American Airlines 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The “can do” spirit is evident

not just in our name, but in

every one of our employees.

We’ve never been more proud

to bear the name American.

– Donald J.Carty

AMR CORPORATION

2001 ANNUAL REPORT

AMR CORPORATION

P. O. Box 619616, Dallas/Fort Worth, Texas 75261-9616

The American Airlines internet address is www.aa.com

The AMR internet address is www.amrcorp.com

Table of contents

-

Page 1

...but in every one of our employees. We've never been more proud to bear the name American. - Donald J. Carty AM R C ORPORAT I ON 2 0 0 1 A N N U AL R EPORT AM R C ORPORAT I ON P.O. Box 619616, Dallas/Fort Worth, Texas 75261-9616 The American Airlines internet address is www.aa.com The AMR internet... -

Page 2

... Shareholders, Customers and Employees Financial Table of Contents Operating Aircraft Fleets Board of Directors Corporate Information 1 5 41 42 44 A BOU T O U R A N N U AL R EPORT Many would say it's no coincidence that the word American ends in "I can." For the cover of this year's annual report... -

Page 3

... to AMR Corporation. For American Airlines, every accomplishment, indeed every other event, was overshadowed by the twin calamities of the September 11 attacks and the loss of Flight 587 in Queens, New York, on November 12. Prior to September 11, our Company's greatest obstacle had been the slowing... -

Page 4

... in-flight amenities, closing most of our city ticket offices and some lesser-used airport lounges and cutting back on advertising and promotions, information technology and corporate overhead. We have also been able to negotiate some meaningful cost reductions with many of our suppliers. None... -

Page 5

... The TWA acquisition was a huge step forward for our domestic network, and it made American Airlines, once again, the largest airline in the world. The More Room Throughout Coach campaign, which we launched in 2000, gained real traction in 2001, giving us an important point of differentiation versus... -

Page 6

... need to establish and sustain strong relationships. Indeed, we could not have emerged from 2001 intact were it not for the support of the government, the communities we serve, our suppliers, our airline partners, the financial community and, most of all, the people of American Airlines and American... -

Page 7

...Cash Flows Consolidated Balance Sheets Consolidated Statements of Stockholders' Equity Notes to Consolidated Financial Statements Report of Independent Auditors Report of Management Operating Aircraft Fleets Board of Directors Management - Divisions and Subsidiaries Corporate Information 43 44 39 40... -

Page 8

... in 2000 were $813 million, or $5.43 per share ($5.03 diluted). On September 11, 2001, two American Airlines aircraft were hijacked and destroyed in terrorist attacks on The World Trade Center in New York City and the Pentagon in northern Virginia. On the same day, two United Air Lines aircraft... -

Page 9

... aircraft fuel, other rentals and landing fees, commissions to agents and food service. American's cost per ASM increased 6.3 percent to 11.14 cents, excluding TWA and the impact of special charges - net of U.S. Government grant. The increase in American's cost per ASM was driven partially by... -

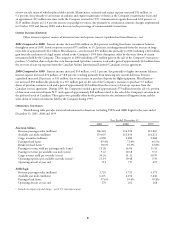

Page 10

... information for American (excluding TWA) and AMR Eagle for the years ended December 31, 2001, 2000 and 1999. Year Ended December 31, 2000 116,594 161,030 2,280 72.4% 65.9% 14.06 10.18 31.31 10.48 717 2001 American Airlines Revenue passenger miles (millions) Available seat miles (millions) Cargo... -

Page 11

... to - airport and off-airport facilities, and the acquisition of various other equipment and assets. During 2001, American issued approximately $2.6 billion of enhanced equipment trust certificates which has been recorded as long-term debt. These enhanced equipment trust certificates are secured by... -

Page 12

...Following the September 11, 2001 events, Standard & Poor's and Moody's downgraded the credit ratings of AMR and American, and the credit ratings of a number of other major airlines. The long-term corporate credit ratings of AMR and American were initially retained on review for possible downgrade by... -

Page 13

... discount rate assumption is based upon the review of high quality corporate bond rates and the change in these rates during the year. The expected return on plan assets and health care cost trend rate are based upon an evaluation of the Company's historical trends and experience taking into account... -

Page 14

... spending, closing facilities, trimming food service and reducing its workforce. In addition, the Company expects to see lower fuel prices in the first quarter of 2002 compared to 2001. Somewhat offsetting these cost savings, however, will be higher wages, salaries and benefit costs, higher security... -

Page 15

... primarily to the increase in the Company's fixed-rate long-term debt during 2001. The fair values of the Company's long-term debt were estimated using quoted market prices or discounted future cash flows based on the Company's incremental borrowing rates for similar types of borrowing arrangements... -

Page 16

...) Revenues Passenger - American Airlines - AMR Eagle Cargo Other revenues Total operating revenues Expenses Wages, salaries and benefits Aircraft fuel Depreciation and amortization Other rentals and landing fees Maintenance, materials and repairs Commissions to agents Aircraft rentals Food service... -

Page 17

... Other Net cash used for investing activities Cash Flow from Financing Activities: Payments on long-term debt and capital lease obligations Proceeds from: Issuance of long-term debt Sale-leaseback transactions Exercise of stock options Short-term loan from Sabre Holdings Corporation Repurchase of... -

Page 18

... current assets Equipment and Property Flight equipment, at cost Less accumulated depreciation 2001 2000 $ 120 2,872 1,414 822 790 522 6,540 $ 89 2,144 1,303 757 695 191 5,179 21,707 6,727 14,980 929 4,202 2,123 2,079 17,988 20,041 6,320 13,721 1,700 3,639 1,968 1,671 17,092 Purchase deposits... -

Page 19

... value) Liabilities and Stockholders' Equity Current Liabilities Accounts payable Accrued salaries and wages Accrued liabilities Air traffic liability Current maturities of long-term debt Current obligations under capital leases Total current liabilities 2001 2000 $ 1,785 721 1,471 2,763 556 216... -

Page 20

...$2 Total comprehensive income Distribution of Sabre Holdings Corporation shares to AMR shareholders Issuance of 3,817,892 shares from Treasury pursuant to stock option, deferred stock and restricted stock incentive plans, net of tax of $11 Balance at December 31, 2000 Net loss Adjustment for minimum... -

Page 21

-

Page 22

-

Page 23

... utilizing models used by the Company in making fleet and scheduling decisions. In determining the fair market value of these aircraft, the Company considered outside third party appraisals and recent transactions involving sales of similar aircraft. Following the events of September 11, 2001, and... -

Page 24

... cost less sales proceeds. Employee charges On September 19, 2001, the Company announced that it would be forced to reduce its workforce by approximately 20,000 jobs across all work groups (pilots, flight attendants, mechanics, fleet service clerks, agents, management and support staff personnel... -

Page 25

... December 31, 2001 2000 460 $ 361 722 649 906 500 333 361 130 442 78 74 2,872 $ 2,144 Overnight investments and time deposits U. S. Government agency notes Corporate and bank notes U. S. Treasury notes Asset backed securities U. S. Government agency mortgages Other $ $ Short-term investments at... -

Page 26

... 17 defendants, including American, in an attempt to recover its past and future cleanup costs (Miami-Dade County, Florida v. Advance Cargo Services, Inc., et al. in the Florida Circuit Court). In addition to the 17 defendants named in the lawsuit, 243 other agencies and companies were also named as... -

Page 27

... lease term at fair market value, but generally not to exceed a stated percentage of the defined lessor's cost of the aircraft or at a predetermined fixed amount. Special facility revenue bonds have been issued by certain municipalities primarily to purchase equipment and improve airport facilities... -

Page 28

... with a positive fair value at the reporting date, reduced by the effects of master netting agreements. To manage credit risks, the Company selects counterparties based on credit ratings, limits its exposure to a single counterparty under defined guidelines, and monitors the market position of the... -

Page 29

...expected 2004 fuel needs. The fair value of the Company's fuel hedging agreements at December 31, 2001 and 2000, representing the amount the Company would receive to terminate the agreements, totaled $39 million and $223 million, respectively. Interest Rate Risk Management American utilizes interest... -

Page 30

... Instruments The fair values of the Company's long-term debt were estimated using quoted market prices where available. For long-term debt not actively traded, fair values were estimated using discounted cash flow analyses, based on the Company's current incremental borrowing rates for similar... -

Page 31

...of a tax loss on the sale of the Company's investment in Canadian (see Note 4). The components of AMR's deferred tax assets and liabilities were (in millions): December 31, 2001 Deferred tax assets: Postretirement benefits other than pensions Rent expense Alternative minimum tax credit carryforwards... -

Page 32

... by the New York Stock Exchange. Accordingly, all outstanding stock options and other stock-based awards, including the related exercise prices, were adjusted to preserve the intrinsic value of the stock options and awards. See Note 14 for information regarding the Sabre spin-off. In 2001, 2000 and... -

Page 33

...) 5,420,028 The weighted-average grant date fair value per share of all stock option awards granted during 2001, 2000 and 1999 was $12.23, $16.54 and $23.17, respectively. Shares of deferred stock are awarded at no cost to officers and key employees under the Plans' Career Equity Program and will... -

Page 34

...December 31, 1994 using the fair value method prescribed by SFAS 123. The fair value for the stock options was estimated at the date of grant using a Black-Scholes option pricing model with the following weighted-average assumptions for 2001, 2000 and 1999: risk-free interest rates ranging from 4.58... -

Page 35

... Benefits 2001 2000 Reconciliation of benefit obligation Obligation at January 1 Service cost Interest cost Actuarial loss Plan amendments Acquisition of TWA Benefit payments Obligation at December 31 Reconciliation of fair value of plan assets Fair value of plan assets at January 1 Actual return... -

Page 36

...10 (205) $ (57) Pension Benefits 2001 2000 Weighted-average assumptions as of December 31 Discount rate Salary scale Expected return on plan assets Other Benefits 2001 2000 $ (2,538) (1,706) (2,538) $ (1,706) Other Benefits 2001 2000 Prepaid benefit cost Accrued benefit liability Additional minimum... -

Page 37

...health care cost trend rates would have the following effects (in millions): One Percent Increase $ 26 $ 206 One Percent Decrease $ (24) $ (196) Impact on 2001 service and interest cost Impact on postretirement benefit obligation as of December 31, 2001... 31, 2001, the Company estimates during... -

Page 38

... in Sabre on March 15, 2000, based upon the quoted market closing price of Sabre Class A common stock on the New York Stock Exchange, was approximately $5.2 billion. In addition, effective March 15, 2000, the Company reduced the exercise price and increased the number of employee stock options and... -

Page 39

... income AMR Services, AMR Combs and TSR Revenues Income taxes Net income 15. Segment Reporting Statement of Financial Accounting Standards No. 131, "Disclosures about Segments of an Enterprise and Related Information", as amended (SFAS 131), requires that a public company report annual and interim... -

Page 40

...$57 million from the sale of the Company's warrants to purchase 5.5 million shares of priceline common stock (see Note 4). During the third quarter of 2000, the Company recorded a $14 million extraordinary loss on the repurchase prior to scheduled maturity of long-term debt (see Note 7). Results for... -

Page 41

REPORT OF I NDEPENDENT AUDITORS THE BOARD OF DIRECTORS AND STOCKHOLDERS AMR CORPORATION We have audited the accompanying consolidated balance sheets of AMR Corporation as of December 31, 2001 and 2000, and the related consolidated statements of operations, stockholders' equity, and cash flows for ... -

Page 42

... on the financial statements contained in their report. The Audit Committee of the Board of Directors, composed entirely of independent directors, meets regularly with the independent auditors, management and internal auditors to review their work and confirm that they are properly discharging... -

Page 43

..., 2001 American Airlines Aircraft Airbus A300-600R Boeing 727-200 1 Boeing 737-800 Boeing 757-200 Boeing 767-200 Boeing 767-200 Extended Range Boeing 767-300 Extended Range Boeing 777-200 Extended Range Fokker 100 McDonnell Douglas MD-80 Total TWA LLC Aircraft Boeing 717-200 2 Boeing 757-200 Boeing... -

Page 44

...Educational Institution) Dallas, Texas Elected in 1982 Retired in March 2001 Philip J. Purcell Chairman and Chief Executive Officer Morgan Stanley Dean Witter & Co. (Financial Services) New York, New York Elected in 2000 Joe M. Rodgers Chairman The JMR Group (Investment Company) Nashville, Tennessee... -

Page 45

... President - Diversity and Talent Management Peggy E. Sterling Vice President - Dallas/Fort Worth Andrew O. Watson Vice President - e-Business Kenneth D. Wilcox Vice President - Technology Services Carolyn E. Wright Vice President - Human Resources Strategic Partnerships AMERICAN EAGLE AIRLINES, INC... -

Page 46

...Corporation Annual Report to the Securities and Exchange Commission for 2001 (Form 10-K) will be furnished without charge upon written request to: Corporate Secretary AMR Corporation Mail Drop 5675 P.O. Box 619616 Dallas/Fort Worth Airport, TX 75261-9616 COMMON STOCK Trustee & Paying Agent Citibank... -

Page 47

... 16 by the New York Stock Exchange after the market close on March 15, 2000 to exclude the value of Sabre. T he pre-March 15, 2000 stock prices in the above table have not been adjusted to give effect to this distribution. Shareholders can also visit AMR's Internet site on the World Wide Web at www... -

Page 48

AM R C ORPORAT I ON P.O. Box 619616, Dallas/Fort Worth, Texas 75261-9616 The American Airlines internet address is www.aa.com The AMR internet address is www.amrcorp.com