Arrow Electronics 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Arrow Electronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Arrow Electronics, Inc.

Annual Report

20

11

Table of contents

-

Page 1

Arrow Electronics, Inc. Annual Report 2011 -

Page 2

..., Norway, Philippines, Poland, Portugal, Romania, the Russian Federation, Serbia, Singapore, Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, Ukraine, United States, Vietnam 69% GLOBAL COMPONENTS 31% GLOBAL ENTERPRISE COMPUTING SOLUTIONS * deï¬ned as Europe... -

Page 3

...ARROW ELECTRONICS, INC. (Exact name of registrant as specified in its charter) New York (State or other jurisdiction of incorporation or organization) 7459 S. Lima Street, Englewood, Colorado (Address of principal executive offices) (303) 824-4000 (Registrant's telephone number, including area code... -

Page 4

... PART III Directors, Executive Officers and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions, and Director Independence. Principal Accounting Fees and Services... -

Page 5

... in Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Israel, Italy, Latvia, Lithuania, the Netherlands, Norway, Poland, Portugal, Romania, the Russian Federation, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, and the United Kingdom. In... -

Page 6

...'s reach in Japan, one of the largest electronics markets in the world. In December 2011, it acquired Flection Group, B.V. ("Flection"), a provider of EAD services in Europe. This acquisition builds on the company's strategy to provide comprehensive services across the entire technology product... -

Page 7

..., Belgium, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Iceland, Israel, Latvia, Lithuania, Luxembourg, Morocco, the Netherlands, Norway, Poland, Portugal, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, and the United Kingdom. Over the past three years... -

Page 8

..., real-time computer systems, with access to the company's Worldwide Stock Check System. This system provides global access to real-time inventory data. No single supplier accounted for more than 9% of the company's consolidated sales in 2011. The company believes that many of the products it sells... -

Page 9

...request directed to the company at the following address and telephone number: Arrow Electronics, Inc. 7459 S. Lima Street Englewood, Colorado 80112 (303) 824-4000 Attention: Corporate Secretary The company also makes these filings available, free of charge, through its website (http://www.arrow.com... -

Page 10

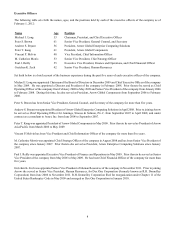

... President, Chief Strategy Officer Executive Vice President, Finance and Operations, and Chief Financial Officer Senior Vice President, Human Resources Set forth below is a brief account of the business experience during the past five years of each executive officer of the company. Michael J. Long... -

Page 11

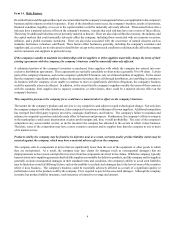

..., as do the resources the company has allocated to the sectors in which it does business. Therefore, some of the competitors may have a more extensive customer and/or supplier base than the company in one or more of its market sectors. Products sold by the company may be found to be defective and... -

Page 12

... or emanating from the company's currently or formerly owned, leased, or operated property, as well as for damages to property or natural resources and for personal injury arising out of such contamination. As the distribution business, in general, does not involve the manufacture of products, it is... -

Page 13

... cost-effective liquidity or capital resources. The company requires cash or committed liquidity facilities for general corporate purposes, such as funding its ongoing working capital, acquisition, and capital expenditure needs, as well as to refinance indebtedness. At December 31, 2011, the company... -

Page 14

... and export regulations that could erode profit margins or restrict exports; the burden and cost of compliance with international laws, treaties, and technical standards and changes in those regulations; potential restrictions on transfers of funds; import and export duties and value-added taxes... -

Page 15

... and supplier relationships; and potential loss of key employees, especially those of the acquired companies. Further, the company has made, and may continue to make acquisitions of, or investments in new services, businesses or technologies to expand our current service offerings and product lines... -

Page 16

... have to stop selling certain products or using technologies, which could affect the company's ability to compete effectively. Compliance with government regulations regarding the use of "conflict minerals" could result in difficulty in obtaining parts and be very costly to the company. As part of... -

Page 17

.... The company owns and leases sales offices, distribution centers, and administrative facilities worldwide. Its executive office is located in Englewood, Colorado and occupies a 115,000 square foot facility that is owned by the company. The company owns 12 locations throughout the Americas, EMEA... -

Page 18

... a defendant in a lawsuit filed in September 2006 in the United States District Court for the Central District of California (Apollo Associates, L.P., et anno. v. Arrow Electronics, Inc. et al.) in connection with alleged contamination at a third site, an industrial building formerly leased by Wyle... -

Page 19

Other From time to time, in the normal course of business, the company may become liable with respect to other pending and threatened litigation, environmental, regulatory, labor, product, and tax matters. While such matters are subject to inherent uncertainties, it is not currently anticipated that... -

Page 20

... Holders On January 27, 2012, there were approximately 2,100 shareholders of record of the company's common stock. Dividend History The company did not pay cash dividends on its common stock during 2011 or 2010. While from time to time the Board of Directors considers the payment of dividends on the... -

Page 21

... 31, 2006 in the company, the S&P 500 Stock Index, and the Peer Group. Total return indices reflect reinvestment of dividends and are weighted on the basis of market capitalization at the time of each reported data point. 2006 Arrow Electronics Peer Group S&P 500 Stock Index 100 100 100 2007... -

Page 22

.... The difference between the "total number of shares purchased" and the "total number of shares purchased as part of publicly announced program" for the quarter ended December 31, 2011 is 6,792 shares, which relate to shares withheld from employees for stock-based awards, as permitted by the... -

Page 23

...Annual Report on Form 10-K (dollars in thousands except per share data): For the years ended December 31: Sales Operating income (loss) Net income (loss) attributable to shareholders Net income (loss) per share: Basic Diluted At December 31: Accounts receivable and inventories Total assets Long-term... -

Page 24

... both a basic and diluted basis). Net income attributable to shareholders also includes an income tax benefit of $6.0 million, net, ($.05 per share on both a basic and diluted basis) principally due to a reduction in deferred income taxes as a result of the statutory tax rate change in Germany. 22 -

Page 25

... Diasa. The impacts of these acquisitions were not individually significant to the company's consolidated financial position and results of operations. Results of operations of Richardson RFPD, Nu Horizons, Pansystem, C1S, Flection, Intechra, Converge, Verical, Transim, ETG, and Petsche are included... -

Page 26

...end mobile handset components offset, in part, by increased demand in the vertical markets led by lighting and transportation. Excluding the impact of foreign currency and pro forma for acquisitions, the company's global components business segment sales remained flat in 2011, compared with the year... -

Page 27

... of the sales increase was driven by certain recent acquisitions which have a higher operating cost structure relative to the company's other businesses and was offset by higher profit margins for those businesses. For the year ended December 31, 2011, the dollar increase in selling, general and... -

Page 28

...are related to exit activities for 7 vacated facilities in the Americas and EMEA due to the company's continued efforts to streamline its operations and reduce real estate costs. These initiatives are due to the company's continued efforts to lower cost and drive operational efficiency. 2009 Charges... -

Page 29

... During 2011, the company acquired Nu Horizons for less than the fair value of its net assets due to Nu Horizons' stock trading below its book value for an extended period of time prior to the announcement of the acquisition. The company offered a purchase price per share for Nu Horizons that... -

Page 30

... and increased gross profit margins. This was offset, in part, by increased selling, general and administrative expenses primarily attributable to acquisitions and the increase in sales, increased interest expense due to higher average debt outstanding primarily to fund acquisitions, and increased... -

Page 31

... provider of reverse logistics services; Verical, an ecommerce business geared towards meeting the end-of-life components and parts shortage needs of customers; Sphinx, a United Kingdom-based value-added distributor of security and networking products; Transim, a service provider of online component... -

Page 32

... for 2009 is $82.3 million related to the company's global ERP initiative. During 2009, the company acquired Petsche, a leading provider of interconnect products, including specialty wire, cable, and harness management solutions, to the aerospace and defense markets for cash consideration of $170... -

Page 33

... a shelf registration statement with the SEC in September 2009 registering debt securities, preferred stock, common stock, and warrants of Arrow Electronics, Inc. that may be issued by the company from time to time. As set forth in the shelf registration statement, the net proceeds from the sale of... -

Page 34

... payment terms with the customer, product returns, and has risk of loss if the customer does not make payment. As the principal with the customer, the company recognizes the sale and cost of sale of the product upon receiving notification from the supplier that the product was shipped. The company... -

Page 35

... sale of supplier service contracts to customers where the company has no future obligation to perform under these contracts or the rendering of logistics services for the delivery of inventory for which the company does not assume the risks and rewards of ownership. Effective January 1, 2011, the... -

Page 36

... estimated. Stock-Based Compensation The company records share-based payment awards exchanged for employee services at fair value on the date of grant and expenses the awards in the consolidated statements of operations over the requisite employee service period. Stock-based compensation expense... -

Page 37

... and the fair value of the North America and EMEA reporting units within the global ECS business segment exceeded their carrying values by approximately 56%, 174%, and 206%, respectively. Impairment of Long-Lived Assets The company reviews long-lived assets, including property, plant and equipment... -

Page 38

... company reports shipping and handling costs, primarily related to outbound freight, in the consolidated statements of operations as a component of selling, general and administrative expenses. If the company included such costs in cost of sales, gross profit margin as a percentage of sales for 2011... -

Page 39

...believes," "seeks," "estimates," and similar expressions. Shareholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The company undertakes no obligation to update publicly or revise any of the... -

Page 40

... the impact of a hypothetical foreign exchange rate on the sales and operating income of the company's international operations. Interest Rate Risk The company's interest expense, in part, is sensitive to the general level of interest rates in North America, Europe, and the Asia Pacific region. The... -

Page 41

...term of the underlying debt. In September 2011, the company entered into a ten-year forward-starting interest rate swap (the "2011 swap") locking in a treasury rate... changes in treasury rates and the impact of future interest payments. The 2011 swap relates to the interest payments for anticipated ... -

Page 42

... audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Arrow Electronics, Inc.'s internal control over financial reporting as of December 31, 2011, based on criteria established in Internal Control-Integrated Framework issued by the Committee of... -

Page 43

ARROW ELECTRONICS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands except per share data) Years Ended December 31, 2011 Sales Costs and expenses: Cost of sales Selling, general and administrative expenses Depreciation and amortization Restructuring, integration, and other charges Settlement... -

Page 44

ARROW ELECTRONICS, INC. CONSOLIDATED BALANCE SHEETS (In thousands except par value) December 31, 2011 2010 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total current assets Property, plant and equipment, at cost: Land Buildings and ... -

Page 45

...Years Ended December 31, 2011 2010 2009 Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operations: Depreciation and amortization Amortization of stock-based compensation Equity in earnings of affiliated companies... -

Page 46

... interest rate swaps designated as cash flow hedges, net Other employee benefit plan items, net Comprehensive income Amortization of stock-based compensation Shares issued for stock-based compensation awards Tax benefits related to stock-based compensation awards Repurchases of common stock Balance... -

Page 47

... rate swaps designated as cash flow hedges, net Other employee benefit plan items, net Comprehensive income Amortization of stock-based compensation Shares issued for stock-based compensation awards Tax benefits related to stock-based compensation awards Repurchases of common stock Acquisition... -

Page 48

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) 1. Summary of Significant Accounting Policies Principles of Consolidation The consolidated financial statements include the accounts of the company and its majority-owned subsidiaries. ... -

Page 49

... segment, which are the Americas, EMEA (Europe, Middle East, and Africa), and Asia/Pacific and each of the two regional businesses within the global Enterprise Computing Solutions ("ECS") business segment, which are North America and EMEA. If the carrying value of the reporting unit is less than its... -

Page 50

... as investments in international affiliates are deemed to be permanent. All other comprehensive income items are net of related income taxes. Stock-Based Compensation The company records share-based payment awards exchanged for employee services at fair value on the date of grant and expenses the... -

Page 51

... payment terms with the customer, product returns, and has risk of loss if the customer does not make payment. As the principal with the customer, the company recognizes the sale and cost of sale of the product upon receiving notification from the supplier that the product was shipped. The company... -

Page 52

... market, with approximately 400 employees. Richardson RFPD's product set includes devices for infrastructure and wireless networks, power management and alternative energy markets. On January 3, 2011, the company acquired Nu Horizons Electronics Corp. ("Nu Horizons") for a purchase price of... -

Page 53

...value-added distributor of computing solutions and services in Germany; Chip One Stop, Inc. ("C1S"), a supplier of electronic components to design engineers throughout Japan; and Flection Group B.V. ("Flection"), a provider of electronics asset disposition in Europe. The impact of these acquisitions... -

Page 54

... logistics services. Converge, with approximately 350 employees, also has offices in Singapore and Amsterdam, with support centers worldwide. Since the dates of the acquisitions, Intechra, Shared, and Converge's sales for the year ended December 31, 2010 of $256,505 were included in the company... -

Page 55

... ("Verical"), an ecommerce business geared towards meeting the end-of-life components and parts shortage needs of customers; Sphinx Group Limited ("Sphinx"), a United Kingdom-based valueadded distributor of security and networking products; Transim Technology Corporation ("Transim"), a service... -

Page 56

... to the aerospace and defense market. With approximately 250 employees, Petsche provides valueadded distribution services to over 3,500 customers in the United States, Canada, Mexico, the United Kingdom, France, and Belgium. Since the date of acquisition, Petsche sales for the year ended December 31... -

Page 57

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) 3. Cost in Excess of Net Assets of Companies Acquired and Intangible Assets, Net Goodwill represents the excess of the cost of an acquisition over the fair value of the assets acquired. ... -

Page 58

...for the years ended December 31 consists of the following: 2011 Marubun/Arrow Altech Industries Other $ 5,338 1,398 - 6,736 $ 2010 5,185 1,184 - 6,369 $ 2009 3,745 1,004 (18) 4,731 $ $ $ Under the terms of various joint venture agreements, the company is required to pay its pro-rata share of the... -

Page 59

.... Annual payments of borrowings during each of the years 2012 through 2016 are $33,843, $343,292, $304,221, $260,519, and $74,035, respectively, and $945,756 for all years thereafter. In August 2011, the company entered into a $1,200,000 revolving credit facility, maturing in August 2016. This new... -

Page 60

...-year commitment maturing in December 2014. The asset securitization program is conducted through Arrow Electronics Funding Corporation ("AFC"), a wholly-owned, bankruptcy remote subsidiary. The asset securitization program does not qualify for sale treatment. Accordingly, the accounts receivable... -

Page 61

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) Level 2 Quoted prices in markets that are not active; or other inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability. ... -

Page 62

... on the consolidated statement of operations is as follows for the years ended December 31: Gain/(Loss) Recognized in Income 2011 2010 2009 Fair value hedges: Interest rate swaps (a) Derivative instruments not designated as hedges: Foreign exchange contracts (b) $ - $ - $ 4,097 $ (3,633) $ 1,938... -

Page 63

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) Cash Flow Hedges Foreign Interest Rate Exchange Swaps (c) Contracts (d) 2011 Effective portion: Gain/(loss) recognized in OCI Gain/(loss) reclassified into income Ineffective portion: ... -

Page 64

... option, or swap contracts (collectively, the "foreign exchange contracts") to mitigate the impact of changes in foreign currency exchange rates. These contracts are executed to facilitate the hedging of foreign currency exposures resulting from inventory purchases and sales and generally have terms... -

Page 65

... of 35% and effective income tax rates for the years ended December 31 are as follows: 2011 United States International Income before income taxes Provision at statutory tax rate State taxes, net of federal benefit International effective tax rate differential Change in valuation allowance Other non... -

Page 66

... to examination by tax authorities. The following describes the open tax years, by major tax jurisdiction, as of December 31, 2011: United States - Federal United States - State Germany (a) Hong Kong Italy (a) Sweden United Kingdom (a) 2008 - present 2005 - present 2007 - present 2005 - present 2007... -

Page 67

..." in the company's consolidated balance sheets, consist of the following at December 31: 2011 Deferred tax assets: Net operating loss carryforwards Inventory adjustments Allowance for doubtful accounts Accrued expenses Interest carryforward Stock-based compensation awards Other comprehensive... -

Page 68

... segment. The facilities costs are related to exit activities for 18 vacated facilities in the Americas and EMEA due to the company's continued efforts to streamline its operations and reduce real estate costs. These initiatives are due to the company's continued efforts to lower cost and drive... -

Page 69

... components business segment. The facilities costs are related to exit activities for 7 vacated facilities in the Americas and EMEA due to the company's continued efforts to streamline its operations and reduce real estate costs. These initiatives are due to the company's continued efforts to lower... -

Page 70

... for facilities totaling $7,072 relate to vacated leased properties that have scheduled payments of $3,835 in 2012, $1,756 in 2013, $726 in 2014, $386 in 2015, $216 in 2016, and $153 thereafter. Other accruals of $1,309 are expected to be utilized over several years. • • Acquisition-Related... -

Page 71

... 3,257 shares, and 3,851 shares for the years ended December 31, 2011, 2010, and 2009, respectively, were excluded from the computation of net income per share on a diluted basis as their effect is anti-dilutive. 12. Employee Stock Plans Omnibus Plan The company maintains the Arrow Electronics, Inc... -

Page 72

... stock options, incentive stock options ("ISOs"), stock appreciation rights, restricted stock, restricted stock units, performance shares, performance units, covered employee annual incentive awards, and other stock-based awards. The Compensation Committee of the company's Board of Directors... -

Page 73

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) The fair value of stock options was estimated using the Black-Scholes valuation model with the following weighted-average assumptions for the years ended December 31: 2011 Volatility (... -

Page 74

...NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) employee director's termination of Board service, each unit in their deferral account will be converted into a share of company stock and distributed to the non-employee director as soon as practicable following... -

Page 75

.... The discount rate represents the market rate for a high-quality corporate bond. The rate of compensation increase is determined by the company, based upon its long-term plans for such increases. The actuarial assumptions used to determine the net periodic pension cost are based upon the prior year... -

Page 76

... plan assets at end of year Funded status Components of net periodic pension cost: Interest cost Expected return on plan assets Amortization of net loss Net periodic pension cost Weighted average assumptions used to determine benefit obligation: Discount rate Expected return on plan assets Weighted... -

Page 77

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) Benefit payments are expected to be paid as follows: 2012 2013 2014 2015 2016 2017-2021 $ 6,336 6,429 6,543 6,627 6,819 35,547 The fair values of the company's pension plan assets at ... -

Page 78

... in net periodic pension cost for the year ended December 31, 2012 are $19 and $2,180, respectively. Defined Contribution Plan The company has a defined contribution plan for eligible employees, which qualifies under Section 401(k) of the Internal Revenue Code. The company's contribution to the... -

Page 79

... a defendant in a lawsuit filed in September 2006 in the United States District Court for the Central District of California (Apollo Associates, L.P., et anno. v. Arrow Electronics, Inc. et al.) in connection with alleged contamination at a third site, an industrial building formerly leased by Wyle... -

Page 80

.... Impact on Financial Statements The company believes that any cost which it may incur in connection with environmental conditions at the Norco, Huntsville, and El Segundo sites and the related litigation is covered by the contractual indemnifications (except, under the terms of the environmental... -

Page 81

... and related depreciation, as well as borrowings, are not directly attributable to the individual operating segments and are included in the corporate business segment. Sales and operating income (loss), by segment, for the years ended December 31 are as follows: 2011 Sales: Global components Global... -

Page 82

... 2,836,006 902,146 9,600,538 Global components Global ECS Corporate Consolidated Sales, by geographic area, for the years ended December 31 are as follows: 2011 $ 10,576,106 6,889,479 3,924,679 $ 21,390,264 $ $ $ $ Americas (b) EMEA Asia/Pacific Consolidated (b) 2010 9,111,557 5,633,508 3,999... -

Page 83

... interim reporting calendar that closes on the Saturday following the end of the calendar quarter. A summary of the company's consolidated quarterly results of operations is as follows: First Quarter 2011 Sales Gross profit Net income attributable to shareholders Net income per share (a): Basic... -

Page 84

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) (g) Includes restructuring, integration, and other charges ($4,095 net of related taxes or $.03 per share on both a basic and diluted basis) and a loss on prepayment of debt ($964 net of... -

Page 85

...'s Chief Executive Officer and Chief Financial Officer, assessed the effectiveness of the company's internal control over financial reporting as of December 31, 2011, and concluded that it is effective. The company acquired eight separate entities over the course of the year ended December 31, 2011... -

Page 86

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Arrow Electronics, Inc. as of December 31, 2011 and 2010, and the related consolidated statements of operations, equity, and cash flows for each of the three years in the period ended December 31... -

Page 87

Changes in Internal Control Over Financial Reporting During the fourth quarter of 2011, the company completed the process of installing a new enterprise resource planning ("ERP") system in a select operation in Europe as part of a phased implementation schedule. This new ERP system, which will ... -

Page 88

... Executive Officers and Corporate Governance. See "Executive Officers" in Part I of this Annual Report on Form 10-K. In addition, the information set forth under the headings "Election of Directors" and "Section 16(a) Beneficial Ownership Reporting Compliance" in the company's Proxy Statement, filed... -

Page 89

PART IV ARROW ELECTRONICS, INC. SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS (In thousands) Balance at beginning of year Allowance for doubtful accounts: Year-ended December 31, 2011 Year-ended December 31, 2010 Year-ended December 31, 2009 $ $ $ 37,998 39,674 52,786 $ $ $ Charged to income 12,... -

Page 90

.../s/ Michael J. Long Michael J. Long, Chairman, President, and Chief Executive Officer /s/ Paul J. Reilly Paul J. Reilly, Executive Vice President, Finance and Operations, and Chief Financial Officer /s/ Jeff Pinkerman Jeff Pinkerman, Vice President, Corporate Controller, and Chief Accounting Officer... -

Page 91

...marks of Arrow Electronics, Inc. © 2012 Arrow Electronics, Inc. Independent Registered Public Accounting Firm Ernst & Young LLP 5 Times Square New York, New York 10036-6530 Transfer Agent and Registrar Wells Fargo Bank N.A. Wells Fargo Shareowner Services 161 North Concord Exchange South St. Paul... -

Page 92