Amgen 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Amgen annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Shareholders,

2015 was a momentous year for Amgen. It was a

year in which we delivered impressive financial

results and an unprecedented six innovative new

product offerings to the market, each of which

helped serve patients suffering from serious

illness. In doing so, we demonstrated clear

progress toward our 2018 commitments to

investors and solidly advanced our strategy for

long-term growth.

We achieved record results in revenues and

earnings in 2015. The strengths of our products

were reflected in eight percent revenue growth,

to a record $21.7 billion. Our 19 percent

adjusted earnings per share* growth reflects

tight control of our business and the benefits of

our ongoing transformation efforts—efforts that

were launched company-wide three years ago.

Beyond delivering record operating results for

2015, we made substantial progress along every

dimension of our strategy: advancing innovative

medicines and a portfolio of biosimilar medicines

to address serious illness; expanding our

geographic reach; transitioning to next-

generation manufacturing; improving our biologic

drug delivery systems; and allocating capital to

shareholders while investing substantially in our

business for long-term growth. My intent in this

letter is to briefly address the progress we have

made on each of these strategic elements.

A Clear, Long-Term Strategy for Growth and

Value Creation

Founded 35 years ago, Amgen’s mission is

clear: it is to serve patients. Our strategy is

also clear: it is to develop innovative medicines

that meet important unmet medical needs.

This focus guided us when we developed our

first medicine three decades ago for patients

suffering from kidney disease. The same

unwavering focus inspired us as we launched six

innovative products during the past year,

including our novel medicine for certain patients

at risk for heart disease, the most significant

unmet medical need facing society today.

Indeed, the common denominator for products

we develop in all six focused therapeutic

areas—oncology/hematology, cardiovascular

disease, inflammation, bone health, nephrology

and neuroscience—is the innovative contribution

they make to addressing serious illness.

There is much discussion about the cost of

innovation in healthcare today. Against this

backdrop, we recognize that new medicines

must help alleviate the social and economic

burden of disease. This calls for truly innovative

medicines that provide large beneficial effects,

not just marginal improvements over existing

therapies. This understanding guides our

investment in the business opportunities we

pursue.

We recognize that investing in developing

innovative medicines is risky. And we also

recognize that shareholders who support this

investment require an appropriate return on the

capital they commit to Amgen. We believe we

have a long track record of delivering these

returns, and it is one we aim to maintain.

As a leading provider of innovative medicines,

Amgen advocates for policies and practices that

make our medicines available to all patients for

whom these therapies are appropriate. In some

cases, that means providing direct assistance to

patients who cannot otherwise afford our

medicines.

A New Cycle of Innovative, Breakaway

Medicines Addressing Important

Unmet Needs

In 2015, we built a solid foundation for future

growth with an unprecedented four innovative

launches in oncology and two in cardiovascular

disease. All of these treatments are showing

positive initial reception by physicians, patients

and payers.

In oncology, for instance, one year after launch,

more than one in four of our Neulasta®

(pegfilgrastim) patients in the United States

are already using the recently launched

Neulasta® Onpro™ kit, a convenient, innovative

delivery option for certain patients who have just

completed chemotherapy. And Kyprolis®

(carfilzomib), our treatment for relapsed or

refractory multiple myeloma, a difficult-to-treat

blood cancer, has strengthened its profile as a

backbone of therapy for patients. The extremely

encouraging ASPIRE and ENDEAVOR study data

are now incorporated into Kyprolis®’ US

prescribing information, demonstrating proven

efficacy in three different treatment regimens.

In cardiovascular disease, Repatha®

(evolocumab), the first PCSK9 inhibitor

in the world approved for the treatment of

certain patients requiring additional LDL

cholesterol lowering, is off to a strong

competitive start in the United States and

Europe. We expect that data over the coming

year from our event-driven outcomes study, as

well as from our cardiovascular coronary imaging

study, will allow us to fully articulate the value of

Repatha® and drive further adoption by both

cardiovascular specialists and general

practitioners.

Following behind our six product launches are a

number of additional exciting innovative pipeline

opportunities progressing in focused therapeutic

areas. Building on our long-term investment in

treating kidney disease, for instance, our

nephrology product candidate Parsabiv™

(etelcalcetide) is under review by global

regulators as a potential novel-dose, highly

effective treatment for patients with secondary

hyperparathyroidism receiving hemodialysis.

Meanwhile, romosozumab, now in Phase 3

development, holds potential as a novel

bone-building therapy for patients with

osteoporosis. Two Phase 3 episodic migraine

studies are progressing rapidly for AMG 334,

an antibody uniquely directed at the receptor

for calcitonin gene-related peptide (CGRP).

Also of note in cardiovascular disease is

Letter to

Shareholders

*This is a non-GAAP financial measure. See reconciliation to US generally accepted accounting principles (GAAP) accompanying this letter.

Robert A. Bradway, Chairman and Chief Executive Officer, Amgen Inc.

Table of contents

-

Page 1

... 3 development, holds potential as a novel bone-building therapy for patients with osteoporosis. Two Phase 3 episodic migraine studies are progressing rapidly for AMG 334, an antibody uniquely directed at the receptor for calcitonin gene-related peptide (CGRP). Also of note in cardiovascular disease... -

Page 2

... work to our strategy, are the driving forces behind our ability to deliver for shareholders and patients. Robert A. Bradway Chairman and Chief Executive Officer *This is a non-GAAP financial measure. See reconciliation to US generally accepted accounting principles (GAAP) accompanying this letter... -

Page 3

...expenses Adjusted research and development expenses GAAP operating income Adjustments to operating income: Acquisition-related expenses(a) Certain charges pursuant to our restructuring and other cost-savings initiatives(b) Expense/(benefit) related to various legal proceedings Expense resulting from... -

Page 4

... respect to many of our marketed products as well as for the discovery and development of new products. Further, some raw materials, medical devices and component parts for our products are supplied by sole third-party suppliers. The discovery of significant problems with a product similar to one of... -

Page 5

...OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 000-12477 Amgen Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) One Amgen Center Drive, Thousand Oaks, California (Address of principal executive offices... -

Page 6

... the power, directly or indirectly, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant. 752,091,038 (Number of shares of common stock outstanding as of February 9, 2016) DOCUMENTS... -

Page 7

...Selected Marketed Products Reimbursement Manufacturing, Distribution and Raw Materials Government Regulation Research and Development and Selected Product Candidates Business Relationships Human Resources Executive Officers of the Registrant Geographic Area Financial Information Investor Information... -

Page 8

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 9

... Act (PDUFA) target action date as a goal for the completion of their review of our application. • In January 2016, we, together with our joint venture partner Astellas Pharma, Inc., announced that the Japanese Ministry of Health, Labour and Welfare approved Repatha® for the treatment of patients... -

Page 10

... for review our New Drug Application (NDA) for Parsabiv™ for the treatment of SHPT in patients with CKD on hemodialysis. The FDA has set an August 24, 2016, PDUFA target action date. Neuroscience AMG 334 • In July 2015, we announced that we initiated phase 3 studies in episodic migraine. AMG 334... -

Page 11

... stopped administration of blinded investigational product in the phase 3 study of trebananib in first-line ovarian cancer based on a recommendation by the Data Safety Monitoring Committee. Vectibix® (panitumumab) • In April 2015, we announced that the EC approved a new use of Vectibix® as first... -

Page 12

... on the distribution practice in each country. Our product sales to three large wholesalers, AmerisourceBergen Corporation, McKesson Corporation and Cardinal Health, Inc., each accounted for more than 10% of total revenues for each of the years ended December 31, 2015, 2014 and 2013. On a combined... -

Page 13

...who receive anti-cancer medicines (chemotherapy) that can cause fever and a low blood cell count. In March 2015, the Neulasta® Onpro™ kit became available in the United States. ESAs (erythropoiesis-stimulating agents) Aranesp® (darbepoetin alfa) We market Aranesp® primarily in Europe and in the... -

Page 14

... expiry date may fall under the same "general subject matter" and are not separately listed. Product Territory General Subject Matter Expiration Enbrel (etanercept) Neulasta® (pegfilgrastim) Aranesp® (darbepoetin alfa) Sensipar®/ Mimpara® (cinacalcet) ® U.S. U.S. U.S. U.S. Europe U.S. Europe... -

Page 15

... competing against epoetin alfa and filgrastim biosimilars in Europe. The introduction of new products, the development of new processes or technologies by competitors or the emergence of new information about existing products may result in increased competition for our marketed products, even for... -

Page 16

... assessments public. These developments create greater pressure on the access, pricing and sales of our products. In the United States, healthcare providers are reimbursed for covered services and products they deliver through Medicare, Medicaid and other government healthcare programs, as well as... -

Page 17

... sales for ENBREL, Sensipar® and Repatha® occur, pharmacy benefit managers (PBMs) and insurers are implementing more rigorous utilization and pricing tools that can reduce Amgen product usage or revenues. PBMs are third-party administrators of prescription drug programs for large employers, health... -

Page 18

... to supplement distribution of our products worldwide. Other In addition to the manufacturing and distribution activities noted above, our operations in the United States, Puerto Rico and the Netherlands include key manufacturing support functions, including quality control, process development... -

Page 19

... Health Service Act, the Federal Food, Drug, and Cosmetic Act (FDCA) and the regulations promulgated thereunder, as well as other federal and state statutes and regulations govern, among other things, the production, research, development, testing, manufacture, quality control, labeling, storage... -

Page 20

... manufacturing/testing facility inspections, testing of drug product upon importation and other domestic requirements. In Asia, a number of countries such as China, South Korea and Taiwan may require local clinical trials as part of the drug registration process in addition to the global clinical... -

Page 21

... State False Claims Acts. In connection with entering into the settlement agreement, Amgen also entered into a corporate integrity agreement with the Office of Inspector General (OIG) of the U.S. Department of Health and Human Services that requires Amgen to maintain its corporate compliance program... -

Page 22

... locations throughout the United States (including Thousand Oaks and San Francisco, California and Cambridge, Massachusetts), Iceland and in the United Kingdom, as well as smaller research centers and development facilities globally. See Item 2. Properties. We conduct clinical trial activities... -

Page 23

... breast cancer; Cancer-related bone damage in patients with multiple myeloma Asthma; Atopic dermatitis Inflammatory bowel diseases Chronic migraine Alzheimer's disease Dyslipidemia Diffuse Large B-Cell Lymphoma (DLBCL) Heart failure Metastatic non-small cell lung cancer (NSCLC) Various cancer types... -

Page 24

... that have advanced into human clinical trials. AMG 334 AMG 334 is a human monoclonal antibody that inhibits the receptor for calcitonin gene-related peptide. It is being evaluated for the prophylaxis of migraine. AMG 334 is being jointly developed with Novartis. Phase 3 studies in episodic migraine... -

Page 25

... Denosumab is a human monoclonal antibody that inhibits RANKL. Prolia® A phase 3 study of Prolia® for the treatment of glucocorticoid-induced osteoporosis is ongoing. XGEVA® Phase 3 studies for the delay or prevention of bone metastases in patients with adjuvant breast cancer and prevention of... -

Page 26

... patients treated with BSC alone. AMG 157 AMG 157 is a human monoclonal antibody that inhibits the action of TSLP. It is being evaluated as a treatment for asthma and atopic dermatitis, with phase 2 studies ongoing. AMG 157 is being jointly developed in collaboration with AstraZeneca. AMG 181 AMG... -

Page 27

... rights which have been transferred to this joint venture from Amgen and Kirin. K-A has given us exclusive licenses to manufacture and market: (i) G-CSF and pegfilgrastim in the United States, Europe, Canada, Australia, New Zealand, all Central American, South American, Middle Eastern and African... -

Page 28

...market ENBREL outside the United States and Canada are reserved to Pfizer. Under the collaboration agreement, Amgen and Pfizer shared in the agreed-upon selling and marketing expenses approved by a joint committee. We paid Pfizer a percentage of annual gross profits on our ENBREL sales in the United... -

Page 29

... the National Broadcasting Corporation, a division of the General Electric Company. From July 1988 to November 1999, Mr. McNamee held human resources positions at General Electric. Mr. David W. Meline, age 58, became Executive Vice President and Chief Financial Officer in July 2014. From April 2011... -

Page 30

... insurance plans. Governments and private payers continue to pursue aggressive initiatives to contain costs and manage drug utilization and are increasingly focused on the effectiveness, benefits and costs of similar treatments, which could result in lower reimbursement rates for our products or... -

Page 31

... usage negotiations with drug manufacturers. Insurers and others are adopting benefit plan changes that shift a greater portion of prescription costs to patients, and some payers may attempt to limit the use of patient co-pay payment assistance programs. Private payers also control costs by imposing... -

Page 32

...with the FDA, Sandoz subsequently announced that its marketing application has now been accepted for review by the FDA. (For information related to our other biosimilars patent litigation, see Part IV-Note 18, Contingencies and commitments, to the Consolidated Financial Statements.) The U.S. pathway... -

Page 33

... restrictive labeling that may result in our decision not to commercialize a product candidate; requirement of risk management activities or other regulatory agency compliance actions related to the promotion and sale of our products; mandated post-marketing commitments or pharmacovigilance programs... -

Page 34

...particularly if competitors are conducting clinical trials in similar patient populations. Delays in planned clinical trials can result in increased development costs, associated delays in regulatory approvals and in product candidates reaching the market and revisions to existing product labels. 26 -

Page 35

... trials is limited, including Russia, India, China, South Korea, the Philippines, Singapore and some Central and South American countries, either through utilization of third-party contract clinical trial providers entirely or in combination with local staff. Conducting clinical trials in locations... -

Page 36

...-party studies, or failure of Amgen or the third-party companies to obtain or maintain regulatory approval or clearance of the devices could result in increased development costs, delays in, or failure to obtain, regulatory approval and/or associated delays in a product candidate reaching the market... -

Page 37

... strategic developments at or affecting the supplier, including bankruptcy; unexpected demand for or shortage of raw materials, medical devices or components; failure to comply with our quality standards which results in quality and product failures, product contamination and/or recall; a material... -

Page 38

... or assist in the production of, a number of our products, and are using contract manufacturers to produce, or assist in the production of, a number of our late-stage product candidates and drug delivery devices. (See Item 1. Business-Manufacturing, Distribution and Raw Materials-Manufacturing.) Our... -

Page 39

...operation of these facilities. (See Manufacturing difficulties, disruptions or delays could limit supply of our products and limit our product sales.) In June 2015, Puerto Rico's Governor stated that the Puerto Rico government, which includes certain government entities, is unable to pay its roughly... -

Page 40

... regarding our sales and marketing practices. In connection with that settlement, we are now operating under a Corporate Integrity Agreement (CIA) with the OIG of the U.S. Department of Health and Human Services that requires us to maintain our corporate compliance program and to undertake... -

Page 41

..., customers and suppliers may become insolvent, which could have a material adverse effect on our product sales, business and results of operations. We maintain a significant portfolio of investments disclosed as cash equivalents and marketable securities on our Consolidated Balance Sheet. The value... -

Page 42

... the global supply of our products. See Item 1. Business-Manufacturing, Distribution and Raw Materials. Item 3. LEGAL PROCEEDINGS Certain of the legal proceedings in which we are involved are discussed in Part IV-Note 18, Contingencies and commitments, to our Consolidated Financial Statements and... -

Page 43

...periods indicated, the range of high and low quarterly closing sales prices of the common stock as quoted on The NASDAQ Global Select Market: Year ended December 31, 2015 High Low Fourth quarter Third quarter Second quarter First quarter Year ended December 31, 2014 164.58 176.59 169.17 170.10... -

Page 44

... indicative of future stock price performance. Amgen vs. Amex Biotech, Amex Pharmaceutical and S&P 500 Indices Comparison of Five-Year Cumulative Total Return Value of Investment of $100 on December 31, 2010 12/31/2010 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 Amgen (AMGN) Amex... -

Page 45

... related expenses. In October 2015, our Board of Directors authorized an increase that resulted in a total of $5.0 billion available under the stock repurchase program. Dividends For the years ended December 31, 2015 and 2014, we paid quarterly dividends. We expect to continue to pay quarterly... -

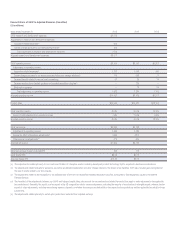

Page 46

Item 6. SELECTED FINANCIAL DATA Years ended December 31, Consolidated Statement of Income Data: 2015 2014 2013 2012 2011 (In millions, except per share data) Revenues: Product sales Other revenues Total revenues Operating expenses: Cost of sales Research and development Selling, general and... -

Page 47

... our innovative pipeline and branded biosimilar programs, developing improved biologic drug delivery systems, transforming our business to a more focused operating model and returning capital to shareholders. • Financial performance was strong, as total revenues and product sales increased... -

Page 48

.... Our transformation and process improvement efforts across the Company have enabled us to reallocate resources to fund many of our innovative pipeline and growth opportunities to deliver value to patients and shareholders. Finally, we continued returning capital to shareholders in 2015 through the... -

Page 49

Selected financial information The following is an overview of our results of operations (in millions, except percentages and per share data): Year ended December 31, 2015 Change Year ended December 31, 2014 Product sales: U.S. Rest of world (ROW) Total product sales Other revenues Total revenues ... -

Page 50

..., Distribution and Selected Marketed Products-Competition. ENBREL Total ENBREL sales by geographic region were as follows (dollar amounts in millions): Year ended December 31, 2015 Change Year ended December 31, 2014 Change Year ended December 31, 2013 ENBREL - U.S. ENBREL - Canada Total ENBREL... -

Page 51

... a material adverse impact on Neulasta® sales. For discussion of ongoing litigation between us and Apotex, see Part IV-Note 18, Contingencies and commitments, to the Consolidated Financial Statements. Future Neulasta® sales will also depend, in part, on the development of new protocols, tests and... -

Page 52

... in foreign currency exchange rates. The increase in global Sensipar®/Mimpara® sales for 2014 was driven primarily by unit demand growth and an increase in net selling price in the United States, offset partially by unfavorable changes in U.S. wholesaler and, based on prescription data, end-user... -

Page 53

...-Marketing, Distribution and Selected Marketed Products-Competition and Part IV-Note 18, Contingencies and commitments, to the Consolidated Financial Statements. Future NEUPOGEN® sales will also depend, in part, on the development of new protocols, tests and/or treatments for cancer and/or new... -

Page 54

... costs in 2016 and 2017 in order to support our ongoing transformation and process improvement efforts. Net savings were not significant in 2015 and 2014 due to the investments in new product launch preparations, later stage clinical programs and external business development. Additional information... -

Page 55

... for new product launches. Historically, under our ENBREL collaboration agreement, we paid Pfizer a percentage of annual gross profits on our ENBREL sales in the United States and Canada on a scale that increased with gross profits. The ENBREL co-promotion term expired on October 31, 2013, and... -

Page 56

... bearing securities in 2015. The increase in interest and other income, net for 2014 compared with 2013 was due primarily to interest earned as a result of a higher average balance of cash and investments offset partially by a reduction in income realized from the sale of investments in 2014. Income... -

Page 57

... and existing sources of and access to financing are adequate to satisfy our needs for working capital; capital expenditure and debt service requirements; our plans to pay dividends and repurchase stock; and other business initiatives we plan to strategically pursue, including acquisitions and... -

Page 58

... levels of risk. Our investment policy limits interest-bearing security investments to certain types of debt and money market instruments issued by institutions with primarily investment grade credit ratings and places restrictions on maturities and concentration by asset class and issuer. Financing... -

Page 59

.... Investing Capital expenditures, which were associated primarily with manufacturing capacity expansions in Singapore, Puerto Rico and Ireland, as well as other site developments, totaled $594 million, $718 million and $693 million in 2015, 2014 and 2013, respectively. We currently estimate 2016... -

Page 60

...2015. See Part IV-Note 14, Financing arrangements, to the Consolidated Financial Statements for further discussion of our long-term debt obligations. Purchase obligations relate primarily to: (i) R&D commitments (including those related to clinical trials) for new and existing products; (ii) capital... -

Page 61

... actual results may differ. For example, we had managed Medicaid rebate adjustments of $164 million in 2013. Changes in annual estimates related to prior annual periods were less than 3% of the estimated rebate amounts charged against product sales for the years ended December 31, 2015 and 2014, and... -

Page 62

... in each location and the tax laws and principles of the respective taxing jurisdictions. For example, the Company conducts significant operations outside the United States in Puerto Rico pertaining to manufacturing, distribution and other related functions to meet its worldwide product demand... -

Page 63

..., but not limited to determining the timing and expected costs to complete in-process projects taking into account the stage of completion at the acquisition date; projecting the probability and timing of obtaining marketing approval from the FDA and other regulatory agencies for product candidates... -

Page 64

... 31, 2015 and 2014. Interest rate sensitive financial instruments Our portfolio of available-for-sale interest-bearing securities at December 31, 2015 and 2014, was comprised of: U.S. Treasury securities and other government-related debt securities; corporate debt securities; residential mortgage... -

Page 65

...dollar relative to exchange rates at December 31, 2015, would have resulted in an increase in fair value of this debt of approximately $660 million on this date and a reduction in income in the ensuing year of approximately $610 million, but would have no material effect on the related cash flows in... -

Page 66

... that limits investments to certain types of debt and money market instruments issued by institutions primarily with investment grade credit ratings and places restriction on maturities and concentrations by asset class and issuer. Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA The information... -

Page 67

... internal control over financial reporting as of December 31, 2015, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Consolidated Balance Sheets as of December 31, 2015 and 2014, and the related... -

Page 68

... in our Proxy Statement. Information about compensation committee matters is incorporated by reference from the sections entitled CORPORATE GOVERNANCE - Board Committees and Charters - Compensation and Management Development Committee and CORPORATE GOVERNANCE - Compensation Committee Report in our... -

Page 69

... AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS Securities Authorized for Issuance Under Existing Equity Compensation Plans The following table sets forth certain information as of December 31, 2015, concerning the shares of our Common Stock that may be issued under any form of award granted under... -

Page 70

... salary to the purchase the Company's Common Stock on the open market at the market price by a third-party trustee as described in the Profit Sharing Plan. (3) (4) (5) (6) Security Ownership of Directors and Executive Officers and Certain Beneficial Owners Information about security ownership... -

Page 71

...as part of this Annual Report on Form 10-K: Page number II. Valuation and Qualifying Accounts F-51 All other schedules are omitted because they are not applicable, not required or because the required information is included in the consolidated financial statements or notes thereto. (a)3. Exhibit... -

Page 72

...Nominee of The Depository Trust Company, and Citibank, N.A., as Paying Agent. (Filed as an exhibit to Form 10-Q for the quarter ended March 31, 1998 on May 13, 1998 and incorporated herein by reference.) Officers' Certificate of Amgen Inc., dated May 30, 2007, including forms of the Company's Senior... -

Page 73

... Form of Restricted Stock Unit Agreement for the Amgen Inc. 2009 Director Equity Incentive Program. (As Amended on March 6, 2013.) (Filed as an exhibit to Form 10-Q for the quarter ended March 31, 2013 on May 3, 2013 and incorporated herein by reference.) Amgen Inc. Supplemental Retirement Plan. (As... -

Page 74

... to the Shareholders' Agreement, dated March 26, 2014. (Filed as an exhibit to Form 10-Q for the quarter ended March 31, 2014 on April 30, 2014 and incorporated herein by reference.) Assignment and License Agreement, dated October 16, 1986 (effective July 1, 1986), between Amgen and Kirin-Amgen, Inc... -

Page 75

... Letter Regarding Collaboration Agreement, dated May 29, 2015, by and between Bayer HealthCare LLC and Onyx Pharmaceuticals, Inc. (Filed as an exhibit to Form 10-Q for the quarter ended June 30, 2015 on August 5, 2015 and incorporated herein by reference.) Term Loan Facility Credit Agreement, dated... -

Page 76

... Securities Exchange Act of 1934, the registrant has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized. AMGEN INC. (Registrant) Date: February 16, 2016 By: /S / DAVID W. MELINE David W. Meline Executive Vice President and Chief Financial Officer... -

Page 77

...) pertaining to the Amgen Profit Sharing Plan for Employees in Ireland; • • • of our reports dated February 16, 2016, with respect to the consolidated financial statements and schedule of Amgen Inc. and the effectiveness of internal control over financial reporting of Amgen Inc. included in... -

Page 78

... of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated: Signature Title Date /S/ ROBERT A. BRADWAY Robert A. Bradway Chairman of the Board, Chief Executive Officer and... -

Page 79

...), Amgen Inc.'s internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) and our report dated February 16, 2016 expressed... -

Page 80

AMGEN INC. CONSOLIDATED STATEMENTS OF INCOME Years ended December 31, 2015, 2014 and 2013 (In millions, except per share data) 2015 2014 2013 Revenues: Product sales Other revenues Total revenues Operating expenses: Cost of sales Research and development Selling, general and administrative Other ... -

Page 81

... 31, 2015, 2014 and 2013 (In millions) 2015 2014 2013 Net income Other comprehensive (loss) income, net of reclassification adjustments and taxes: Foreign currency translation losses Effective portion of cash flow hedges Net unrealized (losses) gains on available-for-sale securities Other Other... -

Page 82

AMGEN INC. CONSOLIDATED BALANCE SHEETS December 31, 2015 and 2014 (In millions, except per share data) 2015 2014 ASSETS Current assets: Cash and cash equivalents Marketable securities Trade receivables, net Inventories Other current assets Total current assets Property, plant and equipment, net ... -

Page 83

... award programs Stock-based compensation Settlement of conversion value of convertible debt in excess of principal Settlement of convertible note hedge Settlement of warrants Tax impact related to employee stock-based compensation Repurchases of common stock Balance at December 31, 2013 Net income... -

Page 84

...) 2015 2014 2013 Cash flows from operating activities: Net income Depreciation and amortization Stock-based compensation expense Deferred income taxes Other items, net Changes in operating assets and liabilities, net of acquisitions: Trade receivables, net Inventories Other assets Accounts payable... -

Page 85

... accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results may differ from those estimates. Product sales Sales of our products... -

Page 86

..., general and administrative costs Selling, general and administrative (SG&A) costs are comprised primarily of salaries, benefits and other staff-related costs associated with sales and marketing, finance, legal and other administrative personnel; facilities and overhead costs; outside marketing... -

Page 87

... Balance Sheets due to their highly liquid nature and because they represent the Company's investments that are available for current operations. See Note 9, Available-for-sale investments, and Note 16, Fair value measurement. Inventories Inventories are stated at the lower of cost or market. Cost... -

Page 88

... using average exchange rates. Recent accounting pronouncements In May 2014, the Financial Accounting Standards Board (FASB) issued a new accounting standard that amends the guidance for the recognition of revenue from contracts with customers to transfer goods and services. The new standard, as... -

Page 89

... launch of our new pipeline molecules, while improving our cost structure. As part of the plan, we are closing our facilities in Washington state and Colorado and reducing the number of buildings we occupy at our headquarters in Thousand Oaks, California, as well as at other locations. We estimate... -

Page 90

Francisco, California, and Cambridge, Massachusetts. During the year ended December 31, 2015, we recognized gains from the sale of assets related to these site closures. The following table summarizes the expenses (excluding non-cash charges) and payments related to the restructuring plan (in ... -

Page 91

...presented because this acquisition is not material to our consolidated results of operations. Onyx Pharmaceuticals On October 1, 2013, we acquired all of the outstanding stock of Onyx Pharmaceuticals, Inc. (Onyx), a global biopharmaceutical company engaged in the development and commercialization of... -

Page 92

... 2013, we entered into an agreement to acquire the licenses to filgrastim and pegfilgrastim effective January 1, 2014 (acquisition date), that were held by F. Hoffmann-La Roche Ltd. (Roche) in approximately 100 markets in Eastern Europe, Latin America, Asia, the Middle East and Africa (Product... -

Page 93

... to acquire the Product Rights $ $ 497 (99) 398 The settlement of the preexisting relationship relates to a supply contract between Amgen and Roche that was terminated as a result of the acquisition of the Product Rights. The fair value of the contract of $99 million was recognized in Cost of sales... -

Page 94

... circumstances as defined in the plans and related grant agreements, including upon death, disability, a change in control, termination in connection with a change in control and the retirement of employees who meet certain service and/or age requirements. RSUs generally vest in approximately equal... -

Page 95

... is generally three years. The performance goals for the units granted in 2015, 2014 and 2013, which are accounted for as equity awards, are based upon Amgen's stockholder return compared with a comparator group of companies, which are considered market conditions and are reflected in the grant date... -

Page 96

... upon the number of performance units earned multiplied by the closing stock price of our common stock on the last day of the performance period. As of December 31, 2015, there was approximately $113 million of unrecognized compensation cost related to the 2015 and 2014 performance unit grants that... -

Page 97

... with the Internal Revenue Service (IRS) for the years ended December 31, 2007, 2008 and 2009. As a result of these developments, we remeasured our UTBs accordingly. Interest and penalties related to UTBs are included in our provision for income taxes. During 2015, 2014 and 2013, we accrued... -

Page 98

... and services from our manufacturer in Puerto Rico. The rate was 2.75% in the first half of 2013 and 4.0% effective July 1, 2013 through December 31, 2017. We account for the excise tax as a manufacturing cost that is capitalized in inventory and expensed in cost of sales when the related products... -

Page 99

... 31, 2013. Under the collaboration agreement in which we were the principal participant, Amgen and Pfizer shared in the agreed-upon selling and marketing expenses approved by a joint committee. We paid Pfizer a percentage of annual gross profits on our ENBREL sales in the United States and Canada on... -

Page 100

..., Bayer now pays Amgen a royalty on U.S. sales of Nexavar® at a percentage rate in the high 30s. Amgen will no longer contribute sales force personnel or medical liaisons to support Nexavar® in the United States. There are no changes to the global research and development or non-U.S. profit share... -

Page 101

... sales in the Consolidated Statements of Income. K-A's expenses consist primarily of costs related to R&D activities conducted on its behalf by Amgen and Kirin. K-A pays Amgen and Kirin for such services at negotiated rates. During the years ended December 31, 2015, 2014 and 2013, we earned revenues... -

Page 102

... 31, 2015 Amortized cost Estimated fair value U.S. Treasury securities Other government-related debt securities: U.S. Foreign and other Corporate debt securities: Financial Industrial Other Residential mortgage-backed securities Other mortgage- and asset-backed securities Money market mutual... -

Page 103

... as follows (in millions): December 31, Classification in the Consolidated Balance Sheets 2015 2014 Cash and cash equivalents Marketable securities Other assets - noncurrent Total available-for-sale investments $ $ 3,738 27,238 136 31,112 $ $ 3,293 23,295 144 26,732 Cash and cash equivalents... -

Page 104

... could change in the future due to new developments or changes in assumptions related to any particular security. As of December 31, 2015 and 2014, we believe the costs basis for our availablefor-sale investments were recoverable in all material aspects. 10. Inventories Inventories consisted of the... -

Page 105

... 31, 2015 Gross carrying amount Accumulated amortization Intangible assets, net Gross carrying amount 2014 Accumulated amortization Intangible assets, net Finite-lived intangible assets: Developed product technology rights Licensing rights R&D technology rights Marketing-related rights Total... -

Page 106

... $1.0 billion in 2016, 2017, 2018, 2019 and 2020, respectively. 13. Accrued liabilities Accrued liabilities consisted of the following (in millions): December 31, 2015 2014 Sales deductions Employee compensation and benefits Dividends payable Clinical development costs Sales returns reserve Other... -

Page 107

...of our long-term borrowings were as follows (in millions): December 31, 2015 2014 2.30% notes due 2016 (2.30% 2016 Notes) 2.50% notes due 2016 (2.50% 2016 Notes) 2.125% notes due 2017 (2.125% 2017 Notes) Floating Rate Notes due 2017 1.25% notes due 2017 (1.25% 2017 Notes) 5.85% notes due 2017 (5.85... -

Page 108

...prior to their maturity dates. In 2013, we issued $8.1 billion of debt in connection with the acquisition of Onyx, comprised of obligations under a Repurchase Agreement and a Term Loan. • • Debt issuance costs incurred in connection with these debt issuances in 2015, 2014 and 2013 totaled $21... -

Page 109

...paper to fund our working capital needs. At December 31, 2015 and 2014, we had no amounts outstanding under our commercial paper program. In July 2014, we entered into a $2.5 billion syndicated, unsecured, revolving credit agreement which is available for general corporate purposes or as a liquidity... -

Page 110

... ended December 31, 2015, 2014 and 2013, was $1.1 billion, $1.1 billion and $1.0 billion, respectively. Interest costs capitalized for the years ended December 31, 2015, 2014 and 2013, were not material. Interest paid, including the ongoing impact and settlements of interest rate and cross currency... -

Page 111

...$33 million benefit in 2013, respectively. Income tax expenses/benefits for unrealized gains and losses and the related reclassification adjustments to income for available-for-sale securities were a $0 million and $18 million expense for 2015, a $14 million expense and $0 million in 2014 and a $105... -

Page 112

..., 2015 Year ended December 31, 2014 Year ended December 31, 2013 Line item affected in the Statements of Income Components of AOCI Cash flow hedges: Foreign currency contract gains Cross-currency swap contract (losses) gains Forward interest rate contract losses $ $ Available-for-sale securities... -

Page 113

...2015, using: Total Assets: Available-for-sale investments: U.S. Treasury securities Other government-related debt securities: U.S. Foreign and other Corporate debt securities: Financial Industrial Other Residential mortgage-backed securities Other mortgage- and asset-backed securities Money market... -

Page 114

... securities are based on quoted market prices in active markets with no valuation adjustment. Most of our other government-related and corporate debt securities are investment grade with maturity dates of five years or less from the balance sheet date. Our other government-related debt securities... -

Page 115

...Ending balance $ 215 110 (12) - (125) $ 595 - (30) (225) (125) 215 $ 188 $ As a result of our acquisition of Dezima in October 2015, we are obligated to pay its former shareholders up to $1.25 billion of additional consideration contingent upon achieving certain development and sales-related... -

Page 116

... flows and review underlying key assumptions on a quarterly basis. There were no significant changes in the estimated aggregate fair value of the contingent consideration obligations for the years ended December 31, 2015 and 2014. As a result of our acquisition of Onyx in October 2013, we assumed... -

Page 117

... Treasury rate between the time we enter into these contracts and the time the related debt is issued. Gains and losses on such contracts, which are designated as cash flow hedges, are reported in AOCI in the Consolidated Balance Sheets and amortized into earnings over the lives of the associated... -

Page 118

...): Years ended December 31, Derivatives in cash flow hedging relationships Statements of Income location 2015 2014 2013 Foreign currency contracts Cross-currency swap contracts Forward interest rate contracts Total Product sales Interest and other income, net Interest expense, net $ 326 $ (182... -

Page 119

... deteriorates, which is generally defined as having either a credit rating that is below investment grade or a materially weaker creditworthiness after the change in control. If these events were to occur, the counterparties would have the right, but not the obligation, to close the contracts under... -

Page 120

... District Court granted Amgen's motion to amend the complaint to add Amgen Manufacturing, Limited and Amgen USA Inc. as plaintiffs and to add the allegation that defendants' infringement of Amgen's patents is willful. The trial date has been set for March 7, 2016. Biosimilars Patent Litigations We... -

Page 121

... from marketing, selling, offering for sale, or importing into the United States Sandoz's FDA-approved Zarxioâ„¢ biosimilar product until the Federal Circuit Court resolved the appeal. On July 21, 2015, the Federal Circuit Court affirmed the district court's dismissal of Amgen's state law claims and... -

Page 122

...28, 2016. Federal Securities Litigation - In re Amgen Inc. Securities Litigation The six federal class action stockholder complaints filed against Amgen, Kevin W. Sharer, Richard D. Nanula, Dennis M. Fenton, Roger M. Perlmutter, Brian M. McNamee, George J. Morrow, Edward V. Fritzky, Gilbert S. Omenn... -

Page 123

... the same. The trial date has been set for July 12, 2016. State Derivative Litigation The three state stockholder derivative complaints filed against Amgen, Kevin W. Sharer, George J. Morrow, Dennis M. Fenton, Brian M. McNamee, Roger M. Perlmutter, David Baltimore, Gilbert S. Omenn, Judith C. Pelham... -

Page 124

...ERISA Litigation On August 20, 2007, the Employee Retirement Income Security Act (ERISA) class action lawsuit of Harris v. Amgen Inc., et al., was filed in the California Central District Court and named Amgen, Kevin W. Sharer, Frank J. Biondi, Jr., Jerry Choate, Frank C. Herringer, Gilbert S. Omenn... -

Page 125

... Supreme Court granted Amgen's petition for certiorari, reversed the judgment of the Ninth Circuit Court and remanded the case back to the California Central District Court for further proceedings. Commitments We lease certain facilities and equipment related primarily to administrative, R&D, sales... -

Page 126

... internal management reporting. Enterprise-wide disclosures about product sales; revenues and long-lived assets by geographic area; and revenues from major customers are presented below. Revenues Revenues were as follows (in millions): Years ended December 31, 2015 2014 2013 Product sales: ENBREL... -

Page 127

December 31, 2015 2014 Long-lived assets: United States Puerto Rico ROW Total long-lived assets Major customers In the United States, we sell primarily to pharmaceutical wholesale distributors. We utilize those wholesale distributors as the principal means of distributing our products to healthcare... -

Page 128

20. Quarterly financial data (unaudited) 2015 Quarters ended (In millions, except per share data) December 31 September 30 June 30 March 31 Product sales Gross profit from product sales Net income Earnings per share: Basic Diluted (In millions, except per share data) $ 5,329 4,258 1,800 2.39 2.37... -

Page 129

SCHEDULE II AMGEN INC. VALUATION AND QUALIFYING ACCOUNTS Years ended December 31, 2015, 2014 and 2013 (In millions) Additions charged to costs and expenses Balance at end of period Allowance for doubtful accounts Balance at beginning of period Other additions Deductions Year ended December 31, ... -

Page 130

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 131

-

Page 132