GNC 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Use these links to rapidly review the document

TABLE OF CONTENTS1

TABLE OF CONTENTS

o

Table of contents

-

Page 1

... number: 001-35113 GNC Holdings, Inc. (Exact name of registrant as specified in its charter) DELTWTRE (state or other jurisdiction of Incorporation or organization) 20-8536244 (I.R.S. Employer Identification No.) 300 Sixth Tvenue Pittsburgh, Pennsylvania (Address of principal executive offices... -

Page 2

... 14, 2014, the number of outstanding shares of Class A common stock, par value $0.001 per share (the "common stock"), of GNC Holdings, Inc. was 94,166,458 shares. DOCUMENTS INCORPORATED BY REFERENCE Certain information in the Company's definitive Proxy Statement for the 2014 Annual Meeting of... -

Page 3

... about Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information 42 44 46 64 65 107 107 107 Part III Item 10 Item 11 Item 12 Item 13 Item 14 Directors, Executive Officers... -

Page 4

... our international operations; failure to keep pace with the demands of our customers for new products and services; limitations of or disruptions in our manufacturing system or losses of manufacturing certifications; limitations of or disruptions in our distribution network; lack of long-term... -

Page 5

• failure to adequately protect or enforce our intellectual property rights against competitors; 3 -

Page 6

...products ("VMHS"), sports nutrition products and diet products. Our diversified, multi-channel business model derives revenue from product sales through company-owned domestic retail stores, domestic and international franchise activities, third-party contract manufacturing, e-commerce and corporate... -

Page 7

...aided by in-store technology. We believe that our expansive retail network, differentiated merchandise offering and quality customer service result in a unique shopping experience that is distinct from that of our competitors. Our principal executive office is located at 300 Sixth Avenue, Pittsburgh... -

Page 8

... and Puerto Rico, our network of domestic retail locations is approximately ten times larger than the next largest United States specialty retailer of nutritional supplements, based on the information we compiled from the public securities filings of our primary competitors. Unique product offerinos... -

Page 9

... revenues across a number of distribution channels in multiple geographies, including retail sales from company-owned retail stores (including 146 stores on United States military bases), retail sales from GNC.com, CuckyVitamin.com, and DiscountSupplements.com, royalties, wholesale sales and fees... -

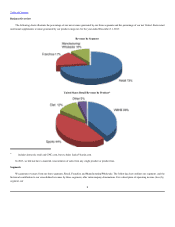

Page 10

... Segment United States Retail Revenue by Product* * includes domestic retail and GNC.com, but excludes CuckyVitamin.com In 2013, we did not have a material concentration of sales from any single product or product line. Segments We generate revenues from our three segments, Retail, Franchise and... -

Page 11

...changing customer demands, the introduction of new merchandise or promotions, and actions of competitors. Retail Our Retail segment generates revenues primarily from sales of products to customers at our company-owned stores in the United States, Canada and Puerto Rico and through our websites, GNC... -

Page 12

...United States for terms of up to five years. Once a store begins operations, franchisees are required to pay us a continuing royalty of 6% of sales and contribute 3% of sales to a national advertising fund. Our standard franchise agreements for the United States are effective for an initial ten-year... -

Page 13

...024 international locations (including distribution centers where retail sales are made) as of December 31, 2013. We typically generate less revenue from franchises outside the United States due to lower international royalty rates and the franchisees purchasing a smaller percentage of products from... -

Page 14

... third-party products. Consumers may purchase a GNC Gold Card in any United States GNC store or at GNC.com for a $15.00 annual fee. During 2013, we expanded our Gold Card Member Pricing model to be nationwide. The program evolves Gold Card from a fixed 20% discount the first week of each month to... -

Page 15

... our point of sales system, and certain revenue adjustments that are recorded to ensure conformity with generally accepted accounting principles in the United States, including deferral of our Gold Card revenue to match the twelve month discount period of the card, and a reserve for customer returns... -

Page 16

... Beyond Raw® brands, and expanded condition specific offerings with the re-launch of the Preventive Nutrition® line. In 2013, we estimate that GNC-branded products generated more than $1.2 billion of retail sales across company-owned retail, domestic franchise locations, GNC.com and Rite Aid store... -

Page 17

... The United States nutritional supplements retail industry is a large, highly fragmented and growing industry, with no single industry participant accounting for a majority of total industry retail sales. Competition is based on price, quality and assortment of products, customer service, marketing... -

Page 18

... of claims in the policy year. We face an inherent risk of exposure to product liability claims in the event that, among other things, the use of products sold by us results in injury. With respect to product liability coverage, we carry insurance coverage typical of our industry and product lines... -

Page 19

... sales in the first four months of 2009. Through December 31, 2013, we estimate that we had refunded approximately $3.5 million to our retail customers and approximately $1.6 million to our wholesale customers for Hydroxycut product returns. As is common in our industry, we rely on our third-party... -

Page 20

... intended for import, require the reporting of serious adverse events, require a recall of illegal or unsafe products from the market, and request the Department of Justice to initiate a seizure action, an injunction action or a criminal prosecution in the United States courts. The FSMA expands the... -

Page 21

... to require dietary supplement companies to identify themselves as a dietary supplement company and update this information annually, provide a list of all dietary supplement products they sell and a copy of the labels and update this information annually, and report all adverse events related to... -

Page 22

... franchisees with regard to franchise terms and charges, royalties and other fees; and place new stores near existing franchises. To date, these laws have not precluded us from seeking franchisees in any given area and have not had a material adverse effect on our operations. Bills concerning the... -

Page 23

... expressed in this Annual Report. If any of the following risks and uncertainties actually occur, our business, financial condition, results of operations or cash flows could be materially and adversely affected. Risks Relating to Our Business and Industry We may not effectively manage our growth... -

Page 24

... require us to reduce our prices, which may result in lower margins. Failure to effectively compete could adversely affect our market share, revenues and growth prospects. Unfavorable publicity or consumer perception of our products, the ingredients they contain and any similar products distributed... -

Page 25

...industry conditions; require us to use all or a large portion of our cash flow from operations to pay principal and interest on our debt, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other business activities; limit our flexibility in planning... -

Page 26

... or, more generally, obtain funding when needed, in each case on acceptable terms, we may be unable to continue our current rate of growth and store expansion, which may have an adverse effect on our revenues and results of operations. We require a significant amount of cash to service our debt... -

Page 27

... of nutritional value that we use to support the marketing of a dietary supplement is an impermissible drug claim, is not substantiated, or is an unauthorized version of a "health claim." See Item 1, "Business-Government Regulation-Product Regulation" for additional information. Any of these actions... -

Page 28

...in advertising or for the use of false or misleading advertising claims. As a result of these enforcement actions, we are currently subject to three consent decrees that limit our ability to make certain claims with respect to our products and required us in the past to pay civil penalties and other... -

Page 29

... retail sales in the first four months of 2009. We provided refunds or gift cards to consumers who returned these products to our stores. In the second quarter of 2009, we experienced a reduction in sales and margin due to this recall as a result of accepting returns of products from customers and... -

Page 30

..., could prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our business, financial condition and results of operation. In the past, due to frequently changing consumer preferences in the... -

Page 31

... and customer relationships. Our manufacturing operations produced approximately 31% and 32% of the products we sold for the years ended December 31, 2013 and 2012, respectively. Other than powders and liquids, nearly all of our proprietary products are produced in our manufacturing facility located... -

Page 32

... the years ended December 31, 2013 and 2012. Our revenues from franchise stores depend on the franchisees' ability to operate their stores profitably and adhere to our franchise standards. In the twelve months ended December 31, 2013, 83 domestic franchise stores were opened and 20 were closed. The... -

Page 33

... their operations. Our revenues substantially depend upon our franchisees' sales volumes, profitability and financial viability. However, our franchisees are independent operators and we cannot control many factors that impact the profitability of their stores. Pursuant to the franchise agreements... -

Page 34

...financial and operational performance of Rite Aid. As of December 31, 2013, Rite Aid operated 2,215 GNC franchise store-within-a-store locations and has committed to open additional franchise store-within-a-store locations. Revenue from sales to Rite Aid (including license fee revenue for new store... -

Page 35

... unsuccessful in expanding into new or high-growth international markets, it could adversely affect our operating results and financial condition. /ur network and communications systems are dependent on third-party providers and are vulnerable to system interruption and damage, which could limit our... -

Page 36

... of certain customer data, such as credit card information. In order for our sales channel to function, we and other parties involved in processing customer transactions must be able to transmit confidential information, including credit card information, securely over public networks. In the... -

Page 37

... centers, a significant number of stores, a manufacturing facility or our corporate headquarters, or impact one or more of our key suppliers, our operations and financial performance could be materially adversely affected through an inability to make deliveries to our stores and through lost sales... -

Page 38

... distribution centers where retail sales are made). In our Retail segment, all but one of our company-owned stores are located on leased premises that typically range in size from 1,000 to 2,000 square feet. In our Franchise segment, primarily all of our franchise stores in the United States... -

Page 39

...13 2,024 * includes distribution centers where retail sales are made and retail stores in China In our Manufacturing/Wholesale segment, there are 2,215 GNC franchise "store-within-a-store" locations under our strategic alliance with Rite Aid. Also, in our Manufacturing/Wholesale segment, we lease... -

Page 40

... its products. During 2013, an additional 7,800 square feet were added to provide capacity for inventory. We own our 253,000 square foot corporate headquarters located in Pittsburgh, Pennsylvania. We lease four small regional sales offices in Fort Cauderdale, Florida, Tustin, California, Mississauga... -

Page 41

...31, 2013, there were 73 pending lawsuits related to Hydroxycut in which we had been named: 67 individual, largely personal injury claims and six putative class action cases, generally inclusive of claims of consumer fraud, misrepresentation, strict liability and breach of warranty. The United States... -

Page 42

... USPCabs, GNC Corporation, et al. United States District Court for the Northern District of California (Case No. CV-140037), filed January 24, 2014 Putative Class Action Claims: • Michael Campos, Jennifer Southwick, and others v. USPCabs, CCC and GNC Corp., United States District Court for the... -

Page 43

• Sandeep Barot v. USPCabs, CCC. and General Nutrition Center Holdings, Inc., United States District Court for the District of New Jersey (Case No. 14-cv-00562), filed February 3, 2014 The proceedings associated with these cases, which generally seek indeterminate money damages, are in the early... -

Page 44

... financial statements. On February 29, 2012, former Senior Store Manager, Elizabeth Naranjo, individually and on behalf of all others similarly situated sued General Nutrition Corporation in the Superior Court of the State of California for the County of Alameda (Case No. RG 12619626). The complaint... -

Page 45

... the board of directors. The amount of such payment was $5.6 million, paid in 2011. No special dividend payment was made in 2013 or 2012, and no further special dividend payments are required to be made. On March 19, 2012, OTPP converted all of its shares of Class B common stock into an equal number... -

Page 46

..., our financial condition, future earnings and cash flows, legal requirements, taxes and any other factors that the board of directors deems relevant. Issuer Purchases of Equity Securities Maximum Number (or Tpproximate Dollar Value) of Shares (or Units) that May Yet Be Purchased under the Plans or... -

Page 47

... the applicable time period. The stock price performance included in the line graph below is not necessarily indicative of future stock price performance. Item 6. SELECTED FINTNCITL DTTT. The selected consolidated financial data presented below as of December 31, 2013 and 2012 and for the years... -

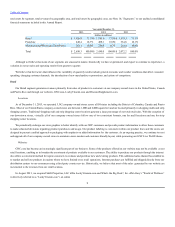

Page 48

... Financial Condition and Results of Operations" and our audited consolidated financial statements and their related notes. Year Ended December 31, (dollars in millions, except per share data) 2013 2012 2011 2010 2009 Statement of Operations Data: Revenue: Retail Franchising Manufacturing/Wholesale... -

Page 49

truck leases and $2.4 million related to severance and other costs) and Term Coan Facility transaction of $0.2 million; in 2012, expenses related to the Offerings and Term Coan Transactions of $1.9 million; in 2011, $13.5 million related to transaction costs related to the 45 -

Page 50

... (2) Working capital represents current assets less current liabilities. The following table summarizes our stores for the periods indicated: Year Ended December 31, 2013 2012 2011 2010 2009 Company-owned stores Beginning of period balance New store openings Franchise conversions(a) Store closings... -

Page 51

46 -

Page 52

... our wholesale distribution channels and increased third-party sales. We generated 8.2% of total revenue growth and a 7.6% increase in total operating income growth. • • We expanded our new Gold Card Member Pricing model to be nationwide, which evolved Gold Card from a fixed 20% discount the... -

Page 53

-

Page 54

... number of our international franchise stores over the next five years. We believe this will result in additional franchise fees associated with new store openings and increased revenues from product sales to, and royalties from, new franchisees. Because our international franchisees pay royalties... -

Page 55

..., and our ability to outsource production can support higher sales volume. With the continued growth in each of our operating segments, the Company has announced that it will be adding a fourth domestic distribution center. This distribution center will be located near Indianapolis, Indiana and will... -

Page 56

...a different mall or shopping center or the date of a conversion. Results of Operations (Dollars in millions and percentages expressed as a percentage of total net revenue) Year Ended December 31, 2013 2012 2011 Revenues: Retail Franchise Manufacturing / Wholesale: Intersegment revenues Third Party... -

Page 57

... related costs Subtotal unallocated corporate and other costs, net (12.4) -0.5% (1.9) -0.1% (13.5) -0.7% (160.4) 460.5 53.0 -6.1% 17.5% (150.5) 427.9 47.6 -6.2% 17.6% (154.5) 282.5 74.9 -7.6% 13.6% Total operating income Interest expense, net Income before income taxes Income tax... -

Page 58

..., 2012. International franchise revenue increased by $17.3 million, to $185.5 million for the year ended December 31, 2013 compared to $168.2 million in 2012, primarily as a result of increases in product sales of $10.2 million and royalties. Our international franchisees reported a 10.2% same store... -

Page 59

... of Member Pricing. Franchise. Operating income increased $19.5 million, or 14.3%, to $156.0 million for the year ended December 31, 2013 compared to $136.5 million in 2012. The increase was primarily due to increased wholesale product sales and royalty income. Manufacturino/Wholesale. Operating... -

Page 60

... retail revenue increased $211.2 million due to an 11.5% increase in our same store sales, the opening of new stores, which accounted for approximately $51.1 million of the increase, sales increases in the sports nutrition, vitamin and diet product categories, and an increase in sales from GNC... -

Page 61

... by an increase in retail gross product margin, occupancy leverage, and a positive mix shift within wholesale and proprietary product sales. Sellino, General and Administrative ("SG&A") Expenses SG&A expenses, including compensation and related benefits, advertising and promotion expense, other SG... -

Page 62

... due to increased wholesale product sales and royalty income. Manufacturino/Wholesale. Operating income increased $13.3 million, or 16.2%, to $95.5 million for the year ended December 31, 2012 compared to $82.2 million in 2011. The increase was driven by a higher gross product margin resulting from... -

Page 63

...effect to $1.1 million utilized to secure letters of credit. We expect that our primary uses of cash in the near future will be for capital expenditures, working capital requirements and funding any quarterly dividends to stockholders and share repurchases that are approved by the board of directors... -

Page 64

...and our new distribution center in Indianapolis, Indiana. We anticipate funding our 2014 capital requirements with cash flows from operations and, if necessary, borrowings under the Revolving Credit Facility. Cash Used in Financing Activities For the year ended December 31, 2013, we used cash of $91... -

Page 65

... the Revolving Credit Facility maturity date to March 2017, and extend the maturity of the Term Coan Facility to March 2019. The 2013 amendments also included changes to ABR, CIBOR, and applicable margin rates for the Revolving Credit Facility. At the Company's option, the Company can borrow at... -

Page 66

... years ended December 31, 2013, 2012 and 2011, these amounts collectively represented approximately 37% of the aggregate costs associated with our company-owned retail store operating leases. These balances consist of $8.2 million of advertising agreements. (3) (4) (5) Excludes cash settlements... -

Page 67

... 31, 2013, 2012 and 2011. We recognize revenues on product sales to franchisees and other third parties when the risk of loss, title and insurable risks have transferred to the franchisee or third-party. We recognize revenues from franchise fees at the time a franchise store opens or at the time of... -

Page 68

... with the initial purchase of a franchise location. The notes are demand notes, payable monthly over periods of five to seven years. We generate a significant portion of our revenue from ongoing product sales to franchisees and third-party customers. An allowance for doubtful accounts is established... -

Page 69

.... We carry general liability insurance with retention of $250,000 per claim with an aggregate cap on retained losses of $1.0 million. The majority of our workers' compensation and auto insurance policies are in deductible/retrospective plans. We reimburse the applicable insurance company for the... -

Page 70

... income or tax due if the tax position is disallowed. This accounting standard update requires entities to assess whether to net the unrecognized tax benefit with a deferred tax asset as of the reporting date. This guidance is effective for fiscal years beginning after December 15, 2013, with early... -

Page 71

... that exists under the Senior Credit Facility. Foreign Currency Exchange Rate Market Risk We are subject to the risk of foreign currency exchange rate changes in the conversion from local currencies to the U.S. dollar of the reported financial position and operating results of our non-U.S. based... -

Page 72

... of Contents Item 8. Financial Statements and Supplementary Data. TTBLE OF CONTENTS Page Reports of Independent Registered Public Accounting Firm 66 Consolidated Balance Sheets As of December 31, 2013 and 2012 Consolidated Statements of Income For the years ended December 31, 2013, 2012 and 2011... -

Page 73

...the financial position of GNC Holdings, Inc. and its subsidiaries at December 31, 2013 and 2012, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2013 in conformity with accounting principles generally accepted in the United States... -

Page 74

...Item 1. Financial Statements GNC HOLDINGS, INC. TND SUBSIDITRIES Consolidated Balance Sheets (in thousands, including share data) December 31, 2013 Current assets: Cash and cash equivalents Receivables, net Inventories (Note 3) Prepaids and other current assets Total current assets Cong-term assets... -

Page 75

67 -

Page 76

... HOLDINGS, INC. TND SUBSIDITRIES Consolidated Statements of Income (in thousands, except per share data) Year ended December 31, 2013 2012 2011 Revenue Cost of sales, including cost of warehousing, distribution and occupancy Gross profit Compensation and related benefits Advertising and promotion... -

Page 77

...Statements of Comprehensive Income (in thousands) Year ended December 31, 2013 2012 2011 Net income Other comprehensive (loss) income: Unrealized gains on derivatives and qualified as cash flow hedges, net of tax of $2,718 for the year... an integral part of the consolidated financial statements. 69 -

Page 78

... GNC HOLDINGS, INC. TND SUBSIDITRIES Consolidated Statements of Stockholders' Equity (in thousands, includes per share data) Common Stock Tccumulated Total Other Treasury Paid-in- Retained Comprehensive Stockholders' Shares Dollars Shares Dollars Stock Equity Capital Earnings Income/(Loss) Class... -

Page 79

Non-cash stockbased compensation Balance at December 31, 2013 - - - - - 7,835 - - 7,835 93,989 $ 112 -$ - $(734,482)$847,886 $700,108 $ 1,955 $ 815,579 The accompanying notes are an integral part of the consolidated financial statements. 70 -

Page 80

... Tax benefit from exercise of stock options Repurchase of treasury stock Repurchase of Series A preferred stock Net proceeds from sale of Class A common stock Proceeds from issuance of long-term debt Deferred financing fees Other financing activities Net cash used in financing activities Effect... -

Page 81

The accompanying notes are an integral part of the consolidated financial statements. 71 -

Page 82

...: Retail, Franchising, and Manufacturing/Wholesale. Corporate retail store operations are located in the United States, Canada, and Puerto Rico, and in addition the Company offers products domestically through GNC.com, CuckyVitamin.com and www.drugstore.com, and beginning in 2013, the United Kingdom... -

Page 83

...November 2013, our board of directors authorized a $500.0 million multi-year share repurchase program of our common stock. On October 2, 2013, the Company acquired DiscountSupplements.com, an online retailer of multi-brand sports nutrition products in the United Kingdom. The aggregate purchase price... -

Page 84

... consist of raw materials, work-in-process, finished product and packaging supplies. Inventories are stated at the lower of cost or market on a first in/first out basis ("FIFO"). The Company regularly reviews its inventory levels in order to identify slow moving and short dated products, expected... -

Page 85

... rollout of the Gold Card Member Pricing model, which evolved the Gold Card from a 20% discount the first week of the month to an everyday variable discount based on our Member Pricing model, for an annual fee. The Company also sells gift cards to its customers. Revenue from gift cards is recognized... -

Page 86

... in 2013, 2012 and 2011 from the national advertising fund derived from the Company's franchisees, respectively. Leases. The Company has various operating leases for company-owned and franchise store locations, distribution centers, and equipment. Ceases generally include amounts relating to... -

Page 87

... retained losses of $10.0 million. The Company carries general liability insurance with retention of $250,000 per claim with an aggregate cap on retained losses of $1.0 million. The majority of the Company's workers' compensation and auto insurance policies are in deductible/retrospective plans. 77 -

Page 88

... stock units (collectively herein referred to as "stock awards") are based on the closing price for a share of the Company's stock on the New York Stock Exchange (the "NYSE") on the grant date. The resulting compensation cost is recognized in the Company's financial statements over the applicable... -

Page 89

... transaction related costs. Financial Instruments and Derivatives. As part of the Company's financial risk management program, it has historically used certain derivative financial instruments to reduce its exposure to market risk for changes in interest rates, primarily in respect of its long term... -

Page 90

... income or tax due if the tax position is disallowed. This accounting standard update requires entities to assess whether to net the unrecognized tax benefit with a deferred tax asset as of the reporting date. This guidance is effective for fiscal years beginning after December 15, 2013, with early... -

Page 91

... for financial reporting purposes and the federal statutory tax rate: Year ended December 31, 2013 2012 2011 Percent of pretax earnings: Statutory federal tax rate Increase (reduction) resulting from: State income tax, net of federal tax benefit Other permanent differences International operations... -

Page 92

...2013 Tssets Liabilities Net Tssets (in thousands) 2012 Liabilities Net Deferred tax: Current assets (liabilities): Operating reserves $ 3,345 $ Deferred revenue 2,871 Prepaid expenses - Accrued worker compensation... 2013 and 2012, the Company had deferred tax assets relating to state net operating ... -

Page 93

... of international subsidiaries, at December 31, 2013 and 2012, as these subsidiaries are either considered to be branches for United States tax purposes, to have incurred cumulative NOCs, or to have only minimal undistributed earnings. In addition, at December 31, 2013 and 2012, the Company had... -

Page 94

...operate. The Company's 2010 and 2011 federal income tax returns have been examined by the Internal Revenue Service. The Company has various state and local jurisdiction tax years open to examination (earliest open period 2005), and the Company also has certain state and local jurisdictions currently... -

Page 95

... Company's consolidated financial statements, and therefore pro forma disclosures have not been presented. The following table summarizes the Company's goodwill activity: Manufacturing/ Wholesale Retail Franchising Total (in thousands) Balance at December 31, 2011-Net Acquired franchise stores... -

Page 96

...2013 WeightedTverage Life Tccumulated Carrying Tmortization Tmount December 31, 2012 Tccumulated Carrying Tmortization Tmount Cost Cost (in thousands) Brands-retail Brands -franchise Retail agreements Franchise agreements Manufacturing agreements Other intangibles Franchise...) Years ending... -

Page 97

...46,243 41,465 33,522 41,350 Total $ 106,459 $ 116,337 Deferred revenue consists primarily of Gold Card membership fees and gift card deferrals. Other current liabilities consist of the liabilities related to accrued taxes, benefits, workers compensation, accrued interest and other occupancy. 86 -

Page 98

... includes the original discount of $4.0 million. The Company's net interest expense is as follows: For the year ended December 31, 2013 2012 (in thousands) 2011 Senior Credit Facility: Term Coan Revolver Early extinguishment of debt Deferred financing fees amortization Mortgage and other interest... -

Page 99

87 -

Page 100

... commitments of $200 million for incremental term loans. In October 2012, Centers entered into an amendment to the Senior Credit Facility that included changes to ABR, CIBOR, and Applicable Margin rates. Specifically, as amended, the facility allowed the Company to borrow at a rate per annum... -

Page 101

... fee on the undrawn portion of the Revolving Credit Facility was 0.5% at both December 31, 2013 and 2012. The Senior Credit Facility contains customary covenants, including incurrence covenants and certain other limitations on the ability of GNC Corporation, Centers, and Centers' subsidiaries... -

Page 102

...active markets, the assets are classified within Cevel 2 on the fair value hierarchy. At December 31, 2013 and 2012, the Company's financial instruments consisted of cash and cash equivalents, receivables, franchise notes receivable, accounts payable, and long-term debt. The carrying amount of cash... -

Page 103

... and 2011, respectively. Minimum future obligations for non-cancelable operating leases with initial or remaining terms of at least one year in effect at December 31, 2013 are as follows: Company Retail Stores Franchise Retail Stores Other (in thousands) Sublease Income Total 2014 2015 2016 2017... -

Page 104

-

Page 105

... product liability claims. Although the effects of these claims to date have not been material to the Company, it is possible that current and future product liability claims could have a material adverse effect on its business or financial condition, results of operations or cash flows. The Company... -

Page 106

...," which were recalled from our stores in November 2013. As of February 14, 2014, we were named in 16 lawsuits involving products containing DMAA, including 13 personal injury cases and three putative class action cases. The proceedings associated with these cases, which generally seek indeterminate... -

Page 107

... financial statements. On February 29, 2012, former Senior Store Manager, Elizabeth Naranjo, individually and on behalf of all others similarly situated sued General Nutrition Corporation in the Superior Court of the State of California for the County of Alameda (Case No. RG 12619626). The complaint... -

Page 108

...Company believes it has complied with, and is currently complying with, its environmental obligations pursuant to environmental and health and safety laws and regulations and that any liabilities for noncompliance will not have a material adverse effect on its business, financial performance or cash... -

Page 109

... based awards and are available to certain eligible employees, directors, consultants or advisors as determined by the Compensation Committee. Stock options under the plans were granted with exercise prices at or above fair market value on the date of grant, typically vest over a four- or five-year... -

Page 110

...the 2007 Stock Plan. The resulting compensation cost is recognized in the Company's financial statements over the option vesting period. The Company recognized $7.8 million, $4.8 million and $3.9 million of non-cash stock-based compensation expense for the year ended December 31, 2013, 2012 and 2011... -

Page 111

.... The assumptions used in the Company's Black Scholes valuation related to stock option grants made during each period below were as follows: Year ended December 31, 2013 2012 2011 Dividend yield Expected option life Volatility factor percentage of market price Discount rate 1.0%-1.4% 4.8 years 35... -

Page 112

... of service and part time employees who have completed 1,000 hours of service are eligible to participate in the plan. The plan provides for employee contributions of 1% to 80% of individual compensation into deferred savings, subject to IRS limitations. The plan provides for Company contributions... -

Page 113

... of the Company's reportable segments, identifiable by the distinct operations and management of each: Retail, Franchising, and Manufacturing/Wholesale. The Retail reportable segment includes the Company's corporate store operations in the United States, Canada, Puerto Rico and its websites GNC.com... -

Page 114

... represents key financial information of the Company's segments: December 31, 2013 2012 (in thousands) 2011 Revenue: Retail Franchise Manufacturing/Wholesale: Intersegment revenues Third Party Sub total Manufacturing/Wholesale Sub total segment revenues Elimination of intersegment revenues $ 1,926... -

Page 115

... $ Total assets Retail Franchise Manufacturing / Wholesale Corporate / Other Total assets $ 1,483,075 $ 1,412,325 $ 1,339,325 522,996 506,021 491,008 423,939 417,945 410,171 310,337 215,749 189,083 $ 2,740,347 $ 2,552,040 $ 2,429,587 Geographic areas Total revenues: United States Foreign Total... -

Page 116

... product sales to franchisees, royalties, franchise fees and interest income on the financing of the franchise locations. The Company enters into franchise agreements with initial terms of ten years. The Company charges franchisees three types of flat franchise fees associated with stores: initial... -

Page 117

... GNC HOLDINGS, INC. TND SUBSIDITRIES NOTES TO THE CONSOLIDTTED FINTNCITL STTTEMENTS (Continued) NOTE 17. FRTNCHISE REVENUE (Continued) The following is a summary of the Company's franchise revenue by type: Year ended December 31, 2013 2012 (in thousands) 2011 Product sales Royalties Franchise fees... -

Page 118

..., General Nutrition Centres Company, the Company's wholly owned subsidiary, was party, as lessee, to 16 lease agreements with Cadillac Fairview Corporation ("Cadillac Fairview"), as lessor, and 1 lease agreement with Ontrea, Inc. ("Ontrea"), as lessor, with respect to properties located in Canada... -

Page 119

... table summarizes the Company's 2013 and 2012 quarterly results: Three months ended (unaudited) March 31, 2013 June 30, 2013 September 30, 2013 December 31, 2013 Year ended December 31, 2013 ($ in thousands, except per share $) Total revenue Gross profit Operating income Net income Weighted... -

Page 120

...the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Our management, with the participation of our CEO and CFO... -

Page 121

... of Directors," "Executive Officers," "Other Board Information," and "Section 16(a) Beneficial Ownership Reporting Compliance." Item 11. EXECUTIVE COMPENSTTION Information with respect to this Item will be included in our definitive Proxy Statement to be filed with respect to our 2014 Annual... -

Page 122

...Certain Relationships and Related Transactions," and "Other Board Information-Director Independence." Item 14. PRINCIPTL TCCOUNTING FEES TND SERVICES. Information with respect to this Item will be included in our definitive Proxy Statement to be filed with respect to our 2014 Annual Meeting to be... -

Page 123

...Report: (1) Financial statements filed in Part II, Item 8 of this Tnnual Report: • • Report of Independent Registered Public Tccounting Firm Consolidated Balance Sheets As of December 31, 2013 and December 31, 2012 • Consolidated Statements of Income For the years ended December 31, 2013... -

Page 124

Table of Contents (2) Financial statement schedules: SCHEDULE I-CONDENSED FINTNCITL INFORMTTION OF GNC HOLDINGS, INC. GNC HOLDINGS, INC. (Parent Company Only) Balance Sheets (in thousands) December 31, 2013 2012 Current assets: Cash and cash equivalents Prepaids and other current assets $ 282 ... -

Page 125

... FINTNCITL INFORMTTION OF GNC HOLDINGS, INC. GNC HOLDINGS, INC. (Parent Company Only) Statements of Income and Comprehensive Income (in thousands, except per share data) Year ended December 31, 2013 2012 2011 Other selling, general and administrative Subsidiary income Operating income $ 749... -

Page 126

... OF GNC HOLDINGS, INC. GNC HOLDINGS, INC. (Parent Company Only) Statements of Cash Flow (in thousands) Year ended December 31, 2013 2012 2011 NET CTSH PROVIDED BY OPERTTING TCTIVITIES: Net income Equity in income of subsidiaries Dividends received Other operating activities Net cash provided... -

Page 127

... to satisfy obligations under the Management Services Agreement (as defined in Note 18, "Related Party Transactions") and Holdings' Class B common stock, par value $0.001 per share. Subsequent to the IPO, certain of Holdings' stockholders completed four registered offerings of our common stock. In... -

Page 128

... our standard policy; reductions to franchise receivable reserves for franchise take-backs and customer product returns; and the collection of previously reserved receivables. Tax Valuation Tllowances Year ended December 31, 2013 2012 (in thousands) 2011 Balance at beginning of period Additions... -

Page 129

... Cife Insurance Company, as Mortgagee. (Incorporated by reference to Exhibit 10.5 to Centers' Registration Statement on Form S-4 (File No. 333-114502), filed April 15, 2004.) 10.2 Cease Agreement, dated as of November 1, 1998, between Greenville County, South Carolina and General Nutrition Products... -

Page 130

...to Centers' Pre-Effective Amendment No. 1 to its Registration Statement on Form S-4 (File No. 333-114502), filed August 9, 2004.)†10.18 Amended and Restated GNC/Rite Aid Retail Agreement, dated July 31, 2007, between Nutra Sales Corporation (f/k/a General Nutrition Sales Corporation) and Rite Aid... -

Page 131

-

Page 132

.... (Incorporated by reference to Exhibit 10.1 to Holdings' Current Report on Form 8-K (File No. 001-35113), filed December 10, 2013.) 10.21 Guarantee and Collateral Agreement, dated as of November 26, 2013, by GNC Corporation, Centers and the other Grantors party thereto in favor of JPMorgan Chase... -

Page 133

** †Management contract or compensatory plan or arrangement of the Company required to be filed as an exhibit. Portions of this exhibit have been omitted pursuant to a request for confidential treatment. The omitted portions have been separately filed with the SEC. 118 -

Page 134

... Executive Officer (principal executive officer) Dated: February 20, 2014 By: /s/ MICHAEC M. NUZZO Michael M. Nuzzo Chief Financial Officer (principal financial officer) Dated: February 20, 2014 By: /s/ ANDREW S. DREXCER Andrew S. Drexler Corporate Controller (principal accountino officer) Dated... -

Page 135

.../s/ MICHAEC F. HINES Michael F. Hines Director Dated: February 20, 2014 By: /s/ AMY B. CANE Amy B. Cane Director Dated: February 20, 2014 By: /s/ PHICIP E. MACCOTT Philip E. Mallott Director Dated: February 20, 2014 By: /s/ ROBERT F. MORAN Robert F. Moran Director Dated: February 20, 2014 By... -

Page 136

-

Page 137

... Nutrition Investment Company GNC Puerto Ricot Inc. General Nutrition Centres Company GNC Columbia SAS LuckyVitamin Corporation GNC Transportationt LLC Gustine Sixth Avenue Associatest Ltd. GNC Headquarterst Inc. Compania Nutricional Mexicana GNC GNC China Holdco LLC GNC Honk Kong Limited GNC Canada... -

Page 138

QuickLinks Exhibit 21.1 Subsidiaries of the Registrant -

Page 139

.... 333-173578) of GNC Holdings, Inc. of our report dated nebruary 20, 2014 relating to the financial statements, financial statement schedules and the effectiveness of internal control over financial reporting, which appears in this norm 10-K. /s/ PricewaterhouseCoopers LLP Pittsburgh, PA nebruary 20... -

Page 140

QuickLinks Exhibit 23.1 CONSENT On INDEPENDENT REGISTERED PUBLIC ACCOUNTING nIRM -

Page 141

... (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 20, 2014 /s/ JOSEPH M. FORTUNATO Joseph M. Fortunato Chief Executive Officer (Principal Executive Officer) -

Page 142

QuickLinks Exhibit 31.1 Certification of Chief Executive Officer of Periodic Report Pursuant to Rule 13a-14(a) and Rule 15d-14(a) -

Page 143

... and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 20, 2014 /s/ MICHAEL M. NUZZO Michael M. Nuzzo Chief Financial Officer... -

Page 144

QuickLinks Exhibit 31.2 Certification of Chief Financial Officer of Periodic Report Pursuant to Rule 13a-14(a) and Rule 15d-14(a) -

Page 145

... the Annual Report on Form 10-K of GNC Holdings, Inc. (the "Company"), for the year ended December 31, 2013 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), Joseph M. Fortunato, as Chief Executive Officer of the Company and Michael M. Nuzzo, as Chief Financial... -

Page 146

QuickLinks Exhibit 32.1 Certification of Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 -

Page 147