Honeywell 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

HONEYWELL INTERNATIONAL INC (HON) 10-K Annual report pursuant to section 13 and 15(d) Filed on 02/13/2009 Filed Period 12/31/2008 -

Page 2

... Township, New Jersey (Address of principal executive offices) Registrant's telephone number, including area code (973)455-2000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Common Stock, par value $1 per share* Zero Coupon Serial Bonds due 2009 1 9 /2% Debentures... -

Page 3

... The aggregate market value of the voting stock held by nonaffiliates of the Registrant was approximately $37.5 billion at June 30, 2008. There were 735,181,035 shares of Common Stock outstanding at January 31, 2009. Documents Incorporated by Reference Part III: Proxy Statement for Annual Meeting of... -

Page 4

... Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Directors and Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder... -

Page 5

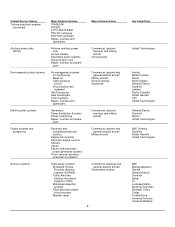

... by Honeywell of the NYSE's corporate governance listing standards as of that date. Major Businesses We globally manage our business operations through four businesses that are reported as operating segments: Aerospace, Automation and Control Solutions, Specialty Materials and Transportation Systems... -

Page 6

... spare parts Air management systems: Air conditioning Bleed air Cabin pressure control Air purification and treatment Gas Processing Heat Exchangers Turbo Systems Repair, overhaul and spare parts Generators Power distribution & control Power conditioning Repair, overhaul and spare parts Electronic... -

Page 7

-

Page 8

..., OEMs, parts distributors and MRO service providers) General contractors (building and tower manufacturers), cell-phone companies Military and commercial vehicles Commercial spacecraft and launch vehicles Commercial, regional, business and military aircraft Transportation Missiles Munitions... -

Page 9

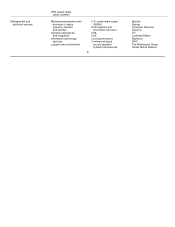

...range safety systems Management and technical services Maintenance/operation and provision of space systems, services and facilities Systems engineering and integration Information technology services Logistics and sustainment U.S. government space (NASA) DoD (logistics and information services) FAA... -

Page 10

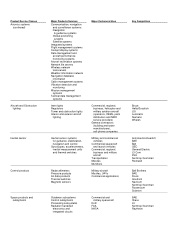

...and systems Access controls and closed circuit television Home health monitoring and nurse call systems Gas detection products and systems Emergency lighting Distribution Hand held imagers Mobile and wireless computers Personal protection equipment Advanced control software and industrial automation... -

Page 11

... Communications systems for Industrial Control equipment and systems Consulting, networking engineering and installation Terminal automation solutions Process control instrumentation Field instrumentation Analyti cal instrumentation Recorders Controllers Critical environment control solutions... -

Page 12

... processing technologies, catalysts, adsorbents, equipment and services, fluorine products, specialty films and additives, advanced fibers and composites, intermediates, specialty chemicals, electronic materials and chemicals. Product/Service Classes Major Products/Services Major Customers/Uses Key... -

Page 13

...-silanes High modulus polyethylene fiber and shield composites Aramid shield composites Diverse by product type Atotech BASF DSM Bullet resistant vests, helmets and other armor applications Cut-resistant gloves Rope & cordage Food and pharmaceutical packaging DuPont DSM Teijin Specialty films... -

Page 14

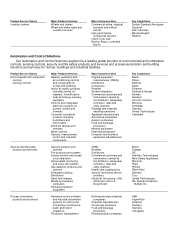

... for passenger cars and commercial vehicles, as well as a leading provider of automotive care and braking products. Product/Service Classes Major Products/Services Major Customers/Uses Key Competitors Charge-air systems Turbochargers for gasoline and diesel engines Passenger car, truck and off... -

Page 15

... and car care products Oil, air, fuel, transmission and coolant filters PCV valves Spark plugs Wire and cable Antifreeze/coolant Windshield washer fluids Waxes, washes and specialty cleaners Automotive and heavy vehicle aftermarket channels, OEMs and Original Equipment Service Providers (OES) Auto... -

Page 16

Product/Service Classes Major Products/Services Major Customers/Uses Key Competitors Brake hard parts and other friction materials Disc brake pads and shoes Drum brake linings Brake blocks Disc and drum brake components Brake hydraulic components Brake fluid Aircraft brake linings Railway ... -

Page 17

... accounted for 71 percent of total 2008 sales of Transportation Systems. The principal manufacturing facilities outside the U.S. are in Europe, with less significant operations in Asia and Latin America. Financial information including net sales and long-lived assets related to geographic areas... -

Page 18

... or distribution rights. We own, or are licensed under, a large number of patents, patent applications and trademarks acquired over a period of many years, which relate to many of our products or improvements to those products and which are of importance to our business. From time to time, new... -

Page 19

... as a whole. Further information, including the current status of significant environmental matters and the financial impact incurred for remediation of such environmental matters, if any, is included in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 20

... hours, aircraft fuel prices, labor issues, airline consolidation, airline insolvencies, terrorism and safety concerns as well as changes in regulations. Future terrorist actions or pandemic health issues could dramatically reduce both the demand for air travel and our Aerospace aftermarket sales... -

Page 21

... and their assembly of major components and subsystems used in our products in a timely manner and in full compliance with purchase order terms and conditions, quality standards, and applicable laws and regulations. In addition, many major components and product equipment items are procured or... -

Page 22

... and 10 percent in Asia. Risks related to international operations include exchange control regulations, wage and price controls, employment regulations, foreign investment laws, import, export and other trade restrictions (such as embargoes and trade restrictions), changes in regulations regarding... -

Page 23

... U.S. Government business necessitating increases in time and investment for design and development, difficulty of forecasting costs and schedules when bidding on developmental and highly sophisticated technical work, and other factors characteristic of the industry, such as contract award protests... -

Page 24

... in our Transportation Systems segment. Legislation or regulations regarding areas such as labor and employment, employee benefit plans, tax, health and safety matters, import, export and trade, intellectual property, product certification, product liability and environmental remediation may... -

Page 25

... expect to continue to incur capital and operating costs to comply with these laws and regulations. In addition, changes in laws, regulations and enforcement of policies, the discovery of previously unknown contamination or new technology or information related to individual sites, or the imposition... -

Page 26

... of plants, research laboratories, sales offices and other facilities. Our headquarters and administrative complex is located at Morris Township, New Jersey. Our plants are generally located to serve large marketing areas and to provide accessibility to raw materials and labor pools. Our properties... -

Page 27

Item 3. Legal Proceedings We are subject to a number of lawsuits, investigations and claims (some of which involve substantial amounts) arising out of the conduct of our business. See a discussion of environmental, asbestos and other litigation matters in Note 21 of Notes to Financial Statements in ... -

Page 28

... Officer Automation and Control Solutions since January 2004. President and Chief Executive Officer Aerospace since January 2005. President and Chief Executive Officer Transportation Systems from July 2001 to December 2004. President and Chief Executive Officer Specialty Materials since March 2008... -

Page 29

... quarter ending December 31, 2008. Honeywell purchased a total of 27,400,000 shares of common stock in 2008. Under the Company's previously reported $3.0 billion share repurchase program, $1.3 billion remained available as of December 31, 2008 for additional share repurchases. The amount and timing... -

Page 30

... non-aerospace businesses conducted by Honeywell and their contribution to our overall segment profits. The annual changes for the five-year period shown in the graph are based on the assumption that $100 had been invested in Honeywell stock and each index on December 31, 2003 and that all dividends... -

Page 31

... in millions, except per share amounts) 2004 Results of Operations Net sales Income from continuing operations Per Common Share Earnings from continuing operations: Basic Assuming dilution Dividends Financial Position at Year-End Property, plant and equipment-net Total assets Short-term debt Long... -

Page 32

Price Volume Foreign Exchange Acquisitions/Divestitures 2% - 1 3 6% 1% 6 2 1 10 % The increase in full year 2008 sales was partially offset by a 6 percent decrease in sales during the fourth quarter of 2008 compared to the prior year period. A discussion of net sales by segment can be found in ... -

Page 33

... our Transportation Systems and Specialty Materials segments, primarily due to lower sales volume, partially offset by (i) lower pension and other post retirement benefits expense, (ii) higher margins in our Automation and Controls Solutions segment of 0.8 of a percentage point mainly resulting from... -

Page 34

... primarily relates to (i) the gain on sale of the Consumables Solutions business, (ii) lower pension and other post retirement expense, (iii) an increase in segment profit (most significantly in Automation and Control Solutions and Aerospace, partially offset by a decline in Transportation Systems... -

Page 35

... to Sun Capital Partners, Inc. BUSINESS OVERVIEW This Business Overview provides a summary of Honeywell and its four reportable operating segments (Aerospace, Automation and Control Solutions, Specialty Materials and Transportation Systems), including their respective areas of focus for 2009 and the... -

Page 36

-

Page 37

... incurred for asbestos and environmental matters, pension and other post-retirement expenses and our tax expense. Review of Business Segments 2008 2007 (Dollars in millions) 2006 Net Sales Aerospace Automation and Control Solutions Specialty Materials Transportation Systems Corporate $ 12,650... -

Page 38

... 1, 2008. Other income/(expense) as presented above includes equity income/(loss) of affiliated companies of $10 and $13 million for the years ended December 31, 2007 and 2006, respectively. (2) Amounts included in cost of products and services sold and selling, general and administrative expenses... -

Page 39

... • Availability and price volatility of raw materials such as titanium and other metals. Results of Operations 2008 2007 (Dollars in millions) 2006 Net sales % change compared with prior year Segment profit % change compared with prior year Aerospace sales by major customer end-markets were as... -

Page 40

27 -

Page 41

... Aerospace sales increased by 3 percent in 2008. Details regarding the net increase in sales by customer end-markets are as follows: • Air transport and regional original equipment (OE) sales decreased by 6 percent in 2008. The decrease is driven by the sale of our Consumables Solutions business... -

Page 42

...more efficient, safe and comfortable. Our ACS products and services include controls for heating, cooling, indoor air quality, ventilation, humidification, lighting and home automation; advanced software applications for home/ building control and optimization; sensors, switches, control systems and... -

Page 43

-

Page 44

... sales and emerging markets, (ii) continued strong demand for life safety products and (iii) introduction of new environmental and combustion control products. • Sales in our Solutions businesses increased by 17 percent with growth in all regions, driven by energy retrofit and refining services... -

Page 45

30 -

Page 46

...; • Process solutions for asset management and energy efficiency; and • Continuing to invest in new product development. Specialty Materials Overview Specialty Materials develops and manufactures high-purity, high-quality and high-performance chemicals and materials for applications in the... -

Page 47

-

Page 48

... other cost inflation. 2009 Areas of Focus Specialty Materials primary areas of focus for 2009 include: • Achieving productivity savings and pricing actions to offset inflation and reduced capacity utilization; • Managing business exposure to commodity market conditions; • Reduce manufacturing... -

Page 49

... car care products; • Regulations mandating lower emissions and improved fuel economy; and • Consumers' ability to obtain financing for new vehicle purchases. Results of Operations 2008 2007 (Dollars in millions) 2006 Net sales % change compared with prior year Segment profit % change compared... -

Page 50

... planning and production issues. 2009 Areas of Focus Transportation Systems primary areas of focus in 2009 include: • Sustaining superior turbocharger technology through successful platform launches; • Maintaining the high quality of current products while executing new product introductions... -

Page 51

... in millions) Automation and Control Solutions Net repositioning charge $ 164 $ 127 $ 39 Years Ended December 31, 2008 2007 2006 (Dollars in millions) Specialty Materials Net repositioning charge Business impairment charges Arbitration award related to phenol supply agreement Probable and... -

Page 52

... from customers and deferred income) and higher cash tax payments of $336 million (most significantly due to the sale of the Consumables Solutions business) partially offset by increased earnings, lower cash payments for asbestos of $121 million, and a decrease in working capital (lower accounts and... -

Page 53

... as well as our ability to sell trade accounts receivables. A source of liquidity is our ability to issue short-term debt in the commercial paper market. Commercial paper notes are sold at a discount and have a maturity of not more than 270 days from date of issuance. Borrowings under the commercial... -

Page 54

... cash requirements, our principal future cash requirements will be to fund capital expenditures, debt repayments, dividends, employee benefit obligations, environmental remediation costs, asbestos claims, severance and exit costs related to repositioning actions, share repurchases and any strategic... -

Page 55

...Our available cash, committed credit lines, access to the public debt and equity markets as well as our ability to sell trade accounts receivables, provide additional sources of short-term and long-term liquidity to fund current operations, debt maturities, and future investment opportunities. Based... -

Page 56

payments are based on our estimate of pending and future claims. Projecting future events is subject to many uncertainties that could cause asbestos 39 -

Page 57

... benefits (OPEB) obligations. We made voluntary cash contributions of $42, $42 and $68 million to our U.S. pension plans in 2008, 2007 and 2006, respectively. In December 2008, we also made a voluntary contribution of $200 million of Honeywell common stock to our U.S. plans to improve the funded... -

Page 58

-

Page 59

... completion of studies, litigation or settlements, and neither the timing nor the amount of the ultimate costs associated with environmental matters can be determined, they could be material to our consolidated results of operations or operating cash flows in the periods recognized or paid. However... -

Page 60

... risk related to changes in interest or currency exchange rates. We manage our exposure to counterparty credit risk through specific minimum credit standards, diversification of counterparties, and procedures to monitor concentrations of credit risk. Our counterparties are substantial investment and... -

Page 61

... the selection, application and disclosure of these critical accounting policies with the Audit Committee of our Board of Directors and our Independent Registered Public Accountants. New accounting standards effective in 2008 which had a material impact on our consolidated financial statements are... -

Page 62

... potential amounts or ranges of probable losses, and recognize a liability, if any, for these contingencies based on a careful analysis of each matter with the assistance of outside legal counsel and, if applicable, other experts. Such analysis includes making judgments concerning matters such as 43 -

Page 63

... of management's judgments applied in the recognition and measurement of insurance recoveries for asbestos related liabilities. Defined Benefit Pension Plans-We maintain defined benefit pension plans covering a majority of our employees and retirees. For financial reporting purposes, net periodic... -

Page 64

... for our pension plans). The discount rate reflects the market rate on December 31 (measurement date) for high-quality fixed-income investments with maturities corresponding to our benefit obligations and is subject to change each year. Further information on all our major actuarial assumption... -

Page 65

... million in cash in 2009 to our non-U.S. defined benefit pension plans to satisfy regulatory funding standards. Long-Lived Assets (including Tangible and Definite-Lived Intangible Assets)-To conduct our global business operations and execute our business strategy, we acquire tangible and intangible... -

Page 66

... current tax liability and deferred taxes in the period in which the facts that give rise to a revision become known. Sales Recognition on Long-Term Contracts-In 2008, we recognized approximately 13 percent of our total net sales using the percentage-of-completion method for long-term contracts in... -

Page 67

... our assumptions regarding contract options, change orders, incentive and award provisions associated with technical performance and price adjustment clauses (such as inflation or index-based clauses). Contract costs are incurred over a period of time, which can be several years, and the estimation... -

Page 68

... HONEYWELL INTERNATIONAL INC. CONSOLIDATED STATEMENT OF OPERATIONS 2008 Years Ended December 31, 2007 2006 (Dollars in millions, except per share amounts) Product sales Service sales Net sales Costs, expenses and other Cost of products sold Cost of services sold Selling, general and administrative... -

Page 69

HONEYWELL INTERNATIONAL INC. CONSOLIDATED BALANCE SHEET December 31, 2008 2007 (Dollars in millions) ASSETS Current assets: Cash and cash equivalents Accounts, notes and other receivables Inventories Deferred income taxes Other current assets Total current assets Investments and long-term ... -

Page 70

50 -

Page 71

...common stock Proceeds from issuance of long-term debt Payments of long-term debt Excess tax benefits from share based payment arrangements Repurchases of common stock Cash dividends paid on common stock Net cash (used for) financing activities Effect of foreign exchange rate changes on cash and cash... -

Page 72

The Notes to Financial Statements are an integral part of this statement. 51 -

Page 73

... (Loss) Common stock issued for employee savings and option plans (including related tax benefits of $101) Stock based compensation expense Repurchases of common stock Uncertain tax positions Dividends on common stock ($1.00 per share) Other owner changes Balance at December 31, 2007 Net income... -

Page 74

... Income (Loss) Common stock issued for employee savings and option plans (including related tax benefits of $28) Common stock contributed to pension plans Stock based compensation expense Repurchases of common stock Dividends on common stock ($1.10 per share) Other owner changes Balance at December... -

Page 75

...new carrying value. Property, Plant and Equipment-Property, plant and equipment are recorded at cost, including any asset retirement obligations, less accumulated depreciation. For financial reporting, the straight-line method of depreciation is used over the estimated useful lives of 10 to 50 years... -

Page 76

... value, such as the sales price for the product or service when it is sold separately or competitor prices for similar products or services. Allowance for Doubtful Accounts-We maintain allowances for doubtful accounts for estimated losses as a result of customer's inability to make required payments... -

Page 77

... postretirement benefit plans that provide health care benefits and life insurance coverage to eligible retirees. For our U.S. defined benefit pension plans we use the market-related value of plan assets reflecting changes in the fair value of plan assets over a three-year period. Further, net... -

Page 78

...140, "Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities". We sell interests in designated pools of trade accounts receivables to third parties. The receivables are removed from the Consolidated Balance Sheet at the time they are sold. The value assigned to... -

Page 79

... number of common shares outstanding and all dilutive potential common shares outstanding. Use of Estimates-The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported... -

Page 80

...1, 2009 did not have a material impact on our consolidated financial position and results of operations. SFAS No. 157, defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date... -

Page 81

...provides that tax benefits associated with dividends on sharebased payment awards be recorded as a component of additional paid-in capital. EITF 06-11 is effective, on a prospective basis, for fiscal years beginning after December 15, 2007. The implementation of this standard did not have a material... -

Page 82

...after November 15, 2008, and fiscal years that include those periods. FSP 133-1 and FIN 45-4 is effective for reporting periods (annual or interim) ending after November 15, 2008. The implementation of this standard did not have a material impact on our consolidated financial position and results of... -

Page 83

... on an employer's disclosures about plan assets of a defined benefit pension or other postretirement plan. FSP 132(R)-1 is effective for fiscal years ending after December 15, 2009. The implementation of this standard will not have a material impact on our consolidated financial position and results... -

Page 84

... in these years are discussed below. In May 2008, the Company completed the acquisition of Safety Products Holding, Inc, which through its subsidiary Norcross Safety Products L.L.C. (Norcross) is a leading manufacturer of personal protective equipment. The purchase price, net of cash acquired, was... -

Page 85

...over their estimated life of 5 years using straight-line and accelerated amortization methods. The excess of the purchase price over the estimated fair values of net assets acquired approximating $183 million, was recorded as goodwill. Goodwill will be deducted over a 15 year period for tax purposes... -

Page 86

...Solutions segment and were not material to the consolidated financial statements. During the year, the Company completed the sales of the First Technology Safety & Analysis business for $93 million and First Technology Automotive for $90 million which were accounted for as part of the purchase price... -

Page 87

... 483 $ 1,012 The following table summarizes the pretax impact of total net repositioning and other charges by segment. Years Ended December 31, 2008 2007 2006 Aerospace Automation and Control Solutions Specialty Materials Transportation Systems Corporate $ 84 164 42 233 489 $ 37 127 14 119 246... -

Page 88

-

Page 89

...and certain administrative facilities, and information technology equipment in our Corporate segment. Also, $20 million of previously established accruals, primarily for severance at our Automation and Control Solutions segment were returned to income in 2008 due mainly to fewer employee separations... -

Page 90

-

Page 91

... except per share amounts) costs related to 2008 repositioning actions which we were not able to recognize at the time the actions were initiated: Automation and Control Solutions Aerospace Transportation Systems Total Expected exit and disposal costs Costs incurred year ended December 31, 2008... -

Page 92

67 -

Page 93

... in millions, except per share amounts) Gain on sale of non-strategic businesses and assets for 2008 includes a $623 million pre-tax gain related to the sale of our Consumables Solutions business. See Note 2 for further details. Note 5-Interest and Other Financial Charges Years Ended December 31... -

Page 94

$ 1,009 68 $ 877 $ 720 -

Page 95

... share amounts) Years Ended December 31, 2008 2007 2006 The U.S. statutory federal income tax rate is reconciled to our effective income tax rate as follows: Statutory U.S. federal income tax rate Taxes on foreign earnings below U.S. tax rate (1) State income taxes (1) Tax benefits on export sales... -

Page 96

... federal tax net operating losses available for carryforward at December 31, 2008 which were generated by certain subsidiaries prior to their acquisition and have expiration dates through 2024. The use of pre-acquisition operating losses is subject to limitations imposed by the Internal Revenue Code... -

Page 97

... tax benefits: 2008 2007 Change in unrecognized tax benefits: Balance at beginning of year Gross increases related to current period tax positions Gross increases related to prior periods tax positions Gross decreases related to prior periods tax positions Decrease related to settlements with tax... -

Page 98

...will materially change from those recorded as liabilities for uncertain tax positions in our financial statements. In addition, the outcome of these examinations may impact the valuation of certain deferred tax assets (such as net operating losses) in future periods. Based on the number of tax years... -

Page 99

...unbilled balances under long-term contracts as of December 31, 2008 and 2007, respectively. These amounts are billed in accordance with the terms of the customer contracts to which they relate. We sell interests in designated pools of trade accounts receivables to third parties. The sold receivables... -

Page 100

... the receivables are sold. The retained interests in the receivables are shown at the amounts expected to be collected by us, and such carrying value approximates the fair value of our retained interests. We are compensated for our services in the collection and administration of the receivables. 72 -

Page 101

...500 ) $ 822 Losses on sales of receivables were $18, $29 and $27 million in 2008, 2007 and 2006, respectively. No credit losses were incurred during those years. Note 9-Inventories December 31, 2008 2007 Raw materials Work in process Finished products Less- Progress payments Reduction to LIFO cost... -

Page 102

Less-Accumulated depreciation and amortization 13,386 (8,452 ) $ 4,934 73 13,362 (8,377 ) $ 4,985 -

Page 103

...-Net The change in the carrying amount of goodwill for the years ended December 31, 2008 and 2007 by segment are as follows: December 31, 2007 Currency Translation Adjustment December 31, 2008 Acquisitions Divestitures Aerospace Automation and Control Solutions Specialty Materials Transportation... -

Page 104

...) (Dollars in millions, except per share amounts) Note 13-Accrued Liabilities December 31, 2008 2007 Compensation, benefit and other employee related Customer advances and deferred income Income taxes Environmental costs Asbestos related liabilities Product warranties and performance guarantees... -

Page 105

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Note 14-Long-term Debt and Credit Agreements December 31, 2008 2007 6.20% notes due 2008 1 7 /8% notes due 2008 Floating rate notes due 2009 Floating rate notes due 2009 Zero ... -

Page 106

... no borrowings outstanding or letters of credit issued under the credit facility at December 31, 2008. The credit agreement does not restrict our ability to pay dividends and contains no financial covenants. The failure to comply with customary conditions or the occurrence of customary events of 76 -

Page 107

... banks has the right to terminate its commitment to lend additional funds or issue letters of credit under the agreement if any person or group acquires beneficial ownership of 30 percent or more of our voting stock, or, during any 12-month period, individuals who were directors of Honeywell at the... -

Page 108

... in 2008. The terms and conditions of our credit sales are designed to mitigate or eliminate concentrations of credit risk with any single customer. Our sales are not materially dependent on a single customer or a small group of customers. Foreign Currency Risk Management-We conduct our business on... -

Page 109

...of Financial Instruments-The carrying value of cash and cash equivalents, trade accounts and notes receivables, payables, commercial paper and short-term borrowings contained in the Consolidated Balance Sheet approximates fair value. The Company holds investments in marketable equity securities that... -

Page 110

... nuclear fuel conversion facilities in our Specialty Materials segment and the future retirement of facilities in our Automation and Control Solutions segment. A reconciliation of our liability for asset retirement obligations for the year ended December 31, 2008, is as follows: 2008 2007 Change... -

Page 111

We are authorized to issue up to 40,000,000 shares of preferred stock, without par value, and can determine the number of shares of each series, and the rights, preferences and limitations of each series. At December 31, 2008, there was no preferred stock outstanding. 80 -

Page 112

..., term and other conditions applicable to each option granted under our stock plans are generally determined by the Management Development and Compensation Committee of the Board. The exercise price of stock options is set on the grant date and may not be less than the fair market value per share of... -

Page 113

81 -

Page 114

... vest over a four-year period and expire after ten years. The fair value of each option award is estimated on the date of grant using the Black-Scholes option-pricing model. Expected volatility is based on implied volatilities from traded options on Honeywell common stock. We used a Monte Carlo... -

Page 115

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) The following table summarizes information about stock option activity for the three years ended December 31, 2008: Number of Options Weighted Average Exercise Price Outstanding... -

Page 116

..., and the balance was classified as cash from operations. At December 31, 2008, there was $77 million of total unrecognized compensation cost related to non-vested stock option awards which is expected to be recognized over a weighted-average period of 2.66 years. The total fair value of options... -

Page 117

... new director receives a one-time grant of 3,000 restricted stock units that will vest on the fifth anniversary of continuous Board service. The Directors' Plan also provides for an annual grant to each director of options to purchase 5,000 shares of common stock at the fair market value on the date... -

Page 118

-

Page 119

... of operations or operating cash flows in the periods recognized or paid. However, considering our past experience and existing reserves, we do not expect that these environmental matters will have a material adverse effect on our consolidated financial position. New Jersey Chrome Sites-Provisions... -

Page 120

... chrome residue at the Publicly Funded Sites that are sewer lines. Honeywell and the plaintiffs have reached a settlement for one group of properties (known as Study Area 6 South), and that settlement has been approved by the Court. The remedial actions regarding the settlements discussed above are... -

Page 121

... under the accounting policy described above. Asbestos Matters Like many other industrial companies, Honeywell is a defendant in personal injury actions related to asbestos. We did not mine or produce asbestos, nor did we make or sell insulation products or other construction materials that have... -

Page 122

... containing products, epidemiological studies to estimate the number of people likely to develop asbestos related diseases, NARCO claims filing history, the pending inventory of NARCO asbestos related claims and payment rates expected to be established by the NARCO trust. This methodology used to... -

Page 123

... New York, disputing obligations for NARCO-related asbestos claims under high excess insurance coverage issued by Travelers and other insurance carriers. Approximately $340 million of coverage under these policies is included in our NARCO-related insurance receivable at December 31, 2008. Honeywell... -

Page 124

... liability for future claims represents the estimated value of future asbestos related bodily injury claims expected to be asserted against Bendix over the next five years. In light of the uncertainties inherent in making long-term projections, as well as certain factors unique to friction 90 -

Page 125

... period of time over which claim settlements are paid (collectively, the "Variable Claims Factors") do not substantially change, Honeywell would not expect future Bendix related asbestos claims to have a material adverse effect on our results of operations or operating cash flows in any fiscal year... -

Page 126

... INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Refractory and Friction Products-The following tables summarize information concerning NARCO and Bendix asbestos related balances: Asbestos Related Liabilities Year Ended December 31, 2008... -

Page 127

-

Page 128

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) NARCO and Bendix asbestos related balances are included in the following balance sheet accounts: December 31, 2008 2007 Other current assets Insurance recoveries for asbestos ... -

Page 129

... cash flows in the periods recognized or paid. Warranties and Guarantees-We have issued or are a party to the following direct and indirect guarantees at December 31, 2008: Maximum Potential Future Payments Operating lease residual values Other third parties' financing Unconsolidated affiliates... -

Page 130

94 -

Page 131

... plans that provide health care benefits and life insurance coverage to eligible retirees. Our retiree medical plans mainly cover U.S. employees who retire with pension eligibility for hospital, professional and other medical services. All non-union hourly and salaried employees joining Honeywell... -

Page 132

...Benefit obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Company contributions Acquisitions Benefits paid Other Fair value of plan assets at end of year Funded status of plans Amounts recognized in Consolidated Balance Sheet... -

Page 133

-

Page 134

... Benefits Years Ended December 31, 2008 2007 2006 Net Periodic Benefit Cost Service cost Interest cost Expected return on plan assets Amortization of transition obligation Amortization of prior service cost (credit) Recognition of actuarial losses Settlements and curtailments Net periodic benefit... -

Page 135

other comprehensive (income) loss 97 -

Page 136

... Benefits 2008 2007 Actuarial assumptions used to determine benefit obligations as of December 31: Discount rate Expected annual rate of compensation increase Actuarial assumptions used to determine net periodic benefit cost for years ended December 31: Discount rate Expected rate of return on plan... -

Page 137

... million in cash to our non-U.S. defined benefit pension plans to satisfy regulatory funding standards. These contributions do not reflect benefits to be paid directly from Company assets. Benefit payments, including amounts to be paid from Company assets, and reflecting expected future service, as... -

Page 138

... Net of Medicare Subsidy 2009 2010 2011 2012 2013 2014-2018 Employee Savings Plans $ 219 221 221 206 198 892 $ 204 207 208 193 185 831 We sponsor employee savings plans under which we match, in the form of our common stock, savings plan contributions for certain eligible employees. Shares... -

Page 139

... We globally manage our business operations through four reportable operating segments serving customers worldwide with aerospace products and services, control, sensing and security technologies for buildings, homes and industry, automotive products and chemicals. Segment information is consistent... -

Page 140

... INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Years Ended December 31, 2007 2006 2008 Net sales Aerospace Automation and Control Solutions Specialty Materials Transportation Systems Corporate $ 12,650 14,018 5,266 4,622 - $ 36,556 $ 12... -

Page 141

-

Page 142

... million for the years ended December 31, 2007 and 2006, respectively. Stock option expense is included for all periods presented. Note 24-Geographic Areas-Financial Data Net Sales(1) Years Ended December 31, 2008 2007 2006 Long-lived Assets(2) Years Ended December 31, 2008 2007 2006 United States... -

Page 143

103 -

Page 144

... capitalized Income taxes paid, net of refunds Non-cash investing and financing activities: Common stock contributed to savings plans Common stock contributed to U.S. pension plans Note 26-Unaudited Quarterly Financial Information 2008 Mar. 31 June 30 Sept. 30 Dec. 31 $ 415 810 220 200 2007 Year... -

Page 145

..., the Company changed the manner in which it accounts for income tax uncertainties in 2007, and the manner in which it accounts for defined benefit pension and other postretirement plans in 2006. A company's internal control over financial reporting is a process designed to provide reasonable... -

Page 146

... Not Applicable. Item 9A. Controls and Procedures Honeywell management, including the Chief Executive Officer and Chief Financial Officer, conducted an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this Annual Report on Form 10... -

Page 147

... Officer and Controller) and employees. Amendments to or waivers of the Code of Business Conduct granted to any of Honeywell's directors or executive officers will be published on our website within five business days of such amendment or waiver. Item 11. Executive Compensation Information relating... -

Page 148

... investment. 50% of any payment related to these growth plan units will be paid in 2009 and the remaining 50% will be paid in 2010, subject to active employment on the payment dates. Because the number of future shares that may be distributed to employees participating in the Honeywell Global Stock... -

Page 149

... of Common Stock the following November at the fair market value on the date of purchase. Participant accounts are credited with matching shares equal to 20% of their contributions that are subject to continued employment for 3 years. For 2008, Honeywell used Treasury shares to provide the shares... -

Page 150

...AlliedSignal Incentive Compensation Plan for Executive Employees of AlliedSignal Inc. and its Subsidiaries and the Deferred Compensation Plan for NonEmployee Directors of Honeywell International Inc. The cash incentive compensation plan has expired. All notional investments in shares of Common Stock... -

Page 151

...Schedules Page Number in Form 10-K (a)(1.) Consolidated Financial Statements: Consolidated Statement of Operations for the years ended December 31, 2008, 2007 and 2006 Consolidated Balance Sheet at December 31, 2008 and 2007 Consolidated Statement of Cash Flows for the years ended December 31, 2008... -

Page 152

... and Controller Pursuant to the requirements of the Securities Exchange Act of 1934, this annual report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the date indicated: Name * David M. Cote Chairman of the Board, Chief Executive Officer and... -

Page 153

George Paz Director * Bradley T. Sheares, Ph.D. Director * John R. Stafford Director * Michael W. Wright Director /s/ Talia M. Griep Talia M. Griep Vice President and Controller (Principal Accounting Officer) *By: /s/ David J. Anderson (David J. Anderson Attorney-in-fact) February 13, 2009 112 -

Page 154

...ended September 30, 2008) 1985 Stock Plan for Employees of AlliedSignal Inc. and its Subsidiaries, as amended (incorporated by reference to Exhibit 19.3 to Honeywell's Form 10-Q for the quarter ended September 30, 1991) Honeywell International Inc. Incentive Compensation Plan for Executive Employees... -

Page 155

... ended September 30, 2008 and the attached amendment (filed herewith)) 2003 Stock Incentive Plan for Employees of Honeywell International Inc. and its Affiliates Award Agreement (incorporated by reference to Exhibit 10.1 to Honeywell's Form 8-K filed February 7, 2005) 2003 Stock Incentive Plan... -

Page 156

... reference to Exhibit 2.1 to Honeywell's Form 8-K filed November 1, 2005) Stock Purchase Agreement dated April 3, 2008 by and among Honeywell International Inc., Safety Products Holdings, Inc., the selling shareholders party thereto, and Odyssey Investment Services, L.L.C. (incorporated by reference... -

Page 157

...22 23 24 31.1 31.2 32.1 32.2 99 Stock and Asset Purchase Agreement dated June 9, 2008, by and between Honeywell International Inc. and BE Aerospace, Inc. (incorporated by reference to Exhibit 10.1 to Honeywell's Form 8-K filed June 11, 2008) Omitted (Inapplicable) Statement re: Computation of Ratio... -

Page 158

HONEYWELL INTERNATIONAL INC SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS Three Years Ended December 31, 2008 (In millions) Allowance for Doubtful Accounts: Balance December 31, 2005 Provision charged to income Deductions from reserves(1) Acquisitions Balance December 31, 2006 Provision charged to ... -

Page 159

Reductions charged to deferred tax assets due to capital loss carryforwards Additions charged to equity Reductions credited to goodwill Balance December 31, 2008 117 (7 ) (51 ) (37 ) $ 445 -

Page 160

..., any non-qualified deferred compensation (within the meaning of Section 409A of the Code) payable to the Employee upon a Termination of Employment pursuant to the terms and conditions of this Plan shall be paid to the Employee upon a "separation from service", as determined in accordance... -

Page 161

...90 days after the date of the Change in Control" immediately following "In addition, each Participant will receive in cash". 13. Section 5.4(d) shall be amended by adding "subject to Section 7.14" immediately following: "Any deferred Restricted Units or other deferred vested Awards (including Awards... -

Page 162

...added: "7.15 Payments to Specified Employees. Notwithstanding anything herein or in any Award grant agreement to the contrary, in the event that a Participant is a "specified employee" (within the meaning of Section 409A(2)(B) of the Code) as of the date of such Participant's separation from service... -

Page 163

...Incentive Compensation Awards or Long-Term Awards made pursuant to the Plan. B. Board of Directors. The Board of Directors of Honeywell International Inc. C. Code. The Internal Revenue Code of 1986 and the regulations promulgated thereunder, as amended from time to time. D. Committee. The Management... -

Page 164

.... The Incentive Compensation Award Reserve established pursuant to Section IV of the Plan. L. Senior Executive Employee. An officer of Honeywell International Inc. or other senior-level Employee who by reason of job responsibilities has been determined by the Committee to be in a position to make... -

Page 165

...term business objectives, consideration will be given to, among other things, the financial plans for the year for the Company and its operating units. The maximum Incentive Compensation Award payable with respect to any fiscal year to an individual who is the Chief Executive Officer during any part... -

Page 166

... they relate; provided, however, that no Incentive Compensation Awards shall be made to Senior Executive Employees prior to receipt by the Chief Executive Officer of assurances from the Chief Financial Officer and the Company's independent accountants that the amount which the Board of Directors has... -

Page 167

...later than the 15th day of the third month following the end of such year, provided that, except as provided in the second paragraph of Section V, the recipient Employee is still actively employed by the Company on the date the Incentive Compensation Award is paid. Notwithstanding the foregoing, the... -

Page 168

... Awards in accordance with and subject to the terms and conditions of the Company's Deferred Incentive Compensation Plan (the "DIC Plan"). IX. Accelerated Payment A. Notwithstanding anything to the contrary in the Plan, in the event of (i) the purchase of shares of the Common Stock of Honeywell... -

Page 169

plan for the benefit of employees of the Company or its subsidiaries) which theretofore beneficially owned less than 30% of the Common Stock then outstanding acquires shares of Common Stock in a transaction or series of transactions that results in such entity, person or group directly or indirectly... -

Page 170

... incurred by the Employee under Section 409A of the Code. B. All expenses and costs in connection with the operation of the Plan shall be borne by the Company and no part thereof (other than the amounts of Incentive Compensation Awards to Senior Executive Employees under the Plan) shall be charged... -

Page 171

SCHEDULE A Notional Interest Rate Award Year Vested RateContingent RateTotal Rate 3% 3% 9% 11% 1998 (Bands 5 and below) 6% 1998 (Bands 6 and above) 8% 9 -

Page 172

... Employees of Honeywell International Inc. and its Subsidiaries (Career Band 6 and above) (the "Executive Supplemental Savings Plan") and the resulting plan from this merger became known as the Plan. The Plan is hereby amended and restated, effective as of January 1, 2009, to implement changes... -

Page 173

... of this Plan, the "Plan Year" shall mean the calendar year. 3. Definitions. Capitalized terms not otherwise defined in the Plan have the respective meanings set forth in the applicable Qualified Savings Plans. 4. Participation. (a) Time and Form of Election. (i) Each Eligible Employee who wishes... -

Page 174

... a Participant's Account under the Supplemental Savings Plan before January 1, 2006, shall accrue amounts (to be posted on the Valuation Date) equivalent to interest, compounded daily, at a rate based upon the cost to the Corporation of borrowing at a fixed rate for a 15-year term; provided however... -

Page 175

... of the Common Stock shall be credited to the Participant's Account as if reinvested in Common Stock, with the number of shares credited determined by dividing the equivalent cash dividend amount by the closing price of Common Stock on the date the dividends would have been payable. Amounts credited... -

Page 176

... from Service (as defined in Section 409A(a)(2)(A)(i) of the Code and its corresponding regulations) with the Corporation and its affiliates, unless the Participant elects in his Election Form at the time of his election to defer Base Annual Salary for such Plan Year that such Participant Deferred... -

Page 177

... Account for such Plan Year shall be paid in one lump-sum payment in cash in January of the Plan Year immediately following the Plan Year in which the Participant has a Separation from Service with the Corporation and its affiliates. Notwithstanding the foregoing, if at the time of the Participant... -

Page 178

...the Plan Employer Contribution Amounts shall have been paid. Any fractional shares of Common Stock shall be paid in an equivalent cash amount, as determined using the closing price of Common Stock on the trading date next preceding the distribution date. (iii) Calculation of Installment Payments. If... -

Page 179

...ninety (90) day period following a Change in Control, as defined in Subparagraph 10(e). Any fractional shares of Common Stock shall be paid in an equivalent cash amount, as determined using the closing price of Common Stock on the trading date next preceding the distribution date. (c) Changing Prior... -

Page 180

... at any time during the Participant's lifetime by filing a subsequent designation in writing with the Plan Administrator. Any fractional shares of Common Stock shall be paid in an equivalent cash amount, as determined using the closing price of Common Stock on the trading date immediately preceding... -

Page 181

... the Plan Administrator along with a Certificate of Unavailability of Resources form, the Plan Administrator, or his designee, may cause the Corporation to accelerate (or require the subsidiary of the Corporation which employs or employed the Participant to accelerate) payment of all or any part of... -

Page 182

... 9 shall be made in Common Stock. Any fractional shares of Common Stock shall be paid in an equivalent cash amount, as determined using the closing price of Common Stock on the trading date next preceding the distribution date. 10. Change in Control. (a) Initial Lump-Sum Payment Election. (i) Non... -

Page 183

..., person or group (other than the Corporation, any subsidiary or any savings, pension or other benefit plan for the benefit of employees of the Corporation or its subsidiaries) which therefore beneficially owned less than 30% of the common stock then outstanding acquires shares of Common Stock in... -

Page 184

... the terms of the Plan) as it deems necessary or appropriate for administration of the Plan; to delegate responsibilities to others to assist it in administering the Plan; to retain attorneys, consultants, accountants or other persons (who may be employees of the Corporation and its subsidiaries) to... -

Page 185

...to obtain information about such procedures, and a statement of the claimant's right to bring an action under Section 502(a) of ERISA. All interpretations, determinations and decisions of the Plan Administrator in respect of any claim shall be made in its sole discretion based on the applicable Plan... -

Page 186

... right shall be no greater than that of an unsecured general creditor of the Corporation. Except as expressly provided herein, any person having an interest in any amount credited to a Participant's Account under the Plan shall not be entitled to payment until the date the amount is due and payable... -

Page 187

... or any person or group publicly announces an intention to take or to consider taking actions which, if consummated, would constitute a Change in Control; (C) any person or group (other than the Corporation, any subsidiary or any savings, pension or other benefit plan for the benefit of employees of... -

Page 188

...interfere with the right of the Corporation or its subsidiaries to discharge any employee at any time without regard to the effect which such discharge might have upon the employee's participation in the Plan or benefits under it. (k) Fiduciary Capacities. Any person or group of persons may serve in... -

Page 189

... group of management or highly compensated employees for purposes of ERISA (as defined below). This Plan is comprised of Part I-general provisions relating to the operation of the Plan, and Part II-special provisions that become effective only upon a Change in Control (as defined below). As set... -

Page 190

...the time (i) when any entity, person or group (other than the Company, any subsidiary or any savings, pension or other benefit plan for the benefit of employees of the Company or its subsidiaries) which theretofore beneficially owned less than 30% of the Common Stock then outstanding acquires shares... -

Page 191

... the amount of Incentive Awards payable for that year. (m) "Effective Date" means March 31, 1983. (n) "Employer" means the Company and its participating divisions, subsidiaries, strategic business units and their respective successors. (o) "ERISA" means the Employee Retirement Income Security Act... -

Page 192

... before the first day of the month following the Participant's attainment of age 65 or, if later, eligibility to receive an unreduced retirement benefit under a qualified defined benefit pension plan maintained by an Employer. In the event of a Change in Control, the Severance Period will commence... -

Page 193

... be paid in accordance with the "short-term deferral exception" under Treas. Reg. §1.409A -1(b)(4). (bb) "Specified Employee" means any Participant who, at any time during the twelve (12) month period ending on the identification date (as determined by the Vice President, Compensation and Benefits... -

Page 194

... to pay to the Employer the prevailing active employee contribution rate, (III) the end of the Severance Period, or (IV) the date on which such coverage must terminate pursuant to the terms of the controlling health insurance benefit plan applicable to the Participant on the date of such Participant... -

Page 195

... fails to pay to the Employer the prevailing active employee contribution rate, (III) the end of the Severance Period, or (IV) the date on which such coverage must terminate pursuant to the terms of the controlling life insurance benefit plan applicable to the Participant on the date of such... -

Page 196

... Honeywell International Inc. Severance Plan for Corporate Staff Employees (Involuntary Termination Following a Change in Control) or any other severance pay plan that applies to such Participant shall be determined in accordance with the terms of this Plan. 4. Benefit Payments. (a) Form and Timing... -

Page 197

... Human Resources and Communications, or such other person as the Board may appoint. The Plan Administrator shall have the authority to appoint and remove any other Named Fiduciary at his or her discretion. Any person acting on behalf of the Named Fiduciary shall serve without additional compensation... -

Page 198

.... The Plan Administrator, or other Named Fiduciary, the Employer, the Company and its officers and directors shall be entitled to rely upon the advice, opinions and determinations of any such persons. Any exercise of the authorities set forth in this Section 7, whether by the Plan Administrator, or... -

Page 199

... 60 days. Where such extension is necessary, the claimant shall be given written notice of the delay. Any decision of the Plan Administrator shall be binding on all persons affected thereby. (f) Arbitration. (i) Any dispute, controversy, or claim arising out of or relating to any Plan benefit... -

Page 200

.... Any action to enforce or vacate the arbitrator's award shall be governed by the Federal Arbitration Act, if applicable. 9. Unfunded Obligation. All benefits payable under this Plan shall constitute an unfunded obligation of the Employer. Payments shall be made, as due, from the general funds of... -

Page 201

... be governed by the terms of the Plan as so amended. Any Participant whose employment continues after termination of the Plan shall have no right to a benefit under the Plan. 13. Plan Not a Contract of Employment; Employer's Policies Control. Nothing contained in this Plan shall give an employee the... -

Page 202

... 409A of the Code, the time and form of payment of any payment that is provided by this Plan and also by the terms of the Honeywell International Inc. Severance Plan for Corporate Staff Employees (Involuntary Termination Following a Change in Control) or any other severance pay plan that applies to... -

Page 203

...19. Definitions. (a) "Honeywell Employer" means the Employer and any other person, organization or entity that agrees in writing to be bound by the terms of the Plan for a period of time that extends through the two-year period following a Change in Control. (b) "Annual Incentive Compensation" means... -

Page 204

... Change in Control. (ii) A material decrease in base compensation. (iii) A material reduction in the aggregate benefits available to the Participant where such reduction does not apply to all similarly-situated employees. (iv) Any geographic relocation of the Participant's position to a new location... -

Page 205

... persons appointed pursuant to Section 22 to administer the Plan upon the occurrence of a Change in Control. 20. Enhancement Benefit. (a) If, following a Change in Control, any payment to a Participant from a Honeywell Employer or from any benefit or compensation plan or program sponsored or funded... -

Page 206

... event the Internal Revenue Service assesses a Section 4999 Tax due which is in excess of the amount determined by the Honeywell Employer under Section 20(b), a Participant shall be paid within 60 days following the date the Participant gives notice to the New Plan Administrator of proof of payment... -

Page 207

... Honeywell Employer shall make payments to Participants as directed by the New Plan Administrator or pursuant to judicial determination pursuant to Section 22(f). (c) Corporation or Honeywell Employer Recommendations. Upon the occurrence of a Change in Control, the Corporation and any Honeywell... -

Page 208

..., the Corporation or responsible Honeywell Employer shall be notified by the New Plan Administrator and given 15 days from the date the Participant gave notice to the new Plan Administrator within which to make a recommendation as to benefit determination. The New Plan Administrator shall also... -

Page 209

...after a Change in Control; provided, however, the Plan may be amended if the purpose of the amendment is to increase benefits hereunder or if the purpose of the amendment is to comply with Section 409A of the Code. (i) No Waiver. No waiver by a Participant at any time of any breach by the Company of... -

Page 210

HONEYWELL INTERNATIONAL INC. SEVERANCE PLAN FOR SENIOR EXECUTIVES Exhibit A ACTIVE PARTICIPANTS IN SENIOR SEVERANCE PROGRAM 36 Months (base and target bonus) Peter M. Kreindler 22 -

Page 211

...December 31, 2008, but who did not receive full payment of such benefit under the Plan as of such date, as well as any individual who becomes a Participant in the Plan on or after January 1, 2009. Plan benefit payments commencing prior to January 1, 2009 are governed by the terms of the Plan as they... -

Page 212

... other compensation or allowance paid or payable by the Corporation or its affiliates (the "Base Annual Salary"). The amount deferred under this Paragraph 4(b) was not permitted to be greater than 50% of the Eligible Employee's Base Annual Salary for any pay period. Effective July 29, 2005, no new... -

Page 213

...defined below) the payments provided in the preceding paragraph shall be paid (or commence in the case of installments) in (i) the January of the Plan Year that follows the Plan Year in which the Participant's Separation from Service with the Corporation and its affiliates occurs, if the Participant... -

Page 214

... Participant has a Separation from Service with the Corporation and its affiliates, unless the Participant elected on his Election Form during the Open Enrollment Period that the Deferral Amounts for such Plan Year will instead be paid to such Participant at a Specified Time (as such term is defined... -

Page 215

... year in which the Deferral Amounts were earned; the date the Participant reaches normal retirement age and is eligible to receive a benefit under a pension plan of the Corporation or one of its affiliates; the date of the Participant's death; or the date the Participant ceases to be employed... -

Page 216

... the Plan Year in which the Participant's Separation from Service with the Corporation and its affiliates occurs, if the Participant's Separation from Service with the Corporation and its affiliates occurs after June 30 of such Plan Year. Payment on account of a Specified Time shall be paid (or... -

Page 217

... if the Participant is still employed by the Corporation or any affiliate at the end of the third full calendar year in which the Deferral Amount relates, provided, however, in the event a Participant has a Separation from Service with the Corporation or an affiliate prior to such date for reasons... -

Page 218

...only if the Participant is still employed by the Corporation or any affiliate at the end of the third full calendar year in which the Deferral Amount relates, provided, however, in the event a Participant terminates employment with the Corporation or an affiliate prior to such date for reasons other... -

Page 219

... as the Corporation shall determine in its sole discretion, provided that any new election shall generally be required to be made at least 12 months prior to any scheduled payment date. (d) Type of Distribution. All distributions from this Plan shall be paid in cash. 9. Distribution on Death... -

Page 220

... Grandfathered Account paid in one lump-sum payment as soon as practicable following a Change in Control (as defined below), but in no event later than 90 days after such Change in Control, and (ii) may designate in his Election Form during the Open Enrollment Period for a particular Plan Year that... -

Page 221

subsidiary or savings, pension or other benefit plan for the benefit of employees of the Corporation or its subsidiaries) which theretofore beneficially owned less than 30% of the Corporation's common stock (the "Common Stock") then outstanding, acquires shares of Common Stock in a transaction or a ... -

Page 222

...entitled to rely on the records of the Corporation and its subsidiaries in determining any Participant's entitlement to and the amount of benefits payable under the Plan. Any determination of the Plan Administrator, including interpretations of the Plan and determinations of questions of fact, shall... -

Page 223

... Code, if it so elects, may direct that such amount be withheld and that same or any part thereof be paid or applied to or for the benefit of such person, the person's spouse, children or other dependents, or any of them, in such manner and proportion as the Corporation may deem proper. (b) No Right... -

Page 224

...Law. The Plan is intended to constitute an unfunded deferred compensation arrangement for a select group of management or highly compensated personnel and all rights thereunder shall be governed by and construed in accordance with the laws of New York. (h) Withholding Taxes. The Corporation may make... -

Page 225

...or any person or group publicly announces an intention to take or to consider taking actions which, if consummated, would result in a Change in Control; (iii) any person or group (other than the Corporation, any subsidiary or any savings, pension or other benefit plan for the benefit of employees of... -

Page 226

... calendar quarter as reported by the Federal Reserve Bank; rate changes each calendar quarter. **/For periods on and after January 1, 2006, rate is based on the Corporation's 15-year borrowing rate and is subject to change annually. Deferred Incentive Awards (Band 5 and Below) Year Award Earned 1975... -

Page 227

...rate for the immediately preceding calendar quarter as reported by the Federal Reserve Bank; rate changes each calendar quarter. **/For periods on and after January 1, 2006, rate is based on the Corporation's 15-year borrowing rate and is subject to change annually. Deferred Salary (Band 6 and Above... -

Page 228

...Market Value per Share on the date on which the Limited Right is converted into cash over (B) the option price per Share at which the related Stock Option is exercisable, by (ii) t (A) be equal to the Fair Market Value on the applicable Acceleration Date of one Share or (B) the number of Shares with... -

Page 229

... of the code) as of the date of such employee's separation from service (as determined pursuant to Section 409A of the Code), any Awards subject to Section 409A of the Code payable to such Participant as a result of his or her separation from service, shall be paid on the first business day of the... -

Page 230

...amount of retirement income payable under the Pension Plan to or with respect to a participant at the date required by this Plan. 2.2 Actuarial Equivalent or Actuarially Equivalent - means, except as otherwise provided in the Plan, a benefit having the same actuarial value as the benefit it replaces... -

Page 231

... Award Deferral Plan for Selected Employees of Honeywell International Inc. and its Affiliates, as the same may be amended from time to time. 2.7 Earliest Retirement Date - means the earliest date as of which the participant would be eligible to commence the receipt of his Pension Plan benefit... -

Page 232

...that term is defined in the Supplemental Savings Plan, been compensation included for calculating benefits under the Pension Plan in the year the compensation would otherwise have been earned or payable as recognized by the Pension Plan, (3) had the portion of base annual salary and incentive awards... -

Page 233

... shall be used in determining the time and form of payment for a participant's Supplemental Benefit: (1) Except as otherwise provided in this paragraph (b), the Actuarial Equivalent value of a participant's Supplemental Benefit shall be paid in a single lump sum payment as of the first day of the... -

Page 234

... as of the first day of the month following 105 days after the later of the participant's Separation from Service Date or Earliest Retirement Date. If a participant fails to elect an annuity payment form by the required date, his Supplemental Benefit shall be paid in a single life annuity if he is... -

Page 235

... with its terms, then the participant shall have a right to only the Supplemental Benefit accrued to the date of termination of the relevant Pension Plan or agreement. In such event, Honeywell shall remain liable for the payment of the Supplemental Benefit and payment shall be made at such times and... -

Page 236

...amount of any similar benefit provided the participant under other supplemental pension plans sponsored by Honeywell International Inc. or its subsidiaries or affiliates (other than the Honeywell International Inc. Supplemental Executive Retirement Plan for Executives in Career Band 6 and Above) for... -

Page 237

...Plan Amendments - Honeywell reserves the right to amend the plan from time to time. The Plan may be amended by the Committee; provided however, that no amendment shall reduce any benefit being paid or then payable to a participant. Further, no amendment shall reduce the benefits provided by the Plan... -

Page 238

... Lump Sum Value of Funded Benefit 2,100,000 $1,400,000 Name ---Richard F. Wallman Barry C. Johnson Date Benefit Funded December 28, 2000 December 28, 2000 The Committee (or its delegate) may determine that the portion of the Plan providing funded Supplemental Benefits to participants designated... -

Page 239

APPENDIX B NAME PAYMENT DATE D. FLATT 11/1/09 T. WEIDENKOPF1/1/11 N. DICCIANI 11/1/09 -

Page 240

... Plan for Executives in Career Band 6 and Above is to provide certain Executives and their Beneficiaries with monthly retirement income benefits under all defined benefit deferred compensation plans maintained by the Company that are at least equal to the benefits that would have been payable... -

Page 241

... corporate restructuring. 2.6 "Company" means Honeywell International Inc. and its subsidiaries and successors. 2.7 "Credited Service" means years of service with the Company for which credit would be given under the terms of Pension Plans for benefit accrual purposes. 2.8 "Earliest Retirement Date... -

Page 242

... termination of employment or retirement date, as applicable, the Executive (a) is not employed by the Company in a Career Band 6 or above position, (b) is entitled to any severance benefits payable under the Honeywell Key Employee Severance Plan or under any other contract, agreement or arrangement... -

Page 243

...Equivalent value of a Participant's Supplemental Benefit shall be paid in a single lump sum payment as of the first day of the month following 105 days after the later of the Participant's Separation from Service Date or Earliest Retirement Date. (b) A Participant who was provided a payment election... -

Page 244

...of this Section 4.2 to the contrary, payment to a Participant under all supplemental defined benefit pension plans shall begin at the same time and in the same form of payment to the extent such payments relate to the same period of Credited Service. (g) Notwithstanding any provision of this Section... -

Page 245

... of the Plan Administrator. (b) The Plan Administrator shall provide notice in writing to any Participant when a claim for benefits under the Plan has been denied in whole or in part. Such notice shall be provided within 90 days of the receipt by the Plan Administrator of the Participant's claim or... -

Page 246

... of such 60-day period for not more than an additional 60 days. Where such extension is necessary, the claimant shall be given written notice of the delay. ARTICLE VI PLAN AMENDMENT OR TERMINATION 6.1 Right to Amend. The Company shall have the right at any time to amend the Plan. No such amendment... -

Page 247

... otherwise be payable shall have been fully paid and satisfied. 7.2 No Implied Rights to Employment. The adoption and maintenance of this Plan shall not be deemed to constitute a contract between the Company and any employee or to be a consideration for or condition of employment of any person. No... -

Page 248

... of Benefits. If the Plan Administrator determines that a person entitled to receive any benefit payment is under a legal disability or is incapacitated in any way so as to be unable to manage his financial affairs, the Plan Administrator may direct the Company to make payments to the Participant... -

Page 249

...such benefit or payment will be provided in full at the earliest time thereafter when such penalties will not be imposed. To the extent that any provision of the Plan would cause a conflict with the applicable requirements of Section 409A of the Code, or would cause the administration of the Plan to... -

Page 250

... Retirement Plan For CECP Participants for the purpose of providing the full benefits promised to employees under the Honeywell Retirement Benefit Plan without regard to the exclusion from earnings of deferred incentive awards paid under the Honeywell Corporate Executive Compensation Plan... -

Page 251

... of the tax-qualified Honeywell Retirement Earnings Plan providing pension benefits to employees under the Honeywell Retirement Benefit Plan formula and provisions as set forth in the applicable Supplement to the Honeywell Retirement Earnings Plan as the same exists and is amended from time to time... -

Page 252

... entire period of the Participant's employment by Honeywell and its subsidiaries and affiliates). 1.2.12. Specified Employee -any Participant who, at any time during the twelve (12) month period ending on the identification date (as determined by the Vice President, Compensation and Benefits or his... -

Page 253

... the general participation requirements of Section 2.1.1 and has a benefit in the Base Plan that, after excluding from earnings any deferred incentive awards paid under the Honeywell Corporate Executive Compensation Plan, the AlliedSignal Inc. Incentive Compensation Plan for Executive Employees, or... -

Page 254

... direct or indirect, formal or informal, determination that an individual is not a member of a select group of management or highly compensated employees (as that expression is used in ERISA), such individual shall not be (and shall not have ever been) a Participant in this Plan at any time except... -

Page 255

... and Incentive Award Deferral Plan for Selected Employees of Honeywell International Inc. and its Affiliates (or any successor plans) or employee deferrals under the Supplemental Savings Plan, over (b) the amount actually paid or payable from the Base Plan. 3.1.2 Minimum Benefit. A Participant who... -

Page 256

...(a) Except as otherwise provided in this Section 4.1, the Actuarial Equivalent value of a Participant's benefit shall be paid in a single lump sum payment as of the first day of the month following 105 days after the later of the participant's Separation from Service Date or Earliest Retirement Date... -

Page 257

... to receive such benefits as required by the Base Plan as long as the Participant satisfies the conditions applicable to such benefits. The Actuarial Equivalent value of such Participant's benefit at retirement shall be paid as of the first day of the month following 105 days after the latest date... -

Page 258

... had terminated employment on the day before the Change in Control and in any additional benefit the employee accrues in this Plan following the Change in Control. 4.2.2. Definition. For all purposes of this Plan, a "Change in Control" shall have occurred if: (a) any "person" as such term is used in... -

Page 259

... of Honeywell or an agreement for the sale or disposition of all or substantially all of Honeywell's assets (or any transaction having a similar effect). 4.3. Taxes. All taxes which may be due with respect to any payments or benefits under this Plan are the obligation of the Participant and... -

Page 260

... any interest under this Plan. No benefit payable under this Plan shall be subject to attachment, garnishment, execution following judgment or other legal process before actual payment to such person. 5.4. No Employment Contract. This Plan shall not give any employee the right to be retained in... -

Page 261

... as of the date the Plan is terminated using the interest rate and mortality assumptions set forth in Table I. 6.2. Change in Control. Notwithstanding Section 6.1, for a period that begins on the date of a Change in Control (as defined in Section 4) and ends on the last day of the thirty-sixth... -

Page 262

...specified amount of additional time (but not more than one hundred twenty days from the date the request for review was filed) to reach... with the claims procedure. The Committee may require that any claim for benefits and any request for a review of a denied claim be filed on forms to be furnished by... -

Page 263

... as provided herein. Honeywell may by action of the Committee, delegate or re-delegate and allocate and reallocate to one or more persons or to a committee of persons jointly or severally, and whether or not such persons are directors, officers or employees, such functions assigned to the Employer... -

Page 264

... that it is in part an unfunded excess benefit plan within the meaning of section 3(36) ERISA and is in part an unfunded plan maintained primarily for the purpose of providing deferred compensation for a select group of management or highly compensated employees as provided in sections 201(2), 301... -

Page 265

TABLE I ACTUARIAL ASSUMPTIONS FOR LUMP SUM PAYMENTS Interest: 8 1/2% per annum discount rate Mortality: 1983 Group Annuity Mortality Table for Healthy Males -

Page 266

...benefits of the following individuals are vested to the extent shown below: NAME ---LIFE ANNUITY Bonsignore, Michael R. $12,338.72 per month payable at age 66 Rosso, Jean Pierre P. $ 2,771.88 per month payable at age 66 SCHEDULE A NAME J. GEORGE S. STARRETT G. PINCUS G. MARCINKOWSKI PAYMENT DATE... -

Page 267