Blackberry 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011

Table of contents

-

Page 1

2011 -

Page 2

... Analysis of Financial Condition and Results of Operations - Cautionary Note Regarding Forward-Looking Statements." ©2011 Research In Motion Limited. All rights reserved. BlackBerry®, RIM®, Research In Motion® and related trademarks, names and logos are the property of Research In Motion Limited... -

Page 3

-

Page 4

... brand for wireless solutions in both business and consumer segments, Research In Motion (RIM) is set to expand the parameters of mobile innovation yet again. It's game time for the newest addition to the BlackBerry® portfolio - the BlackBerry® PlayBook™ tablet. With an ultra portable design... -

Page 5

... works with the touch screen and trackpad and integrates a new WebKit-based browser that renders HTML web pages quickly and beautifully. The BlackBerry® PlayBook™ connects you to all of the content that's important to you, including rich websites, streaming videos, online games and more, giving... -

Page 6

INFORMATION EXCHANGE Social Connections With more than 39 million users (and counting), BBM is the real-time messaging app of choice for BlackBerry smartphone users around the world. BlackBerry® Messenger (BBM) has captivated enterprise and consumer audiences everywhere, and its popularity ... -

Page 7

...to the businesses, retailers, people, restaurants, movies, events and weather information that users are looking for. Armed with open tools, RIM's network of developers have access to the APIs and services that allow for deep, rich integration between their applications and core BlackBerry features... -

Page 8

...years. It helps RIM deliver real-time data push, market-leading security and backend integration with carrier systems. It helps BlackBerry smartphones deliver a renowned user experience. In the past year, RIM has extended its cloud architecture to deliver developer services, including push, payment... -

Page 9

...whom are upgrading to a smartphone for the first time, are attracted to the flexibility of prepaid plans and the ease of messaging and social networking through BlackBerry apps. 1 2 IDC Worldwide Mobile Phones Quarterly Tracker - Final data - Q4 2010 GfK R&T, Smartphones, Volume Sales, 2010 and Q4... -

Page 10

... together with expanded messaging capabilities and intuitive features to simplify the management of social networking and RSS feeds. The new BlackBerry Tablet OS is built upon one of the most reliable, secure and robust operating systems in the world - the QNX Neutrino Real-Time OS - which has been... -

Page 11

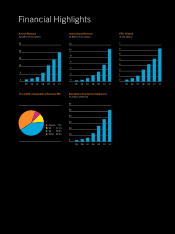

... Revenue (in billions of U.S. dollars) 25 International Revenue (in billions of U.S. dollars) 12 10 8 EPS-Diluted (in U.S. dollars) 7 6 5 4 20 15 6 10 4 5 2 0 05 06 07 08 09 10 11 05 06 07 08 09 10 11 3 2 1 0 05 06 07 08 09 10 11 0 Fiscal 2011 Geographical Revenue Mix BlackBerry Smartphone... -

Page 12

2011 ANNUAL REPORT -

Page 13

...) and the Toronto Stock exchange (TSX: RIM). For more information, visit www.rim.com or www.blackberry.com. ©2011 Research In Motion Limited. All rights reserved. BlackBerry®, RIM®, Research In Motion® and related trademarks, names and logos are the property of Research In Motion Limited and are... -

Page 14

...Net income Earnings per share Basic Diluted Operating data [percentage of revenue] Gross margin Research and development Selling, marketing and administration Balance Sheet data Cash, cash equivalents, short-term investments and long-term investments Total Assets Shareholders' equity $ $ 2,698 8,938... -

Page 15

...number of markets around the world including the united States, Canada, latin America,1 and the united Kingdom.2 Heading into the new fiscal year, we have an exciting roadmap of products and services planned, including 4G tablets and a variety of new QWeRtY, hybrid and touch screen smartphone models... -

Page 16

... and Co-CEO Jim Balsillie Co-CEO ticularly in international markets where our partners have strongly embraced prepaid BlackBerry service offerings. the efficiency of the BlackBerry solution on both older and newer networks allows our partners to offer economical pricing plans for the messaging and... -

Page 17

... to add purchases directly to the mobile phone bill they receive from their carrier. Over the coming year we plan to further grow the number of apps on BlackBerry App World and to make these new payment options more broadly available to our customer base. Growing Application Platform In fiscal 2011... -

Page 18

RESEARCH IN MOTION LIMITED Financial Information RESEARCH IN MOTION ANNUAL REPORT 2011 5 -

Page 19

... months ended February 27, 2010 Selected Quarterly Financial Data Financial Condition Legal Proceedings Market Risk of Financial Instruments Disclosure Controls and Procedures and Internal Controls Management's Responsibility for Financial Reporting Report of Independent Registered Public Accounting... -

Page 20

... use software or components supplied by third parties; • potential impact of copyright levies in numerous countries; • RIM's ability to enhance current products and services, or develop new products and services in a timely manner at competitive prices; RESEARCH IN MOTION ANNUAL REPORT 2011 7 -

Page 21

... and services through software development kits, wireless connectivity to data and third-party support programs. RIM's portfolio of award-winning products, services and embedded technologies are used by thousands of organizations and millions of consumers around the world and include the BlackBerry... -

Page 22

... charged for each subscriber using the BlackBerry service via a BES; (iii) maintenance and upgrades to software; and (iv) technical support. Revenues are also generated from non-warranty repairs, sales of accessories and non-recurring engineering development contracts ("NRE"). On September 27, 2010... -

Page 23

...26, 2011, February 27, 2010 and February 28, 2009, which is expressed in millions of dollars. (in millions, except for share and per share amounts) As at and for the Fiscal Year Ended February 26, 2011 Revenue Cost of sales Gross margin Operating expenses Research and development Selling, marketing... -

Page 24

... 2010. A more comprehensive analysis of these factors is contained in "Results of Operations". On November 4, 2009, the Company's Board of Directors authorized the repurchase of common shares up to an authorized limit of $1.2 billion (the "2010 Repurchase Program"). Under the 2010 Repurchase Program... -

Page 25

... if the fair value of undelivered elements is determinable. Revenue from software maintenance, unspecified upgrades and technical support contracts is recognized over the period that such items are delivered or those services are provided. Other Revenue from the sale of accessories is recognized... -

Page 26

... on a standalone basis. The Company determines BESP for a product or service by considering multiple factors including, but not limited to, market conditions, competitive landscape, internal costs, gross margin objectives and pricing practices. The determination of BESP is made through consultation... -

Page 27

... customer demand. The Company performs an assessment of inventory during each reporting period, which includes a review of, among other factors, demand requirements, component part purchase commitments of the Company and certain key suppliers, product life cycle and development plans, component cost... -

Page 28

...historical licensing activities, royalty payment experience and forward-looking expectations. Warranty The Company provides for the estimated costs of product warranties at the time revenue is recognized. BlackBerry devices are generally covered by a time-limited warranty for varying periods of time... -

Page 29

... between the cost basis and the fair value of the individual investment at the balance sheet date of the reporting period for which the assessment was made. The Company's assessment on whether an investment is other-than-temporarily impaired or not, could change due to new developments or changes... -

Page 30

... way of common shares purchased on the open market or issued by the Company. DSUs are accounted for as liability-classified awards and are awarded on a quarterly basis. These awards are measured at their fair value on the date of grant, and remeasured at each reporting period, until settlement. For... -

Page 31

... of its officers and directors, including its Co-Chief Executive Officers ("Co-CEOs"), relating to the previously disclosed OSC investigation of the Company's historical stock option granting practices. As discussed under "Restatement of Previously Issued Financial Statements - SEC Settlements... -

Page 32

...in net new BlackBerry subscriber accounts since the end of fiscal 2010. Software revenue includes fees from licensed BES software, CALs, technical support, maintenance and upgrades. Software revenue increased $35 million, or 13.5%, to $294 million in fiscal 2011 from $259 million in fiscal 2010. The... -

Page 33

... of amortization expense relating to property, plant and equipment and intangible assets recorded as amortization or cost of sales for fiscal 2011 compared to fiscal 2010. Intangible assets are comprised of acquired technology, licenses and patents. 20 RESEARCH IN MOTION ANNUAL REPORT 2011 -

Page 34

... Cost of sales Amortization expense relating to certain property, plant and equipment and certain intangible assets employed in the Company's manufacturing operations and BlackBerry service operations increased by $183 million to $489 million for fiscal 2011 compared to $306 million for fiscal 2010... -

Page 35

...% of the Company's public float of common shares. Fiscal year end February 27, 2010 compared to fiscal year ended February 28, 2009 Revenue Revenue for fiscal 2010 was $15.0 billion, an increase of $3.9 billion, or 35.1%, from $11.1 billion in fiscal 2009. 22 RESEARCH IN MOTION ANNUAL REPORT 2011 -

Page 36

... in fiscal 2009. The majority of the increase was attributable to increases in non-warranty repair and sales of accessories offset partially by losses realized from revenue hedging instruments. See "Market Risk of Financial Instruments - Foreign Exchange" for additional information on the Company... -

Page 37

... during fiscal 2010 compared to fiscal 2009 were attributable to salaries and benefits due to an increase in the headcount associated with research and development activities, new product development costs and office and building infrastructure costs. Selling, Marketing and Administration Expenses... -

Page 38

... RIM's Co-CEOs, related to the exercise of certain stock options issued by the Company. Amortization Expense The table below presents a comparison of amortization expense relating to property, plant and equipment and intangible assets recorded as amortization or cost of sales for fiscal 2010... -

Page 39

... of fiscal 2010 and the amounts paid in excess of the per share paid-in capital of the common shares of $728 million were charged to retained earnings. All common shares repurchased by the Company pursuant to the 2010 Repurchase Program have been cancelled. 26 RESEARCH IN MOTION ANNUAL REPORT 2011 -

Page 40

... the three months ended February 26, 2011 and February 27, 2010: (in millions, except for share and per share amounts) For the Three Months Ended February 26, 2011 Revenue Cost of sales Gross margin Operating expenses Research and development Selling, marketing and administration Amortization 383... -

Page 41

... launch of next generation versions of smartphones in the second quarter and beyond. The Company currently expects that its smartphone and related software and services business gross margin will remain consistent throughout fiscal 2012, but as the BlackBerry PlayBook increases as a percentage... -

Page 42

... 6.5% of revenue, in the third quarter of fiscal 2011. The majority of the increase was attributable to salaries and benefits due to an increase in the headcount associated with research and development activities, as well as increased materials usage. Selling, Marketing and Administration Expenses... -

Page 43

... made during fiscal 2011. Cost of sales Amortization expense relating to certain property, plant and equipment and certain intangible assets employed in the Company's manufacturing operations and BlackBerry service operations increased by $92 million to $186 million for the fourth quarter of fiscal... -

Page 44

... time periods and the foreign exchange impact of the enactment of functional currency tax legislation in Canada. See "Results of Operations - Selling, Marketing and Administration Expenses" for the fiscal year ended February 26, 2011. (2) In the second quarter of fiscal 2010, the Company settled... -

Page 45

... revenues and the increasing international mix of business where payment terms tend to be longer as well as the timing of shipments in the quarter. Days sales outstanding increased to 65 days in the fourth quarter of fiscal 2011 from 58 days at the end of fiscal 2010. The increase in current... -

Page 46

... with third parties for the use of intellectual property, software, messaging services and other BlackBerry related features, as well as intangible assets associated with business acquisitions. Business acquisitions during fiscal 2011 related to the purchase of a company whose acquired technology... -

Page 47

... technology, including service operations. The remaining balance consists of purchase orders or contracts with suppliers of raw materials, as well as other goods and services utilized in the operations of the Company. The expected timing of payment of these 34 RESEARCH IN MOTION ANNUAL REPORT 2011 -

Page 48

... detail under "Risk Factors - Risks Related to Intellectual Property" in RIM's Annual Information Form, which is included in RIM's Annual Report on Form 40-F. Management reviews all of the relevant facts for each claim and applies judgment in evaluating the likelihood and, if applicable, the amount... -

Page 49

.... The petitions for review were granted on March 25, 2011. Proceedings are ongoing. On January 14, 2010, Kodak filed a complaint with the ITC against the Company and Apple Inc. alleging infringement of the '218 Patent and requesting the ITC to issue orders prohibiting certain RIM products from being... -

Page 50

... relate to antennae technology. The complaint seeks an injunction and monetary damages. The Court issued a claim construction order on November 9, 2010. The jury selection for trial is scheduled for May 2, 2011. Proceedings are ongoing. On August 21, 2009, Xpoint Technologies filed a lawsuit... -

Page 51

..., Inc. ("Eatoni") filed a motion to vacate a June 8, 2010 arbitration award and a March 2007 arbitration award in the Southern District of New York in a lawsuit filed on November 19, 2008 against the Company alleging that: RIM breached the March 2007 arbitration award; the license to RIM for Eatoni... -

Page 52

... The Company has historically been dependent on an increasing number of significant telecommunication carriers and distribution partners and on larger more complex contracts with respect to sales of the majority of its products and services. The Company RESEARCH IN MOTION ANNUAL REPORT 2011 39 -

Page 53

... carrier customer base in terms of numbers, sales and account receivables volumes, and in some instances, new or significantly increased credit limits. The Company, in the normal course of business, monitors the financial condition of its customers and reviews the credit history of each new customer... -

Page 54

... compliance with the policies or procedures may deteriorate. Management assessed the effectiveness of the Company's internal control over financial reporting as of February 26, 2011. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the... -

Page 55

... Committee and approved by the Board of Directors of Research In Motion Limited. In fulfilling its responsibility for the reliability and integrity of financial information, management has developed and maintains systems of accounting and internal controls and budgeting procedures. Management... -

Page 56

... the years ended February 26, 2011, February 27, 2010 and February 28, 2009 of the Company and our report dated March 29, 2011 expressed an unqualified opinion thereon. Kitchener, Canada, March 29, 2011. Chartered Accountants Licensed Public Accountants RESEARCH IN MOTION ANNUAL REPORT 2011 43 -

Page 57

... Organizations of the Treadway Commission and our report dated March 29, 2011 expressed an unqualified opinion on the Company's internal control over financial reporting. Kitchener, Canada, March 29, 2011. Chartered Accountants Licensed Public Accountants 44 RESEARCH IN MOTION ANNUAL REPORT 2011 -

Page 58

RESEARCH IN MOTION LIMITED Incorporated Under the Laws of Ontario Consolidated Balance Sheets (United States dollars, in millions) As at February 26, 2011 Assets Current Cash and cash equivalents Short-term investments Accounts receivable, net Other receivables Inventories Other current assets ... -

Page 59

... stock options Stock-based compensation Tax benefits related to stock-based compensation Purchase of treasury stock Common shares repurchased Balance as at February 27, 2010 Comprehensive income: Net income Net change in unrealized losses on available-for-sale investments Net change in fair value of... -

Page 60

RESEARCH IN MOTION LIMITED Consolidated Statements of Operations (United States dollars, in millions, except per share data) For the Year Ended February 26, 2011 Revenue Hardware and other Service and software Cost of sales Hardware and other Service and software Gross margin Operating expenses ... -

Page 61

... in working capital items Net cash provided by operating activities Cash flows from investing activities Acquisition of long-term investments Proceeds on sale or maturity of long-term investments Acquisition of property, plant and equipment Acquisition of intangible assets Business acquisitions, net... -

Page 62

... and services through software development kits, wireless connectivity to data and third-party support programs. RIM's portfolio of award-winning products, services and embedded technologies are used by thousands of organizations and millions of consumers around the world and include the BlackBerry... -

Page 63

... at the balance sheet date of the reporting period for which the assessment was made. The fair value of the investment then becomes the new cost basis of the investment. Effective in the second quarter of fiscal 2010, if a debt security's market value is below its amortized cost and the Company... -

Page 64

...inventories are stated at the lower of cost and net realizable value. Cost includes the cost of materials plus direct labour applied to the product and the applicable share of manufacturing overhead. Cost is determined on a first-in-first-out basis. Property, plant and equipment, net Property, plant... -

Page 65

...the implied fair value of the goodwill, an impairment loss is recognized in an amount equal to the excess and is presented as a separate line item in the consolidated statements of operations. Impairment of long-lived assets The Company reviews long-lived assets such as property, plant and equipment... -

Page 66

... if the fair value of undelivered elements is determinable. Revenue from software maintenance, unspecified upgrades and technical support contracts is recognized over the period that such items are delivered or those services are provided. Other Revenue from the sale of accessories is recognized... -

Page 67

... on a standalone basis. The Company determines BESP for a product or service by considering multiple factors including, but not limited to, market conditions, competitive landscape, internal costs, gross margin objectives and pricing practices. The determination of BESP is made through consultation... -

Page 68

...reporting period when such revisions are made. Advertising costs The Company expenses all advertising costs as incurred. These costs are included in selling, marketing and administration. 2. ADOPTION OF ACCOUNTING POLICIES In January 2010, the Financial Accounting Standards Board (the "FASB") issued... -

Page 69

... the new authoritative guidance implemented in the first quarter of fiscal 2011, the Company modified its revenue recognition accounting policy, which is described above. In June 2009, the FASB issued authoritative guidance to amend the manner in which an enterprise performs an analysis to determine... -

Page 70

... Gains Unrealized Losses Cash and Cash Equivalents Short-term Investments Long-term Investments Cost Basis Fair Value As at February 26, 2011 Bank balances Money market fund Bankers acceptances Term deposits/certificates Commercial paper Non-U.S. treasury bills/notes U.S. treasury bills/notes... -

Page 71

... the inputs used in the valuation methodologies in measuring fair value into three levels: • Level 1 - Unadjusted quoted prices at the measurement date for identical assets or liabilities in active markets. • Level 2 - Observable inputs other than quoted prices included in Level 1, such as... -

Page 72

... also reviews and understands the inputs used in the valuation process and assesses the pricing of the securities for reasonableness. The fair values of money market funds were derived from quoted prices in active markets for identical assets or liabilities. For bankers' acceptances, term deposits... -

Page 73

..., credit ratings, pricing changes relative to asset class, priority in capital structure, principal payment windows, and maturity dates. All asset backed securities held by the Company are issued by government or consumer agencies and are primarily backed by commercial automobile and equipment... -

Page 74

...contracts Currency option contracts Total liabilities As at February 27, 2010 Assets Available-for-sale investments Money market fund Bankers acceptances Term deposits/certificates Commercial paper Non-U.S. treasury bills/notes U.S. treasury bills/notes U.S. Government sponsored enterprise notes Non... -

Page 75

...2011 Cost Land Buildings, leaseholds and other BlackBerry operations and other information technology Manufacturing equipment, research and development equipment, and tooling Furniture and fixtures Accumulated amortization Net book value $ 128 1,155 1,803 380 433 3,899 1,395 $2,504 February 27, 2010... -

Page 76

... intellectual property, software, messaging services and other BlackBerry related features and intangible assets associated with the business acquisitions discussed in note 7. For the year ended February 26, 2011, amortization expense related to intangible assets was $430 million (February 27, 2010... -

Page 77

... tax purposes. In-process research and development is charged to amortization expense immediately after acquisition. The Company includes the operating results of each acquired business in the consolidated financial statements from the date of acquisition. 64 RESEARCH IN MOTION ANNUAL REPORT 2011 -

Page 78

... closed on February 13, 2009. The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition along with prior year's acquisition allocations: For the year ended February 26, 2011 Assets purchased Current assets Property, plant... -

Page 79

... to the current period acquisitions. Acquisition related costs were recognized in selling, marketing and administration during the year. The weighted average amortization period of the acquired technology related to the business acquisitions completed in fiscal 2011 is approximately 3.8 years (2010... -

Page 80

...: As at February 26, 2011 Assets Non-deductible reserves Tax loss carryforwards Unrealized losses on financial instruments Other tax carryforwards Net deferred income tax assets Liabilities Property, plant and equipment Research and development Unrealized gains on financial instruments Net deferred... -

Page 81

... it operates. The Company regularly assesses the status of these examinations and the potential for adverse outcomes to determine the adequacy of the provision for income taxes. The Canada Revenue Agency ("CRA") is currently examining the Company's fiscal 2006 to fiscal 2009 Canadian corporate tax... -

Page 82

...160) On November 4, 2009, the Company's Board of Directors authorized the repurchase of common shares up to an authorized limit of $1.2 billion (the "2010 Repurchase Program"). In the first quarter of fiscal 2011, the Company repurchased 5.9 million common shares at a cost of $410 million pursuant... -

Page 83

... 2011 (fiscal 2010 - $37 million; fiscal 2009 - $38 million) in relation to stock-based compensation expense. The Company has presented excess tax benefits from the exercise of stock-based compensation awards as a financing activity in the consolidated statement of cash flows. Stock options granted... -

Page 84

... million (February 27, 2010 - $30 million). Tax deficiencies incurred by the Company related to the stock options exercised was $1 million (February 27, 2010 - tax benefits realized of $2 million; February 28, 2009 - tax benefits realized of $13 million). RESEARCH IN MOTION ANNUAL REPORT 2011 71 -

Page 85

RESEARCH IN MOTION LIMITED Notes to the Consolidated Financial Statements In millions of United States dollars, except share and per share data, and except as otherwise indicated continued During the years ended February 26, 2011 and February 28, 2009, there were no stock options granted, ... -

Page 86

RESEARCH IN MOTION LIMITED Notes to the Consolidated Financial Statements In millions of United States dollars, except share and per share data, and except as otherwise indicated continued As of February 26, 2011, there was $95 million of unrecognized compensation expense related to RSUs which ... -

Page 87

... is included in RIM's Annual Report on Form 40-F and "Legal Proceedings" in the Management's Discussion and Analysis ("MD&A") of financial condition and results of operations for fiscal 2011. 11. PRODUCT WARRANTY The Company estimates its warranty costs at the time of revenue recognition based on... -

Page 88

... flow hedges Total accumulated other comprehensive income (loss) $ 5 (15) $(10) February 27, 2010 $ 7 44 $51 February 28, 2009 $- 1 $1 $3,411 (2) February 27, 2010 $2,457 7 February 28, 2009 $1,893 (7) (20) 28 (6) (39) $3,350 15 $2,507 (16) $1,864 RESEARCH IN MOTION ANNUAL REPORT 2011 75 -

Page 89

... by the Government of Canada in the first quarter of fiscal 2010, the Company changed the basis for calculating its income tax provision for its Canadian operations from Canadian dollars, to the U.S. dollar, its reporting currency with an effective date being the beginning of fiscal 2009. The gains... -

Page 90

... 26, 2011, the net unrealized losses on these forward and option contracts was $20 million (February 27, 2010 - net unrealized gains of $62 million; February 28, 2009 - net unrealized losses of $3 million). Unrealized gains associated with these contracts were recorded in other current assets and... -

Page 91

... gains of $16 million). Unrealized gains associated with these contracts were recorded in other current assets and selling, marketing and administration. Unrealized losses were recorded in accrued liabilities and selling, marketing and administration. 78 RESEARCH IN MOTION ANNUAL REPORT 2011 -

Page 92

RESEARCH IN MOTION LIMITED Notes to the Consolidated Financial Statements In millions of United States dollars, except share and per share data, and except as otherwise indicated continued The following table shows the fair values of derivative instruments that are not subject to hedge accounting... -

Page 93

... is organized and managed as a single reportable business segment. The Company's operations are substantially all related to the research, design, manufacture and sales of wireless communications products, services and software. Revenue, classified by major geographic segments in which our customers... -

Page 94

... LLP Chartered Accountants 515 Riverbend Drive Kitchener, Ontario, N2K 3S3 Stock Exchange Listings Nasdaq Global Select Market Symbol: RIMM The Toronto Stock Exchange Symbol: RIM Corporate Office Research In Motion Limited 295 Phillip Street Waterloo, Ontario, N2L 3W8 Corporate Website www.rim.com -

Page 95

Research In Motion 295 Phillip Street, Waterloo, Ontario Canada N2L 3W8 Tel: (519) 888-7465 Fax: (519) 888-7884 www.rim.com www.blackberry.com