Dunkin' Donuts 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Dunkin' Donuts annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

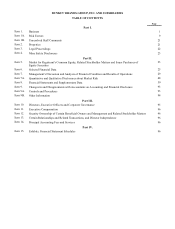

Table of contents

-

Page 1

-

Page 2

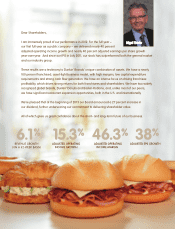

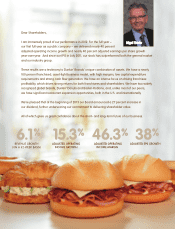

... adjusted earnings per share growth year-over-year. And since our IPO in July 2011, our stock has outperformed both the general market and our industry group. These results are a testimony to Dunkin' Brands' unique combination of assets. We have a nearly 100 percent franchised, asset-light business...

-

Page 3

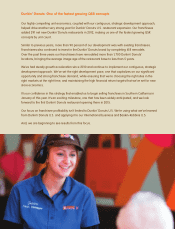

...look forward to the first Dunkin' Donuts restaurant opening there in 2015. Our focus on franchisee profitability isn't limited to Dunkin' Donuts U.S. We're using what we've learned from Dunkin' Donuts U.S. and applying it to our International business and Baskin-Robbins U.S. And, we are beginning to...

-

Page 4

... Dunkin' Donuts U.S. segment achieved 4.2 percent comp store sales growth over 2011 despite an intensely competitive marketplace and continued economic uncertainty. We believe this reflects the overall strength of our brand, and the great products and good value that we offer to customers every day...

-

Page 5

... market that we believe presents a great opportunity for both our brands is Vietnam. We opened 13 Baskin-Robbins restaurants in Vietnam last year with a new franchisee, and recently signed a franchise agreement to develop Dunkin' Donuts in that country as well. We are approaching our international...

-

Page 6

... our asset-light business model, and we expect another year of 15 percent plus earnings per share growth. Thank you for your investment in Dunkin' Brands. We look forward to continuing to deliver on our long-term targets and driving value for you, our shareholders.

Regards,

Nigel Travis

Chief...

-

Page 7

...held by non-affiliates of Dunkin' Brands Group, Inc. computed by reference to the closing price of the registrant's common stock on the NASDAQ Global Select Market as of June 30, 2012, was approximately $2.88 billion. As of February 15, 2013, 106,273,454 shares of common stock of the registrant were...

-

Page 8

-

Page 9

... of Operations Quantitative and Qualitative Disclosures about Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Part III. Directors, Executive Officers and Corporate...

-

Page 10

... performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this report. In addition, even if our results of...

-

Page 11

... international markets; (iv) sales at our company-owned restaurants, and (v) other income including fees for the licensing of the Dunkin' Donuts brand for products sold in non-franchised outlets (such as retail packaged coffee) and the licensing of the rights to manufacture Baskin-Robbins ice cream...

-

Page 12

... renewed excitement for the brand. Baskin-Robbins' "31 flavors", offering consumers a different flavor for each day of the month, is recognized by ice cream consumers nationwide. For fiscal year 2012, the Baskin-Robbins franchise system generated U.S. franchisee-reported sales of $509 million, which...

-

Page 13

...agreements may be put in place to develop restaurants. The master franchisee is required to pay an upfront initial franchise fee for each developed restaurant and, for the Dunkin' Donuts brand, royalties. For the Baskin-Robbins brand, the master franchisee is typically required to purchase ice cream...

-

Page 14

... million, of our total revenue from license fees from Dean Foods. We distribute ice cream products to Baskin-Robbins franchisees who operate Baskin-Robbins restaurants located in certain foreign countries and receive revenue associated with those sales. For fiscal year 2012, we generated 14.4%, or...

-

Page 15

...-reported sales. For the same period, our revenues from international operations totaled $117.5 million, with the Baskin-Robbins brand generating approximately 87% of such revenues. Overview of key markets As of December 29, 2012, the top foreign countries and regions in which the Dunkin' Donuts...

-

Page 16

... 58% of Dunkin' Donuts' U.S. franchisee-reported sales for fiscal year 2012 generated from coffee and other beverages. We believe QSRs, including Dunkin' Donuts, are positioned to capture additional coffee market share through an increased focus on coffee offerings. Our Baskin-Robbins brand competes...

-

Page 17

...the Dunkin' Donuts brand is facilitated by National DCP, LLC (the "NDCP"), which is a Delaware limited liability company operated as a cooperative owned by its franchisee members. The NDCP is managed by a staff of supply chain professionals who report directly to the NDCP's Executive Management Team...

-

Page 18

...rely on our internal culinary team, which uses consumer research, to develop and test new products. Operational support Substantially all of our executive management, finance, marketing, legal, technology, human resources and operations support functions are conducted from our global headquarters in...

-

Page 19

... on imported commodities and equipment, and laws regulating foreign investment. We believe that the international disclosure statements, franchise offering documents and franchising procedures for our Baskin-Robbins brand and Dunkin' Donuts brand comply in all material respects with the laws of the...

-

Page 20

... lower demand for products, downward pressure on prices, the loss of market share and the inability to attract, or loss of, qualified franchisees, which could result in lower franchise fees and royalty income, and materially and adversely affect our business and operating results. We cannot...

-

Page 21

... variable rates. Other debt we incur also could be variable rate debt. If market interest rates increase, variable rate debt will create higher debt service requirements, which could adversely affect our cash flow. In September 2012, we entered into variable-to-fixed interest rate swap agreements to...

-

Page 22

...our intellectual property could harm our business. We regard our Dunkin' Donuts® and Baskin-Robbins® trademarks as having significant value and as being important factors in the marketing of our brands. We have also obtained trademark protection for several of our product offerings and advertising...

-

Page 23

... implement our growth strategy, which includes opening new domestic and international restaurants, our ability to increase our revenues and operating profits could be adversely affected. Our growth strategy relies in part upon new restaurant development by existing and new franchisees. We...

-

Page 24

...comparable store sales. Our failure to add a significant number of new restaurants or grow comparable store sales would adversely affect our ability to increase our revenues and operating income and could materially and adversely harm our business and operating results. Increases in commodity prices...

-

Page 25

...burdens and costs of local operators' compliance with a variety of laws, including trade restrictions and tariffs; interruption of the supply of product; increases in anti-American sentiment and the identification of the Dunkin' Donuts brand and Baskin-Robbins brand as American brands; political and...

-

Page 26

... the operation of one of our brands in a particular market or markets. Any such delay or interruption would result in a delay in, or loss of, royalty income to us whether by way of delayed royalty income or delayed revenues from the sale of ice cream products by us to franchisees internationally, or...

-

Page 27

... (including polystyrene used in the iconic Dunkin' Donuts cup) or requiring the display of detailed nutrition information. Each of these regulations would be costly to comply with and/or could result in reduced demand for our products. In connection with the continued operation or remodeling of...

-

Page 28

.... The Internal Revenue Service ("IRS") concluded its examination of the federal income tax returns for the fiscal years 2006 through 2009 during fiscal year 2012 and agreed to a settlement regarding the recognition of revenue for gift cards and other matters. The Company made a cash payment for...

-

Page 29

...of the Dunkin' Donuts brand and the Baskin-Robbins brand. The councils are comprised of franchisees, brand employees and executives, and they meet to discuss the strengths, weaknesses, challenges and opportunities facing the brands as well as the rollout of new products and projects. Internationally...

-

Page 30

... our business and operating results. Risks related to our common stock Our stock price could be extremely volatile and, as a result, you may not be able to resell your shares at or above the price you paid for them. Since our initial public offering in July 2011, the price of our common stock, as...

-

Page 31

... support functions: legal, marketing, technology, human resources, public relations, financial and research and development. As of December 29, 2012, we owned 96 properties and leased 941 locations across the U.S. and Canada, a majority of which we leased or subleased to franchisees. For fiscal year...

-

Page 32

... occurred 10 to 15 years ago, including but not limited to, alleging that the Company breached its franchise agreements and provided inadequate management and support to Dunkin' Donuts franchisees in Quebec ("Bertico litigation"). On June 22, 2012, the Quebec Superior Court found for the plaintiffs...

-

Page 33

... from July 27, 2011, the date of our initial public offering, through the end of the quarter

On February 15, 2013, we had 248 holders of record of our common stock. Dividend policy No dividends were declared or paid during fiscal year 2011. During fiscal year 2012, the Company paid dividends on...

-

Page 34

... - 9.54

10,660,674 - 10,660,674

$

The following graph depicts the total return to shareholders from July 27, 2011, the date our common stock became listed on the NASDAQ Global Select Market, through December 29, 2012, relative to the performance of the Standard & Poor's 500 Index and the Standard...

-

Page 35

... share data or as otherwise noted)

Consolidated Statements of Operations Data: Franchise fees and royalty income Rental income Sales of ice cream products Sales at company-owned restaurants Other revenues Total revenues Amortization of intangible assets Impairment charges(1) Other operating costs...

-

Page 36

... Total assets Total debt(6) Total liabilities Common stock, Class L(7) Total stockholders' equity (deficit)(7) Other Financial Data: Capital expenditures Adjusted operating income Adjusted net income(8) Points of Distribution(9): Dunkin' Donuts U.S. Baskin-Robbins U.S. Baskin-Robbins International...

-

Page 37

... the presentation of our financial results in accordance with GAAP. Use of the terms adjusted operating income and adjusted net income may differ from similar measures reported by other companies. Adjusted operating income and adjusted net income are reconciled from operating income (loss) and net...

-

Page 38

..., net(b) Adjusted operating income Net income (loss) attributable to Dunkin' Brands Adjustments: Amortization of other intangible assets Impairment charges Sponsor termination fee Secondary offering costs Peterborough plant closure Bertico litigation(c) Loss (gain) on debt extinguishment and...

-

Page 39

... ice cream products to Baskin-Robbins franchisees in certain international markets. The balance of our revenue for fiscal year 2012 consisted of revenue from our company-owned restaurants, license fees on products sold in non-franchised outlets, license fees on sales of ice cream products to Baskin...

-

Page 40

... sales growth, revenues, and expenses. Selected operating and financial highlights

Fiscal year 2012 2011 2010

Systemwide sales growth Comparable store sales growth: Dunkin' Donuts U.S. Dunkin' Donuts International(1) Baskin-Robbins U.S. Baskin-Robbins International Total revenues Operating income...

-

Page 41

... store sales growth of 5.1% driven by both increased average ticket and transaction counts, net restaurant development of 243 restaurants in 2011, and approximately 190 basis points of growth attributable to the extra week in fiscal year 2011. Dunkin' Donuts International systemwide sales growth...

-

Page 42

... of the increase in total revenues was attributable to the extra week in fiscal year 2011, consisting primarily of additional royalty income and sales of ice cream products. Operating income increased $11.8 million, or 6.1%, for fiscal year 2011 driven by the increase in franchise fees and royalty...

-

Page 43

... year 2012 compared to fiscal year 2011 Consolidated results of operations

Fiscal year 2012 2011 Increase (Decrease) $ %

(In thousands, except percentages)

Franchise fees and royalty income Rental income Sales of ice cream products Sales at company-owned restaurants Other revenues Total revenues...

-

Page 44

... in our Dunkin' Donuts U.S. contiguous growth strategy and our international brands, additional stock compensation expense, and higher incentive compensation payouts. Offsetting this increase was additional breakage income recorded in fiscal year 2012 of $5.4 million on unredeemed gift card and gift...

-

Page 45

... the Company's initial public offering completed in August 2011. Net interest expense for fiscal year 2012 also benefited from the re-pricing of outstanding term loans in conjunction with the February and May 2011 upsize transactions, the proceeds of which were used to repay the higher rate senior...

-

Page 46

...Dunkin' Donuts U.S. contiguous growth strategy and higher projected incentive compensation payouts. Dunkin' Donuts International

Fiscal year 2012 2011 Increase (Decrease) $ %

(In thousands, except percentages)

Royalty income Franchise fees Rental income Other revenues Total revenues Segment profit...

-

Page 47

... was the $1.4 million decline in total revenues. Baskin-Robbins International

Fiscal year 2012 2011 Increase (Decrease) $ %

(In thousands, except percentages)

Royalty income Franchise fees Rental income Sales of ice cream products Other revenues Total revenues Segment profit

$

9,301 1,292 561 90...

-

Page 48

... the number of leased properties. Cost of ice cream products increased 22.2% from the prior year, as compared to a 17.7% increase in sales of ice cream products, resulting from unfavorable commodity prices and foreign exchange, slightly offset by increases in selling prices. Company-owned restaurant...

-

Page 49

...in the average cost of borrowing due to refinancing and re-pricing transactions, offset by an increase in the weighted average long-term debt outstanding and an extra week of interest expense in fiscal year 2011. As the senior notes were fully repaid upon completion of the initial public offering on...

-

Page 50

...is no corresponding tax benefit. Operating segments Dunkin' Donuts U.S.

Fiscal year 2011 2010 Increase (Decrease) $ %

(In thousands, except percentages)

Royalty income Franchise fees Rental income Sales at company-owned restaurants Other revenues Total revenues Segment profit

$

317,203 29,905 86...

-

Page 51

... the sale of Baskin-Robbins ice cream products to franchisees. Additionally, franchise fees declined $0.4 million driven by fewer store openings, and rental income declined $0.3 million due to a reduction in the number of leased locations. Approximately $0.3 million of the increase in total revenues...

-

Page 52

Baskin-Robbins International

Fiscal year 2011 2010 Increase (Decrease) $ %

(In thousands, except percentages)

Royalty income Franchise fees Rental income Sales of ice cream products Other revenues Total revenues Segment profit

$

8,422 1,593 616 96,288 (32)

6,191 1,289 572 80,962 390 89,404 40,...

-

Page 53

... year 2012 excess cash flow and leverage ratio requirements, considering all payments made, the excess cash flow payment required in the first quarter of 2013 will be $21.7 million, which may be applied to future minimum required principal payments. However, the Company intends on making quarterly...

-

Page 54

... costs associated with various franchiseerelated information technology investments and one-time market research programs, and the net impact of other nonrecurring and individually insignificant adjustments.

Based upon our current level of operations and anticipated growth, we believe that the cash...

-

Page 55

... with terms of approximately three to ten years for various business purposes. We recognize a liability and offsetting asset for the fair value of such guarantees. The fair value of a guarantee is based on historical default rates of our total guaranteed loan pool. We monitor the financial condition...

-

Page 56

..., financial condition, and cash flow in future years. The following is a description of what we consider to be our most significant critical accounting policies. Revenue recognition Initial franchise fee revenue is recognized upon substantial completion of the services required of us as stated in...

-

Page 57

... fiscal years 2012, 2011, or 2010. We have intangible assets other than goodwill and trade names that are amortized on a straight-line basis over their estimated useful lives or terms of their related agreements. Other intangible assets consist primarily of franchise and international license rights...

-

Page 58

... to its estimated fair value, which is based on discounted cash flow. Income taxes Our major tax jurisdictions are the U.S. and Canada. The majority of our legal entities were converted to limited liability companies ("LLCs") on March 1, 2006 and a number of new LLCs were created on or about March...

-

Page 59

.... In September 2012, we entered into variable-to-fixed interest rate swap agreements to hedge the floating interest rate on $900.0 million notional amount of our outstanding term loan borrowings. These swaps are scheduled to mature in November 2017. We are required to make quarterly payments on the...

-

Page 60

... Financial Statements and Supplementary Data Report of Independent Registered Public Accounting Firm The Board of Directors and Stockholders Dunkin' Brands Group, Inc.: We have audited the accompanying consolidated balance sheets of Dunkin' Brands Group, Inc. and subsidiaries as of December 29, 2012...

-

Page 61

... Long-term debt, net Capital lease obligations Unfavorable operating leases acquired Deferred income Deferred income taxes, net Other long-term liabilities Total long-term liabilities Commitments and contingencies (note 17) Stockholders' equity: Preferred stock, $0.001 par value; 25,000,000 shares...

-

Page 62

DUNKIN' BRANDS GROUP, INC. AND SUBSIDIARIES Consolidated Statements of Operations (In thousands, except per share data)

Fiscal year ended December 29, 2012 December 31, 2011 December 25, 2010

Revenues: Franchise fees and royalty income Rental income Sales of ice cream products Sales at company-...

-

Page 63

DUNKIN' BRANDS GROUP, INC. AND SUBSIDIARIES Consolidated Statements of Comprehensive Income (In thousands)

Fiscal year ended December 29, 2012 December 31, 2011 December 25, 2010

Net income including noncontrolling interests Other comprehensive income (loss), net: Effect of foreign currency ...

-

Page 64

... in connection with initial public offering Issuance of common stock Exercise of stock options Share-based compensation expense Repurchases of common stock Retirement of treasury stock Excess tax benefits from share-based compensation

Balance at December 31, 2011 Net income Other comprehensive loss...

-

Page 65

... Other, net Net cash used in investing activities Cash flows from financing activities: Proceeds from issuance of long-term debt Repayment of long-term debt Payment of deferred financing and other debt-related costs Proceeds from initial public offering, net of offering costs Repurchases of common...

-

Page 66

...-Robbins brand, we develop and franchise restaurants featuring ice cream, frozen beverages, and related products. Additionally, we distribute Baskin-Robbins ice cream products to Baskin-Robbins franchisees and licensees in certain international markets. Throughout these financial statements, "Dunkin...

-

Page 67

... Notes, (iii) product sourcing and real estate reserves used to pay ice cream product obligations to affiliates and real estate obligations, respectively, (iv) cash collections related to the advertising funds and gift card/certificate programs, and (v) cash collateral requirements associated with...

-

Page 68

... consolidated balance sheets. (g) Assets held for sale Assets held for sale primarily represent costs incurred by the Company for store equipment and leasehold improvements constructed for sale to franchisees, as well as restaurants formerly operated by franchisees waiting to be resold. The value of...

-

Page 69

... under the lease, discounted using credit-adjusted risk-free rates and net of estimated sublease recovery, is recognized as a liability and charged to operations at the time we cease use of the property. The value of any equipment and leasehold improvements related to a closed store is assessed for...

-

Page 70

... in the consolidated balance sheets were valued based on an estimate of future revenues and costs related to the ongoing management of the contracts over the remaining useful lives. Favorable and unfavorable operating leases acquired were recorded on purchased leases based on differences between...

-

Page 71

...form of store development agreements ("SDA agreements") that grant the right to develop restaurants in designated areas. Our franchise and SDA agreements typically require the franchisee to pay an initial nonrefundable fee and continuing fees, or royalty income, based upon a percentage of sales. The...

-

Page 72

... Company does not use derivative instruments for trading purposes and we have procedures in place to monitor and control their use. We record all derivative instruments on our consolidated balance sheets at fair value. For derivative instruments that are designated and qualify as a cash flow hedge...

-

Page 73

...franchise fees, royalty income, and sales of ice cream products. In addition, we have note and lease receivables from certain of our franchisees and licensees. The financial condition of these franchisees and licensees is largely dependent upon the underlying business trends of our brands and market...

-

Page 74

...technology, data processing, product development, legal, administrative support services, and other operating expenses, which amounted to $5.6 million, $5.7 million, and $5.6 million for fiscal years 2012, 2011, and 2010, respectively. Such management fees are included in the consolidated statements...

-

Page 75

....3% 33.3%

Summary financial information for the joint venture operations on an aggregated basis was as follows (in thousands):

December 29, 2012 December 31, 2011

Current assets Current liabilities Working capital Property, plant, and equipment, net Other assets Long-term liabilities Joint venture...

-

Page 76

... its quoted market price on the last business day of the year, is approximately $154.9 million. No quoted market prices are available for the Company's investment in BR Korea. Net income (loss) of equity method investments in the consolidated statements of operations for fiscal years 2012, 2011, and...

-

Page 77

... at December 29, 2012 Accumulated impairment charges Net Balance

Dunkin' Donuts International

Goodwill Accumulated impairment charges Net Balance

Baskin-Robbins International

Goodwill Accumulated impairment charges Net Balance Goodwill

Total

Accumulated impairment charges Net Balance

$1,148,796...

-

Page 78

... long-term debt as of December 29, 2012 in the consolidated balance sheets. Based on all payments made, including the required excess cash flow payment in the first quarter of 2013, no additional principal payments would be required in 2013. Other events and transactions, such as certain asset sales...

-

Page 79

... years 2011 and 2010, respectively, which is included in interest expense in the consolidated statements of operations. In conjunction with the additional term loan borrowings during 2011, the Company repaid $250.0 million of senior notes. Using funds raised by the Company's initial public offering...

-

Page 80

... risk of increases in cash flows (interest payments) attributable to increases in three-month LIBOR above 1.0%, the designated benchmark interest rate being hedged, through November 2017. The notional value of the swaps totals $900.0 million, and the Company is required to make quarterly payments on...

-

Page 81

... statements of operations related to the swaps in fiscal year 2012, which is included in interest expense. The interest expense had not been paid in cash as of December 29, 2012 and is accrued in other current liabilities in the consolidated balance sheets. During the next twelve months, the Company...

-

Page 82

...Included in the Company's consolidated balance sheets are the following amounts related to assets leased to others under operating leases, where the Company is the lessor (in thousands):

December 29, 2012 December 31, 2011

Land Buildings Leasehold improvements Store, production, and other equipment...

-

Page 83

...party license agreement. Baskin-Robbins International primarily derives its revenues from sales of ice cream products, as well as royalty income, franchise fees, and license fees. The operating results of each segment are regularly reviewed and evaluated separately by the Company's senior management...

-

Page 84

...the Dunkin' Donuts U.S. segment revenues. Prior to fiscal year 2012, retail sales for Dunkin' Donuts U.S. company-owned restaurants were excluded from segment revenues. Additionally, revenue and segment profit for Baskin-Robbins' sales to United States military locations located internationally were...

-

Page 85

...States International Total property and equipment, net (13) Stockholders' equity (a) Public offerings

$ $

180,525 647 181,172

179,616 5,744 185,360

On August 1, 2011, the Company completed an initial public offering in which the Company sold 22,250,000 shares of common stock at an initial public...

-

Page 86

... Company accounts for treasury stock under the cost method, and as such recorded an increase in common treasury stock of $450.4 million during fiscal year 2012, based on the fair market value of the shares on the date of repurchase and the direct costs incurred. During fiscal year 2012, the Company...

-

Page 87

... may be delivered in satisfaction of stock options. The Dunkin' Brands Group, Inc. 2011 Omnibus Long-Term Incentive Plan (the "2011 Plan") was adopted in July 2011, and is the only plan under which the Company currently grants awards. A maximum of 7,000,000 shares of common stock may be delivered in...

-

Page 88

... cost remains related to restricted shares. The total grant-date fair value of shares vested during fiscal years 2012, 2011, and 2010, was $1.2 million, $484 thousand, and $1.3 million, respectively. 2006 Plan stock options-executive During fiscal years 2011 and 2010, the Company granted options...

-

Page 89

...aggregate amount of cash received by the Sponsors through sales, distributions, or dividends is two times the original purchase price of all shares purchased by the Sponsors. As the Tranche 5 options require the satisfaction of multiple vesting conditions, the requisite service period is the longest...

-

Page 90

...status of the Company's executive stock options as of December 29, 2012 and changes during fiscal year 2012 are presented below:

Weighted average exercise price Weighted average remaining contractual term (years) Aggregate intrinsic value (in millions)

Number of shares

Share options outstanding at...

-

Page 91

...of the Company's nonexecutive and 2011 Plan options as of December 29, 2012 and changes during fiscal year 2012 is presented below:

Weighted average exercise price Weighted average remaining contractual term (years) Aggregate intrinsic value (in millions)

Number of shares

Share options outstanding...

-

Page 92

...years 2011 and 2010. (4) The weighted average number of common shares in the common diluted earnings per share calculation for fiscal year 2012 includes the dilutive effect of 1,989,281 restricted shares and stock options, using the treasury stock method. The weighted average number of common shares...

-

Page 93

... operations differed from the expense computed using the statutory federal income tax rate of 35% due to the following:

Fiscal year ended December 29, 2012 December 31, 2011 December 25, 2010

Computed federal income tax expense, at statutory rate Permanent differences: Impairment of investment...

-

Page 94

... accounts Deferred gift cards and certificates Rent Deferred income Other current liabilities Capital loss Other Valuation allowance Total current Noncurrent: Capital leases Rent Property and equipment Deferred compensation liabilities Deferred income Real estate reserves Franchise rights and other...

-

Page 95

...Substantially all loan proceeds are used by the franchisees to finance store improvements, new store development, new central production locations, equipment purchases, related business acquisition costs, working capital, and other costs. In limited instances, the Company guarantees a portion of the...

-

Page 96

... occurred 10 to 15 years ago, including but not limited to, alleging that the Company breached its franchise agreements and provided inadequate management and support to Dunkin' Donuts franchisees in Quebec ("Bertico litigation"). On June 22, 2012, the Quebec Superior Court found for the plaintiffs...

-

Page 97

...Company's liabilities under the NQDC Plan. The NQDC Plan liability, included in other long-term liabilities in the consolidated balance sheets, was $7.4 million and $6.9 million at December 29, 2012 and December 31, 2011, respectively. As of December 29, 2012 and December 31, 2011, total investments...

-

Page 98

... 29, 2012 and December 31, 2011. The pooled fund is comprised of numerous underlying investments and is valued at the unit fair values supplied by the fund's administrator, which represents the fund's proportionate share of underlying net assets at market value determined using closing market prices...

-

Page 99

... Sponsor continues to serve on the board of directors. Prior to the closing of the Company's initial public offering on August 1, 2011, the Company was charged an annual management fee by the Sponsors of $1.0 million per Sponsor, payable in quarterly installments. In connection with the completion...

-

Page 100

.... (c) Board of directors Certain family members of one of our directors hold an ownership interest in an entity that owns and operates Dunkin' Donuts restaurants and holds the right to develop additional restaurants under store development agreements. During fiscal years 2012 and 2011, the Company...

-

Page 101

...335 0.32 0.32

Three months ended March 26, 2011 June 25, 2011 September 24, 2011 December 31, 2011

(In thousands, except per share data)

Total revenues(2) Operating income(2)(3)(4) Net income (loss) attributable to Dunkin' Brands Earnings (loss) per share)(2)(3)(4)(5): Class L - basic and diluted...

-

Page 102

...the results of operations for 13-week periods. The third quarter of fiscal year 2011 includes an expense of approximately $14.7 million related to the termination of the Sponsor management agreement incurred in connection with the completion of the initial public offering in August 2011 (see note 19...

-

Page 103

... reporting. Internal control over financial reporting is defined in Rule 13a-15(f) promulgated under the Exchange Act as a process, designed by, or under the supervision of the Company's principal executive and principal financial officers and effected by the Company's board of directors, management...

-

Page 104

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Dunkin' Brands Group, Inc. and subsidiaries as of December 29, 2012 and December 31, 2011, and the related consolidated statements of operations, comprehensive income, stockholders' equity...

-

Page 105

..., 2013. Nigel Travis, age 63, has served as Chief Executive Officer of Dunkin' Brands since January 2009. From 2005 through 2008, Mr. Travis served as President and Chief Executive Officer, and on the board of directors of Papa John's International, Inc., a publicly-traded international pizza chain...

-

Page 106

...as Chief Operating Officer for Panera Bread Company. The remaining information required by this item will be contained in our definitive Proxy Statement for our 2013 Annual Meeting of Stockholders, which will be filed not later than 120 days after the close of our fiscal year ended December 29, 2012...

-

Page 107

... Executive Employment Agreement between Dunkin' Brands, Inc., Dunkin' Brands Group, Inc. and Nigel Travis (incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K, File No. 001-35258, filed with the SEC on December 3, 2012) Offer Letter to Neil Moses dated September 27...

-

Page 108

...-Robbins and Dunkin' Donuts Franchise Agreement Form of Dunkin' Donuts Store Development Agreement (incorporated by reference to Exhibit 10.34 to the Company's Annual Report on Form 10-K, File No. 001-35258, filed with the SEC on February 24, 2012) Form of Baskin-Robbins Store Development Agreement...

-

Page 109

... following financial information from the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2011, formatted in Extensible Business Reporting Language, (i) the Consolidated Balance Sheets, (ii) the Consolidated Statements of Operations, (iii) the Consolidated Statements of...

-

Page 110

... the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Date: February 22, 2013 DUNKIN' BRANDS GROUP, INC. By: Name: Title: /s/ Nigel Travis Nigel Travis Chief Executive Officer

Pursuant to the requirements of the Securities and Exchange...

-

Page 111

-

Page 112

..., Dunkin' Brands International

Scott Murphy

Senior Vice President & Chief Supply Officer

Bill Mitchell

President, Baskin-Robbins U.S. & Canada

Karen Raskopf

Senior Vice President & Chief Communications Officer

Paul Twohig

President, Dunkin' Donuts U.S. & Canada

Dunkin' Brands Group, Inc...