FTD.com 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 FTD.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

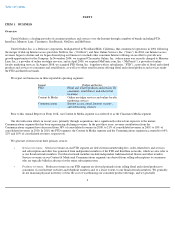

UNITED ONLINE INC

FORM 10-K

(Annual Report)

Filed 02/28/11 for the Period Ending 12/31/10

Address 21301 BURBANK BOULEVARD

WOODLAND HILLS, CA 91367

Telephone 8182873000

CIK 0001142701

Symbol UNTD

SIC Code 7370 - Computer Programming, Data Processing, And

Industry Computer Services

Sector Technology

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2011, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

... ONLINE INC FORM 10-K (Annual Report) Filed 02/28/11 for the Period Ending 12/31/10 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 21301 BURBANK BOULEVARD WOODLAND HILLS, CA 91367 8182873000 0001142701 UNTD 7370 - Computer Programming, Data Processing, And Computer Services... -

Page 2

...charter) Delaware (State or other jurisdiction of incorporation or organization) 21301 Burbank Boulevard Woodland Hills, California (Address of principal executive office) 77-0575839 (I.R.S. Employer Identification No.) 91367 (Zip Code) (818) 287-3000 (Registrant's telephone number, including area... -

Page 3

...affiliates of the Registrant, based on the last reported sales price of the Registrant's common stock on such date reported by The Nasdaq Global Select Market, was $483,097,369 (calculated by excluding shares directly or indirectly held by directors and officers). At February 18, 2011, there were 88... -

Page 4

... amortization; tax payments; foreign currency exchange rates; hedging arrangements; our ability to repay indebtedness, pay dividends and invest in initiatives; our products and services; pricing and revenue streams; competition; strategies; and new business initiatives, products, services, features... -

Page 5

... accompany the related forward-looking statements in this Annual Report on Form 10-K and our other filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's analysis only as the date hereof... -

Page 6

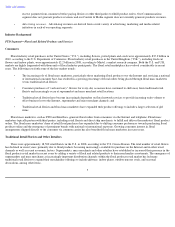

... three reportable operating segments: Segment Products and Services BUSINESS FTD Content & Media Communications Floral and related products and services for consumers, retail florists and other retail locations Online nostalgia services and online loyalty marketing services Internet access, email... -

Page 7

... and media-related initiatives in each of our operating segments. Industry Background FTD Segment-Floral and Related Products and Services Consumers Floral industry retail purchases in the United States ("U.S."), including flowers, potted plants and seeds were approximately $35.2 billion in 2010... -

Page 8

... of a retail florist's business, including the ability to send, receive and deliver floral orders. Additional products and services offered by providers of floral network services include: point-of-sale and related technology systems and services, credit card processing services, e-commerce website... -

Page 9

...direct marketing channels. Online loyalty marketing programs can also easily measure click-through rates on display advertising and response rates to email campaigns, providing rapid feedback for advertisers that can be used to identify potential customers and create new targeted offers. In addition... -

Page 10

... and retail florists, as well as to other retail locations offering floral and related products and services, in the U.S., Canada, the U.K., and the Republic of Ireland. The business uses the highly recognized FTD and Interflora brands, both supported by the Mercury Man logo. FTD is a floral mass... -

Page 11

... point-of-sale and related technology services and systems that enable its floral network members to transmit and receive orders and manage several back office functions of a floral retailer's business, including accounting, customer relationship management, direct marketing campaigns, and delivery... -

Page 12

... of charge, accessing certain types or amounts of content and using certain features requires them to register for membership and purchase an All-Access Pass that is available for terms ranging from one day to two years. Revenues from our Memory Lane website are derived primarily from the sale of... -

Page 13

... locations, based on zip codes, of the members in the All-Access Pass holder's high school or other community affiliation. International. In addition to our Memory Lane website that includes the Classmates service, we operate five international websites that offer nostalgia services, primarily... -

Page 14

... shipping and service fees, less discounts and refunds, for FTD consumer orders, as well as revenues generated from sales of containers, software and hardware systems, cut flowers, packaging and promotional products, and a wide variety of other floral-related supplies to floral network members... -

Page 15

...also use targeting technologies and website integrations in order to provide effective solutions for advertisers. Communications Our Communications services generate advertising revenues from search placements, display advertisements and online market research associated with our Internet access and... -

Page 16

... will place an order directly with one of our floral network members since floral retailers frequently highlight their association with our floral network in their marketing efforts. FTD also employs a dedicated sales force to market our products and services to our floral network members and... -

Page 17

... and Related Products and Services We compete in the market for flowers and, to a lesser degree, gifts. In the consumer market, consumers are our customers for direct sales of floral products and gifts through our websites and telephone numbers. In the floral network services market, retail florists... -

Page 18

... from other online loyalty marketing programs as well as offline loyalty marketing programs that have a significant online presence, such as those operated by credit card, airline and hotel companies. In addition, we also face competition for members from online providers of discounted offerings and... -

Page 19

... these seasonal trends will continue in the future. Billing Orders placed through FTD's consumer websites or telephone numbers typically are paid for using a credit, debit or payment card; therefore, consumers generally pay for floral and gift orders before FTD pays the floral network members and... -

Page 20

... communication to our floral network members and third-party suppliers. We also have developed software to enhance the functionality of certain components of our services, including connectivity, web services, billing, email, customer support, customer loyalty applications, and targeted advertising... -

Page 21

... Germany. Our operations in the U.K. provide floral and related products and services to consumers and floral network members in the U.K. and the Republic of Ireland. Our operations in India primarily handle email customer support, product development and quality assurance. Our operations in Germany... -

Page 22

... of our businesses in a number of ways including reduced demand, more aggressive pricing for similar products and services by our competitors, decreased spending by advertisers, increased credit risks, increased credit card failures, a loss of customers, and increased use of discounted pricing plans... -

Page 23

... access pay accounts. In addition, prior to 2010, our Content & Media and FTD segments collectively derived significant advertising revenues from domestic post-transaction sales agreements. Post-transaction sales involve the online presentation of a third-party offer immediately following the point... -

Page 24

... business, financial condition, results of operations, and cash flows. In addition, our Content & Media and Communications businesses outsource a majority of their live technical and billing support functions. These businesses rely on one customer support vendor, and we maintain only a small number... -

Page 25

... could adversely affect our brands and could harm our business. A security breach or inappropriate access to, or use of, our networks, computer systems or services or those of third-party vendors could expose us to liability, claims and a loss of revenue. The success of our business depends on the... -

Page 26

... of emails. Without the ability to email these members, we have very limited means of inducing members to return to our websites and utilize our services. In addition, each month, a significant number of email addresses for members of our online nostalgia and online loyalty marketing services become... -

Page 27

... other uses; exposure to risks specific to the acquired business, service or technology to which we are not currently exposed; risks of entering markets in which we have little or no direct prior experience; unforeseen obligations or liabilities; difficulty assimilating the acquired customer bases... -

Page 28

... the related discount accretion and debt issuance cost amortization, which would impact interest expense, and certain prepayments may be subject to penalties. • Under the terms of the FTD Credit Agreement, we will be permitted to incur additional indebtedness subject to certain conditions... -

Page 29

... additional income taxes, sales and use taxes, value-added taxes or other taxes on our business activities and Internet-based transactions, including our past sales, which could decrease our ability to compete, reduce our sales, or have a material adverse effect on our business, financial condition... -

Page 30

... cash dividend from $0.20 per share of common stock to $0.10 per share of common stock. A decline in our cash flows, changes in our business needs, including working capital and funding for business initiatives or acquisitions, or a change in tax laws relating to dividends, among other factors... -

Page 31

... and gifts through our websites and telephone numbers. In the floral network services market, retail florists and supermarkets are our principal customers for memberships and subscriptions to our various floral network services, including access to the FTD and Interflora brands and the Mercury Man... -

Page 32

... and a high level of customer service. Our business depends, in part, on the ability of our independent floral network members and third-party suppliers who fulfill our orders to do so at high-quality levels. We work with our floral network members and third-party suppliers to develop best practices... -

Page 33

...declines in the number of local retail florists as a result of economic factors and competition. If we lose a significant number of floral network members, or if we are not able to maintain or increase revenues from our floral network members, our business, financial condition, results of operations... -

Page 34

..., financial condition, results of operations, and cash flows. In accordance with current industry practice by domestic floral and gift order gatherers and our interpretation of applicable law, our FTD consumer business collects and remits sales and use taxes on orders that are delivered in states... -

Page 35

... with the quality of the customer service they receive, they may not place orders with us again, which could have a material adverse effect on our business, financial condition, results of operations, and cash flows. ADDITIONAL RISKS RELATING TO OUR CONTENT & MEDIA SEGMENT The transition of our... -

Page 36

... generate subscription revenue is highly dependent on our ability to attract visitors to our websites, register them as free members, encourage them to return to our websites, and convince them to become pay accounts in order to access the pay features of our websites. The number of pay accounts has... -

Page 37

... the number of visitors to our websites and members for our online nostalgia and online loyalty marketing services or the activity level of these visitors and members could cause our business and financial results to suffer. The success of our online nostalgia and online loyalty marketing services... -

Page 38

...impact our business, financial condition, results of operations, and cash flows. Revenues and profitability of our Communications segment are expected to decrease. Most of our Communications revenues and profits come from our dial-up Internet access services. Our dial-up Internet access pay accounts... -

Page 39

... that, as the dial-up Internet access market declines and new technologies emerge, we will be able to continue to effectively distribute and deliver our services. ITEM 1B. None. ITEM 2. PROPERTIES UNRESOLVED STAFF COMMENTS Our corporate headquarters are located in Woodland Hills, California and... -

Page 40

...issued an Order formally denying final approval of the settlement. Discovery has not recommenced and no trial date has been set. In 2009, Classmates Online, Inc., now known as Memory Lane, Inc., received a civil investigative demand from the Attorney General for the State of Washington. In 2010, FTD... -

Page 41

... "NZRO" since September 23, 1999. The following table sets forth, for the quarters indicated, the high and low sales prices per share of our common stock as reported on the NASDAQ. 2009 High Low High 2010 Low First Quarter Second Quarter Third Quarter Fourth Quarter $ $ $ $ 6.39 7.74 9.46 9.28... -

Page 42

... of common stock. We then pay the applicable required employee withholding taxes. Common stock repurchases during the quarter ended December 31, 2010 were as follows (in thousands, except per share amounts): Total Number of Shares Purchased as Part of a Publicly Announced Program Maximum Approximate... -

Page 43

... Internet Index ("MS Internet Index"). Measurement points are the last trading day of each of the Company's fiscal years ended December 31, 2005, 2006, 2007, 2008, 2009, and 2010. The graph assumes that $100 was invested on December 31, 2005 in the common stock of the Company, the Nasdaq Composite... -

Page 44

... assets and long-lived assets related to our Communications segment. In August 2008, we acquired FTD. The results of FTD are included in our consolidated statements of operations from the date of acquisition. For additional information regarding our acquisitions, see Note 12-"Acquisitions" of the... -

Page 45

... Definitions We report our businesses in three reportable segments: Segment Products and Services FTD Floral and related products and services for consumers, retail florists and other retail locations Online nostalgia services and online loyalty marketing services Internet access, email, Internet... -

Page 46

... based on the average foreign currency exchange rates; product mix; changes in merchandise pricing, shipping and service fees; levels of certain refunds issued; and discounts, among other factors. Content & Media and Communications Segment Metrics Pay Accounts. We generate a significant portion of... -

Page 47

... online loyalty marketing members who have earned or redeemed points during such period. Communications segment active accounts include all Communications segment pay accounts as of the date presented combined with the number of free Internet access and email accounts that logged on to our services... -

Page 48

...2010 December 31, 2009 Consolidated: Revenues (in thousands) FTD: Segment revenues (in thousands) % of consolidated revenues Consumer orders (in thousands) Average order value Average currency exchange rate: GBP to USD Content & Media: Segment revenues (in thousands) % of consolidated revenues Pay... -

Page 49

..., installation and customer acceptance have all occurred. Services revenues based on enabling the delivery of orders by floral network members are generally recognized in the period in which the orders are delivered. Monthly, recurring fees and other floral network service-based fees are recognized... -

Page 50

Table of Contents Advertising revenues for our online loyalty marketing service consist primarily of fees generated when emails are transmitted to members, when members respond to emails and when members complete online transactions. Each of these activities is a discrete, independent activity, ... -

Page 51

...- FTD, Interflora, Classmates Online, MyPoints, and Communications-for purposes of evaluating goodwill. These reporting units each constitute a business or group of businesses for which discrete financial information is available and is regularly reviewed by segment management. The goodwill related... -

Page 52

...fourth quarter of 2010, an increase or decrease of 100 basis points in the discount rate or the terminal growth rate for each of our reporting units would not have resulted in any goodwill impairment. We believe the assumptions and rates used in our impairment assessment are reasonable, but they are... -

Page 53

... required redemption thresholds or when points expire prior to redemption. MyPoints members may redeem points for third-party gift cards and other rewards. Members earn points when they respond to direct marketing offers delivered by MyPoints, purchase goods or services from advertisers, engage in... -

Page 54

...matter. Financial Statement Presentation Revenues Services Revenues FTD FTD services revenues consist of fees charged to its floral network members for access to the FTD and Interflora brands and the Mercury Man logo, access to the floral networks, credit card processing services, e-commerce website... -

Page 55

...related shipping and service fees, less discounts and refunds, for FTD consumer orders as well as revenues generated from sales of containers, software and hardware systems, cut flowers, packaging and promotional products, and a wide variety of other floral-related supplies to floral network members... -

Page 56

... support for floral network members; fees associated with the storage and processing of customer credit cards and associated bank fees; and domain name registration fees. Content & Media Content & Media cost of revenues includes costs of points earned by members of our online loyalty marketing... -

Page 57

... of: acquired pay accounts and free accounts; certain acquired trademarks and trade names; purchased software and technology; acquired customer and advertising contracts and related relationships; acquired rights, content and intellectual property; and other acquired identifiable intangible... -

Page 58

...31, 2008 Content & Media Year Ended December 31, 2010 2009 2008 Communications Year Ended December 31, 2010 2009 2008 Year Ended December 31, 2010 Revenues: Services $ Products Advertising Total revenues Operating expenses: Cost of revenues Sales and marketing Technology and development General and... -

Page 59

56 -

Page 60

... was as follows for each period presented (in thousands): Year Ended December 31, 2009 2008 2010 Segment revenues: FTD Content & Media Communications Intersegment eliminations Consolidated revenues $ 554,576 $ 545,845 $ 201,644 236,022 167,153 211,233 (2,820) (2,968) $ 920,553 $ 990,132 $ 181... -

Page 61

... related to our FTD, Content & Media and Communications segments constituted 82.1%, 8.5% and 9.4%, respectively, of our total segment cost of revenues for the year ended December 31, 2010, compared to 79.5%, 8.6% and 12.0%, respectively, for the year ended December 31, 2009. Sales and Marketing... -

Page 62

... FTD, Content & Media and Communications segments constituted 53.1%, 35.2% and 11.6%, respectively, of total segment sales and marketing expenses for the year ended December 31, 2010, compared to 43.9%, 36.6% and 19.5%, respectively, for the year ended December 31, 2009. Technology and Development... -

Page 63

...operations as a percentage of FTD revenues for the years ended December 31, 2010 and 2009. Year Ended December 31, 2010 2009 Revenues Operating expenses: Cost of revenues Sales and marketing Technology and development General and administrative Restructuring charges Total operating expenses Segment... -

Page 64

... the volume and level of discounts on products sold to consumers, increased shipping costs, a shift in the mix of products and services sold, and a decrease in post-transaction sales, which have minimal cost of revenues. FTD Sales and Marketing Expenses. FTD sales and marketing expenses increased by... -

Page 65

... the cost of points earned by members of our online loyalty marketing service and a $0.7 million increase in overhead-related costs, partially offset by a $1.3 million decrease in credit card processing fees and a $0.4 million decrease in personnel-related costs. The increase in cost of revenues as... -

Page 66

...in costs to acquire online loyalty marketing members and other sales and marketing costs. Content & Media Technology and Development Expenses. Content & Media technology and development expenses decreased by $2.7 million, or 11%, to $22.8 million for the year ended December 31, 2010, compared to $25... -

Page 67

... the number of dial-up Internet access pay accounts and a decrease in hourly usage per pay account and a $3.1 million decrease in customer support and billing-related costs due to a decrease in the number of dial-up Internet access pay accounts. In addition, Communications cost of revenues decreased... -

Page 68

... to continued declines in revenues due to continuing declines in the number of dial-up Internet access pay accounts. Communications Restructuring Charges. Communications restructuring charges decreased by $41,000, or 3%, to $1.3 million for the year ended December 31, 2010, compared to $1.4 million... -

Page 69

... for the year ended December 31, 2009 whereas such expenses were included only from August 26, 2008 (date of acquisition) in the prior-year period. The increase was also due to an increase in technology and development expenses related to our Content & Media segment and an increase of $1.5 million... -

Page 70

... December 31, 2009, compared to $4.5 million for the year ended December 31, 2008. The decrease in interest income was primarily due to the liquidation of our short-term investments portfolio to partially fund the FTD acquisition in August 2008, as well as to a decline in interest rates as a result... -

Page 71

... of the indebtedness incurred in connection with the FTD acquisition, which closed on August 26, 2008. Interest expense was primarily related to interest on our credit facilities, including accretion of discounts and amortization of debt issue costs. Other Income (Expense), net. Other income, net... -

Page 72

... at the SEC's website at www.sec.gov . Year Ended December 31, 2008 (Combined) 2009 (in thousands, except average order value and average currency exchange rates) % Change Revenues Operating expenses: Cost of revenues Sales and marketing Technology and development General and administrative... -

Page 73

..., 2009, compared to 60.2% for the prior-year period. Cost of revenues as a percentage of revenues was positively impacted by a shift in the mix of products and services sold as well as by cost reductions, primarily related to shipping costs. FTD Sales and Marketing Expenses. FTD sales and marketing... -

Page 74

... 2009, this increase was largely due to an increase in our offerings of discounted pricing plans, with a significant number of the new pay accounts generated during the period under this promotional pricing, resulting in a decrease in the churn rate. The increase in Content & Media services revenues... -

Page 75

... online nostalgia services without a corresponding increase in related sales and marketing costs. Content & Media Technology and Development Expenses. Content & Media technology and development expenses increased by $3.6 million, or 16%, to $25.5 million, for the year ended December 31, 2009... -

Page 76

...-up Internet access services primarily due to a decrease in the number of pay accounts, a decrease in hourly usage per pay account and lower average hourly telecommunications costs. In addition, Communications cost of revenues decreased as a result of a $2.8 million decrease in customer supportand... -

Page 77

... in lieu of fractional shares of United Online, Inc. common stock. The FTD acquisition was funded, in part, with the net proceeds from (i) a $60 million senior secured credit agreement with Silicon Valley Bank (the "UOL Credit Agreement") and (ii) $375 million of term loan borrowings under senior... -

Page 78

... expenditures, investments, dividends, asset sales, and the incurrence of additional debt and liens. On the date of the FTD acquisition, term loan A and term loan B under the FTD Credit Agreement were fully funded. In connection with the closing of the FTD acquisition, all of the approximately $122... -

Page 79

...we automatically withhold, from the restricted stock units that vest and the stock awards that are issued, the portion of those shares with a fair market value equal to the amount of the required employee withholding taxes due. We then pay the applicable withholding taxes in cash. The withholding of... -

Page 80

...; the development and/or acquisition of other services, businesses or technologies; the repurchase of our common stock underlying restricted stock units and stock awards to pay the required employee withholding taxes due on vested restricted stock units and stock awards issued; the repurchase... -

Page 81

... in 2009, compared to the prior-year period, resulting from an increase in the number of pay accounts with discounted promotional pricing plans in our Content & Media segment as well as a reduction in the number of pay accounts with longer-term plans in our Communications segment. Net cash used for... -

Page 82

... at declining levels through the terms of the related leases. In addition, standby letters of credit are maintained by FTD to secure credit card processing activity. Other Commitments In the ordinary course of business, we may provide indemnifications of varying scope and terms to customers, vendors... -

Page 83

... and will evaluate the impact on our consolidated financial statements upon the issuance of additional updates. Inflation Inflation did not have a material impact on our consolidated revenues and results of operations during the years ended December 31, 2010, 2009 and 2008, and we do not currently... -

Page 84

...than the U.S. Dollar, which increases or decreases the related U.S. Dollar-reported revenues and expenses depending on the trend in currencies. Therefore, changes in foreign currency exchange rates may negatively affect our consolidated revenues and net income. A 1% adverse change in overall foreign... -

Page 85

... the Exchange Act is accumulated and communicated to the Company's management, including the Company's Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure. Management's Report on Internal Control Over Financial Reporting The... -

Page 86

...stated in their report which appears herein. Changes in Internal Control Over Financial Reporting There have not been any changes in the Company's internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the most recent fiscal... -

Page 87

... Ownership Reporting Compliance". ITEM 11. EXECUTIVE COMPENSATION The information required by Item 11 is included under the following captions in our definitive proxy statement relating to our 2011 annual meeting of stockholders to be filed with the SEC within 120 days after the end of our fiscal... -

Page 88

... the information required to be set forth therein is not applicable, not required or is shown in the consolidated financial statements or notes related thereto. 3. Exhibits: The agreements included as exhibits to this Annual Report on Form 10-K contain representations and warranties by each of... -

Page 89

... by Reference to Form File No. Date Filed 2.1 Stock Purchase Agreement, dated as of April 9, 2006, by and between United Online, Inc. and UAL Corporation 2.2 Agreement and Plan of Merger, dated April 30, 2008, among United Online, Inc., UNOLA Corp. and FTD Group, Inc. 2.3 Amendment No. 1 to... -

Page 90

... 10.14 Form of Stock Option Agreement for 2010 Incentive Compensation Plan (officers version I) 10.15 Form of Stock Option Agreement for 2010 Incentive Compensation Plan (officers version II) 10.16 Amended and Restated United Online, Inc. Severance Benefit Plan 10.17 Employment Agreement between the... -

Page 91

the Registrant and Frederic A. Randall, Jr. 87 -

Page 92

... 10.31 United Online, Inc. 2010 Management Bonus Plan 10.32 Office Lease between LNR Warner Center, LLC and NetZero, Inc. 10.33 Credit Agreement, dated as of August 4, 2008, among UNOLA Corp., the financial institutions party thereto from time to time and Wells Fargo Bank, National Association... -

Page 93

manager and administrative agent 88 -

Page 94

... 10-K Incorporated by Reference to Form File No. Date Filed 10.34 Credit Agreement, dated as of August 11, 2008, among United Online, Inc., the lenders party thereto from time to time and Silicon Valley Bank, as administrative agent 21.1 List of Subsidiaries 23.1 Consent of Independent Registered... -

Page 95

-

Page 96

... 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on February 28, 2011. UNITED ONLINE, INC. By: /s/ MARK R. GOLDSTON Mark R. Goldston Chairman, President and Chief Executive Officer POWER OF ATTORNEY KNOW ALL PERSONS BY THESE... -

Page 97

Table of Contents Signature Title Date /s/ DENNIS HOLT Director Dennis Holt /s/ HOWARD G. PHANSTIEL Director Howard G. Phanstiel /s/ CAROL A. SCOTT Director Carol A. Scott 91 February 28, 2011 February 28, 2011 February 28, 2011 -

Page 98

... filings, which are available without charge through the SEC's website at www.sec.gov. No. Exhibit Description Filed with this Form 10-K Incorporated by Reference to Form File No. Date Filed 2.1 Stock Purchase Agreement, dated as of April 9, 2006, by and between United Online, Inc. and UAL... -

Page 99

....4 2010 Incentive Compensation Plan 10.5 Form of Restricted Stock Unit Issuance Agreement for 2001 Stock Incentive Plan and 2001 Supplemental Stock Incentive Plan 10.6 Form of Restricted Stock Unit Issuance Agreement for 2001 Stock Incentive Plan, 2001 Supplemental Stock Incentive Plan and FTD Group... -

Page 100

... by Reference to Form File No. Date Filed 10.11 Form of Restricted Stock Unit Issuance Agreement for 2010 Incentive Compensation Plan (nonemployee directors-annual grant) 10.12 Form of Restricted Stock Unit Issuance Agreement for 2010 Incentive Compensation Plan (officers) 10.13 Form of Restricted... -

Page 101

Agreement Amendment Agreement between United Online, Inc. and Mark R. Goldston 94 -

Page 102

... 10.31 United Online, Inc. 2010 Management Bonus Plan 10.32 Office Lease between LNR Warner Center, LLC and NetZero, Inc. 10.33 Credit Agreement, dated as of August 4, 2008, among UNOLA Corp., the financial institutions party thereto from time to time and Wells Fargo Bank, National Association... -

Page 103

95 -

Page 104

Table of Contents No. Exhibit Description Filed with this Form 10-K Incorporated by Reference to Form File No. Date Filed 32.2 Certification of the Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 101.INS XBRL Instance Document 101.SCH XBRL Taxonomy Extension ... -

Page 105

Table of Contents UNITED ONLINE, INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Operations Consolidated Statements of Comprehensive Income (Loss) Consolidated Statements of ... -

Page 106

...2010 and 2009, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2010 in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the financial statement schedules listed... -

Page 107

... revenue Long-term debt, net of discounts Deferred tax liabilities, net Other liabilities Total liabilities Commitments and contingencies (see Note 14) Stockholders' equity: Preferred stock, $0.0001 par value; 5,000 shares authorized; no shares issued or outstanding at December 31, 2010 and 2009... -

Page 108

... ONLINE, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share amounts) Year Ended December 31, 2009 2008 2010 Revenues: Services Products Total revenues Operating expenses: Cost of revenues-services Cost of revenues-products Sales and marketing Technology and development... -

Page 109

... of Contents UNITED ONLINE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in thousands) Year Ended December 31, 2009 2008 2010 Net income (loss) Change in unrealized loss on short-term investments, net of tax of $0, $0 and $(102) for the years ended December 31, 2010, 2009 and 2008... -

Page 110

... of common stock in connection with acquisition Dividends and dividend equivalents paid on shares outstanding and restricted stock units Change in dividend equivalents payable on restricted stock units Stock-based compensation Change in unrealized loss on short-term investments, net of tax Foreign... -

Page 111

... equivalents paid on shares outstanding and restricted stock units Change in dividend equivalents payable on restricted stock units Stock-based compensation Foreign currency translation Tax shortfalls from equity awards Net income Balance at December 31, 2009 Exercises of stock options Issuance of... -

Page 112

... Dividends and dividend equivalents paid on outstanding shares and restricted stock units Excess tax benefits from equity awards Net cash provided by (used for) financing activities Effect of foreign currency exchange rate changes on cash and cash equivalents Change in cash and cash equivalents Cash... -

Page 113

restricted stock units Reduction in goodwill in connection with a release of a portion of the valuation allowance for deferred tax assets Issuance of common stock in connection with the acquisition of FTD (see Note 12) $ $ $ (138) $ - $ - $ 207 $ - $ 385 128 - $ 126,151 The accompanying notes ... -

Page 114

...The Company reports its business in three reportable segments: FTD, Content & Media and Communications. The Company's FTD segment provides floral and related products and services to consumers and retail florists, as well as to other retail locations offering floral and related products and services... -

Page 115

...accounts receivable are derived primarily from revenue earned from advertising customers and floral network members located in the U.S. and the U.K., and pay accounts. The Company extends credit based upon an evaluation of the customer's financial condition and, generally, collateral is not required... -

Page 116

... balance is reduced and related credit allowance adjusted accordingly. Fair value approximates the carrying amount of financing receivables because such receivables are discounted at a rate comparable to market. Property and Equipment -Property and equipment are stated at historical cost less... -

Page 117

...825, Disclosures about Fair Value of Financial Instruments . Fair value of long-term debt is estimated based on the discounted cash flow method. Business Combinations -All of the Company's acquisitions occurred prior to the effective date of ASC 805, Business Combinations and, accordingly, have been... -

Page 118

... in accordance with ASC 360, Property, Plant and Equipment , which addresses financial accounting and reporting for the impairment and disposition of identifiable intangible assets and other long-lived assets. Intangible assets acquired in a business combination are initially recorded at management... -

Page 119

... required redemption thresholds or when points expire prior to redemption. MyPoints members may redeem points for third-party gift cards and other rewards. Members earn points when they respond to direct marketing offers delivered by MyPoints, purchase goods or services from advertisers, engage in... -

Page 120

... sales that include software, revenue is recognized when delivery, installation and customer acceptance have all occurred. Services revenues based on enabling the delivery of orders by floral network members are recognized in the period in which the orders are delivered. Monthly fees, recurring fees... -

Page 121

... support; costs related to customer billing and billing support for the Company's pay accounts and floral network members; fees associated with the storage and processing of customer credit cards and associated bank fees; and domain name registration fees. Sales and Marketing -Sales and marketing... -

Page 122

... expenses for the Company's technology group in various office locations. Costs incurred by the Company to manage and monitor the Company's technology and development activities are expensed as incurred. Costs relating to the acquisition and development of internal-use software are capitalized when... -

Page 123

... fair value of share-based payment awards on the grant date using an option-pricing model. The Company values its restricted stock units based on the grant-date closing price of the Company's common stock. The Company uses the Black-Scholes option-pricing model for valuing stock options. The value... -

Page 124

... adjustments directly attributable to the business combination included in the reported pro forma revenue and earnings. The amendments in this update are effective prospectively for business combinations for which the acquisition date is on or after the beginning of the first annual reporting period... -

Page 125

... on its consolidated financial statements upon the issuance of additional updates. 2. SEGMENT INFORMATION Segment revenues and segment income (loss) from operations were as follows (in thousands): Year Ended December 31, 2010 Content & Media Communications FTD Total Services Products Advertising... -

Page 126

... UNITED ONLINE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2. SEGMENT INFORMATION (Continued) A reconciliation of segment revenues to consolidated revenues was as follows for each period presented (in thousands): Year Ended December 31, 2009 2008 2010 Segment revenues: FTD... -

Page 127

..., which consist of property and equipment and other assets, was as follows (in thousands): December 31, 2009 2010 2008 United States Europe Total long-lived assets $ 68,222 $ 71,280 $ 76,436 8,997 9,204 6,952 $ 77,219 $ 80,484 $ 83,388 Segment assets are not reported to, or used by, the Company... -

Page 128

..., respectively. Accrued Liabilities Accrued liabilities consisted of the following (in thousands): December 31, 2010 2009 Employee compensation and related expenses Income taxes payable Non-income taxes payable Customer deposits Reserve for pending lawsuit Other Total $ 23,411 $ 22,475 5,987 8,565... -

Page 129

...of Contents UNITED ONLINE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 4. GOODWILL, INTANGIBLE ASSETS AND OTHER LONG-LIVED ASSETS Goodwill The changes in goodwill by reportable segment for the years ended December 31, 2009 and 2010 were as follows (in thousands): FTD Content & Media... -

Page 130

... Valley Bank (the "UOL Credit Agreement") and borrowed $60 million thereunder. The net proceeds of the term loan under the UOL Credit Agreement were used to finance, in part, the acquisition of FTD. In April 2010, United Online, Inc. paid $14.7 million to retire this credit facility. FTD Credit... -

Page 131

... Contents UNITED ONLINE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 5. CREDIT AGREEMENTS (Continued) interest rate depending on FTD's leverage ratio. The interest rate set forth in the FTD Credit Agreement for loans made under the term loan B facility is either the prime rate plus... -

Page 132

... about assets at December 31, 2010 that are required to be measured at fair value on a recurring basis (in thousands): Level 1 Fair Value Description Money market funds $ 67,150 The Company estimated the fair value of its long-term debt using a discounted cash flow technique that incorporates... -

Page 133

... 31, 2010 and 2009, the Company had no preferred shares issued or outstanding. Common Stock Repurchases United Online, Inc.'s Board of Directors authorized a common stock repurchase program (the "Program") that allowed the Company to repurchase shares of its common stock through open market or... -

Page 134

... 31, 2010, see "Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities," which appears elsewhere in this Annual Report on Form 10-K. Dividends Dividends are paid on shares of common stock outstanding as of the record date. In addition... -

Page 135

... a variety of vesting schedules and are canceled upon termination of employment. Restricted stock units granted to non-employee members of United Online, Inc.'s Board of Directors generally vest annually over a one-year period. Stock options granted to employees generally vest over a three- or four... -

Page 136

... thousands): Year Ended December 31, 2010 2009 2008 Operating expenses: Cost of revenues-services Cost of revenues-products Sales and marketing Technology and development General and administrative Total stock-based compensation Tax benefit recognized Restricted Stock Units $ 502 $ 943 $ 1,049 41... -

Page 137

... stock units will vest as to twenty-five percent of the total number of shares awarded annually over a four-year period beginning February 15, 2011. Stock Option Exchange Program for Three Executive Officers In March 2009, the Compensation Committee implemented a stock option exchange program... -

Page 138

...United Online, Inc. (the "Compensation Committee") approved grants of 2.4 million stock options with a grant-date fair value equal to $4.7 million to certain members of the Company's senior management. Each stock option entitles the recipient to receive one share of United Online Inc.'s common stock... -

Page 139

... the expected annual dividend by the closing market price of United Online, Inc. common stock at the date of grant. For the years ended December 31, 2010, 2009 and 2008, the Company recognized $1.4 million, $2.8 million and $1.1 million, respectively, of stock-based compensation related to the... -

Page 140

... tax rate (in thousands): Year Ended December 31, 2009 2008 2010 Federal taxes at statutory rate of 35% State taxes, net Nondeductible executive compensation Goodwill impairment Effects of foreign income Foreign distribution Foreign tax credit Changes in uncertain tax positions Benefits of tax... -

Page 141

... UNITED ONLINE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 9. INCOME TAXES (Continued) The significant components of net deferred tax balances were as follows (in thousands): December 31, 2010 2009 Deferred tax assets: Net operating loss and foreign tax credit carryforwards Stock... -

Page 142

...the Company's effective income tax rate. The changes in gross unrecognized tax benefits for the years ended December 31, 2010, 2009 and 2008 were as follows, excluding interest and penalties (in thousands): Balance at January 1, 2008 Additions due to FTD acquisition Additions related to current year... -

Page 143

...33) (1.33) The diluted net income (loss) per common share computations exclude stock options and restricted stock units which are antidilutive. Weighted-average antidilutive shares for the years ended December 31, 2010, 2009 and 2008 were 2.5 million, 5.2 million and 7.1 million, respectively. 11... -

Page 144

... of United Online, Inc. common stock. The FTD acquisition was financed in part with the net proceeds of term loan borrowings under a $425 million credit facility, which included up to $50 million in a revolving credit facility that was undrawn at the closing of the transaction, with Wells Fargo Bank... -

Page 145

...Online, Inc.'s closing stock price for the period from two days prior through two days after the announcement of the receipt of the commitment from Silicon Valley Bank for the $60 million credit facility, and in connection with that commitment, United Online, Inc.'s election to substitute additional... -

Page 146

....9 million impairment charge for the trademarks and trade names of FTD and Interflora, respectively. Additionally, the Company recorded a goodwill impairment charge of $114.0 million related to the FTD reporting unit. Impairment charges of goodwill, intangible assets and long-lived assets consisted... -

Page 147

Table of Contents UNITED ONLINE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 14. COMMITMENTS AND CONTINGENCIES (Continued) consolidated balance sheets at December 31, 2010 and 2009, respectively. Commitments under letters of credit at December 31, 2010 were scheduled to expire as ... -

Page 148

... number of NetZero shares issued in connection with the offering; and (ii) the underwriters had entered into agreements with customers whereby the underwriters agreed to allocate NetZero shares to those customers in the offering in exchange for which the customers agreed to purchase additional... -

Page 149

... and adversely affect the Company's business, financial condition, results of operations, or cash flows. At December 31, 2010, the Company had a reserve of $2.2 million for a pending lawsuit. 15. QUARTERLY FINANCIAL DATA (UNAUDITED) (in thousands, except per share data) Quarter Ended September 30... -

Page 150

Table of Contents UNITED ONLINE, INC. SCHEDULE I-CONDENSED FINANCIAL INFORMATION OF REGISTRANT PARENT COMPANY BALANCE SHEETS (in thousands) December 31, 2010 2009 Assets Current assets: Cash and cash equivalents Other current assets Total current assets Investments in subsidiaries Other assets ... -

Page 151

Table of Contents UNITED ONLINE, INC. PARENT COMPANY STATEMENTS OF OPERATIONS (in thousands) Year Ended December 31, 2009 2008 2010 Revenues Operating expenses: General and administrative Total operating expenses Operating loss Interest income Intercompany interest income Interest expense Other ... -

Page 152

...31, 2009 2008 2010 Net cash provided by operating activities Cash flows from investing activities: Purchases of short-term investments Proceeds from maturities of short-term investments Proceeds from sales of short-term investments Cash paid for acquisitions, net of cash acquired Net cash used for... -

Page 153

... them ("date of acquisition"). The Parent Company's share of net income (loss) of its subsidiaries is included in net income (loss) using the equity method. The Parent Company financial statements should be read in conjunction with the consolidated financial statements of United Online, Inc... -

Page 154

...UNITED ONLINE, INC. SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS (in thousands) Charged (Credited) to Other Accounts Balance at Beginning of Period Additions Charged to Expense Charges Utilized (Write-offs) Balance at End of Period Allowance for doubtful accounts: Year ended December 31, 2010... -

Page 155

-

Page 156

... the vesting of that unit. The number of shares of Common Stock subject to the awarded Restricted Stock Units, the applicable vesting schedule for those shares, the dates on which those vested shares shall become issuable to Participant and the remaining terms and conditions governing the award (the... -

Page 157

...or its designee. 3. Cessation of Service . Except as otherwise provided in Paragraphs 4 and 6 below, should the Participant cease to serve as a Board member for any reason prior to vesting in the Shares subject to this Award, then the awarded Restricted Stock Units will be immediately cancelled with... -

Page 158

..., but in no event later than three (3) business days following such effective date. 7. Adjustment in Shares . Should any change be made to the Common Stock by reason of any stock split, stock dividend, recapitalization, combination of shares, exchange of shares, spin-off transaction or other change... -

Page 159

...Exchange on which the Common Stock is listed for trading at the time of such issuance. 10. Notices . Any notice required to be given or delivered to the Corporation under the terms of this Agreement shall be in writing and addressed to the Corporation at its principal corporate offices, and directed... -

Page 160

... of Code Section 409A and the Treasury Regulations thereunder that apply to such exception. IN WITNESS WHEREOF , the parties have executed this Agreement on the day and year first indicated above. UNITED ONLINE, INC. By: Title: Mark R. Goldston Chairman, President and Chief Executive Officer... -

Page 161

...by or is under common control with, the Corporation) acquires directly or indirectly (whether as a result of a single acquisition or by reason of one or more acquisitions within the twelve (12)-month period ending with the most recent acquisition) beneficial ownership (within the meaning of Rule 13d... -

Page 162

... Board members described in clause (A) who were still in office at the time the Board approved such appointment or nomination. F. G. Code shall mean the Internal Revenue Code of 1986, as amended. Common Stock shall mean shares of the Corporation's common stock. Corporation shall mean United Online... -

Page 163

... Stock (the "Shares") The Shares shall vest upon the Participant's continued service as a Board member through February 15, (the "Vesting Date"). Should the scheduled Vesting Date otherwise occur on a date on which the Common Stock is not traded on the Stock Exchange serving as the primary market... -

Page 164

... business days following such effective date. Any Shares in which the Participant vests or is deemed to vest pursuant to the provisions of Paragraph 4 of this Agreement shall be issued on the earlier of (i) the date of the Participant's cessation of service as a Board member or (ii) the Vesting Date... -

Page 165

..., but in no event later than three (3) business days following such effective date. 7. Adjustment in Shares . Should any change be made to the Common Stock by reason of any stock split, stock dividend, recapitalization, combination of shares, exchange of shares, spin-off transaction or other change... -

Page 166

...Exchange on which the Common Stock is listed for trading at the time of such issuance. 10. Notices . Any notice required to be given or delivered to the Corporation under the terms of this Agreement shall be in writing and addressed to the Corporation at its principal corporate offices, and directed... -

Page 167

... of Code Section 409A and the Treasury Regulations thereunder that apply to such exception. IN WITNESS WHEREOF , the parties have executed this Agreement on the day and year first indicated above. UNITED ONLINE, INC. By: Title: Mark R. Goldston Chairman, President and Chief Executive Officer... -

Page 168

...by or is under common control with, the Corporation) acquires directly or indirectly (whether as a result of a single acquisition or by reason of one or more acquisitions within the twelve (12)-month period ending with the most recent acquisition) beneficial ownership (within the meaning of Rule 13d... -

Page 169

... members described in clause (A) who were still in office at the time the Board approved such appointment or nomination. F. G. Code shall mean the Internal Revenue Code of 1986, as amended. Common Stock shall mean shares of the Corporation's common stock. H. Corporation shall mean United Online... -

Page 170

... of this Agreement. The number of shares of Common Stock subject to the awarded Restricted Stock Units, the applicable vesting schedule for those shares, the dates on which those vested shares shall become issuable to Participant and the remaining terms and conditions governing the award (the... -

Page 171

..., are to be issued. The terms and provisions of the Employment Agreement (including any conditions, restrictions or limitations governing the accelerated vesting or the issuance of the Shares, including (without limitation) the execution and delivery of an effective general release), as they apply... -

Page 172

...of the Withholding Taxes applicable to that distribution. In no event shall any such phantom dividend equivalents vest or become distributable unless the Shares to which they relate vest in accordance with the terms of this Agreement. 5. Change of Control . (a) Any Restricted Stock Units subject to... -

Page 173

... of any replacement cash retention program, including (without limitation) the execution and delivery of an effective general release) shall apply to any Restricted Stock Units which are assumed or otherwise continued in effect in connection with a Change in Control or replaced with a cash retention... -

Page 174

...'s delivery of his or her separate check payable to the Corporation in the amount of such Withholding Taxes, or • the use of the proceeds from a next-day sale of the Shares issued to the Participant, provided and only if (i) such a sale is permissible under the Corporation's trading policies... -

Page 175

... Exchange on which the Common Stock is listed for trading at the time of such issuance. 9. Notices. Any notice required to be given or delivered to the Corporation under the terms of this Agreement shall be in writing and addressed to the Corporation at its principal corporate offices and directed... -

Page 176

... otherwise required in order to avoid a prohibited distribution under Code Section 409A(a)(2). The deferred Shares or other distributable amount shall be issued or distributed in a lump sum on the first day of the seventh (7th) month following the date of Participant's Separation from Service or, if... -

Page 177

...by or is under common control with, the Corporation) acquires directly or indirectly (whether as a result of a single acquisition or by reason of one or more acquisitions within the twelve (12)-month period ending with the most recent acquisition) beneficial ownership (within the meaning of Rule 13d... -

Page 178

... members described in clause (A) who were still in office at the time the Board approved such appointment or nomination. F. G. Code shall mean the Internal Revenue Code of 1986, as amended. Common Stock shall mean shares of the Corporation's common stock. H. Corporation shall mean United Online... -

Page 179

... absence. S. York Stock Exchange. Stock Exchange shall mean the American Stock Exchange, the Nasdaq Global or Global Select Market or the New Plan shall mean the Corporation's 2010 Incentive Compensation Plan, as amended and restated from time to time. Plan Administrator shall mean either the Board... -

Page 180

... of this Agreement. The number of shares of Common Stock subject to the awarded Restricted Stock Units, the applicable vesting schedule for those shares, the dates on which those vested shares shall become issuable to Participant and the remaining terms and conditions governing the award (the... -

Page 181

... in accordance with the terms of this Agreement shall be issued, subject to the Corporation's collection of all applicable Withholding Taxes, on the applicable vesting date for that Share or as soon thereafter as administratively practicable, but in no event later than the close of the calendar year... -

Page 182

...of the Withholding Taxes applicable to that distribution. In no event shall any such phantom dividend equivalents vest or become distributable unless the Shares to which they relate vest in accordance with the terms of this Agreement. 5. Change of Control . (a) Any Restricted Stock Units subject to... -

Page 183

... the number of Shares unvested immediately prior to the date of the Participant's Involuntary Termination. The Shares that vest upon such Involuntary Termination of Service shall be issued to the Participant, subject to the Corporation's collection of all applicable Withholding Taxes, on the date of... -

Page 184

...'s delivery of his or her separate check payable to the Corporation in the amount of such Withholding Taxes, or • the use of the proceeds from a next-day sale of the Shares issued to the Participant, provided and only if (i) such a sale is permissible under the Corporation's trading policies... -

Page 185

... of Code Section 409A and the Treasury Regulations thereunder that apply to such exception. IN WITNESS WHEREOF , the parties have executed this Agreement on the day and year first indicated above. UNITED ONLINE, INC. By: Title: Mark R. Goldston Chairman, President and Chief Executive Officer... -

Page 186

... and shall be the date indicated in Paragraph 1 of the Agreement. D. Board shall mean the Corporation's Board of Directors. Agreement shall mean this Restricted Stock Unit Issuance Agreement. Award shall mean the award of restricted stock units made to the Participant pursuant to the terms of this... -

Page 187

... members described in clause (A) who were still in office at the time the Board approved such appointment or nomination. G. H. Code shall mean the Internal Revenue Code of 1986, as amended. Common Stock shall mean shares of the Corporation's common stock. I. Corporation shall mean United Online... -

Page 188

...effect at the time of such leave, no Service credit shall be given for vesting purposes for any period the Participant is on a leave of absence. A-3 Plan shall mean the Corporation's 2010 Incentive Compensation Plan, as amended and restated from time to time. Plan Administrator shall mean either the... -

Page 189

... in such chain. U. Withholding Taxes shall mean the federal, state and local income taxes and the employee portion of the federal, state and local employment taxes required to be withheld by the Corporation in connection with the issuance of the shares of Common Stock which vest under the Award and... -

Page 190

... Stock Option Agreement, the Option shall not become exercisable for any additional Option Shares after Optionee's cessation of Service. Optionee understands and agrees that the Option is granted subject to and in accordance with the terms of the United Online, Inc. 2010 Incentive Compensation... -

Page 191

DATED: , 2011 UNITED ONLINE, INC. By: Title: OPTIONEE ATTACHMENTS EXHIBIT A - STOCK OPTION AGREEMENT -

Page 192

... Notice. The Option Shares shall be purchasable from time to time during the option term specified in Paragraph 2 at the Exercise Price. 2. Option Term . The term of this option shall commence on the Grant Date and continue in effect until the close of business on the Expiration Date, unless sooner... -

Page 193

..., but in no event shall this option be exercisable at any time after the close of business on the last business day coincident with or immediately preceding the Expiration Date. (b) In the event Optionee ceases Service by reason of his or her death while this option is outstanding, then this option... -

Page 194

...by an additional period of time equal in duration to any interval within such post-Service exercise period during which the exercise of this option or the immediate sale of the Option Shares acquired under this option cannot be effected in compliance with applicable federal and state securities laws... -

Page 195

... or the special vesting acceleration provisions of Paragraph 6 below, following Optionee's cessation of Service. Upon the expiration of such limited exercise period or (if earlier) upon the close of business on the last business day coincident with or immediately preceding the Expiration Date, this... -

Page 196

... or sell or transfer all or any part of its business or assets. 7. Adjustment in Option Shares . Should any change be made to the Common Stock by reason of any stock split, stock dividend, recapitalization, combination of shares, exchange of shares, spin-off transaction, or other change affecting... -

Page 197

... in a manner reasonably satisfactory to the Corporation) held for the requisite period (if any) necessary to avoid any resulting charge to the Corporation's earnings for financial reporting purposes and valued at Fair Market Value on the Exercise Date; or (C) through a special sale and remittance... -

Page 198

... of the Option Shares upon such exercise shall be subject to compliance by the Corporation and Optionee with all applicable requirements of law relating thereto and with all applicable regulations of any Stock Exchange on which the Common Stock is listed for trading at the time of such exercise... -

Page 199

...to the Corporation. In no event shall this option be exercised in the absence of such acceptance. IN WITNESS WHEREOF , United Online, Inc. has caused this Agreement to be executed on its behalf by its duly-authorized officer on the day and year first indicated in the Grant Notice. UNITED ONLINE, INC... -

Page 200

...by or is under common control with, the Corporation) acquires directly or indirectly (whether as a result of a single acquisition or by reason of one or more acquisitions within the twelve (12)-month period ending with the most recent acquisition) beneficial ownership (within the meaning of Rule 13d... -

Page 201

... members described in clause (A) who were still in office at the time the Board approved such appointment or nomination. D. E. Code shall mean the Internal Revenue Code of 1986, as amended. Common Stock shall mean shares of the Corporation's common stock. F. Corporation shall mean United Online... -

Page 202

... share of Common Stock on any relevant date shall be the closing price per share of Common Stock at the close of regular trading hours (i.e., before after-hours trading begins) on the date in question on the Stock Exchange serving as the primary market for the Common Stock, as such price is reported... -

Page 203

...the Corporation's 2010 Incentive Compensation Plan, as amended and restated from time to time. CC. Plan Administrator shall mean the Compensation Committee of the Board (or a subcommittee thereof) acting in its capacity as administrator of the Plan. DD. Service shall mean the Optionee's performance... -

Page 204

... shall mean the federal, state and local income taxes and the employee portion of the federal, state and local employment taxes required to be withheld by the Corporation in connection with the exercise of the option. HH. II. With Cause shall have the meaning assigned to such term in the Employment... -

Page 205

... Stock Option Agreement, the Option shall not become exercisable for any additional Option Shares after Optionee's cessation of Service. Optionee understands and agrees that the Option is granted subject to and in accordance with the terms of the United Online, Inc. 2010 Incentive Compensation... -

Page 206

DATED: , 2011 UNITED ONLINE, INC. By: Title: OPTIONEE ATTACHMENTS EXHIBIT A - STOCK OPTION AGREEMENT -

Page 207

... Notice. The Option Shares shall be purchasable from time to time during the option term specified in Paragraph 2 at the Exercise Price. 2. Option Term . The term of this option shall commence on the Grant Date and continue in effect until the close of business on the Expiration Date, unless sooner... -

Page 208

..., but in no event shall this option be exercisable at any time after the close of business on the last business day coincident with or immediately preceding the Expiration Date. (b) In the event Optionee ceases Service by reason of his or her death while this option is outstanding, then this option... -

Page 209

...by an additional period of time equal in duration to any interval within such post-Service exercise period during which the exercise of this option or the immediate sale of the Option Shares acquired under this option cannot be effected in compliance with applicable federal and state securities laws... -

Page 210

...common stock with a fair market value equivalent to the cash consideration paid per share of Common Stock in such Change in Control, provided such common stock is readily tradable on an established U.S. securities exchange. (d) Immediately upon an Involuntary Termination of Optionee's Service within... -

Page 211

... or sell or transfer all or any part of its business or assets. 7. Adjustment in Option Shares . Should any change be made to the Common Stock by reason of any stock split, stock dividend, recapitalization, combination of shares, exchange of shares, spin-off transaction, or other change affecting... -

Page 212

... in a manner reasonably satisfactory to the Corporation) held for the requisite period (if any) necessary to avoid any resulting charge to the Corporation's earnings for financial reporting purposes and valued at Fair Market Value on the Exercise Date; or (C) through a special sale and remittance... -

Page 213

.... 12. Notices . Any notice required to be given or delivered to the Corporation under the terms of this Agreement shall be in writing and addressed to the Corporation at its principal corporate offices and directed to the attention of the Stock Plan Administrator. Any notice required to be given or... -

Page 214

...to the Corporation. In no event shall this option be exercised in the absence of such acceptance. IN WITNESS WHEREOF , United Online, Inc. has caused this Agreement to be executed on its behalf by its duly-authorized officer on the day and year first indicated in the Grant Notice. UNITED ONLINE, INC... -

Page 215

... such transaction or series of related transactions, directly or indirectly controls, is controlled by or is under common control with, the Corporation) acquires directly or indirectly (whether as a result of a single acquisition or by reason of one or more acquisitions within the twelve (12)-month... -

Page 216

... members described in clause (A) who were still in office at the time the Board approved such appointment or nomination. E. F. Code shall mean the Internal Revenue Code of 1986, as amended. Common Stock shall mean shares of the Corporation's common stock. G. Corporation shall mean United Online... -

Page 217

... share of Common Stock on any relevant date shall be the closing price per share of Common Stock at the close of regular trading hours (i.e., before after-hours trading begins) on the date in question on the Stock Exchange serving as the primary market for the Common Stock, as such price is reported... -

Page 218

...or more. Y. Plan shall mean the Corporation's 2010 Incentive Compensation Plan, as amended from time to time. Z. Plan Administrator shall mean the Compensation Committee of the Board (or a subcommittee thereof) acting in its capacity as administrator of the Plan. AA. Service shall mean the Optionee... -

Page 219

...of absence in effect at the time of such leave, no Service credit shall be given for vesting purposes for any period Optionee is on a leave of absence. BB. York Stock Exchange. Stock Exchange shall mean the American Stock Exchange, the Nasdaq Global or Global Select Market or the New CC. Subsidiary... -

Page 220

Exhibit 10.16 AMENDED AND RESTATED UNITED ONLINE, INC. SEVERANCE BENEFIT PLAN AND SUMMARY PLAN DESCRIPTION Amended and Restated Effective January 1, 2010 -

Page 221

..., agreements or policies regarding severance pay, except such terms as are set forth in a written agreement signed by an authorized officer of the Company or one of its subsidiaries and in effect at the time of the applicable termination of employment. This Plan supplements any such written... -

Page 222

...Online, Inc. " Covered Subsidiary " means any subsidiary listed in attached Schedule A , as such schedule may be revised from time to time, as a participating Employer in the Plan. "Employer Group" means the Company and each member of the group of commonly controlled corporations or other businesses... -

Page 223

... in Control or Corporate Transaction with respect to United Online, Inc. " Misconduct " means the (i) commission of any act of fraud, embezzlement or dishonesty, (ii) any unauthorized use or disclosure of confidential information or trade secrets of the Company (or any other member of the Employer... -

Page 224

...your residence or your most recent work place; provided, however, that this condition will not be required during the Transaction Protection Period. 4. Prior to your employment termination date, you have signed a form of confidential/proprietary/trade secret information, nondisclosure and inventions... -

Page 225

...to the Company all items of property received by you for your use during employment with your Employer, including, but not limited to, any laptops, computer equipment, software programs, cell phones, keys and passes, and credit and calling cards. 9. You have signed a general release of all claims in... -

Page 226

... of the maximum applicable delivery/review and revocation periods and you have otherwise complied with all the other terms and conditions of Section III.A, or on such subsequent date as the Company may determine in its sole discretion, but in no event later the last business day of such sixty... -

Page 227

... conditions stated above, including (without limitation) the execution and effectiveness of the Required Release on or before applicable date specified in Section III.A.9. above, but in no event after the expiration of the sixty (60)-day period measured from the date of your Separation from Service... -

Page 228

...elect such coverage and you timely pay the full amount of premiums due. In connection with your Layoff Termination, you and your eligible dependents will be provided with COBRA election forms and a notice that describes your rights to, and the terms and conditions of, temporary continuation coverage... -

Page 229

... a signed, written application to the Chief Personnel Officer of the Company within ninety (90) days after the effective date of your Layoff Termination or Involuntary Termination. 2. Denial of Application for Benefits . In the event that your application for benefits is denied in whole or in part... -

Page 230

... after the Plan Administrator receives the application, unless special circumstances require an extension of time, in which case, the Plan Administrator has up to an additional ninety (90) days for processing the application. If an extension of time for processing is required, written notice of the... -

Page 231

...or in part, you must receive a written explanation of the reason for the denial. You have the right to have the Plan Administrator review and reconsider ... and pay you up to $110 a day until you receive the materials, unless the materials were not sent because of reasons beyond the control of ... -

Page 232

... lose, the court may order you to pay these costs and fees, for example, if it finds that your claim or suit is frivolous. If you have any questions about the Plan, this statement or your rights under ERISA, you should contact the Plan Administrator or the nearest Area Office of the Pension and... -

Page 233

ADDITIONAL PLAN INFORMATION Plan Sponsor: Plan Name: Employer Identification Number Plan Number: Plan Effective Date: Plan Administrator: United Online, Inc. The United Online, Inc. Severance Benefit Plan 77-0575839 5 01 January 1, 2010 United Online, Inc. 21301 Burbank Blvd. Woodland Hills, CA ... -

Page 234

..., INC. HAS CAUSED THIS AMENDED AND RESTATED SEVERANCE BENEFIT PLAN AND SUMMARY PLAN DESCRIPTION TO BE EXECUTED ON ITS BEHALF BY ITS DULY AUTHORIZED OFFICER ON THE DATE AND YEAR INDICATED BELOW. UNITED ONLINE, INC. By: Title: /s/ Mark R. Goldston Chief Executive Officer Dated: November 22, 2010 15 -

Page 235

SCHEDULE A LIST OF COVERED SUBSIDIARIES PARTICIPATING IN THE PLAN AS OF JANUARY 1, 2010 NetZero, Inc. Juno Internet Services, Inc. United Online Advertising Network, Inc. Classmates Online, Inc. MyPoints.com, Inc. FTD.COM, Inc. Florists' Transworld Delivery, Inc. 16 -

Page 236

Exhibit 10.17 EMPLOYMENT AGREEMENT This Employment Agreement (the " Agreement ") is made and entered into effective the 6th day of December, 2010 by and between United Online, Inc., a Delaware corporation (the " Company "), with principal corporate offices at 21301 Burbank Boulevard, Woodland Hills,... -

Page 237

... materially interfere with the services required under this Agreement and do not present any conflict with the interests of the Company. 3. COMPENSATION AND OTHER BENEFITS 3.1 Base Salary . During the Term, the Company shall pay to Employee a base salary per fiscal year equal to Employee's current... -

Page 238

...termination of employment. The Severance Payment to which Employee accordingly becomes entitled hereunder will be made to Employee in a lump sum on the third business day following the expiration of the maximum applicable review/delivery and revocation periods with respect to the required release or... -

Page 239

... if Employee is not offered and provided the position of Chairman of the Board of Directors and Chief Executive Officer of the Company or its successor as well as the acquiring and ultimate parent entity, if any, following a Change in Control), (b) a material decrease in pay and/or benefits from... -

Page 240

...by or is under common control with, the Company) acquires directly or indirectly (whether as a result of a single acquisition or by reason of one or more acquisitions within the twelve (12)-month period ending with the most recent acquisition) beneficial ownership (within the meaning of Rule 13d3 of... -

Page 241

... or other communication. 8.7 Notwithstanding any provision to the contrary in this Agreement, no payment or distribution under this Agreement which constitutes an item of deferred compensation under Section 409A of the Code and becomes payable by reason of Employee's termination of employment 6 This... -

Page 242

... addition, no payment or benefit which constitutes an item of deferred compensation under Section 409A of the Code and becomes payable by reason of Employee's separation from service will be made to Employee prior to the earlier of (i) the first day of the seventh (7th) month measured from the date... -

Page 243

... each of the parties hereto has executed this Agreement on the date specified therefor below. UNITED ONLINE, INC. By: /s/ Robert Berglass Name: Robert Berglass Title: Lead Independent Director, Compensation Committee Chair of United Online, Inc. Dated: December 6, 2010 By: /s/ Charles B. Ammann Name... -

Page 244

Exhibit 10.18 EMPLOYMENT AGREEMENT This Employment Agreement (the " Agreement ") is made and entered into effective the 7th day of February, 2011 (the " Effective Date ") by and between United Online, Inc. , a Delaware corporation (the " Company "), with principal corporate offices at 21301 Burbank ... -

Page 245

... is earned. 4. Restricted Stock Units and Other Equity Awards. If Employee's employment is terminated by the Company "without cause" or by Employee for "good reason" (as each term is (a) defined below) during the Term, then upon Employee's satisfaction of the Release Condition set forth in Section... -

Page 246

... be required in order to comply with any applicable requirements of Section 409A of the Code, the shares of the Company's common stock underlying the equity awards that vest on an accelerated basis in accordance with this Section 4(c) will be issued on the date of such separation from service or as... -

Page 247

... unpaid compensation for services rendered through that termination date and any accrued but unused vacation days as of that termination date (collectively, the " Accrued Obligations "). If Employee terminates his employment with the Company for "good reason" (as defined below) during the Term, then... -

Page 248

... Employee continued in the Company's employ through such payment date. (III) In no event shall any such Additional Payment be made later than the last day of the applicable period necessary to qualify such Additional Payment for the short-term deferral exception under Code Section 409A. Payment of... -

Page 249

... cause" (as defined below) or if Employee terminates his employment with the Company for "good reason" (as defined below) during the Term and within the twenty-four (24) month period beginning on the effective date of a Qualifying Change in Control (as defined below), the Separation Payment to which... -

Page 250

... or benefit received pursuant to this Agreement or otherwise) would be (in whole or part) subject to the excise tax imposed by Section 4999 of the Code, or any successor provision thereto, or any similar tax imposed by state or local law, or any interest or penalties with respect to such excise... -

Page 251