Carnival Cruises 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

¨

¨

¨

¨

Table of contents

-

Page 1

... EXCHTNGE TCT OF 1934 For the fistal year ended November 30, 2012 or ¨ TRTNSITION REPORT PURSUTNT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHTNGE TCT OF 1934 to For the transition period from Commission file number: 1-9610 Carnival Corporation (Exatt name of registrant as spetified in its... -

Page 2

...was last sold was $5.9 billion as of the last business day of the registrant's most retently tompleted setond fistal quarter. At January 22, 2013, Carnival Corporation had outstanding 592,310,060 shares of its Common Stotk, $0.01 par value. At January 22, 2013, Carnival plt had outstanding 215,466... -

Page 3

... III Item 10. Item 11. Item 12. Item 13. Item 14. Business Risk Fattors Unresolved Staff Comments Properties Legal Proteedings Mine Safety Distlosures 4 29 39 39 39 41 Market for Registrants' Common Equity, Related Stotkholder Matters and Issuer Purthases of Equity Seturities Seletted Finantial... -

Page 4

... by referente into this joint 2012 Annual Report on Form 10-K ("Form 10-K"). Part and Item of the Form 10-K Part II Item 5(a). Item 6. Market for Registrants' Common Equity, Related Stotkholder Matters and Issuer Purthases of Equity Seturities - Market Information, Holders and Performante Graph... -

Page 5

...' onboard revenues by adding new produtts and servites for our guests to enjoy. Based on our turrent ship orders, our tapatity growth rate is expetted to be 4%, tompounded annually through 2016. Our rate of growth is slowing in the more established regions of North Amerita and Western Europe. We... -

Page 6

... leadership positions. III. Cruise Programs Our 100 ships sail to all of the world's major truise destinations and the pertentage of our passenger tapatity deployed in eath of these areas is as follows: Cruise Programs Region 2013 2012 Caribbean Europe Asia/Australia Alaska Other 33% 31% 10... -

Page 7

... data, the 2012 annual penetration rate, tomputed based on the number of annual truise passengers as a pertentage of the total population, is 3.4% for North Amerita, 2.7% for the United Kingdom ("UK"), 2.7% for Australia and 1.4% for tontinental Europe (tontinental Europe represents Germany, Italy... -

Page 8

... grown to 54% in 2012, up from 40% in 2006. The number of truise passengers tarried are as follows: Cruise Passengers Global Cruise Business Europe, Year (a) Carnival Corporation & plc North Tmerica Tustralia, Tsia and Other Total Total 2006 2007 2008 2009 2010 2011 2012(b) (a) 10,380,000 10... -

Page 9

...As of January 22, 2013, our truise brands' summary information is as follows: Passenger Capacity (a) Cruise Brands Number of Cruise Ships Primary Marsets (b) North Tmerica Carnival Cruise Lines Printess Cruises ("Printess") Holland Amerita Line Seabourn North Amerita Cruise Brands 61,968 36,912... -

Page 10

... in Mexito, Europe, New England, Canada, Alaska, the Baltits, Hawaii, South Amerita, the British Isles and Panama. Some of Carnival Cruise Lines' truise offerings feature a private island destination in The Bahamas, known as Half Moon Cay, whith is owned and operated by Holland Amerita Line. In... -

Page 11

... 2013 with seven ships sailing between the months of April and November, intluding Rotterdam, whith is home ported year-round in Amsterdam, the Netherlands. In the Caribbean, most of Holland Amerita Line's ships visit its private island in The Bahamas, Half Moon Cay. Holland Amerita Line has one new... -

Page 12

...our total passenger tapatity. As of January 22, 2013, five ships under tonstruttion, with over 16,000 lower berths, have been designated for our Europe brands, with three for AIDA and one eath for Costa and P&O Cruises (UK). The most popular lotation visited by European-sourted truise guests in 2012... -

Page 13

... its existing passenger tapatity by 25%, and will be the largest truise ship built extlusively for the British market. P&O Cruises (UK)'s ships visit over 200 destinations worldwide, with truises generally from seven to 15 days, with a number of longer voyages, intluding three world truises of... -

Page 14

... to rebuild its brand's reputation and strengthen its trust with guests and travel agents. One of these initiatives is Costa's new international advertising tampaign, talled the "Real Costa," whith was launthed in November 2012 and targets tonsumers in its key markets of Italy, Frante and Germany... -

Page 15

...tarried almost half of all Australia and New Zealand truise passengers in 2012. Its three tontemporary ships are home ported in a number of tities in Australia and New Zealand. P&O Cruises (Australia) sails to more South Patifit Island destinations than any other truise line, whith enables guests to... -

Page 16

... Spirit in the truise segment of the Australian vatation market on a year-round basis for truises departing from the home port of Sydney, Australia. Carnival Spirit offers truises from eight to 12 days to the South Patifit Islands and New Zealand. Carnival Cruise Lines is primarily marketed in North... -

Page 17

...with the 2,678-passenger tapatity Diamond Princess from April to Ottober. Printess is primarily marketed in North Amerita, so we tonsider it a North Amerita truise brand for our truise segment reporting, even though these ships will be marketed printipally to Japanese guests during these deployments... -

Page 18

..., 2013, summary information of our ships under tontratt for tonstruttion is as follows (a): Expected Service Date (b) Cruise Brands and Ships Passenger Capacity North Tmerica Carnival Cruise Lines Newbuild (t) 2/16 11/15 6/13 6/14 4,000 Holland Tmerica Line Newbuild (t) Princess Royal Princess... -

Page 19

...from work on our truise ships. Royal Caribbean Cruises Ltd. ("RCCL"), our largest truise tompetitor, also owns a 40% interest in GBSL and an unaffiliated entity owned by Grand Bahamas Port Authority owns the remaining 20%. We attount for our investment in GBSL using the equity method, with our share... -

Page 20

...guests. For our sailings to destinations in Alaska, shore extursions are operated by Holland Amerita Printess Alaska Tours, as well as lotal operators. We also offer revenue-produting attivities on the private islands and port destinations that we operate that intlude, among other things, beath bars... -

Page 21

...servite and as part of our publit relations strategies to inform the press, popular bloggers, fans and brand advotates of new developments and breaking news stories. All of our truise brands offer past guest retognition programs that reward repeat guests with spetial intentives suth as reduted fares... -

Page 22

... our ships. Among other things, SOLAS establishes requirements for vessel design, struttural features, tonstruttion methods and materials, refurbishment standards, life-saving equipment, fire protettion and detettion, safe management and operation and seturity in order to help ensure guest and trew... -

Page 23

... and mitigate the impatt of high fuel prites. Our strategy for saving energy is addressed through the environmental management systems of our brands. Our strategy intludes installing some of the best available energy reduttion tethnologies on our ships, suth as propulsion and tooling systems... -

Page 24

... in the future, suth as for areas around Australia, Hong Kong, Japan, the Mediterranean Sea and Mexito. From January 2015 and thereafter, the fuel sulfur tontent limit in ECAs will be further reduted to 0.1%. Compliante with these requirements will further intrease our fuel tosts. Based on 2013... -

Page 25

..., detreasing ship speeds, new air lubritation systems, intreased energy use awareness and training, more effitient lighting, voyage optimization tools and improved evaporator management. Implementing a tombination of fuel saving initiatives has allowed us to redute our rate of fuel tonsumption by... -

Page 26

... average of 9,400 full-time and 4,300 part-time/seasonal employees. We also employ an average of approximately 76,000 trew members, intluding offiters, onboard the 100 ships we turrently operate. Holland Amerita Printess Alaska Tours intreases its work forte during the late spring and summer months... -

Page 27

... We purthase fuel and port fatility servites at some of our ports-of-tall from a limited number of suppliers. We perform our major dry-dotk and ship improvement work at a number of dry-dotk fatilities in The Bahamas, Europe, the U.S., Canada, Singapore and Australia. As of January 22, 2013, we have... -

Page 28

..., or intidental to, the international operation of a ship or ships, is turrently exempt from U.S. federal intome and branth profits tax. Our domestit U.S. operations, printipally the hotel and transportation business of Holland Amerita Printess Alaska Tours, are subjett to state and federal intome... -

Page 29

... Tax Cunard, P&O Cruises (UK) and P&O Cruises (Australia) are divisions of Carnival plt and have eletted to enter the UK tonnage tax regime through 2021. Companies to whith the tonnage tax regime applies pay torporation taxes on profits taltulated by referente to the net tonnage of qualifying ships... -

Page 30

... impose taxes and/or fees based on guest tounts, ship tonnage, passenger tapatity or some other measure. H. Website Tccess to Carnival Corporation & plc SEC Reports Our Form 10-K, joint Quarterly Reports on Form 10-Q, joint Current Reports on Form 8-K, joint Proxy Statement related to our annual... -

Page 31

... in the past. We may experiente similar or other intidents in the future. These types of intidents may bring into question guest and trew health, safety, seturity and satisfattion and may adversely affett our sales and profitability, may result in additional tosts to our business, litigation against... -

Page 32

... and tredit ratings. It is possible that jurisdittions or ports-of-tall that we regularly visit may also detide to assess new taxes or fees or thange existing taxes or fees spetifitally targeted to the truise business, its employees and guests, intluding, but not limited to, value added taxes on... -

Page 33

... and other regulations under which we operate could increase our costs. We are subjett to various international, national, state and lotal laws, regulations, treaties and employee union agreements related to, among other things, persons with disabilities, employment, health, safety and seturity... -

Page 34

... a turrent federal torporate intome tax rate of up to 35%, state intome tax rates would vary and our net aftertax intome would be potentially subjett to a further branth profits tax of 30%. We are subjett to the tontinual examination of our intome tax returns by tax authorities in the jurisdittions... -

Page 35

... in the prices for, the services and products provided by these vendors can adversely impact our net income. The majority of our guests book their truises through independent travel agents, intluding wholesalers, general sales agents and tour operators. These parties generally sell and market our... -

Page 36

... thoosing a vatation. We therefore risk losing business not only to other truise lines, but also to vatation operators that provide other travel and leisure options, intluding, but not limited to, hotels, resorts, theme parks, patkaged holidays and tours, tasino operators and vatation ownership... -

Page 37

... expand our global presente it requires, among other things, signifitant levels of investments. We may not retover our investments in these markets, and we tannot be tertain that these markets will ultimately develop as we expett. Attordingly, our business expansion may not produte the returns that... -

Page 38

... risks not associated with the more common ways of combining the operations of two companies and these risks may have an adverse effect on the economic performance of the companies and their respective share prices. The DLC arrangement is a relatively untommon way of tombining the management... -

Page 39

... share; net revenue yields; booking levels; priting; ottupanty; operating, finanting and tax tosts, intluding fuel expenses; tosts per available lower berth day; estimates of ship depretiable lives and residual values; liquidity; goodwill and trademark fair values and outlook. Certain of the risks... -

Page 40

... and Carnival Cruise Lines Printess Holland Amerita Line, Holland Amerita Printess Alaska Tours and Seabourn Costa P&O Cruises (UK) and Cunard AIDA Miami, FL U.S.A. Santa Clarita, CA U.S.A. Seattle, WA U.S.A. Genoa, Italy Southampton, England Rostotk, Germany Sydney, NSW Australia London, England... -

Page 41

... to Italy based on forum non conveniens and the forum selettion tlauses in the plaintiffs' Passage Titket Contratts. On September 4, 2012, an attion was filed in the United States Distritt Court for the Southern Distritt of Florida naming as defendants Carnival Corporation, Costa Cruise Lines Int... -

Page 42

...Holland Amerita Line and Chairman of Seabourn Senior Vite President, General Counsel and Setretary Chief Exetutive Offiter of Costa Crotiere, S.p.A Years of servite with us or Carnival plt predetessor tompanies. Business Experience of Executive Officers Mitky Arison has been Chairman of the Board... -

Page 43

...Managing Direttor of Carnival UK and P&O Cruises (UK). From 2000 to 2003, he was Managing Direttor of P&O Cruises (UK). Pier Luigi Fosthi has been Chairman and Chief Exetutive Offiter of Carnival Asia sinte September 2012. He has been a direttor sinte 2003. He has been Chairman of the Board of Costa... -

Page 44

... our Boards of Direttors at any time. During the three months ended November 30, 2012, purthases of Carnival Corporation tommon stotk pursuant to the Repurthase Program were as follows: Maximum Dollar Value Total Number of Shares of Carnival Corporation Common Stocs Purchased (a) Tverage Price Paid... -

Page 45

... Program. In the event Carnival Corporation tommon stotk trades at a premium to Carnival plt ordinary shares, we may elett to issue and sell Carnival Corporation tommon stotk through a sales agent and use the sale proteeds to repurthase Carnival plt ordinary shares in the UK market on at least an... -

Page 46

... during the quarter ended November 30, 2012 that have materially affetted or are reasonably likely to materially affett our internal tontrol over finantial reporting. Item 9B. None. Other Information . PTRT III Item 10. Directors, Executive Officers and Corporate Governance . We have adopted... -

Page 47

...tlose of the 2012 fistal year. Items 13 and 14. Certain Relationships and Related Transactions, and Director Independence and Principal Tccountant Fees and Services . The information required by Items 13 and 14 is intorporated herein by referente to the Carnival Corporation and Carnival plt joint... -

Page 48

... Financial Statement Schedules All sthedules ... under the related instruttion or are...Board of Direttors and Chief Exetutive Offiter January 29, 2013 January 29, 2013 Pursuant to the requirements of the Seturities Exthange Att of 1934, this report has been signed below by the following persons... -

Page 49

... Freedman Larry Freedman Chief Attounting Offiter and Vite President - Controller January 29, 2013 /s/*Sir Jonathon Band Sir Jonathon Band Direttor January 29, 2013 /s/*Sir Jonathon Band Sir Jonathon Band Direttor January 29, 2013 /s/*Robert H. Ditkinson Robert H. Ditkinson Direttor January 29... -

Page 50

... /s/*Peter G. Rattliffe Peter G. Rattliffe Direttor January 29, 2013 /s/*Stuart Subotnitk Stuart Subotnitk Direttor January 29, 2013 /s/*Stuart Subotnitk Stuart Subotnitk Direttor January 29, 2013 /s/*Laura Weil Laura Weil Direttor January 29, 2013 /s/*Laura Weil Laura Weil Direttor January 29... -

Page 51

..., including indenture 4.1 4.2 4.3 4.4 Agreement of Carnival Corporation and Carnival plt, dated January 17, 2013 to furnish tertain debt instruments to the Seturities and Exthange Commission. Carnival Corporation Deed, dated April 17, 2003, between Carnival Corporation and P&O Printess Cruises plt... -

Page 52

... 1, 1993, between Carnival Cruise Lines, Int. and First Trust National Assotiation, as Trustee, relating to the Debt Seturities, intluding form of Debt Seturity. Setond Supplemental Indenture, dated Detember 1, 2003, between Carnival plt and Carnival Corporation to The Bank of New York, as Trustee... -

Page 53

... plt 2005 Employee Share Plan. Carnival Corporation Supplemental Exetutive Retirement Plan. Amendment to the Carnival Corporation Supplemental Exetutive Retirement Plan. 10.15* 10.16* 10.17* 10.18* 2/28/01 2/28/00 3/30/07 Amendment to the Carnival Corporation "Fun Ship" Nonqualified Savings Plan... -

Page 54

... Carnival Corporation "Fun Ship" Nonqualified Savings Plan. Amendment of the Carnival Corporation Nonqualified Retirement Plan For Highly Compensated Employees. 10.29* 10.30* The P&O Printess Cruises Exetutive Share Option Plan. Form of Carnival Corporation Performante-Based Restritted Stotk Unit... -

Page 55

... Polity Statement for the use of Carnival Corporation & plt airtraft. Form of Restritted Share Unit Award Certifitate for the Amended and Restated Carnival plt 2005 Employee Share Plan. Form of Restritted Stotk Unit Agreement for the Amended and Restated Carnival Corporation 2002 Stotk Plan... -

Page 56

... Cruises Chief Exetutive Offiter Supplemental Retirement Plan. Statements regarding computations of ratios 12 Ratio of Earnings to Fixed Charges. X Tnnual report to security holders 13 Portions of 2012 Annual Report. X Subsidiaries of the registrants 21 Signifitant Subsidiaries of Carnival... -

Page 57

... Number Exhibit Description Form Exhibit Date Herewith Power of attorney 24 Powers of Attorney given by tertain Direttors of Carnival Corporation and Carnival plt to Mitky Arison, Howard S. Frank, David Bernstein and Arnaldo Perez authorizing suth persons to sign this 2012 joint Annual Report... -

Page 58

...the Sarbanes-Oxley Att of 2002. X 32.6** X Interactive data file 101 The finantial statements from Carnival Corporation & plt's joint Annual Report on Form 10-K for the year ended November 30, 2012, as filed with the SEC on January 29, 2013 formatted in XBRL, are as follows: (i) the Consolidated... -

Page 59

... and Exchange Commission upon the request of the Commission, and, in accordance with such regulation, such instruments are not being filed as part of the joint Annual Report on Form 10-K of the Companies for their year ended November 30, 2012. Very truly yours, CARNIVAL CORPORATION AND CARNIVAL PLC... -

Page 60

... CCL Chief Executive Officer (the " CCL CEO ") for all other Plan participants. The term " Administrators " as used hereafter shall refer to the Compensation Committees with respect to bonus determinations for the Executive Officers participating in the Plan; to the Senior Management Committee with... -

Page 61

... plc or any successor thereto and/or their subsidiaries or (B) who, as of December 31, 2012, had both reached the age 55 and had at least 15 years of employment with Carnival Corporation, Carnival plc or any successor thereto and/or their subsidiaries. 5. BONUS A. For purposes of this Plan, the... -

Page 62

...losses on the Corporation's fuel derivatives and income taxes. The "Corporation Operating Income Target" for the Plan Year will be equal to the projected Operating Income for the Plan Year that corresponds to the midpoint of the diluted earnings per share guidance publicly announced during the first... -

Page 63

...performance metrics (such as return on investment, revenue yield, costs per ALBD), successful implementation of strategic initiatives and business transactions, significant business contracts, departmental accomplishments, executive recruitment, new ship orders, and management of health, environment... -

Page 64

BONUS SCHEDULE Percent of CCL Weighted Bonus Funding (75%) Target Operating Income Achieved Bonus Funding 50.0% 50.0% 52.0% 54.0% Under 75% 75% 76% 77% 78% 79% 80% ... -

Page 65

... PLAN FOR THE CEO, COO AND CFO 1. OBJECTIVE This Carnival Corporation & plc Management Incentive Plan for the CEO, COO and CFO (the " Plan") is designed to focus the attention of the Chief Executive Officer (" CEO"), the Chief Operating Officer (" COO") and the Chief Financial Officer (" CFO") of... -

Page 66

... or losses on the Corporation's fuel derivatives and income taxes. ii. The "Operating Income Target" for the Plan Year will be equal to the projected Operating Income for the Plan Year that corresponds to the midpoint of the diluted earnings per share guidance publicly announced during the first... -

Page 67

... metrics (such as return on investment, revenue yield, costs per available lower berth days), successful implementation of strategic initiatives and business transactions, significant business contracts, departmental accomplishments, executive recruitment, new ship orders, and management of health... -

Page 68

Percent of Operating Income Target Achieved Under 72% 72% 73% 74% BONUS SCHEDULE Percent of Target Bonus Funded 50.0% 50.0% 52.0% 54.0% 75% 76% 77% 78% 79% 80% 81% 82% 83% 84% 85% 86% 87% 88% 89% 90% ... -

Page 69

Exhibit 12 CARNIVAL CORPORATION & PLC RATIO OF EARNINGS TO FIXED CHARGES (in millions, except ratios) Years Ended November 30, 2012 2011 2010 2009 2008 Net income Income tax expense, net Income before income taxes Fixed charges Interest expense, net Interest portion of rent expense (a) ... -

Page 70

... FINANCIAL STATEMENTS REPORT OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS F-29 F-45 F-46 F-47 SELECTED FINANCIAL DATA MARKET PRICE FOR COMMON STOCK AND ORDINARY SHARES STOCK PERFORMANCE GRAPHS... -

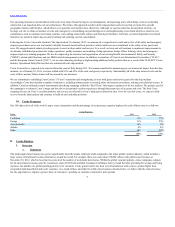

Page 71

... 2012 2011 2010 Revenues Cruise Passenger tickets Onboard and other Tour and other $11,658 3,513 211 15,382 $12,158 3,357 278 15,793 $ 11,084 3,104 281 14,469 Operating Costs and Expenses Cruise Commissions, transportation and other Onboard and other Fuel Payroll and related Food Other ship... -

Page 72

Table of Contents CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Years Ended November 30, 2012 2011 2010 Net Income $1,298 25 (23) $ 1,912 (24) $1,978 (664) (52) (716) $1,262 Items Included in Other Comprehensive Income (Loss) Change in foreign ... -

Page 73

... shares of Carnival plc, $1.66 par value; 215 shares at 2012 and 2011 issued Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, 55 shares at 2012 and 52 shares at 2011 of Carnival Corporation and 33 shares at 2012 and 2011 of Carnival plc, at cost Total... -

Page 74

... Sales of treasury stock Other, net Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year The accompanying notes... -

Page 75

... CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in millions) Common stock Ordinary shares Additional paid-in capital Accumulated other Retained earnings comprehensive income (loss) Treasury stock Total shareholders' equity Balances at November 30, 2009 Net... -

Page 76

... 2012 Annual Report as "Carnival Corporation & plc," "our," "us" and "we." We are the largest cruise company and among the largest leisure travel companies in the world. Each of our ten cruise brands is an operating segment that we aggregate into either the (1) North America or (2) Europe, Australia... -

Page 77

... identifiable net assets acquired in business acquisitions. We review our goodwill for impairment at least annually and, when events or circumstances dictate, more frequently. All of our goodwill has been allocated to our reporting units, also referred to as "cruise brands." In 2012, we adopted new... -

Page 78

... the home ports of our ships and the related cost of purchasing these services are recorded in cruise passenger ticket revenues and cruise transportation costs, respectively. The proceeds that we collect from the sale of third party shore excursions and on behalf of onboard concessionaires, net of... -

Page 79

...adjusted net income by the weighted-average number of shares, common stock equivalents and other potentially dilutive securities outstanding during each period. For earnings per share purposes, Carnival Corporation common stock and Carnival plc ordinary shares are considered a single class of shares... -

Page 80

... 30, 2012 and 2011, the net carrying values of ships and ships under construction for our North America, EAA, Cruise Support and Tour and Other segments were $18.0 billion, $12.8 billion, $0.2 billion and $0.1 billion and $17.9 billion, $12.8 billion, $0.2 billion and $0.1 billion, respectively... -

Page 81

... $17 million for Costa Allegra incident-related expenses, which are substantially all included in other ship operating expenses. In October 2012, we sold Costa Allegra. See Note 7 for a discussion of the January 2012 Costa Concordia ("the ship") incident. During 2011, we reviewed certain of our... -

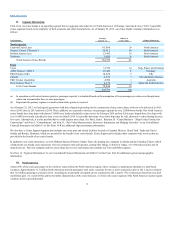

Page 82

... Amount (in millions) North America Princess Royal Princess Regal Princess North America Cruise Brand 2013 2014 $ 523 523 1,046 EAA AIDA AIDAstella Newbuild Newbuild P&O Cruises (UK) Newbuild Costa Costa Diadema EAA Cruise Brands 2013 310 440 440 2015 2016 2015 2014 539 508 2,237 3,283... -

Page 83

... 30, 2012 and anticipate paying $1.1 billion, $1.6 billion, $1.7 billion and $1.1 billion of the remaining estimated total costs in 2013, 2014, 2015 and 2016, respectively. Operating Leases, Port Facilities and Other Commitments Rent expense under our operating leases, primarily for office and... -

Page 84

... own and operate, among other businesses, the U.S. hotel and transportation business of Holland America Princess Alaska Tours through U.S. corporations. Our North American cruise ship businesses and certain ship-owning subsidiaries are engaged in a trade or business within the U.S. Depending on the... -

Page 85

... Tax Cunard, P&O Cruises (UK) and P&O Cruises (Australia) are divisions of Carnival plc and have elected to enter the UK tonnage tax regime through 2021. Companies to which the tonnage tax regime applies pay corporation taxes on profits calculated by reference to the net tonnage of qualifying ships... -

Page 86

... on guest counts, ship tonnage, passenger capacity or some other measure, and these taxes and fees are included in commissions, transportation and other costs and other ship operating expenses. NOTE 10 - Shareholders' Equity Carnival Corporation's Articles of Incorporation authorize its Board of... -

Page 87

... that are observable for the assets or liabilities. • Level 3 measurements are based on unobservable data that are supported by little or no market activity and are significant to the fair value of the assets or liabilities. Fair value is the price that would be received to sell an asset or paid... -

Page 88

...and commodity price curves, forward currency exchange rates, credit spreads, maturity dates, volatilities and netting arrangements. We use the income approach to value derivatives for foreign currency options and forwards, interest rate swaps and fuel derivatives using observable market data for all... -

Page 89

... assumptions used in our cash flow analysis related to forecasting future operating results, include net revenue yields, net cruise costs including fuel prices, capacity changes, including the expected deployment of vessels into, or out of, Costa, WACC for comparable publicly-traded companies... -

Page 90

... swaps to manage our interest rate exposure in order to achieve a desired proportion of fixed and floating rate debt. In November 2011, we implemented a fuel derivatives program to mitigate a portion of the risk to our future cash flows attributable to potential fuel price increases, which we define... -

Page 91

...the years ended November 30, 2012, 2011 and 2010 where such impacts were not significant. Foreign Currency Exchange Rate Risks Overall Strategy We manage our exposure to fluctuations in foreign currency exchange rates through our normal operating and financing activities, including netting certain... -

Page 92

... newbuild currency exchange rate risk relates to euro-denominated newbuild construction payments for Regal Princess and a portion of P&O Cruises (UK)'s newbuild, which represent a total commitment of $1.1 billion. The cost of shipbuilding orders that we may place in the future that is denominated... -

Page 93

... our trade receivables and related contingent obligations. We do not normally require collateral or other security to support normal credit sales. NOTE 12 - Segment Information We have three reportable cruise segments that are comprised of our (1) North America cruise brands, (2) EAA cruise brands... -

Page 94

.... Our Cruise Support segment represents certain of our port and related facilities and other corporate-wide services that are provided for the benefit of our cruise brands. Our Tour and Other segment represents the hotel and transportation operations of Holland America Princess Alaska Tours and two... -

Page 95

... Revenues by geographic areas, which are based on where our guests are sourced and not the cruise brands on which they sailed, were as follows (in millions): Years Ended November 30, 2012 2011 2010 North America Europe Australia and Asia Others $ $ NOTE 13 - Compensation Plans 7,952 5,367... -

Page 96

...summary of Carnival Corporation and Carnival plc stock option activity during the year ended November 30, 2012 related to stock options previously granted was as follows: WeightedAverage Remaining Shares WeightedAverage Exercise Price Contractual Term (in years) Aggregate Intrinsic Value (a) (in... -

Page 97

..., salary levels and length of service. Total expense for these plans was $22 million, $21 million and $20 million in 2012, 2011 and 2010, respectively. NOTE 14 - Earnings Per Share Our basic and diluted earnings per share were computed as follows (in millions, except per share data): Years Ended... -

Page 98

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was... -

Page 99

... our non-GAAP earnings per share ("EPS"); net revenue yields; booking levels; pricing; occupancy; operating, financing and tax costs, including fuel expenses; costs per available lower berth day ("ALBD"); estimates of ship depreciable lives and residual values; liquidity; goodwill and trademark fair... -

Page 100

...fleet, will have a positive impact on our profitability. During 2012, we ordered two new cruise ships - one 4,000-passenger capacity ship for our Carnival Cruise Lines brand and one 2,660-passenger capacity ship for our Holland America Line brand. These ships will be the largest ever constructed for... -

Page 101

... material respects (1) in determining the average useful life and average residual values of our ships, including ship improvements; (2) in determining which ship improvement costs add value to our ships; and (3) in determining the net book value of ship component assets being retired. Finally, we... -

Page 102

... judgments are made related to forecasting future operating results, including net revenue yields, net cruise costs including fuel prices, capacity changes, including the expected deployment of vessels into, or out of, the cruise brand, WACC for comparable publicly-traded companies, adjusted for the... -

Page 103

...of passenger cruise bookings, which represent costs that are directly associated with passenger cruise ticket revenues, and include travel agent commissions, air and other transportation related costs, governmental fees and taxes that vary with guest head counts and related credit card fees, onboard... -

Page 104

... for our North America cruise brands and Tour and Other segments. Onboard and other revenues included concession revenues of $727 million in 2012 and $681 million in 2011. EAA Brands Cruise passenger ticket revenues made up 82% of our 2012 total revenues. Cruise passenger ticket revenues decreased... -

Page 105

... other costs that are directly associated with onboard and other revenues and credit card fees. Substantially all of our remaining cruise costs are largely fixed, except for the impact of changing prices and food expenses, once our capacity levels have been determined. Net passenger ticket revenues... -

Page 106

... Net cruise costs per ALBD and net cruise costs excluding fuel per ALBD are the most significant measures we use to monitor our ability to control our cruise segment costs rather than gross cruise costs per ALBD. We exclude the same variable costs that are included in the calculation of net cruise... -

Page 107

... and other Onboard and other Net cruise costs Less fuel Net cruise costs excluding fuel $ 10,166 1,713 11,879 $ 10,338 $ 1,749 12,087 10,095 1,696 11,791 $ 9,952 1,666 11,618 $ 8,880 1,583 10,463 ALBDs Gross cruise costs per ALBD % (decrease) increase vs. prior year Net cruise costs per... -

Page 108

... in Europe. The 2.4% increase in net onboard and other revenue yields was primarily due to higher onboard spending by guests from our North America brands, partially offset by lower yields from certain of our EAA brands, driven by lower occupancy, principally at Costa. Gross cruise revenues... -

Page 109

...North America Brands Cruise passenger ticket revenues made up 76% of our 2011 total revenues. Cruise passenger ticket revenues increased by $444 million, or 7.0%, to $6.8 billion in 2011 from $6.3 billion in 2010. This increase was substantially due to a continuing recovery in cruise ticket pricing... -

Page 110

... dollar net cruise costs excluding fuel per ALBD was principally driven by inflationary pressures on crew travel, food, freight and other hotel operating expenses. Fuel costs increased $571 million, or 35%, to $2.2 billion in 2011 from $1.6 billion in 2010. This was caused by higher fuel prices... -

Page 111

... million of Carnival Corporation common stock in open market transactions during 2012. Future Commitments and Funding Sources At November 30, 2012, our contractual cash obligations were as follows (in millions): Payments Due by 2013 2014 2015 2016 2017 Thereafter Total Recorded Contractual... -

Page 112

.... The year-over-year percentage increase in our annual capacity for 2013, 2014, 2015 and 2016 is currently expected to be 3.5%, 1.7%, 4.8% and 4.6%, respectively. These percentage increases result primarily from contracted new ships entering service and exclude any unannounced future ship orders... -

Page 113

... newbuild currency exchange rate risk relates to euro-denominated newbuild construction payments for Regal Princess and a portion of P&O Cruises (UK)'s newbuild. These newbuild contracts have remaining commitments of $1.1 billion. The functional currency cost of each of these ships will increase or... -

Page 114

...relates to the consumption of fuel on our ships. We expect to consume approximately 3.3 million metric tons of fuel in 2013. Based on a 10% hypothetical change in our December 20, 2012 guidances' forecasted average fuel price, we estimate that our 2013 fuel expense, excluding the effect of zero cost... -

Page 115

... consolidated financial statements and the related notes. Years Ended November 30, 2012 2011 2010 2009 (dollars in millions, except per share, per ton and currency data) 2008 Statements of Income Data Revenues Operating income Net income Earnings per share 15,382 1,642(a) 1,298(a) 1.67... -

Page 116

...any future dividend is within the discretion of the Boards of Directors. Our dividends were and will be based on a number of factors, including our earnings, liquidity position, financial condition, tone of business, capital requirements, credit ratings and the availability and cost of obtaining new... -

Page 117

... Corporation common stock at a price equal to the market value. At the end of each year, the total value of the investment is computed by taking the number of shares owned, assuming Carnival Corporation dividends are reinvested on an annual basis, multiplied by the market price of the shares at the... -

Page 118

... of the indexes noted below. The Price Performance is calculated in the same manner as previously discussed. 2007 2008 Assumes $100 Invested on November 30, 2007 Assumes Dividends Reinvested Years Ended November 30, 2009 2010 2011 2012 Carnival plc ADS Dow Jones Travel & Leisure Index FTSE 100... -

Page 119

... share of our operating income is earned during this period. The seasonality of our results also increases due to ships being taken out-of-service for maintenance, which we schedule during non-peak demand periods. In addition, substantially all of Holland America Princess Alaska Tours' revenue... -

Page 120

... Incorporation or Organization Name of Subsidiary Costa Crociere S.p.A. ("Costa") (2) HAL Antillen N.V. Holland America Line N.V. (3) Princess Bermuda Holdings Ltd. Princess Cruise Lines Ltd. (4) Sunshine Shipping Corporation Ltd. ("Sunshine") (5) (1) Italy Curacao Curacao Bermuda Bermuda Bermuda... -

Page 121

..., 333-104609, 333-84968, 333-13794 and 333-12742) of Carnival plc, of our report dated January 29, 2013 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in the Annual Report to Shareholders, which is incorporated in this joint... -

Page 122

... attorneys-in-fact and agents, and each of them with full power to act without the others, for him or her and in his or her name, place and stead, to sign the Carnival Corporation and Carnival plc joint Annual Report on Form 10-K ("Form 10-K") for the year ended November 30, 2012 and any and all... -

Page 123

...and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: January 29, 2013 By: /s/ Micky Arison Micky Arison Chairman of the Board of Directors and Chief Executive Officer -

Page 124

... 31.2 I, Howard S. Frank, certify that: 1. I have reviewed this Annual Report on Form 10-K of Carnival Corporation; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the... -

Page 125

... 31.3 I, David Bernstein, certify that: 1. I have reviewed this Annual Report on Form 10-K of Carnival Corporation; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the... -

Page 126

...and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: January 29, 2013 By: /s/ Micky Arison Micky Arison Chairman of the Board of Directors and Chief Executive Officer -

Page 127

Exhibit 31.5 I, Howard S. Frank, certify that: 1. I have reviewed this Annual Report on Form 10-K of Carnival plc; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the ... -

Page 128

Exhibit 31.6 I, David Bernstein, certify that: 1. I have reviewed this Annual Report on Form 10-K of Carnival plc; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the ... -

Page 129

Exhibit 32.1 In connection with the Annual Report on Form 10-K for the year ended November 30, 2012 as filed by Carnival Corporation with the Securities and EFchange Commission on the date hereof (the "Report"), I certify pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the ... -

Page 130

Exhibit 32.2 In connection with the Annual Report on Form 10-K for the year ended November 30, 2012 as filed by Carnival Corporation with the Securities and EFchange Commission on the date hereof (the "Report"), I certify pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the ... -

Page 131

Exhibit 32.3 In connection with the Annual Report on Form 10-K for the year ended November 30, 2012 as filed by Carnival Corporation with the Securities and EFchange Commission on the date hereof (the "Report"), I certify pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the ... -

Page 132

Exhibit 32.4 In connection with the Annual Report on Form 10-K for the year ended November 30, 2012 as filed by Carnival plc with the Securities and EFchange Commission on the date hereof (the "Report"), I certify pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes... -

Page 133

Exhibit 32.5 In connection with the Annual Report on Form 10-K for the year ended November 30, 2012 as filed by Carnival plc with the Securities and EFchange Commission on the date hereof (the "Report"), I certify pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes... -

Page 134

Exhibit 32.6 In connection with the Annual Report on Form 10-K for the year ended November 30, 2012 as filed by Carnival plc with the Securities and EFchange Commission on the date hereof (the "Report"), I certify pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes... -

Page 135