Kentucky Fried Chicken 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1999 annual report

Table of contents

-

Page 1

1999 annual report -

Page 2

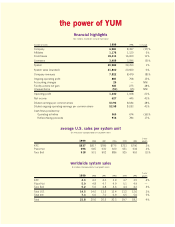

...5-year growth 1999 KFC Pizza Hut Taco Bell $837 696 918 1998 1997 1996 1995 1994 $817 645 931 $786 630 902 $775 620 886 $733 651 925 $706 634 953 3% 2% (1)% worldwide system sales $ in billions (Compounded annual growth rates) 5-year growth 1999 KFC Pizza Hut Taco Bell Total U.S. Total... -

Page 3

..., demonstrating our Passion the way we start all of our major system meetings - with a "YUM Cheer!" Give me a "Y"! Give me a "U"! Give me a "M"! David Alston KFC Restaurant General Manager Jackie Lopez Pizza Hut Restaurant General Manager Carlos Diaz Taco Bell Franchise Restaurant General Manager 1 -

Page 4

... to report that 1999 was an outstanding year for Tricon, with solid progress made against almost every operational and ï¬nancial goal we set for ourselves. We've worked hard at increasing our performance by developing our culture, driving same store sales growth, improving our restaurant economics... -

Page 5

... is delivering on its competitive positioning to have the "Best Pizzas Under One Roof." In fact, Pizza Hut outperformed its major competitors for the year in same store sales growth and grew market share in the key traditional segment. At KFC, our strategy is to reposition the brand as the "chicken... -

Page 6

... is Pizza Hut in China, Canada and the U.K. In fact, one-fourth of our total ongoing operating proï¬t in 1999 came from our international business, and we expect it to grow on average at least 15-20% per year. We plan to build over 700 new restaurants across our system outside of the United States... -

Page 7

.... In fact, on our front cover, we've featured three of our Restaurant General Managers - our #1 leaders - who represent a system built around restaurant teams committed to serving customers better than anyone. David Alston (KFC), Jackie Lopez (Pizza Hut) and Carlos Diaz (Taco Bell) are demonstrating... -

Page 8

cer Chief Executive Ofï¬ urants, Inc. Tricon Global Resta PO Box 32220 2-2220 Louisville, KY 4023 David C. Novak -

Page 9

our formula for success is working 1 people capability ï¬rst 2 satisï¬ed customers follow 3 then we make more money -

Page 10

... our success with driving margins and increasing customer satisfaction, it's a message that's paying off. Second, we're making recognition a key part of our operation. Recognition shows you care and, in this demanding quick-service business, if you don't care, people leave. So every day we celebrate... -

Page 11

... best at driving their business with a passion toward putting YUMs on customers' faces around the world. (from back to front) Jackie Lopez, Pizza Hut RGM, Big Cheese Award; Goh Kim Yian, KFC Market Manager, Globe Award; Carlos Delgado, KFC RGM, Bulldog Award; Henry Yip, Pizza Hut Franchise General... -

Page 12

...C.H.A.M.P.S. programs is paying terriï¬c dividends, namely charged-up, customer-focused teams and dynamite sales - as well as improved operations. And though C.H.A.M.P.S. started out at our international business, TRI, we've since spread it across the entire system - ï¬rst to KFC then to Taco Bell... -

Page 13

...innovative systems and operational initiative called TriYUMf. Aimed at our back-of-the house and above-restaurant systems, TriYUMf gleans the best demonstrations of food quality maintenance, labor cost control and other operational procedures in an ongoing effort to improve margins in our stores. We... -

Page 14

... and feel and customers in both company and franchise markets love them. In fact, 1999 sales from these assets were extremely promising. Truly, 1999 was another great year for Pizza Hut. And with strategies in place to continue to drive sales, develop new units, build out our delivery segment and... -

Page 15

Pizza QSR Sales 21% 12% 7% 6% 7% 47% Pizza Hut Domino's Little Caesar's Papa John's Regionals Independents* *Highly fragmented Mike Rawlings President & Chief Concept Ofï¬cer Mike Miles Chief Operating Ofï¬cer 13 -

Page 16

14 -

Page 17

... products and programs put in place in 1999 should have positive long-range effects on our brand. In 1999, KFC franchisees and company operators built 190 new restaurants and upgraded another 200 - even more activity in restaurant development than last year's aggressive action. These new restaurants... -

Page 18

... Year of the Food!" We'll build sales and transactions by introducing several greattasting new products and differentiating Taco Bell as the best QSR value, bar none. We'll also drive our customerfocused culture even deeper into our restaurants. And you'll ï¬nd us in many new locations - not just... -

Page 19

Mexican QSR Sales 72% 3% 3% 2% 2% 18% Taco Bell Del Taco Taco John's Taco Bueno Taco Time Independents Peter Waller President & Chief Concept Ofï¬cer Bob Nilsen Chief Operating Ofï¬cer 17 -

Page 20

...year it's been for our international business. We've seen increased profits, continued development of operating systems, like C.H.A.M.P.S., outstanding product launches, a stronger franchise relationship and a culture that is changing - for the better. In 1999, our operating proï¬t was $265 million... -

Page 21

Peter Hearl Executive Vice President Pete Bassi President International System Sales By Brand 63% KFC 35% Pizza Hut 2% Taco Bell 19 -

Page 22

... on company assets in the key countries in which we operate. MARK COSBY, CHIEF DEVELOPMENT OFFICER: Fourth, we're also building and upgrading more stores. Over the last two years, we built a new unit growth machine and completed a plan for every market and trade area in the United States. This plan... -

Page 23

...ve begun operating as one system, sharing everything from information systems to accounting functions to media buying. We've also teamed with our franchisees to form the largest purchasing cooperative in the restaurant industry. The cooperative purchases more than $4 billion in product each year for... -

Page 24

... of System Sales in International Restaurants SNACKS BREAKFAST 2% LUNCH 24% DINE OUT 63% GREATER CHINA 11% DINE IN 37% AMERICAS 21% EUROPE S. AFRICA 25% ASIA PACIFIC 43% DINNER 74% SNACKS BREAKFAST 2% DINNER 64% LUNCH 34% DINE OUT 71% DINE IN 29% Worldwide Units (In thousands, year-end 1999... -

Page 25

...to reï¬,ect the transfer of management responsibility. breakdown of worldwide system units Year-end 1999 unconsolidated afï¬liates company franchised licensed total U.S. KFC Pizza Hut Taco Bell Total U.S. International KFC Pizza Hut Taco Bell Total International Total 1,439 2,355 1,190 4,984... -

Page 26

... 66 management's responsibility for ï¬nancial statements & report of independent auditors 67 selected ï¬nancial data 68 shareholder information 69 board of directors and ofï¬cers In 1999, our international business accounted for 33% of system sales, 27% of total revenues and 25% of operating pro... -

Page 27

... provide dine-in, carry-out and delivery services within the same trade area. The following table summarizes store closure activities for the last ï¬ve years: Total 1999 301 $ 13(a) 1998 1997 1996 1995 Number of units closed Store closure net costs (a) (b) (c) 2,119 $ 312 572 632 347 267... -

Page 28

... Businesses operating proï¬t, before disposal charges Unusual disposal charges Net loss $ 268 3% $ 13 54 (26) Worldwide Results of Operations % B(W) 1999 vs. 1998 1998 % B(W) vs. 1997 System Sales $ 21,762 6 Revenues Company sales $ 7,099 (10) Franchise and 723 15 license fees(1) Total Revenues... -

Page 29

..., franchise and license fees increased $95 million or 17%. The growth was primarily driven by units acquired from us and new unit development primarily in Asia and at Taco Bell in the U.S., partially offset by store closures by franchisees and licensees. Worldwide Company Restaurant Margin 1999... -

Page 30

... Worldwide Facility Actions Net (Gain) Loss related to continuing efforts to improve and standardize administrative and accounting systems. Worldwide Other (Income) Expense % B(W) 1999 vs. 1998 1998 % B(W) vs. 1997 Equity income from investments in unconsolidated afï¬liates Foreign exchange net... -

Page 31

..., publicly owned company, as well as, additional expenses related to the efforts to improve and standardize operating, administrative and accounting systems. Worldwide Interest Expense, Net 1999 1998 1997 Reported Income taxes Effective tax rate Ongoing(a) Income taxes Effective tax rate (a) $ 411... -

Page 32

...effective net pricing and volume increases led by Pizza Hut's ï¬rst quarter new product introduction, "The Big New Yorker." Franchise and license fees increased $69 million or 16% in 1999. The increase was driven by units acquired from us, new unit development and franchisee same store sales growth... -

Page 33

...the special 1997 KFC renewal fees, 1998 franchise and license fees increased $74 million or 21%. The increase was primarily driven by units acquired from us and new unit development, partially offset by the impact of store closures by franchisees and licensees. In 1998, same store sales at Pizza Hut... -

Page 34

... and amortization for stores included in the charge. International Results of Operations 1999 Amount % B(W) vs. 1998 10 - 13 2 Amount 1998 % B(W) vs. 1997 System Sales Revenues Company sales Franchise and license fees Total Revenues Company Restaurant Margin % of sales Ongoing Operating Pro... -

Page 35

...Our operating working capital deï¬cit, which excludes cash, short-term investments and short-term borrowings, is typical of restaurant operations where the majority of sales are for cash while payment to suppliers for food and supply inventories carry longer payment terms, generally from 10-30 days... -

Page 36

... make required debt repayments and buy back shares under our current stock repurchase program. Consolidated Financial Condition Assets decreased $570 million or 13% to $4.0 billion at yearend 1999. This decrease is primarily attributable to the portfolio effect and a decrease in cash and short-term... -

Page 37

... franchise community are working closely together to proactively address the bankruptcy situation and develop appropriate contingency plans. It is our intention to take all actions reasonably necessary and prudent to ensure continued supply of restaurant products and equipment to the TRICON system... -

Page 38

... determined the timing of the formation of these new ventures. Upon formation of these ventures, we will recognize our share of the ventures' net income or loss as equity income from investments in unconsolidated afï¬liates. Currently, the results from these restaurants are being consolidated. The... -

Page 39

... supply of restaurant products and equipment in our stores; our ability to complete our conversion plans or the ability of our key suppliers to be Euro-compliant; our potential inability to identify qualiï¬ed franchisees to purchase restaurants at prices we consider appropriate under our strategy... -

Page 40

... 1997 (in millions, except per share amounts) 1999 $ 7,099 723 7,822 1998 1997 Revenues Company sales Franchise and license fees $ 7,852 627 8,479 $ 9,112 578 9,690 Costs and Expenses, net Company restaurants Food and paper Payroll and employee beneï¬ts Occupancy and other operating expenses... -

Page 41

... current liabilities Income taxes payable Net change in operating working capital Net Cash Provided by Operating Activities Cash Flows - Investing Activities Capital spending Refranchising of restaurants Acquisition of restaurants Sales of Non-core Businesses Sales of property, plant and equipment... -

Page 42

... Assets Cash and cash equivalents Short-term investments, at cost Accounts and notes receivable, less allowance: $13 in 1999 and $17 in 1998 Inventories Prepaid expenses and other current assets Deferred income tax assets Total Current Assets Property, Plant and Equipment, net Intangible Assets, net... -

Page 43

... Income Adjustment to opening equity related to net advances from PepsiCo Repurchase of shares of common stock Stock option exercises (includes tax beneï¬ts of $14 million) Compensation-related events Balance at December 25, 1999 See accompanying Notes to Consolidated Financial Statements... -

Page 44

...Financial Statements are made using the ï¬rst person notations of "we" or "us." Our worldwide businesses, KFC, Pizza Hut and Taco Bell ("Core Business(es)"), include the operations, development and franchising or licensing of a system of both traditional and non-traditional quick service restaurant... -

Page 45

..."Accounting for Stock Issued to Employees," and its related interpretations and include pro forma information in Note 15 as required by Statement of Financial Accounting Standards No. 123, "Accounting for Stock-Based Compensation" ("SFAS 123"). Accordingly, we measure compensation cost for the stock... -

Page 46

... original maturities not exceeding three months) as part of managing our day-to-day operating cash receipts and disbursements. Inventories. We value our inventories at the lower of cost (computed on the ï¬rst-in, ï¬rst-out method) or net realizable value. Property, Plant and Equipment. We state... -

Page 47

... the best information available, we write down an impaired restaurant to its estimated fair market value, which becomes its new cost basis. We generally measure estimated fair market value by discounting estimated future cash ï¬,ows. In addition, after April 23, 1998, when we decide to close a store... -

Page 48

... being developed is not yet ready for its intended use. The amortization of assets that became ready for their intended use in 1999 was immaterial. In addition, we adopted Emerging Issues Task Force Issue No. 97-11 ("EITF 97-11"), "Accounting for Internal Costs Relating to Real Estate Property... -

Page 49

... our 1999 operating proï¬t of over $8 million. At the end of 1998, we changed our method of determining the pension discount rate to better reï¬,ect the assumed investment strategies we would most likely use to invest any short-term cash surpluses. Accounting for pensions requires us to develop an... -

Page 50

... related to stores closed. Our operating proï¬t includes beneï¬ts from the suspension of depreciation and amortization of approximately $12 million ($7 million after-tax) and $33 million ($21 million after-tax) in 1999 and 1998, respectively, for stores held for disposal. The relatively short-term... -

Page 51

.... Facility actions net (gain) loss consists of three components: • Gains and losses on sales of our restaurants to new and existing franchisees, • Costs of closing our underperforming stores and • Impairment charges both for restaurants we intend to continue to use in the business and, since... -

Page 52

... and settlement of lease liabilities associated with properties retained upon the sale of a Non-core Business. Unusual items in 1997 included: (1) $120 million ($125 million after-tax) of unusual asset impairment and severance Stores held for disposal or disposed of in 1999: Sales Restaurant margin... -

Page 53

... KFC renewal fees. note 7 Other (Income) Expense Accounts payable Accrued compensation and beneï¬ts Other accrued taxes Other current liabilities $ 281 85 344 $ 1,085 310 98 399 $ 1,283 1999 1998 1997 Equity income from investments in unconsolidated afï¬liates $ (19) Foreign exchange net... -

Page 54

...use of derivative instruments, our management of inherent credit risk and fair value information related to debt and interest rate swaps. At December 25, 1999, we had unused borrowings available under the Revolving Credit Facility of $1.9 billion, net of outstanding letters of credit of $152 million... -

Page 55

... leases require us to pay related executory costs, which include property taxes, maintenance and insurance. Future minimum commitments and sublease receivables under non-cancelable leases are set forth below: Commitments Capital Operating Sublease Receivables Direct Financing Operating 2000 2001... -

Page 56

...ts generally on years of service and compensation or stated amounts for each year of service. The components of net periodic beneï¬t cost are set forth below: Pension Beneï¬ts 1999 1998 1997 Debt Short-term borrowings and long-term debt, excluding $ 2,411 capital leases Debt-related derivative... -

Page 57

... compute the information above are set forth below: Pension Beneï¬ts Postretirement Medical Beneï¬ts 1999 1998 1999 1998 Discount rate - projected beneï¬t obligation Expected long-term rate of return on plan assets Rate of compensation increase We have assumed the annual increase in cost of... -

Page 58

... Global Restaurants, Inc. SharePower Plan ("SharePower"). We may grant options to purchase up to 7.6 million and 22.5 million shares of stock under the 1999 LTIP and 1997 LTIP, respectively, at a price equal to or greater than the average market price of the stock on the date of grant. New options... -

Page 59

..., we introduced a new investment option for the EID Plan allowing participants to defer certain incentive compensation into the purchase of phantom shares of our Common Stock at a 25% discount from the average market price at the date of deferral (the "Discount Stock Account"). Participants bear the... -

Page 60

... of the Internal Revenue Code ("401(k) Plan") for eligible full-time U.S. salaried and certain hourly employees. Participants may elect to contribute up to 15% of their eligible compensation on a pre-tax basis. We are not required to make contributions to the Plan. In 1998, a Stock Ownership Program... -

Page 61

...of income taxes calculated at the U.S. federal tax statutory rate to our effective tax rate is set forth below: 1999 1998 Intangible assets and property, plant and equipment Other Gross deferred tax liabilities Net operating loss and tax credit carryforwards Employee beneï¬ts Self-insured casualty... -

Page 62

... Capital Spending 1999 1998 1997 note 20 United States International Corporate $ Reportable Operating Segments $ 315 139 16 470 $ $ 305 150 5 460 $ 381 157 3 $ 541 We are engaged principally in developing, operating, franchising or licensing the worldwide KFC, Pizza Hut and Taco Bell... -

Page 63

...also purchased insurance in 1998 to limit the cost of our retained risks for the years 1994 to 1996. Effective August 16, 1999, we made changes to our U.S. and portions of our International property and casualty loss programs which we believe will reduce our annual property and casualty costs. Under... -

Page 64

... 1,300 current and former California restaurant general managers of Pizza Hut and PacPizza. The lawsuit alleges violations of state wage and hour laws involving unpaid overtime wages and vacation pay and seeks an unspeciï¬ed amount in damages. On January 12, 2000, the Court certiï¬ed a class of... -

Page 65

... wage and hour allegations by opening a claims process to all putative class members prior to certiï¬cation of the class. In this cure process, Taco Bell has currently paid out less than $1 million. On January 26, 1999, the Court certiï¬ed a class of all current and former shift managers and crew... -

Page 66

...bankruptcy unsecured creditors. The interest rate is prime plus 4%. To help ensure that our supply chain continues to remain open, we have begun to purchase (and take title to) supplies directly from suppliers (the "temporary direct purchase program") for use in our restaurants as well as for resale... -

Page 67

... 23 Selected Quarterly Financial Data (Unaudited) 1999 First Quarter Second Quarter Third Quarter Fourth Quarter Total Revenues: Company sales Franchise and license fees Total revenues Total costs and expenses Operating proï¬t Net income Diluted earnings per common share Operating proï¬t (loss... -

Page 68

... an active Code of Conduct program intended to ensure employees adhere to the highest standards of personal and professional integrity. Our internal audit function monitors and reports on the adequacy of and compliance with the internal control system, and appropriate actions are taken to address... -

Page 69

...-term debt Total debt Investments by and advances from PepsiCo Other Data: Number of stores at year-end(1) Company Unconsolidated Afï¬liates Franchisees Licensees System U.S. Company same store sales growth(1) KFC Pizza Hut Taco Bell Blended Shares outstanding at year-end (in millions) Market price... -

Page 70

... KY 40202 Telephone: (502) 587-0535 capital stock information Stock Trading Symbol - YUM The New York Stock Exchange is the principal market for Tricon Common Stock. Shareholders At year-end 1999, there were approximately 156,000 shareholders of record. Dividend Policy Tricon does not currently pay... -

Page 71

... and Shared Services Tricon David J. Deno 42 Chief Financial Ofï¬cer Tricon Peter R. Hearl 48 Executive Vice President Tricon Restaurants International Aylwin B. Lewis 45 Executive Vice President Operations and New Business Development, Tricon Michael A. Miles 38 Chief Operating Ofï¬cer Pizza Hut... -

Page 72

Best pizzas under one roof! We do chicken right! Grande Taste. Loco Value. Alone we're delicious, together we're YUM! hungry for more information? contact: www.triconglobal.com