Burger King 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B K C

FRESH

FLAME-BROILED

APPETIZING

BRAND

BUSINESS

INVESTMENT

2006 ANNUAL REPORT

ALL HAIL THE

Table of contents

-

Page 1

2006 ANNUAL REPORT FRESH BRAND B KC FLAME-BROILED BUSINESS APPETIZING INVESTMENT ALL HAIL THE -

Page 2

-

Page 3

... the world's second largest fast food hamburger restaurant chain. We own or franchise more than 11,100 restaurants in more than 65 countries and U.S. territories. And on May 18, 2006, we became a stand-alone publicly traded company for the first time, trading on the New York Stock Exchange under... -

Page 4

HE GETS SUPERFANS PUMPED HE SCORES IN THE NFL HE'S IN YOUR NEIGHBORHOOD HE TAKES THE CHECKERED FLAG OUR BRAND IS (and the world is eating it up) -

Page 5

...King Holdings Inc. has achieved 10 consecutive quarters of comparable same store sales growth worldwide. We are definitely on a roll - in fact, it's been more than a decade since we've enjoyed this kind of comp sales success. Our consolidated company revenues and system-wide average restaurant sales... -

Page 6

... to increase franchisee profitability. And we're getting it done. The last 50 restaurants that opened in the United States and have operated at least a year are earning recordhigh average annual sales of more than $1.4 million, which is more than 25 percent higher than our U.S. and worldwide average... -

Page 7

2006 FISCAL YEAR RECORD HIGHS $2.05 BILLION RECORD REVENUES $1.13 MILLION RECORD U.S. AVERAGE RESTAURANT SALES $1.11 MILLION RECORD INTERNATIONAL AVERAGE RESTAURANT SALES LIKE CRAZY (but an intelligent crazy) -

Page 8

... in fast food hamburger restaurants across the United States. Our BKTM Stacker is our most successful permanent new menu item in years, exceeding our own sales expectations. Our BKTM Value Menu - with 10 items at about a buck each - is increasing traffic. And we're waking up breakfast profitability... -

Page 9

® (we're good like that) -

Page 10

... strategies across all our markets. We've also established a global product development team to reduce complexity and increase consistency in our worldwide menu. We expect to use our global purchasing power to negotiate lower product costs and savings for our restaurants outside of the United States... -

Page 11

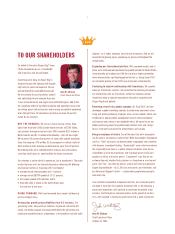

...Executive Officer Ben K. Wells Chief Financial Officer and Treasurer Christopher M. Anderson Vice President and Controller Anne Chwat General Counsel and Secretary Charles M. Fallon President, North America James F. Hyatt Chief Operations Officer Russell B. Klein President Global Marketing, Strategy... -

Page 12

...7696 STOCK LISTING New York Stock Exchange Symbol: BKC The Bank of New York Investor Services Church Street Station P.O. Box 11258 New York, NY 10286-1258 Phone: 800.524.4458 KPMG LLP Miami, Florida TR ANSFER AGENT INDEPENDENT REGIS TERED PUBLIC ACCOUNTING FIRM ANNUAL MEETING The Annual Meeting... -

Page 13

... the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes n No ¥ The initial public offering of Burger King Holdings, Inc.'s common stock, par value of $0.01 per share, commenced on May 18, 2006. Prior to that date, there was no public market for the registrant's common... -

Page 14

BURGER KING HOLDINGS, INC. 2006 FORM 10-K ANNUAL REPORT TABLE OF CONTENTS Page Item Item Item Item Item Item 1. 1A. 1B. 2. 3. 4. PART I Business Risk Factors Unresolved Staff Comments Properties Legal Proceedings Submission of Matters to a Vote of Security Holders PART II Market for ... -

Page 15

... food items. During our more than 50 years of operating history, we have developed a scalable and cost-efficient quick service hamburger restaurant model that offers customers fast food at modest prices. We generate revenues from three sources: sales at company restaurants; royalties and franchise... -

Page 16

... management team have worked at McDonald's, Taco Bell, The Coca-Cola Company and KFC. Global Operations We operate in three reportable business segments: United States and Canada; Europe, Middle East and Africa and Asia Pacific, or EMEA/APAC; and Latin America. Additional financial information about... -

Page 17

... Reporting in Part II, Item 8 in Note 20 of this Form 10-K. United States and Canada Restaurant Operations Our restaurants are limited-service restaurants of distinctive design and are generally located in hightraffic areas throughout the United States and Canada. At June 30, 2006, 878 company... -

Page 18

...report gross sales on a monthly basis and pay royalties based on reported sales. The five largest franchisees in the United States and Canada in terms of restaurant count represented in the aggregate approximately 16% of U.S. and Canadian Burger King franchise restaurants at June 30, 2006. Franchise... -

Page 19

...APAC operations. EMEA. EMEA is the second largest geographic area in the Burger King system behind the United States as measured by the number of restaurants. At June 30, 2006, EMEA had 2,168 restaurants in 26 countries and territories, including 291 company restaurants located in the United Kingdom... -

Page 20

... Restaurant Development. Unlike the United States and Canada, where all new development must be approved by the development committee, our market planning and site selection process in EMEA/APAC is managed by our regional teams, who are knowledgeable about the local market. In several of our markets... -

Page 21

... drive profitable customer traffic and pricing power over the long term. Our global strategy is focused on our core customer, the SuperFan (who are consumers who reported eating at a fast food hamburger outlet nine or more times in the past month), our Have It Your Way brand promise, our core menu... -

Page 22

..., and those terms are made available to company restaurants and franchise restaurants. In non-company restaurant markets, franchisees typically negotiate the purchase terms directly with Burger King approved suppliers for food and packaging products used in their restaurants. In fiscal 2000, we... -

Page 23

... In addition, Burger King restaurants compete internationally against local FFHR chains, and single-store locations. In one of our major European markets, the United Kingdom, much of the growth in the quick service restaurant segment is expected to come from sandwich shops, bakeries and new entrants... -

Page 24

...the results that may be achieved for any other quarter or for the full fiscal year. Our Employees As of June 30, 2006, we had approximately 37,000 employees in our company restaurants, field management offices and global headquarters. As franchisees are independent business owners, they and their 12 -

Page 25

... of Operations'' in Part II, Item 7; and in the ""Financial Statements and Supplementary Data'' in Part II, Item 8. Available Information The Company makes available through the Investor Relations section of its internet website at www.bk.com, this annual report on Form 10-K, quarterly reports on... -

Page 26

...restaurant chains and other retail businesses for quality site locations and hourly employees. Our operating results are closely tied to the success of our franchisees. Over the last several years, many franchisees in the United States, Canada and the United Kingdom have experienced severe financial... -

Page 27

... revenues and operating profits could be adversely affected and our overall business could be adversely affected. A significant component of our growth strategy involves opening new international restaurants in both existing and new markets. We and our franchisees face many challenges in opening new... -

Page 28

... our business, results of operations and financial condition. We recently promoted members of our existing senior management team as a result of the departure of our Chairman and Chief Executive Officer; failure to manage a smooth transition of those senior management into their new positions, the... -

Page 29

...; President, Global Marketing Strategy and Innovation, Russell Klein; Chief Operations Officer, Jim Hyatt; and other key personnel who have extensive experience in the franchising and food industries. If we lose the services of any of these key personnel and fail to manage a smooth transition to new... -

Page 30

...number of our franchisees cannot or decide not to renew their franchise agreements with us, then our business, results of operations and financial condition would suffer. Increases in the cost of food, paper products and energy could harm our profitability and operating results. The cost of the food... -

Page 31

... costs and may cause our profitability to decline. Our restaurants are currently operated, directly by us or by franchisees, in 64 foreign countries and U.S. territories (Guam and Puerto Rico, which are considered part of our international business). During fiscal 2006 and fiscal 2005, our revenues... -

Page 32

... translated value of our earnings and cash flow associated with our foreign operations, as well as the translation of net asset or liability positions that are denominated in foreign currencies. In countries outside of the United States where we operate company restaurants, we generate revenues and... -

Page 33

... assets on our balance sheet, and we believe that it is very important to our success and our competitive position to increase brand awareness and further develop our branded products in both domestic and international markets. We rely on a combination of trademarks, copyrights, service marks, trade... -

Page 34

... promotional items available in our restaurants or our playground equipment. In addition to decreasing our sales and profitability and diverting our management resources, adverse publicity or a substantial judgment against us could negatively impact our business, results of operations, financial... -

Page 35

... United States Congress that would compel the listing of all nutritional information on fast food menu boards and the Center for Science in the Public Interest, a non-profit advocacy organization, has sued the U.S. Food and Drug Administration to reduce the permitted sodium levels in processed foods... -

Page 36

... entirely of independent directors with a written charter addressing the committee's purpose and responsibilities; and ‚ for an annual performance evaluation of the nominating and governance committee and compensation committee. While our executive and corporate governance committee and our... -

Page 37

... sales could occur, could cause the market price of our common stock to decline. The shares of our common stock outstanding prior to our initial public offering will be eligible for sale in the public market at various times in the future. We, all of our executive officers, directors and the private... -

Page 38

... presents information regarding our properties as of June 30, 2006: Leased Building/ Land & Building Total Leases Owned(1) Land Total United States and Canada: Company restaurants Franchisee-operated properties Non-operating restaurant locations ÃÃÃÃ Offices Total International: Company... -

Page 39

... adopted the Burger King Holdings, Inc. Amended and Restated Equity Incentive Plan. The Company did not solicit proxies. Information regarding executive officers is contained in Part III, Item 10 of this Form 10-K under the heading ""Executive Officers of the Registrant.'' Part II Item 5. Market for... -

Page 40

... common stock to a director of the Company for an aggregate of $1,000,000 in a private placement. In addition, during the 2006 fiscal year the Company issued an aggregate of 29,746 shares of common stock to certain employees in settlement of restricted stock unit awards in consideration of services... -

Page 41

... operating data for the fiscal years ended June 30, 2006, 2005 and 2004 have been derived from our internal records. The selected historical consolidated financial and other operating data included below and elsewhere in this report are not necessarily indicative of future results. The information... -

Page 42

... per share data) Income Statement Data: Revenues: Company restaurant revenues Franchise revenues Property revenues Total revenues Company restaurant expenses: Food, paper and product costs Payroll and employee benefits Occupancy and other operating costs Total company restaurant expenses... -

Page 43

... $1,143 Burger King Holdings, Inc. and Subsidiaries For the Years Ended June 30, 2006 2005 2004 Other System-Wide Operating Data: Comparable sales growth(5)(6 System-wide sales growth(5 Average restaurant sales (in millions)(5 Number of company restaurants: United States and Canada EMEA/APAC... -

Page 44

Burger King Holdings, Inc. and Subsidiaries For the Years Ended June 30, 2006 2005 2004 Segment Data: Operating income (in millions): United States and Canada EMEA/APAC(7 Latin America(8 Unallocated(9 Total operating income Company Restaurant Revenues (in millions): United States and Canada ... -

Page 45

... as capital expenditures and related depreciation, principal and interest payments and tax payments. The following table is a reconciliation of our net income to EBITDA: Burger King Holdings, Inc. and Subsidiaries For the Fiscal Year Ended June 30, 2006 2005 2004 Combined Twelve Months Ended June... -

Page 46

...sales. Burger King Holdings, Inc. and Subsidiaries Restaurant Count Analysis The following tables present information relating to the analysis of our restaurant count for the geographic areas and periods indicated. Worldwide Company Franchise Total Beginning Balance July 1, 2003 Openings Closings... -

Page 47

...2005 Openings Closings Acquisitions, net of refranchisings Ending Balance June 30, 2006 Latin America 280 21 (4) (20) 277 21 (14) (1) 283 10 (4) 4 293 2,179 177 (68) 20 2,308 165 (101) 1 2,373 191 (66) (4) 2,494 2,459 198 (72) Ì 2,585 186 (115) Ì 2,656 201 (70) Ì 2,787 Company Franchise... -

Page 48

... to price, service, location and food quality. Our restaurants feature flame-broiled hamburgers, chicken and other specialty sandwiches, french fries, soft drinks and other reasonably-priced food items. Our business operates in three reportable segments: (1) the United States and Canada; (2) Europe... -

Page 49

... breakfast and late night day parts. We have reduced the capital costs to build a restaurant which, together with the improved financial health of our franchise system in the United States, is leading to increased restaurant development in our U.S. business. During fiscal 2007, we anticipate opening... -

Page 50

... revenues from franchisees are affected primarily by sales at franchise restaurants, the timing of franchise restaurant openings and closings and the financial strength and stability of the franchise system. Costs and Expenses Company restaurants incur three types of operating expenses: ‚ food... -

Page 51

... as the United States, Canada, the United Kingdom and Germany, we manage an advertising fund for that country by collecting required advertising contributions from company and franchise restaurants and purchasing advertising and other marketing initiatives on behalf of all Burger King restaurants in... -

Page 52

... States and Canada EMEA/APAC Latin America Total System-Wide 2.5% 0.0% 2.5% 1.9% 6.6% 2.8% 5.5% 5.6% (0.5)% 5.4% 4.0% 1.0% Our comparable sales growth in fiscal 2006 was driven by new products and marketing and operational initiatives. Comparable sales did not increase at the same rate... -

Page 53

...-performing restaurants during the same two-year period. Our system-wide sales in the United States and Canada increased slightly in fiscal 2006, primarily as a result of positive comparable sales growth partially offset by restaurant closures. We had 6,656 franchise restaurants in the United States... -

Page 54

... Accounting Standards Board (""FASB'') Statement of Financial Accounting Standards (""SFAS'') No. 141, Business Combinations. Purchase accounting required a preliminary allocation of the purchase price to the assets acquired and liabilities assumed at their estimated fair market values at the time... -

Page 55

... the financial health and performance of our franchisee base in the United States and Canada. Franchise restaurant average restaurant sales in the United States and Canada have improved from $973,000 in the twelve months ended June 30, 2003 to $1.1 million in fiscal 2006. Our collection rates, which... -

Page 56

... franchise system in the United States and Canada. Our Global Reorganization and Realignment After our acquisition of BKC, we retained consultants during fiscal 2004 and fiscal 2005 to assist us in the review of the management and efficiency of our business, focusing on our operations, marketing... -

Page 57

... new restaurant openings (net of closures), the acquisition of 44 franchise restaurants (net of refranchisings), and positive comparable sales in the United States and Canada. Partially offsetting these factors were negative comparable sales in EMEA/APAC. In fiscal 2005, company restaurant revenues... -

Page 58

...were opened since June 30, 2005, including 277 new international franchise restaurants. Partially offsetting these factors was the elimination of royalties from 360 franchise restaurants that were closed or acquired by us, primarily in the United States and Canada. In fiscal 2005, franchise revenues... -

Page 59

... of new company restaurants in Germany and increased wages and benefits costs. Payroll and employee benefits costs were 30.8% of company restaurant revenues in EMEA/APAC, compared to 30.3% in fiscal 2004. In Latin America, where labor costs are lower than in the United States and Canada and EMEA... -

Page 60

...and employee benefits costs increased 12% to $6 million, primarily as a result of new company restaurants. Payroll and employee benefits costs were 11.4% of company restaurant revenues in Latin America in fiscal 2005, compared to 11.0% in fiscal 2004. Occupancy and other operating costs increased 11... -

Page 61

... million of increased costs associated with operational excellence initiatives. Our remaining general and administrative expense increases in fiscal 2005 were attributable to the acquisition of franchise restaurants and increases in restaurant operations and business development teams, particularly... -

Page 62

... Operating income Operating income increased by $19 million to $170 million in fiscal 2006, primarily as a result of improved restaurant sales and the improved financial health of our franchise system, partially offset by the effect of the compensatory make-whole payment and the management agreement... -

Page 63

... to our valuation allowances related to deferred tax assets in foreign countries and certain state income taxes in fiscal 2005. See Note 13 to our audited consolidated financial statements for further information regarding our effective tax rate and valuation allowances. Net Income Our net income... -

Page 64

... restaurant revenues 394 $ 368 $ 379 $ 375 $ 364 $ 339 $ 354 $ 350 Franchise revenues 111 100 104 105 107 100 104 102 Property revenues 28 27 29 28 32 29 30 29 Total revenues Company restaurant expenses: Food, paper and product costs Payroll and employee benefits Occupancy and other operating... -

Page 65

... of our advertising, new products and promotional programs. Our results of operations also fluctuate from quarter to quarter as a result of seasonal trends and other factors, such as the timing of restaurant openings and closings and our acquisition of franchise restaurants as well as variability... -

Page 66

...on asset and business disposals, impairment charges and settlement losses recorded in connection with acquisitions of franchise restaurants. Unusual charges incurred during each quarter for fiscal 2006 and fiscal 2005 were as follows: Jun 30, 2006 Mar 31, 2006 Dec 31, 2005 For the Quarters Ended Sep... -

Page 67

...in the fiscal years ended June 30, 2006 and 2005 was as follows: Jun 30, 2006 Mar 31, 2006 For the Quarters Ended Dec 31, Sep 30, Jun 30, 2005 2005 2005 (In constant currencies) Mar 31, 2005 Dec 31, 2004 Sep 30, 2004 Comparable Sales Growth: United States and Canada EMEA/APAC Latin America Total... -

Page 68

...term investments in fiscal 2004, which were sold for $122 million in fiscal 2005. In fiscal 2006, our cash used to acquire franchise restaurants and franchisee debt decreased by $43 million, partially offsetting the comparative cash flow effect of the $122 million in proceeds for the investment sale... -

Page 69

... Asian holding companies. Each of these new holding companies is responsible in its region for (a) management, development and expansion of the Burger King trade names and trademarks, (b) management of existing and future franchises and licenses for both franchise and company-owned restaurants, and... -

Page 70

... marketing services from third parties in advance on behalf of the Burger King system and obligations related to information technology service agreements. As of June 30, 2006, we leased 1,090 properties to franchisees and other third parties. At June 30, 2006, we also leased land, buildings, office... -

Page 71

... Up, Inc. to supply Company and franchise restaurants with their products and obligating Burger King restaurants in the United States to purchase a specified number of gallons of soft drink syrup. These volume commitments are not subject to any time limit. As of June 30, 2006, we estimate that it... -

Page 72

...of operations is based on our consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires our management to make estimates and judgments that affect the reported amounts of assets... -

Page 73

...our audited consolidated financial statements included elsewhere in this report for further information about purchase accounting allocations, related adjustments and intangible assets recorded in connection with our acquisition of BKC and acquisition of restaurant operations. Long-Lived Assets Long... -

Page 74

... of the fair value of the asset with its carrying amount in each segment, as defined by SFAS No. 131, which are the United States and Canada, EMEA/APAC, and Latin America. When assessing the recoverability of these assets, we make assumptions regarding estimated future cash flow similar to those... -

Page 75

... over the service period of the award, based on the fair value at the grant date. The impact of the adoption of this statement on the Company in fiscal 2007 and beyond will depend on various factors including, but not limited to, our future stock-based compensation grants. We currently estimate the... -

Page 76

... translated value of our earnings and cash flow associated with our foreign operations, as well as the translation of net asset or liability positions that are denominated in foreign countries. In countries outside of the United States where we operate company restaurants, we generate revenues and... -

Page 77

... BURGER KING HOLDINGS, INC. AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of June 30, 2006 and 2005 Consolidated Statements of Operations for each of the years in the three-year period ended... -

Page 78

...'s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the... -

Page 79

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Consolidated Balance Sheets As of June 30, 2006 2005 (In millions, except share data) ASSETS Current assets: Cash and cash equivalents Trade and notes receivable, net Prepaids and other current assets, net Deferred income taxes, net Total current ... -

Page 80

... Statements of Operations Fiscal Years Ended June 30, 2006 2005 2004 (In millions, except per share data) Revenues: Company restaurant revenues Franchise revenues Property revenues Total revenues Company restaurant expenses: Food, paper and product costs Payroll and employee benefits... -

Page 81

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of Stockholders' Equity and Comprehensive Income (Loss) Issued Issued Common Restricted Additional Accum. Other Common Stock Stock Paid-In Retained Comprehensive Treasury Stock Shares Amount Units Capital Earnings Income (Loss) ... -

Page 82

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of Cash Flows Years Ended June 30, 2006 2005 2004 (In millions) Cash flows from operating activities: Net income 27 $ 47 $ 5 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and ... -

Page 83

... of Business Burger King Holdings, Inc. (""BKH'' or the ""Company'') is a Delaware corporation formed on July 23, 2002. It is the parent of Burger King Corporation (""BKC''), a Florida corporation that franchises and operates fast food hamburger restaurants, principally under the Burger King brand... -

Page 84

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) intangible assets and other liabilities, respectively. In connection with these adjustments to the preliminary allocations, the Company recognized a net benefit of $2 million as a change in ... -

Page 85

... for Company-owned and franchised Burger King restaurants in the United States for the purchase of food, packaging, and equipment. These restaurants place purchase orders and receive the respective products from distributors with whom, in most cases, RSI has service agreements. For the year ended... -

Page 86

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Company enters into an agreement with a franchisee that releases the franchisee from outstanding obligations, (b) franchise agreements are terminated and the projected costs of collections exceed ... -

Page 87

... and shared by all restaurants in each country. As a result, the Company has defined operating markets as the entire country in the case of The Netherlands, Spain, Mexico and China. If the carrying amount of an asset exceeds the estimated and undiscounted future cash flows generated by the asset, an... -

Page 88

...with Statement of Position (""SOP'') No. 93-7, Reporting on Advertising Costs. Franchised restaurants and Company-owned restaurants contribute to advertising funds managed by the Company in the United States and certain international markets where Company-owned restaurants operate. Under the Company... -

Page 89

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) advertising, marketing and related activities, and result in no gross profit recognized by the Company. Amounts which are contributed to the advertising funds by company owned restaurants are ... -

Page 90

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Compensation value for the fair value disclosure is estimated for each option grant using a Black-Scholes option-pricing model. The following weighted average assumptions were used for option grants... -

Page 91

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Closures and Dispositions (Gains) losses on asset and business disposals are comprised primarily of lease termination costs relating to restaurant closures and refranchising of Company-owned ... -

Page 92

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) June 30, 2004. The change in allowances for doubtful accounts for each of the three years ending June 30, 2006 are as follows: Years Ended June 30, 2006 2005 2004 Beginning balance Bad debt ... -

Page 93

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) The table below presents intangible assets subject to amortization, along with their useful lives (in millions): Years Ended June 30, 2006 2005 Franchise agreements Favorable lease contracts ... -

Page 94

... financing costs, which is recorded as a loss on early extinguishment of debt in the consolidated statement of operations for the fiscal year ended June 30, 2006. In May 2006, the Company utilized a portion of the $392 million in net proceeds received from the initial public offering to prepay... -

Page 95

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Company's option, either (a) ABR, plus a rate of 0.50% or (b) LIBOR plus 1.50%, in each case so long as the Company's leverage ratio remains at or below certain levels (but in any event not to ... -

Page 96

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Note 11. Derivative Instruments Interest rate swaps During the year ended June 30, 2006, the Company entered into interest rate swap contracts with a notional value of $750 million that qualify as ... -

Page 97

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Note 12. Interest Expense Years Ended June 30, 2006 2005 2004 Interest expense is comprised of the following (in millions): Term loans and PIK Notes Capital lease obligations Total $72 9 $81... -

Page 98

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) The U.S. Federal tax statutory rate reconciles to the effective tax rate as follows: Years Ended June 30, 2006 2005 2004 U.S. Federal income tax rate State income taxes, net of federal income tax ... -

Page 99

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) The significant components of deferred income tax expense (benefit) attributable to income from continuing operations are as follows (in millions): Years Ended June 30, 2006 2005 2004 Deferred ... -

Page 100

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) For the year ended June 30, 2006, the valuation allowance increased by $11 million. After considering the level of historical taxable income, projections for future taxable income over the periods ... -

Page 101

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) the Company was charged a quarterly fee not to exceed 0.5% of the prior quarter's total revenues. The Company incurred management fees and reimbursable out-of-pocket expenses under the management ... -

Page 102

... of long-term debt and capital leases. Property revenues, which are classified within franchise and property revenues, are comprised primarily of rental income from operating leases and earned income on direct financing leases with franchisees as follows (in millions): Years Ended June 30, 2006 2005... -

Page 103

... 104,692,735 common shares to the private equity funds controlled by the Sponsors. As described in Note 1, in connection with the initial public offering, the Board of Directors of the Company authorized an increase in the number of shares of the Company's $0.01 par value common stock to 300 million... -

Page 104

... public offering, the Company granted a one-time grant of 447,886 options to purchase shares of BKH common stock to certain executive officers. The following table summarizes the status and activity of options granted during fiscal 2005 and 2006: Number of Options Weighted Average Exercise Price... -

Page 105

... dividend payment. The make-whole payment was recorded as employee compensation cost, and is included in selling, general and administrative expenses in the accompanying statement of operations for the year ended June 30, 2006. Note 17. Retirement Plan and Other Postretirement Benefits The Company... -

Page 106

... consolidated statements of operations for the fiscal year ended June 30, 2006 and was paid by the Company to employees in cash or contributed to the 401(k) plan in which the employee participates. Expenses incurred for the savings plan and ERP totaled $6 million for the year ended June 30, 2006... -

Page 107

...in Statement of Financial Position Accrued benefit liability Accumulated other comprehensive loss Net accrued benefit cost (54) Ì $(54) (55) (5) $(60) (24) Ì $(24) (23) Ì $(23) Additional year-end information for Pension Plans with accumulated benefit obligations in excess of plan assets... -

Page 108

... Plans (retirement benefits) and Postretirement Plans (other benefits) are as follows: Retirement Benefits Years Ended June 30, 2006 2005 2004 Other Benefits Years Ended June 30, 2006 2005 2004 Discount rate Range of compensation rate increase Expected long-term rate of return on plan assets... -

Page 109

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Estimated Future Cash Flows Total contributions to the Pension Plans were $2 million, $17 million and $1 million for the years ended June 30, 2006, 2005, and 2004, respectively. The Pension and ... -

Page 110

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) For the year ended June 30, 2004, the Company recognized a charge of $3 million for settlement of a claim in Australia by BKC's joint venture partner. Under the terms of a settlement agreement, BKC ... -

Page 111

... their products and obligating Burger King restaurants in the United States to purchase a specified number of gallons of soft drink syrup. These volume commitments are not subject to any time limit. As of June 30, 2006, the Company estimates that it will take approximately 16 years and 17 years to... -

Page 112

... this period. Note 20. Segment Reporting The Company operates in the fast food hamburger restaurant industry. Revenues include retail sales at Company-owned restaurants and franchise revenues. The business is managed as distinct geographic segments: United States and Canada, Europe, Middle East and... -

Page 113

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Years Ended June 30, 2006 2005 2004 Operating Income: United States and Canada EMEA/APAC Latin America Unallocated Total operating income Interest expense, net Loss on early distinguishment ... -

Page 114

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Years Ended June 30, 2006 2005 Long-Lived Assets: United States and Canada EMEA/APAC Latin America Unallocated Total long-lived assets $ 854 114 35 31 $1,034 $ 892 102 31 23 $1,048 Long-... -

Page 115

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) Quarterly results were impacted by timing of expenses and charges which affect comparability of results. The impact of these items during each quarter for fiscal 2006 and 2005 was as follows: Jun 30... -

Page 116

BURGER KING HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Ì (Continued) preparation for the sale of any class of equity securities in a public market is considered a public entity for purposes of SFAS No. 123(R). The Company implemented SFAS No. 123(R) effective July 1,... -

Page 117

... over financial reporting as of the end of our most recent fiscal year, including a statement as to whether or not our internal control over financial reporting is effective, and (4) a statement that our registered independent public accounting firm has issued an attestation report on management... -

Page 118

... Franchise Operations from February 2004 to July 2004. Mr. Hyatt joined us as Senior Vice President, Operations Services and Programs in May 2002. From 1995 to May 2002, Mr. Hyatt was a Burger King franchisee in Atlanta, Georgia. Peter C. Smith has served as our Chief Human Resources Officer since... -

Page 119

... Statement. Item 14. Principal Accounting Fees and Services Incorporated herein by reference from the Company's 2006 Proxy Statement. Part IV Item 15. Exhibits and Financial Statement Schedules (1) All Financial Statements Consolidated financial statements filed as part of this report are listed... -

Page 120

... Lejeune, Inc. and Burger King Corporation Burger King Holdings, Inc. Equity Incentive Plan Burger King Holdings, Inc. 2006 Omnibus Incentive Plan Burger King Corporation Fiscal Year 2006 Executive Team Restaurant Support Incentive Plan Form of Management Restricted Unit Agreement Form of Amendment... -

Page 121

... Inc. 2006 Omnibus Incentive Plan 14 Burger King Code of Business Ethics and Conduct 21.1 List of Subsidiaries of the Registrant 31.1 Certification of Chief Executive Officer of Burger King Holdings, Inc. pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 31.2 Certification of Chief Financial... -

Page 122

... undersigned, thereunto duly authorized. BURGER KING HOLDINGS, INC. By: /s/ John W. Chidsey Name: John W. Chidsey Title: Chief Executive Officer and Director Date: August 31, 2006 Pursuant to the requirements of the Securities Exchange Act of 1934, this report been signed by the following persons... -

Page 123

Signature Title Date /s/ Adrian Jones Adrian Jones /s/ Sanjeev k. Mehra Sanjeev k. Mehra /s/ Stephen G. Pagliuca Stephen G. Pagliuca /s/ Kneeland C. Youngblood Kneeland C. Youngblood Director August 31, 2006 Director August 31, 2006 Director August 31, 2006 Director August 31, 2006 111 -

Page 124

... Lejeune, Inc. and Burger King Corporation Burger King Holdings, Inc. Equity Incentive Plan Burger King Holdings, Inc. 2006 Omnibus Incentive Plan Burger King Corporation Fiscal Year 2006 Executive Team Restaurant Support Incentive Plan Form of Management Restricted Unit Agreement Form of Amendment... -

Page 125

... Inc. 2006 Omnibus Incentive Plan 14 Burger King Code of Business Ethics and Conduct 21.1 List of Subsidiaries of the Registrant 31.1 Certification of Chief Executive Officer of Burger King Holdings, Inc. pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 31.2 Certification of Chief Financial... -

Page 126

... King Restaurants B.V. Burger King Restaurants K.B. Burger King Restaurants of Canada Inc. Burger King Schweiz GmbH Burger King Sweden K.B. Burger King Sweden, Inc. Burger King UK Pension Plan Trustee Company Limited Burger Station B.V. Burger King Limited Mexico Delaware Delaware Singapore Florida... -

Page 127

...Bale Limited Mid-America Aviation, Inc. Mini Meals Limited Montrap Limited Montrass Limited Moxie's, Inc. QZ, Inc. Servicios de Burger King, S.A. de C.V. The Melodie Corporation TPC Number Four, Inc. TPC Number Six, Inc. TQW Company Florida United Kingdom United Kingdom Canada United Kingdom United... -

Page 128

..., process, summarize and report financial information; and b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ John W. Chidsey John W. Chidsey Chief Executive Officer Date... -

Page 129

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b. Any fraud, whether or not material, that involves management or other employees who... -

Page 130

... financial condition and results of operations of the Company. /s/ John W. Chidsey John W. Chidsey Chief Executive Officer Dated: August 31, 2006 A signed original of this written statement required by Section 906 has been provided to Burger King Holdings, Inc. and will be retained by Burger King... -

Page 131

...and results of operations of the Company. /s/ Ben K. Wells Ben K. Wells Chief Financial Officer Dated: August 31, 2006 A signed original of this written statement required by Section 906 has been provided to Burger King Holdings, Inc. and will be retained by Burger King Holdings, Inc. and furnished...