Incredimail 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Incredimail annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PERION NETWORK LTD.

FORM 20-F

(Annual and Transition Report (foreign private issuer))

Filed 03/22/12 for the Period Ending 12/31/11

Telephone 972-3-769-6100

CIK 0001338940

Symbol PERI

SIC Code 7371 - Computer Programming Services

Industry Computer Services

Sector Technology

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2012, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

... 20-F (Annual and Transition Report (foreign private issuer)) Filed 03/22/12 for the Period Ending 12/31/11 Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 972-3-769-6100 0001338940 PERI 7371 - Computer Programming Services Computer Services Technology 12/31 http://www.edgar-online.com... -

Page 2

... the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the Annual Report. As of December 31, 2011, the Registrant had outstanding 9,916,194 ordinary shares, par value NIS 0.01 per share. Name of Each Exchange on which... -

Page 3

... Exchange Act (Check one): Large accelerated filer £ Accelerated filer £ Non-accelerated filer T Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: U.S. GAAP x International Financial Reporting Standards as issued... -

Page 4

PRELIMINARY NOTES Terms In November 2011, the Company changed its name from IncrediMail Ltd. to Perion Network Ltd. As used herein, and unless the context suggest otherwise, the terms "Perion", "Company", "we", "us" or "ours" refer to Perion Network Ltd. References to "U.S. dollars," "U.S.$" and "$"... -

Page 5

... the risks and uncertainties relating to our business described in this annual report at "Item 3.D Risk Factors." Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for our management to predict all risks, nor can we... -

Page 6

...58 59 60 78 79 Defaults, Dividend Arrearages and Delinquencies Material Modifications to the Rights of Security Holders and Use of Proceeds Controls and Procedures [Reserved] Audit Committee Financial Expert Code of Ethics Principal Accountant Fees and Services Exemptions from the Listing Standards... -

Page 7

...- Operating and Financial Review and Prospects" and our consolidated financial statements and related notes appearing elsewhere in this annual report. We derived the selected operations data below for the years ended December 31, 2009, 2010 and 2011 and the selected balance sheet data as of December... -

Page 8

... has other limited termination rights. If this agreement is terminated, substantially amended, or not renewed on favorable terms, we would be forced to seek an alternative search provider. There are very few companies in the market that provide Internet search services similar to those provided by... -

Page 9

... to Google services when providing downloadable applications have changed as compared to the previous agreement, this had negative revenue implications, offset by some positive changes made in the agreement. Should Google, or the other companies providing the internet browsers, effectively further... -

Page 10

... that many email users have multiple email clients and accounts, many of which are likely provided to them free of charge by large Internet and software companies, positively affects the potential market demand for our enhanced email software products. The growing popularity of web based mail and... -

Page 11

... web-based solution have more established brands, products and customer relationships than we do, which could inhibit our market penetration efforts even if they may not offer features similar to IncrediMail ® . For example, consumers may choose to receive an extensive package of Internet and email... -

Page 12

... reasonable steps to ensure the security of personal information, concerns may be expressed, from time to time, about whether our products compromise the privacy or confidentiality of the information of users and others. Concerns about our collection, use, sharing or handling of personal information... -

Page 13

... may have difficulty managing our growth, which could limit our ability to increase our sales and control our costs. The organic growth of our operations has slowed in recent years. To accelerate growth we have invested heavily in advertising and the acquisition of new businesses and products. This... -

Page 14

... further discussion of the effects of exchange rate fluctuations on earnings. A loss of the services of our senior management and other key personnel could adversely affect execution of our business strategy. We depend on the continued services of our senior management, particularly Josef Mandelbaum... -

Page 15

...currency exchange restrictions; compliance with different consumer and data protection laws and restrictions on pricing or discounts; lower levels of adoption or use of the Internet and other technologies vital to our business and the lack of appropriate infrastructure to support widespread Internet... -

Page 16

.... In addition, although email software programs and services currently enjoy a large market, the development and consumer acceptance of other means of electronic communication, such as text messaging over phone networks, chat-boards, blogs and web-based social networks, have slowed the growth... -

Page 17

... an increasing number of services for free. Internet based companies are providing an increasing number of services for free, including email clients and anti-spam software and services. A substantial part of our revenues comes from selling software products and services, currently accounting for... -

Page 18

... Internet protocol addresses and cookies are intrinsically personally identifiable information that is subject to privacy standards. We cannot assure you that our current policies and procedures would meet these restrictive standards. In addition, technology is changing constantly and data security... -

Page 19

... absence of a significant number of our employees related to military service or the absence for extended periods of military service of one or more of our executive officers or key employees. Any disruption in our operations would harm our business. Investors and our shareholders generally may have... -

Page 20

... Investments, 1959" for more information about these programs, the Investment Law and the abovementioned amendments. Risks Related to our Ordinary Shares and their Listing on a Stock Exchange Although we have paid dividends in the past, our policy since the beginning of 2011 is not to distribute... -

Page 21

... effects of Israeli law. These provisions of Israeli law may delay, prevent or make difficult an acquisition of our Company, which could prevent a change of control and therefore depress the price of our shares. Future sales of our ordinary shares could reduce our stock price. Sales by shareholders... -

Page 22

... and\or issuances of securities or debt. Recent Developments On August 1, 2011 we signed a definitive agreement to acquire (via our Delaware Subsidiary) Smilebox Inc., a U.S. consumer focused photo sharing and social expression company. Smilebox is an Internet photo sharing service available for the... -

Page 23

... million IncrediMail® emails and our Smilebox users shared 2.3 million photo creations. Our users typically use our products for as long as six years. However, the length of use varies dramatically based on the product, whether it's the free version or paid for, when the product was downloaded and... -

Page 24

... content was critical in attracting the user to the product, the use of the product was based on our ability to provide our consumer segment of "second wave adopters", software that is simple, safe and useful, assisting them in better utilizing their time. Our user. Our products ideally service... -

Page 25

... through a personal computer running on a Microsoft Windows operating system: Communication vertical: • IncrediMail ® Xe is our communication client, available over the Internet free of charge, which is used for managing email messages and Facebook feeds, and which has the following main features... -

Page 26

... Creator is an application that enables IncrediMail ® users to design and create their own personalized email letters and ecards. • Digital photo vertical: • Smilebox is an Internet photo sharing service available for the desktop and smart-phone. o On the desktop, Smilebox can be used both on... -

Page 27

... our HiYo product in the latter part of 2008. Having achieved the objectives originally set out, and in light of the new market conditions and our focus on profitability in 2009, we scaled back our marketing efforts and remained at a similar level in 2010. In 2011 we supplemented the viral marketing... -

Page 28

... photo services and PC safety and security, aiming to offer simple, safe and useful applications. Perion was among the first companies to offer to the consumer email market a solution that combines an easy to use and intuitive email product with a gallery of creative content. Providing this kind... -

Page 29

... provides a customized and entertaining email experience similar to IncrediMail ® . For example, consumers may choose to receive an extensive package of Internet and email services from a more dominant and recognized company, such as Microsoft Corporation (Outlook Express) or America Online, Inc... -

Page 30

...about their use of our services as mentioned above, in the EU at least, it is likely that further transparency and consent will be required in connection with some of our activities which use cookies and similar technologies. We also provide users with the opportunity to opt out of receiving certain... -

Page 31

... have data security breach laws that impose various requirements on service providers to report to state attorneys general and send notices to affected consumers in the event of a breach of security of network and computer systems that compromise a user's personal financial and other information... -

Page 32

... residents and regulates information collected about users. The Massachusetts Office of Consumer Affairs and Business Regulation established data security regulations (201 CMR 17.00 et seq.) which became effective on March 1, 2010. They require any company which possesses the personal information of... -

Page 33

... Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements regarding the Company's expectations, beliefs, intentions, or future strategies that are signified by the words "expects," "anticipates," "intends," "believes," or similar language. These forward looking... -

Page 34

... our email users sent over 369 million IncrediMail® emails and our Smilebox users shared 2.3 million creations each month. Included in our "installed base" are users who have our software installed on their computer on the measurement date. Our users use our products for as long as six years, based... -

Page 35

... downloads, users and subsequently revenue generated. Customer acquisition costs were; $1.9 million, $1.8 million and $8.1 million in 2009, 2010 and 2011, respectively. Credit card commissions include nominal transaction costs and percentage commission costs, both of which vary based on the service... -

Page 36

...of the agreement terms to be evidence of an arrangement. Delivery : Delivery is considered to occur when the license key is sent via email to the customer or alternatively the customer is given access to download the licensed key. Fixed or determinable fee : Fees are determinable at the time of sale... -

Page 37

... industry sector index similar to the Company's characteristics, since it did not have sufficient company specific data. In 2011, expected volatility was calculated based upon actual historical stock price movements. The expected option term was calculated based on the Company's assumptions of early... -

Page 38

... acquired companies and relevant market and industry data and are, inherently, uncertain. Critical estimates made in valuing certain of the intangible assets include, but are not limited to, the following: (i) future expected cash flows from license sales, maintenance agreements, customer contracts... -

Page 39

... the reporting unit and assumptions about the period of time we will continue to use the brand in our product portfolio. If these estimates or their related assumptions change in the future, we may be required to record impairment charges for our goodwill. Our most recent annual goodwill impairment... -

Page 40

... million in 2010, to $25.5 million in 2011. This increase was due to an increase in the number of downloads and subsequently the number of users using our search service. As the number of downloads of our IncrediMail products increased, while the number of downloads of our Magentic and HiYo products... -

Page 41

... primarily due to our building a management team, primarily in the latter part of 2010, capable of scaling the business model and taking the Company to the next level, both organically and through acquisitions. As a result, in 2011 G&A on average was at a level similar to that off the last quarter... -

Page 42

...from other search providers, primarily InfoSpace. The continued increase in search generated revenues reflects the success of our strategy to leverage our large user base, primarily those using our free products. In 2011, as we implement our strategy for growth and invest in customer acquisition, we... -

Page 43

... in working capital, cash, cash equivalents and marketable securities, as well as the increase in other short term liabilities and expenses, was entirely due to the acquisition of Smilebox Inc. in the second half of 2011. Under the terms of the acquisition agreement, the Company paid approximately... -

Page 44

... of taking the Company to the next level by implementing organic and non-organic growth strategies. This effort began in the latter part of 2010 and had full financial effect in 2011, (ii) the acquisition of Smilebox in the middle of 2011, together with required overhead to manage that business, and... -

Page 45

... of photo sharing and email. In recent years, we have witnessed an increase in the use of web-based e-mail solutions such as Microsoft Hotmail, Yahoo! Mail and Google's Gmail. Facebook Mail is relatively new addition to this market, having a lot of potential based on its social network popularity... -

Page 46

... well as a shift to online from traditional retail has opened up the industry to new opportunities and growth possibilities. Users no longer have their information in one place and the persistent connectivity and cloud provide even more ways for criminals to access your data. There would seem to be... -

Page 47

...and was elected as a Director in January 2011. Before joining the Company, Mr. Mandelbaum worked at American Greetings as Chief Executive Officer of the AG Intellectual Properties group, since 2000 and as Senior Vice President of the Sales and Business Development AG Interactive group from1998 until... -

Page 48

... in May 2011 and was recently appointed General Manager of the Communications Business division. Before joining the Company, Ron worked at ICQ/AOL for almost ten years, and was a member of the management team from 2005. During those years, Ron acted as Vice President of Web R&D, Vice President... -

Page 49

... Microsoft Corporation, where he managed the consumer imaging and publishing business, including Picture It!, Home Publishing, and the Greetings product lines. B. COMPENSATION The aggregate direct compensation we paid to our officers as a group (8 persons) for the year ended December 31, 2011, was... -

Page 50

... with the shareholders' approval of December 27, 2007 each of the directors who is not an employee of the Company, receives for each year of service by such person as a director of the Company, an option to purchase 10,000 ordinary shares of the Company (in this subsection - the "Annual Grant... -

Page 51

... of Ofer Adler for personal reasons, which took effect on August 7 th 2011. Mr. Gelman was appointed to complete Mr. Adler's term until the annual meeting of shareholders of the Company to be held in the year 2013 and the due election of his successor. If the number of directors constituting the... -

Page 52

... the nominating and governance committee or, subject to the Companies Law, by any of our shareholders. However, any shareholder or shareholders holding at least 5% of the voting rights in our issued share capital may nominate one or more persons for election as directors at a general meeting only if... -

Page 53

... votes); or the total number of shares of non-controlling shareholders voted against the election of the external director does not exceed two percent of the aggregate voting rights in the company. • The Israeli Companies Law provides for an initial three-year term for an external director... -

Page 54

... of the work of the issuer's public accountants). In addition, applicable NASDAQ Listing Rules require that a foreign private issuer can maintain an audit committee that meets the requirements of Rule 10A-3(b)(subject to the exemptions provided in Rule 10A-3(c)) under the Exchange Act, instead... -

Page 55

... concerning corporate governance matters. Under Israeli Companies Law, the nominations for director are generally made by our directors but may be made by one or more of our shareholders. However, any shareholder or shareholders holding at least 5% of the voting rights in our issued share capital... -

Page 56

... any interested party or office holder, and may not be a member of the company's independent accounting firm or its representative. The Israeli Companies Law defines an interested party as a substantial shareholder of 5% or more of the shares or voting rights of a company, any person or entity that... -

Page 57

... contributes approximately 12% and the employer contributes approximately 5.9%. E. SHARE OWNERSHIP Security Ownership of Directors and Executive Officers The following table sets forth information regarding the beneficial ownership of our ordinary shares as of February 29, 2012 by each of our... -

Page 58

... connection with share-based compensation. Please also see Note 11 of our financial statements included in this annual report for information on the options issued under our plan. Under the 2003 Plan, we may grant to our directors, officers, employees, service providers and controlling shareholders... -

Page 59

... agreements that if the options are not substituted or exchanged by a successor company, then the vesting of the options shall accelerate. Adjustments to the number of options or exercise price shall not be made in the event of rights offering on outstanding shares. In December 2011, the Company... -

Page 60

... meeting the shareholders approved a proposal to amend the terms of options granted to the directors of the Company. It was resolved that; (a) the recurring annual stock option grants to the directors, for board service, will have a vesting period applicable to one term of office of a director... -

Page 61

... financial statements for the year ended December 31, 2011 are included in this annual report pursuant to Item 18. Legal Proceedings We are not aware of any legal proceedings the outcome of which would have a significant impact on the Company's financial condition. Policy on Dividend Distribution... -

Page 62

... Tel Aviv Stock Exchange ("TASE") on December 4, 2007 under the Hebrew letters which read "EMAIL" and since November 16, 2011 under the Hebrew letters which read "PERION". The following table shows, for the periods indicated, the high and low closing sale prices of our ordinary shares as reported on... -

Page 63

... Aviv Stock Exchange under the Hebrew letters which read "PERION". D. SELLING SHAREHOLDERS Not applicable. E. DILUTION Not applicable. F. EXPENSES OF THE ISSUE Not applicable. ITEM 10. A. ADDIT IO NAL INFORMATION SHARE CAPITAL At our 2010 annual shareholder meeting held on January 6, 2011... -

Page 64

... company's office holders with respect to certain liabilities incurred by them require the approval at a general meeting of shareholders holding more than twothirds of the voting power of the issued and outstanding share capital of the company. Notices Under the Israeli Companies Law, shareholders... -

Page 65

...or transaction of the company, including a personal interest of his relative and of a corporate body in which that person or a relative of that person is a 5% or greater shareholder, a holder of 5% or more of a company's outstanding shares or voting rights, a director or general manager, or in which... -

Page 66

... or in which a controlling shareholder has a personal interest; and direct or indirect employment of or receipt of services by the company from a controlling shareholder or a relative of a controlling shareholder. The shareholder approval must include the majority of shares voted at the meeting. In... -

Page 67

.... As of the date of this Annual Report, the Israeli Securities Authority has not issued any regulations yet with respect to this code, and it has not been determined to what extent this code will be relevant to Israeli companies that are also listed on non-Israeli stock exchanges. Fines. The Israeli... -

Page 68

... treats some acquisitions, such as a stock-for-stock swap between an Israeli company and a foreign company, less favorably than U.S. tax law. For example, Israeli tax law may subject a shareholder who exchanges his ordinary shares for shares in a foreign corporation to immediate taxation. Please see... -

Page 69

...it did not receive the affirmative vote of shareholders present in person or by proxy and holding Ordinary Shares amounting in the aggregate to at least more than two-thirds of the voting power of the issued and outstanding share capital of the Company, as such number of shareholders was not present... -

Page 70

... generally accepted business practice in Israel is not to distribute such reports to shareholders. We do however make our audited financial statements available to our shareholders at the Company's offices and mail such reports to shareholders upon request. We also file our annual reports with the... -

Page 71

... the Company's applications. Since then this agreement has been amended and extended numerous times. Most recently, we signed an agreement with Google which was effective as of January 1, 2011 through January 31, 2013. Although, the agreement may be terminated by either side after one year, neither... -

Page 72

... investment program. The benefits available to an Approved Enterprise are conditioned upon terms stipulated in the Investment Law and the regulations thereunder and the criteria set forth in the applicable certificate of approval. If we do not fulfill these conditions in whole or in part, the... -

Page 73

... investors. Furthermore, such definition now also includes the purchase of shares of a company from another shareholder, provided that the company's outstanding and paid-up share capital exceeds NIS 5 million. Such changes to the aforementioned definition will take effect retroactively from 2003. 70 -

Page 74

...income to tax at the reduced corporate income tax rates pertaining to the Beneficiary Enterprise and Approved Enterprise programs upon distribution, or complete liquidation in the case of a Beneficiary Enterprise's exempt income. Since 2011 the Company has changed its dividend policy, under which it... -

Page 75

... The tax rate generally applicable to Israeli individuals on capital gains from by the sale of shares, whether listed on a stock market or not, is 25%, or 30% if the individual is considered a "substantial shareholder" in the company issuing the shares. Israeli corporations are generally subject to... -

Page 76

...U.S. federal income tax law, including insurance companies; dealers in stocks, securities or currencies; financial institutions and financial services entities; real estate investment trusts; regulated investment companies; persons that receive ordinary shares as compensation for the performance of... -

Page 77

... under "Information Reporting and Back-up Withholding," a Non-U.S. Holder generally will not be subject to U.S. federal income or withholding tax on dividends received on ordinary shares unless that income is effectively connected with the conduct by that Non-U.S. Holder of a trade or business in... -

Page 78

..., gain from the sale or exchange of preferred shares by a U.S. person who is or was a 10-Percent Shareholder at any time during the five-year period ending with the sale or exchange is treated as dividend income to the extent of earnings and profits of the company attributable to the stock sold or... -

Page 79

... value our total assets, in part, based on our total market value determined using the average of the selling price of our ordinary shares on the last trading day of each calendar quarter. We believe this valuation approach is reasonable. While we intend to manage our business so as to avoid passive... -

Page 80

... at Perion Network Ltd., 4 HaNechoshet Street, Tel-Aviv 69710, Israel, Attention: Yacov Kaufman, Telephone: +972-3-7696100. A copy of each report submitted in accordance with applicable United States law is available for public review at our principal executive offices. In addition, our filings with... -

Page 81

... to in this annual report on Form 20-F, is available for public view (subject to confidential treatment of agreements pursuant to applicable law) at our principal executive offices at Perion Network Ltd., 4 HaNechoshet Street, Tel-Aviv 69710, Israel. I. SUBSIDIARY INFORMATION Not applicable. ITEM 11... -

Page 82

... average maturity of no more than 3 years. We are exposed to market risks resulting from changes in interest rates relating primarily to our financial investments in cash, deposits and marketable securities. We do not use derivative financial instruments to limit exposure to interest rate risk. Our... -

Page 83

... of changes in conditions, the effectiveness of internal control over financial reporting may vary over time. Our management assessed the effectiveness of our internal control over financial reporting as of December 31, 2011. In making this assessment, our management used the criteria set forth... -

Page 84

...Fees Audit related fee Total $ 128 68 9 205 $ 2011 173 150 39 362 $ $ Audit Fees include fees for professional services rendered by our principal accountant in connection with the audit of our consolidated annual financial statements and review of our unaudited interim financial statements. Audit... -

Page 85

... of the outstanding shares of the company's common voting stock. However, our articles of association, consistent with the Israeli Companies Law, provide that the quorum requirements for an adjourned meeting are the presence of a minimum of two shareholders present in person. Our quorum requirements... -

Page 86

...are filed as part of this annual report: Page Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2010 and 2011 Consolidated Statements of Income for the Years Ended December 31, 2009, 2010 and 2011 Consolidated Statements of Changes in Shareholders... -

Page 87

... Share Option Plan and the form of Option Agreement (1) and the US Addendum to such plan (4) Google Services Agreement, dated December 27, 2010(3) Stock Purchase Agreement among Ofer Adler, the Company and the purchasers listed therein, dated January 24, 2011. (5) Registration Rights Agreement... -

Page 88

... 31, 2011 IN U.S. DOLLARS INDEX Page Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2010 and 2011 Consolidated Statements of Income for the Years Ended December 31, 2009, 2010 and 2011 Consolidated Statements of Changes in Shareholders' Equity... -

Page 89

... consolidated balance sheets of Perion Network Ltd. (formerly: Incredimail Ltd.) ("the Company") and its subsidiaries as of December 31, 2010 and 2011, and the related consolidated statements of income, changes in shareholders' equity and cash flows for each of the three years in the period ended... -

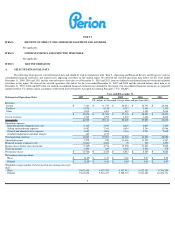

Page 90

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) CONSOLIDATED BALANCE S HE ETS U.S. dollars in thousands December 31, 2010 ASSETS CURRENT ASSETS: Cash and cash equivalents Marketable securities Trade receivables Other receivables and prepaid expenses Total current assets LONG-... -

Page 91

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) CONSOLIDATED BALANCE SHEETS U.S. dollars in thousands (except share and per share data) December 31, 2010 LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES: Trade payables Deferred revenues Payment obligation related to ... -

Page 92

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) CONSOLIDATED STATEMENTS OF INCOME U.S. dollars in thousands (except per share data) Year ended December 31, 2010 2009 Revenues: Search Products Other 2011...Ordinary share: Basic Diluted The accompanying notes are an integral part ... -

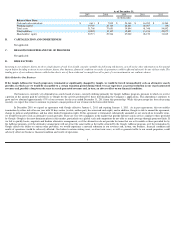

Page 93

...(100) 31,815 Share capital Balance as of January 1, 2009 $ Cumulative effect from adoption of FSP No. 115-2/124-2 (primarily codified in ASC 320-10, "Investments - Debt and Equity Securities - Overall") on April 1, 2009 Stock based compensation expense Exercise of share options Dividends Repurchase... -

Page 94

... and content costs Acquisition of subsidiary, net of acquired cash Proceeds from sales of marketable securities Investment in marketable securities Net cash (used in) provided by investing activities The accompanying notes are an integral part of the consolidated financial statements. F-7 $ 2011... -

Page 95

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) CONSOLIDATED STATEMENTS OF CASH FLOWS U.S. dollars in thousands Year ended December 31, 2010 2009 Cash flows from financing activities: Exercise of share options Excess tax benefit from share-based payment arrangements Repurchase... -

Page 96

... major customer has limited termination rights. On December 27, 2010, the Company signed an agreement with the customer, effective January 1, 2011 through January 31, 2013. NOTE 2:ACQUISITION OF SMILEBOX INC. On August 31, 2011, the Company completed the acquisition of all of the outstanding shares... -

Page 97

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 2:ACQUISITION OF SMILEBOX INC. (Cont.) In addition the Company incurred acquisition related costs in a total amount of $ ... -

Page 98

... per share data) NOTE 2:ACQUISITION OF SMILEBOX INC (Cont.) Fair value Customer relationships Technology Trade name Total intangible assets $ 1,488 3,000 1,870 6,358 $ The following unaudited condensed combined pro forma information for the years ended December 31, 2010 and 2011, gives effect to... -

Page 99

... estimates, judgments and assumptions. The Company's management believes that the estimates, judgments and assumptions used are reasonable based upon information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities... -

Page 100

... NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 3:SIGNIFICANT ACCOUNTING POLICIES (Cont.) e. Marketable securities: The Company accounts for investments in debt securities... -

Page 101

...of the purchase price in a business combination over the fair value of net tangible and intangible assets acquired. Goodwill is not amortized, but rather is subject to an impairment test. The Company performs an annual impairment test during the fourth quarter of each fiscal year, or more frequently... -

Page 102

...an agreement exists, delivery of the product has occurred, the fee is fixed or determinable, and collectability is probable. Company's e-mail product users may also purchase a license to its content database. This content database provides additional Perion Network content files in the form of email... -

Page 103

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 3:SIGNIFICANT ACCOUNTING POLICIES (Cont.) Deferred revenues include upfront payments received from customers, for whom ... -

Page 104

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 3:SIGNIFICANT ACCOUNTING POLICIES (Cont.) The Company accounts for uncertain tax positions in accordance with ASC 740, ... -

Page 105

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 3:SIGNIFICANT ACCOUNTING POLICIES (Cont.) o. Severance pay: The Company's liability for severance pay is calculated ... -

Page 106

... of diluted net earnings per Ordinary share because these securities are anti-dilutive was 789,411, 922,069 and 1,266,919 for the years ended December 31, 2009, 2010 and 2011, respectively. q. Accounting for stock-based compensation: The Company accounts for stock-based compensation under ASC 718... -

Page 107

... (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 3:SIGNIFICANT ACCOUNTING POLICIES (Cont.) In November 2010 the Company's Board decided to change its dividend policy so that beginning with earnings of 2011 and... -

Page 108

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 3:SIGNIFICANT ACCOUNTING POLICIES (Cont.) In determining fair value, the Company uses various valuation approaches. ASC ... -

Page 109

... from investments by, or distributions to, shareholders. The Company determined that its items of other comprehensive income relates to unrealized gains and losses on available for sale securities. v. Business combinations: The Company accounts for business combination in accordance with ASC 805... -

Page 110

... it is necessary to perform the two-step goodwill impairment test required under current accounting standards. The guidance is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011, with early adoption permitted. The adoption of... -

Page 111

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 4:MARKETABLE SECURITIES The Company's marketable securities are classified as available-for-sale securities and are ... -

Page 112

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 6:PROPERTY AND EQUIPMENT, NET December 31, 2010 2011 Cost: Computers and peripheral equipment Office furniture and ... -

Page 113

... and per share data) NOTE 7:GOODWILL AND OTHER INTANGIBLE ASSETS, NET (Cont.) b. Other intangible assets, net Net other intangible assets consisted of the following: Useful life Original amount: Capitalized software development costs Capitalized content costs Domain Technology Trade name Customer... -

Page 114

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 8:ACCRUED EXPENSES AND OTHER LIABILITIES December 31, 2010 2011 Employees and payroll accruals Current severance pay ... -

Page 115

...be subject to the statutory Israeli corporate tax rate and the Company could be required to refund a portion of the tax benefits already received, with respect to such programs. As of December 31, 2011, management believes that the Company is in compliance with all the conditions required by the Law... -

Page 116

... SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 10:INCOME TAXES (Cont.) In November 2010 the Company's Board decided to change its dividend policy so that beginning with earnings of 2011 and beyond... -

Page 117

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 10:- INCOME TAXES (Cont.) d. Tax reports filed by the Company in Israel through the year ended December 31, 2008 are ... -

Page 118

... NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 10:- INCOME TAXES (Cont.) Components of the Company's deferred tax assets (liabilities) are as follows: December 31, 2010 2011... -

Page 119

...: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 10:- INCOME TAXES (Cont.) g. A reconciliation of the Company's effective tax rate to the statutory tax rate in Israel is as follows: Year ended December 31, 2010 2011 11... -

Page 120

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 10:- INCOME TAXES (Cont.) i. Uncertain tax position: A reconciliation of the beginning and ending balances of unrecognized... -

Page 121

... (except share and per share data) NOTE 11:- SHAREHOLDERS' EQUITY a. Ordinary share: The Ordinary shares entitle their holders to voting rights, the right to receive cash dividend and the right to a share in excess assets upon liquidation of the Company. In January 6, 2011 the shareholders resolved... -

Page 122

... and per share data) NOTE 11:- SHAREHOLDERS' EQUITY (Cont.) A summary of the activity in the share options granted to employees and directors for the year ended December 31, 2011 and related information is as follows: Weighted average remaining contractual Term (in Years) 3.24 $ Number of options... -

Page 123

... dollars in thousands (except share and per share data) NOTE 12:- SUPPLEMENTARY DATA ON SELECTED CONSOLIDATED STATEMENTS OF INCOME ITEMS a. Financial income, net: Year ended December 31, 2010 2011 360 12 9 381 Financial expenses: Losses from marketable securities, net Exchange rate differences , net... -

Page 124

...: Year ended December 31, 2010 2011 $ 8,389 $ 5,668 2009 Net income available to Ordinary shareholders 2. Denominator: $ 8,013 2009 Denominator for basic net earnings per share Weighted average number of Ordinary shares, net of treasury stock Effect of dilutive securities: Add - stock options... -

Page 125

PERION NETWORK LTD. AND ITS SUBSIDIARIES (Formerly: Incredimail Ltd.) NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) NOTE 13:- DERIVATIVE FINANCIAL INSTRUMENTS (Cont.) The Company measured the fair value of the contracts in accordance with ASC ... -

Page 126

...registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this annual report on its behalf. Perion Network Ltd. By: /s/ Josef Mandelbaum Josef Mandelbaum Chief Executive Officer Date: March 22, 2012 85 -

Page 127

... Share Option Plan and the form of Option Agreement (1) and the US Addendum to such plan (4) Google Services Agreement, dated December 27, 2010(3) Stock Purchase Agreement among Ofer Adler, the Company and the purchasers listed therein, dated January 24, 2011. (5) Registration Rights Agreement... -

Page 128

... The Company: Incredimail Ltd. Registered Number 512849498 Has changed its name, and shall be henceforth named: PERION NETWORK LTD. Given in Jerusalem 9 Cheshvan 5772 November 6, 2011 (-) Stamp of the Ministry of Justice Registrar of Companies and Partnerships (-) Boaz Avrahami, Adv. Corporations... -

Page 129

Exhibit 4.7 To: IncrediMail Limited (the " Company " and/or the " Borrower " ) Date: September 6, 2011 Dear Sirs, Whereas you have informed us of your intention also to use the Credit (as defined below) for the purpose of acquisitions of assets, including various companies; and Whereas you have ... -

Page 130

... collateral granted to secure a car lease agreement and/or a landlord commitment and/or hedging activity in a total aggregate amount that shall not exceed $750,000 USD shall rank prior to the Debenture, subject to receiving similar consent from FIBI, if applicable. 4. Additional Conditions for the... -

Page 131

.... If the terms and conditions specified above are acceptable to you, please confirm your agreement thereto by countersigning this letter in the space provided below and returning a copy thereof to us by no later than September 13, 2011. Without derogating from any of the terms set out herein, the... -

Page 132

...We hereby confirm our agreement to the above and instruct you to debit the Loan Account with the commissions specified in Clause 5 above, whenever same shall be due, whether the account is in credit or in debit or shall be become overdrawn as a result thereof. IncrediMail Limited I, the undersigned... -

Page 133

... of loans, credit facility as set forth in the attached Commitment letter or other banking services and receiving various undertakings and guarantees from us, to the undersigned IncrediMail Ltd . (hereinafter: the " Company "), you have requested that we issue this document and we have agreed... -

Page 134

... based on applicable accounting standards, that there have been /are about to be changes in the Company's Financial Reports as a result of the New Accounting Standards that by regulation apply to the company, the Bank may, after consultation with the Company but without requiring its consent, inform... -

Page 135

... receiving the Bank's prior written consent. 3.2 For the purpose of this clause the term "shares" shall include shares of the capital stock, partnership interests, membership rights and/or any other means of ownership and/or control in a corporation. 4. Undertaking to Provide Financial Reports... -

Page 136

... Bank. Without derogating from the generality of the aforesaid, such additional information may include a detailed business plan as provided by the Company to its board of directors, reports that the Company provided to its shareholders, all in the form and order as reasonably requested by the Bank... -

Page 137

... are or will become due to the Bank by the Company any amounts whatsoever on account of the Credit granted and/or which shall be granted ...signed or to be signed by us, nor shall the forgoing in any way diminish any of the Bank's rights to declare our indebtedness and undertakings, in whole or in part... -

Page 138

... in the Borrower's existing bank account (the " Loan Account "), No. 682-110-088800/22 in the name of IncrediMail Limited and IncrediMail Limited shall provide the Bank, upon request, with any additional reasonable and customary documents of the banks and sign such reasonable and customary forms of... -

Page 139

... to the Company or other persons guaranteed by Company (the " Banking Services "); WHEREAS, the people/corporations listed in Annex A attached herein and constituting an integral part of this letter constitute Interested Parties and/or Controlling Shareholder as defined in the Israeli Securities Law... -

Page 140

... which originate from an acquisition/acquisitions by the Company of holdings in any corporations, including of the Company's subsidiaries and/or affiliates, as such information will be approved by the Company's accountant, at those times prescribed for in Section 7.4 below. Interested Parties, and... -

Page 141

... statements and the EBITDA in annual terms shall not exceed 3.5. Financing Obligations -defined as loans (short and long term) received from banks and other financial institutions, obligations on account of finance leasing, bonds and convertible bonds. For the removal of doubt, operational leasing... -

Page 142

... on account of issues concerning such new owners' identities. The Company hereby undertakes that in the event it acquires holdings in any type of corporation, the aforementioned acquired corporation's field of operations will be similar or complementary to that of the Company. Loans received/or... -

Page 143

... on account of Shareholder Loans and/or dividend payments and/or management fees and/or indemnity payments and/or consulting fees, or any other payment, in part or in full, to an Interested Party in the Company, except for payments detailed in this section below, for which the Company has the right... -

Page 144

... Company at any time the Company provides Financial Statements to the bank (quarterly, including administrative and annual) with respect to the value of Intangible Assets on Account of Acquisitions, as defined above, originating from acquisitions made within 3 years of the date this letter is signed... -

Page 145

.../or any right the bank has towards the Company and/or towards Interested Parties pursuant to the General Debit Contract and/or the general conditions for account management, and any other document signed/or which will be signed by them or by any of them. 13. 14. Sincerely, _____ Incredimail Ltd... -

Page 146

...-annual payment of the principal and interest. 2. The Credit Line Will Be Secured by the Following Collateral: A. A first-ranking floating charge without a monetary limit on all the property of the company as well as all the insurance rights in connection therewith, and a fixed charge on the share... -

Page 147

... pursuant to the floating charge debenture, you will execute in our favor an undertaking to not create liens on the foregoing acquired corporation(s). It is clarified that: -The bank will be authorized to change from time to time the advance rate against any of the collateral set forth above in... -

Page 148

... on the company to disclose information as set forth above due to requirements of applicable law, the company shall fulfill the requirements of the applicable law and/or the requirements of the applicable stock exchange and/or authority and will provide the bank with due notice thereof. Term of the... -

Page 149

... OF THE SECURITIES EXCHANGE ACT OF 1934; [***] DENOTES OMISSIONS. EXECUTION COPY AGREEMENT AND PLAN OF MERGER among INCREDIMAIL LTD. and INCREDIMAIL, INC. and SEDER MERGER, INC. and SMILEBOX, INC. and ANDREW WRIGHT and SHAREHOLDER REPRESENTATIVE SERVICES LLC, AS THE SHAREHOLDER REPRESENTATIVE _____... -

Page 150

... OF FOUNDER. CERTAIN COVENANTS OF THE COMPANY. ADDITIONAL COVENANTS OF THE PARTIES. CONDITIONS PRECEDENT TO OBLIGATIONS OF PARENT AND PURCHASER. CONDITIONS PRECEDENT TO OBLIGATIONS OF THE COMPANY. TERMINATION. INDEMNIFICATION, ETC. MISCELLANEOUS PROVISIONS. SHAREHOLDER REPRESENTATIVE -i1 16 41 43 44... -

Page 151

... Following the Merger, the Company shall continue as the surviving corporation (the " Surviving Corporation ") and the separate corporate existence of Merger Sub shall cease. 1.2 Effective Time . Subject to the terms and conditions set forth in this Agreement, on the Closing Date (as defined below... -

Page 152

...the " Closing Date "), at the offices of Goldfarb Seligman & Co., 98 Yigal Alon Street, Tel-Aviv, Israel, unless another time, date or place is agreed to in writing by the parties hereto. The parties (other than the Shareholder Representative) shall use their best efforts to cause the conditions set... -

Page 153

...Company Stock Options, or issue any securities in exchange therefor, in connection with the transactions contemplated hereby. Immediately prior to the Effective Time and subject to consummation of the Merger and the terms and conditions of this Agreement, the vesting of all outstanding Company Stock... -

Page 154

... and appropriate actions) to provide that, subject to consummation of the Merger and the terms and conditions of this Agreement, at the Effective Time, each then outstanding Company Warrant shall terminate, and the holder thereof shall have the right to receive the consideration equal to the... -

Page 155

... as such holder's " Holder Share Amount "). If between the date of this Agreement and the Effective Time, the number of outstanding shares of Company Common Stock, Preferred (c) Stock, Company Stock Option or Company Warrant is changed into a different number of shares or a different class or option... -

Page 156

... to each Person who was, at the Effective Time, (i) a holder of record of Shares as set forth in the Closing Spreadsheet (excluding Dissenting Shares (and any Shares with respect to which dissenters' rights have not terminated) and Excluded Shares) (each, a " Participating Shareholder ") a form of... -

Page 157

..., there shall be no transfers on the stock transfer books of the Surviving Corporation of shares of capital stock of the Company that were outstanding immediately prior to the Effective Time. (d) On the seven-month anniversary of the Closing Date, Purchaser shall deposit with the Paying Agent the... -

Page 158

... agent pursuant to the Escrow Agreement, and applied for the payment of indemnification obligations under Article 10 hereof, provided, however, that the amount ...event later than three Business Days thereafterthe Paying Agent shall cause each Participating Securityholder to receive its portion of the ... -

Page 159

...amount paid to a public official pursuant to any applicable abandoned property, escheat or similar law. The Surviving Corporation shall pay all charges and expenses in connection with the exchange of cash for Shares. (h) With respect to the Founder Share Consideration that is being held in escrow by... -

Page 160

... with the WBCA, or lost such Shareholder's rights to appraisal of such shares under the WBCA, shall thereupon be deemed to have been converted into, and to have become exchangeable for, as of the Effective Time, the right to receive the applicable Merger Consideration, without any interest thereon... -

Page 161

... and accurately present the Company's good faith best estimate (based on reasonable assumptions) of the balance sheet of the Company and the estimated Company Net Working Capital as of the close of business on the Closing Date. The Company Net Working Capital Certificate shall be used to reduce the... -

Page 162

... Company Net Working Capital calculations set forth in the Purchaser NWC Certificate by providing written notice of such objection to Purchaser within 20 Business Days after Purchaser's delivery of the Purchaser NWC Certificate (the " Notice of Objection "). If the Shareholder Representative timely... -

Page 163

...as determined by the Reviewing Accountant is closer to the Company Net Working Capital as set forth in the Notice of Objection than to the Company Net Working Capital as set forth in the Purchaser NWC Certificate, then two-thirds of the fees and expenses of the Reviewing Accountant shall be borne by... -

Page 164

... ") during the Earn-out Period, provided that (i) such New Installs are acquired directly by the Company and not through third-party distribution or business development partnerships (" Direct Users ") and (ii) at least *** of the amount of the Company's customer acquisition costs ("media buy") (as... -

Page 165

... mean that each new Windows PC Direct User of the Company's product in English, during the process of download thereof, is offered Parent's search service, as described in Schedule 1.13(h) attached hereto; provided, however, that during the first thirty days following the Effective Time, the Search... -

Page 166

... Subsidiary has full corporate power and authority to own, lease and operate its properties and assets to conduct its business as now being conducted. Except as specified in Part 2.1(e) of the Disclosure Schedule, no person has any right to participate in, or receive any payment based on any amount... -

Page 167

... Closing. The rights, privileges and preferences of the Preferred Stock are as stated in the Charter Documents. All of the outstanding shares of Preferred Stock have been duly authorized, are fully paid and nonassessable and were issued in compliance with all applicable federal and state securities... -

Page 168

...in writing, obligating the Company to issue any additional shares or any securities convertible into, or exchangeable for, or evidencing the right to subscribe for, any shares of the Company Capital Stock. None of the Company's stock purchase agreements or stock option documents contains a provision... -

Page 169

... owned, by such Person. The number of such Shares set forth as being so owned, or subject to Company Stock Options so owned, by such Person will constitute the entire interest of such person in the issued and outstanding share capital, voting securities or other securities of the Company. As of the... -

Page 170

... any shares or other securities of the Company except the repurchase of Common Stock upon termination of service of any employee, director or consultant of the Company, pursuant to Stock Subscription Agreements, a form of which was delivered to Purchaser; the Company has not sold, issued or... -

Page 171

...to file any material Tax Return or pay any material Tax timely when due, (ii) made or changed any election with (p) respect to any material Tax, (iii) adopted or changed any accounting method in respect of any material Taxes, (iv) entered into any Tax allocation agreement, Tax sharing agreement, Tax... -

Page 172

... hereof. (b) Except as set forth in Part 2.7(b) of the Disclosure Schedule, the Company has no Accounts Receivable. Part 2.7(b) of the Disclosure Schedule provides an accurate and complete breakdown and aging of all Accounts Receivable, notes receivable and other receivables of the Company as of the... -

Page 173

... methods, or results, descriptions, business or scientific plans, depictions, customer lists and any other written, printed or electronically stored materials or information, including pricing plans, market research or data, potential marketing strategies, prospective users and distribution channels... -

Page 174

... inventions and non-disclosure agreement with the Company regarding ownership and treatment of the Company Intellectual Property. With respect to Service Providers who are employees, such agreements are substantially similar to the forms provided to Purchaser. The Company has not received any claim... -

Page 175

... licenses licensed for an annual fee of less than $1,000 per single user; (ii) standard terms governing third Person's access to, and use of, the Company's website; and (iii) confidentiality or non-disclosure agreements entered into in the ordinary course of business. Part 2.9(g)(1)(ii) of the... -

Page 176

... any source code owned by Company, other than disclosures to Service Providers involved in the development of Company Intellectual Property by or for the Company under terms set forth in Section 2.9 (c) above, and, except for the escrow agreements set forth in Part 2.9(h) of the Disclosure Schedule... -

Page 177

... has not received any complaint regarding the Company's collection, use or disclosure of personal data. (k) Digital Millennium Copyright Act . The Company operates and has operated its business in such a manner as to take reasonable advantage, if and when applicable, of the safe harbors provided by... -

Page 178

... course of business or non-exclusive "shrink wrap" or other form-based licenses licensed for an annual fee of less than $1,000 per single user; (2) standard terms governing third Person's access to, and use of, the Company's website; (3) confidentiality or non-disclosure agreements entered into... -

Page 179

(xii) any (1) non-disclosure, confidentiality, or similar agreement between the Company and any other Person not entered into in the ordinary course of business or (2) assignment of invention, work for hire or similar agreement between the Company and any other Person, except to the extent any such ... -

Page 180

..., credit sale or conditional sale agreement or any contract providing for payment on deferred terms in respect of assets purchased by the Company. (c) The Company is not aware of any Encumbrances on, over or affecting the issued or unissued capital stock of the Company, nor is the Company aware of... -

Page 181

...Returns filed by the Company with the applicable Governmental Bodies in respect of 2007, 2008 and 2009 have been provided to Purchaser. The Company has at all times and within the requisite time limits promptly, fully and accurately observed, performed and complied with all obligations or conditions... -

Page 182

...or prior to the Closing Date: (i) an installment sale or other open transaction or (ii) any adjustment under Section 481(a) or 263A of the Code or any comparable provision under any Legal Requirement relating to Taxes by reason of a change in the accounting method of the Company or any Subsidiary or... -

Page 183

... 1.1502-6 or any similar provision of state, local or non-U.S. law as a transferee or successor, by contract or otherwise. (p) During the five (5) year period ending on the date of this Agreement, neither the Company nor any Subsidiary has been either a "distributing corporation" or a "controlled... -

Page 184

...Section 280G(b)(1) of the Code). No Service Provider is entitled to receive any gross-up or additional payment by reason of the tax required by Section 409A or 4999 of the Code being imposed on such person. (u) Each grant of Company Stock Options was validly issued and properly approved by the Board... -

Page 185

... in a timely manner. Each of the Service Providers Agreements were entered into prior to or coincident with the commencement of each Service Provider's applicable relationship with the Company. The Company does not have any material liability with respect to any misclassification of any Person as an... -

Page 186

... of any material term of any employment, consulting, independent contractor, non-disclosure, non-competition, inventions assignment or any other Contract relating to the relationship of such Service Provider with the Company. Neither the execution, delivery or performance of this Agreement, nor the... -

Page 187

... policy, the annual premiums, the amount of any deductible, termination provisions, change of control provisions, waiver of subrogation rights and information regarding any claims made or outstanding against any of the policies over the past three years. The insurance policies listed on Part 2.17... -

Page 188

...has any time competed directly or indirectly, with the Company; and (e) no Related Party has any claim or right against the Company (including indemnification agreements but excluding rights to receive compensation and benefits for services performed as a Service Provider of the Company as set forth... -

Page 189

..., in each case relating to the Company, that prohibits such Service Provider from engaging in or continuing any conduct, activity or practice relating to the Company's business. 2.20 Authority; Binding Nature of Agreement (a) The Company has the requisite corporate power and authority to enter into... -

Page 190

... relates to the Company's business or to any of the assets owned or used by the Company; (d) contravene, conflict with or result in a violation or breach of, or result in a default under, any provision of any Material Agreement, or give any Person the right to (i) declare a default or exercise any... -

Page 191

2.24 Propriety of Past Payments . Neither the Company nor, to the Company's Knowledge, any agent, employee or other Person associated with or acting on behalf of the Company, has, directly or indirectly, used any corporate funds for unlawful contributions, gifts, entertainment or other unlawful ... -

Page 192

... 25, 2011. The Parent Shares to be issued pursuant to this Agreement will, when issued in accordance with the provisions of this Agreement, be validly issued, fully paid and nonassessable. 3.8 Parent SEC Documents; Financial Statements . (a) Parent has timely filed all forms, reports and documents... -

Page 193

... circumstances and that otherwise such securities must be held indefinitely. In this connection, the Founder represents that it understands the resale limitations imposed by the Securities Act and is familiar with SEC Rule 144, as presently in effect, and the conditions which must be met in order... -

Page 194

... in the Company Net Working Capital being lower than the Working Capital Target (as such terms are defined in Section 1.12 above), and shall not repurchase, redeem or otherwise reacquire any shares or other securities of the Company, except pursuant to restricted stock purchase agreements that were... -

Page 195

... convertible into or exchangeable for any capital stock or other security of the Company; (h) the Company shall not amend or waive any of its rights under, or permit the acceleration of vesting under, (i) any provision of any share or option plan, (ii) any provision of any agreement evidencing any... -

Page 196

...discussions or negotiations or enter into any agreement with, or provide any information to, any Person (other than Parent and Purchaser) relating to or in connection with a possible Acquisition Transaction (except outstanding Company Warrants set forth in Part 2.3(c) of the Disclosure Schedule); or... -

Page 197

...give full effect to transactions contemplated by this Agreement; provided, however , that (i) the Company shall be responsible for making all filings with and obtaining all such Consents from Governmental Bodies pursuant to Legal Requirements applicable to the Company or its businesses or properties... -

Page 198

...Plans (not including the Stock Option Plans) in effect as of the Closing Date, or, alternatively, provide the Employees of the Company who remain employed by the Company or the Surviving Corporation or one of its subsidiaries after the Effective Time (collectively, the " Continuing Employees ") with... -

Page 199

... relevant party in this Agreement; (c) any breach of any material covenant or obligation of the relevant party; and (d) any event, condition, fact or circumstance that would make the timely satisfaction of any of the conditions set forth in Section 7 (in the case of the Company or Section 8 (in the... -

Page 200

...and email addresses, telephone number, taxpayer identification numbers (if any), bank information (including the respective bank name and number, branch name and address, swift number and account number); (b) the number and class of Shares held by, or subject to Company Warrants or the Company Stock... -

Page 201

... to go into effect upon the Effective Time, which policy (i) contains terms that are substantially similar to those of the Company's directors' and officers' insurance policy in effect on the date of this Agreement, (ii) has an effective term of six (6) years from the Effective Time and (iii) covers... -

Page 202

.... Purchaser shall have received the following agreements and documents, each of which shall be in full force and (b) a certificate executed by the Chief Executive Officer and principal financial officer of the Company which certifies that the conditions relating to the Company set forth in Sections... -

Page 203

...the Effective Time other than liens for Taxes not yet due and payable. UCC termination statements and the non-U.S. equivalent termination statements, as applicable, shall have been filed wherever UCC financing statements or non-U.S. equivalent liens perfection statements were filed, and any security... -

Page 204

... . The Company shall have received the following agreements and documents, each of which shall be in full force and effect: (a) a certificate executed by the Chief Executive Officer and Chief Financial Officer of each of Parent, Purchaser and Merger Sub certifying that the conditions set forth in... -

Page 205

... any covenant or obligation of Parent, Purchaser or Merger Sub set forth in this Agreement); or (c) by the Company if the Closing has not taken place on or before September 27, 2011 (other than as a result of the failure on the part of the Company to comply with or perform any covenant or obligation... -

Page 206

... to an Acquisition Transaction (except with regard to Company Stock Options or pending Company Warrants set forth in Part 2.3 of the Disclosure Schedule) or shall have resolved to do any of the foregoing or the approval of the Shareholders of this Agreement or the Merger shall have been rescinded or... -

Page 207

... remedies that may be exercised by the Shareholder Representative, shall not be limited or otherwise affected by or as a result of either (i) any waiver of Closing conditions by the Company or any of its Representatives, or (ii) any information furnished to, or any investigation made by or knowledge... -

Page 208

... of such objection to the applicable Parent Indemnitee within 16 Business Days after the delivery of the Notice of Claim (the " Notice of Escrow Objection "). If the Shareholder Representative timely provides the Notice of Escrow Objection, then the parties shall confer in good faith for a period of... -

Page 209

... or obligation, then (without limiting any of their rights as Parent Indemnitees) Purchaser and Parent shall also be deemed, by virtue of its direct or indirect ownership of the shares of the Company, to have incurred Damages as a result of and in connection with such incompleteness, inaccuracy or... -

Page 210

...effect on the date of this Agreement and pursuant to any indemnification agreements listed on Part 2.18 of the Disclosure Schedule, with respect to claims arising out of matters occurring at or prior to the Closing; (vii) any fraud of the Company or its officers, directors or employees in connection... -

Page 211

... jointly, the Parent Indemnitees based on each Preferred Holder's Consideration Fraction for Preferred Stock; provided that the Preferred Holders shall... to collect the applicable Default Amounts from the defaulting Participating Securityholders, severally and not jointly. Following the Closing, no... -

Page 212

... loss carry forward or tax credit carry forward) of the Company or (ii) the ability of Parent, Purchaser or the Surviving Corporation or their Affiliates to utilize any such Tax asset for any taxable period commencing after the Effective Time. (c) Damages in each case shall be net of the amount... -

Page 213

... delivered to any party under this Agreement shall be in writing and shall be deemed properly delivered, given and received when delivered (by hand, by courier or express delivery service, by electronic mail or by facsimile) to the address or facsimile telephone number set forth beneath the name of... -

Page 214

...: [email protected] if to the Shareholder Representative: Shareholder Representative Services LLC 601 Montgomery Street, Suite 2020 San Francisco, CA 94111 Facsimile: (415) 962-4147 Telephone: (415) 367-9400 Attention: Managing Director Email: [email protected] with a copy to (which shall... -

Page 215

... (if sent on a non-Business Day) on the first Business Day following the acknowledgement of sending. 11.5 Headings . The headings contained in this Agreement are for convenience of reference only, shall not be deemed to be a part of this Agreement and shall not be referred to in connection with the... -

Page 216

... rights under this Agreement to any other Person without obtaining first the written consent of the Company. 11.10 Remedies . The parties to this Agreement agree that, in the event of any breach or threatened breach by any party to this Agreement of any covenant, obligation or other provision set... -

Page 217

...any power, right, privilege or remedy under this Agreement, unless the waiver of such claim, power, right, privilege or remedy is expressly set forth in a written instrument duly executed and delivered on behalf of such Person; and any such waiver shall not be applicable or have any effect except in... -

Page 218

... advised they should do so in connection with this waiver and consent. Section 12. SHAREHOLDER REPRESENTATIVE 12.1 Power of Attorney . Effective as of the date hereof, for purposes of this Agreement, each Participating Securityholder, without any further action on the part of any such Participating... -

Page 219

...may be removed by the Shareholders representing a majority in interest of the Shareholders (based on the number of shares of Common Stock on an as-converted basis held by them, as set forth on the Signing Spreadsheet or, if delivered, the Closing Spreadsheet) (the " Required Shareholders ") upon not... -

Page 220

... but not limited to any attorney's fees and costs incurred in connection with the Shareholder Representative's duties pursuant to this Agreement) based on their respective Consideration Fraction and Consideration Fraction for Preferred Stock, as applicable, in accordance with the priority set forth... -

Page 221

...caused this Agreement to be executed and delivered as of the date first above written. INCREDIMAIL LTD. By: Name: Title: INCREDIMAIL, INC. By: Name: Title: SEDER MERGER, INC. By: Name: Title: SMILEBOX, INC. By: Name: Title: FOUNDER Name: Andrew Wright SHAREHOLDER REPRESENTATIVE SERVICES LLC , solely... -

Page 222

... Receivable" shall mean all accounts receivable, including without limitation, all trade accounts receivable, notes receivable, from customers, vendor credits and accounts receivable from employees and all other obligations from customers with respect to sales of goods or services by the Company... -

Page 223

...and Merger Sub on behalf of the Company. Encumbrance . "Encumbrance" shall mean any lien, pledge, hypothecation, charge, mortgage, security interest, encumbrance, claim, conditional and installment sale agreement, option, right of first refusal, preemptive right, call, community property interest or... -

Page 224

...securities (or other rights to acquire capital stock) deemed converted or exercised, as the case may be, into shares of capital stock in accordance with their terms, whether or not then currently vested, exercisable, exchangeable or convertible. GAAP . "GAAP" shall mean generally accepted accounting... -

Page 225

... by this Agreement; provided, however , that none of the following shall be taken into account in determining whether there has been a "Material Adverse Effect": (1) the effects of changes that are generally applicable to the industry in which the Company operates, provided that the Company is not... -

Page 226

... into Common Shares prior to the Effective Time. Representatives . "Representatives" shall mean officers, directors, employees, agents, attorneys, accountants, advisors and representatives. SEC . "SEC" shall mean the United States Securities and Exchange Commission. Securities Act . "Securities Act... -

Page 227

... Costs Certificate shall include a representation of the Company, certified by the principal financial officer of the Company, that such certificate includes all of the Transaction Costs paid or payable at any time prior to, at or following the Closing, it being the expressed intent of the parties... -

Page 228

Exhibit 8 List of all subsidiaries 1. 2. 3. IncrediMail Inc., a Delaware corporation Perion Interactive Ltd., an Israeli corporation Smilebox Inc., a Washington Corporation -

Page 229

EXHIBIT 12.1 CERTIFICATIONS I, Josef Mandelbaum, Chief Executive Officer of Perion Network Ltd., certify that: 1. 2. 3. 4. I have reviewed this annual report on Form 20-F of Perion Network Ltd.; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to ... -

Page 230

EXHIBIT 12.2 CERTIFICATIONS I, Yacov Kaufman, Chief Financial Officer of Perion Network Ltd., certify that: 1. 2. 3. 4. I have reviewed this annual report on Form 20-F of Perion Network Ltd.; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state... -

Page 231

... OF PERIODIC FINANCIAL REPORTS UNDER 18 U.S.C 1350 In connection with the Annual Report on Form 20-F of Perion Network Ltd., (the "Issuer"), for the year ended December 31, 2011, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), the undersigned hereby... -

Page 232

... OF PERIODIC FINANCIAL REPORTS UNDER 18 U.S.C 1350 In connection with the Annual Report on Form 20-F of Perion Network Ltd., (the "Issuer") for the year ended December 31, 2011, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), the undersigned hereby... -

Page 233

...-133968), pertaining to the 2003 Israeli Share Option Plan, of our report dated March 22, 2012, with respect to the consolidated financial statements of the Company and its subsidiaries included in this Annual Report on Form 20-F for the year ended December 31, 2011. Tel Aviv, Israel March 22, 2012...