Archer Daniels Midland 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Archer Daniels Midland annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A r c h e r D a n i e l s M i d l a n d C o m p a n y

2 0 0 6 A N N U A L R E P O R T

WeSeeOpportunity

Table of contents

-

Page 1

2006 ANNUAL REPORT We฀See฀Opportunity Archer Daniels Midland Company -

Page 2

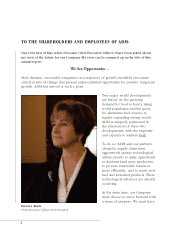

...U.S. Treasury Department, and was named treasurer of the Company in 1986. After fulï¬lling a number of important roles in Europe and at corporate headquarters in Decatur, Allen was named Chief Executive Ofï¬cer in ï¬scal 1997. It was a time of structural change in both agriculture and world trade... -

Page 3

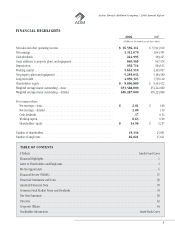

Archer Daniels Midland Company / 2006 Annual Report FINANCIAL HIGHLIGHTS Net sales and other operating income Net earnings Cash dividends Gross additions to property, plant, and equipment Depreciation Working capital Net property, plant and equipment Long-term debt Shareholders' equity ... -

Page 4

...aggressively pursue technological advancements to make agricultural or dormant land more productive, to process renewable resources more efï¬ciently, and to create new fuel and industrial products. These technological advances are already occurring. At the same time, our Company must choose to move... -

Page 5

Archer Daniels Midland Company / 2006 Annual Report the desire and ability to drive growth simultaneously in both food and biofuels. Without question, we have that desire and ability. Clearly, this is the opportunity we see. Record Performance Our performance last year provides strong momentum to ... -

Page 6

...of our people. We also recognize the need for our Company's leadership to provide the foundation for The ADM Strategic Planning Committee (from left: Brian Peterson, William Camp, Steven Mills, David Smith, Patricia Woertz, Douglas Schmalz and John Rice) discusses corporate growth initiatives . 4 -

Page 7

Archer Daniels Midland Company / 2006 Annual Report a culture that fosters strong ethics. Staying safe, managing costs and enabling capital discipline round out the priorities that will enable us to arrive at our ultimate destination: sustained proï¬table growth. I have asked each member of our ... -

Page 8

6 -

Page 9

... fuels. ADM plans to maintain its leadership position in the ethanol market, along with other products from the corn value stream, capitalizing on new opportunities for this versatile crop. At the site of ADM's 275-million-gallon ethanol plant expansion in Cedar Rapids, Iowa, Brian Miller, Project... -

Page 10

8 -

Page 11

Archer Daniels Midland Company / 2006 Annual Report ADDING SUSTAINABILITY TO CROPS-AND FARMS Commitment to farmers and workers creates the opportunity for enhanced sustainability of both farms and agricultural communities. Healthy, properly trained partners increase success by many measures. ... -

Page 12

10 -

Page 13

Archer Daniels Midland Company / 2006 Annual Report BUILDING GLOBAL BIODIESEL CAPACITY Global demand for renewable fuels offers multiple opportunities to derive added value from crop origination, processing and distribution. Renewable fuels expand farm economies while bringing new choices to ... -

Page 14

12 -

Page 15

Archer Daniels Midland Company / 2006 Annual Report ENHANCING CUSTOMERS' GROWTH OPPORTUNITIES Productive partnerships with customers create opportunities to increase both product sales and long-term relationships. From joint planning for new products to capital investment decisions, customer focus... -

Page 16

14 -

Page 17

Archer Daniels Midland Company / 2006 Annual Report INVESTING TO MEET RISING MARKET DEMAND Trade and processing opportunities ï¬,ow from economic expansion, as growing wealth translates into more sophisticated dietary demands. When incomes rise, consumers add increasing amounts of meat protein and... -

Page 18

16 -

Page 19

Archer Daniels Midland Company / 2006 Annual Report CULTIVATING TALENT New perspectives offer new opportunities to improve processes and expand the value of key products at ADM. They also reveal the opportunities presented by ADM as the career destination for talented professionals. ADM's asset ... -

Page 20

18 -

Page 21

Archer Daniels Midland Company / 2006 Annual Report DELIVERING WHAT...WHEN...WHERE IT'S NEEDED Agricultural markets and the processing of crops are ultimately dependent on physical movement of goods. Transportation capacity and logistics expertise present an ongoing opportunity to control costs, ... -

Page 22

20 -

Page 23

Archer Daniels Midland Company / 2006 Annual Report MANAGING RISK Long-term returns on assets ï¬,ow from continuous adjustments to changing commodity markets. Effective hedging and other risk management strategies ensure that opportunities for proï¬table growth can be realized. ADM manages ... -

Page 24

22 -

Page 25

Archer Daniels Midland Company / 2006 Annual Report CONNECTING FARMERS WITH THE WORLD Investments in infrastructure provide attractive opportunities to add value to crops. Effective positioning of assets increases both capacity and ï¬,exibility, which facilitate stronger returns on capital. In the... -

Page 26

... Management's Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm Quarterly Financial Data (Unaudited Common Stock Market Prices and Dividends Ten-Year Summary 25 36 39 40 42 43 44 55 56 58 59 60 24 Archer Daniels Midland Company -

Page 27

...principally engaged in procuring, transporting, storing, processing, and merchandising agricultural commodities and products . The Company's operations are classified into three reportable business segments: Oilseeds Processing, Corn Processing, and Agricultural Services . Each of these segments... -

Page 28

... to higher average selling prices of agricultural commodities and increased sales volumes and selling prices of corn processing products, partially offset by decreased average selling prices of cocoa products and currency exchange rate decreases of $415 million . Net sales and other operating... -

Page 29

... products . These increases were partially offset by increased energy costs . Sweeteners and Starches operating profits include a $5 million charge related to the adoption of FIN 47 . Bioproducts operating profits increased $187 million primarily due to higher ethanol sales 2006 Annual Report... -

Page 30

... industry overcapacity . Ethanol experienced good demand and increased selling prices due to higher gasoline prices . Increased lysine production capacity in China created excess supplies of lysine which reduced selling prices and related margins . The record United States corn and soybean crops... -

Page 31

... of agricultural commodities, and increased average selling prices of ethanol and corn sweeteners . Net sales and other operating income by segment are as follows: Oilseeds Processing Corn Processing Sweeteners and Starches Bioproducts Total Corn Processing Agricultural Services Other... -

Page 32

... prior year . The increase in the Company's effective tax rate is principally due to changes in the jurisdictional mix of pretax earnings and the result of tax benefits derived from the majority of the Company's tax planning initiatives being fixed in nature . 30 Archer Daniels Midland Company -

Page 33

... levels of commodity-based agricultural raw materials . Purchases of the Company's common stock decreased $137 million . Cash dividends paid in 2006 were $242 million as compared to $209 million in 2005 . Capital resources were strengthened as shown by the increase in the Company's net worth from... -

Page 34

... the Company's merchandisable agricultural commodity inventories, forward fixed-price purchase and sale contracts, and exchange-traded futures and options contracts are valued at estimated market values . These merchandisable agricultural commodities are freely traded, have quoted market prices... -

Page 35

... financial statements . Asset Abandonments and Write-Downs The Company is principally engaged in the business of procuring, transporting, storing, processing, and merchandising agricultural commodities and products . This business is global in nature and is highly capital-intensive . Both... -

Page 36

...living, and global production of similar and competitive crops . To reduce price risk caused by market fluctuations, the Company generally follows a policy of using exchange-traded futures and options contracts to minimize its net position of merchandisable agricultural commodity inventories and... -

Page 37

...have a high correlation to the price changes in the currency of the related hedged transactions . The potential loss in fair value for such net currency position resulting from a hypothetical 10% adverse change in foreign currency exchange rates is not material . The amount the Company considers... -

Page 38

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Nature of Business The Company is principally engaged in procuring, transporting, storing, processing, and merchandising agricultural commodities and products . Segregated Cash and Investments The Company segregates certain cash and ... -

Page 39

...costs and handling charges related to sales are recorded as a component of cost of products sold . Net sales to unconsolidated affiliates during 2006 and 2005 were $3 .1 billion and $2 .9 billion, respectively . Stock Compensation Effective July 1, 2004, the Company adopted the fair... -

Page 40

... employee stock options and restricted stock awards in each year . 2005 2004 (In thousands, except per share amounts) $1,312,070 $1,044,385 $494,710 2006 Net earnings, as reported Add: stock-based compensation expense reported in net earnings, net of related tax Deduct: stock... -

Page 41

... Net sales and other operating income Cost of products sold Gross Proï¬t Selling, general, and administrative expenses Other expense (income) - net Earnings Before Income Taxes Income taxes Net Earnings Basic earnings per common share Diluted earnings per common share Average number... -

Page 42

CONSOLIDATED BALANCE SHEETS ASSETS June 30 2006 2005 (In thousands) Current Assets ... Long-term marketable securities Goodwill Other assets Property, Plant, and Equipment Land Buildings Machinery and equipment Construction... 5,184,380 $18,598,105 40 Archer Daniels Midland Company -

Page 43

... 2006 2005 (In thousands) Current Liabilities Short-term debt Accounts payable Accrued expenses Current maturities of long-term debt Total Current Liabilities Long-Term Liabilities Long-term debt Deferred income taxes Other Shareholders' Equity Common stock Reinvested earnings... -

Page 44

...net of dividends Stock contributed to employee benefit plans Pension and postretirement payments in excess of accruals Other - net Changes in operating assets and liabilities Segregated cash and investments Receivables Inventories Other assets Accounts payable...Archer Daniels Midland Company -

Page 45

...425) (139,112) 85,746 8,433,472 Comprehensive income Net earnings Other comprehensive income Total comprehensive income . Cash dividends paid- $.37 per share Treasury stock purchases 43) Other 5,329 Balance June 30, 2006 655,685 See notes to consolidated ï¬nancial statements. 1,312... -

Page 46

...businesses for a total cost of $182 million . The Company has recorded a preliminary allocation of the purchase price related to these acquisitions . This purchase price allocation resulted in goodwill of $3 million, of which $2 million and $1 million were assigned to the Agricultural Services... -

Page 47

... of commodities to be purchased and processed in a future month . The Company also uses futures, options, and swaps to fix the purchase price of the Company's anticipated natural gas requirements for certain production facilities . In addition, certain of the Company's ethanol sales contracts... -

Page 48

... Company's share of derivative gains reported by unconsolidated affiliates of the Company . 2006 Oilseeds Processing Corn Processing Agricultural Services Other Total 2005 Oilseeds Processing Corn Processing Agricultural Services Other Total Consolidated Investments Businesses... -

Page 49

... rate of U .S . Treasury zero-coupon issues with a remaining term equal to the expected life of option grants . The assumptions used in the Black-Scholes single option pricing model are as follows . Dividend yield Risk-free interest rate Stock volatility Average expected life (years 2006... -

Page 50

... June 30, 2006, there was $33 million of total unrecognized compensation expense related to option grants . Amounts to... losses reclassiï¬ed to net earnings Tax effect Net of tax amount Balance at June 30, 2006 Foreign Currency Translation Adjustment ...48 Archer Daniels Midland Company -

Page 51

..., $238 million, and $273 million in 2006, 2005, and 2004, respectively . The Company has $85 million and $105 million of tax assets for net operating loss carryforwards related to certain international subsidiaries at June 30, 2006 and 2005, respectively . As of June 30... -

Page 52

... years 2007 2008 2009 2010 2011 Thereafter Total minimum lease payments In thousands) $ 77,457 60,481 47,946 35,361 20,970 135,613 $377,828 Note 12-Employee Beneï¬t Plans The Company provides substantially all domestic employees and employees at certain international subsidiaries with... -

Page 53

...Employee contributions Benefits paid Plan amendments Acquisitions and divestitures Foreign currency effects Fair value of plan assets, ending Funded status Unamortized transition amount Unrecognized net loss Unrecognized prior service...$ - - (141,974) - - $(141,974) 2006 Annual Report 51 -

Page 54

...to 5 .0% for 2011 and remain at that level thereafter . Assumed health care cost trend rates have a significant impact on the amounts reported for the health care plans . A 1% change in assumed health care cost trend rates would have the following effect: Effect on combined service and interest... -

Page 55

...principally engaged in procuring, transporting, storing, processing, and merchandising agricultural commodities and products . The Company's operations are classified into three reportable business segments: Oilseeds Processing, Corn Processing, and Agricultural Services . Each of these segments... -

Page 56

... In 2004, the Company entered into a settlement agreement related to a class action antitrust suit involving the sale of high-fructose corn syrup pursuant to which the Company accrued $400 million ($252 million after tax) . The $400 million was paid in 2005 . 54 Archer Daniels Midland Company -

Page 57

... on management's assessment of the Company's internal control over financial reporting as of June 30, 2006 . That report is included herein . Patricia A . Woertz Chief Executive Officer and President Douglas J . Schmalz Senior Vice President & Chief Financial Officer 2006 Annual Report 55 -

Page 58

... . generally accepted accounting principles . We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Archer Daniels Midland Company and subsidiaries' internal control over financial reporting as of June 30, 2006... -

Page 59

...' equity, and cash flows for each of the three years in the period ended June 30, 2006, of Archer Daniels Midland Company and subsidiaries, and our report dated September 1, 2006, expressed an unqualified opinion thereon . St . Louis, Missouri September 1, 2006 2006 Annual Report 57 -

Page 60

... to the abandonment and write-down of certain long-lived assets . For the year ended June 30, 2005, net earnings include a gain of $159 million ($119 million after tax, equal to $ .18 per share) related to sales of the Company's interests in Tate & Lyle PLC . 58 Archer Daniels Midland Company -

Page 61

... AND DIVIDENDS The Company's common stock is listed and traded on the New York Stock Exchange, Chicago Stock Exchange, Frankfurt Stock Exchange, and Swiss Stock Exchange . The following table sets forth, for the periods indicated, the high and low market prices of the common stock as reported on... -

Page 62

... 654,242 656,123 23,091 25,641 647,698 649,810 24,394 26,317 Share and per share data have been adjusted for annual 5% stock dividends from September 1996 through September 2001 . 60 Archer Daniels Midland Company -

Page 63

...,753 685,328 685,426 31,764 23,603 686,047 686,809 32,539 23,132 690,352 691,409 33,834 17,160 2006 Annual Report 61 -

Page 64

... Maciel Neto Chief Executive Ofï¬cer and President, Suzano Papel e Celulose (a Brazilian producer of paper and pulp products) Mr . Maciel, 49, joined ADM's Board in 2006 . He serves on the Compensation/ Succession and Nominating/Corporate Governance Committees . 62 Archer Daniels Midland Company -

Page 65

... and Chief Executive Ofï¬cer of Smurï¬t-Stone Container Corporation (a producer of paperboard and paper-based packaging products) Mr . Moore, 52, joined ADM's Board in 2003 . Mr . Moore serves on the Audit, Executive and Nominating/Corporate Governance Committees . M. Brian Mulroney Senior... -

Page 66

... Vice President (Human Resources) Dennis Riddle Vice President (Corn Processing) Kenneth A. Robinson Vice President (Commodity Risk Management) Ismael Roig Vice President (Planning and Business Development) Scott A. Roney Vice President (Compliance and Ethics) A. James Shafter Vice President... -

Page 67

... Archer Daniels Midland Company Common Stock is listed and traded on the New York Stock Exchange, Chicago Stock Exchange, Frankfurt Stock Exchange and the Swiss Stock Exchange. Ticker symbol: ADM. Transfer Agent and Registrar Hickory Point Bank and Trust, fsb 1099 W. Wood St., Suite G Decatur, IL... -

Page 68