, 2013, we had... -

Page 54

... customer and typically require cash outlays that represent only a fraction of the original amount in the offset agreement. At December 31, 2013, the remaining obligations under our outstanding offset agreements totaled $9.9 billion, which primarily relate to our Aeronautics, MFC, and MST business... -

Page 55

... on our performance. Under time-and-materials contracts, which accounted for about 5% of our total net sales in 2013, 2012, and 2011, we are paid a fixed hourly rate for each direct labor hour expended, and we are reimbursed for allowable material costs and allowable out-of-pocket expenses. To the... -

Page 56

...; asset impairments; and insurance recoveries; among others. Segment operating profit and items such as risk retirements, reductions of profit booking rates, or other matters are presented net of state income taxes. Services Method of Accounting Under a fixed-price service contract, we are paid... -

Page 57

... postretirement benefit plan expense for the following calendar year are the discount rate, the expected long-term rate of return on plan assets, employee turnover, and participant mortality estimates for all postretirement benefit plans; the expected rates of increase in future compensation levels... -

Page 58

... benefit obligations at December 31, 2013 related to our retiree medical plans, compared to 3.75% at the end of 2012 and 4.50% at the end of 2011. We evaluate several data points in order to arrive at an appropriate discount rate, including results from cash flow models, quoted rates from long-term... -

Page 59

...billion as CAS cost on our contracts and expect to make contributions of $1.0 billion related to our qualified defined benefit pension plans, which would increase our cash flow from operations. We expect our required contributions to continue to be temporarily lowered in 2014 and 2015 as a result of... -

Page 60

..., in either California or at the federal level, we expect a material increase in our estimates for environmental liabilities and the related assets for the portion of the increased costs that are probable of future recovery in the pricing of our products and services for the U.S. Government. The... -

Page 61

... on existing firm orders, expected future orders, contracts with suppliers, labor agreements, and general market conditions; changes in working capital; most recent long-term business plans in place at the time of our testing date; and recent operating performance. The discount rates utilized in the... -

Page 62

... compensation plans. As of December 31, 2013, investments in the trust totaled $1.0 billion and are reflected at fair value on our Balance Sheet in other noncurrent assets. The trust holds investments in marketable equity securities and fixed-income securities that are exposed to price changes... -

Page 63

... consolidated balance sheets of Lockheed Martin Corporation as of December 31, 2013 and 2012, and the related consolidated statements of earnings, comprehensive income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2013. These financial statements... -

Page 64

Lockheed Martin Corporation Consolidated Statements of Earnings (in millions, except per share data) Years Ended December 31, 2012 2011 $ 37,817 9,365 47,182 (33,495) (8,383) - (48) (1,060) (42,986) 4,196 238 4,434 (383) 21 4,072 (1,327) 2,745 - $ 2,745 $ 36,925 9,574 46,... -

Page 65

Lockheed Martin Corporation Consolidated Statements of Comprehensive Income (in millions) Years Ended December 31, 2012 2011 $ 2,745 $ 2,655 Net earnings Other comprehensive income (loss), net of tax Postretirement benefit plans: Unrecognized amounts, net of tax (expense) benefit of $(1.6) billion ... -

Page 66

Lockheed Martin Corporation Consolidated Balance Sheets (in millions, except par value) December 31, 2013 2012 Assets Current assets Cash and cash equivalents Receivables, net Inventories, net Deferred income taxes Other current assets Total current assets Property, plant, and equipment, net ... -

Page 67

Lockheed Martin Corporation Consolidated Statements of Cash Flows (in millions) Years Ended December 31, 2012 2011 $ 2,745 $ 2,655 2013 Operating activities Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation and amortization Stock-based ... -

Page 68

Lockheed Martin Corporation Consolidated Statements of Stockholders' Equity (in millions, except per share data) Additional Paid-In Capital $ - - - (589) - 589 - - - (889) - 889 - - - (1,294) - 1,294 $ - Accumulated Other Comprehensive Loss $ (9,010) - (2,247) - - - (11,257) - (2,236) - - - (13,493)... -

Page 69

... to Consolidated Financial Statements Note 1 - Significant Accounting Policies Organization - We are a global security and aerospace company principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. We... -

Page 70

...09 per share) in 2013, $1.2 billion ($3.70 per share) in 2012, and $1.0 billion ($3.00 per share) in 2011. Services Method of Accounting - For cost-reimbursable contracts for services to non-U.S. Government customers, we record net sales as services are performed, except for award and incentive fees... -

Page 71

...long-term contracts and programs in progress represent recoverable costs incurred for production or contract-specific facilities and equipment, allocable operating overhead, advances to suppliers and, in the case of contracts with the U.S. Government and substantially all other governments, research... -

Page 72

... on existing firm orders, expected future orders, contracts with suppliers, labor agreements, and general market conditions; changes in working capital; most recent long-term business plans in place at the time of our testing date; and recent operating performance. The discount rates utilized in the... -

Page 73

... to fund our deferred compensation plan liabilities. Net gains on trading securities in 2013, 2012, and 2011 were $64 million, $67 million, and $40 million. Gains and losses on these investments are included in other unallocated costs within cost of sales on our Statements of Earnings in order to... -

Page 74

... related to our Information Systems & Global Solutions (IS&GS), Mission Systems and Training (MST), and Space Systems business segments. These charges reduced our net earnings by $130 million ($.40 per share) and primarily related to a plan we committed to in November 2013 to close and consolidate... -

Page 75

...segments: • Aeronautics - Engaged in the research, design, development, manufacture, integration, sustainment, support, and upgrade of advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles, and related technologies. • Information Systems & Global Solutions... -

Page 76

... net sales Operating profit Aeronautics Information Systems & Global Solutions Missiles and Fire Control Mission Systems and Training Space Systems Total business segment operating profit Unallocated expenses, net FAS/CAS pension expense Goodwill impairment charge (a) Severance charges (b) Stock... -

Page 77

Selected Financial Data by Business Segment (continued) Net Sales by Customer Category Net sales by customer category were as follows (in millions): 2013 U.S. Government Aeronautics Information Systems & Global Solutions Missiles and Fire Control Mission Systems and Training Space Systems Total U.S.... -

Page 78

... Financial Data by Business Segment (continued) Total assets, goodwill, and customer advances and amounts in excess of costs incurred for each of our business segments were as follows (in millions): 2013 Assets (a) Aeronautics Information Systems & Global Solutions Missiles and Fire Control Mission... -

Page 79

... our net sales and cost of sales. As a result, the impact of certain transactions on our operating profit and of other matters presented in these financial statements is disclosed net of state income taxes. Our total net state income tax expense was $121 million for 2013, $183 million for 2012, and... -

Page 80

...recognized additional tax benefits and reduced our income tax expense for 2011 by $89 million ($.26 per share). We participate in the IRS Compliance Assurance Process program. The IRS examinations of the years 2012, 2011, and 2010 were completed in the fourth quarter of 2013, 2012, and 2011. We also... -

Page 81

... in 2013. In 2011, we repurchased $84 million of our long-term notes through open-market purchases. We paid premiums of $48 million in connection with the early extinguishments of debt, which were recognized in other non-operating income (expense), net. At December 31, 2013 and 2012, we had in place... -

Page 82

...1,821 Retiree Medical and Life Insurance Plans 2013 2012 2011 $ 27 $ 28 $ 32 116 131 162 (145) (131) (140) 44 32 34 (17) (12) (16) $ 25 $ 48 $ 72 Service cost Interest cost Expected return on plan assets Recognized net actuarial losses Amortization of prior service cost (credit) and other Total net... -

Page 83

... status related to our qualified defined benefit pension plans and our retiree medical and life insurance plans (in millions): Qualified Defined Benefit Pension Plans 2013 2012 Change in benefit obligation Beginning balance Service cost Interest cost Benefits paid (a) Actuarial losses (gains) Plan... -

Page 84

...qualified defined benefit pension plans and retiree medical and life insurance plans as described below. The following table provides the amounts recognized in other comprehensive income (loss) related to postretirement benefit plans, net of tax, for the years ended December 31, 2013, 2012, and 2011... -

Page 85

... 4.30% Retiree Medical and Life Insurance Plans 2013 2012 2011 4.50% 3.75% 4.50% 8.00% 8.00% 8.00% 8.75% 5.00% 2029 9.00% 5.00% 2029 9.50% 5.00% 2021 Discount rate Expected long-term rate of return on assets Rate of increase in future compensation levels Health care trend rate assumed for next year... -

Page 86

...fair values estimated using significant unobservable inputs. December 31, 2013 Level 1 Level 2 Level 3 Total Cash and cash equivalents (a) Equity (a): U.S. equity securities International equity securities Commingled equity funds Fixed income (a): Corporate debt securities U.S. Government securities... -

Page 87

... closing prices on the last trading day of the year. Contributions and Expected Benefit Payments We generally determine funding requirements for our defined benefit pension plans in a manner consistent with CAS and Internal Revenue Code rules. In 2013, we made contributions of $2.25 billion related... -

Page 88

... our share repurchase program, additional paid-in capital was reduced to zero, with the remainder of the excess purchase price over par value of $434 million and $108 million recorded as a reduction of retained earnings in 2013 and 2012. Accumulated Other Comprehensive Loss Changes in the balance of... -

Page 89

... to the closing market price of our common stock on the date of grant less a discount to reflect the delay in payment of dividend-equivalent cash payments. We recognize the grant-date fair value of RSUs, less estimated forfeitures, as compensation expense ratably over the requisite service period... -

Page 90

...on the number of awards expected to vest at each reporting date and, therefore, the associated compensation expense recognized could vary from year to year. The remaining PSUs were valued at $61.13 per PSU using a Monte Carlo model as the performance target is related to our total shareholder return... -

Page 91

... such factors as changing remediation technologies and continually evolving regulatory environmental standards. There are a number of former operating facilities that we are monitoring or investigating for potential future remediation. We perform quarterly reviews of the status of our environmental... -

Page 92

..., in either California or at the federal level, we expect a material increase in our estimates for environmental liabilities and the related assets for the portion of the increased costs that are probable of future recovery in the pricing of our products and services for the U.S. Government. The... -

Page 93

... Acquisitions We paid $269 million and $259 million in 2013 and 2012 for acquisition activities. Acquisitions in 2013 primarily related to the acquisition of Amor Group, a United Kingdom-based company specializing in information technology, civil government services, and the energy market and has... -

Page 94

... of our non-qualified deferred compensation plans and are recorded in other noncurrent assets on our Balance Sheets. The fair values of equity securities and mutual funds are determined by reference to the quoted market price per unit in active markets multiplied by the number of units held without... -

Page 95

...key Corporate functions, under the supervision of the Chief Executive Officer (CEO) and Chief Financial Officer (CFO). Based on this evaluation, the CEO and CFO concluded that our disclosure controls and procedures were operating and effective as of December 31, 2013. Management's Report on Internal... -

Page 96

...Accounting Oversight Board (United States), the consolidated balance sheets of Lockheed Martin Corporation as of December 31, 2013 and 2012, and the related consolidated statements of earnings, comprehensive income, stockholders' equity, and cash flows for each of the three years in the period ended... -

Page 97

..., by contacting Investor Relations, Lockheed Martin Corporation, 6801 Rockledge Drive, Bethesda, Maryland 20817. We are required to disclose any change to, or waiver from, our Code of Ethics and Business Conduct for our Chief Executive Officer and senior financial officers. We use our website to... -

Page 98

... Equity - Years ended December 31, 2013, 2012, and 2011 ...Notes to Consolidated Financial Statements ... 56 57 58 59 60 61 The report of Lockheed Martin Corporation's independent registered public accounting firm with respect to the abovereferenced financial statements and their report on internal... -

Page 99

...'s Annual Report on Form 10-K for the year ended December 31, 2012). Lockheed Martin Corporation 2006 Management Incentive Compensation Plan (Performance Based), as amended (incorporated by reference to Exhibit 10.2 to Lockheed Martin Corporation's Current Report on Form 8-K filed with the SEC on... -

Page 100

... for the year ended December 31, 2012). Lockheed Martin Corporation Executive Severance Plan, prior to November 1, 2013, known as the Lockheed Martin Corporation Severance Benefit Plan for Certain Management Employees. Lockheed Martin Corporation 2009 Directors Equity Plan (incorporated by reference... -

Page 101

...dated February 7, 2013, and executed by Ms. Gooden on February 8, 2013 (incorporated by reference to Exhibit 10.2 of Lockheed Martin Corporation's Current Report on Form 8-K filed with the SEC on February 12, 2013). Lockheed Martin Corporation 2006 Management Incentive Compensation Plan (Performance... -

Page 102

....CAL 101.DEF 101.LAB 101.PRE * Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm. Powers of Attorney. Certification of Marillyn A. Hewson pursuant to Section 302 of the Sarbanes...10.21 through 10.47 constitute management contracts or compensatory plans or arrangements. 94 -

Page 103

... the undersigned, thereunto duly authorized. Lockheed Martin Corporation (Registrant) Date: February 14, 2014 By: Christopher J. Gregoire Vice President, Controller, and Chief Accounting Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by... -

Page 104

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 105

... to record, process, summarize, and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. (b) Marillyn A. Hewson Chief Executive Officer Date... -

Page 106

...to record, process, summarize, and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. (b) Bruce L. Tanner Chief Financial Officer Date: February... -

Page 107

... with the Annual Report of Lockheed Martin Corporation (the "Corporation") on Form 10-K for the period ended December 31, 2013, as filed with the U.S. Securities and Exchange Commission on the date hereof (the "Report"), I, Marillyn A. Hewson, Chief Executive Officer of the Corporation, and I, Bruce... -

Page 108

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 109

... plan, provides new investors and current stockholders with a convenient, cost-effective way to purchase Lockheed Martin common stock, increase holdings and manage the investment. For more information about Lockheed Martin Direct Invest, contact our transfer agent, Computershare Trust Company... -

Page 110

Lockheed Martin Corporation 6801 Rockledge Drive Bethesda, MD 20817 www.lockheedmartin.com The cover and insert of this report are printed on Rolland Enviro100 Print, which contains 100% post-consumer ï¬bre, is manufactured in Canada using renewable biogas energy and is certiï¬ed EcoLogo, ...