Kentucky Fried Chicken 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

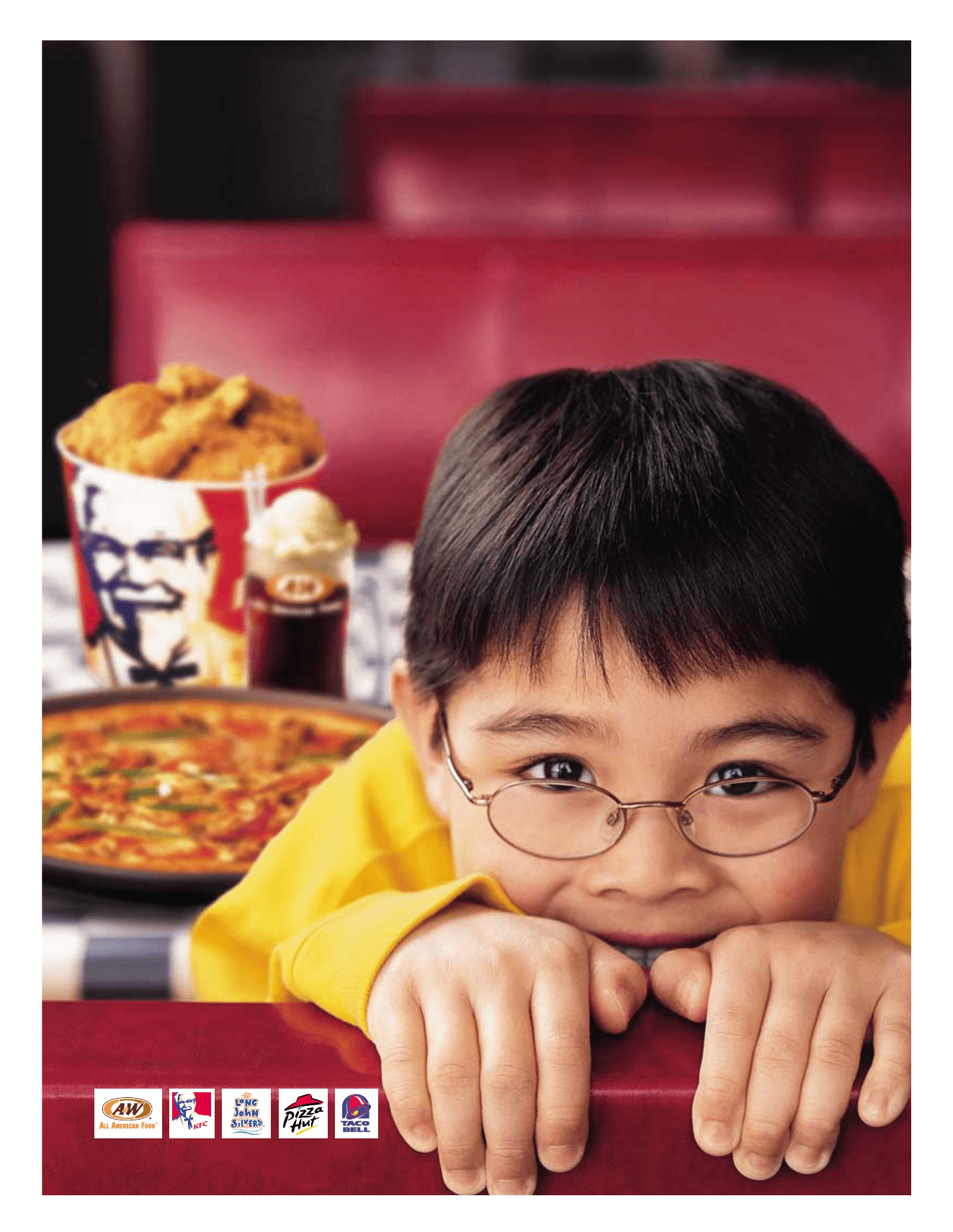

up

Pull

seat

a

for a serving of customer mania.

Yum! Brands

2002 ANNUAL REPORT

®

Table of contents

-

Page 1

seat for a serving of up a Pull customer mania. Yum! Brands 2002 ANNUAL REPORT ® -

Page 2

-

Page 3

1. -

Page 4

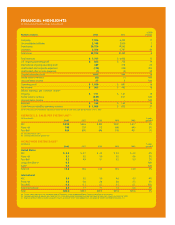

... annual growth rate. $ 898 748 964 $ 865 724 890 $ 833 712 896 $ 837 696 918 $ 817 645 931 3% 3% 1% WORLDWIDE SYSTEM SALES(a) (in billions) 2002 2001 2000 1999 1998 5-year growth(b) United States KFC Pizza Hut Taco Bell Long John Silver's(c) A&W(c) Total U.S. International KFC Pizza Hut Taco... -

Page 5

... agree the best year any business can have is when you beat your financial plan and set the table for future growth. I'm pleased to report 2002 was just that kind of year for Yum! Brands. Our stated long-term goal is to grow our annual earnings per share by at least 10% every year. In 2002, we grew... -

Page 6

... Bell, Long John Silver's and A&W. While we see our level of new restaurant development increasing gradually, we are not predicting a more rapid increase because to do so could threaten the high standards we have for our returns. We're focusing our international company operations in seven countries... -

Page 7

... the Chinese customer's favorite brand of any kind...period. The biggest challenge we face today is developing new markets...getting to scale in We're committed to Continental Europe, in Brazil with KFC, and in India with Pizza Hut. Opening up KFCs doubling our number of international restaurants in... -

Page 8

...one food category. Pizza Hut has pizza in its name. KFC means Kentucky Fried Chicken. Taco Bell stands for Mexican-style food. And every time we've tried to broaden our appeal by moving into new categories, it fails because our brands stand for just one thing. No one's looking for a KFC or Taco Bell... -

Page 9

...more our customers can count on a trusted experience every time they visit one of our restaurants, the more consistent our sales will be. In 2002, Yum! was up 2% on a blended or combined same store sales basis in the U.S. Taco Bell led the way, with same store sales up 7%, and KFC and Pizza Hut were... -

Page 10

... Customer Mania is driving improvement as we speak. To date, customer complaints are down and compliments are up. We are making improvements in speed at Taco Bell and Pizza Hut. And KFC has improved product quality. The key to great restaurant operations is the capability of our people, and our team... -

Page 11

... a 2% blended same store sales growth rate in 2003 and beyond. 4) Franchise Fees...we generate over $860 million in franchise fees with minimal capital investment. We expect to grow fees 4-6% each year. 5) Return on Invested Capital...at 18%, we are leading the quick-service restaurant industry. We... -

Page 12

Setting around the the table world. -

Page 13

...making the right strategic bets on the growth of certain developing and start-up markets that should be very rapidly growing in the next five years - namely, KFC Europe and we're just starting in KFC Brazil. Graham: In Western Europe, we've focused our initial investment in three important countries... -

Page 14

... for us to become the premier global restaurant company. Above left Around the world Yum!'s Customer Maniacs are busy introducing exciting new products like the KFC Pocket Meal in the U.K. Above right Celebrations marking the 100th Pizza Hut in China took place in the port city of Tienjian. Below... -

Page 15

Below left We are currently opening more than 200 restaurants each year in China. Pictured here, the first store in Shangxi Province. Below right KFC Mexico opened this landmark 400th restaurant in Ensenada. 13. -

Page 16

branded Bringing convenience to the choice & table. -

Page 17

...in our restaurants for customers and Team Members and helps leverage the cost of land, buildings and equipment. That ensures us a better return on our investment. When you're adding a recognized second brand, it increases sales a lot faster than if you just add new products to your primary brand. It... -

Page 18

alone we're delicious. Together we're YUM! 16. Multibranding allows us to give more choice and variety to our customers. That's how we demonstrate our Customer Mania - fish, pizza, wings, burritos or chili dogs, anyone? Yum! -

Page 19

... in the family. It's convenient for them because you've got two restaurants instead of one, and it's fast. That's because you've got a new store with the latest in equipment so you're able to do things faster. We are working to maximize the service time on the drive-thru to make sure customers get... -

Page 20

... out to make this thing work, it's these folks who will lead in Multibranding. The others will come along because this is all about making money. That's why we're in the business - we're here to increase profits. Aylwin: How does Customer Mania impact operations? Jackie: We think Customer Mania is... -

Page 21

1+1= 19. 3 -

Page 22

Serving up 100% CHAMPS with a yes! -

Page 23

... and improving execution through our 100% CHAMPS with a Yes! program. We're training people four times a year, making steady progress and having fun doing it. We just need to continue to drive success at the restaurant level and get better, and better and bet ter at satisfying our customers. Rather... -

Page 24

... felt they can each make our customers' experience in our store the best it can be." Cheryl Richardson, RGM Pizza Hut/Taco Bell Left "Customer Mania makes this an exciting place to work and an exciting place to serve customers. I love talking to our customers. When they smile, it makes us smile too... -

Page 25

..., Assistant Manager, KFC/Long John Silver's DeVonne: Selection is the key, I think. When it comes to hiring great new Customer Maniacs, I go through 50 applications just to get one Team Member. It's a time-consuming, always-uncer tain process. I would much rather put extra efforts into making sure... -

Page 26

...100% of your energy and enthusiasm to making your customers 100% satisfied - every hour, every day." Joe Gootee, Assistant Manager Long John Silver's/A&W Below "I'm proud of my work. I make sure that every piece of chicken I fry and every product I make is delicious. That's because I know that what... -

Page 27

... in International Restaurants* • Dinner 26% • Lunch 47% • Snacks/Breakfast 27% SOURCE: CREST * System sales represents the combined sales of Company, unconsolidated affiliates, franchise and license restaurants. • Dine Out 48% • Dine In 52% • Asia-Pacific 40% • Europe, South Africa... -

Page 28

...our New York Stock Exchange ticker symbol (NYSE:YUM), we received shareholder approval to change our corporate name to Yum! Brands from Tricon Global Restaurants. HERE'S HOW WE SET OUR TABLE IN 2002: TACO BELL Taco Bell had outstanding results in 2002, with a 7% increase in company same store sales... -

Page 29

...batter - sure to give every bite that delicious crunch. DELUXE BACON CHEESEBURGER: This all-American classic is so thick and juicy you'll need two hands to hold it. Pair it with a cool and frosty mug A&W Root Beer Float and there's only one word for it: Yum! BRANDED CHOICE IN ALL MAJOR CATEGORIES! -

Page 30

... annual growth rate excludes the impact of transferring 30 units from Taco Bell U.S. to Taco Bell International in 2002. BREAKDOWN OF WORLDWIDE SYSTEM UNITS Unconsolidated Affiliate Year-end 2002 Company Franchised Licensed Total United States KFC Pizza Hut Taco Bell Long John Silver... -

Page 31

... worldwide operations of KFC, Pizza Hut, Taco Bell, Long John Silver's ("LJS") and A&W AllAmerican Food Restaurants ("A&W") (collectively "the Concepts") and is the world's largest quick service restaurant ("QSR") company based on the number of system units. LJS and A&W were added when YUM acquired... -

Page 32

... impairment on an annual basis through the comparison of fair value of our reporting units to their carrying values. Our reporting units are our operating segments in the U.S. and our business management units internationally (typically individual countries). Fair value is the price a willing buyer... -

Page 33

...refranchising program, we have closed certain restaurants over the past several years. Restaurants closed include poor performing restaurants, restaurants relocated to a new site within the same trade area or U.S. Pizza Hut delivery units consolidated with a new or existing dine-in traditional store... -

Page 34

...Company store closure activities: U.S. 2002 2001 2000 2002 International Worldwide Number of units closed Store closure costs Impairment charges for stores to be closed 224 $ 15 $ 9 270 $ 17 $ 5 208 $ 10 $ 6 Decreased restaurant margin Increased franchise fees Decreased G&A (Decrease) increase... -

Page 35

... vs. 2000 Revenues Company sales Franchise and license fees Total revenues Company restaurant margin % of Company sales Ongoing operating proï¬t Facility actions net (loss) gain Unusual items income Operating proï¬t Interest expense, net Income tax provision Net income Diluted earnings per share... -

Page 36

... Statements of Income. However, we believe that system sales is useful to investors as a signiï¬cant indicator of our Concepts' market share and the overall strength of our business as it incorporates all of our revenue drivers, company and franchise same store sales as well as net unit development... -

Page 37

Yum! Brands Inc. WORLDWIDE COMPANY RESTAURANT MARGIN 2002 2001 2000 WORLDWIDE OTHER (INCOME) EXPENSE Other (income) expense is comprised of equity (income) loss from investments in unconsolidated afï¬liates and foreign exchange net (gain) loss. Other (income) expense increased $7 million or 28% ... -

Page 38

... the effects of facility actions net loss (gain) and unusual items (income) expense. See Note 7 for a discussion of these items. Revenues Company sales Franchise and license fees Total revenues Company restaurant margin % of Company sales Ongoing operating proï¬t $ 4,778 569 $ 5,347 $ $ 764... -

Page 39

... lapping the ï¬fty-third week in 2000, system sales increased 2%. The increase was driven by new unit development and same store sales growth at KFC and Pizza Hut, partially offset by store closures. U.S. REVENUES Company sales increased $491 million or 11% in 2002. Excluding the favorable impact... -

Page 40

... Taco Bell franchisees. The decrease was partially offset by same store sales growth and new unit development. INTERNATIONAL RESULTS OF OPERATIONS 2002 % B(W) vs. 2001 2001 % B(W) vs. 2000 Revenues Company sales Franchise and license fees Total revenues Company restaurant margin % of Company sales... -

Page 41

...fty-third week in 2000, system sales increased 9%. The increase was driven by new unit development and same store sales growth, partially offset by store closures. Company sales Food and paper Payroll and employee beneï¬ts Occupancy and other operating expenses Company restaurant margin 100.0% 36... -

Page 42

... settlement of working capital liabilities (primarily accounts payable and property taxes) related to the units refranchised and payment of taxes on the gains. The after-tax proceeds can be used to pay down debt or repurchase shares. After-tax proceeds were approximately $71 million in 2002 which re... -

Page 43

... for taxes that are now expected to be paid within the next twelve months. LIQUIDITY Operating in the QSR industry allows us to generate substantial cash ï¬,ows from the operations of our company stores and from our franchise operations, which require a limited YUM investment in operating assets... -

Page 44

... our PBO by approximately $56 million at September 30, 2002. Due to recent stock market declines, our pension plan assets have experienced losses in value in 2002 and 2001 totaling approximately $75 million. We changed our expected long-term rate of return on plan assets from 10% to 8.5% for the... -

Page 45

... corporate expenses. In addition, the Company's net asset exposure (defined as foreign currency assets less foreign currency liabilities) totaled approximately $1 billion as of December 28, 2002. Operating in international markets exposes the Company to movements in foreign currency exchange rates... -

Page 46

CONSOLIDATED STATEMENTS OF INCOME Fiscal years ended December 28, 2002, December 29, 2001 and December 30, 2000 (in millions, except per share data) 2002 2001 2000 Revenues Company sales Franchise and license fees $ 6,891 866 7,757 $ 6,138 815 6,953 $ 6,305 788 7,093 Costs and Expenses, net ... -

Page 47

...long-term debt Repayments of long-term debt Short-term borrowings-three months or less, net Repurchase shares of common stock Employee stock option proceeds Other, net Net Cash Used in Financing Activities Effect of Exchange Rate on Cash and Cash Equivalents Net Increase (Decrease) in Cash and Cash... -

Page 48

... Total Current Assets Property, plant and equipment, net Goodwill, net Intangible assets, net Investments in unconsolidated afï¬liates Other assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Accounts payable and other current liabilities Income taxes payable Short-term... -

Page 49

...Net unrealized loss on derivative instruments (net of tax beneï¬ts of $1 million) Minimum pension liability adjustment (net of tax beneï¬ts of $14 million) Comprehensive Income Repurchase of shares of common stock Employee stock option exercises (includes tax beneï¬ts of $13 million) Compensation... -

Page 50

... International changed its name to YUM! Restaurants International. YUM! Brands, Inc. and Subsidiaries (collectively referred to as "YUM" or the "Company") comprises the worldwide operations of KFC, Pizza Hut, Taco Bell and since May 7, 2002, Long John Silver's ("LJS") and A&W All-American Food... -

Page 51

... and payment of a renewal fee, a franchisee may generally renew the franchise agreement upon its expiration. We recognize initial fees as revenue when we have performed substantially all initial services required by the franchise or license agreement, which is generally upon the opening of a store... -

Page 52

... held for sale or (b) its current fair market value. This value becomes the store's new cost basis. We charge (or credit) any difference between the store's carrying amount and its new cost basis to refranchising gains (losses). When we make a decision to close a store previously held for sale, we... -

Page 53

...-based employee compensation cost is reï¬,ected in net income, as all options granted under those plans had an exercise price equal to the market value of the underlying common stock on the date of grant. The following table illustrates the effect on net income and earnings per share if the Company... -

Page 54

... assets and the associated asset retirement costs. SFAS 143 is effective for the Company for fiscal year 2003. We currently do not anticipate that the adoption of SFAS 143 will have a material impact on our Consolidated Financial Statements. In June 2002, the FASB issued SFAS No. 146, "Accounting... -

Page 55

... current portion Future rent obligations related to sale-leaseback agreements Other long-term liabilities Total liabilities assumed $ 35 58 250 209 85 637 100 59 168 35 362 $ 275 3 TWO-FOR-ONE COMMON STOCK SPLIT NOTE Net assets acquired (net cash paid) On May 7, 2002, the Company announced... -

Page 56

... 29, 2001, pro forma Company sales, and franchise and license fees would have been as follows: 2002 2001 Unexercised employee stock options to purchase approximately 1.4 million, 5.1 million and 21.7 million shares of our Common Stock for the years ended December 28, 2002, December 29, 2001 and... -

Page 57

...our Pizza Hut reporting unit. (d) Store impairment charges for 2002, 2001 and 2000 were recorded against the following asset categories: U.S. International Worldwide Property, plant and equipment, net Other assets Assets classiï¬ed as held for sale $8 - $8 $ 32 4 $ 36 $ 40 4 $ 44 2002 2001... -

Page 58

payroll and employee benefits and occupancy and other operating expenses. NOTE 2002 2001 2000 8 SUPPLEMENTAL CASH FLOW DATA 2002 2001 2000 Stores held for sale at December 28, 2002: Sales Restaurant proï¬t Stores disposed of in 2002, 2001 and 2000: Sales Restaurant proï¬t $ 228 31 $ 147 20 $ ... -

Page 59

... from the poor performance of the Pizza Hut France reporting unit during 2002. (c) Includes goodwill related to the YGR purchase price allocation. For International, includes a $13 million transfer of goodwill to assets held for sale (see Note 7). The Company's business combinations have included... -

Page 60

... of reported net income to adjusted net income as though SFAS 142 had been effective for the years ended 2001 and 2000: 2001 Amount Basic EPS Diluted EPS NOTE 14 LONG-TERM DEBT SHORT-TERM BORROWINGS AND 2002 2001 Short-term Borrowings Current maturities of long-term debt International lines... -

Page 61

... in our Consolidated Financial Statements as of December 28, 2002. Rental payments made under these agreements will be made on a monthly basis through 2019 with an effective interest rate of approximately 11%. The annual maturities of long-term debt as of December 28, 2002, excluding capital lease... -

Page 62

... and long-term operating leases, primarily for our restaurants. Capital and operating lease commitments expire at various dates through 2087 and, in many cases, provide for rent escalations and renewal options. Most leases require us to pay related executory costs, which include property taxes... -

Page 63

...and the short-term nature of the franchise and license fee receivables. Fair Value At December 28, 2002 and December 29, 2001, the fair values of cash and cash equivalents, short-term investments, accounts receivable, and accounts payable approximated carrying value because of the short-term nature... -

Page 64

... using market quotes and calculations based on market rates. NOTE 17 MEDICAL BENEFITS PENSION AND POSTRETIREMENT The components of net periodic beneï¬t cost are set forth below: Pension Beneï¬ts 2002 2001 2000 Pension Benefits We sponsor noncontributory defined benefit pension plans covering... -

Page 65

...501 448 251 $ 420 369 291 The assumptions used to compute the information above are set forth below: Postretirement Medical Beneï¬ts 2000 2002 2001 2000 Pension Beneï¬ts 2002 2001 Discount rate Long-term rate of return on plan assets Rate of compensation increase 6.85% 8.50% 3.85% 7.60% 10.00... -

Page 66

... 2002 by approximately $2 million. The impact on our 2002 beneï¬t cost would not have been signiï¬cant. 18 STOCK-BASED EMPLOYEE COMPENSATION NOTE At year-end 2002, we had four stock option plans in effect: the YUM! Brands, Inc. Long-Term Incentive Plan ("1999 LTIP"), the 1997 Long-Term Incentive... -

Page 67

... of performance restricted stock units of YUM's Common Stock to our Chief Executive Officer ("CEO"). The awards were made under the 1997 LTIP and may be paid in Common Stock or cash at the discretion of the Compensation Committee of the Board of Directors. Payment of an award of $2.7 million was... -

Page 68

.... These investment options are limited to cash and phantom shares of our Common Stock. The EID Plan allows participants to defer incentive compensation to purchase phantom shares of our Common Stock at a 25% discount from the average market price at the date of deferral (the "Discount Stock Account... -

Page 69

...the Internal Revenue Service relating to the deductibility of reacquired franchise rights and other intangibles offset by an $8 million reduction in deferred and accrued taxes payable. In 2002, valuation allowances related to deferred tax assets in certain states and foreign countries were increased... -

Page 70

... when we acquired YGR. KFC, Pizza Hut, Taco Bell, LJS and A&W operate throughout the U.S. and in 88, 85, 12, 5 and 17 countries and territories outside the U.S., respectively. Our ï¬ve largest international markets based on operating proï¬t in 2002 are China, United Kingdom, Canada, Australia and... -

Page 71

... by reportable operating segment of facility actions net (loss) gain and unusual items income (expense). (c) Includes investment in unconsolidated afï¬liates of $225 million, $213 million and $257 million for 2002, 2001 and 2000, respectively. (d) Primarily includes deferred tax assets, fair value... -

Page 72

...performance, outplacement services and a tax gross-up for any excise taxes. These Agreements have a three-year term and automatically renew each January 1 for another three-year term unless the Company elects not to renew the Agreements. If these Agreements had been triggered as of December 28, 2002... -

Page 73

... maintained its tax-free status. These restrictions, which were generally applicable to the two-year period following October 6, 1997, included among other things, limitations on any liquidation, merger or consolidation with another company, certain issuances and redemptions of our Common Stock, our... -

Page 74

... NOTE 2002 SELECTED QUARTERLY FINANCIAL DATA (UNAUDITED) First Quarter Second Quarter Third Quarter Fourth Quarter Total Revenues: Company sales Franchise and license fees Total revenues Total costs and expenses, net Operating proï¬t Net income Diluted earnings per common share Operating pro... -

Page 75

... States of America. As discussed in Notes 2 and 12 to the consolidated ï¬nancial statements, YUM adopted the provisions of the Financial Accounting Standards Board's Statement of Financial Accounting Standards No. 142, "Goodwill and Other Intangible Assets," in 2002. KPMG LLP Louisville, Kentucky... -

Page 76

... FINANCIAL DATA Fiscal Year (in millions, except per share and unit amounts) 2002 2001 2000 1999 1998 Summary of Operations Revenues Company sales (a) Franchise and license fees Total Facility actions net (loss) gain (b) Unusual items income (expense) (b) (c) Operating proï¬t Interest expense, net... -

Page 77

... and Operating Ofï¬cer, Yum! Brands, Inc. Tony Mastropaolo 39 Chief Operating Ofï¬cer, KFC, U.S.A. Michael A. Miles 40 Chief Operating Ofï¬cer, Pizza Hut, U.S.A. Charles E. Rawley, III 52 Chief Development Ofï¬cer, Yum! Brands, Inc. Rob Savage 41 Chief Operating Ofï¬cer, Taco Bell, U.S.A. Brent... -

Page 78

... Louisville, KY 40202 Telephone: (502) 587-0535 CAPITAL STOCK INFORMATION Stock Trading Symbol - YUM The New York Stock Exchange is the principal market for YUM Common Stock. Shareholders At year-end 2002, there were approximately 115,000 registered holders of record of Yum! Brands' Common Stock... -

Page 79

...of the 840,000 employees and franchisees in the Yum! system give back every day, in many ways, all with a hope that we can leave this globe a little bit better than we found it. We believe we truly can make a difference and we want to thank them for their outstanding community service and dedication... -

Page 80

Yum! to you! Alone we're delicious. Together we're ®