Honeywell 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

HONEYWELL INTERNATIONAL INC (HON) 10-K Annual report pursuant to section 13 and 15(d) Filed on 02/11/2011 Filed Period 12/31/2010 -

Page 2

..., New Jersey (Address of principal executive offices) Registrant's telephone number, including area code (973) 455-2000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Common Stock, par value $1 per share* 9½% Debentures due June 1, 2016 Name of Each Exchange on... -

Page 3

... Data 9 Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 9A Controls and Procedures 9B Other Information 10 Directors and Executive Officers of the Registrant 11 Executive Compensation 12 Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 4

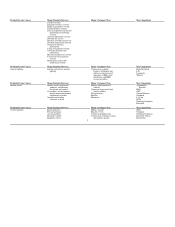

..., Automation and Control Solutions, Specialty Materials and Transportation Systems. Financial information related to our operating segments is included in Note 23 of Notes to Financial Statements in "Item 8. Financial Statements and Supplementary Data." The major products/services, customers/uses... -

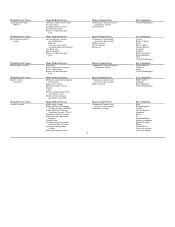

Page 5

... control Air purification and treatment Gas Processing Heat Exchangers Repair, overhaul and spare parts Major Customers/Uses Commercial, regional, business and military aircraft Ground power Key Competitors United Technologies Product/Service Classes Environmental control systems Major Customers... -

Page 6

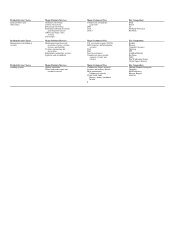

... Collins Rosemount Product/Service Classes Control products Major Products/Services Radar altimeters Pressure products Air data products Thermal switches Magnetic sensors Major Customers/Uses Military aircraft Missiles, UAVs Commercial applications Commercial, regional, business and military... -

Page 7

... Raytheon Product/Service Classes Management and technical services Major Customers/Uses U.S. government space (NASA) DoD (logistics and information services) FAA DoE Local governments Commercial space ground segment systems and services Major Customers/Uses Commercial airline, regional, business... -

Page 8

... Major Products/Services Security products and systems Fire products and systems Access controls and closed circuit television Home health monitoring and nurse call systems Gas detection products and systems Emergency lighting Distribution Personal protection equipment Major Customers/Uses Original... -

Page 9

... Product/Service Classes Building solutions and services Major Customers/Uses Building managers and owners Contractors, architects and developers Consulting engineers Security directors Plant managers Utilities Large global corporations Public school systems Universities Local governments Public... -

Page 10

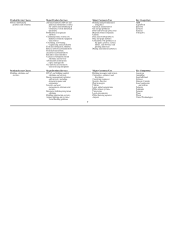

... processing technologies, catalysts, adsorbents, equipment and services, fluorine products, specialty films and additives, advanced fibers and composites, intermediates, specialty chemicals, electronic materials and chemicals. Product/Service Classes Resins & chemicals Major Products/Services Nylon... -

Page 11

... Plastics Reflective coatings Safety & security applications Major Customers/Uses Semiconductors Photovoltaics Semiconductors Microelectronics Telecommunications LED Photovoltaics Product/Service Classes Electronic chemicals Key Competitors KMG BASF General Chemical BASF Brewer Kyocera Nikko... -

Page 12

... provider of automotive care and braking products. Product/Service Classes Charge-air systems Major Products/Services Turbochargers for gasoline and diesel engines Major Customers/Uses Passenger car, truck and off-highway OEMs Engine manufacturers Aftermarket distributors and dealers Passenger... -

Page 13

... total 2010 sales of Aerospace-related products and services were exports of U.S. manufactured products and systems and performance of services such as aircraft repair and overhaul. Exports were principally made to Europe, Canada, Asia and Latin America. Foreign manufactured products and systems and... -

Page 14

... manufactured products accounted for 70 percent of total 2010 sales of Transportation Systems. The principal manufacturing facilities outside the U.S. are in Europe, with less significant operations in Asia and Latin America. Financial information including net sales and long-lived assets related to... -

Page 15

... future on the Company's business or markets that it serves, nor on its results of operations, capital expenditures or financial position. We will continue to monitor emerging developments in this area. Further information, including the current status of significant environmental matters and the... -

Page 16

... terrorist actions or pandemic health issues could dramatically reduce both the demand for air travel and our Aerospace aftermarket sales and margins. The operating results of our Automation and Control Solutions (ACS) segment, which generated 41 percent of our consolidated revenues in 2010, are... -

Page 17

... and subsystems used in our products in a timely manner and in full compliance with purchase order terms and conditions, quality standards, and applicable laws and regulations. In addition, many major components and product equipment items are procured or subcontracted on a single-source basis; in... -

Page 18

... products manufactured in the U.S. and in international locations) were outside of the U.S. including 28 percent in Europe and 11 percent in Asia. Risks related to international operations include exchange control regulations, wage and price controls, employment regulations, foreign investment laws... -

Page 19

... practices can impact Aerospace sales, research and development expenditures, operating costs and profitability. The demand for and cost of providing Automation and Control Solutions products, services and solutions can be impacted by fire, security, safety, health care, environmental and energy... -

Page 20

... which involve substantial amounts claimed) arising out of the conduct of our business, including matters relating to commercial transactions, government contracts, product liability (including asbestos), prior acquisitions and divestitures, employment, employee benefits plans, intellectual property... -

Page 21

... long-term rate of return on plan assets, and how our financial statements can be affected by pension plan accounting policies, see "Critical Accounting Policies" included in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations." Additional tax expense... -

Page 22

... site was also previously voluntarily disclosed to the Illinois Environmental Protection Agency, with whom Honeywell has been working to resolve related civil environmental claims. In November 2010 Honeywell reached a final settlement agreement with the New York State Department of Environmental... -

Page 23

... Aerospace Engineering and Technology and Chief Technology Officer from March 2007 to August 2009. President of Air Transport and Regional from July 2005 to March 2007. President and Chief Executive Officer Specialty Materials since March 2008. President of Environmental and Combustion Controls... -

Page 24

... under the Company's previously reported share repurchase program. Honeywell presently expects to repurchase outstanding shares from time to time during 2011 to offset the dilutive impact of employee stock based compensation plans, including future option exercises, restricted unit vesting and... -

Page 25

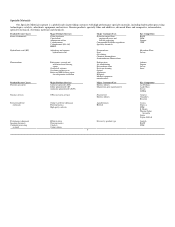

... our change in accounting policy for recognizing pension expense. See Note 1 of the Notes to the Financial Statements for a discussion of the change and the impacts for the years ended December 31, 2009 and 2008. Item 6. Selected Financial Data 2010 Years Ended December 31, 2009 (1) 2008 (1) 2007... -

Page 26

... condition of Honeywell International Inc. ("Honeywell") for the three years ended December 31, 2010. All references to Notes related to Notes to the Financial Statements in "Item 8-Financial Statements and Supplementary Data". CONSOLIDATED RESULTS OF OPERATIONS Net Sales 2010 Net sales $ % change... -

Page 27

... gain related to the deconsolidation of a subsidiary within our Automation and Control Solutions segment in 2009 (See Note 4 to the financial statements) and ii) lower interest income primarily due to lower interest rates on cash balances. Interest and Other Financial Charges 2010 2009 2008 Interest... -

Page 28

...$ 1.08 Earnings per share of common stock - assuming dilution increased by $0.54 per share in 2010 compared with 2009 primarily due to increased segment profit in our Automation and Control Solutions, Specialty Materials and Transportation Systems segments and lower pension expense, partially offset... -

Page 29

... and emerging regions) and industry conditions on demand in our key end markets; • Overall sales mix, in particular the mix of Aerospace original equipment and aftermarket sales and the mix of Automation and Control Solutions (ACS) products and services sales; • The extent to which cost savings... -

Page 30

... of Business Segments 2010 Net Sales Aerospace Product Service Total Automation and Control Solutions Product Service Total Specialty Materials Product Service Total Transportation Systems Product Service Total Corporate Product Service Total Segment Profit Aerospace Automation and Control Solutions... -

Page 31

... Profit. $ 2008 4,845 685 (456) (128) 91 (3,290) (135) (1,012) 600 $ (2) Amounts included in cost of products and services sold and selling, general and administrative expenses. (3) As revised for the change in our method of recognizing pension expense. See Note 1 of Notes to Financial Statements... -

Page 32

... Automation and Control Solutions Sales Specialty Materials Sales UOP Advanced Materials Total Specialty Materials Sales Transportation Systems Sales Turbo Technologies Consumer Products Group Total Transportation Systems Sales Corporate Net Sales Aerospace Overview $ 2009 2008 % Change 2010 2009... -

Page 33

...2009 vs. 2008 Segment Sales Profit (13)% (18)% (2)% (2)% - 2% (15)% (18)% % of Aerospace Sales Customer End-Markets Commercial: Air transport and regional Original equipment Aftermarket Business and general aviation Original equipment Aftermarket Defense and Space Total 2010 compared with 2009 2010... -

Page 34

• Air transport and regional aftermarket sales increased by 1 percent for 2010 primarily due to increased sales of spare parts driven by the impact of increased flying hours of approximately 6 percent in 2010. • Business and general aviation OE sales decreased by 27 percent in 2010 due to ... -

Page 35

...building control and optimization; sensors, switches, control systems and instruments for measuring pressure, air flow, temperature and electrical current; security, fire and gas detection; personal protection equipment; access control; video surveillance; remote patient monitoring systems; products... -

Page 36

Automation and Control Solutions 2010 13,749 $ 9,312 2,480 187 1,770 $ 2009 12,611 8,561 2,256 206 1,588 Change 9% $ 2008 14,018 9,594 2,709 93 1,622 Change (10)% Net sales Cost of products and services sold Selling, general and administrative expenses Other Segment profit Factors Contributing to ... -

Page 37

...impact of lower sales described above resulting in a 5 percent increase in segment profit. 2011 Areas of Focus ACS's primary areas of focus for 2011 include Products and solutions for energy efficiency and asset management; Extending technology leadership: lowest total installed cost and integrated... -

Page 38

...Increasing demand for renewable energy and biofuels. Specialty Materials 2010 2009 4,726 $ 4,144 3,554 3,127 345 345 78 67 $ 749 $ 605 Change 2008 5,266 4,121 395 29 24% $ 721 Change (21)% Net sales Cost of products and services sold Selling, general and administrative expenses Other Segment profit... -

Page 39

... of 2009 these factors more than offset the impact of lower sales described above resulting in a 56 percent increase in segment profit. 2011 Areas of Focus Specialty Materials primary areas of focus for 2011 include Continuing to develop new processes, products and technologies that address energy... -

Page 40

Transportation system 2010 Net sales Cost of products and services sold Selling, general and administrative expenses Other Segment profit Factors Contributing to Year-Over-Year Change 2010 vs. 2009 Segment Sales Profit Organic growth/ Operational segment profit Foreign exchange Total % Change 2010 ... -

Page 41

... launch schedules. Repositioning and Other Charges See Note 3 to the financial statements for a discussion of repositioning and other charges incurred in 2010, 2009, and 2008. Our repositioning actions are expected to generate incremental pretax savings of approximately $200 million in 2011 compared... -

Page 42

..., long-term borrowings, and access to the public debt and equity markets, as well as the ability to sell trade accounts receivables. We continue to balance our cash and financing uses through investment in our existing core businesses, acquisition activity, share repurchases and dividends. Cash Flow... -

Page 43

... payable, ii) increased pension and other postretirement payments of $598 million and iii) the absence of $155 million sale of long-term receivables in 2009. Cash used for investing activities increased by $1,136 million during 2010 compared with 2009 primarily due to an increase in cash paid... -

Page 44

... be used for general corporate purposes, including repayment of existing indebtedness, capital expenditures and acquisitions. As a source of liquidity, we sell interests in designated pools of trade accounts receivables to third parties. As of December 31, 2010 and 2009, none of the receivables in... -

Page 45

...of our plans. See Note 22 to the financial statements for further discussion of pension contributions. In addition, the Company is evaluating additional voluntary contributions in 2011 and currently expects to contribute a portion of the proceeds from the sale of its Consumer Products Group business... -

Page 46

..., access to the public debt and equity markets as well as our ability to sell trade accounts receivables, provide additional sources of short-term and long-term liquidity to fund current operations, debt maturities, and future investment opportunities. Based on our current financial position and... -

Page 47

...tax positions. See Note 6 to the financial statements. The table also excludes our pension and other postretirement benefits (OPEB) obligations. In January 2011, we made a voluntary cash contribution of $1 billion to our U.S. plans to improve the funded status of our plans. In addition, the company... -

Page 48

... technology and information related to individual sites, we do not believe it is possible to develop an estimate of the range of reasonably possible environmental loss in excess of our recorded liabilities. We expect to fund expenditures for these matters from operating cash flow. The timing of cash... -

Page 49

... versus local currency exchange rates across all maturities, and the potential change in fair value of contracts hedging commodity purchases based on a 20 percent decrease in the price of the underlying commodity across all maturities at December 31, 2010 and 2009. Estimated Increase (Decrease) in... -

Page 50

... out of the conduct of our global business operations or those of previously owned entities, including matters relating to commercial transactions, government contracts, product liability (including asbestos), prior acquisitions and divestitures, employee benefit plans, intellectual property, and... -

Page 51

... of insurance recoveries for asbestos related liabilities. Defined Benefit Pension Plans- We sponsor both funded and unfunded U.S. and non-U.S. defined benefit pension plans covering the majority of our employees and retirees. In 2010, we elected to change our method of recognizing pension expense... -

Page 52

...of return on plan assets and discount rate. We also expect to contribute approximately $55 million to our non-U.S. defined benefit pension plans in 2011 to satisfy regulatory funding standards. Long-Lived Assets (including Tangible and Definite-Lived Intangible Assets)-To conduct our global business... -

Page 53

... of ongoing tax planning strategies. The projections of future taxable income include a number of estimates and assumptions regarding our volume, pricing and costs. Additionally, valuation allowances related to deferred tax assets can be impacted by changes to tax laws. Our net deferred tax asset of... -

Page 54

... sales using the percentage-ofcompletion method for long-term contracts in our Automation and Control Solutions, Aerospace and Specialty Materials segments. These long-term contracts are measured on the cost-to-cost basis for engineering-type contracts and the units-of-delivery basis for production... -

Page 55

...Note 1 to the financial statements for a discussion of recent accounting pronouncements. Item 7A. Quantitative and Qualitative Disclosures About Market Risk Information relating to market risk is included in Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations... -

Page 56

...806 1.09 1.08 1.10 2010 Product sales Service sales Net sales Costs, expenses and other Cost of products sold Cost of services sold Selling, general and administrative expenses Other (income) expense Interest and other financial charges Income before taxes Tax expense (benefit) Net income Less: Net... -

Page 57

Honeywell International Inc. Consolidated Balance Sheet December 31, 2010 2009 (Dollars in millions) ASSETS Current assets: Cash and cash equivalents Accounts, notes and other receivables Inventories Deferred income taxes Investments and other current assets Total current assets Investments and long... -

Page 58

... of long-term debt Excess tax benefits from share based payment arrangements Repurchases of common stock Cash dividends paid Net cash used for financing activities Effect of foreign exchange rate changes on cash and cash equivalents Net (decrease)/increase in cash and cash equivalents Cash and cash... -

Page 59

... 734.6 957.6 Common stock, par value Additional paid-in capital Beginning balance 3,823 Issued for employee savings and option plans (35) Contributed to pension plans 32 Stock-based compensation expense 157 Other owner changes - Ending balance 3,977 Treasury stock Beginning balance (193.4) (8,995... -

Page 60

...generally accepted in the United States of America. The following is a description of the significant accounting policies of Honeywell International Inc. Principles of Consolidation-The consolidated financial statements include the accounts of Honeywell International Inc. and all of its subsidiaries... -

Page 61

... per share amounts) the contractual period or as services are rendered. Sales under long-term contracts in the Aerospace and Automation and Control Solutions segments are recorded on a percentage-of-completion method measured on the cost-to-cost basis for engineering-type contracts and the units-of... -

Page 62

... both funded and unfunded U.S. and non-U.S. defined benefit pension plans covering the majority of our employees and retirees. We also sponsor postretirement benefit plans that provide health care benefits and life insurance coverage to eligible retirees. In 2010 we elected to change our method... -

Page 63

...Cost of products sold Cost of services sold Selling, general and administrative expenses Income before taxes Tax expense (benefit) Net income Net income attributable to Honeywell Earnings per share of common stock-basic Earnings per share of common stock-assuming dilution Consolidated Balance Sheet... -

Page 64

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Consolidated Statement of Shareowners Equity Year Ended December 31, 2009 Effect of Previously Change Reported Revised Retained earnings Beginning balance Net income attributable to... -

Page 65

... potential common shares outstanding. Use of Estimates-The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts in the financial statements and related... -

Page 66

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Recent Accounting Pronouncements-Changes to accounting principles generally accepted in the United States of America (U.S. GAAP) are established by the Financial Accounting ... -

Page 67

... Automation and Control Solutions segment and were not material to the consolidated financial statements. In May 2008, the Company completed the acquisition of Safety Products Holding, Inc, which through its subsidiary Norcross Safety Products L.L.C. (Norcross) is a leading manufacturer of personal... -

Page 68

... December 31, 2008, are included in the Automation and Control Solutions segment and were not material to the consolidated financial statements. In January 2011, the Company entered into a definitive agreement to sell its Consumer Products Group business (CPG) to Rank Group Limited for approximately... -

Page 69

...195 $ 478 $ 2010 Aerospace Automation and Control Solutions Specialty Materials Transportation Systems Corporate $ 32 79 18 180 291 600 2008 84 164 42 233 489 1,012 $ In 2010, we recognized repositioning charges totaling $181 million including severance costs of $145 million related to workforce... -

Page 70

...our Automation and Control Solutions, Aerospace, and Transportation Systems segments, were returned to income in 2009 due to fewer employee separations than originally planned associated with prior severance programs and changes in the scope of previously announced repositioning actions. In 2008, we... -

Page 71

... sites located in Syracuse, New York in accordance with remediation plans submitted to state environmental regulators; and $38 million primarily related to changes in cost estimates (due to, among other things, increases in the cost of steel, waste transportation and disposal costs) and settlement... -

Page 72

... to the consolidated financial statements. Gain on sale of non-strategic businesses and assets for 2009 includes a $50 million pre-tax gain, $42 million net of tax, related to the deconsolidation of a subsidiary within our Automation and Control Solutions segment. The subsidiary achieved contractual... -

Page 73

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Note 6-Income Taxes Income from continuing operations before taxes Years Ended December 31, 2009 $ 1,138 911 $ 2,049 2010 United States Foreign Tax expense (benefit) $ $ 1,249 1,... -

Page 74

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) The effective tax rate increased by 5.7 percentage points in 2010 compared with 2009 primarily due to a change in the mix of earnings related to lower U.S. pension expense, the ... -

Page 75

... limitations for specific jurisdictions, it is reasonably possible that the related unrecognized tax benefits for tax positions taken regarding previously filed tax returns will materially change from those recorded as liabilities for uncertain tax positions in our financial statements. In addition... -

Page 76

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) not possible to estimate the impact of any amount of such changes, if any, to previously recorded uncertain tax positions. Unrecognized tax benefits for examinations in progress ... -

Page 77

... customer contracts to which they relate. The following table summarizes long term trade, financing and other receivables by segment, including current portions and allowances for credit losses. December 31, 2010 Automation and Control Solutions Specialty Materials Transportation Systems Corporate... -

Page 78

... 513 9,982 2,621 405 13,521 (8,674) 4,847 Aerospace Automation and Control Solutions Specialty Materials Transportation Systems Intangible assets amortization expense was $263, $250, and $201 million in 2010, 2009, 2008, respectively. Estimated intangible asset amortization expense for each of the... -

Page 79

... costs Asbestos related liabilities Product warranties and performance guarantees Repositioning Other taxes (payroll, sales, VAT etc.) Insurance Accrued interest Other (primarily operating expenses) Note 14-Long-term Debt and Credit Agreements $ $ 7.50% notes due 2010 6.125% notes due 2011... -

Page 80

... of 2010, the Company repaid $1,000 million of its 7.50% notes. The repayment was funded with cash provided by operating activities. As a source of liquidity, we sell interests in designated pools of trade accounts receivables to third parties. As of December 31, 2010 and December 31, 2009 none... -

Page 81

... exchange rates and commodity prices and restrict the use of derivative financial instruments to hedging activities. We continually monitor the creditworthiness of our customers to which we grant credit terms in the normal course of business. The terms and conditions of our credit sales are designed... -

Page 82

... table sets forth the Company's financial assets and liabilities that were accounted for at fair value on a recurring basis as of December 31, 2010 and 2009: December 31, 2010 Assets: Foreign currency exchange contracts Available for sale investments Interest rate swap agreements Forward commodity... -

Page 83

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) The carrying value of cash and cash equivalents, trade accounts and notes receivables, payables, commercial paper and short-term borrowings contained in the Consolidated Balance ... -

Page 84

...: 2010 $ 12 (7) $ 2009 18 (1) Designated Cash Flow Hedge Foreign currency exchange contracts Income Statement Location Product sales Cost of products sold Sales & general administrative Year Ended December 31, 2010 2009 $ (19) $ 54 30 (44) (3) (1) Commodity contracts Cost of products sold... -

Page 85

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Note 17-Other Liabilities Year Ended December 31, 2010 Pension and other employee related Environmental Income taxes Insurance Asset retirement obligations(1) Deferred income Other ... -

Page 86

...Plan for Non-Employee Directors of Honeywell International Inc. (the Directors Plan) 500,000 shares of Honeywell common stock may be awarded. Stock Options-The exercise price, term and other conditions applicable to each option granted under our stock plans are generally determined by the Management... -

Page 87

... INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) The following table sets forth fair value per share information, including related weighted-average assumptions, used to determine compensation cost: Years Ended December 31, 2010 2009 2008... -

Page 88

...$1 and $28 million, respectively. In 2010, 2009 and 2008 we classified $13, $1 and $21 million, respectively, of this benefit as a financing cash inflow in the Consolidated Statement of Cash Flows, and the balance was classified as cash from operations. At December 31, 2010, there was $94 million of... -

Page 89

...million in 2010, 2009, and 2008, respectively. Non-Employee Directors' Plan-Under the Directors' Plan each new director receives a one-time grant of 3,000 restricted stock units that will vest on the fifth anniversary of continuous Board service. The Directors' Plan also provides for an annual grant... -

Page 90

...a predecessor Honeywell site located in Jersey City, New Jersey, known as Study Area 7 was completed in January 2010. We have also received approval of the United States District Court for the District of New Jersey for the implementation of related groundwater and sediment remedial actions, and are... -

Page 91

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) matter will have a material adverse impact on our consolidated financial position or operating cash flows. Given the scope and complexity of this project, it is possible that the ... -

Page 92

...31, 2010 and December 31, 2009, our consolidated financial statements reflect an insurance receivable corresponding to the liability for settlement of pending and future NARCO-related asbestos claims of $718 and $831 million, respectively. This coverage reimburses Honeywell for portions of the costs... -

Page 93

... to predict whether resolution values for Bendix related asbestos claims will increase, decrease or stabilize in the future. 2010 2009 Our consolidated financial statements reflect an estimated liability for resolution of pending and future 90 2010 4,856 17,624 22,480 2009 4,727 15,213 19,940 2006... -

Page 94

...future Bendix related asbestos claims, of which $157 and $172 million are reflected as receivables in our consolidated balance sheet at December 31, 2010 and December 31, 2009, respectively. This coverage is provided by a large number of insurance policies written by dozens of insurance companies in... -

Page 95

... for asbestos related liabilities Insurance receivables settlements and write offs Other End of year NARCO and Bendix asbestos related balances are included in the following balance sheet accounts: December 31, 2010 2009 50 $ 62 825 941 875 $ 1,003 162 $ 1,557 1,719 $ 654 1,040 1,694 Other current... -

Page 96

... substantial amounts claimed) arising out of the conduct of our business, including matters relating to commercial transactions, government contracts, product liability, prior acquisitions and divestitures, employee benefit plans, intellectual property, and environmental, health and safety matters... -

Page 97

...year Adjustment of pre-existing warranties/guarantees Settlement of warranty/guarantee claims End of year $ $ Product warranties and product performance guarantees are included in the following balance sheet accounts: 2010 Accrued liabilities Other liabilities 94 $ $ 380 35 415 $ $ 2009 382 25 407 -

Page 98

... plans that provide health care benefits and life insurance coverage to eligible retirees. Our retiree medical plans mainly cover U.S. employees who retire with pension eligibility for hospital, professional and other medical services. All non-union hourly and salaried employees joining Honeywell... -

Page 99

... year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Company contributions Benefits paid Other Fair value of plan assets at end of year Funded status of plans Amounts recognized in Consolidated Balance Sheet consist of: Prepaid pension benefit cost... -

Page 100

...INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Other Postretirement Benefits 2010 2009 Change in benefit obligation: Benefit obligation at beginning of year Service cost Interest cost Plan amendments Actuarial (gains) losses Benefits paid... -

Page 101

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Pension Benefits Net periodic benefit cost Service cost Interest cost Expected return on plan assets Amortization of transition (asset) obligation Amortization of prior service cost... -

Page 102

... rate of compensation increase Actuarial assumptions used to determine net periodic benefit cost for years ended December 31: Discount rate Expected rate of return on plan assets Expected annual rate of compensation increase 99 5.25% 4.50% 2008 6.95% 4.50% 2010 5.40% 3.79% 2008 6.21% 3.33% 5.75... -

Page 103

.... 2010 2009 Our asset investment strategy for our U.S. pension plans focuses on maintaining a diversified portfolio using various asset classes in order to achieve our long-term investment objectives on a risk adjusted basis. Our actual invested positions in various securities change over time based... -

Page 104

... common stock U.S. large cap stocks U.S. mid cap stocks U.S. small cap stocks International stocks Real estate investment trusts Fixed income investments: Short term investments Government securities Corporate bonds Mortgage/Asset-Backed securities Insurance contracts Investments in private funds... -

Page 105

...- 2,787 $ Total Common stock/preferred stock: U.S. companies Non-U.S. companies Fixed income investments: Short-term investments Government securities Corporate bonds Mortgage/Asset-backed securities Insurance contracts Investments in private funds: Private funds Hedge funds Real estate funds $ 338... -

Page 106

... FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) U.S. Plans Private Equity/Debt Funds Balance at December 31, 2008 Actual Return on plan assets: Relating to assets still held at year-end Relating to assets sold during the year Purchases, sales and settlements Balance... -

Page 107

... 2010, we contributed marketable securities valued at $242 million to one of our non-U.S. plans. In 2011, we also expect to contribute approximately $55 million to our non-U.S. defined benefit pension plans to satisfy regulatory funding standards and to fund benefits to be paid directly from Company... -

Page 108

... reportable segments are as follows: • Aerospace is organized by customer end-market (Air Transport and Regional, Business and General Aviation and Defense and Space) and provides products and services which include auxiliary power units; propulsion engines; environmental control systems; electric... -

Page 109

...$ 2010 Net Sales Aerospace Product Service Total Automation and Control Solutions Product Service Total Specialty Materials Product Service Total Transportation Systems Product Total Corporate Service Total Depreciation and amortization Aerospace Automation and Control Solutions Specialty Materials... -

Page 110

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts A reconciliation of segment profit to consolidated income from continuing operations before taxes are as follows: Years Ended December 31, 2009 4,616 $ 4,097 $ 66 29 (386) (459) (164... -

Page 111

... from sale of insurance receivable Insurance receipts for asbestos related liabilities Asbestos related liability payments Interest paid, net of amounts capitalized Income taxes paid, net of refunds Non-cash investing and financing activities: Common stock contributed to savings plans Common stock... -

Page 112

... Note of Notes to Financial Statements for a discussion of our accounting policy. For the quarter ended March 31, 2009 our retrospective change in recognizing pension expense reduced Gross Profit by $42 million, Net income attributable to Honeywell by $22 million, Earnings per share, basic by $0.03... -

Page 113

..., 2010 in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the financial statement schedule listed in the index appearing under Item 15(a)(2)presents fairly, in all material respects, the information set forth therein when read in... -

Page 114

... of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Management assessed the effectiveness of Honeywell's internal control over financial reporting as of December 31, 2010. In making this assessment, management used the criteria set forth... -

Page 115

... that term is defined in applicable SEC Rules and NYSE listing standards. Honeywell's Code of Business Conduct is available, free of charge, on our website under the heading "Investor Relations" (see "Corporate Governance"), or by writing to Honeywell, 101 Columbia Road, Morris Township, New Jersey... -

Page 116

.... Exhibits and Financial Statement Schedules Page Number in Form 10-K (a)(1.) Consolidated Financial Statements: Consolidated Statement of Operations for the years ended December 31, 2010, 2009 and 2008 Consolidated Balance Sheet at December 31, 2010 and 2009 Consolidated Statement of Cash Flows for... -

Page 117

.... HONEYWELL INTERNATIONAL INC. Date: February 11, 2011 By: /s/ Kathleen A. Winters Kathleen A. Winters Vice President and Controller (on behalf of the Registrant and as the Registrant's Principal Accounting Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this annual... -

Page 118

...to Honeywell's Form 8-K filed April 27, 2010) Honeywell International Inc. is a party to several long-term debt instruments under which, in each case, the total amount of securities authorized does not exceed 10% of the total assets of Honeywell and its subsidiaries on a consolidated basis. Pursuant... -

Page 119

... 31, 2008 Honeywell International Inc. Severance Plan for Corporate Staff Employees (Involuntary Termination Following a Change in Control), as amended and restated (incorporated by reference to Exhibit 10.16 to Honeywell's Form 10-K for the year ended December 31, 2008) Employment Agreement dated... -

Page 120

... year ended December 31, 2008) 2007 Honeywell Global Employee Stock Plan (incorporated by reference to Honeywell's Proxy Statement, dated March 12, 2007, filed pursuant to Rule 14a-6 of the Securities and Exchange Act of 1934) Letter Agreement dated July 20, 2007 between Honeywell and Roger Fradin... -

Page 121

.... and Rank Group Limited dated January 27, 2011 (incorporated by reference to Exhibit 10.1 to Honeywell's Form 8-K filed January 31, 2011) Statement re: Computation of Ratio of Earnings to Fixed Charges (filed herewith) Letter on Change in Accounting Principles (filed herewith) Subsidiaries of the... -

Page 122

Honeywell International Inc. SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS Three Years Ended December 31, 2010 (Dollars in millions) Allowance for Doubtful Accounts: Balance December 31, 2007 Provision charged to income Deductions from reserves Acquisitions Balance December 31, 2008 Provision ... -

Page 123

... 2010-1 TO THE SUPPLEMENTAL NON-QUALIFIED SAVINGS PLAN FOR HIGHLY COMPENSATED EMPLOYEES OF HONEYWELL INTERNATIONAL INC. AND ITS SUBSIDIARIES (Amended and Restated Effective January 1, 2009) The Supplemental Non-Qualified Savings Plan for Highly Compensated Employees of Honeywell International... -

Page 124

... January 1, 2009) Pursuant to the authority granted to you by the Chief Executive Officer of Honeywell International Inc. on December 23, 2010, the Supplemental NonQualified Savings Plan for Highly Compensated Employees of Honeywell International Inc. and Its Subsidiaries (the "Plan") shall be... -

Page 125

... Participant's account under the Qualified Savings Plans; provided, however, that in no event shall the combined Plan Employer Contributions and Savings Plan Employer Contributions exceed 8% of the Participant's Base Annual Salary without regard to any limitations that may apply under the Code, and... -

Page 126

... Letter Agreement dated July 20, 2007 will be subject to a minimum annual single life annuity of $1,400,000 commencing on the later of August 5, 2013 or your termination of employment with Honeywell. The augmented retirement benefit described herein is subject to the following terms and conditions... -

Page 127

...as defined in the 2006 Stock Incentive Plan); and You must not be terminated for Cause. If the Company determines, in its sole judgment, that you have violated any of the terms or conditions applicable to the extraordinary equity vesting as described herein or the terms of Exhibit A or B, Honeywell... -

Page 128

... terms and conditions of the applicable stock plans and award agreements. Special Conditions If, at any time while you are still employed by Honeywell, David M. Cote (a) ceases to be employed by Honeywell, or (b) ceases to be the Chief Executive Officer of Honeywell, the extraordinary equity vesting... -

Page 129

... in Honeywell's Trade Secrets, Proprietary and Confidential Information and in Inventions to which it is rightfully entitled. Ownership of Inventions. Each and every Invention I Make during the period of time I am employed by Honeywell (a) which relates directly to the business of Honeywell or... -

Page 130

...any of Honeywell's Trade Secrets, Proprietary and Confidential Information for dissemination outside Honeywell or file any patent application relating to any Invention I Make during the period of time I am employed by Honeywell without the prior written approval of Honeywell's Law Department. I will... -

Page 131

... ever placed in a position where I will be required or am given an assignment that will require me to use, directly or indirectly, any trade secrets, proprietary or confidential information of any person, previous employer or any third party, I will promptly inform Honeywell's Law Department and my... -

Page 132

... be used as substitutes for any products or services offered by Honeywell. 11. Notice to Future Employers. For the period of two years immediately following the end of my employment by Honeywell, I will inform each new employer, prior to accepting employment, of the existence of this agreement and... -

Page 133

... of, my employment by Honeywell and which includes, without limitation, any information, whether patentable, patented or not, relating to any existing or contemplated products, inventions, services, technology, concepts, designs, patterns, processes, compounds, formulae, programs, devices, tools... -

Page 134

..."Termination of Employment" means my last day of active employment with Honeywell. "Date on which Salary Continuation Benefits End" means the last day on which I receive any salary continuation benefits under any (i) severance plan sponsored or funded by Honeywell, (ii) agreement by Honeywell to pay... -

Page 135

SCHEDULE A INVENTIONS I MADE BEFORE THE TERM OF MY EMPLOYMENT BY HONEYWELL IN WHICH I HAVE AN OWNERSHIP INTEREST WHICH ARE NOT THE SUBJECT MATTER OF ISSUED PATENTS OR PRINTED PUBLICATIONS: (If there are none, please enter the word "NONE") NOTE: Please describe each such Invention without disclosing ... -

Page 136

SCHEDULE B RESTRICTIVE WRITTEN AND ORAL OBLIGATIONS: (If there are none, please enter the word "NONE") NOTE: Please give date of, and parties to, obligations and the nature and substance of the restriction. NONE Attach additional sheets if more space is needed.] 11 -

Page 137

... such Business Entity designs, develops, produces, offers for sale or sells security and fire protection products and systems or products or services that can be used as a substitute for, or are generally intended to satisfy the same customer needs for, any fire and security products or services of... -

Page 138

...prior to my termination of employment (including, but not limited to, security, building automation, controls and combustion, building solutions and systems integration, refining, petrochemical technologies and materials, resins and chemicals, electronic materials, fluorine products, advanced fibers... -

Page 139

...be entitled, in addition to its rights at law, to seek an injunction or other equitable relief without the need to post a bond. This Agreement should be read in concert with the Honeywell International Inc. Employee Agreement Relating to Trade Secrets, Proprietary and Confidential Information and is... -

Page 140

.... The Company has granted you an Option to purchase [NUMBER] Shares of Common Stock, subject to the provisions of this Agreement and the 2006 Stock Incentive Plan for Employees of Honeywell International Inc. and its Affiliates (the "Plan"). This Option is a nonqualified Option. Exercise Price. The... -

Page 141

... Awards forfeited as of Full Retirement (Voluntary Termination of Employment on or Full Retirement. after age 60 and 10 Years of Service) Early Retirement (Termination of Unvested Awards forfeited as of Early Retirement. Employment because of retirement from active employment on or after age 55... -

Page 142

... become payable under the terms of the severance plan. If your employment is terminated under any other circumstances and you are not entitled to severance benefits under a severance plan of the Company or an Affiliate, "Termination of Employment" refers to the last day you actively perform services... -

Page 143

... and Customers, Suppliers, Business Partners and Vendors. 1. You acknowledge that Honeywell has invested and will invest significant time and money to recruit and retain its employees. Therefore, recognizing that in the course of your employment you have obtained valuable information about employees... -

Page 144

..., you enter into an employment, consultation or similar agreement or arrangement (including any arrangement for service as an agent, partner, stockholder, consultant, officer or director) with any entity or person engaged in a business in which Honeywell is engaged if the business is competitive (in... -

Page 145

...determination. Notwithstanding anything in the Plan or this Agreement to the contrary, you acknowledge that the Company may be entitled or required by law, Company policy or the requirements of an exchange on which the Shares are listed for trading, to recoup compensation paid to you pursuant to the... -

Page 146

... local employer holds, by means of an automated data file, certain personal information about you, including, but not limited to, name, home address and telephone number, date of birth, social insurance number, salary, nationality, job title, any shares or directorships held in the Company, details... -

Page 147

... United States law will govern all options granted under the Plan. Benefits and rights provided under the Plan are wholly discretionary and, although provided by the Company, do not constitute regular or periodic payments. The benefits and rights provided under the Plan are not to be considered part... -

Page 148

...the extent not superseded by applicable federal law. Acknowledgements. By accepting this Agreement, you agree to the following: (a) you have carefully read, fully understand and agree to all of the terms and conditions described in this Agreement, the Plan, the Plan's prospectus and all accompanying... -

Page 149

I Accept: Signature 10 Date -

Page 150

... and CEO, Honeywell Aerospace (Band 7), located in Phoenix, Arizona and reporting to David Cote, Chairman and CEO of Honeywell. The effective date of your promotion is September 3, 2009 ("Effective Date"), subject to the terms and conditions of this letter agreement ("Letter"). The terms of this... -

Page 151

...law. By executing this Letter, you acknowledge the sufficiency of the benefits for termination pay under the Severance Plan. STOCK OWNERSHIP GUIDELINES FOR HONEYWELL OFFICERS • • As an Officer of the Corporation, you will be required to hold four-times your annual base salary in Honeywell shares... -

Page 152

... need any further information about our offer, please contact me directly. Congratulations, /s/ Mark James Mark James Senior Vice President-Human Resources and Communications Honeywell International Inc. P.O. Box 2245 101 Columbia Road Morristown, New Jersey 07962-2245 Read and Accepted: /s/ Timothy... -

Page 153

... in Honeywell's Trade Secrets, Proprietary and Confidential Information and in Inventions to which it is rightfully entitled. Ownership of Inventions. Each and every Invention I Make during the period of time I am employed by Honeywell (a) which relates directly to the business of Honeywell or... -

Page 154

...any of Honeywell's Trade Secrets, Proprietary and Confidential Information for dissemination outside Honeywell or file any patent application relating to any Invention I Make during the period of time I am employed by Honeywell without the prior written approval of Honeywell's Law Department. I will... -

Page 155

... ever placed in a position where I will be required or am given an assignment that will require me to use, directly or indirectly, any trade secrets, proprietary or confidential information of any person, previous employer or any third party, I will promptly inform Honeywell's Law Department and my... -

Page 156

... may be used as substitutes for any products or services offered by Honeywell. Notice to Future Employers. For the period of two years immediately following the end of my employment by Honeywell, I will inform each new employer, prior to accepting employment, of the existence of this agreement and... -

Page 157

... me or my then-current employer which may also include but not be limited to contract damages, lost profits and punitive damages. Successors; Binding Agreement. This agreement binds my heirs, executors, administrators, legal representatives and assigns and inures to the benefit of Honeywell and its... -

Page 158

... of, my employment by Honeywell and which includes, without limitation, any information, whether patentable, patented or not, relating to any existing or contemplated products, inventions, services, technology, concepts, designs, patterns, processes, compounds, formulae, programs, devices, tools... -

Page 159

SCHEDULE A INVENTIONS I MADE BEFORE THE TERM OF MY EMPLOYMENT BY HONEYWELL IN WHICH I HAVE AN OWNERSHIP INTEREST WHICH ARE NOT THE SUBJECT MATTER OF ISSUED PATENTS OR PRINTED PUBLICATIONS: (If there are none, please enter the word "NONE") NOTE: Please describe each such Invention without disclosing... -

Page 160

SCHEDULE B RESTRICTIVE WRITTEN AND ORAL OBLIGATIONS: (If there are none, please enter the word "NONE") NOTE: Please give date of, and parties to, obligations and the nature and substance of the restriction. [Attach additional sheets if more space is needed.] -

Page 161

... Agreement, "Competing Business" shall mean any business engaged in the research, development, manufacture or sales of products or systems serving Aerospace Commercial, Defense, or Space, original equipment manufacturers or suppliers, the Aerospace aftermarket or Aerospace services. Without limiting... -

Page 162

...plans, plans for acquisition or disposition of products, expansion plans, financial status and plans, financial data, customer lists and data, and personnel information. I understand and agree that as part of my continued employment with Honeywell, I will continue to have access to and receive Trade... -

Page 163

... conducted or planned by any Honeywell business for which I (A) was employed or performed services in a job covered by this Program, or (B) had knowledge of operations over the Look Back Period, or (ii) designs, develops, produces, offers for sale or sells a product or service that can be used... -

Page 164

...this Agreement, including employment or continued employment by Honeywell, goodwill, access or continued access to Honeywell's Trade Secrets, Proprietary and Confidential Information, access or continued access to customers, and additional good and valuable consideration, including the Annual Equity... -

Page 165

...of this Agreement should be returned by mailing or emailing a signed copy of the Agreement to [ADDRESS]. 8. Notice to Future Employers. For the period of [NUMBER] year(s) immediately following the end of my employment with Honeywell, I will inform each new employer, prior to accepting employment, of... -

Page 166

... of, my employment by Honeywell and which includes, without limitation, any information, whether patentable, patented or not, relating to any existing or contemplated products, inventions, services, technology, ideas, concepts, designs, patterns, processes, compounds, formulae, programs, devices... -

Page 167

... Business, as set forth in your Noncompete Agreement. In addition, pursuant to Paragraph 1 of your Noncompete Agreement, please note that the term Competing Business, as defined in your Noncompete Agreement, will include competitors of any Honeywell business in which you have worked in a job... -

Page 168

... 12 HONEYWELL INTERNATIONAL INC. STATEMENT RE: COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES (Dollars in millions) 2010 Determination of Earnings: Income before taxes Add (Deduct): Amortization of capitalized interest Fixed charges Equity income, net of distributions Total earnings, as defined... -

Page 169

... included in the Company's Annual Report on Form 10-K for the year ended December 31, 2010 and issued our report thereon dated February 11, 2011. As discussed further in Note 1 to the consolidated financial statements, the Company changed its method of accounting for pension costs. As a result of... -

Page 170

... Aerospace Service Corporation Alsip Packaging, Inc. Grimes Aerospace Company Hand Held Products, Inc. Honeywell (China) Co., Ltd. Honeywell Aerospace GmbH Honeywell ASCa Inc. Honeywell Automation India Limited Honeywell Automotive Parts Services (Shanghai) Co., Ltd. Honeywell Avionics Systems... -

Page 171

...) and Form S-4 (No. 333-82049) of Honeywell International Inc. of our report dated February 11, 2011 relating to the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in this Form 10-K. /s/ PricewaterhouseCoopers... -

Page 172

...my name, place and stead in any and all capacities, (i) to sign the Company's Annual Report on Form 10-K under the Securities Exchange Act of 1934 for the year ended December 31, 2010, (ii) to sign any amendment to the Annual Report referred to in (i) above, and (iii) to file the documents described... -

Page 173

...shares of the Company's Common Stock (or participations where appropriate) to be offered under the savings, stock or other benefit plans of the Company, its affiliates or any predecessor thereof, including the Honeywell Savings and Ownership Plan, the Honeywell Puerto Rico Savings and Ownership Plan... -

Page 174

This Power of Attorney may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the ..., Director /s/ Linnet F. Deily Linnet F. Deily, Director Dated: December 10, 2010 /s/ Clive R. Hollick Clive R. Hollick, Director /s/ George Paz George Paz, Director... -

Page 175

... per share, including shares of common stock to be offered under the Dividend Reinvestment and Share Purchase Plan of the Company and any successor or new plan for such purposes; (ii) shares of the Company's preferred stock, without par value; (iii) debt securities of the Company, with such terms as... -

Page 176

This Power of Attorney may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the ..., Director /s/ Linnet F. Deily Linnet F. Deily, Director Dated: December 10, 2010 /s/ Clive R. Hollick Clive R. Hollick, Director /s/ George Paz George Paz, Director... -

Page 177

...my name, place and stead in any and all capacities, (i) to sign the Company's Annual Report on Form 10-K under the Securities Exchange Act of 1934 for the year ended December 31, 2010, (ii) to sign any amendment to the Annual Report referred to in (i) above, and (iii) to file the documents described... -

Page 178

...shares of the Company's Common Stock (or participations where appropriate) to be offered under the savings, stock or other benefit plans of the Company, its affiliates or any predecessor thereof, including the Honeywell Savings and Ownership Plan, the Honeywell Puerto Rico Savings and Ownership Plan... -

Page 179

... per share, including shares of common stock to be offered under the Dividend Reinvestment and Share Purchase Plan of the Company and any successor or new plan for such purposes; (ii) shares of the Company's preferred stock, without par value; (iii) debt securities of the Company, with such terms as... -

Page 180

... and report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ David M. Cote David M. Cote Chief Executive Officer Date: February 11, 2011 -

Page 181

... report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ David J. Anderson David J. Anderson Chief Financial Officer Date: February 11, 2011 -

Page 182

...In connection with the Annual Report of Honeywell International Inc. (the Company) on Form 10-K for the period ending December 31, 2010 as filed with the Securities and Exchange Commission on the date hereof (the Report), I, David M. Cote, Chief Executive Officer of the Company, certify, pursuant to... -

Page 183

... connection with the Annual Report of Honeywell International Inc. (the Company) on Form 10-K for the period ending December 31, 2010 as filed with the Securities and Exchange Commission on the date hereof (the Report), I, David J. Anderson, Chief Financial Officer of the Company, certify, pursuant...