Lockheed Martin 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United We Serve

Annual Report 2001

Table of contents

-

Page 1

United We Serve Annual Report 2001 -

Page 2

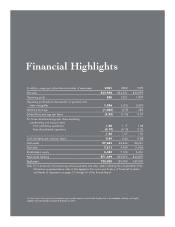

... items and other matters affecting the comparability of the information presented above, refer to Management's Discussion and Analysis of Financial Condition and Results of Operations on pages 21 through 41 of this Annual Report. On The Cover: To carry out their critical missions, pilots require... -

Page 3

... of Lockheed Martin renew their commitment to making our company the world's best advanced technology systems integrator, serving our customers at their defining moments. Contents To Our Shareholders 3 Financial Section 21 Corporate Directory 71 General Information 73 Lockheed Martin Annual Report... -

Page 4

... the Systems Integration business area, our Patriot Advanced Capability-3 (PAC-3) Missile successfully completed development testing and continues in low-rate production; in the Space Systems Company, we delivered the first Atlas V launcher on schedule to Cape Canaveral; and our Technology Services... -

Page 5

.... March 1, 2002 >>> 5 Lockheed Martin Annual Report technology services to state and local governments, for $825 million in pre-tax proceeds. Since 1999, our six key divestitures have contributed more than $3 billion in pre-tax proceeds. The sale of IMS completes our divestiture plans announced in... -

Page 6

...Lockheed Martin Annual Report When our nation calls, the men and women of the armed forces respond with a steadfast commitment to serve, inspiring courage and love of the ideals that keep America strong. At Lockheed Martin, we offer our gratitude to those who wear the uniforms of the armed services... -

Page 7

...new requirements posed by a world in transformation. Lockheed Martin serves air traffic management customers, such as the Federal Aviation Administration, with state-of-the-art software and hardware that is modernizing air traffic control for safer, more efficient air travel. Lockheed Martin Annual... -

Page 8

... Lockheed Martin Annual Report Lockheed Martin people are dedicated to serving those who are at the front lines of freedom's fight. We apply transformational technology and systems integration expertise so America and its allies can meet the security challenges of the 21st Century. -

Page 9

... or control the skies in the event of combat. Lockheed Martin Annual Report -

Page 10

... are qualities that America's pioneers in space have used to meet the great challenges of exploration, bringing the benefits of space to people on Earth in their everyday lives. Lockheed Martin has a long history >>> 14 >>> 15 Lockheed Martin Annual Report of supporting America's space program and... -

Page 11

...those goals with state-of-the-art e-government solutions. The result: efficient, accurate and timely delivery of Social Security benefits. Lockheed Martin Annual Report -

Page 12

...the partner of choice, with customers and alliances in over 30 countries, focusing on mutual benefit, as well as new technologies and quality jobs in-country. >>> 18 Lockheed Martin Annual Report -

Page 13

... Cash Flows Consolidated Balance Sheet Consolidated Statement of Stockholders' Equity >>> 20 Inside Front Cover 21 42 43 44 45 46 47 48 69 74 Notes to Consolidated Financial Statements Consolidated Financial Data-Five Year Summary Forward-Looking Statements-Safe Harbor Provisions Lockheed Martin... -

Page 14

..., products and services. The Corporation serves customers in both domestic and international defense and commercial markets, with its principal customers being agencies of the U.S. Government. The following discussion should be read in conjunction with the audited consolidated financial statements... -

Page 15

... OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Lockheed Martin Corporation December 31, 2001 Lockheed Martin's broad mix of programs and capabilities makes it a likely beneficiary of any increases in defense spending. The Corporation's product areas and programs include missile defense, space... -

Page 16

... denial of export privileges. Management is currently unaware of any violations of export control regulations which could have a material adverse effect on the Corporation's business or its consolidated results of operations, cash flows or financial position. Lockheed Martin Annual Report >>> 23 -

Page 17

... a result of the above actions, the Global Telecommunications segment will no longer be reported as a separate business segment. The Corporation recognized nonrecurring and unusual charges, net of state income tax benefits, totaling approximately $2.0 billion in the fourth quarter of 2001 related to... -

Page 18

...Corporation's consolidated financial statements. Discontinued Operations The $2.0 billion in charges recorded in the fourth quarter of 2001 included charges, net of state income tax benefits, of approximately $1.4 billion related to certain global telecommunications services businesses held for sale... -

Page 19

...results of operations and related gains or losses associated with businesses divested prior to January 1, 2001, the effective date of the Corporation's adoption of SFAS No. 144, including the divestitures of the Corporation's Aerospace Electronics Systems (AES) businesses and Lockheed Martin Control... -

Page 20

... and state income tax payments. Net sales included in the year 2000 related to the AES businesses totaled approximately $655 million, excluding intercompany sales. In September 2000, the Corporation sold Lockheed Martin Control Systems (Control Systems) to BAE SYSTEMS for $510 million in cash. This... -

Page 21

... AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Lockheed Martin Corporation December 31, 2001 In September 1999, the Corporation sold its interest in Airport Group International Holdings, LLC which resulted in a nonrecurring and unusual gain, net of state income taxes, of $33 million... -

Page 22

..., Space Systems and Technology Services segments were more than offset by lower sales in the Aeronautics segment. Adjusting for acquisitions and divestitures, sales remained comparable when comparing 2001 to 2000 and 2000 to 1999. The U.S. Government remained the Corporation's largest customer... -

Page 23

...per diluted share) related to the Corporation's decision to exit the Global Telecommunications services business. The 2001 results also include a nonrecurring and unusual after-tax gain of $309 million ($0.71 per diluted share) from the third quarter 2001 sale of Lockheed Martin IMS Corporation. The... -

Page 24

...) 2001 2000 1999 Segment effects of nonrecurring and unusual items-operating (loss) profit Systems Integration $ Space Systems Aeronautics Technology Services Corporate and Other $ - (3) - - (915) (918) $ (304) 25 - (34) (226) (539) $ 13 21 - - 215 249 $ $ Lockheed Martin Annual Report... -

Page 25

... THAAD program's movement into the engineering, manufacturing and development (EMD) phase. These increases were partially offset by a reduction in sales of $410 million primarily related to the divestiture of the AES and Control Systems businesses in 2000. Lockheed Martin Annual Report Operating... -

Page 26

... Area Review team recommendations, provided for a more balanced sharing of future risk. The improved performance on the program resulted from the successful implementation of corrective actions and initiatives taken since the previously mentioned 1999 Titan IV launch failure. Space Systems operating... -

Page 27

... with its divestiture in July 2001. The decline in net sales from 1999 was primarily due to reduced volume in the segment's properties line of business and the absence in 2000 of sales attributable to the Corporation's commercial graphics company, Real 3D, which was divested in the fourth quarter of... -

Page 28

... of backlog associated with the segment's AES and Control Systems businesses, which were divested during Lockheed Martin Annual Report Backlog Systems Integration Space Systems Aeronautics Technology Services >>> 35 Backlog Total negotiated backlog of $71.3 billion at December 31, 2001 included... -

Page 29

...AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Lockheed Martin Corporation December 31, 2001 for NASA programs, primarily the Consolidated Space Operations Contract. This decrease was mostly offset by increased orders associated with government information technology services and the... -

Page 30

... from the disposal of property, plant and equipment and by income taxes paid related to divested businesses and investments. Free cash flow was $2.0 billion for 2001 and $1.8 billion for 2000. Capital Structure and Resources Total debt, including short-term borrowings, decreased by approximately... -

Page 31

.... Lockheed Martin Annual Report The Corporation has entered into standby letter of credit agreements and other arrangements with financial institutions and customers primarily relating to the guarantee of future performance on certain contracts to provide products and services to customers... -

Page 32

... market price of Loral Space stock and the potential impact of underlying market and industry conditions on Loral Space's ability to execute its current business plans, the Corporation recorded a nonrecurring and unusual charge, net of state income tax benefits, of $361 million in the third quarter... -

Page 33

...ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Lockheed Martin Corporation December 31, 2001 As more fully described in "Note 16-Commitments and Contingencies," the Corporation is responding to three administrative orders issued by the California Regional Water Quality Control Board (the... -

Page 34

... useful lives of other intangible assets as part of its adoption of the Statement. As a result of that review, the estimated useful life of the intangible asset related to the F-16 fighter aircraft program has been extended. This change is expected to decrease annual amortization expense associated... -

Page 35

... reviews of interim financial information and their annual audit. Essential to the Corporation's internal control system is management's dedication to the highest standards of integrity, ethics and social responsibility. In connection therewith, management has issued the Code of Ethics and Business... -

Page 36

... financial position of Lockheed Martin Corporation at December 31, 2001 and 2000, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2001, in conformity with accounting principles generally accepted in the United States... -

Page 37

... loss on early extinguishments of debt Cumulative effect of change in accounting See accompanying Notes to Consolidated Financial Statements. $ >>> 44 0.18 (2.55) (0.08) - $ (0.95) (0.10) (0.24) - $ (1.29) $ 1.91 0.02 - (0.93) 1.00 $ (2.45) $ Lockheed Martin Annual Report $ 0.18 (2.52... -

Page 38

... Customer advances and amounts in excess of costs incurred Income taxes Other Net cash provided by operating activities Investing Activities Expenditures for property, plant and equipment Sale of IMS Investments in affiliated companies AES Transaction Sale of Control Systems business Sale of shares... -

Page 39

CONSOLIDATED BALANCE SHEET Lockheed Martin Corporation December 31, (In millions) 2001 2000 Assets Current assets: Cash and cash equivalents Receivables Inventories Deferred income taxes Assets of businesses held for sale Other current assets Total current assets Property, plant and equipment, ... -

Page 40

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY Lockheed Martin Corporation (In millions, except per share data) Common Stock Additional Paid-In Capital Retained Earnings Unearned ESOP Shares Accumulated Other Comprehensive Loss Total Stockholders' Equity Comprehensive Income (Loss) Balance ... -

Page 41

... Accounting Policies Organization-Lockheed Martin Corporation (Lockheed Martin or the Corporation) is engaged in the conception, research, design, development, manufacture, integration and operation of advanced technology systems, products and services. Its products and services range from... -

Page 42

... all contracts and programs in progress under U.S. Government contractual arrangements. Corporation-sponsored product development costs not otherwise allocable are charged to expense when incurred. Under certain arrangements in Lockheed Martin Annual Report Sales and earnings-Sales and anticipated... -

Page 43

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Lockheed Martin Corporation December 31, 2001 which a customer shares in product development costs, the Corporation's portion of such unreimbursed costs is expensed as incurred. Customer-sponsored research and development costs incurred pursuant to ... -

Page 44

... The results of operations and related gains or losses associated with businesses divested prior to the effective date of the Corporation's adoption of SFAS No. 144, including the divestitures of the Corporation's Aerospace Electronics Systems (AES) businesses and Lockheed Martin Control Systems in... -

Page 45

... on the Corporation's consolidated results of operations. COMSAT-International (formerly Enterprise SolutionsInternational)-provides telecommunications network services in Latin America, primarily Argentina and Brazil. • Lockheed Martin Annual Report The Global Telecommunications segment equity... -

Page 46

... $878 million ($2.18 per diluted share). In September 2000, the Corporation sold Lockheed Martin Control Systems (Control Systems) for $510 million in cash. This transaction resulted in the recognition of a nonrecurring and unusual gain, net of state income taxes, of $302 million which is reflected... -

Page 47

... In the fourth quarter of 1998, the Corporation recorded a nonrecurring and unusual pretax charge, net of state income tax benefits, of $233 million related to actions surrounding the decision to fund a timely non-bankruptcy shutdown of the business of CalComp Technology, Inc. (CalComp), a majority... -

Page 48

... businesses, net of IMS gain Extraordinary loss on early extinguishments of debt Cumulative effect of change in accounting 0.18 $ (0.95) $ 1.91 Work in process, commercial launch vehicles Work in process, primarily related to other long-term contracts and programs in progress Less customer... -

Page 49

...482 Lockheed Martin Annual Report In addition, included in cost of sales in 2001, 2000 and 1999 were general and administrative costs, including research and development costs, of approximately $679 million, $632 million and $466 million, respectively, related to commercial programs and activities... -

Page 50

... the market price of Loral Space stock and the potential impact of underlying market and industry conditions on Loral Space's ability to execute its current business plans. In the first quarter of 2001, the Corporation recorded a nonrecurring and unusual charge, net of state income tax benefits, of... -

Page 51

... repaid by the Corporation on May 1, 2008. A leveraged employee stock ownership plan (ESOP) incorporated into the Corporation's salaried savings plan borrowed $500 million through a private placement of notes in 1989. These notes are being repaid in quarterly installments over terms ending in 2004... -

Page 52

... 155 81 $344 Lockheed Martin Annual Report Net provisions for state income taxes are included in general and administrative expenses, which are primarily allocable to government contracts. The net state income tax benefit for 2001 was $8 million, and net state income tax expense was $100 million... -

Page 53

...TO CONSOLIDATED FINANCIAL STATEMENTS Lockheed Martin Corporation December 31, 2001 Note 13-Stockholders' Equity and Related Items Capital stock-At December 31, 2001, the authorized capital of the Corporation was composed of 1.5 billion shares of common stock (approximately 441 million shares issued... -

Page 54

...(k) plans, employees' eligible contributions are matched by the Corporation at established rates. The Corporation's matching obligations were $226 million in 2001, $221 million in 2000 and $222 million in 1999. The Lockheed Martin Corporation Salaried Savings Plan includes an ESOP which purchased 34... -

Page 55

...Dividends paid to the salaried and hourly ESOP trusts on the allocated shares are paid annually by the ESOP trusts to the participants based upon the number of shares allocated to each participant. Defined benefit pension plans, and retiree medical and life insurance plans-Most employees are covered... -

Page 56

... effect on the Corporation's consolidated results of operations or financial position. These matters include the following items: Environmental matters-The Corporation is responding to three administrative orders issued by the California Regional Water Quality Control Board (the Regional Board... -

Page 57

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Lockheed Martin Corporation December 31, 2001 in groundwater, and therefore are intended to assist the Corporation in determining its ultimate clean-up obligation, if any, with respect to perchlorates. In January 2002, the State of California reduced its ... -

Page 58

... C-5, F-117 and U2 aircraft. Technology Services-Provides a wide array of management, engineering, scientific, logistic and information management services to federal agencies and other customers. Major product lines include e-commerce, enterprise information Lockheed Martin Annual Report >>> 65 -

Page 59

...TO CONSOLIDATED FINANCIAL STATEMENTS Lockheed Martin Corporation December 31, 2001 services, software modernization, information assurance and data center management primarily for DoD and civil government agencies, and also for commercial customers; engineering, science and information services for... -

Page 60

... per share data) 2000 Quarters First(a)(g) Second(a)(h) Third(a)(i) $6,070 431 $5,721 413 Fourth(j) $7,315 498 U.S. Government Systems Integration Space Systems Aeronautics Technology Services Corporate and Other Foreign Systems Integration Space Systems Aeronautics Technology Services Corporate... -

Page 61

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Lockheed Martin Corporation December 31, 2001 (f) The sum of the diluted earnings (loss) per share amounts for the four quarters of 2000 do not equal the related amounts included in the consolidated statement of operations for the year ended December 31, ... -

Page 62

... operations Extraordinary item Cumulative effect of change in accounting Cash dividends Condensed Balance Sheet Data Current assets Property, plant and equipment Intangible assets related to contracts and programs acquired Goodwill Other assets Total Short-term borrowings Current maturities of... -

Page 63

CONSOLIDATED FINANCIAL DATA-FIVE YEAR SUMMARY Lockheed Martin Corporation December 31, 2001 (Continued) Notes to Five Year Summary (a) Includes the effects of nonrecurring and unusual items which, on a combined basis, decreased earnings from continuing operations before income taxes by $918 million... -

Page 64

... Electrical Engineering Stanford University Robert J. Stevens President and Chief Operating Officer Lockheed Martin Corporation Caleb B. Hurtt Retired President and Chief Operating Officer Martin Marietta Corporation Management Development and Compensation Committee and Stock Option Subcommittee... -

Page 65

... Officer >>> 72 Marillyn A. Hewson Senior Vice President James R. Ryan Vice President Robert B. Coutts Executive Vice President Systems Integration Nancy M. Higgins Vice President Albert E. Smith Executive Vice President Space Systems Jay F. Honeycutt Vice President Lockheed Martin Annual... -

Page 66

...05 43.75 46.67 Stock Quote Printed Material Requests Internet & E-Mail Repeat Menu 1 2 3 News Releases Shareholder Services Corporate Profile >>> 73 Lockheed Martin Annual Report Transfer Agent & Registrar EquiServe Trust Company, N.A. P.O. Box 2500 Jersey City, New Jersey 07303-2500 Telephone... -

Page 67

... continued pricing pressures associated with commercial satellites and launch services); economic business and political conditions (including economic disruption caused by recent terrorist acts, government import and export policies, and economic uncertainties in Latin America); program performance... -

Page 68

Lockheed Martin Applies Its Vision, Its Purpose And Its Values To Customer Priorities Our Vision: â- To be the world's best advanced technology systems integrator. To achieve Mission Success by attaining total customer satisfaction and meeting all our commitments. Ethics Excellence "Can-Do'' ... -

Page 69

Lockheed Martin Corporation 6801 Rockledge Drive Bethesda, MD 20817 www.lockheedmartin.com