Dollar Rent A Car 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Dollar Rent A Car annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dollar Thrifty Automotive Group, Inc. 2009 Annual Report

Table of contents

-

Page 1

-

Page 2

... ACT OF 1934 For the fiscal year ended December 31, 2009 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _____ to _____ Commission file number 1-13647 _____ DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. (Exact name of registrant... -

Page 3

.... The aggregate market value of the voting and non-voting common equity held by nonaffiliates of the registrant as of June 30, 2009, the last business day of the registrant's most recently completed second fiscal quarter, based on the closing price of the stock on the New York Stock Exchange on such... -

Page 4

... ABOUT MARKET RISK ...FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ...CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE ...CONTROLS AND PROCEDURES ...OTHER INFORMATION ...DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE ...EXECUTIVE COMPENSATION...SECURITY... -

Page 5

... of the monoline insurers that provide credit support for our asset backed financing structures; the cost and other terms of acquiring and disposing of automobiles and the impact of conditions in the used car market on our ability to reduce our fleet capacity as and when projected by our plans; the... -

Page 6

... the airport and local markets operating through a network of company-owned stores and franchisees. Dollar and Thrifty currently derive the majority of their U.S. revenues from providing rental vehicles and services directly to rental customers. Consequently, Dollar and Thrifty incur the costs of... -

Page 7

...airport markets in the U.S. and in key leisure destinations. As part of this process, beginning in late 2008 and continuing throughout 2009, the Company closed over 100 company-owned stores that did not meet financial return objectives. The Company does not anticipate significant additional location... -

Page 8

... to support operations in future periods. Vehicle rental companies are also dependent on vehicle manufacturers and overall economic conditions in the new and used vehicle markets, as these factors directly impact the cost of acquiring vehicles, and the ultimate disposition value of vehicles, both... -

Page 9

... Company has two value rental car brands, Dollar and Thrifty, with a strategy to operate companyowned stores in the top 75 airport markets and in key leisure destinations in the United States. In the U.S., the Dollar and Thrifty brands are marketed separately, but operate under a single management... -

Page 10

... locations. Thrifty's total rental revenue generated by company-owned stores was $628 million for the year ended December 31, 2009. Corporate Operations United States The Company's operating model for U.S. Dollar and Thrifty company-owned stores includes generally maintaining separate airport... -

Page 11

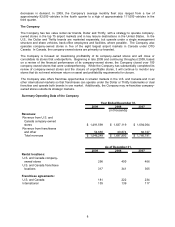

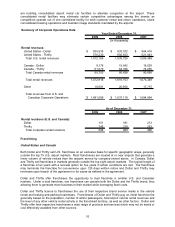

...image standards mandated by the airports. Summary of Corporate Operations Data 2009 Year Ended December 31, 2008 (in thousands) 2007 Rental revenues: United States - Dollar United States - Thrifty Total U.S. rental revenues Canada - Dollar Canada - Thrifty Total Canada rental revenues Total rental... -

Page 12

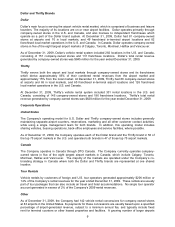

..., image and standards, rental rate management analysis and customer satisfaction programs. Additionally, Dollar and Thrifty offer their respective franchisees centralized corporate account and tour billing and travel agent commission payments. Summary of U.S. and Canada Franchise Operations Data As... -

Page 13

...Marketing Dollar and Thrifty are positioned as value car rental companies in the travel industry, providing on-airport convenience with low rates on quality vehicles. Customers who rent from Dollar and Thrifty are costconscious leisure, government and business travelers who want to save money on car... -

Page 14

... customers, including the promotion of special offers and programs. From a new product perspective, dollar.com and thrifty.com launched the ability to reserve commonly requested rental options such as GPS units and toll passes. Dollar and Thrifty are among the leading car rental companies in direct... -

Page 15

... Web sites and various distribution networks allow the Company's products to be marketed and reserved directly or through our various channel partners. The Company continues to invest in new business system capabilities to facilitate operations and reduce operating costs to operate them. In 2009... -

Page 16

... ten months but extended holding periods in 2009 to approximately 18 to 20 months. DTG Operations remarketed 67% of its Non-Program Vehicles through auctions and 33% directly to used car dealers, wholesalers and its franchisees during the year ended December 31, 2009. Fleet Management The Company... -

Page 17

...as well as Dollar and Thrifty. Insurance The Company is subject to third-party bodily injury liability and property damage claims resulting from accidents involving its rental vehicles. In 2007, the Company retained the risk of loss up to $4.0 million per occurrence for public liability and property... -

Page 18

... to customers. Dollar and Thrifty are subject to federal, state and local laws and regulations relating to taxing and licensing of vehicles, franchise sales, franchise relationships, vehicle liability, used vehicle sales, insurance, telecommunications, vehicle rental transactions, environmental... -

Page 19

... bargaining agreements as of December 31, 2009. The Company believes its relationship with its employees is good. ITEM 1A. RISK FACTORS Expanding upon the factors discussed in the Forward-Looking Statements section provided at the beginning of this Annual Report on Form 10-K, the following are... -

Page 20

... value of our risk vehicles declines significantly or we experience cumulative losses on disposition of a specified percentage of our fleet, we could be required to increase the monthly depreciation payments under our asset backed medium term notes during the remaining life of the vehicles, increase... -

Page 21

... the used car market value risk on approximately 95% of our vehicles at December 31, 2009 and expect that risk vehicles will account for approximately 90% to 95% of our fleet in 2010. The depreciation costs for these vehicles are highly dependent on used car prices at the time of sale, requiring... -

Page 22

...180 days after year-end and actual results may differ from current projections. Increased cash tax payments may be incurred in 2010 and beyond, depending on future vehicle purchase and sale transactions. Dependence on Air Travel We get approximately 90% of our rental revenues from airport locations... -

Page 23

... providing various insurance coverages in our domestic vehicle rental operations are regulated under state laws governing the licensing of such products. Any changes in U.S. or foreign law that change our operating requirements with respect to optional insurance products could increase our costs... -

Page 24

... negatively impact our results. Litigation Relating to the Constitutionality of the Removal of Vicarious Liability The federal Highway Bill removed unlimited vicarious liability for vehicle rental and leasing companies, limiting exposure to state minimum financial responsibility amounts. Before... -

Page 25

.... Dollar and Thrifty each operate company-owned stores under concession agreements with various governmental authorities charged with the operation of airports. Concession agreements for airport locations, which are usually competitively bid, are important for securing air traveler business. These... -

Page 26

... the Colorado Uniform Declaratory Judgment Law related to the assessment of loss of use and administrative fees in connection with vehicle damage claims against renters. The case is styled: Susan and Jeffrey Dillon v. DTG Operations, Inc. d/b/a Thrifty Car Rental (Case No. 09CH34874, Cook County... -

Page 27

... FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES DTG's common stock is listed on the NYSE under the trading symbol "DTG." The high and low closing sales prices for the common stock for each quarterly period during 2009 and 2008 were as follows... -

Page 28

..., appliances, tools and other miscellaneous goods. The results are based on an assumed $100 invested on December 31, 2004, and reinvestment of dividends through December 31, 2009. COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN AMONG DOLLAR THRIFTY AUTOMOTIVE GROUP, RUSSELL 2000 INDEX AND HEMSCOTT... -

Page 29

... from Company records. Year Ended December 31, 2007 2006 2009 Statements of Operations: (in thousands except per share amounts) 2008 2005 Revenues: Vehicle rentals Other Total revenues Costs and expenses: Direct vehicle and operating Vehicle depreciation and lease charges, net Selling, general... -

Page 30

...429 836 369 483 852 Company-owned Stores Data: Vehicle rental data: Average number of vehicles operated Number of rental days Vehicle utilization Average revenue per day Monthly average revenue per vehicle Average depreciable fleet Monthly average depreciation (net) per vehicle $ $ $ 102,948 30,616... -

Page 31

... OF OPERATIONS The Company operates two value rental car brands, Dollar and Thrifty. The majority of its customers pick up their vehicles at airport locations. Both brands are value priced and the Company seeks to be the industry's low cost provider. Leisure customers typically rent vehicles for... -

Page 32

... The tax effect of the (increase) decrease in fair value of derivatives is calculated using the entity-specific, U.S. federal and blended state tax rate applicable to the derivative instruments which amounts are ($11,931,000), $14,843,000 and $16,177,000 for the years ended December 31, 2009, 2008... -

Page 33

...to GAAP results. Year Ended December 31, 2008 2007 (in thousands) 2009 Reconciliation of net income (loss) to Corporate Adjusted EBITDA Net income (loss) - as reported (Increase) decrease in fair value of derivatives Non-vehicle interest expense Income tax expense (benefit) Non-vehicle depreciation... -

Page 34

...operations: 2009 Revenues: Vehicle rentals Other Total revenues Costs and expenses: Direct vehicle and operating Vehicle depreciation and lease charges, net Selling, general and administrative Interest expense, net Goodwill and long-lived asset impairment Total costs and expenses (Increase) decrease... -

Page 35

...2009 Compared with Year Ended December 31, 2008 Operating Results The Company had income before income taxes of $81.0 million for 2009 compared to a loss before income taxes of $456.8 million in 2008. Revenues $ Increase/ (decrease) (in millions) 2009 2008 % Increase/ (decrease) Vehicle rentals... -

Page 36

... unit in 2008. The decrease in the depreciation rate is due to extended vehicle holding periods, improved conditions in the used car market and increased residual values in 2009 as compared to 2008, partially offset by an increase due to the one-time $12.9 million settlement of certain manufacturer... -

Page 37

... increasing the consolidated effective tax rate in 2009, and reducing the consolidated effective tax rate in 2008, due to an overall pre-tax loss. Year Ended December 31, 2008 Compared with Year Ended December 31, 2007 Operating Results The Company had a loss before income taxes of $456.8 million... -

Page 38

...decrease) (in millions) 2008 2007 % Increase/ (decrease) Direct vehicle and operating Vehicle depreciation and lease charges, net Selling, general and administrative Interest expense, net of interest income Goodwill and long-lived asset impairment Total expenses (Increase) decrease in fair value... -

Page 39

...wrote off certain fleet related software totaling $3.7 million made obsolete by the Pros Fleet Management Software the Company began implementing during the third quarter of 2007. The change in fair value of the Company's interest rate swap agreements was a decrease of $36.1 million in 2008 compared... -

Page 40

... by the purchase of revenue-earning vehicles, which totaled $1.1 billion and the $100 million of cash and cash equivalents required to be maintained at all times under the Company's amendment of the Senior Secured Credit Facilities separately identified on the face of the balance sheet as cash and... -

Page 41

... fund its revenue-earning vehicles with cash provided from operations and from disposal of used vehicles. The Company also used net cash for non-vehicle capital expenditures of $15.5 million. These expenditures consist primarily of airport facility improvements for the Company's rental locations and... -

Page 42

... 10 of Notes to Consolidated Financial Statements. Amounts include both principal and interest payments. Amounts exclude related discounts, where applicable. The Company also has self-insured liabilities related to third-party bodily injury and property damage claims totaling $108.6 million that are... -

Page 43

... Series 2005-1 Notes. In November 2009, the Company had fully utilized the $200 million re-designation capacity. In relation to the amendments to the medium term note programs, the Company amended its Senior Secured Credit Facilities, whereby the Company may not increase the available amount of the... -

Page 44

... vehicle fleet by incurring additional secured vehicle debt and with cash generated from operations. The Company has significant requirements for bonds and letters of credit to support its insurance programs, airport concession and other obligations. At December 31, 2009, various insurance companies... -

Page 45

... the life used for depreciation purposes could result in a significant loss on sale. A one percent change in the expected residual value of Non-Program Vehicles sold during 2009 would have impacted vehicle depreciation expense net by $4.7 million. In 2009, the Company increased the holding term on... -

Page 46

... option rights and restricted stock to key employees and non-employee directors. The Company's performance share awards contain both a performance condition and a market condition. The Company uses the closing market price of DTG's common stock on the date of grant to estimate the fair value... -

Page 47

... in moderate price increases in revenue per day on a year-over-year basis. Finally, the Company believes that recent favorable trends in the used vehicle markets will continue throughout 2010, resulting in solid residual values and improvements in monthly fleet operating costs year over year. Based... -

Page 48

... of the Company. The fair value and average receive rate of the interest rate swaps is calculated using projected market interest rates over the term of the related debt instruments as provided by the counterparties. Expected Maturity Dates as of December 31, 2009 (in thousands) Debt: Vehicle debt... -

Page 49

... rates Vehicle debt and obligationsCanadian dollar denominated Weighted average interest rates Non-vehicle debt - term loan Weighted average interest rates Interest Rate Swaps: Variable to Fixed Average pay rate Average receive rate $ $ 2009 2010 2011 2012 2013 Thereafter Total Fair Value... -

Page 50

... balance sheets of Dollar Thrifty Automotive Group, Inc. and subsidiaries (the "Company") as of December 31, 2009 and 2008, and the related consolidated statements of operations, stockholders' equity and comprehensive income (loss), and cash flows for each of the three years in the period ended... -

Page 51

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS YEAR ENDED DECEMBER 31, 2009, 2008 AND 2007 (In Thousands Except Per Share Data) 2009 REVENUES: Vehicle rentals Other Total revenues COSTS AND EXPENSES: Direct vehicle and operating Vehicle depreciation and ... -

Page 52

...In Thousands Except Share and Per Share Data) 2009 ASSETS Cash and cash equivalents Cash and cash equivalents-required minimum balance Restricted cash and investments Receivables, net Prepaid expenses and other assets Revenue-earning vehicles, net Property and equipment, net Income taxes receivable... -

Page 53

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY AND COMPREHENSIVE INCOME (LOSS) YEAR ENDED DECEMBER 31, 2009, 2008 AND 2007 (In Thousands Except Share and Per Share Data) Common Stock $.01 Par Value Shares Amount BALANCE, JANUARY 1, 2007 Issuance... -

Page 54

... impairment Interest income earned on restricted cash and investments Performance share incentive, stock option and restricted stock plans Provision for losses on receivables Deferred income taxes (Increase)/decrease in fair value of derivatives Change in assets and liabilities, net of acquisitions... -

Page 55

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS YEAR ENDED DECEMBER 31, 2009, 2008 AND 2007 (In Thousands) 2009 CASH FLOWS FROM FINANCING ACTIVITIES: Debt and other obligations: Proceeds from vehicle debt and other obligations Payments of vehicle debt and... -

Page 56

..., insurance and other services to franchisees. RCFC and DTFC provide vehicle financing to the Company. Estimates - The preparation of the Company's consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to... -

Page 57

... the term of the related debt using the effective interest method. Revenue-Earning Vehicles and Related Vehicle Depreciation Expense - Revenue-earning vehicles are stated at cost, net of related discounts. In 2009, the Company continued to increase the level of Non-Program Vehicles in its fleet and... -

Page 58

... in fair value are recorded in accumulated other comprehensive loss (Note 11). Vehicle Insurance Reserves - Provisions for public liability and property damage and supplemental liability insurance ("SLI") on self-insured claims are made by charges primarily to direct vehicle and operating expense... -

Page 59

... allowance related to DTG Canada and a portion of the Company's net operating losses for state tax purposes. The Company evaluates its tax policies quarterly under ASC Topic 740, "Income Taxes" ("ASC Topic 740") to identify uncertain tax positions. Earnings Per Share - Basic earnings per share ("EPS... -

Page 60

...of the financial statements. The Company noted no reportable subsequent events. New Accounting Standards - In September 2006, the Financial Accounting Standards Board ("FASB") defined fair value, issued a framework to account for measuring fair value, and expanded the related disclosure requirements... -

Page 61

... will have a significant impact on the Company's consolidated financial statements. In June 2009, the FASB issued "The FASB Accounting Standards CodificationTM and the Hierarchy of Generally Accepted Accounting Principles" which is effective for interim periods ending after September 15, 2009 and is... -

Page 62

..., all options to purchase shares of common stock were included in the computation of diluted EPS because no exercise price was greater than the average market price of the common shares. 4. RECEIVABLES Receivables consist of the following: December 31, 2009 (In Thousands) Trade accounts receivable... -

Page 63

Trade accounts receivable include primarily amounts due from rental customers, franchisees and tour operators arising from billings under standard credit terms for services provided in the normal course of business. Other vehicle manufacturer receivables include primarily amounts due under ... -

Page 64

... depreciation and lease charges include the following: Year Ended December 31, 2008 (In Thousands) $ 539,024 (774) 1,156 539,406 $ 2009 Depreciation of revenue-earning vehicles Net gains from disposal of revenue-earning vehicles Rents paid for vehicles leased $ 2007 493,712 (18,745) 2,886 477... -

Page 65

... annual basis to perform a goodwill impairment assessment, which requires, among other things, a reconciliation of current equity market capitalization to stockholders' equity. As a result of the decline in the Company's stock price during the first quarter of 2008, the Company's total stockholders... -

Page 66

... receivables related to revenue-earning vehicles are available to satisfy the claims of its creditors. Dollar and Thrifty lease vehicles from RCFC under the terms of a master lease and servicing agreement. The asset backed medium term note indentures also provide for additional credit enhancement... -

Page 67

..., at any time, the aggregate amount of such letters of credit would exceed $24.4 million. The Company believes that conditions in the asset backed medium term note market have improved during the last half of 2009. The Company intends to use a combination of cash on its balance sheet and new vehicle... -

Page 68

... least $60 million in separate accounts with the Collateral Agent to secure payment of amounts outstanding under the Term Loan and letters of credit issued under the Revolving Credit Facility. Additionally, the Company agreed to a 50 basis point increase in the interest rate on its Term Loan and its... -

Page 69

... have any impact on, the Company's existing medium term notes and enhancement letters of credit. During 2009, the Company paid $6.6 million in financing issue costs primarily related to various amendments of its asset backed medium term notes and Senior Secured Credit Facilities. Expected maturities... -

Page 70

... approximately $13.2 million of net deferred loss related to the 2007 Swap will be reclassified into earnings within the next 12 months. 12. FAIR VALUE MEASUREMENTS Financial instruments are presented at fair value in the Company's balance sheets. Fair value is defined as the price which would be... -

Page 71

... not reported at fair value as of the transition, but rather set to equal fair value of the assets held in the related rabbi trust. Note: Deferred Compensation Plan Liabilities, which were disclosed in the fair value disclosure table above in the Consolidated Financial Statements for the year ended... -

Page 72

... be federally insured. The Company has not experienced any losses in such accounts and believes it is not exposed to significant credit risk. Debt and Other Obligations - At December 31, 2009, the fair value of the asset backed medium term notes with fixed interest rates of $110.4 million was more... -

Page 73

...are equal to the fair market value of the Company's common stock at the date of grant, except for the initial grant, which was made at the initial public offering price. The non-qualified option rights have a term not exceeding ten years from the date of grant. The maximum number of shares for which... -

Page 74

... the fair value of the options at the date of the grant. The assumptions used to calculate compensation expense relating to the stock option awards granted during 2009 and 2008 were as follows: 2009 Weighted-average expected life (in years) Expected price volatility Risk-free interest rate Dividend... -

Page 75

..., share-based compensation deductions are, effectively, always considered last to be realized. Due to full utilization of the net operating losses in 2009, the Company realized $1.3 million in tax benefits from the options exercised. The Company did not realize any tax benefits from option exercises... -

Page 76

... on the current accounting accrual, but will not be issued until the end of the performance period or earlier, if needed to comply with the Internal Revenue Code Section 409A. Any performance share installments not earned at the end of the requisite service period are forfeited. In March 2009, the... -

Page 77

... stock units to key employees and non-employee directors. The grant-date fair value of the award is based on the closing market price of the Company's common shares at the date of the grant. The Company recognizes compensation expense on a straight-line basis over the vesting period. In January 2009... -

Page 78

...other comprehensive income that relates to the interest rate swap and foreign currency translation, and ($1.3 million) of tax benefit of equity compensation recognized as an increase to paid-in capital. During 2009, the Company utilized all of the remaining federal net operating loss ("NOL") and has... -

Page 79

...statement of operations. No amounts were recognized for interest and penalties under ASC Topic 740 during the years ended December 31, 2009, 2008 and 2007. Restatement Relating to 2008 Income Tax Benefit and Deferred Tax Liability In late 2009, the Company's management determined that the income tax... -

Page 80

... agreements provide airport terminal counter space in return for a minimum rent. In many cases, the Company's subsidiaries are also obligated to pay insurance and maintenance costs and additional rents generally based on revenues earned at the location. Certain of the airport locations are operated... -

Page 81

...The Company maintains insurance for losses above these levels. The Company continues to retain the risk of loss on SLI policies sold to vehicle rental customers. The Company records reserves for its vehicle liability exposure using actuarially-based loss estimates, which are updated semi-annually in... -

Page 82

... Dollar and Thrifty brands. Consistent with this structure, management makes business and operating decisions on an overall company basis. Included in the consolidated financial statements are the following amounts relating to geographic locations: Year Ended December 31, 2008 (In Thousands) 2009... -

Page 83

... Restatement of Cash Flow Statement Presentation Related to Purchases and Sales of Revenue-Earning Vehicles The Company has restated its consolidated statement of cash flows for the years ended December 31, 2008 and 2007 to exclude the impact of sales of revenue-earning vehicles for which proceeds... -

Page 84

... of sales of revenue-earning vehicles and incentives related to vehicle purchases for which cash has not been received is to exclude them from both the operating and investing sections of the cash flow statement, with supplemental disclosure of such amounts reported in the footnotes. The impact of... -

Page 85

... and increased net loss by $6.3 million or $0.30 per share. Operating income (loss) in the table above represents pre-tax income before interest, goodwill and long-lived asset impairment and (increase) decrease in fair value of derivatives. During the second and fourth quarters of 2009, the Company... -

Page 86

.... The prospective restatements of 2009 amounts in 2010 quarterly periods will be as follows: Three Months Ended March 31, 2009 (unaudited) As Previously As Reported Adjustment Restated (In Thousands) Net cash provided by operating activities Net cash provided by investing activities CHANGE IN CASH... -

Page 87

SCHEDULE II DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS YEAR ENDED DECEMBER 31, 2009, 2008 AND 2007 Balance at Beginning of Year Additions Charged to Charged to costs and other expenses accounts (In Thousands) Deductions Balance at End of Year 2009 ... -

Page 88

... to the Company's management and board of directors regarding the preparation and fair presentation of published financial statements. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only... -

Page 89

... below under "Attestation Report of the Registered Public Accounting Firm". Changes in Internal Control Over Financial Reporting There has been no change in the Company's internal control over financial reporting as defined in Rules 13(a)-15(f) and 15(d)-15(f) under the Exchange Act during the last... -

Page 90

...INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Dollar Thrifty Automotive Group, Inc.: We have audited the internal control over financial reporting of Dollar Thrifty Automotive Group, Inc. and subsidiaries (the "Company") as of December 31, 2009, based on... -

Page 91

... have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the year ended December 31, 2009 of the Company and our report dated March 4, 2010 expressed an... -

Page 92

... the fiscal year ended December 31, 2009 with respect to the Second Amended and Restated Long-Term Incentive Plan and Director Equity Plan ("LTIP") under which Common Stock of the Company is authorized for issuance: Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and... -

Page 93

... 120 days after the end of the Company's fiscal year ended December 31, 2009, and is incorporated herein by reference. ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES Reference is made to the information appearing under "Proposal No. 2 - Appointment of Independent Registered Public Accounting Firm... -

Page 94

... as of April 16, 2002 by and among Rental Car Finance Corp., Dollar, Thrifty, and Deutsche Bank Trust Company Americas, formerly known as Bankers Trust Company, filed as the same numbered exhibit with DTG's Form 10-Q for the quarterly period ended June 30, 2002, filed August 13, 2002, Commission... -

Page 95

... Assignment of Exchange Agreement dated as of March 28, 2006 among Rental Car Finance Corp., DTG Operations, Inc. and Deutsche Bank Trust Company Americas, filed as the same numbered exhibit with DTG's Form 8-K, filed April 3, 2006, Commission No. 1-13647* Note Guaranty Insurance Policy No. AB0981BE... -

Page 96

... Vehicle Lease and Servicing Agreement (Group II) dated as of February 14, 2007 among Rental Car Finance Corp., DTG Operations, Inc., Dollar Thrifty Automotive Group, Inc. and Deutsche Bank Trust Company Americas, filed as the same numbered exhibit with DTG's Form 10-Q for the quarterly period ended... -

Page 97

...* Enhancement Letter of Credit Application and Agreement dated as of June 15, 2007 among DTG Operations, Inc., Rental Car Finance Corp., Dollar Thrifty Automotive Group, Inc. and Deutsche Bank Trust Company Americas (Series 2004-1), filed as the same numbered exhibit with DTG's Form 8-K, filed June... -

Page 98

... among Rental Car Finance Corp., Dollar Thrifty Automotive Group, Inc., DTG Operations, Inc., Dollar Thrifty Funding Corp., Deutsche Bank Trust Company Americas, Deutsche Bank AG, New York Branch, JPMorgan Chase Bank, N.A., The Bank of Nova Scotia, Credit Suisse, acting through its New York Branch... -

Page 99

...Master Collateral Agent, filed as the same numbered exhibit with DTG's Form 8-K, filed June 8, 2009, Commission File No. 1-13647* Letter Agreement, dated as of June 2, 2009, among Dollar Thrifty Automotive Group, Inc., Ambac Assurance Corporation and Financial Guaranty Insurance Company, relating to... -

Page 100

... the Vehicle Supply Agreement between DaimlerChrysler Motors Company, LLC and DTG, filed as the same numbered exhibit with DTG's Form 10-Q for the quarterly period ended June 30, 2004, filed August 6, 2004, Commission File No. 113647* Dollar Thrifty Automotive Group, Inc. Retirement Savings Plan... -

Page 101

...Dollar Thrifty Automotive Group, Inc. Retirement Savings Plan, with Appendix C attached, filed as the same numbered exhibit with DTG's Form 8-K, filed February 7, 2006, Commission File No. 1-13647†* First Amendment to Amended and Restated Long-Term Incentive Plan and Director Equity Plan effective... -

Page 102

... numbered exhibit with DTG's Form 8-K, filed February 6, 2007, Commission File No. 1-13647†* Credit Agreement dated as of June 15, 2007 among Dollar Thrifty Automotive Group, as the borrower, various financial institutions as are or may become parties thereto, Deutsche Bank Trust Company Americas... -

Page 103

... executed by John C. Pope, filed as the same numbered exhibit with DTG's Form 10-K for the fiscal year ended December 31, 2007, filed February 29, 2008, Commission File No. 1-13647†* Consent to Action in Lieu of Meeting of the Board of Directors of Dollar Thrifty Automotive Group, Inc. effective... -

Page 104

...Trust Company Americas, as administrative agent, and various financial institutions as are party to the Credit Agreement, filed as the same numbered exhibit with DTG's Form 8-K, filed September 30, 2008, Commission File No. 1-13647* Dollar Thrifty Automotive Group, Inc. 2008/2009 Executive Retention... -

Page 105

... Amendment to Credit Agreement dated as of February 25, 2009 among Dollar Thrifty Automotive Group, Inc., as borrower, Deutsche Bank Trust Company Americas, as administrative agent, and various financial institutions as are party thereto, filed as the same numbered exhibit with DTG's Form 8-K, filed... -

Page 106

...25, 2009 and effective as of June 26, 2009, among Dollar Thrifty Automotive Group, Inc., as borrower, Deutsche Bank Trust Company Americas, as administrative agent and letter of credit issuer, and various financial institutions as are party thereto, filed as the same numbered exhibit with DTG's Form... -

Page 107

... of DTG** Consent of HoganTaylor LLP regarding Registration Statement on Form S8, Registration No. 333-89189, filed as the same numbered exhibit with Dollar Thrifty Automotive Group, Inc. Retirement Savings Plan's Form 11-K for the fiscal year ended December 31, 2008, filed June 24, 2009, Commission... -

Page 108

..., thereunto duly authorized. Date: March 4, 2010 DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. By: Name: Title: /s/ SCOTT L. THOMPSON Scott L. Thompson President and Principal Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 109

...the applicable director Dollar Thrifty Automotive Compensation Plan Group, Inc. 2010 Executive Incentive 10.229 10.230 10.231 10.232 10.233 Second Amendment effective as of February 24, 2010, to the Vehicle Supply Agreement dated as of February 9, 2009, between Ford Motor Company and DTG (portions... -

Page 110

...19, 2009, Scott L. Thompson, Chief Executive Officer, submitted to the New York Stock Exchange the Annual CEO Certification that he was not aware of any violation by Dollar Thrifty Automotive Group, Inc. of the New York Stock Exchange listing standards. Worldwide Reservations Dollar Rent A Car 1-800... -

Page 111

Dollar Thrifty Automotive Group, Inc. 5330 East 31st Street PO Box 35985 Tulsa, OK 74153-0985 Telephone: 918-660-7700 www.dtag.com