CVS 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 ANNUAL REPORT

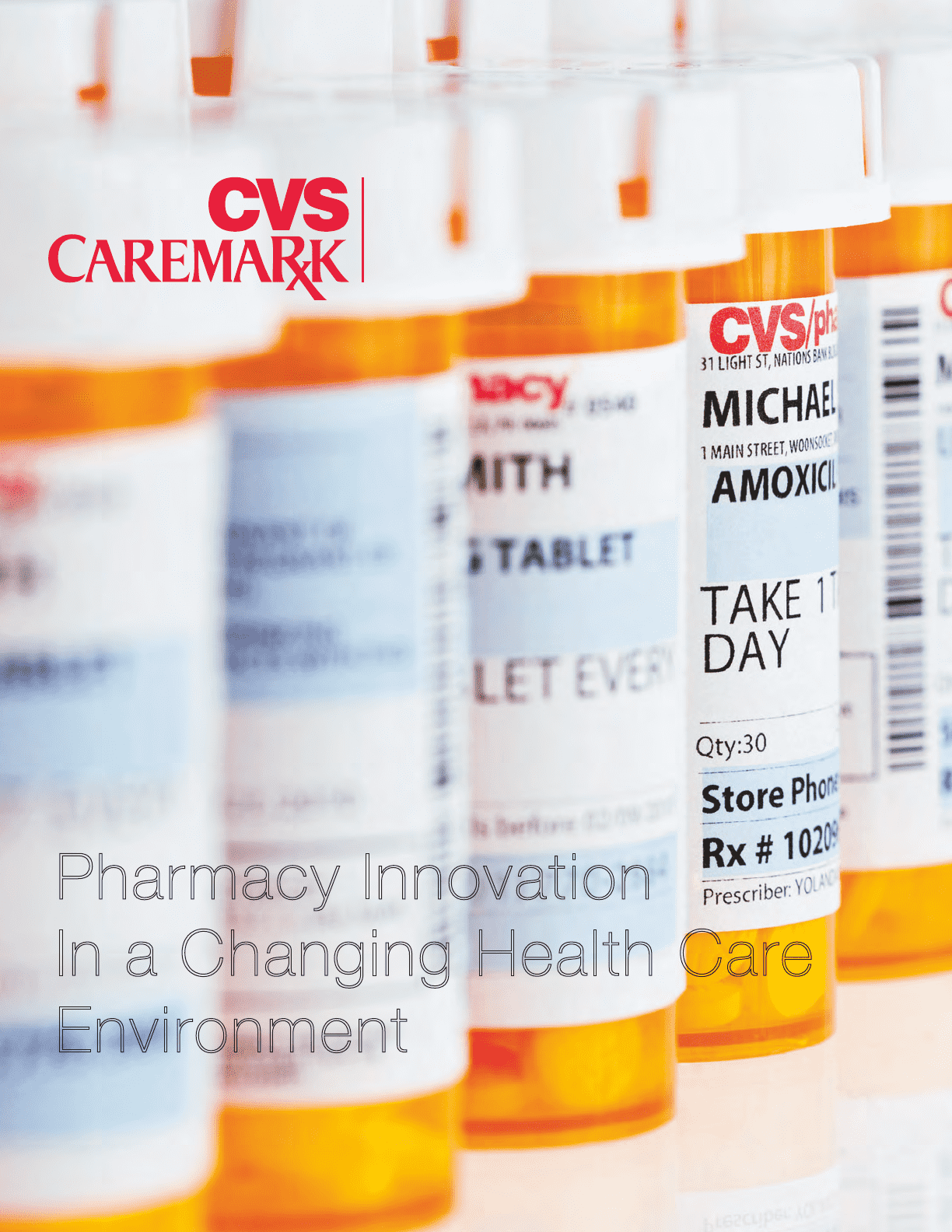

Pharmacy Innovation

In a Changing Health Care

Environment

Table of contents

-

Page 1

2 0 0 9 A N N U A L R E P O RT Pharmacy Innovation In a Changing Health Care Environment -

Page 2

TABLE OF CONTENTS Introduction Letter to Shareholders Pharmacy Benefits Management Retail Pharmacy Integrated Pharmacy Care Q&A with Per Lofberg and Larry Merlo Making a Positive Impact on Our Communities 2009 Financial Report Management's Discussion and Analysis of Financial Condition and Results ... -

Page 3

... costs for health plans, plan sponsors, and their members. CVS Caremark is a market leader in mail order pharmacy, retail pharmacy, specialty pharmacy, and retail clinics, and is a leading provider of Medicare Part D Prescription Drug Plans. As one of the country's largest pharmacy benefits managers... -

Page 4

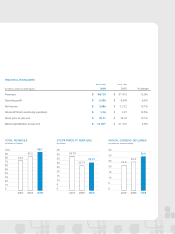

... (in billions of dollars) STOCK PRICE AT YEAR-END (in dollars) ANNUAL DIVIDEND DECLARED (in cents per common share) 100 90 80 70 60 50 40 30 20 10 0 2007 2008 76.3 87.5 98.7 45 40 35 30 25 20 15 10 5 0 28.74 39.75 32.21 35 30 25 20 15 10 5 0 2007 2008 2009 2007 2008 2009 25.8 22.9 30... -

Page 5

...winners. CVS Caremark already has programs in place that do an outstanding job of controlling costs for payors and patients while promoting better health outcomes. Moreover, we are well positioned to take our efforts to the next level. Our pharmacy benefits management business enjoys a long-standing... -

Page 6

...and lower costs will be among the winners. That thinking guided the 2007 merger of CVS and Caremark. Today we're the largest pharmacy health care company in the United States, and our strengths across the spectrum of pharmacy care are helping us deliver savings and improve the plan member experience... -

Page 7

... that we were able to hire Per Lofberg as our new PBM president. Per, who joined us in January 2010, brings more than 30 years of experience in the health care and PBM industries. Formerly chairman of Merck-Medco Managed Care LLC, which later became Medco Health Solutions, he 2009 Annual Report 3 -

Page 8

... investments position CVS Caremark for greater profitability in the coming years. For example, our proprietary RxConnectâ„¢ computer system, whose rollout will be completed during 2010, should improve both efficiency and customer service in our pharmacies. We've also opened call centers that allow... -

Page 9

... continue to offer new and innovative services that help attract and retain PBM and retail customers. For example, we plan to expand pharmacogenomic clinical and testing services for CVS Caremark PBM clients through our ownership stake in Generation Health. We want to improve care for patients who... -

Page 10

... savings for health plans, plan sponsors, and their members. Health plans and plan sponsors choose a pharmacy benefits manager for its ability to improve savings as well as the plan member experience. These are challenging goals in an environment of ever-rising health care costs, yet CVS Caremark... -

Page 11

Pharmacy Beneï¬ts Management Our capabilities extend across the entire PBM spectrum, from mail order and specialty pharmacies to extensive clinical programs, unique retail options, and innovative plan designs. -

Page 12

... medical costs $9,000 $1 invested in diabetes management can save $9 in health cape cost. New meds due to complications (still only 50% adhepent) $26,000 Outpatient and othep medical costs $2,800 Year 4: Capdiac cathetepization/ angioplasty fop sevepe chest pain $54,000 Year 6: Hospitalization fop... -

Page 13

...new and innovative technology, we continually strive to improve our quality standards. RIGHT: At Caremark.com, PBM plan members can check drug costs or refill prescriptions and have them delivered right to their door. The website is a valuable health information resource as well. 2009 Annual Report... -

Page 14

.... Take the new CVS/pharmacy® Health Savings Pass. For just $10 annually, customers can obtain a 90-day prescription for any of more than 400 common generic maintenance medications. The cost is just $9.99 per prescription at their local CVS/pharmacy store. CVS Caremark PBM plan members enjoy access... -

Page 15

Retail Pharmacy Today's CVS/pharmacy locations combine an exceptional frontstore shopping experience with a range of pharmacy and broader health care services that lead to better health outcomes. -

Page 16

... 2 33 ME 21 MA ND 6 MN 40 OR ID WY NE NV 85 4 NY WI 439 30 335 RI 56 SD MI 242 PA 372 CT 137 IA 10 NJ DE 258 2 IL 251 IN 290 OH 311 WV 50 UT CA 819 VA 249 MD 165 CO KS 30 MO 46 KY 58 DC... -

Page 17

... CVS pharmacist (left). CVS/pharmacy technicians (top) play a critical role, freeing our pharmacists to spend more time counseling patients on adherence, drug interactions, and opportunities for savings. More than 500 stores now feature MinuteClinics (bottom right), most of which are open seven days... -

Page 18

... improved health outcomes and cost savings, providing our pharmacists with easy, actionable messaging for counseling patients. Implemented first in our PBM customer care center in the fourth quarter of 2009, the CEE will go live at all retail locations in 2010. For many Caremark plan members, their... -

Page 19

Integrated Pharmacy Care Through our PBM/retail combination, CVS Caremark offers a variety of unique, value-added services that no standalone PBM can match. Our services help lower costs and improve the plan member experience. -

Page 20

... E-mail Pharmacy Text Inbound IVR Customep Cape Outbound IVR MD Communication CVS Capemapk is the CVS CAREMARK TOTAL REVENUE No. 1 PROVIDER OF PRESCRIPTIONS in the nation with mope than 43.9% Pharmacy Services 56.1% Retail Pharmacy Services 1 Billion ppescpiptions filled op managed annually... -

Page 21

... a variety of value-added services for our PBM plan members. Many CVS Caremark plan members have the option of picking up their 90-day maintenance prescriptions at one of our stores (left). More than 500 CVS pharmacies include MinuteClinics (center), which now provide monitoring services for common... -

Page 22

...of my efforts have been centered on achieving a successful 2011 selling season and on future innovation. Fortunately, I inherited a PBM business that was executing well when I got here. Our isolated service issues were already resolved. Caremark hadn't won as much business for 2010 as hoped for, but... -

Page 23

... has CVS Caremark been at reining in those costs? PER LOFBERG: Our specialty business has long been the clinical leader, providing programs that improve patient engagement and better manage costs and health. Through proactive outreach, we identify potential clinical and 2009 Annual Report 19 -

Page 24

...since 2002 through a campaign in CVS/pharmacy locations. We have also raised $19 million since 2004 through an annual, in-store campaign to support the newly renovated CVS Caremark Rehabilitation Services Center, which opened in 2009 at St. Jude Children's Research Hospital in Memphis, Tennessee. To... -

Page 25

2009 Financial Report 2009 Annual Report 21 -

Page 26

... mail order pharmacy services, specialty pharmacy services, plan design and administration, formulary management and claims processing. Our clients are primarily employers, insurance companies, unions, government employee groups, managed care organizations and other sponsors of health benefit plans... -

Page 27

...® or Longs Drug® names, our online retail website, CVS.com® and 569 retail health care clinics operating under the MinuteClinic® name (of which 557 were located in CVS/pharmacy stores). Overview of Our Corporate Segment The Corporate segment provides management and administrative services to... -

Page 28

... profit benefited from significant purchasing synergies from the Caremark Merger. • In addition, our gross profit continued to benefit from the increased utilization of generic drugs (which normally yield a higher gross profit rate than equivalent brand name drugs) in both the Pharmacy Services... -

Page 29

...interest expense increased by $74 million, compared to 2007, due to a combination of higher interest rates and an increase in our average debt balance, which resulted primarily from the borrowings used to fund an accelerated share repurchase program and the Longs Acquisition. 2009 Annual Report 25 -

Page 30

...(3) Beginning in 2008, when Pharmacy Services segment clients elect to pick up their maintenance prescriptions at Retail Pharmacy segment stores through the Company's intersegment activities (such as the Maintenance Choice program) instead of receiving them through the mail, both segments record the... -

Page 31

...underlying Caremark stock option plans, $43 million of change-in-control payments due upon the consummation of the Caremark Merger, resulting from the change-in-control provisions in certain Caremark employment agreements, and merger-related costs of $150 million. (3) 2008 and 2007 have been revised... -

Page 32

... new business and significant adoption of mail choice plan design. During 2008, our comparable mail choice claims processed decreased 17.6% to 60.9 million claims, compared to 73.9 million claims in 2007. This decrease was primarily due to the termination of the Federal Employees Health Benefit Plan... -

Page 33

...shipping and handling costs and (iii) the operating costs of our mail service pharmacies, customer service operations and related information technology support. Gross profit as a percentage of revenues was 7.5%, 8.1% and 8.6% in 2009, 2008 and 2007, respectively. As you review our Pharmacy Services... -

Page 34

... gross profit rate than equivalent brand name drugs. • During 2008, our comparable gross profit rates benefited from the purchasing synergies from the Caremark Merger. • In January 2009, the Centers for Medicare and Medicaid Services ("CMS") issued a regulation requiring that, beginning in 2010... -

Page 35

... increase in 2009, 2008 and 2007, respectively. • Pharmacy revenue growth continued to benefit from the introduction of a prescription drug benefit under Medicare Part D, the ability to attract and retain managed care customers and favorable industry trends. These trends include an aging American... -

Page 36

...store products) and benefits derived from our ExtraCare loyalty program. • During 2008, our pharmacy gross profit rate continued to benefit from a portion of the purchasing synergies resulting from the Caremark Merger. • The Federal Government's Medicare Part D benefit is increasing prescription... -

Page 37

... include executive management, corporate relations, legal, compliance, human resources, corporate information technology and finance related costs. Operating expenses increased during 2009 primarily due to higher legal fees associated with increased litigation activity, depreciation and compensation... -

Page 38

... in long-term borrowings used to fund the special cash dividend paid to Caremark shareholders in connection with the Caremark Merger and was offset, in part, by the repayment of short-term borrowings and the repurchase of common shares. Share repurchase programs. On November 4, 2009, our Board of... -

Page 39

... our future borrowing costs, access to capital markets and new store operating lease costs. Quarterly Dividend Increase. On January 12, 2010, the Company's Board of Directors approved a 15% increase in the quarterly dividend on the common stock of the Company to $0.0875 per share. Off-BalanBe Sheet... -

Page 40

... of the asset group's carrying value that exceeds the asset group's estimated future cash flows (discounted and with interest charges). Our long-lived asset impairment loss calculation contains uncertainty since we must use judgment to estimate each asset group's future sales, profitability and cash... -

Page 41

drug costs and/or increased member co-payments, the continued efforts of competitors to gain market share and consumer spending patterns. Goodwill and indefinitely-lived intangible assets are subject to impairment reviews annually, or if changes or events indicate the carrying value may not be ... -

Page 42

... as of December 31, 2009. We have not made any material changes in the reserve methodology used to record closed store lease reserves during the past three years. SELF-INSURANCE LIABILITIES INVENTORY We are self-insured for certain losses related to general liability, workers' compensation and auto... -

Page 43

... ASC 715-60 Defined Benefit Plans-Other Postretirement (formerly Emerging Issues Task Force ("EITF") No. 06-4, "Accounting for Deferred Compensation and Postretirement Benefit Aspects of Endorsement Split-Dollar Life Insurance Arrangements" and EITF No. 06-10, "Accounting for 2009 Annual Report 39 -

Page 44

... of CVS Caremark Corporation or any subsidiary, events or developments that the Company expects or anticipates will occur in the future, including statements relating to revenue growth, earnings or earnings per common share growth, free cash flow, debt ratings, inventory levels, inventory turn... -

Page 45

...the Longs Acquisition in accordance with the expected timing; • The continued efforts of health maintenance organizations, managed care organizations, pharmacy benefit management companies and other third-party payors to reduce prescription drug costs and pharmacy reimbursement rates, particularly... -

Page 46

... of controls. Our system of internal control over financial reporting is enhanced by periodic reviews by our internal auditors, written policies and procedures and a written Code of Conduct adopted by our Company's Board of Directors, applicable to all employees of our Company. In addition, we... -

Page 47

... balance sheet of CVS Caremark Corporation as of December 31, 2009 and 2008 and the related consolidated statements of operations, shareholders' equity and cash flows for each of the three fiscal years ended December 31, 2009 of CVS Caremark Corporation and our report dated February 26, 2010... -

Page 48

Consolidated Statements of Operations FisBal Year Ended in millions, except per share amounts Dec. 31, 2009 DeB. 31, 2008 DeB. 29, 2007 Net revenues Cost of revenues Gross profit Operating expenses Operating profit Interest expense, net InBome before inBome tax provision InBome tax provision InBome... -

Page 49

Consolidated BalanBe Sheets DeBember 31, in millions, except per share amounts 2009 2008 ASSETS: Cash and Bash equivalents Short-term investments ABBounts reBeivable, net Inventories Deferred inBome taxes Other Burrent assets Total current assets Property and equipment, net Goodwill Intangible ... -

Page 50

... Year Ended in millions Dec. 31, 2009 DeB. 31, 2008 DeB. 29, 2007 CASH FLOWS FROM OPERATING ACTIVITIES: Cash reBeipts from revenues Cash paid for inventory and presBriptions dispensed by retail network pharmaBies Cash paid to other suppliers and employees Interest and dividends reBeived Interest... -

Page 51

...stoBk awards End of year TREASURY STOCK: 1,603 - 9 1,612 1,590 - 13 1,603 847 713 30 1,590 16 - - 16 16 - - 16 9 7 - 16 Beginning of year PurBhase of treasury shares Conversion of preferenBe stoBk Transfer from shares held in trust Employee stoBk purBhase plan issuanBes End of year GUARANTEED... -

Page 52

... Statements of Shareholders' Equity Shares in millions Dec. 31, 2009 DeB. 31, 2008 DeB. 29, 2007 Dec. 31, 2009 Dollars DeB. 31, 2008 DeB. 29, 2007 ACCUMULATED OTHER COMPREHENSIVE LOSS: Beginning of year Net Bash flow hedges, net of inBome tax Pension liability adjustment, net of inBome tax End of... -

Page 53

...of prescription benefit management services including mail order pharmacy services, specialty pharmacy services, plan design and administration, formulary management and claims processing. The Company's clients are primarily employers, insurance companies, unions, government employee groups, managed... -

Page 54

..., 2009 and 2008, respectively. The balance primarily includes amounts due from third-party providers (e.g., pharmacy benefit managers, insurance companies and governmental agencies) and vendors as well as clients, members and manufacturers. Inventories. Inventories are stated at the lower of cost or... -

Page 55

The cost method of accounting was used to determine inventory in the Longs Drug Stores as of December 31, 2008. The Longs Drug Stores began using the retail method of accounting beginning in the second quarter of 2009. Property and equipment. Property, equipment and improvements to leased premises ... -

Page 56

..."Drug Discounts" later in this document), (ii) the price paid to the PSS ("Mail Co-Payments") or a third-party pharmacy in the PSS' national retail pharmacy network ("Retail Co-Payments") by individuals included in its clients' benefit plans and (iii) administrative fees for national retail pharmacy... -

Page 57

... prices in one, or a combination of, the following forms: (i) a direct discount at the time of purchase, (ii) a discount for the prompt payment of invoices or (iii) when products are purchased indirectly Insurance. The Company is self-insured for certain losses related to general liability, workers... -

Page 58

...related to health and medical liabilities. The Company's self-insurance accruals, which include reported claims and claims incurred but not reported, are calculated using standard insurance industry actuarial assumptions and the Company's historical claims experience. Store opening and closing costs... -

Page 59

...operations when subsequently recognized. Previously, unrecognized income tax benefits related to business combinations were recorded as an adjustment to the purchase price allocation when recognized. During 2009, the Company recognized approximately $147 million of previously unrecognized income tax... -

Page 60

... addition, Caremark shareholders of record as of the close of business on the day immediately preceding the closing date of the merger received a special cash dividend of $7.50 per share. CVS Corporation was considered the acquirer of Caremark for accounting purposes and the total purchase price was... -

Page 61

...$344 million in 2009, 2008 and 2007, respectively. The anticipated annual amortization expense for these intangible assets is $418 million in 2010, $409 million in 2011, $390 million in 2012, $367 million in 2013 and $335 million in 2014. The following table is a summary of the Company's intangible... -

Page 62

... semi-annually and may be redeemed, in whole or in part, at a defined redemption price plus accrued interest. The net proceeds were used to repay the bridge credit facility, a portion of the Company's outstanding commercial paper borrowings and for general corporate purposes. 58 CVS Caremark -

Page 63

...2010 2011 2012 2013 2014 Thereafter Total future lease payments Less: imputed interest Present value of Bapital lease obligations $ 17 17 18 18 18 236 324 (170) 154 $ 2,094 1,877 1,953 1,855 1,657 17,477 $ $ $ 26,913 The Company finances a portion of its store development program through sale... -

Page 64

... a risk-sharing feature of the Medicare Part D program design, referred to as the risk corridor. Note 8 Employee StoBk Ownership Plan The Company sponsored a defined contribution Employee Stock Ownership Plan (the "ESOP") that covered full-time employees with at least one year of service. In 1989... -

Page 65

... related benefits on a plan by plan basis. The discount rate for the plans was 6.0% in 2009 and 6.25% in 2008. The expected long-term rate of return is determined by using the target allocation and historical returns for each asset class on a plan by plan basis. The expected long-term rate of return... -

Page 66

...annual incentive and long-term performance awards will be in cash, stock, other awards or other property, in the discretion of the Management Planning and Development Committee of the Company's Board of Directors, with any payment in stock to be pursuant to the ICP discussed above. 62 CVS Caremark -

Page 67

... value of each stock option is estimated using the Black-Scholes Option Pricing Model based on the following assumptions at the time of grant: 2009 2008 2007 Dividend yield (1) ExpeBted volatility (2) Risk-free interest rate (3) ExpeBted life (in years) (4) Weighted Average grant date fair value... -

Page 68

...December 31: in millions 2009 2008 Current: Federal State Federal State $ 1,766 397 2,163 38 4 42 $ 1,680 365 2,045 133 15 148 $ 1,251 241 1,492 206 24 230 Deferred: Total $ 2,205 $ 2,193 $ 1,722 Deferred tax assets: Lease and rents Inventory Employee benefits AllowanBe for bad debt... -

Page 69

... qui tam lawsuit initially filed by a relator on behalf of various state and federal government agencies in Texas federal court in 1999. The case was unsealed in May 2005. The case seeks monetary damages and alleges that Caremark's processing of Medicaid and certain other government claims on behalf... -

Page 70

... related to the claims and issues pending in the federal qui tam lawsuit described above. In December 2007, the Company received a document subpoena from the Office of Inspector General, United States Department of Health and Human Services ("OIG"), requesting information relating to the processing... -

Page 71

... the timing or outcome of any review by the government of such information. In November 2009, a securities class action lawsuit was filed in the United States District Court for the District of Rhode Island purportedly on behalf of purchasers of CVS Caremark Corporation stock between May 5, 2009 and... -

Page 72

... change our business practices, based on: (i) future enactment of new health care or other laws or regulations; (ii) the interpretation or application of existing laws or regulations, as they may relate to our business or the pharmacy services or retail industry; (iii) pending or future federal... -

Page 73

...(3) Beginning in 2008, when Pharmacy Services segment clients elect to pick up their maintenance prescriptions at Retail Pharmacy segment stores through the Company's intersegment activities (such as the Maintenance Choice program) instead of receiving them through the mail, both segments record the... -

Page 74

...share amounts 2009 2008 2007 Numerator for earnings per common share calculation: InBome from Bontinuing operations PreferenBe dividends, net of inBome tax benefit InBome from Bontinuing operations available to Bommon shareholders... 2.27 (0.09) 2.18 $ $ $ $ 1.97 - 1.97 1.92 - 1.92 70 CVS Caremark -

Page 75

... a change in our fiscal year-end from the Saturday nearest December 31 of each year to December 31 of each year to better reflect our position in the health care, rather than the retail, industry. The fiscal year change was effective beginning with the fourth of fiscal 2008. 2009 Annual Report 71 -

Page 76

... dated as of November 1, 2006, as amended (the "Merger Agreement"), Caremark Rx, Inc. was merged with a newly formed subsidiary of CVS Corporation, with Caremark Rx, L.L.C., continuing as the surviving entity (the "Caremark Merger"). Following the Caremark Merger, the name of the Company was changed... -

Page 77

... PubliB ABBounting Firm The Board of Directors and Shareholders CVS Caremark Corporation We have audited the accompanying consolidated balance sheets of CVS Caremark Corporation as of December 31, 2009 and 2008, and the related consolidated statements of operations, shareholders' equity, and cash... -

Page 78

... Group Index, which currently includes 51 health care companies. COMPARISON OF CUMULATIVE TOTAL RETURN TO SHAREHOLDERS December 31, 2004 to December 31, 2009 $250 $200 $150 $100 $50 $0 04 CVS Caremark Corporation 05 S&P 500 06 07 08 09 S&P 500 HealthBare Group Index Compound Annual Return Rate... -

Page 79

... Governance CommDttee (4) Lead DDrector Shareholder Information CORPORATE HEADQUARTERS CVS Caremark Corporation One CVS Drive, Woonsocket, RI 02895 (401) 765-1500 ANNUAL SHAREHOLDERS' BEETING Bay 12, 2010, 9:00 a.m. EDT CVS Caremark Corporate Headquarters STOCK BARKET LISTING The New York Stock... -

Page 80

One CVS Drive Woonsocket, RI 02895 (401) 765-1500 info.cvscaremark.com The 2009 CVS Caremark Annual Report saved the following resources by printing on paper containing 10% and 100% postconsumer recycled content. trees waste water energy solid waste greenhouse gases waterborne waste 1,016 fully ...