Baker Hughes 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015

ANNUAL REPORT

Table of contents

-

Page 1

2015 ANNUAL REPORT -

Page 2

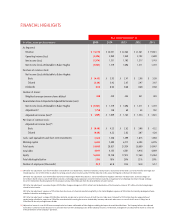

...except per share amounts) 2015 2014 2013 2012 2011 As Reported: Revenue Operating income (loss) Net income (loss) Net income (loss) attributable to Baker Hughes Per share of common stock: Net income (loss) attributable to Baker Hughes: Basic Diluted Dividends Number of shares: Weighted average... -

Page 3

...compared to 2014. On a GAAP basis, Baker Hughes reported a net loss for 2015 of $2 billion ($4.49 per diluted share), versus net income of $1.7 billion ($3.92 per diluted share) in 2014. Given the difficult market conditions throughout 2015, we took significant actions to align our business and cost... -

Page 4

... trend in 2016. While we are working diligently to improve profitability, to comply with the merger agreement with Halliburton and in preparation for the combined Baker Hughes/ Halliburton entity we have retained certain costs, which in the fourth quarter of 2015 exceeded 300 basis points, or in... -

Page 5

...help prevent deposits inside pumps and pipes that create serious production issues such as plugged flow lines and clogged equipment, reducing the need to stop operations and perform costly procedures to get production back online at acceptable levels. SPECTREâ„¢ disintegrating frac plug is the first... -

Page 6

... contest this action. As we continue to work toward closing the transaction, I remain proud of the efforts of the entire Baker Hughes team in supporting the regulatory review process in jurisdictions around the world and working on the integration plans. In closing, while 2015 was extremely... -

Page 7

FORM 10-K/A -

Page 8

... 2100, Houston, Texas (Address of principal executive offices) Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock, $1 Par Value per Share Name of each exchange on which registered New York Stock Exchange SIX Swiss Exchange Securities registered pursuant to... -

Page 9

EXPLANATORY NOTE Baker Hughes Incorporated (the "Company") is filing this Amendment No. 1 to its Form 10-K for the year ended December 31, 2015 originally filed with the Securities and Exchange Commission on February 17, 2016 (the "2015 Form 10-K") solely for the purpose of removing the caption "AEC... -

Page 10

... Supplementary Data Management's Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Statements of Income (Loss) Consolidated Statements of Comprehensive Income (Loss) Consolidated Balance Sheets Consolidated Statements of Changes... -

Page 11

...gas industry. We also provide products and services for other businesses including downstream chemicals, and process and pipeline services. Baker Hughes was formed as a corporation in April 1987 in connection with the combination of Baker International Corporation and Hughes Tool Company. We conduct... -

Page 12

..., headquartered in Houston, Texas, which includes the downstream chemicals business and the process and pipeline services business. Certain support operations are organized at the enterprise level and include the supply chain and product line technology organizations. The supply chain organization... -

Page 13

... production. Pressure Pumping - includes cementing, stimulation, including hydraulic fracturing, and coil tubing services used in the completion of new oil and natural gas wells and in remedial work on existing wells, both onshore and offshore. Hydraulic fracturing is the practice of pumping fluid... -

Page 14

...and services. Stock points and service centers for our products and services are located in areas of drilling and production activity throughout the world. Our primary competitors include the major diversified oilfield service companies such as Schlumberger, Halliburton and Weatherford International... -

Page 15

... products, processes and services, the improvement of existing products and services and the design of specialized products to meet specific customer needs. We have technology centers located in the U.S. (several in Houston, Texas and surrounding areas and one in Claremore, Oklahoma), Germany (Celle... -

Page 16

... to 2011. Various positions at United Technologies from 1987 to 2006, including Vice President and Chief Information Officer for Carrier North America. Employed by the Company in 2013. Chief Human Resources Officer since January 2015. Former Chief Human Resources Officer for Dell from 2007 to 2010... -

Page 17

... 2008. Employed by the Company in 2009. President, Europe, Africa and Russia Caspian Region of the Company since 2013. President, Global Products and Services from 2012 to 2013. Vice President Supply Chain of the Company from April 2009 to January 2012. Vice President, Global Supply Chain for Pratt... -

Page 18

...these may adversely affect our business, financial condition, results of operations and cash flows and, thus, the value of an investment in Baker Hughes. Risk Factors Related to the Worldwide Oil and Natural Gas Industry Our business is focused on providing products and services to the worldwide oil... -

Page 19

..., may interrupt or curtail our operations, or our customers' operations, cause supply disruptions and result in a loss of revenue and damage to our equipment and facilities, which may or may not be insured. Extreme winter conditions in Canada, Russia or the North Sea may interrupt or curtail our... -

Page 20

... short lead times. People are a key resource to developing, manufacturing and delivering our products and services to our customers around the world. Our ability to manage the recruiting, training, retention and efficient usage of the highly skilled workforce required by our plans and to manage the... -

Page 21

... our ability to continue to manage our agents and business partners, and supervise, train and retain competent employees. Our compliance program is also dependent on the efforts of our employees to comply with applicable law and the Baker Hughes Business Code of Conduct. We could be subject to... -

Page 22

... Trading System; the United Kingdom's Carbon Reduction Commitment which affects more than 40 Baker Hughes facilities; and, in the U.S., the Regional Greenhouse Gas Initiative, the Western Regional Climate Action Initiative, and various state programs implementing California Assembly Bill 32. Current... -

Page 23

... for the Company's well stimulation (including hydraulic fracturing) services. The EPA and other governmental bodies are studying well stimulation (including hydraulic fracturing) operations. Government actions relating to the development of unconventional oil and natural gas resources may impede... -

Page 24

... affect our results of operations and financial condition. During 2015, we implemented a number of restructuring activities to reduce expenses, which included a reduction in our workforce, the termination of various contracts, the closing or abandoning of certain facilities, and the downsizing of... -

Page 25

... Merger, management attention and resources will be required to plan for such integration. Potential difficulties the combined company may encounter in the integration process include the following: • the inability to successfully integrate the respective businesses of Baker Hughes and Halliburton... -

Page 26

... chemical processing centers, and primary research and technology centers to be our principal properties. The following sets forth the location of our principal owned or leased facilities for our oilfield operations: North America: Houston, Pasadena, Tomball, and The Woodlands, Texas; Broken Arrow... -

Page 27

...our pending Merger with Halliburton: • On November 24, 2014, Gary Molenda, a purported shareholder of the Company, filed a class action lawsuit in the Court of Chancery of the State of Delaware ("Delaware Chancery Court") against Baker Hughes, the Company's Board of Directors, Halliburton, and Red... -

Page 28

..., 2015, TRIUVA Kapitalverwaltungsgesellschaft mbH filed a lawsuit in the United States District Court for the Southern District of Texas (Houston Division) against the Company and Baker Hughes Oilfield Operations, Inc. alleging that the plaintiff is the owner of gas storage caverns in Etzel, Germany... -

Page 29

... and information. We are not able to predict what action, if any, might be taken in the future by the DOJ or other governmental authorities as a result of the investigation. ITEM 4. MINE SAFETY DISCLOSURES Our barite mining operations, in support of our drilling fluids products and services business... -

Page 30

... For information regarding quarterly high and low sales prices on the New York Stock Exchange for our common stock during the two years ended December 31, 2015, and information regarding dividends declared on our common stock during the two years ended December 31, 2015, see Note 16. "Quarterly Data... -

Page 31

... dividends) assumes that $100 was invested on December 31, 2010 in Baker Hughes common stock, the S&P 500 Index and the S&P 500 Oil and Gas Equipment and Services Index. The corporate performance graph and related information shall not be deemed "soliciting material" or to be "filed" with the SEC... -

Page 32

... common stock: Net (loss) income attributable to Baker Hughes: Basic Diluted Dividends Balance Sheet Data: Cash, cash equivalents and short-term investments Working capital (current assets minus current liabilities) Total assets Long-term debt Total equity Notes To Selected Financial Data (1) 2015... -

Page 33

... oilfield operations. We manage our oilfield operations through four geographic segments consisting of North America, Latin America, Europe/Africa/Russia Caspian, and Middle East/ Asia Pacific. Our Industrial Services businesses are reported in a fifth segment. As of December 31, 2015, Baker Hughes... -

Page 34

... of Baker Hughes. For further information about the Merger, see Note 2. "Halliburton Merger Agreement" of the Notes to Consolidated Financial Statements in Item 8 herein. BUSINESS ENVIRONMENT We operate in more than 80 countries helping customers find, evaluate, drill, produce, transport and process... -

Page 35

...process and resulting data is reliable; however, it is subject to our ability to obtain accurate and timely information. Rig counts are compiled weekly for the U.S. and Canada and monthly for all international rigs. Published international rig counts do not include rigs drilling in certain locations... -

Page 36

... rich zones in Alberta to service the oil sands drilling activity. Overall, Canada rig counts increased 7% in 2014 compared to 2013. Outside North America, the rig count increased 3% in 2014 compared to 2013. The rig count in Latin America decreased 5% as a result of reduced rig activity in Brazil... -

Page 37

...(149) (8,809) % Change (50)% (20)% (26)% (23)% (11)% (36)% $ $ $ Year Ended December 31, 2015 2014 Profit (Loss) Before Tax: North America Latin America Europe/Africa/Russia Caspian Middle East/Asia Pacific Industrial Services Total Operations Corporate and other Total North America $ (687) 134... -

Page 38

... the Andean area where the rig count has declined 46%, and in Venezuela where we restructured our operational footprint in late 2014. This reduction was partially offset by revenue growth in Brazil from share gains in our drilling services product line. Latin America profit before tax decreased $156... -

Page 39

...of 2014. North America profit before tax was $1,466 million in 2014, an increase of $498 million or 51% compared to 2013. In addition to the strong activity levels in U.S. onshore, increased profitability was driven by improved contractual terms and utilization in our pressure pumping operations, as... -

Page 40

... services and pressure pumping product lines in the United Arab Emirates and India. Within Asia Pacific, revenue growth was strongest in South East Asia and China, predominately in our drilling services product line. MEAP profit before tax improved $218 million or 48% in 2014 compared to 2013... -

Page 41

...revenue as a percentage of revenue was due primarily to the continued improvement in our U.S. onshore pressure pumping business, which resulted in higher asset utilization and organizational efficiencies, as well as improved contractual terms. In Latin America, margins improved due to cost reduction... -

Page 42

...litigation settlements during the second quarter of 2015. Interest Expense, Net Interest expense, net of interest income of $20 million, was $217 million in 2015, a decrease of $15 million compared to $232 million in 2014. The decrease is due primarily to lower short-term borrowings in Latin America... -

Page 43

... a web-based antiboycott reporting tool and a global trade management software tool. We have a program designed to encourage reporting of any ethics or compliance matter without fear of retaliation including a worldwide business helpline operated by a third party and currently available toll-free in... -

Page 44

... to corruption-related risks, and a uniform policy for new hire training with a compliance component. LIQUIDITY AND CAPITAL RESOURCES Our objective in financing our business is to maintain sufficient liquidity, adequate financial resources and financial flexibility in order to fund the requirements... -

Page 45

...hole and property, machinery, and equipment no longer used in operations that was sold throughout the year. In 2015, we purchased short-term and long-term investment securities totaling $310 million. In 2014, we paid $314 million for acquisitions, net of cash acquired of $7 million. Under the Merger... -

Page 46

... will provide us with sufficient capital resources and liquidity to manage our working capital needs, meet contractual obligations, fund capital expenditures and dividends, and support the development of our short-term and long-term operating strategies. If necessary, we may issue commercial paper... -

Page 47

... subject to uncertainty and, accordingly, these estimates may change as new events occur, as more experience is acquired, as additional information is obtained and as the business environment in which we operate changes. We have defined a critical accounting estimate as one that is both important to... -

Page 48

... at closing of the Merger, based on the terms of the Merger Agreement, compared to the carrying value of the Company and its reporting units. Based on our assessment and consideration of the totality of the facts and circumstances, including our business environment in the fourth quarter of 2015, we... -

Page 49

... settlement through an administrative process; the impartiality of the local courts; the number of countries in which we do business; and the potential for changes in the tax paid to one country to either produce, or fail to produce, an offsetting tax change in other countries. Our experience has... -

Page 50

... on assets of our principal pension plans would have increased pension expense by approximately $7 million in 2015. NEW ACCOUNTING STANDARDS UPDATES In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2014-09, Revenue from Contracts with... -

Page 51

... regarding our business outlook, including changes in revenue, pricing, capital spending, profitability, strategies for our operations, impact of any common stock repurchases, oil and natural gas market conditions, the business plans of our customers, market share and contract terms, costs and... -

Page 52

..., such as exchange rates. Based on quoted market prices as of December 31, 2015 and 2014 for contracts with similar terms and maturity dates, we recorded losses of $1 million and $11 million, respectively, to adjust these foreign currency forward contracts to their fair market value. These losses... -

Page 53

... LLP, the Company's independent registered public accounting firm, has issued an attestation report on the effectiveness of the Company's internal control over financial reporting. /s/ MARTIN S. CRAIGHEAD Martin S. Craighead Chairman and Chief Executive Officer Houston, Texas February 16, 2016... -

Page 54

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Baker Hughes Incorporated Houston, Texas We have audited the accompanying consolidated balance sheets of Baker Hughes Incorporated and subsidiaries (the "Company") as of December 31, 2015 and 2014, ... -

Page 55

BAKER HUGHES INCORPORATED CONSOLIDATED STATEMENTS OF INCOME (LOSS) (In millions, except per share amounts) Revenue: Sales Services Total revenue Costs and expenses: Cost of sales Cost of services Research and engineering Marketing, general and administrative Impairment and restructuring charges ... -

Page 56

BAKER HUGHES INCORPORATED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (In millions) Net (loss) income Other comprehensive (loss) income: Foreign currency translation adjustments during the period Pension and other postretirement benefits, net of tax (2015 - $15; 2014 - $9; 2013 - $(23)) ... -

Page 57

... current assets Property, plant and equipment - less accumulated depreciation (2015 - $7,378; 2014 - $8,215) Goodwill Intangible assets, net Other assets Total assets LIABILITIES AND EQUITY Current Liabilities: Accounts payable Short-term debt and current portion of long-term debt Accrued employee... -

Page 58

... CHANGES IN EQUITY Baker Hughes Stockholders' Equity Capital in Excess of Par Value Accumulated Other Comprehensive Loss Noncontrolling Interests (In millions, except per share amounts) Common Stock Retained Earnings Treasury Stock Total Balance at December 31, 2012 Comprehensive income: Net... -

Page 59

BAKER HUGHES INCORPORATED CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Cash flows from operating activities: Net (loss) income Adjustments to reconcile net (loss) income to net cash flows from operating activities: Depreciation and amortization (Benefit) provision for deferred income taxes ... -

Page 60

... Incorporated ("Baker Hughes," "Company," "we," "our," or "us,") is a leading supplier of oilfield services, products, technology and systems used in the worldwide oil and natural gas industry. We also provide products and services for other businesses including downstream chemicals, and process... -

Page 61

Baker Hughes Incorporated Notes to Consolidated Financial Statements products and services. Costs for research and development of new products and services were $347 million, $430 million and $370 million for the years ended December 31, 2015, 2014 and 2013, respectively. Cash and Cash Equivalents ... -

Page 62

... on the terms of the Merger Agreement (as defined below), compared to the carrying value of the Company and its reporting units. Based on our assessment and consideration of the totality of the facts and circumstances, including our business environment in the fourth quarter of 2015, we determined... -

Page 63

Baker Hughes Incorporated Notes to Consolidated Financial Statements Environmental Matters Estimated remediation costs are accrued using currently available facts, existing environmental permits, technology and enacted laws and regulations. Our cost estimates are developed based on internal ... -

Page 64

... quoted market prices as of December 31, 2015 or 2014 for forward contracts with similar terms and maturity dates, we recorded losses of $1 million and $11 million, respectively, to adjust these forward contracts to their fair market value. New Accounting Standards Updates In May 2014, the Financial... -

Page 65

... Merger to the later of December 15, 2015 or 30 days following the date on which both companies have certified final, substantial compliance with the Second Request. On December 16, 2015, Baker Hughes' and Halliburton's timing agreement with the DOJ expired without reaching a settlement or the DOJ... -

Page 66

... to pay regular quarterly cash dividends during such period. In addition, under the terms of the Merger Agreement, Halliburton and Baker Hughes have agreed to coordinate the declaration and payment of dividends in respect of each party's common stock including record dates and payment dates relating... -

Page 67

... on closed facilities and certain equipment, and other estimated exit costs, and is net of expected sublease income. This also includes costs to terminate or restructure certain take-or-pay supply contracts related to the purchase of materials used in our pressure pumping operations in North America... -

Page 68

..., products, technology and systems to the worldwide oil and natural gas business, referred to as oilfield operations, which are managed through operating segments that are aligned with our geographic regions. We also provide services and products to the downstream chemicals, and process and pipeline... -

Page 69

Baker Hughes Incorporated Notes to Consolidated Financial Statements The following table presents total assets by segment at December 31: 2015 Segments Assets 2014 Assets 2013 Assets North America Latin America Europe/Africa/Russia Caspian Middle East/Asia Pacific Industrial Services Shared ... -

Page 70

...31, and net property, plant and equipment by its geographic location at December 31. Amounts for Industrial Services have been included in the applicable geographic locations. 2015 Revenue 2014 Revenue 2013 Revenue U.S. Canada and other North America Latin America (1) Europe/Africa/Russia Caspian... -

Page 71

Baker Hughes Incorporated Notes to Consolidated Financial Statements Stock-based compensation costs are as follows for the years ended December 31: 2015 2014 2013 $ 120 $ 122 $ 115 (28) (26) (24) $ 92 $ 96 $ 91 Stock-based compensation cost Tax benefit Stock-based compensation cost, net of tax For... -

Page 72

Baker Hughes Incorporated Notes to Consolidated Financial Statements The following table presents the changes in stock options outstanding and related information (in thousands, except per option prices): Weighted Average Exercise Price Per Option Number of Options Outstanding at December 31, 2014... -

Page 73

Baker Hughes Incorporated Notes to Consolidated Financial Statements The weighted average grant date fair value per share for RSAs and RSUs granted in 2015, 2014 and 2013 was $57.37, $69.67 and $45.58, respectively. The total fair value of RSAs and RSUs vested in 2015, 2014 and 2013 was $72 million,... -

Page 74

Baker Hughes Incorporated Notes to Consolidated Financial Statements NOTE 7. INCOME TAXES The benefit or provision for income taxes is comprised of the following for the years ended December 31: 2015 Current: U.S. Foreign Total current Deferred: U.S. Foreign Total deferred (Benefit) provision for ... -

Page 75

Baker Hughes Incorporated Notes to Consolidated Financial Statements The tax effects of our temporary differences and carryforwards are as follows at December 31: 2015 Deferred tax assets: Receivables Inventory Employee benefits Other accrued expenses Operating loss carryforwards Tax credit ... -

Page 76

Baker Hughes Incorporated Notes to Consolidated Financial Statements The following table presents the changes in our gross unrecognized tax benefits and associated interest and penalties included in the consolidated balance sheets. Gross Unrecognized Tax Benefits, Excluding Interest and Penalties ... -

Page 77

Baker Hughes Incorporated Notes to Consolidated Financial Statements NOTE 8. EARNINGS PER SHARE A reconciliation of the number of shares used for the basic and diluted loss or earnings per share ("EPS") computations is as follows for the years ended December 31: 2015 438 - 438 2 3 2014 437 2 439 - 2... -

Page 78

Baker Hughes Incorporated Notes to Consolidated Financial Statements NOTE 11. GOODWILL AND INTANGIBLE ASSETS The changes in the carrying amount of goodwill are detailed below by segment. Europe/ Africa/ Russia Caspian Middle East/ Asia Pacific North America Latin America Industrial Services ... -

Page 79

... Germany pension plan is an unfunded plan where benefits are based on creditable years of service, creditable pay and accrual rates. We also provide certain postretirement health care benefits ("Other Postretirement Benefits"), through an unfunded plan, to a closed group of U.S. employees who retire... -

Page 80

Baker Hughes Incorporated Notes to Consolidated Financial Statements Funded Status Below is the reconciliation of the beginning and ending balances of benefit obligations, fair value of plan assets and the funded status of our plans. Non-U.S. Pension Benefits 2015 2014 Other Postretirement Benefits ... -

Page 81

Baker Hughes Incorporated Notes to Consolidated Financial Statements Information for the plans with ABOs in excess of plan assets is as follows at December 31: Non-U.S. Pension Benefits 2015 2014 Other Postretirement Benefits 2015 2014 U.S. Pension Benefits 2015 2014 Projected benefit obligation ... -

Page 82

...used to determine net periodic cost for these plans are as follows for the years ended December 31: Non-U.S. Pension Benefits 2015 2014 2013 Other Postretirement Benefits 2015 2014 2013 U.S. Pension Benefits 2015 2014 2013 Discount rate Expected long-term return on plan assets Rate of compensation... -

Page 83

Baker Hughes Incorporated Notes to Consolidated Financial Statements The majority of investments are held in the form of units of funds. The funds hold underlying securities and are redeemable as of the measurement date. Investments in equities and fixed-income funds are generally measured at fair ... -

Page 84

Baker Hughes Incorporated Notes to Consolidated Financial Statements Non-U.S. Pension Plans The investment policies of our pension plans with plan assets, which are primarily in Canada and the U.K., (the "Non-U.S. Plans"), cover the asset allocations that the governing boards believe are the most ... -

Page 85

Baker Hughes Incorporated Notes to Consolidated Financial Statements The following table presents the changes in the fair value of assets determined using level 3 unobservable inputs: U.S. Private Equity Fund U.S. Real Estate Fund Non-U.S. Real Estate Fund U.S. Hedge Funds Non-U.S. Insurance ... -

Page 86

... supplemental retirement plan ("SRP") for certain officers and employees whose benefits under the Thrift Plans and/or the U.S. qualified pension plan are limited by federal tax law. The SRP also allows eligible employees to defer a portion of their eligible compensation and provides for employer... -

Page 87

Baker Hughes Incorporated Notes to Consolidated Financial Statements The following lawsuits have been filed in Delaware in connection with our pending Merger with Halliburton: • On November 24, 2014, Gary Molenda, a purported shareholder of the Company, filed a class action lawsuit in the Court of... -

Page 88

... 2015, TRIUVA Kapitalverwaltungsgesellschaft mbH filed a lawsuit in the United States District Court for the Southern District of Texas, (Houston Division) against the Company and Baker Hughes Oilfield Operations, Inc. alleging that the plaintiff is the owner of gas storage caverns in Etzel, Germany... -

Page 89

... of Justice ("DOJ") pursuant to the Antitrust Civil Process Act. The CID seeks documents and information from us for the period from May 29, 2011 through the date of the CID in connection with a DOJ investigation related to pressure pumping services in the U.S. We are working with the DOJ to provide... -

Page 90

... prior service credit, and curtailments which are included in the computation of net periodic pension cost (see Note 13. "Employee Benefit Plans" for additional details). Net periodic pension cost is recorded across the various cost and expense line items within the consolidated statement of income... -

Page 91

... Hughes Incorporated Notes to Consolidated Financial Statements NOTE 16. QUARTERLY DATA (UNAUDITED) First Quarter Second Quarter Third Quarter Fourth Quarter Total Year 2015 Revenue Gross profit (1) Impairment and restructuring charges (2) Net loss attributable to Baker Hughes Basic loss per share... -

Page 92

...our management included a report of their assessment of the design and effectiveness of our internal controls over financial reporting as part of this annual report on Form 10-K for the fiscal year ended December 31, 2015. Deloitte & Touche LLP, the Company's independent registered public accounting... -

Page 93

... the SEC pursuant to the Exchange Act within 120 days of the end of our fiscal year on December 31, 2015 ("Proxy Statement"), which sections are incorporated herein by reference. For information regarding our executive officers, see "Item 1. Business - Executive Officers" in this annual report on... -

Page 94

...Deferral Plan. (2) The per share purchase price under the Baker Hughes Incorporated Employee Stock Purchase Plan is determined in accordance with section 423 of the Code and is 85% of the lower of the fair market value of a share of our common stock on the date of grant or the date of purchase. Our... -

Page 95

.... Exhibit Number 2.1 3.1 3.2 4.1 4.2 4.3 4.4 4.5 4.6 4.7 4.8 4.9 4.10 Exhibit Description Agreement and Plan of Merger dated as of November 16, 2014 among Halliburton Company, Red Tiger LLC and Baker Hughes Incorporated (filed as Exhibit 2.1 to the Current Report of Baker Hughes Incorporated on... -

Page 96

... officers effective as of January 1, 2009 (filed as Exhibit 10.4 to the Current Report of Baker Hughes Incorporated on Form 8-K filed on December 19, 2008). Baker Hughes Incorporated Director Retirement Policy for Certain Members of the Board of Directors (filed as Exhibit 10.10 to the Annual Report... -

Page 97

... & Officer Long-Term Incentive Plan effective April 24, 2014 (filed as Exhibit 10.1 to the Current Report of Baker Hughes Incorporated on Form 8-K filed on April 29, 2014). Baker Hughes Incorporated Employee Stock Purchase Plan, as amended and restated, effective as of January 1, 2012 (filed as... -

Page 98

... Extension, dated July 10, 2015, of the Agreement and Plan of Merger among Halliburton Company, Red Tiger LLC and Baker Hughes Incorporated dated November 16, 2014, extending the termination date to December 1, 2015 (filed as Exhibit 99.1 to the Quarterly Report of Baker Hughes Incorporated on Form... -

Page 99

... Extension, dated September 25, 2015, of the Agreement and Plan of Merger among Halliburton Company, Red Tiger LLC and Baker Hughes Incorporated dated November 16, 2014, extending the termination date to December 16, 2015 (filed as Exhibit 99.2 to the Quarterly Report of Baker Hughes Incorporated on... -

Page 100

Baker Hughes Incorporated Schedule II - Valuation and Qualifying Accounts Balance at Beginning of Period Charged to Cost and Expenses Balance at End of Period (In millions) Writeoffs (1) Other Changes (2) (3) Year Ended December 31, 2015 Reserve for doubtful accounts receivable Reserve for ... -

Page 101

... Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. BAKER HUGHES INCORPORATED Date: February 18, 2016 /s/ MARTIN S. CRAIGHEAD Martin S. Craighead Chairman and Chief Executive Officer KNOWN... -

Page 102

...) * (J. Larry Nichols) * (James W. Stewart) * (Charles L. Watson) Director Director Director Director Director Director Director Director Director Director Director Director * By: /s/ KIMBERLY A. ROSS Kimberly A. Ross Attorney-in-fact 93 -

Page 103

... Change of name or address enrollment Duplicate mailings Lost stock certificates Additional administrative services Consolidation of accounts Transfer of stock to another person Dividend reinvestment Access your investor statements online 24 hours a day, seven days a week. For more information, go... -

Page 104

2929 Allen Parkway, Suite 2100 Houston, Texas 77019-2118 P.O. Box 4740 Houston, Texas 77210-4740 BakerHughes.com