Best Buy 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 3, 2012

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-9595

________________________________

BEST BUY CO., INC.

(Exact name of registrant as specified in its charter)

Minnesota 41-0907483

State or other jurisdiction of

incorporation or organization (I.R.S. Employer

Identification No.)

7601 Penn Avenue South

Richfield, Minnesota 55423

(Zip Code)

(Address of principal executive offices)

Registrant's telephone number, including area code 612-291-1000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, par value $.10 per share New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

____________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and

will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of August 27, 2011, was approximately

$6.6 billion, computed by reference to the price of $24.79 per share, the price at which the common equity was last sold on August 27, 2011, as reported

on the New York Stock Exchange-Composite Index. (For purposes of this calculation all of the registrant's directors and executive officers are deemed

affiliates of the registrant.)

As of April 26, 2012, the registrant had 342,198,524 shares of its Common Stock issued and outstanding.

Table of contents

-

Page 1

... billion, computed by reference to the price of $24.79 per share, the price at which the common equity was last sold on August 27, 2011, as reported on the New York Stock Exchange-Composite Index. (For purposes of this calculation all of the registrant's directors and executive officers are deemed... -

Page 2

...materially from the anticipated results expressed in such forward-looking statements. Readers should review Item 1A, Risk Factors, of this Annual Report on Form 10-K for a description of important factors that could cause our future results to differ materially from those contemplated by the forward... -

Page 3

...and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions, and Director Independence. Principal Accounting Fees and Services. Exhibits, Financial Statement Schedules... -

Page 4

...refers to Best Buy Co., Inc. and, as applicable, its consolidated subsidiaries. Description of Business We are a multinational retailer of consumer electronics, computing and mobile phone products, entertainment products, appliances and related services. We operate retail stores and call centers and... -

Page 5

... retail and distribution business with nearly 2,400 small-format The Carphone Warehouse and The Phone House stores, online channels, device insurance operations, and mobile and fixed-line telecommunication services. In fiscal 2009, we also expanded our Best Buy Mobile operations to Canada by opening... -

Page 6

...operating model similar to that used in our U.S. Best Buy Mobile stores. Our Five Star stores primarily utilize vendor employees and full-time sales associates to sell our products. Corporate retail management generally controls advertising, merchandise purchasing and pricing, and inventory policies... -

Page 7

... from Canada Best Buy Mobile stand-alone stores is primarily derived from mobile phone hardware, subscription service commissions from mobile phone network operators and related mobile phone accessories. In China, our Five Star stores have offerings in four revenue categories: Appliances, Consumer... -

Page 8

... The Phone House stores in Europe. Domestic Segment During fiscal 2012, we opened 135 new stores and closed five stores in our Domestic segment. Although we have closed all of our Geek Squad stand-alone stores, we offer Geek Squad support services, as well as the Best Buy Mobile store-within-a-store... -

Page 9

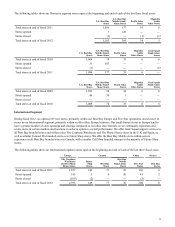

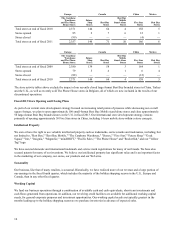

... years: Europe The Carphone Warehouse and The Phone House Stores Future Shop Stores Canada Best Buy Mobile Stand-Alone Stores China Mexico Best Buy Stores Five Star Stores Best Buy Stores Total stores at end of fiscal 2011 Stores opened Stores closed Total stores at end of fiscal 2012 2,357... -

Page 10

...current store development strategy focused on increasing retail points of presence while decreasing our overall square footage, we plan to open approximately 100 small-format Best Buy Mobile stand-alone stores and close approximately 50 large-format Best Buy branded stores in the U.S. in fiscal 2013... -

Page 11

... automated energy management system for our U.S. Best Buy stores and retail energy reports by store. We continue to evolve our High Performance Building Program as we remodel and update locations. For example, where economically viable, during remodels we are installing skylights and dimmable... -

Page 12

... take-back program allows customers to bring many consumer electronics products to our U.S. stores for free recycling. This recycling program is available in all U.S. Best Buy stores. We also collect old, inefficient appliances for recycling through a haul-away program. Best Buy has publicly... -

Page 13

... in a timely manner, our operating results could materially suffer. Our business depends, in large part, on our ability to successfully introduce new products, services and technologies to consumers, the frequency of such introductions, the level of consumer acceptance, and the related impact on... -

Page 14

...in mobile phones, tablets and other computing devices; enhanced digital and e-commerce strategies, including competitive online pricing, broader use of free shipping, expanded online assortment and the further development of the Best Buy Marketplace; growth in our services business; and expansion of... -

Page 15

... meet our rate of return expectations. We expect to continue the expansion of our small-format Best Buy Mobile stand-alone stores in the U.S. and our Five Star branded stores in China. We cannot ensure that our new stores, regardless of brand, size, format or market, will be profitably deployed. As... -

Page 16

... and operating results could suffer materially. Likewise, our failure to integrate and manage acquired companies successfully may lead to impairment of the associated goodwill and intangible asset balances. Failure to protect the integrity, security and use of our customers' information and... -

Page 17

... responsibility to the consumer for warranty replacements and repairs as a result of product defects, as we generally have less recourse to contracted manufacturers for such warranty liabilities; We may be subject to regulatory compliance and/or product liability claims relating to personal injury... -

Page 18

...that manage and directly extend credit to our customers. The cardholders can receive low- or no-interest promotional financing on qualifying purchases. Promotional financing credit card sales accounted for 20%, 18% and 17% of our Domestic segment's revenue in fiscal 2012, 2011 and 2010, respectively... -

Page 19

... on human resources support to attract, develop and retain a sufficient number of qualified employees. Furthermore, we have engaged other key third-party business partners to manage various functions of our business, including but not limited to, customer loyalty programs, promotional financing and... -

Page 20

Item 2. Properties. Stores, Distribution Centers and Corporate Facilities Domestic Segment The following table summarizes the location of our Domestic segment stores at the end of fiscal 2012: U.S. Best Buy Stores 15 2 26 9 126 23 12 4 2 67 30 2 5 58 23 13 10 9 16 6 25 29 34 28 9 21 3 6 10 6 27 5 55... -

Page 21

...413 U.S. Best Buy Mobile StandAlone Stores - - 305 428 Pacific Sales Stores - - 34 876 Magnolia Audio Video Stores - - 5 68 The following table summarizes the location, ownership status and total square footage of space utilized for distribution centers, service centers and corporate offices by our... -

Page 22

...of our Europe, China and Mexico operations on a two-month lag. The following table summarizes the location of our International segment stores at the end of fiscal 2012: Europe The Carphone Warehouse Stores Europe France Germany Ireland Netherlands Portugal Spain Sweden United Kingdom Canada Alberta... -

Page 23

... end of fiscal 2012: Europe The Carphone Warehouse Stores Owned store locations Leased store locations Square footage (in thousands) - 885 711 The Phone House Stores 2 1,506 788 Canada Best Buy Mobile Stand-Alone Stores - 30 31 China Mexico Future Shop Stores - 149 3,944 Best Buy Stores 3 74 2,432... -

Page 24

... duty, among other claims, including violation of Section 10(b) of the Exchange Act and Rule 10b-5 thereunder, in failing to correct public misrepresentations and material misstatements and/or omissions regarding our fiscal 2011 earnings projections and, for certain directors, selling stock while in... -

Page 25

..., software engineering, technology services, program management, information security, global infrastructure, and international technology, as well as all of its digital business activities. Mr. Gillett joined Starbucks in 2008 as its senior vice president, chief information officer and general... -

Page 26

...as a part-time sales associate and steadily advanced his career as our company grew. He has served us as Regional Manager, District Manager and Store General Manager. Upon moving from the field into corporate, Mr. Sheehan served in positions in retail operations, consumer relations and store support... -

Page 27

...and the Consumer Electronics Association executive board. Resignation of Chief Executive Officer On April 9, 2012, Brian J. Dunn notified the Board that he resigned, and the Board accepted his resignation, as Chief Executive Officer and Director of Best Buy, effective April 10, 2012. Director George... -

Page 28

.... Future dividend payments will depend on our earnings, capital requirements, financial condition and other factors considered relevant by our Board. Purchases of Equity Securities by the Issuer and Affiliated Purchasers From time to time, we repurchase our common stock in the open market pursuant... -

Page 29

... business plans and the market price of our stock. We expect that cash provided by future operating activities, as well as available cash and cash equivalents and short-term investments, will be the sources of funding for our share repurchase program. Based on the anticipated amounts to be generated... -

Page 30

Best Buy Stock Comparative Performance Graph The information contained in this Best Buy Stock Comparative Performance Graph section shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of ... -

Page 31

... Comparable store sales (decline) gain(7) Gross profit rate Selling, general and administrative expenses rate Operating income rate Year-End Data Current ratio(8) Total assets Debt, including current portion Total equity(9) Number of stores Domestic International(10) Total(10) Retail square footage... -

Page 32

Carphone Warehouse Group plc's interest in the profit share-based management fee paid to Best Buy Europe pursuant to the 2007 Best Buy Mobile agreement (which represents earnings attributable to the noncontrolling interest). (3) Included within our Operating income and Net earnings from continuing ... -

Page 33

... the impact of sales from new stores opened. Our comparable store sales is comprised of revenue from stores operating for at least 14 full months, as well as revenue related to call centers, Web sites and our other comparable sales channels. Revenue we earn from sales of merchandise to wholesalers... -

Page 34

...our business. While we believe Best Buy Mobile will remain an important driver of our connections performance, we plan to leverage our mobile connections expertise for other devices - including tablets, notebooks and e-Readers - to drive increased attachments of connections, accessories and services... -

Page 35

...by the net addition of 235 new stores during fiscal 2012, an extra week of revenue from stores in our Domestic segment and Canada, and the favorable impact of foreign currency exchange rate fluctuations, partially offset by a comparable store sales decline of 1.7%. Our gross profit rate decreased by... -

Page 36

...per share amounts): Consolidated Performance Summary 2012(1) 2011 2010 Revenue Revenue gain % Comparable store sales % (decline) gain Gross profit Gross profit as % of revenue(2) SG&A SG&A as % of revenue(2) Restructuring charges Operating income Operating income as % of revenue Net (loss) earnings... -

Page 37

...comparable store sales decline. The components of the net revenue increase in fiscal 2011 were as follows: Net new stores Impact of foreign currency exchange rate fluctuations Comparable store sales impact One less week of revenue for Best Buy Europe(1) Non-comparable sales channels(2) Total revenue... -

Page 38

...: Fiscal 2010 Total Stores at End of Fiscal Year Stores Opened Fiscal 2011 Stores Closed Total Stores at End of Fiscal Year Stores Opened Fiscal 2012 Stores Closed Total Stores at End of Fiscal Year Best Buy Best Buy Mobile stand-alone Pacific Sales Magnolia Audio Video Geek Squad Total Domestic... -

Page 39

... as tablets, e-Readers and mobile phones, which all experienced sales growth in fiscal 2012. In addition, our focus on growing our market share in appliances led to sales growth throughout fiscal 2012. In light of continued strong competition in the consumer electronics industry and greater price... -

Page 40

...in fiscal 2011. Excluding the impact of the extra week, our Domestic segment's SG&A declined, as increased costs driven by the opening of new stores and increased advertising were more than offset by decreases in compensation costs, a decrease in the Best Buy Mobile profit share-based management fee... -

Page 41

... store sales due to the timing of their opening. The net addition of large-format Best Buy branded stores, including 30 stores in fiscal 2011, contributed the majority of the total change in revenue associated with net new stores. The addition of small-format Best Buy Mobile stand-alone stores... -

Page 42

... televisions. Our Domestic segment's SG&A grew $393 million, or 5.7%, in fiscal 2011 compared to fiscal 2010. The increase in SG&A was driven by the opening of new stores and an increase in the Best Buy Mobile profit share-based management fee, partially offset by lower incentive compensation costs... -

Page 43

...of Canada, China and Mexico, as well as small-format stores in Europe. Notable store opening plans in fiscal 2013 include approximately 50 new Five Star stores in the growing China market. The International segment comparable store sales decline in fiscal 2012 was led primarily by declines in mobile... -

Page 44

... SG&A rate were both driven by a decrease in the Best Buy Mobile profit share-based management fee and other costs as a result of the strategic changes made at Best Buy Europe, and increased advertising costs and the deleveraging impact of negative comparable store sales in Canada. These increases... -

Page 45

... Best Buy Mobile profit share-based management fees paid in fiscal 2011. The 4.7% increase in revenue for fiscal 2011 was due to the positive impact of foreign currency exchange rate fluctuations (mainly related to the Canadian dollar), a 2.3% comparable store sales gain and the impact of net new... -

Page 46

... as the unfavorable impact of foreign currency exchange rate fluctuations and increased spending associated with new store openings in our Canada and Five Star operations, were offset by a decrease in Europe due to the higher Best Buy Mobile profit share-based management fee. Excluding the impact of... -

Page 47

...included inventory write-downs, property and equipment impairments, employee termination benefits and facility closure costs as a result of our decision to exit the Turkey market and close our Best Buy branded stores in China. The increase in loss from discontinued operations in fiscal 2011 compared... -

Page 48

... 2012 to repurchase shares of our common stock, as well as the $1.3 billion payment for the Mobile buy-out. Working capital, the excess of current assets over current liabilities, was $1.4 billion at the end of fiscal 2012, a decrease from $1.8 billion at the end of fiscal 2011. Operating cash flow... -

Page 49

... efforts to manage inventory levels in light of comparable store sales declines. The decrease in cash provided by accounts receivable was due primarily to the timing of several large payments due from our vendors at the end of fiscal 2011. Other fluctuations in cash from operating activities were... -

Page 50

... retail and consumer electronics industries, our financial position, and changes in our business strategy. If further changes in our credit ratings were to occur, they could impact, among other things, our future borrowing costs, access to capital markets, vendor financing terms and future new-store... -

Page 51

... by restricted cash balances that are pledged as collateral or restricted to use for vendor payables, general liability insurance, workers' compensation insurance and customer warranty and insurance programs. Restricted cash and cash equivalents, which are included in other current assets, were $459... -

Page 52

... 2012, we had $149 million outstanding under financing lease obligations. Share Repurchases and Dividends From time to time, we repurchase our common stock in the open market pursuant to programs approved by our Board. We may repurchase our common stock for a variety of reasons, such as acquiring... -

Page 53

... 12 months ended as of each of the respective balance sheet dates. The multiple of eight times annual rental expense in the calculation of our capitalized operating lease obligations is the multiple used for the retail sector by one of the nationally recognized credit rating agencies that rate our... -

Page 54

... decrease over time, the related balances have not been reflected in the "Payments Due by Period" section of the table. Included in Long-term liabilities on our Consolidated Balance Sheet at March 3, 2012, was a $62 million obligation for deferred compensation. As the specific payment dates for the... -

Page 55

... product is sold. Sell-through credits are generally based on the number of units we sell over a specified period and are recognized when the related product is sold. Based on the provisions of our vendor agreements, we develop vendor fund accrual rates by estimating the point at which we will have... -

Page 56

... of $3 million and $10 million in fiscal 2012 and 2011, respectively, related to certain indefinite-lived tradenames in our Domestic segment. These impairments were recorded within Loss from discontinued operations within our Consolidated Statements of Earnings for the respective years. We do not... -

Page 57

... Canada. Points earned enable members to receive a certificate that may be redeemed on future purchases at Best Buy branded stores and Web sites. The value of points earned by our loyalty program members is included in accrued liabilities and recorded as a reduction in revenue at the time the points... -

Page 58

... stock option awards are primarily valued using a lattice model. We determine the fair value of our marketbased and performance-based nonvested share awards at the date of grant using generally accepted valuation techniques and the closing market price of our stock. Management reviews its... -

Page 59

...of such assets and liabilities will have an impact on our net earnings. See Note 4, Acquisitions, to the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K, for the acquisition-related information associated... -

Page 60

.... The fair value recorded on our Consolidated Balance Sheet related to our foreign exchange forward contracts outstanding at March 3, 2012, and February 26, 2011, was $(1) million and $(1) million, respectively. The amount recorded in our Consolidated Statement of Earnings related to all contracts... -

Page 61

...independent registered public accounting firm that audited our consolidated financial statements for the year ended March 3, 2012, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K, has issued an unqualified attestation report on our internal control... -

Page 62

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Best Buy Co., Inc.: Richfield, Minnesota We have audited the accompanying consolidated balance sheets of Best Buy Co., Inc. and subsidiaries (the "Company") as of March 3, 2012 and February 26, 2011 and the related consolidated... -

Page 63

...REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Best Buy Co., Inc.: Richfield, Minnesota We have audited the internal control over financial reporting of Best Buy Co., Inc. and subsidiaries (the "Company") as of March 3, 2012, based on criteria established in Internal... -

Page 64

... Customer Relationships, Net Equity and Other Investments Other Assets Total Assets Liabilities and Equity Current Liabilities Accounts payable Unredeemed gift card liabilities Accrued compensation and related expenses Accrued liabilities Accrued income taxes Short-term debt Current portion of long... -

Page 65

Consolidated Statements of Earnings $ in millions, except per share amounts Fiscal Years Ended March 3, 2012 February 26, 2011 February 27, 2010 Revenue Cost of goods sold Restructuring charges - cost of goods sold Gross profit Selling, general and administrative expenses Restructuring charges ... -

Page 66

... on sale of investment Deferred income taxes Excess tax benefits from stock-based compensation Other, net Changes in operating assets and liabilities, net of acquired assets and liabilities: Receivables Merchandise inventories Other assets Accounts payable Other liabilities Income taxes Total cash... -

Page 67

... stock under employee stock purchase plan Stock-based compensation Common stock dividends, $0.56 per share Balances at February 27, 2010 Net earnings Other comprehensive income (loss), net of tax: Foreign currency translation adjustments Unrealized gains on available-for-sale securities Cash flow... -

Page 68

...U.S., operating under the brand names Best Buy, Best Buy Mobile, Geek Squad, Magnolia Audio Video and Pacific Sales. U.S. Best Buy stores offer a wide variety of consumer electronics, computing and mobile phone products, entertainment products, appliances and related services. Best Buy Mobile offers... -

Page 69

... 26, 2011, respectively, and are reflected within Accounts payable in our Consolidated Balance Sheets. Receivables Receivables consist principally of amounts due from mobile phone network operators for commissions earned; banks for customer credit card, certain debit card and electronic benefits... -

Page 70

... 26, 2011, respectively, and are included in Other current assets or Equity and Other Investments in our Consolidated Balance Sheets. Such balances are pledged as collateral or restricted to use for vendor payables, general liability insurance, workers' compensation insurance and warranty programs... -

Page 71

... 2012 were Best Buy Domestic, Best Buy Canada, Five Star China and Best Buy Europe. The impairment test involves comparing the fair value of each reporting unit to its carrying value, including goodwill. Fair value reflects the price a market participant would be willing to pay in a potential sale... -

Page 72

... to Note 2, Profit Share Buy-Out, for further information on the $1,207 goodwill impairment attributable to the Best Buy Europe reporting unit recorded in the fourth quarter of fiscal 2012. Tradenames and Customer Relationships We have an indefinite-lived tradename related to Pacific Sales included... -

Page 73

...from our acquisitions of Best Buy Europe and Five Star. As part of our fiscal 2011 restructuring activities, we recorded an impairment charge related to certain indefinite-lived tradenames in our Domestic segment. See Note 7, Restructuring Charges, for further information. As a result of the sale of... -

Page 74

..., 2011 and 2010, respectively. We expect current lease rights amortization expense to be approximately $7 for each of the next five fiscal years. Investments Debt Securities Our long-term investments in debt securities are comprised of auction-rate securities ("ARS"). Based on our ability to market... -

Page 75

... them as available-for-sale. Investments in marketable equity securities are included in Equity and Other Investments in our Consolidated Balance Sheets, and are reported at fair value based on quoted market prices. All unrealized holding gains and losses are reflected net of tax in accumulated... -

Page 76

... revenue, deferred compensation plan liabilities and self-insurance reserves. Foreign Currency Foreign currency denominated assets and liabilities are translated into U.S. dollars using the exchange rates in effect at our consolidated balance sheet date. For operations reported on a two-month... -

Page 77

..., 2011 and 2010: 2012 2011 2010 Gift card breakage income Credit Services and Financing $ 54 $ 51 $ 41 In the U.S., we have private-label and co-branded credit card agreements with banks for the issuance of promotional financing and customer loyalty credit cards bearing the Best Buy brand... -

Page 78

...Second, under our co-branded credit card agreements with banks, we have a customer loyalty credit card bearing the Best Buy brand. Cardholders earn points for purchases made at our stores and related Web sites in the U.S., as well as purchases at other merchants. Points earned entitle cardholders to... -

Page 79

... Warehouse Group plc ("Carphone Warehouse") (the "profit share agreement"). Under the terms of this agreement, Carphone Warehouse provided expertise and certain other resources to enhance our mobile telephone retail business ("Best Buy Mobile") in return for a share of incremental profits generated... -

Page 80

... the retail business of Carphone Warehouse, subsequently renamed Best Buy Europe Distributions Limited ("Best Buy Europe"), which included the profit share agreement with Best Buy Mobile. Carphone Warehouse holds a 50% noncontrolling interest in Best Buy Europe. Following the acquisition of Best Buy... -

Page 81

... stores during the fourth quarter of fiscal 2012. Belgium - During the fourth quarter of fiscal 2012, Best Buy Europe sold its retail business in Belgium, consisting of 82 smallformat The Phone House stores, to Belgacom S.A. As a result of the sale, a pre-tax gain of $5 was recorded in fiscal 2012... -

Page 82

... with our retail, Geek Squad services and Best Buy for Business operations, we anticipate that mindSHIFT will capture a greater share of the small-to-mid-sized managed service provider market. 5. Investments Investments were comprised of the following: March 3, 2012 February 26, 2011 Short-term... -

Page 83

... We invest in marketable equity securities and classify them as available-for-sale. Investments in marketable equity securities are classified as non-current assets within Equity and Other Investments in our Consolidated Balance Sheets, and are reported at fair value based on quoted market prices... -

Page 84

... noted Our investments in marketable equity securities were as follows: March 3, 2012 February 26, 2011 Common stock of TalkTalk Telecom Group PLC Common stock of Carphone Warehouse Group plc Other Total $ $ - - 3 3 $ $ 62 84 - 146 We purchased shares of The Carphone Warehouse Group PLC... -

Page 85

...Treasury bills (restricted assets) Foreign currency derivative instruments Equity and other investments Auction rate securities Marketable equity securities Other assets Marketable securities that fund deferred compensation Liabilities Accrued liabilities Foreign currency derivative instruments Long... -

Page 86

...Treasury bills (restricted assets) Foreign currency derivative instruments Equity and other investments Auction rate securities Marketable equity securities Other assets Marketable securities that fund deferred compensation Liabilities Accrued liabilities Foreign currency derivative instruments Long... -

Page 87

... and 2010. The following table summarizes the fair value remeasurments recorded for fiscal 2012 and 2011: Fiscal 2012 Impairments Remaining Net Carrying Value Fiscal 2011 Impairments Remaining Net Carrying Value Continuing operations Goodwill of Best Buy Europe reporting unit Property and equipment... -

Page 88

... our strategy for certain mobile broadband offerings, and in our International segment we closed our large-format Best Buy branded stores in the U.K. to refocus our Best Buy Europe strategy on our small-format stores. In addition, we impaired certain information technology ("IT") assets supporting... -

Page 89

... segment's operations, primarily focused on modifications to our distribution channels and exit from certain digital delivery services within our entertainment product category. The actions also included plans to exit the Turkey market and restructure the Best Buy branded stores in China. As part of... -

Page 90

... addition, in the first quarter of fiscal 2010, we incurred restructuring charges related to employee termination benefits and business reorganization costs at Best Buy Europe within our International segment. As a result of our restructuring efforts, we recorded charges of $52 in the first quarter... -

Page 91

... Europe receivables financing facility Old Europe revolving credit facility Canada revolving demand facility China revolving demand facilities Total short-term debt $ $ - - 480 - - - - 480 -% $ -% 2.4 - - - 455 98 - 4 557 -% -% -% 3.7% 3.6% -% 4.8% Fiscal Year 2012 2011 Maximum month... -

Page 92

... to expire in July 2012. The RCF also replaced Best Buy Europe's previous £125 revolving credit facility (the "Old RCF") with one of Best Buy Co., Inc.'s subsidiaries and Carphone Warehouse as lenders. The Old RCF was originally scheduled to expire in March 2013. Canada Revolving Demand Facility We... -

Page 93

... the related credit agreements, are made available at the sole discretion of the respective lenders and are payable on demand. Certain of these facilities are secured by a guarantee of Best Buy Co., Inc. Long-Term Debt Long-term debt consisted of the following: March 3, 2012 February 26, 2011 2013... -

Page 94

... the volatility of net earnings and cash flows associated with changes in foreign currency exchange rates. We do not hold or issue derivative financial instruments for trading or speculative purposes. We record all foreign currency derivative instruments on our Consolidated Balance Sheets at fair... -

Page 95

...to our employees, officers, advisors, consultants and directors. Awards issued under the Omnibus Plan vest as determined by the Compensation and Human Resources Committee of our Board of Directors at the time of grant. At March 3, 2012, a total of 22.7 million shares were available for future grants... -

Page 96

... purchase period, whichever is less. Stock-based compensation expense was as follows in fiscal 2012, 2011 and 2010: 2012 2011 2010 Stock options Share awards Market-based Performance-based Time-based Employee stock purchase plans Total Stock Options Stock option activity was as follows in fiscal... -

Page 97

... service period (or to an employee's eligible retirement date, if earlier). At March 3, 2012, compensation expense had been fully recognized. Performance-Based Share Awards The fair value of performance-based share awards is determined based on the closing market price of our stock on the date... -

Page 98

... closing market price of our stock on the date of grant. A summary of the status of our nonvested time-based share awards at March 3, 2012, and changes during fiscal 2012, is as follows: WeightedAverage Fair Value per Share Time-Based Share Awards Shares Outstanding at February 26, 2011 Granted... -

Page 99

...2012 does not include potentially dilutive securities because their inclusion would be anti-dilutive (i.e., reduce the net loss per share). Repurchase of Common Stock In June 2011, our Board of Directors authorized a new $5,000 share repurchase program. The June 2011 program terminated and replaced... -

Page 100

...-sale investments Unrealized losses on derivative instruments (cash flow hedges) Total 11. Leases $ 93 $ (3) - 90 $ 102 72 (1) 173 $ The composition of net rent expense for all operating leases, including leases of property and equipment, was as follows in fiscal 2012, 2011 and 2010: 2012 2011... -

Page 101

... Total minimum lease payments have not been reduced by minimum sublease rent income of approximately $121 due under future noncancelable subleases. During fiscal 2012 and 2011, we entered into agreements totaling $18 and $52, respectively, related to various IT equipment leases. 12. Benefit Plans... -

Page 102

... reporting and income tax purposes. Deferred tax assets and liabilities were comprised of the following: March 3, 2012 February 26, 2011 Accrued property expenses Other accrued expenses Deferred revenue Compensation and benefits Stock-based compensation Loss and credit carryforwards Other Total... -

Page 103

... tax assets and liabilities included in our Consolidated Balance Sheets were as follows: March 3, 2012 February 26, 2011 Other current assets Other assets Other long-term liabilities Net deferred tax assets $ 226 $ 53 (16) 263 $ 261 98 (68) 291 $ At March 3, 2012, we had total net operating... -

Page 104

... our business segment information in fiscal 2012, 2011 and 2010: 2012 2011 2010 Revenue Domestic International Total revenue Percentage of revenue, by revenue category Domestic: Consumer Electronics Computing and Mobile Phones(1) Entertainment Appliances Services Other Total International: Consumer... -

Page 105

... operating loss for fiscal 2012 is a $1.2 billion goodwill impairment charge. Geographic Information The following tables present our geographic information in fiscal 2012, 2011 and 2010: 2012 2011 2010 Net sales to customers United States Europe Canada China Other Total revenue Long-lived assets... -

Page 106

... duty, among other claims, including violation of Section 10(b) of the Exchange Act and Rule 10b-5 thereunder, in failing to correct public misrepresentations and material misstatements and/or omissions regarding our fiscal 2011 earnings projections and, for certain directors, selling stock while in... -

Page 107

... Best Buy Europe had the following related party transactions and balances with CPW and Carphone Warehouse in fiscal 2012, 2011 and 2010: 2012 2011 2010 Payment made to Carphone Warehouse for their share of the profit share agreement buyout (see Note 2, Profit Share Buy-Out) Revenue earned... -

Page 108

...format Best Buy branded stores in the U.S., changes to the store and corporate operating models, and other measures intended to reduce costs associated with product life-cycle management and supply chain. The costs of implementing the changes primarily consist of lease exit costs, employee severance... -

Page 109

... operations Diluted earnings per share Note: Certain fiscal year totals may not add due to rounding. (1) Comprised of revenue from stores operating for at least 14 full months as well as revenue related to call centers, Web sites and our other comparable sales channels. Revenue we earn from sales... -

Page 110

... by us in the reports we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer (principal... -

Page 111

... accounting officer. Our Code of Business Ethics is available on our Web site, www.investors.bestbuy.com - select the "Corporate Governance" link. A copy of our Code of Business Ethics may also be obtained, without charge, upon written request to: Best Buy Co., Inc. Investor Relations Department... -

Page 112

... Under Equity Compensation Plans" included in Part II of this Annual Report on Form 10-K. Security Ownership of Certain Beneficial Owners and Management The information provided under the caption "Security Ownership of Certain Beneficial Owners and Management" in the Proxy Statement is incorporated... -

Page 113

... Sale and Purchase Agreement, dated May 7, 2008, as amended, among The Carphone Warehouse Group PLC, CPW Retail Holdings Limited; Best Buy Co., Inc. and Best Buy Distributions Limited Agreement and Plan of Merger, dated November 2, 2011, by and among Best Buy Co., Inc., Mars Acquisition Corporation... -

Page 114

... by the Board of Directors 2010 Long-Term Incentive Program Award Agreement, as approved by the Board of Directors Best Buy Fifth Amended and Restated Deferred Compensation Plan, as amended Best Buy Co., Inc. Performance Share Award Agreement dated August 5, 2008 Statements re: Computation of Ratios... -

Page 115

... in Extensible Business Reporting Language (XBRL): (i) the consolidated balance sheets at March 3, 2012 and February 26, 2011, (ii) the consolidated statements of earnings for the years ended March 3, 2012, February 26, 2011 and February 27, 2010, (iii) the consolidated statements of cash flows for... -

Page 116

...the undersigned, thereunto duly authorized. Best Buy Co., Inc. (Registrant) By: /s/ George L. Mikan III George L. Mikan III Chief Executive Officer (Interim) May 1, 2012 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on... -

Page 117

...3, 2012 Allowance for doubtful accounts Year ended February 26, 2011 Allowance for doubtful accounts Year ended February 27, 2010 Allowance for doubtful accounts (1) $ $ $ 107 101 97 $ $ $ 8 46 48 $ $ $ (43) $ (40) $ (44) $ 72 107 101 Includes bad debt write-offs and recoveries, acquisitions...